A Payment Receipt Template provides a structured format for documenting transaction details between a buyer and a seller. It typically includes essential information such as payment amount, date, payment method, and receipt number. Using a well-designed template ensures accuracy and professionalism in financial record-keeping.

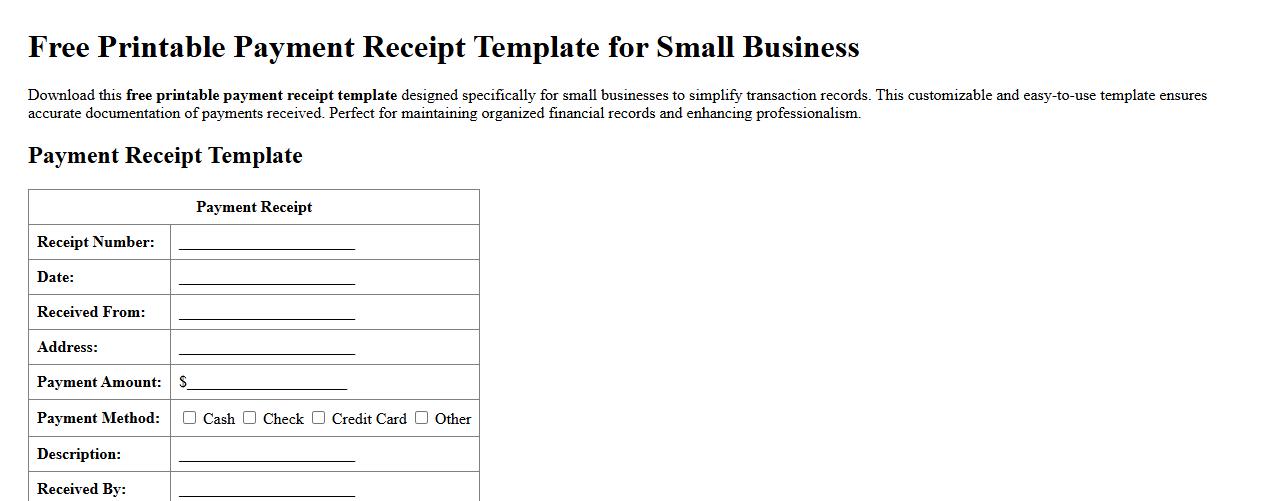

Free printable payment receipt template for small business

Download this free printable payment receipt template designed specifically for small businesses to simplify transaction records. This customizable and easy-to-use template ensures accurate documentation of payments received. Perfect for maintaining organized financial records and enhancing professionalism.

