A Sales Receipt Format outlines the essential details of a transaction between a buyer and seller, including the date, item descriptions, quantities, prices, and total amount paid. This format ensures clear communication of purchase information and serves as proof of payment for both parties involved. Properly structured receipts help maintain accurate financial records and facilitate easy tracking of sales.

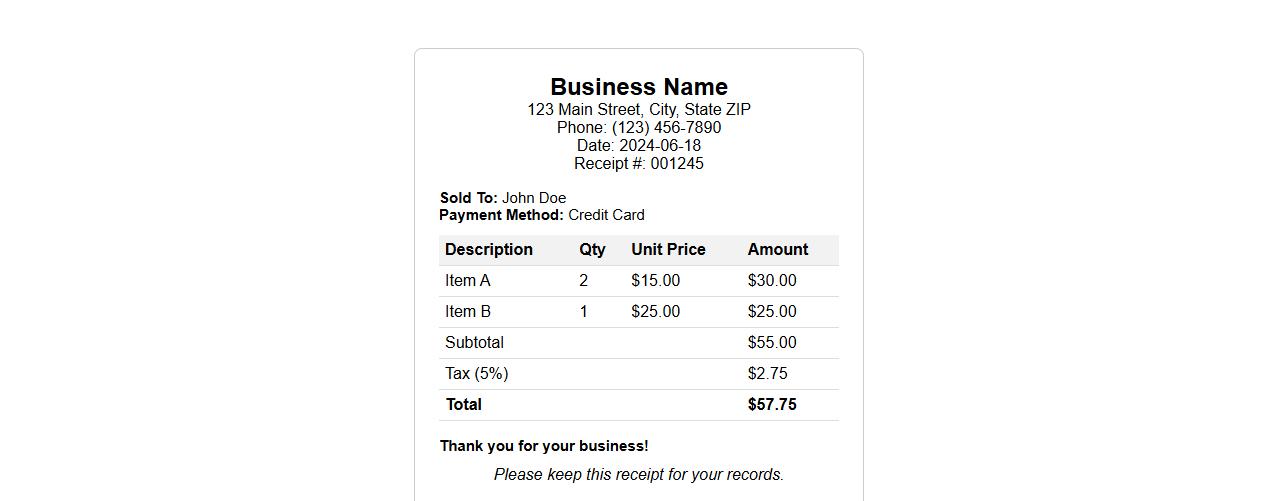

Sales receipt format for small business

A sales receipt format for small business ensures clear documentation of transactions between the seller and buyer. It typically includes essential details like item descriptions, prices, taxes, and payment methods. Using a well-structured receipt helps maintain accurate financial records and improves customer trust.

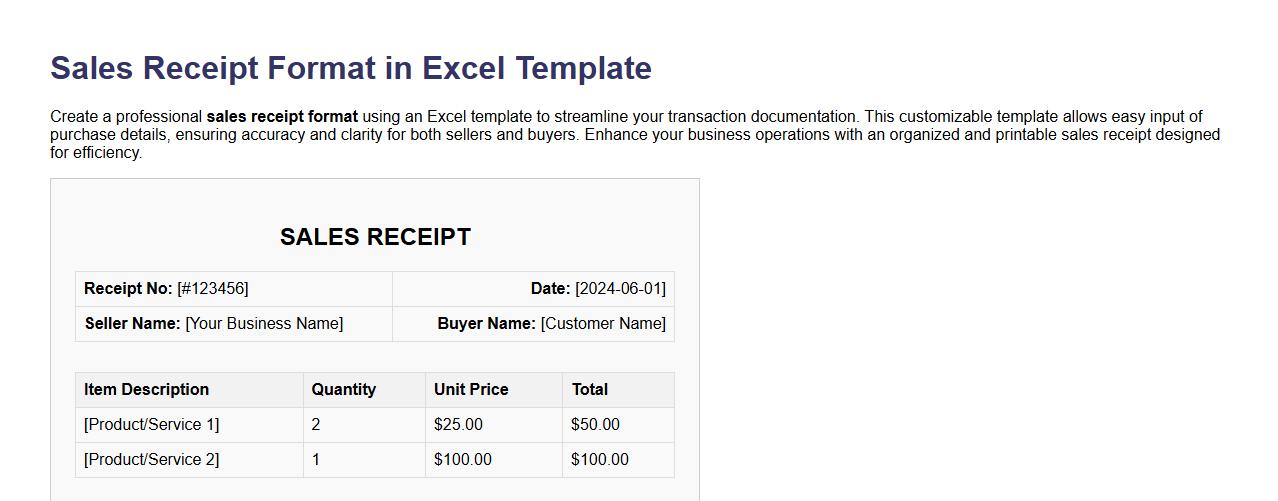

Sales receipt format in Excel template

Create a professional sales receipt format using an Excel template to streamline your transaction documentation. This customizable template allows easy input of purchase details, ensuring accuracy and clarity for both sellers and buyers. Enhance your business operations with an organized and printable sales receipt designed for efficiency.

