A tax receipt is an official document provided by a government agency or authorized entity confirming the payment of taxes. It serves as proof of tax compliance and is essential for record-keeping and potential audits. Businesses and individuals often use tax receipts to verify deductions or credits when filing tax returns.

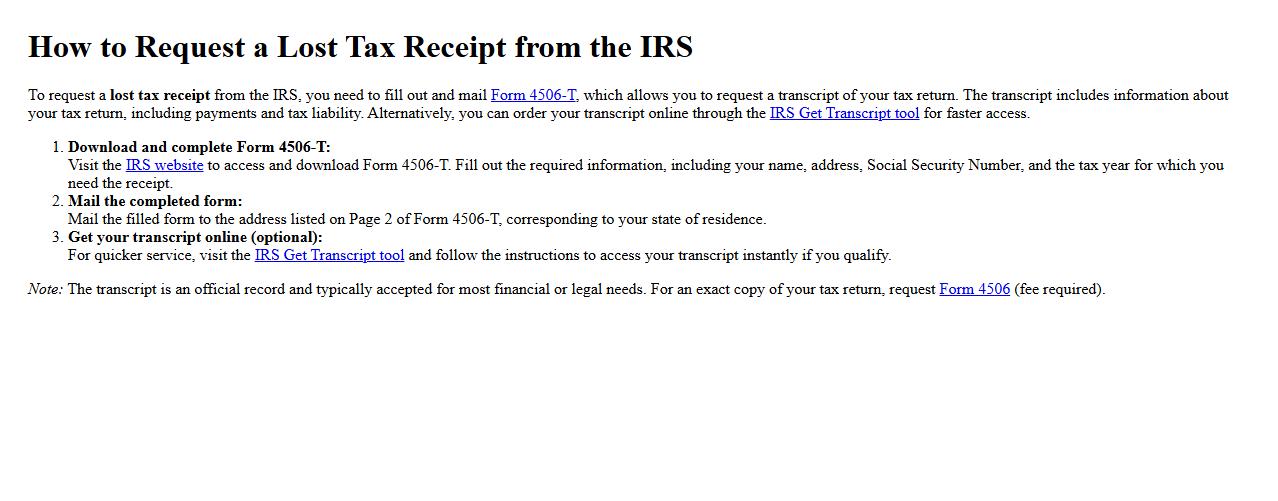

How to request a lost tax receipt from the IRS

To request a lost tax receipt from the IRS, you need to fill out and mail Form 4506-T, which allows you to request a transcript of your tax return. The transcript includes information about your tax return, including payments and tax liability. Alternatively, you can order your transcript online through the IRS Get Transcript tool for faster access.

