A Vehicle Sale Receipt serves as a legal document confirming the transfer of ownership from seller to buyer. It includes essential details such as the vehicle identification number (VIN), sale price, and date of transaction. This receipt protects both parties by providing proof of the sale and terms agreed upon.

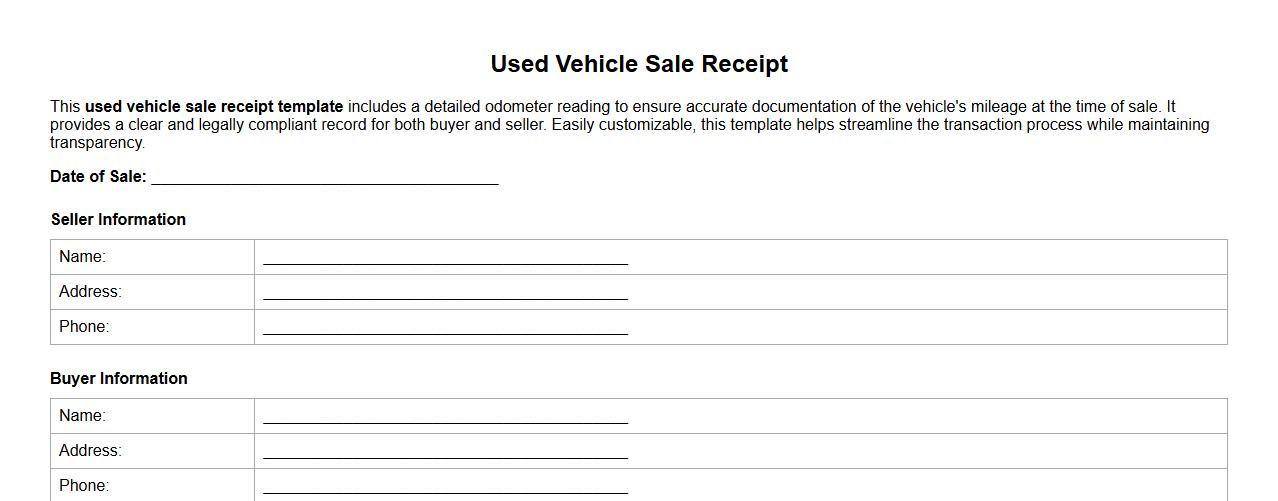

Used vehicle sale receipt template with odometer reading

This used vehicle sale receipt template includes a detailed odometer reading to ensure accurate documentation of the vehicle's mileage at the time of sale. It provides a clear and legally compliant record for both buyer and seller. Easily customizable, this template helps streamline the transaction process while maintaining transparency.

