A cash receipt is a document issued to confirm the payment received in cash for goods or services. It serves as proof of transaction and helps maintain accurate financial records for both the payer and the recipient. Proper management of cash receipts is essential for effective cash flow tracking and auditing.

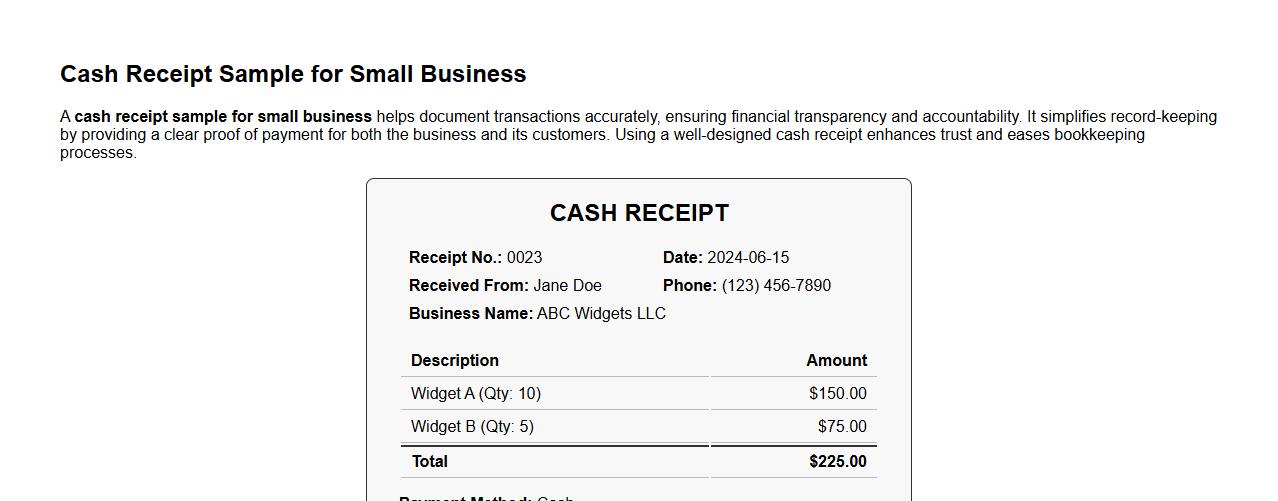

Cash receipt sample for small business

A cash receipt sample for small business helps document transactions accurately, ensuring financial transparency and accountability. It simplifies record-keeping by providing a clear proof of payment for both the business and its customers. Using a well-designed cash receipt enhances trust and eases bookkeeping processes.