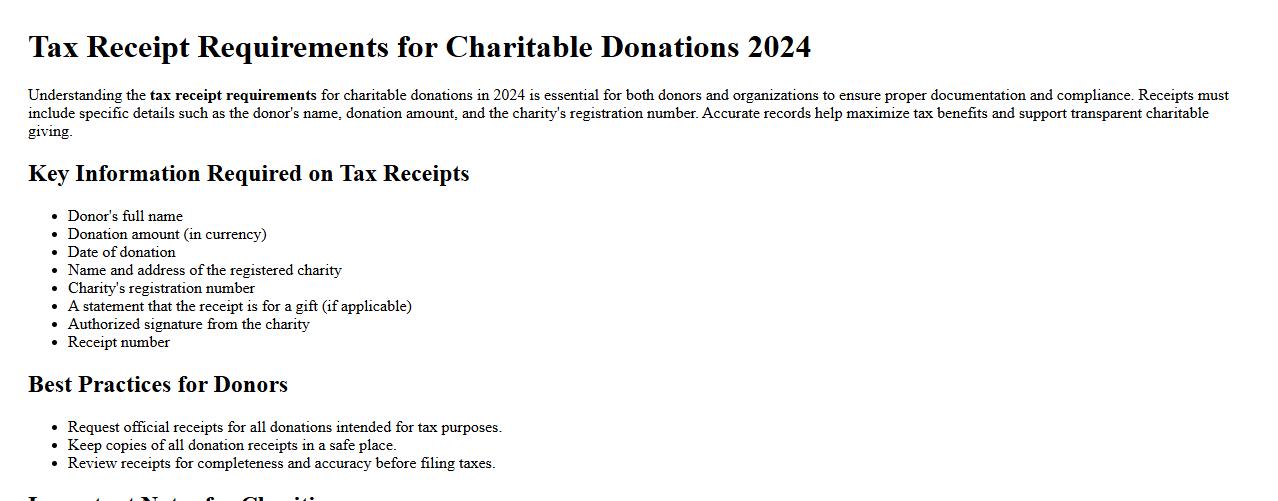

Tax receipt requirements for charitable donations 2024

Understanding the tax receipt requirements for charitable donations in 2024 is essential for both donors and organizations to ensure proper documentation and compliance. Receipts must include specific details such as the donor's name, donation amount, and the charity's registration number. Accurate records help maximize tax benefits and support transparent charitable giving.

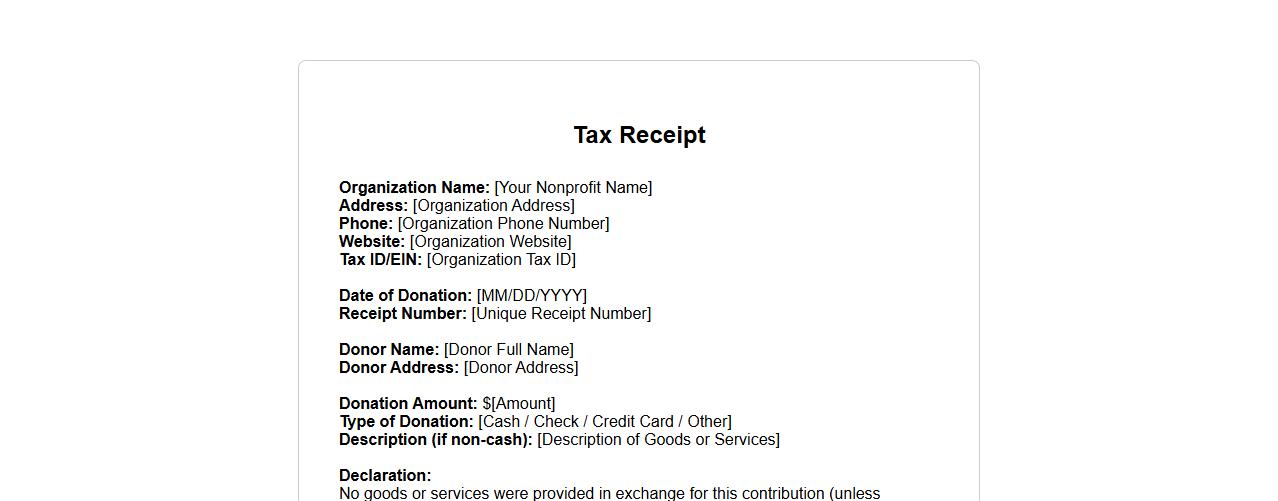

Sample tax receipt format for nonprofit organizations

A sample tax receipt format for nonprofit organizations provides a clear template to acknowledge donations officially. It includes essential elements such as donor information, donation amount, date, and organization's tax ID. Using this format ensures compliance with tax regulations and enhances donor trust.