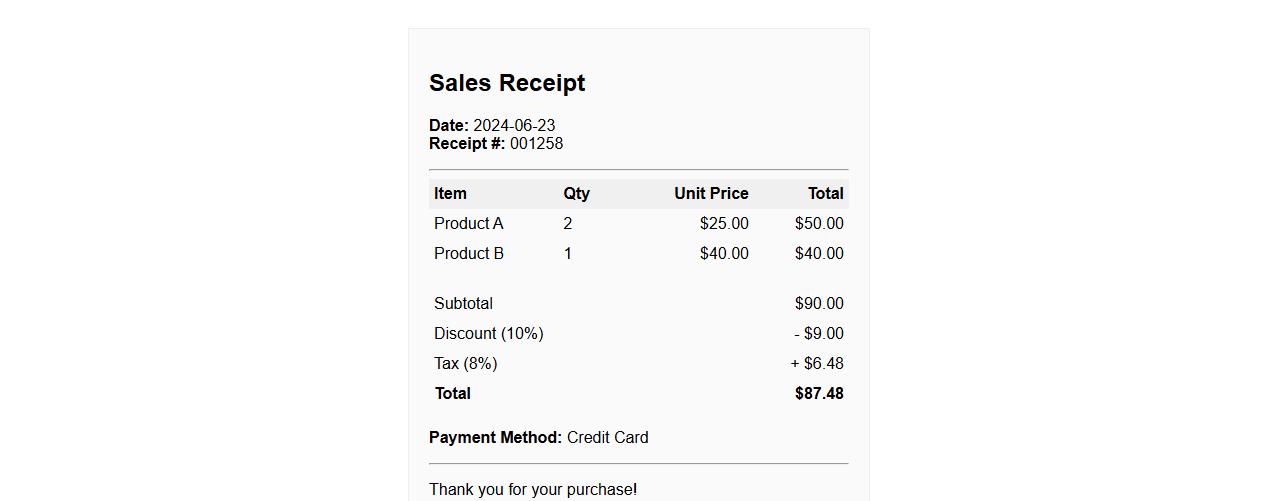

Sales receipt format including tax and discount

A sales receipt format clearly displays the transaction details, including the itemized list, applied taxes, and any discounts offered. This format ensures transparency for both the seller and the buyer by summarizing the total payable amount. Incorporating tax and discount information enhances accuracy and record-keeping efficiency.

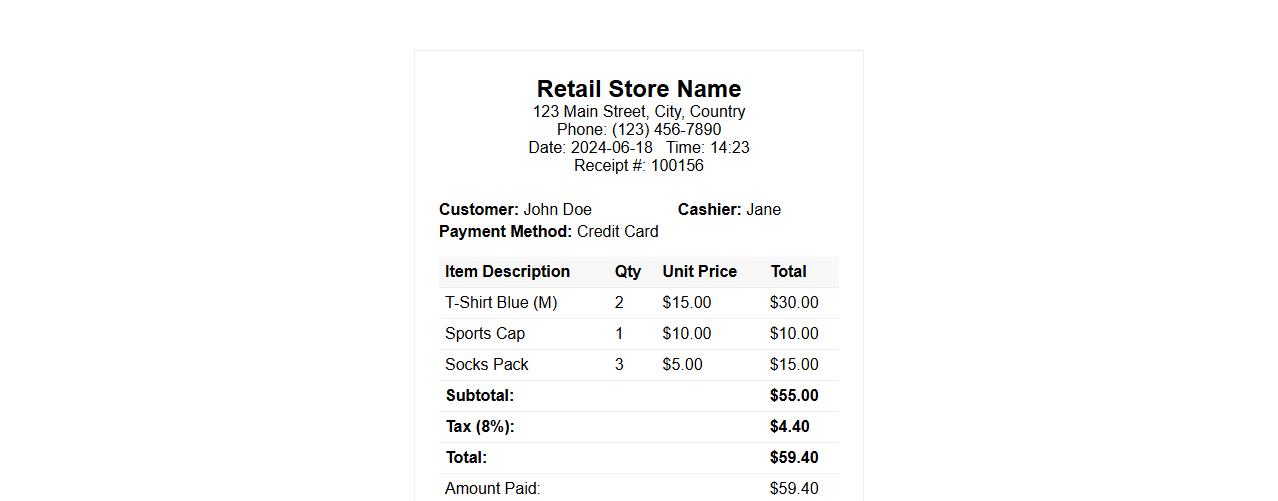

Sales receipt format for retail store

A well-structured sales receipt format for retail stores ensures clear and concise transaction records for both customers and businesses. It typically includes essential details such as item descriptions, quantities, prices, payment methods, and store information. This format enhances transparency and helps in efficient record-keeping and customer service.