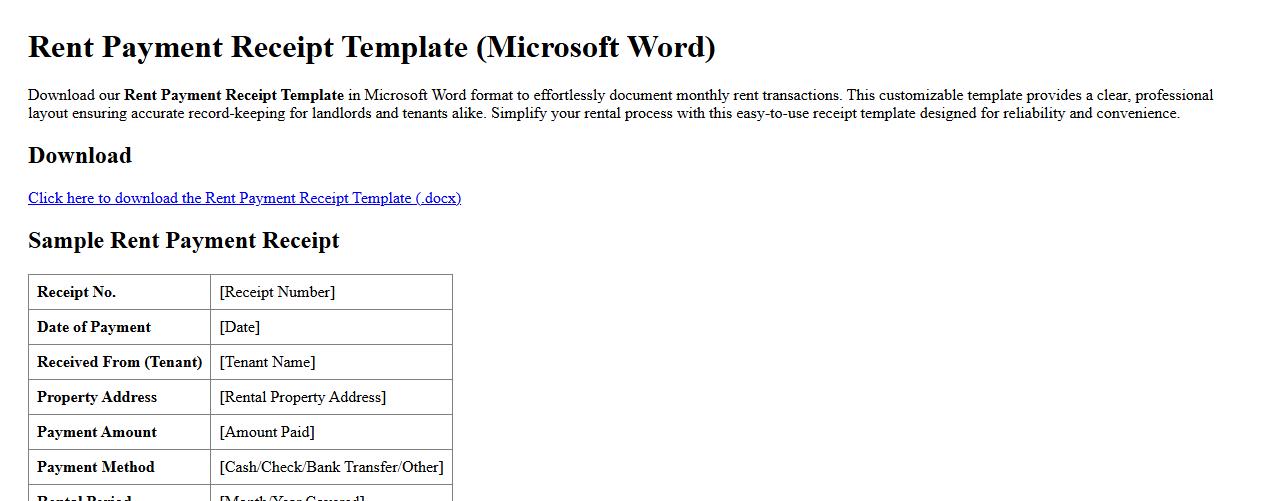

Rent payment receipt template in Microsoft Word format

Download our Rent Payment Receipt Template in Microsoft Word format to effortlessly document monthly rent transactions. This customizable template provides a clear, professional layout ensuring accurate record-keeping for landlords and tenants alike. Simplify your rental process with this easy-to-use receipt template designed for reliability and convenience.

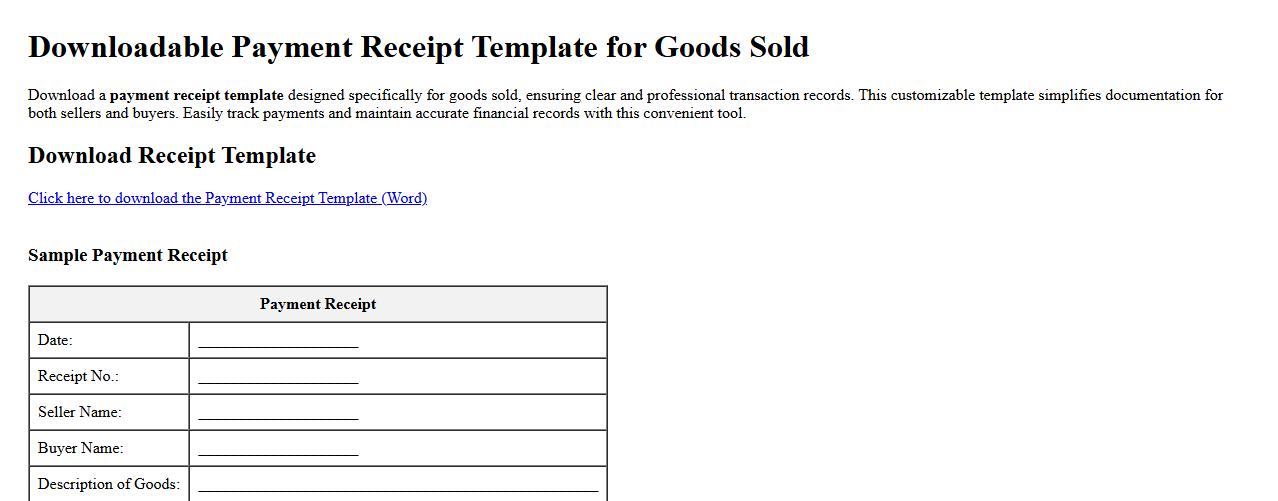

Downloadable payment receipt template for goods sold

Download a payment receipt template designed specifically for goods sold, ensuring clear and professional transaction records. This customizable template simplifies documentation for both sellers and buyers. Easily track payments and maintain accurate financial records with this convenient tool.