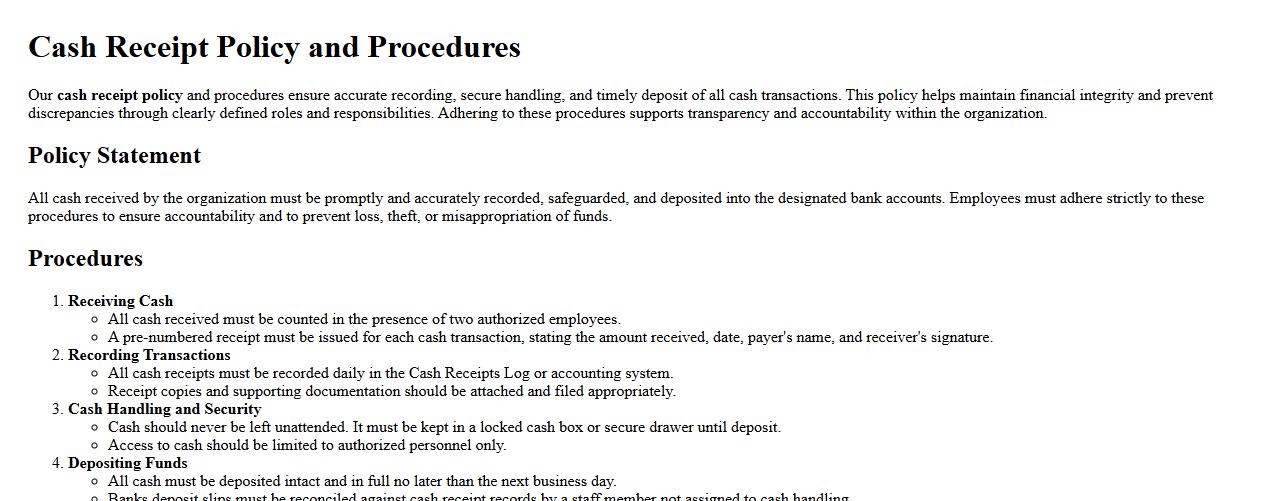

Cash receipt policy and procedures

Our cash receipt policy and procedures ensure accurate recording, secure handling, and timely deposit of all cash transactions. This policy helps maintain financial integrity and prevent discrepancies through clearly defined roles and responsibilities. Adhering to these procedures supports transparency and accountability within the organization.

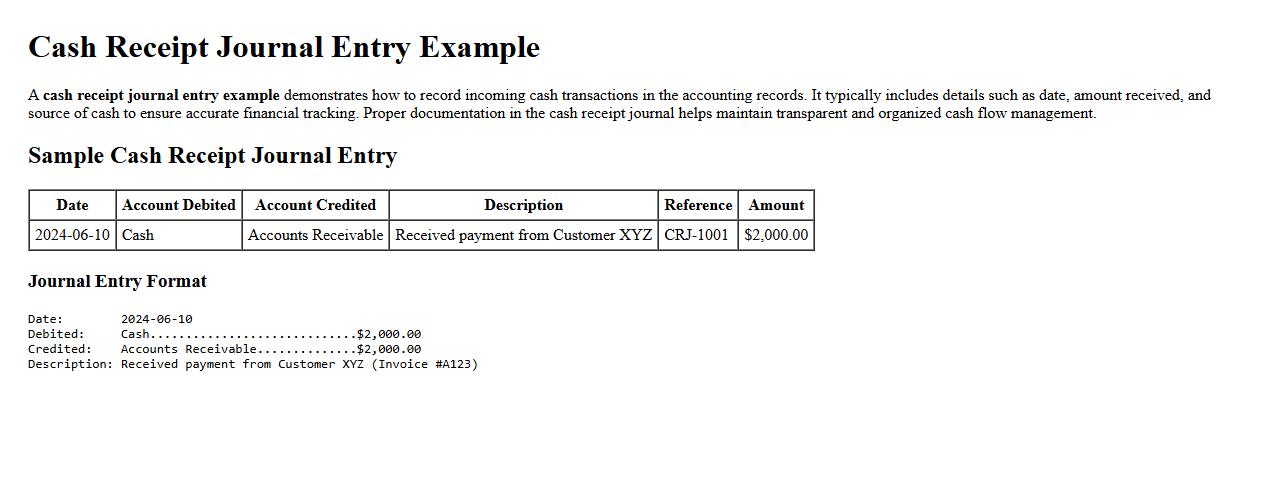

Cash receipt journal entry example

A cash receipt journal entry example demonstrates how to record incoming cash transactions in the accounting records. It typically includes details such as date, amount received, and source of cash to ensure accurate financial tracking. Proper documentation in the cash receipt journal helps maintain transparent and organized cash flow management.