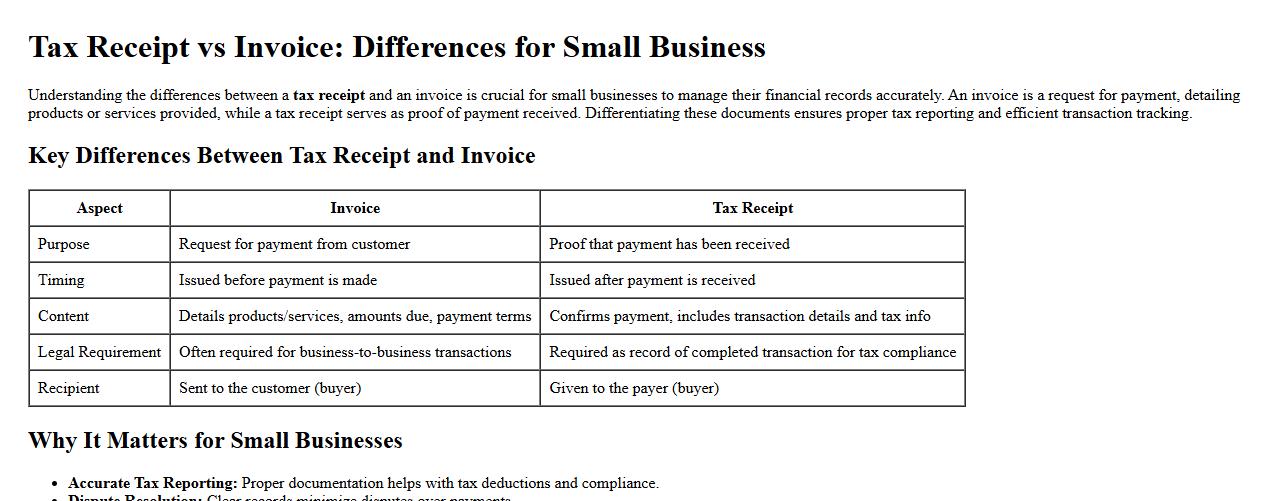

Tax receipt vs invoice differences for small business

Understanding the differences between a tax receipt and an invoice is crucial for small businesses to manage their financial records accurately. An invoice is a request for payment, detailing products or services provided, while a tax receipt serves as proof of payment received. Differentiating these documents ensures proper tax reporting and efficient transaction tracking.

Digital tax receipt acceptance by tax authorities

The digital tax receipt acceptance by tax authorities ensures streamlined verification and compliance processes. This system enhances accuracy and reduces processing time by allowing secure electronic submission of tax documents. It supports transparency and facilitates efficient tax administration nationwide.

Tax receipt retention period for businesses

Businesses must adhere to a specific tax receipt retention period to comply with legal and financial regulations. Typically, these receipts should be kept for at least seven years to ensure proper record-keeping for audits and tax filings. Proper retention helps in verifying expenses and supporting tax deductions efficiently.

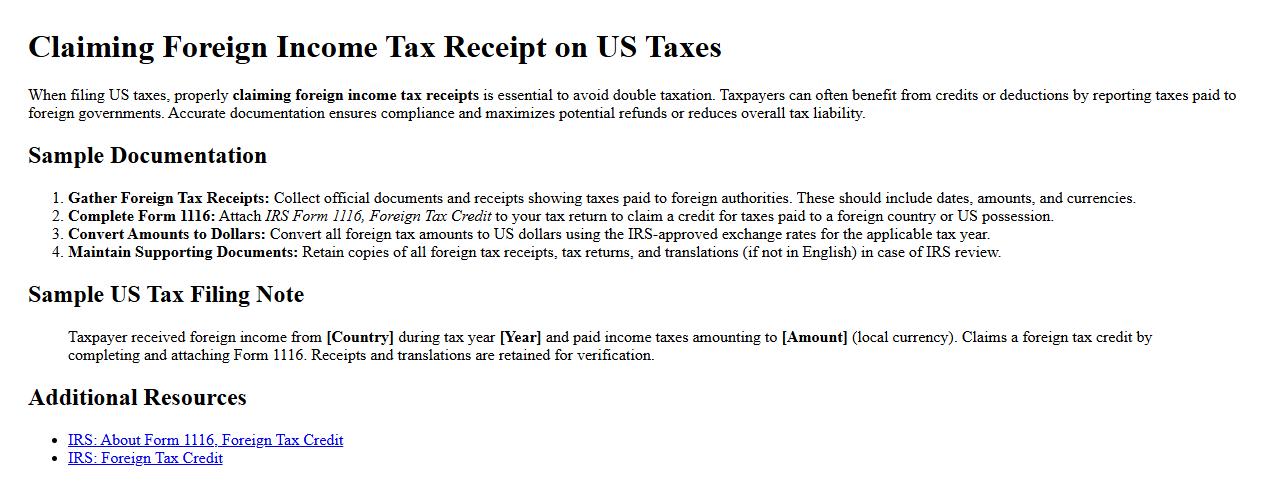

Claiming foreign income tax receipt on US taxes

When filing US taxes, properly claiming foreign income tax receipts is essential to avoid double taxation. Taxpayers can often benefit from credits or deductions by reporting taxes paid to foreign governments. Accurate documentation ensures compliance and maximizes potential refunds or reduces overall tax liability.