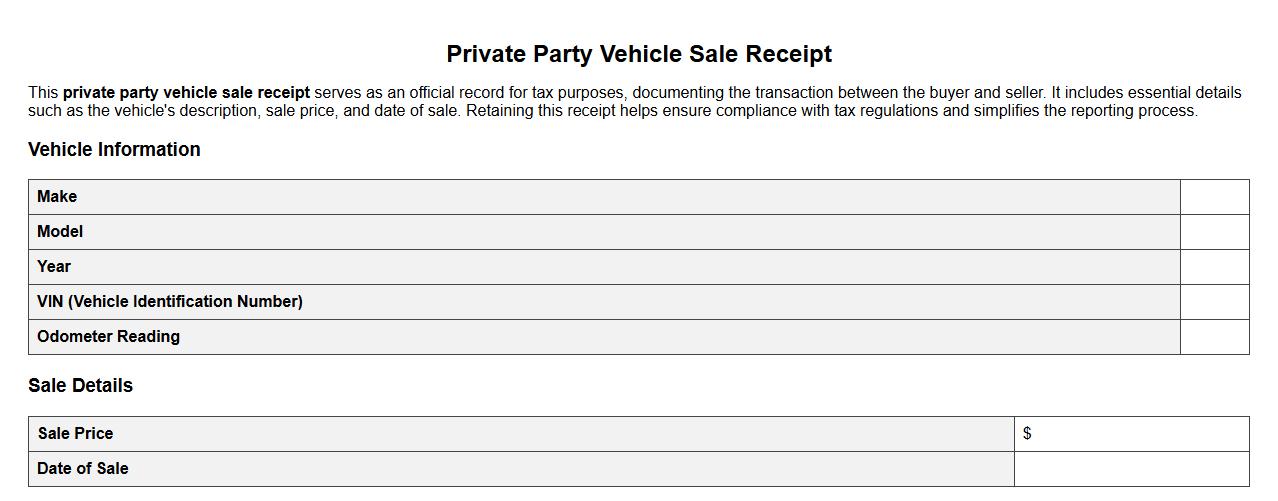

Private party vehicle sale receipt for tax purposes

This private party vehicle sale receipt serves as an official record for tax purposes, documenting the transaction between the buyer and seller. It includes essential details such as the vehicle's description, sale price, and date of sale. Retaining this receipt helps ensure compliance with tax regulations and simplifies the reporting process.

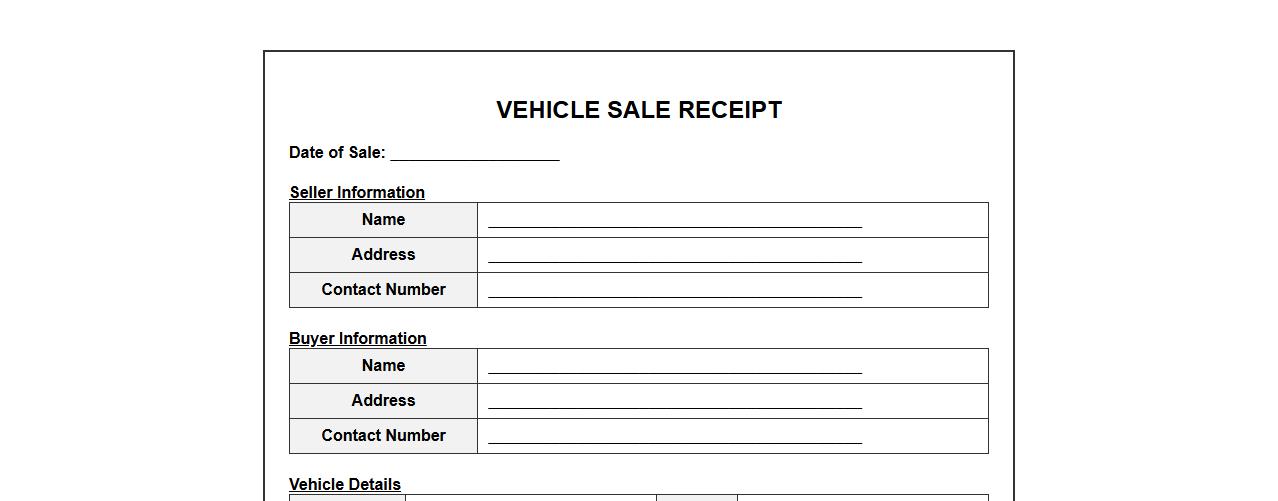

Printable vehicle sale receipt with payment terms

This printable vehicle sale receipt provides a clear record of the transaction, including detailed payment terms to ensure transparency between buyer and seller. It includes essential information such as vehicle details, sale price, and agreed payment schedule. This document serves as a legal proof of sale and payment agreement.