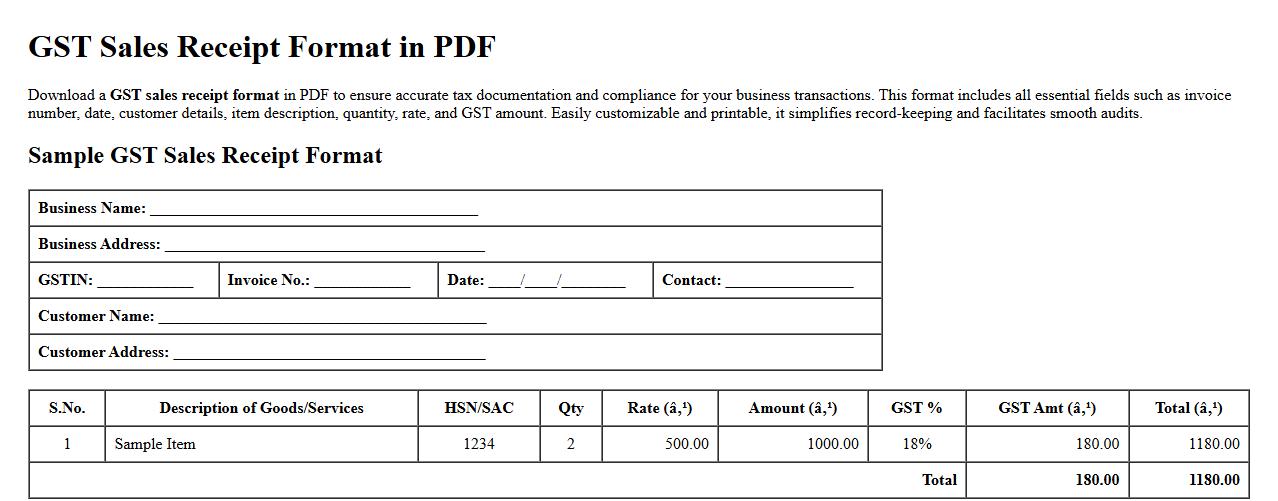

GST sales receipt format in PDF

Download a GST sales receipt format in PDF to ensure accurate tax documentation and compliance for your business transactions. This format includes all essential fields such as invoice number, date, customer details, item description, quantity, rate, and GST amount. Easily customizable and printable, it simplifies record-keeping and facilitates smooth audits.

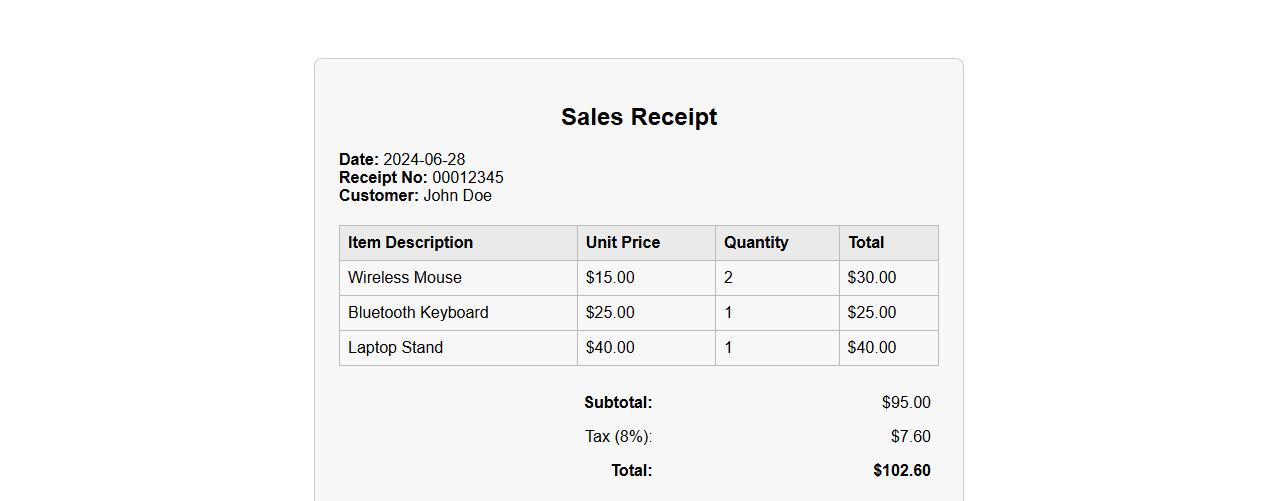

Sales receipt format with itemized details

A sales receipt format with itemized details clearly lists each purchased product along with its price, quantity, and total cost. This format ensures transparency and helps customers easily verify their transactions. It is essential for both record-keeping and resolving any purchase disputes efficiently.

