A Salary Receipt is an official document issued by an employer to an employee as proof of payment for work done during a specific period. It typically includes details such as the employee's name, salary amount, payment date, deductions, and net salary. This receipt serves as evidence for both the employee and employer in financial and tax-related matters.

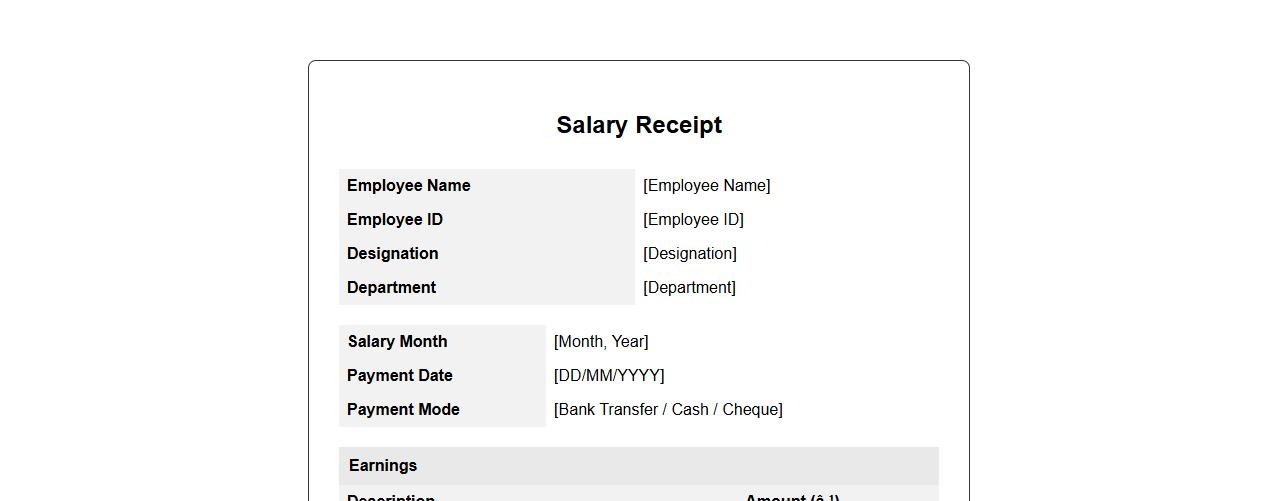

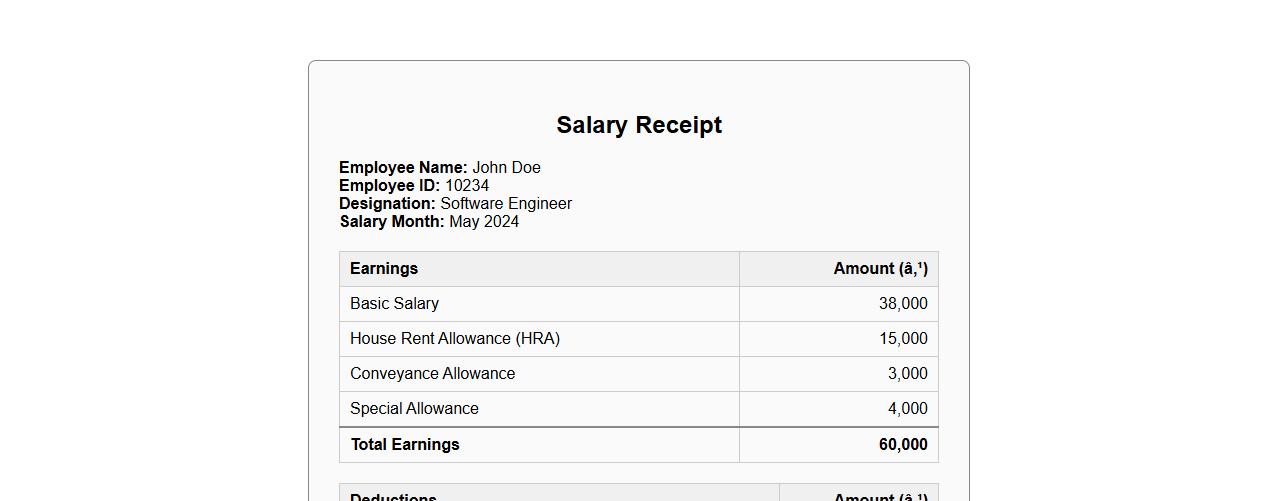

Salary receipt format for monthly employees

Creating a salary receipt format for monthly employees ensures clear documentation of wage payments and deductions. This format typically includes employee details, payment period, gross salary, deductions, and net pay. Proper salary receipts help maintain transparency and serve as official proof of income for both employers and employees.