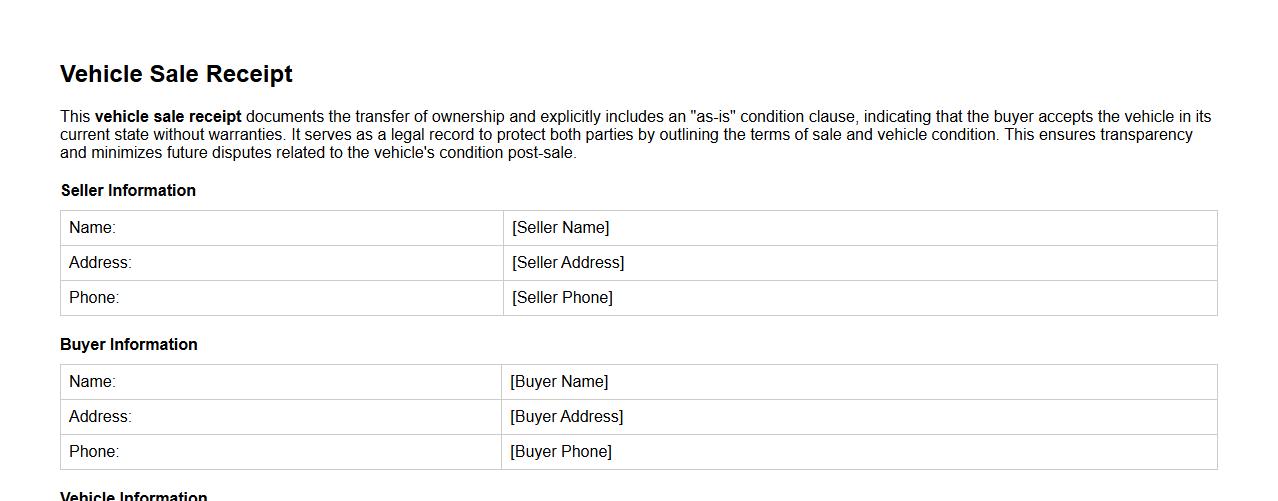

Vehicle sale receipt including as-is condition clause

This vehicle sale receipt documents the transfer of ownership and explicitly includes an "as-is" condition clause, indicating that the buyer accepts the vehicle in its current state without warranties. It serves as a legal record to protect both parties by outlining the terms of sale and vehicle condition. This ensures transparency and minimizes future disputes related to the vehicle's condition post-sale.

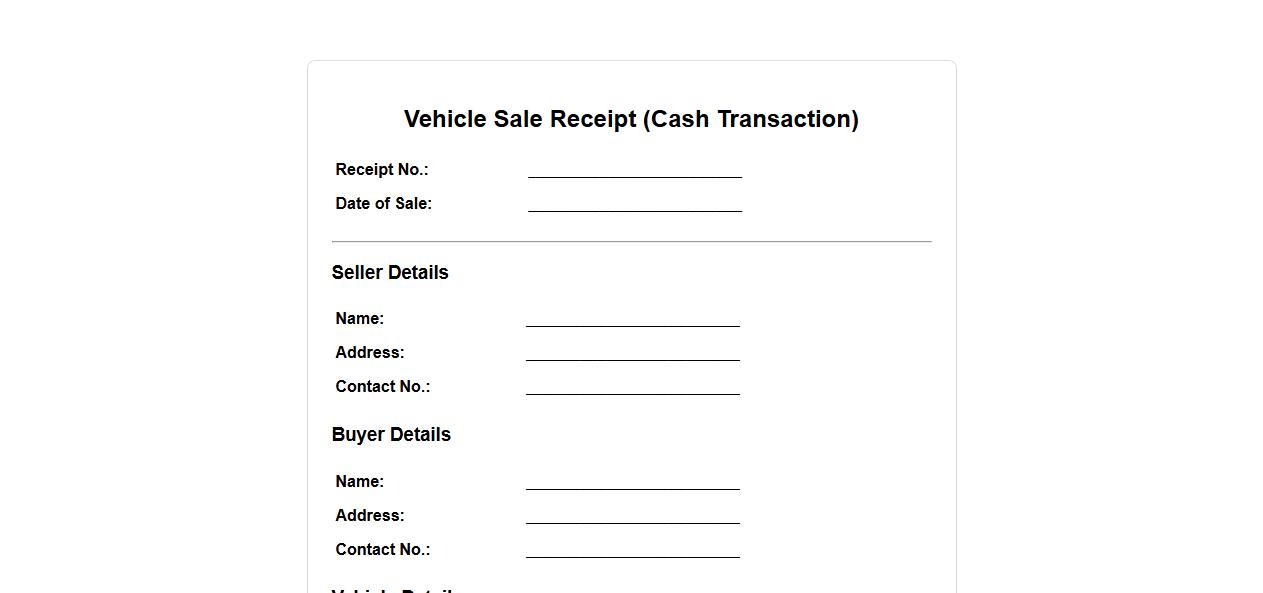

Vehicle sale receipt format for cash transactions

A vehicle sale receipt format for cash transactions ensures clear documentation of the payment and transfer details between the buyer and seller. It includes essential information such as the vehicle description, sale amount, date, and signatures to validate the transaction. This receipt serves as proof of ownership and protects both parties in case of future disputes.