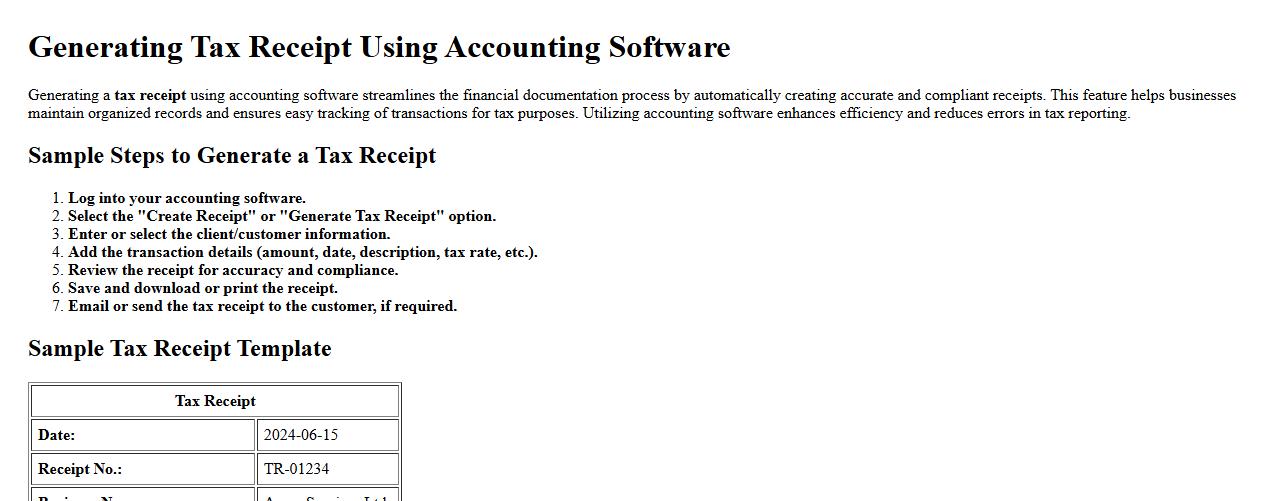

Generating tax receipt using accounting software

Generating a tax receipt using accounting software streamlines the financial documentation process by automatically creating accurate and compliant receipts. This feature helps businesses maintain organized records and ensures easy tracking of transactions for tax purposes. Utilizing accounting software enhances efficiency and reduces errors in tax reporting.

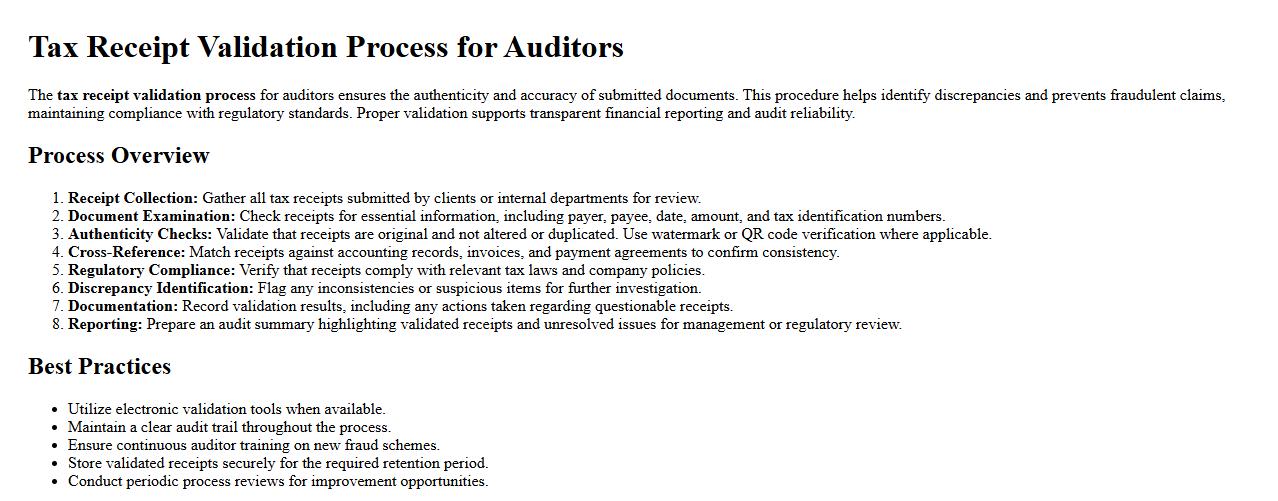

Tax receipt validation process for auditors

The tax receipt validation process for auditors ensures the authenticity and accuracy of submitted documents. This procedure helps identify discrepancies and prevents fraudulent claims, maintaining compliance with regulatory standards. Proper validation supports transparent financial reporting and audit reliability.