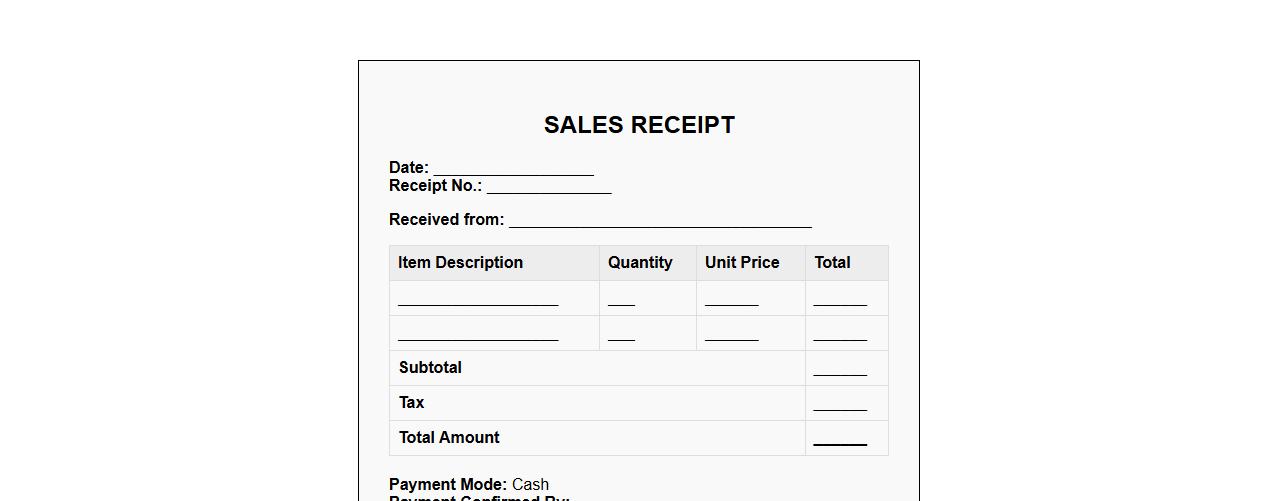

Sales receipt format for cash payments

A sales receipt format for cash payments provides a clear and organized record of transactions made in cash, ensuring transparency and accountability. It typically includes essential details such as the date, items purchased, total amount, and payment confirmation. Using a standardized format helps both businesses and customers maintain accurate financial records.