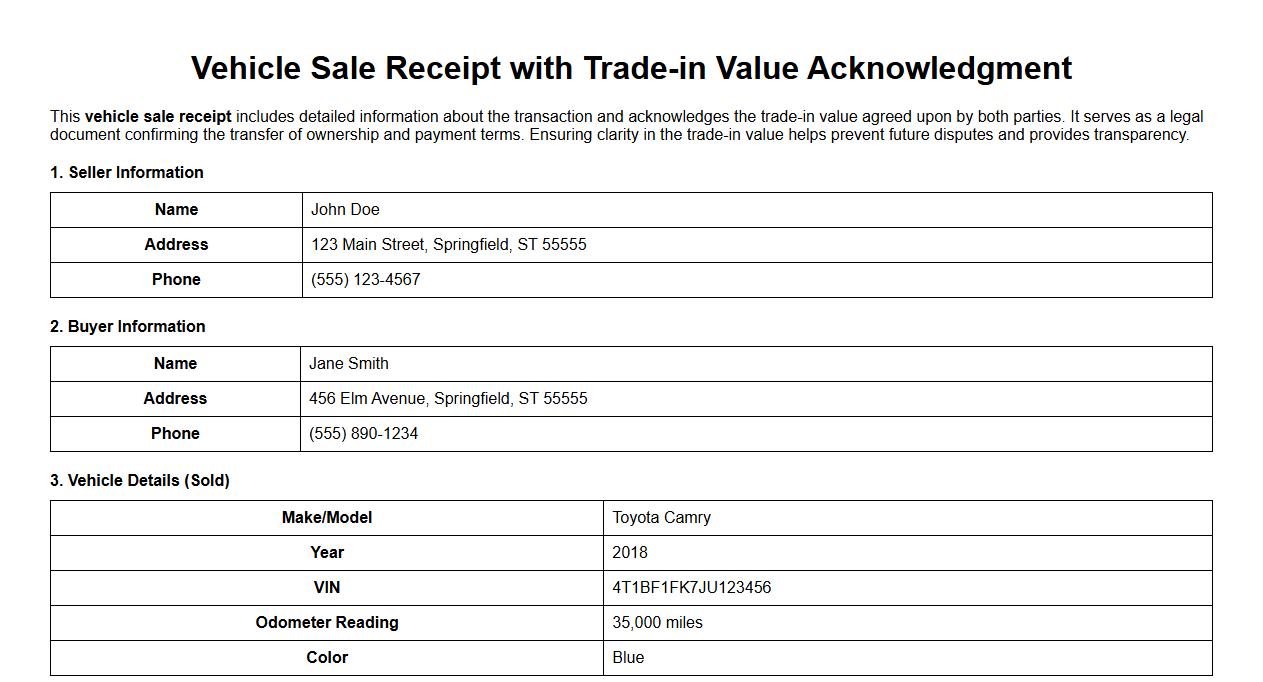

Vehicle sale receipt with trade-in value acknowledgment

This vehicle sale receipt includes detailed information about the transaction and acknowledges the trade-in value agreed upon by both parties. It serves as a legal document confirming the transfer of ownership and payment terms. Ensuring clarity in the trade-in value helps prevent future disputes and provides transparency.