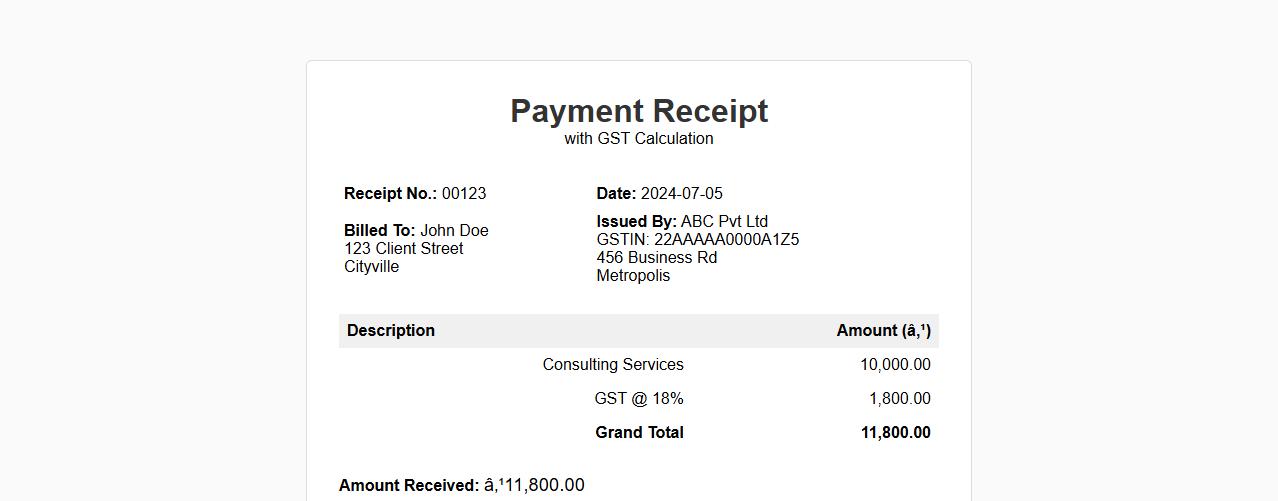

Payment receipt template with GST calculation

This payment receipt template efficiently includes GST calculation, ensuring accurate tax documentation for all transactions. It simplifies record-keeping for businesses by providing a clear and professional format. Using this template enhances transparency and compliance with tax regulations.

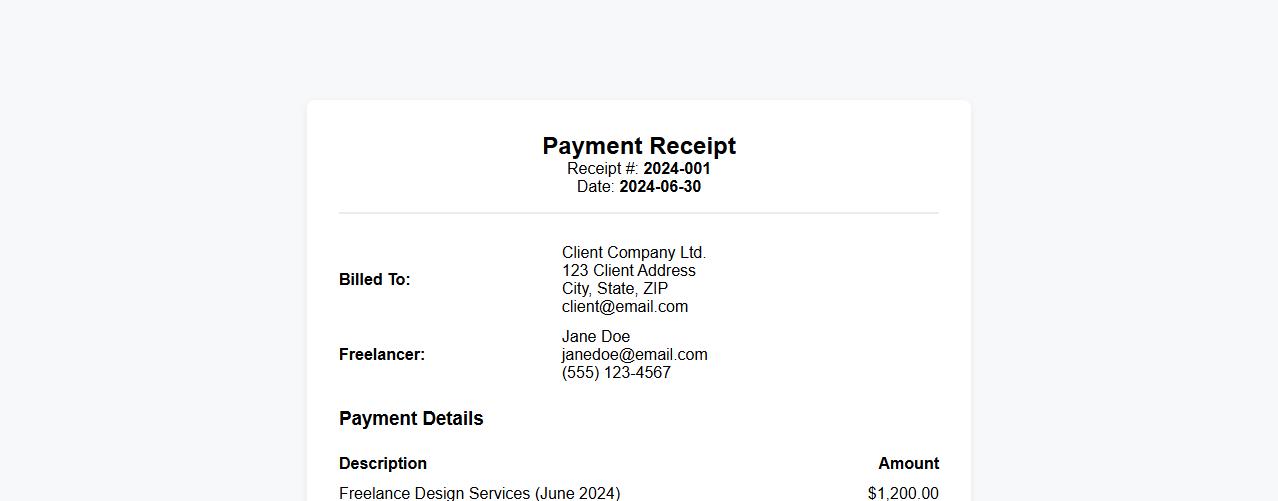

Professional payment receipt template for freelancers

Streamline your invoicing process with this professional payment receipt template designed specifically for freelancers. Easily customize and deliver clear proof of payment to your clients, enhancing trust and transparency. Perfect for keeping your financial records organized and efficient.