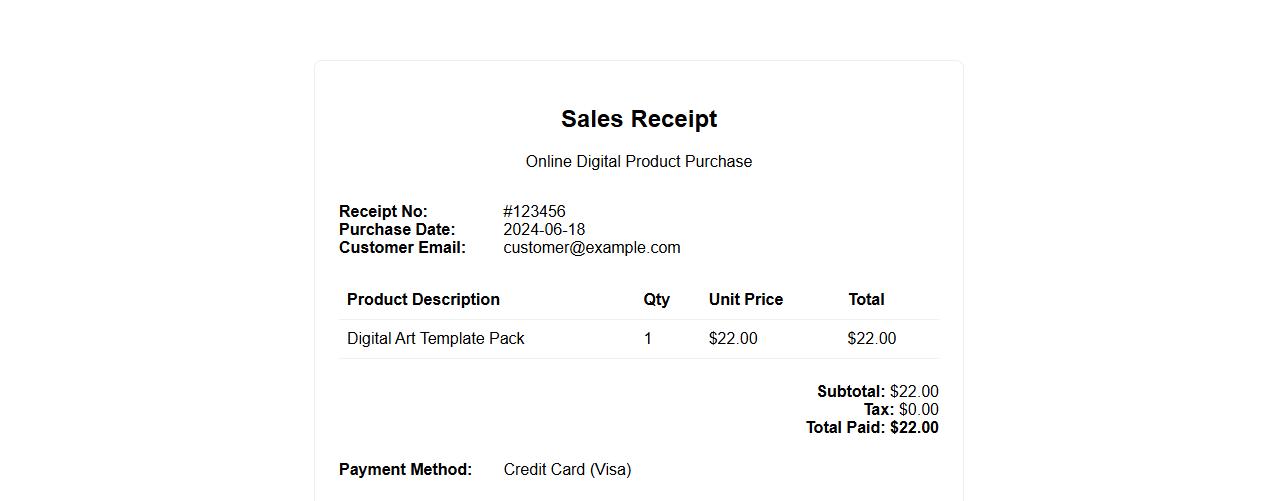

Sales receipt format for online digital products

Use a clear and concise sales receipt format for online digital products to ensure accurate transaction records. Include essential details such as product description, price, purchase date, and payment method to enhance customer trust. This format simplifies order verification and supports efficient bookkeeping for digital sales.

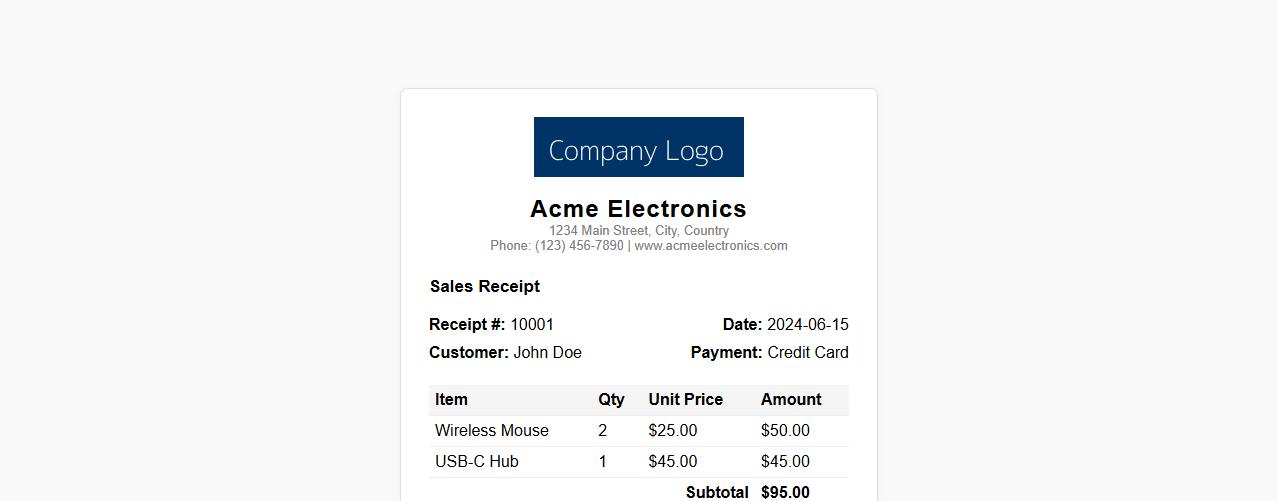

Sales receipt format with company logo

A well-designed sales receipt format with company logo enhances brand recognition and provides a professional appearance to transaction documents. It clearly outlines purchase details, payment information, and company identity, ensuring transparency and trust. Including the logo at the top strengthens brand consistency across all customer communications.

What essential elements must a sales receipt format include for tax compliance?

A sales receipt format must include the buyer and seller information, such as names and addresses, for accurate record-keeping. It should clearly state the date of transaction and a unique receipt number for tracking purposes. Additionally, detailed item descriptions, quantities, prices, and applicable taxes must be presented to satisfy tax authorities.

How can a sales receipt template be customized for digital product sales?

For digital product sales, the sales receipt template should include a section specifying the digital nature of the goods and delivery method. It is essential to add license terms or usage rights associated with the digital product. Including a clear download link or access instructions enhances customer convenience and receipt clarity.

What are the recommended layout practices for itemizing bulk purchases on a sales receipt?

When itemizing bulk purchases, the format should incorporate a table layout that separates product descriptions, quantities, unit prices, and total amounts. Using grouping and subtotal rows for different categories or product types helps improve readability. Highlighting bulk discounts or tiered pricing allows customers to better understand the purchase structure.

How should discounts and promotions be displayed on a sales receipt format?

Discounts and promotions must be clearly listed with a dedicated line item showing the discount type and amount deducted. The original price should be visible alongside the discounted price for transparency. Summarizing total savings at the bottom of the receipt reinforces the promotion's value to the customer.

What legal disclaimers should be included on a sales receipt for international transactions?

International sales receipts should include disclaimers about customs duties and taxes that may apply after purchase. It is important to specify any limitations on returns or warranties due to cross-border regulations. Including a statement regarding governing law and dispute resolution helps clarify legal responsibilities for both parties.