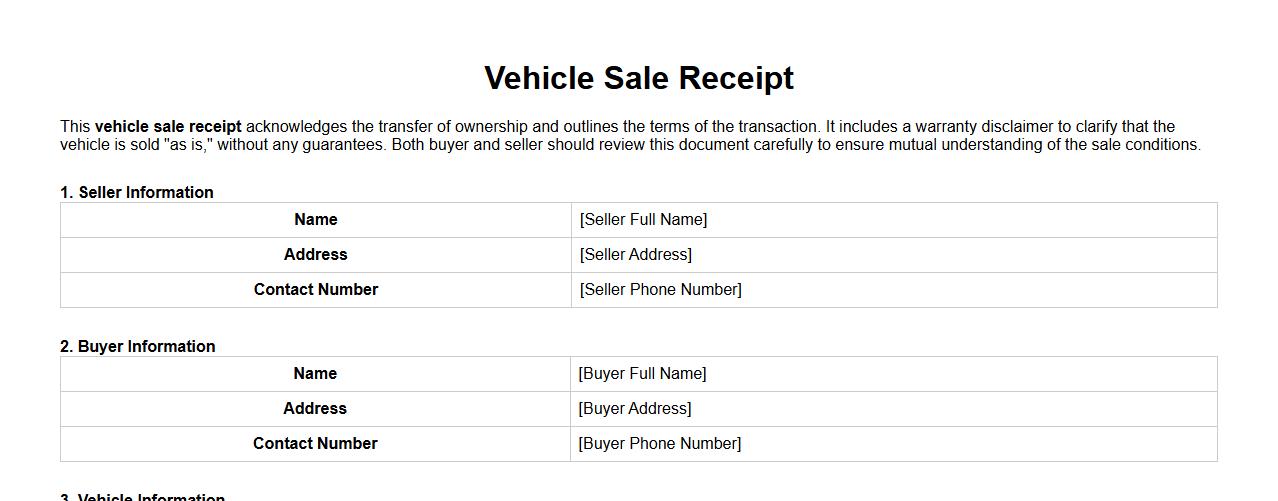

Vehicle sale receipt with warranty disclaimer

This vehicle sale receipt acknowledges the transfer of ownership and outlines the terms of the transaction. It includes a warranty disclaimer to clarify that the vehicle is sold "as is," without any guarantees. Both buyer and seller should review this document carefully to ensure mutual understanding of the sale conditions.

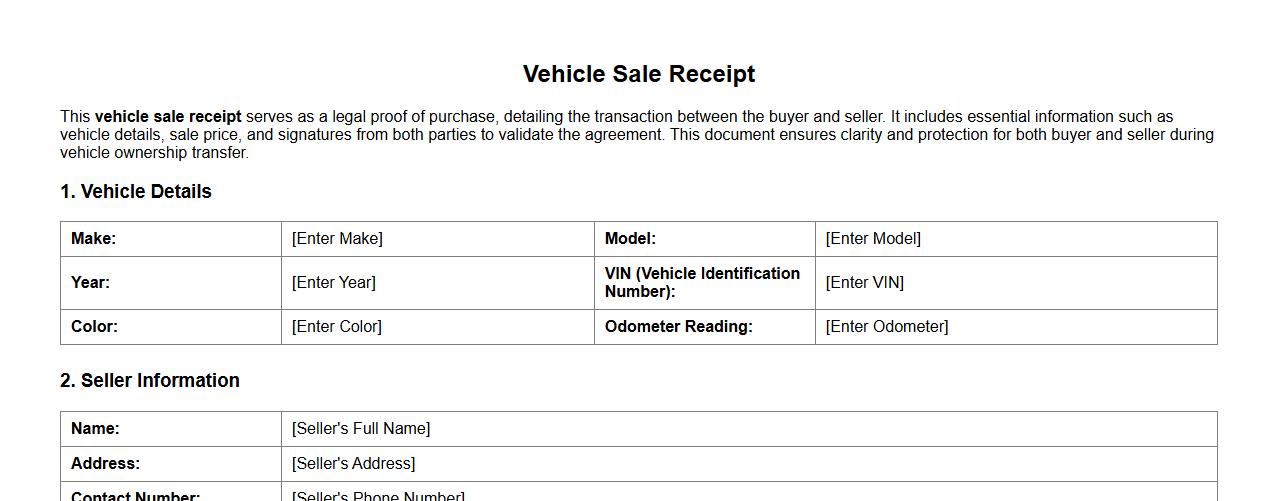

Vehicle sale receipt with buyer and seller signatures

This vehicle sale receipt serves as a legal proof of purchase, detailing the transaction between the buyer and seller. It includes essential information such as vehicle details, sale price, and signatures from both parties to validate the agreement. This document ensures clarity and protection for both buyer and seller during vehicle ownership transfer.