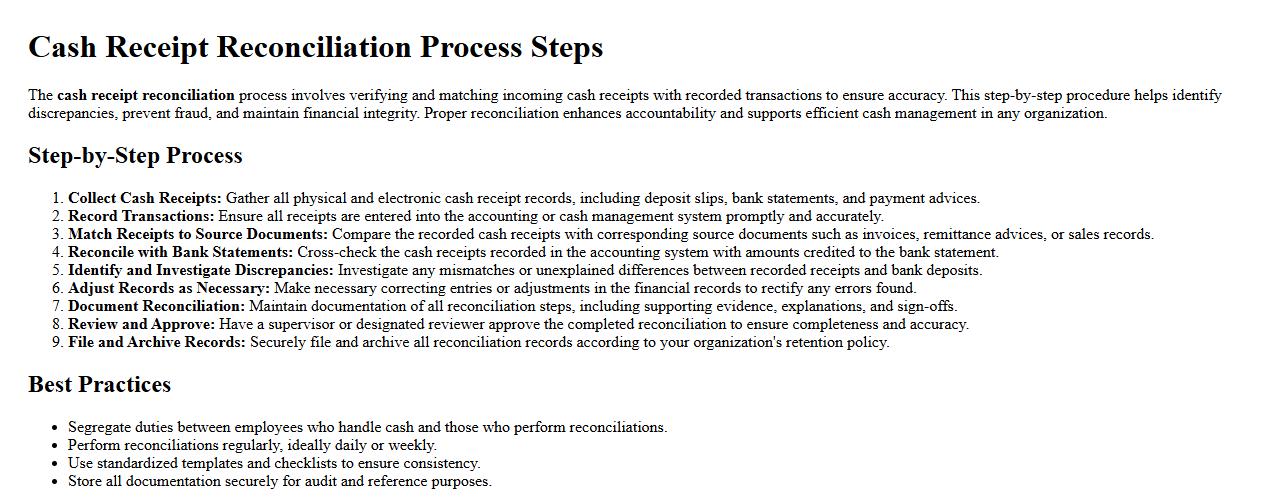

Cash receipt reconciliation process steps

The cash receipt reconciliation process involves verifying and matching incoming cash receipts with recorded transactions to ensure accuracy. This step-by-step procedure helps identify discrepancies, prevent fraud, and maintain financial integrity. Proper reconciliation enhances accountability and supports efficient cash management in any organization.

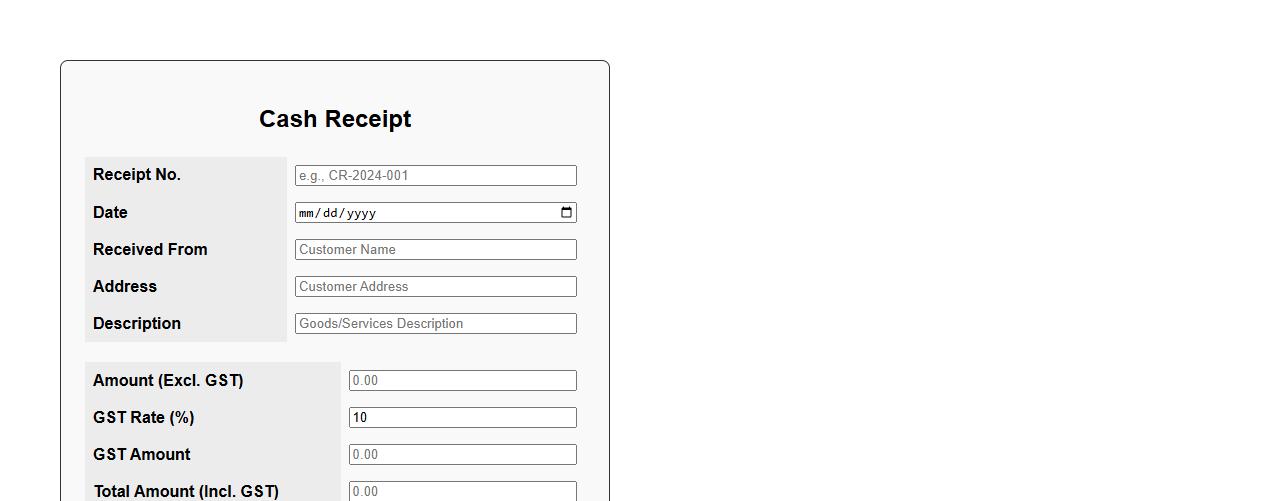

Cash receipt template with gst

A cash receipt template with GST simplifies your transaction records by clearly detailing the amount, GST applied, and total payment received. It ensures compliance with tax regulations while providing a professional format for business or personal use. This template is essential for accurate financial documentation and easy audit processes.