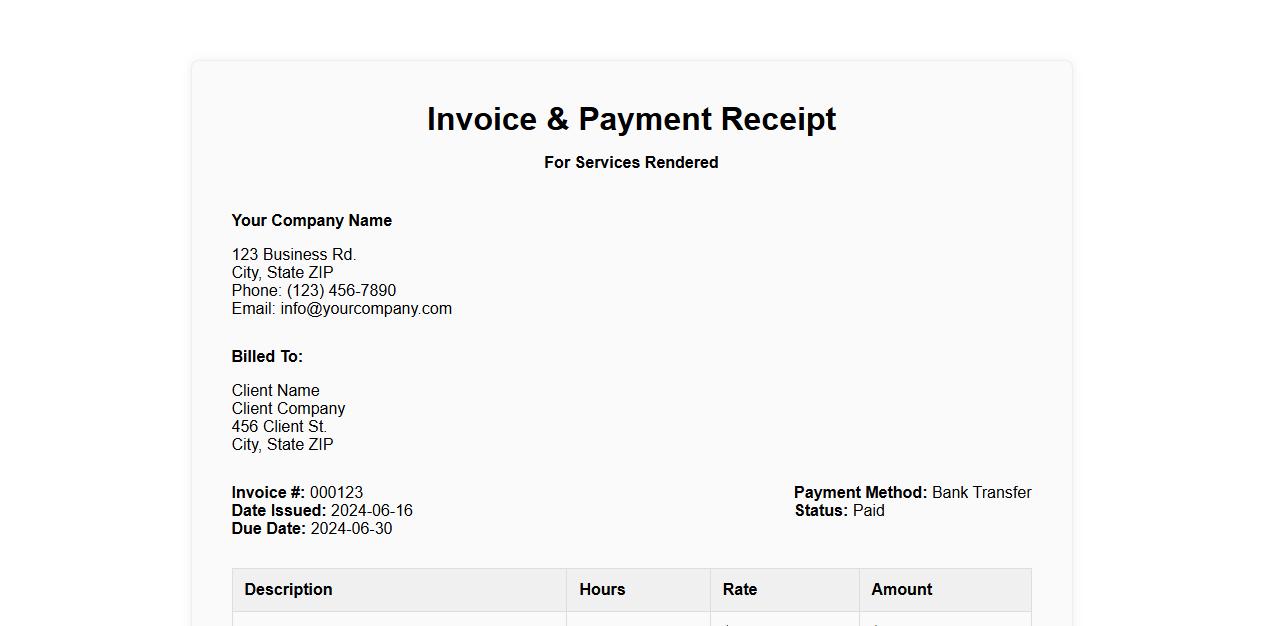

Invoice and payment receipt template for services rendered

Streamline your billing process with this Invoice and payment receipt template designed specifically for services rendered. It ensures clear documentation of transactions, enhancing professionalism and client trust. Customize it easily to fit your business needs and simplify financial record-keeping.