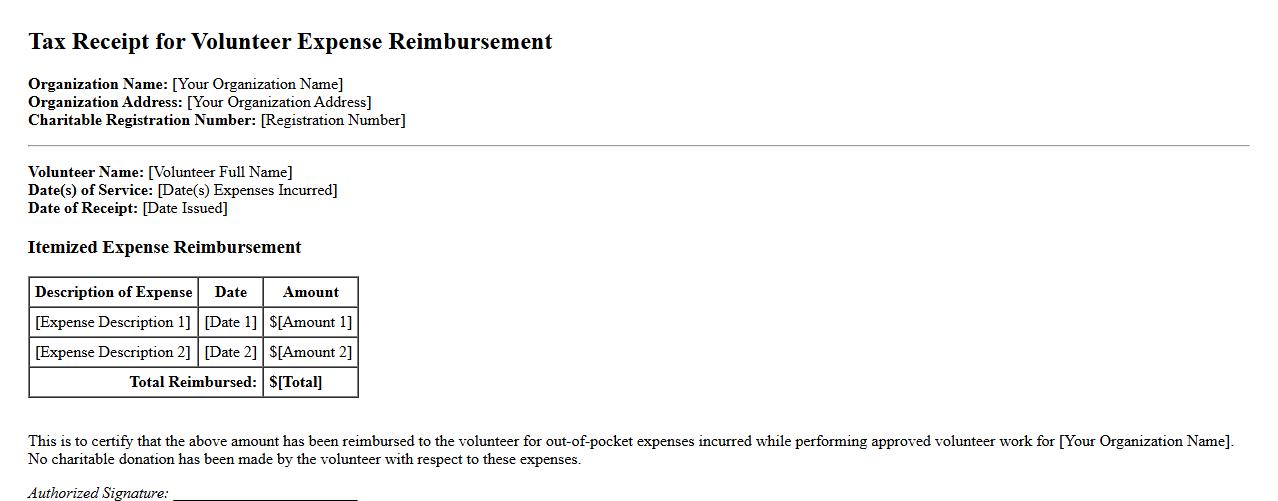

Tax receipt wording for volunteer expense reimbursement

When creating a tax receipt for volunteer expense reimbursement, clearly itemize the reimbursed costs and assert that no donation was made. Ensure the receipt includes the volunteer's name, date of service, and a statement confirming expenses were refunded. This transparency helps both parties maintain accurate financial records for tax purposes.

What supporting documents are required to validate a tax receipt?

To validate a tax receipt, supporting documents such as invoices, payment confirmations, and proof of transaction are essential. These documents help confirm the authenticity and accuracy of the tax receipt. Additionally, any relevant contracts or agreements may be required to further substantiate the transaction.

How can discrepancies on a tax receipt be formally disputed?

Discrepancies on a tax receipt can be formally disputed by submitting a written dispute letter to the issuer, outlining the specific errors. It is important to attach any supporting evidence such as bank statements or correspondence that highlights the discrepancy. Following the issuer's official dispute resolution process ensures that the issue is addressed properly.

Which details on a tax receipt are mandated for audit compliance?

For audit compliance, a tax receipt must include the date of issue, the taxpayer's identification number, and the total amount of the transaction. The description of goods or services provided, along with the applicable tax rate and amount, must also be clearly stated. These details ensure transparency and facilitate accurate auditing processes.

What is the legal retention period for issued tax receipts?

The legal retention period for issued tax receipts typically ranges from 5 to 7 years, depending on jurisdiction and tax authority regulations. This period allows for thorough review during audits or investigations. Businesses are advised to store receipts securely during this time to comply with legal requirements.

How should digital tax receipts be securely archived?

Digital tax receipts should be archived using secure cloud storage or encrypted digital repositories to prevent unauthorized access. Regular backups and access controls are critical to maintaining the integrity and availability of these records. Ensuring compliance with data protection laws is also essential in the archiving process.