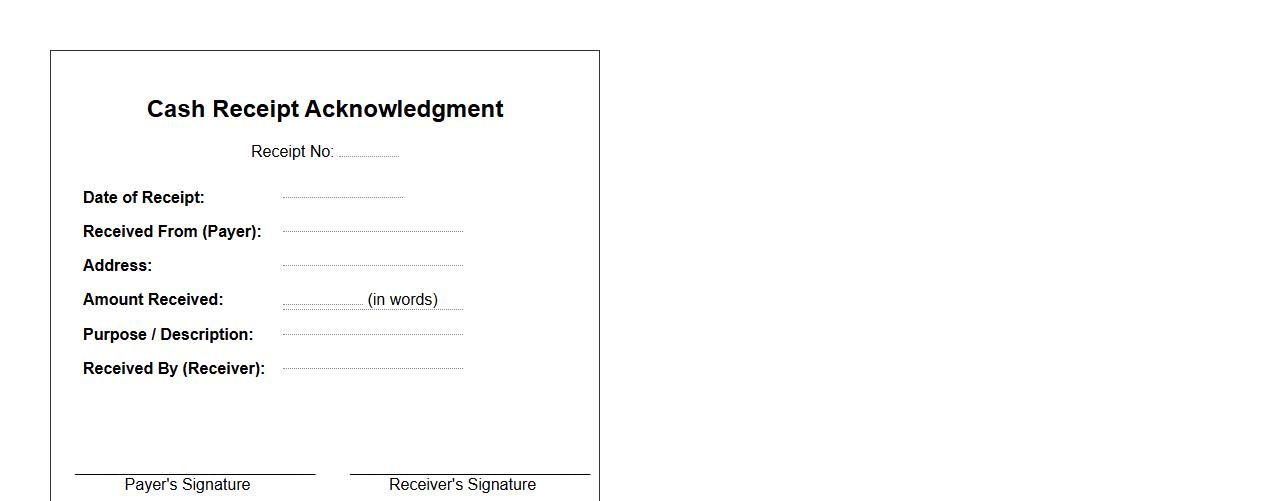

Cash receipt acknowledgment format

The cash receipt acknowledgment format is a structured document used to confirm the receipt of cash payments. It serves as proof for both the payer and payee, ensuring transparency and accountability in financial transactions. This format typically includes details such as the amount received, date, payer's and receiver's information.