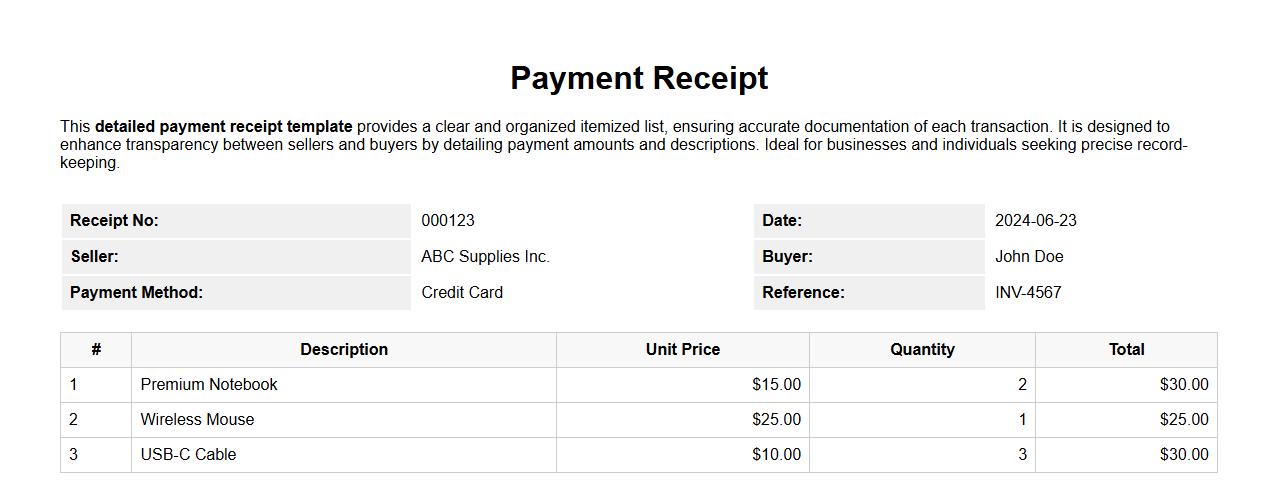

Detailed payment receipt template with itemized list

This detailed payment receipt template provides a clear and organized itemized list, ensuring accurate documentation of each transaction. It is designed to enhance transparency between sellers and buyers by detailing payment amounts and descriptions. Ideal for businesses and individuals seeking precise record-keeping.

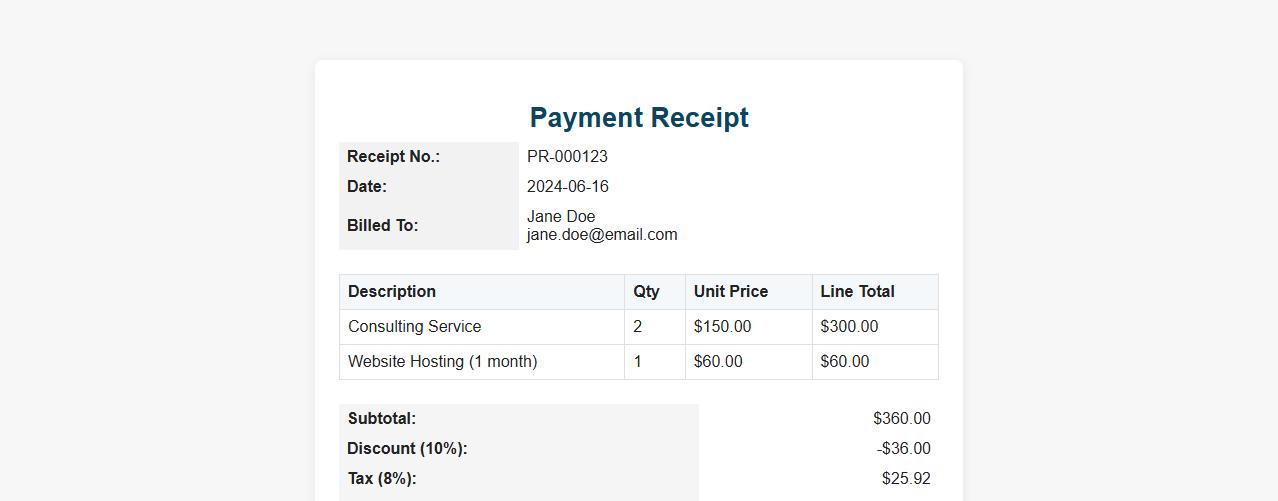

Payment receipt template including tax and discount fields

This payment receipt template is designed to clearly display transaction details, including tax and discount fields, ensuring transparent and accurate records. It simplifies tracking payments by itemizing charges, applied discounts, and taxes. Ideal for businesses aiming to maintain professional and comprehensive financial documentation.