State-specific vehicle sale receipt requirements

Each state has vehicle sale receipt requirements that vary significantly, including necessary details and format. These regulations ensure proper documentation for legal ownership transfer and tax purposes. Buyers and sellers must adhere to their state's specific rules to validate the transaction.

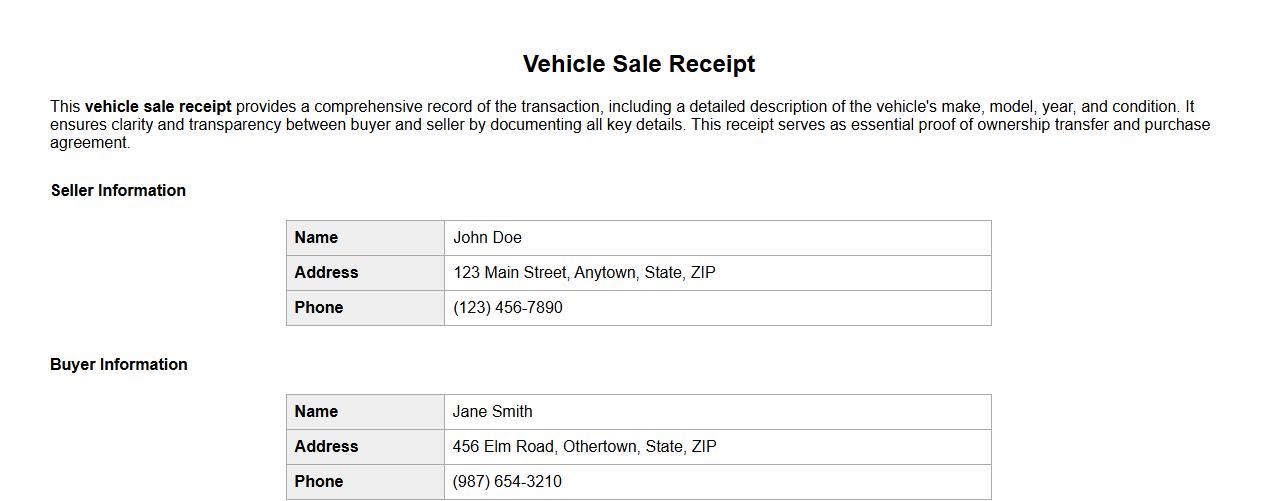

Vehicle sale receipt with detailed vehicle description

This vehicle sale receipt provides a comprehensive record of the transaction, including a detailed description of the vehicle's make, model, year, and condition. It ensures clarity and transparency between buyer and seller by documenting all key details. This receipt serves as essential proof of ownership transfer and purchase agreement.

What details must be included in a legally valid vehicle sale receipt?

A legally valid vehicle sale receipt must include the full names and addresses of both the buyer and seller. It should clearly state the vehicle identification number (VIN), make, model, year, and sale price of the vehicle. Additionally, the date of sale and terms of payment must be specified to ensure complete documentation.

How can odometer readings be accurately documented on a vehicle sale receipt?

To accurately document odometer readings, the receipt should include the exact mileage displayed on the vehicle at the time of sale. This reading must be clearly stated in both numeric and written form to avoid disputes. It is also advisable to note any discrepancies or known inaccuracies related to the odometer reading.

What are common mistakes to avoid when drafting a vehicle sale receipt?

Common mistakes include omitting essential details such as the VIN or sale price, which can lead to legal complications. Another error is failing to specify the condition of the vehicle, potentially causing disputes post-sale. Finally, neglecting to include signatures or using vague language can render the receipt invalid.

How does one address as-is condition clauses in a vehicle sale receipt?

The as-is condition clause should be explicitly stated to clarify that the buyer accepts the vehicle with all faults. This clause protects the seller from future liability regarding vehicle defects or issues. Including this statement in clear language is crucial for enforceability and transparency.

What signatures are required for a vehicle sale receipt to be enforceable?

For a vehicle sale receipt to be enforceable, it must contain the signatures of both the buyer and the seller. These signatures confirm mutual agreement to the sale terms documented in the receipt. In some jurisdictions, witness signatures or notarization may be required to enhance validity.