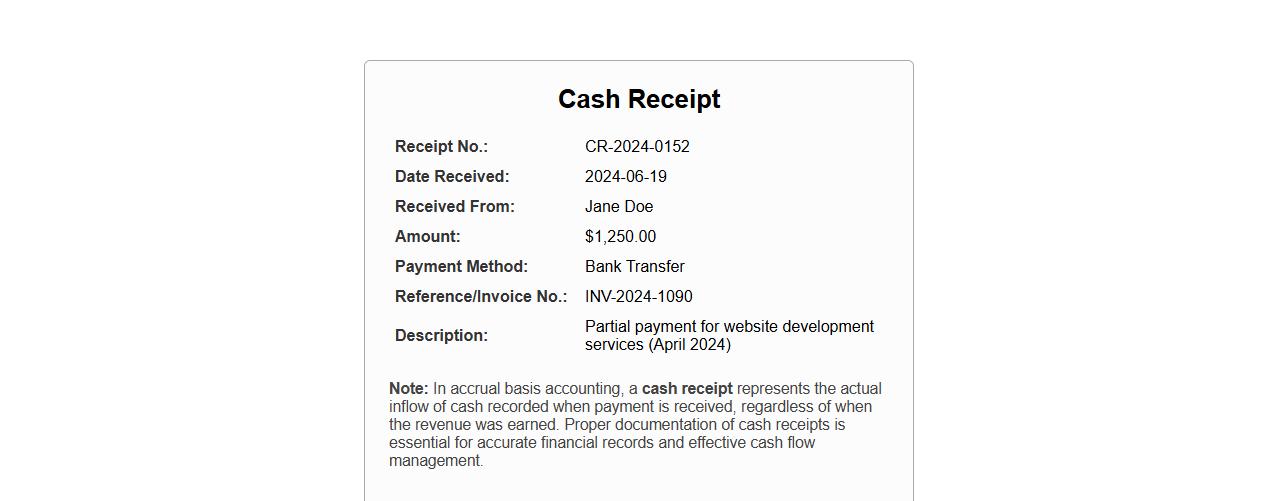

Cash receipt in accounting under accrual basis

In accrual basis accounting, a cash receipt represents the actual inflow of cash recorded when payment is received, regardless of when the revenue was earned. This ensures accurate tracking of cash transactions separate from when sales or services are recognized. Proper documentation of cash receipts is essential for maintaining precise financial records and managing cash flow effectively.

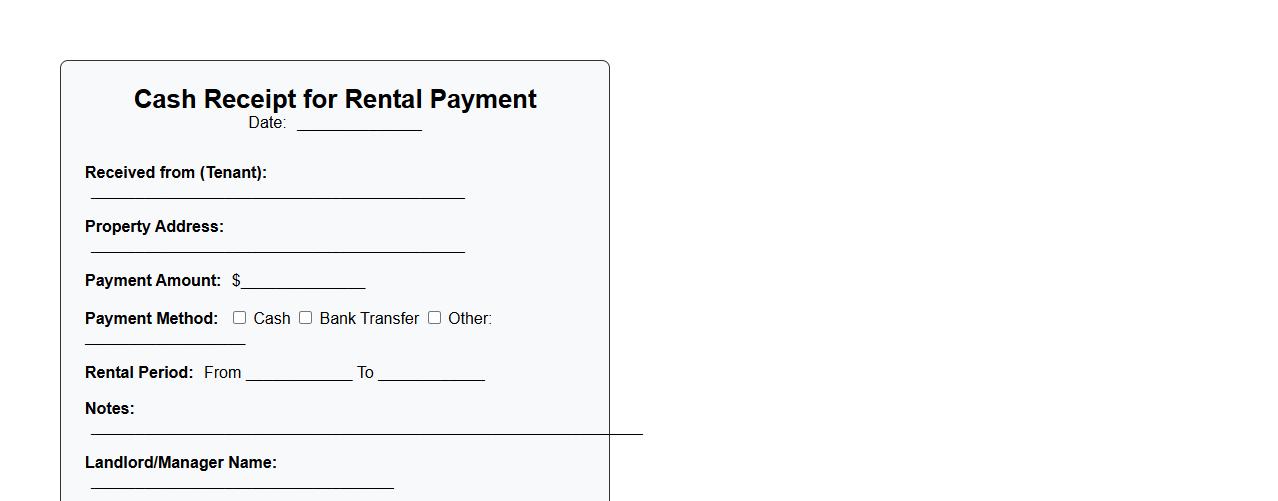

Cash receipt for rental payment record

A cash receipt for rental payment serves as a formal document acknowledging the tenant's payment for rent. It provides a clear record of the transaction, including the date, amount, and payment method. This receipt is essential for both landlords and tenants to maintain accurate financial records.

Cash receipt voucher meaning and use

A cash receipt voucher is a financial document used to record and acknowledge the receipt of cash payments. It serves as proof of transaction and helps maintain accurate accounting records. Businesses use this voucher to track cash inflows and ensure transparency in financial operations.