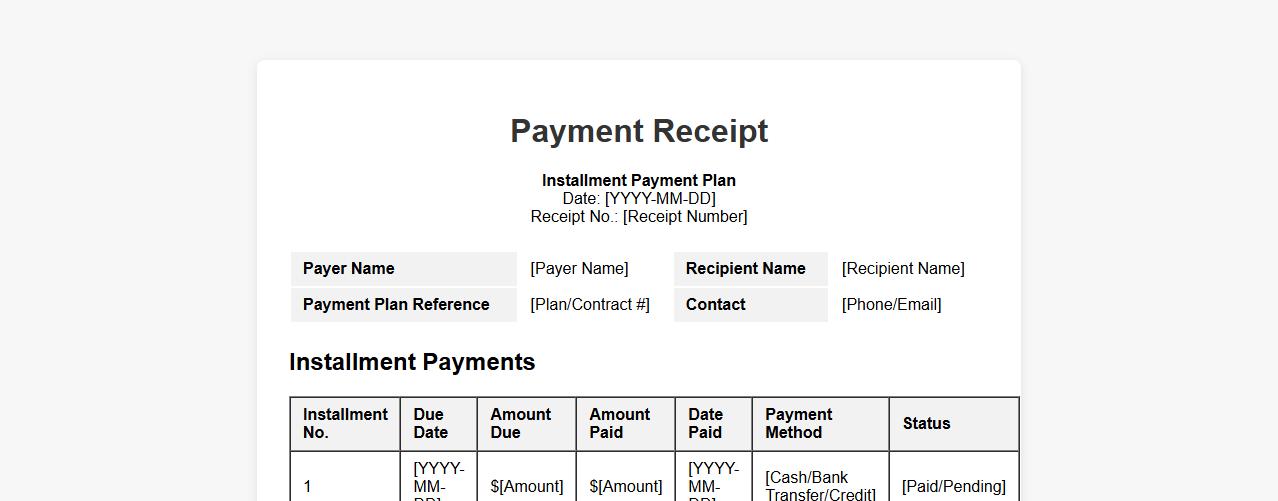

Payment receipt template suitable for installment payments

This payment receipt template is designed specifically for installment payments, providing clear and organized documentation of each transaction. It helps both payers and recipients track payment progress efficiently. Ideal for businesses and individuals managing payment plans.

How do you verify the authenticity of a payment receipt letter?

To verify the authenticity of a payment receipt letter, first check the sender's contact details and ensure they match the official business records. Next, cross-reference the transaction details like date, amount, and payment method with your financial records. Finally, look for official signatures or company stamps that confirm the document's legitimacy.

What legal elements must be included in a payment receipt letter?

A legal payment receipt letter must include the payer's and payee's full names and contact information to establish identity. It also needs to clearly state the amount paid, date of payment, and a detailed description of the goods or services involved. Additionally, a signature from an authorized representative and a unique receipt number are essential for legal validation.

How should discrepancies in payment amounts be addressed in the receipt letter?

If there are discrepancies in payment amounts, the receipt letter should explicitly mention the discrepancy and the reason behind it. Both parties should confirm and sign an acknowledgment statement to avoid future disputes. Clear documentation helps maintain transparency and ensures all records align with actual transactions.

What is the recommended format for digital payment receipt letters?

The digital payment receipt letter should be formatted as a PDF to ensure document integrity and easy sharing. It should include digital signatures or encryption to verify authenticity and prevent tampering. Additionally, incorporating a standardized header with company logo and transaction details enhances professionalism and clarity.

How long should payment receipt letters be retained for audit purposes?

Payment receipt letters should be retained for a minimum of 5 to 7 years to comply with most audit and tax regulations. This retention period ensures you can provide proof of transactions during financial audits or legal reviews. Organizing these documents systematically aids in easy retrieval and efficient record management.