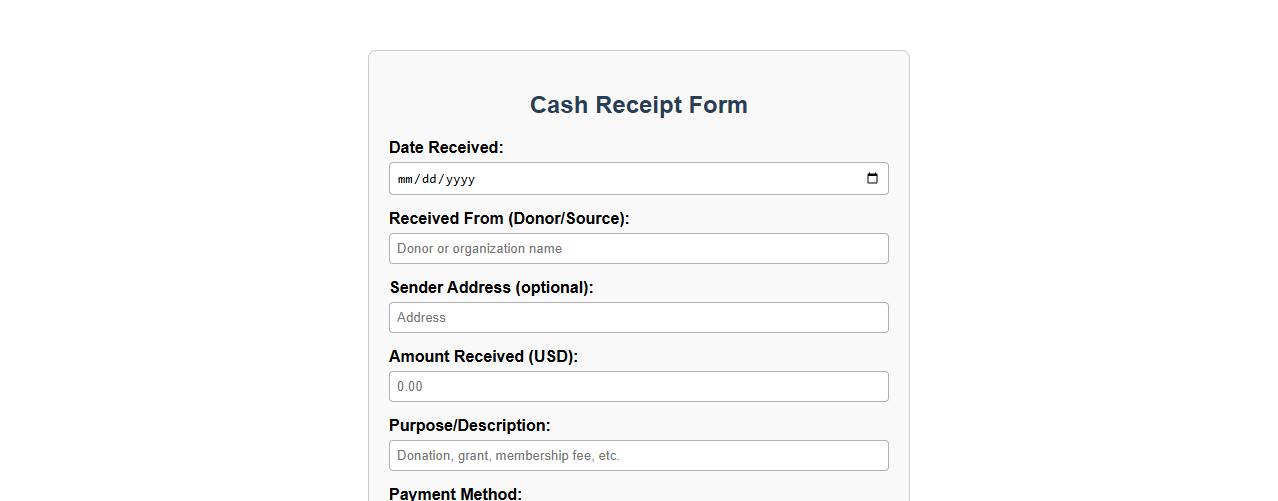

Cash receipt form for nonprofit organizations

A cash receipt form for nonprofit organizations is essential for accurately documenting all cash transactions and ensuring financial transparency. It helps maintain proper records for donations, grants, and other cash inflows, supporting accountability and audit readiness. Utilizing this form promotes efficient financial management within nonprofit entities.

What specific details must be included in a legally compliant digital cash receipt?

A legally compliant digital cash receipt must include the seller's name, date of transaction, and the total amount paid. It should also feature a unique transaction identifier and payment method details. These elements help ensure the receipt is valid and traceable for both parties.

How can cash receipts be authenticated and verified in remote transactions?

Cash receipts in remote transactions can be authenticated using digital signatures or encrypted QR codes. Additionally, sending receipts through secure, verified email or payment platforms improves trust. Verification is often completed by matching transaction IDs with payment gateway records.

What common errors lead to disputes over issued cash receipts?

Disputes often arise due to incorrect transaction amounts, missing seller information, or unclear payment descriptions on receipts. Another common error is failing to provide a receipt promptly after the transaction. These mistakes create confusion and undermine trust between buyer and seller.

Which industries require specialized wording in cash receipt documentation?

Industries like healthcare, finance, and hospitality require specialized wording to comply with regulatory standards. Medical receipts often include procedure codes, while financial services must disclose transaction fees. Hospitality businesses may need to detail service charges or taxes specifically.

How long should physical and electronic cash receipts be retained for audit purposes?

Physical and electronic cash receipts should be retained for a minimum of five to seven years, depending on local tax laws and industry regulations. This retention period supports audit readiness and legal compliance. Proper storage methods ensure receipts remain legible and accessible during this time.