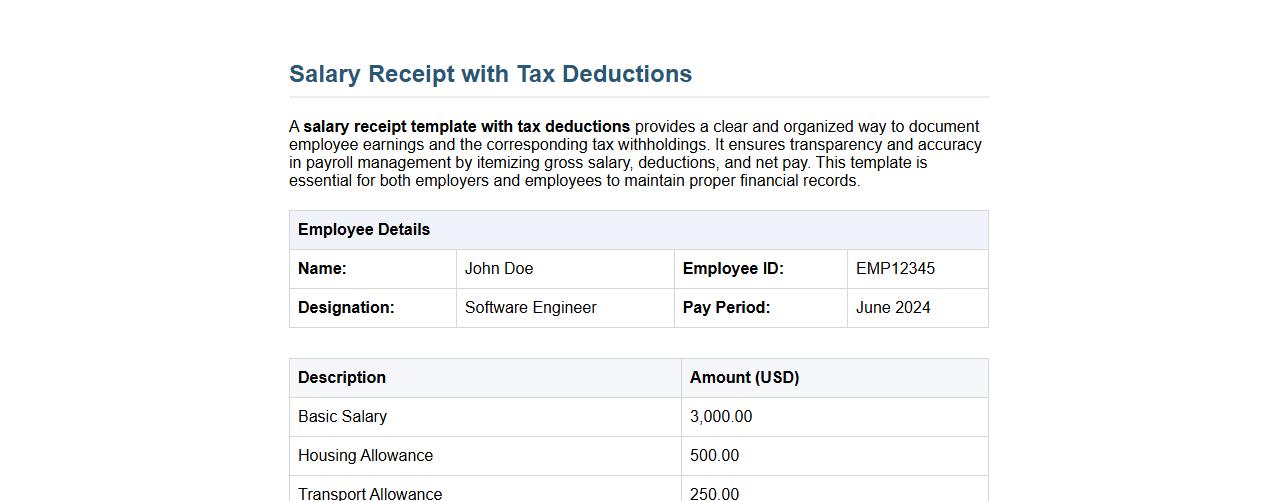

Salary receipt template with tax deductions

A salary receipt template with tax deductions provides a clear and organized way to document employee earnings and the corresponding tax withholdings. It ensures transparency and accuracy in payroll management by itemizing gross salary, deductions, and net pay. This template is essential for both employers and employees to maintain proper financial records.

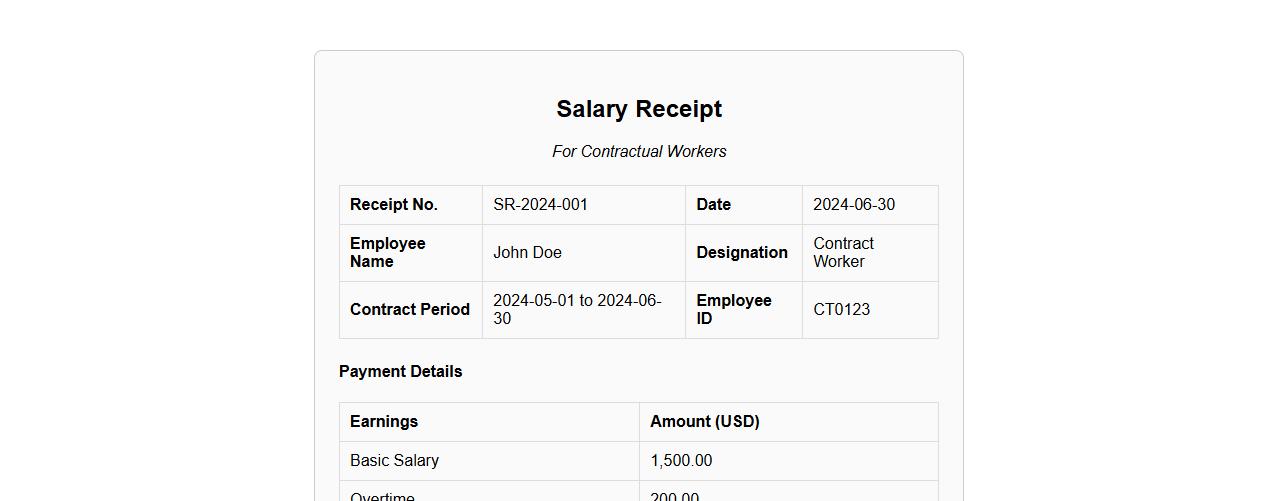

Salary receipt sample for contractual workers

A salary receipt sample for contractual workers provides a clear and professional format to document payment details, including the amount, payment date, and deductions if any. It ensures transparency and serves as an essential proof of income for contractual employees. Using a standardized salary receipt helps maintain accurate financial records and enhances trust between employers and workers.

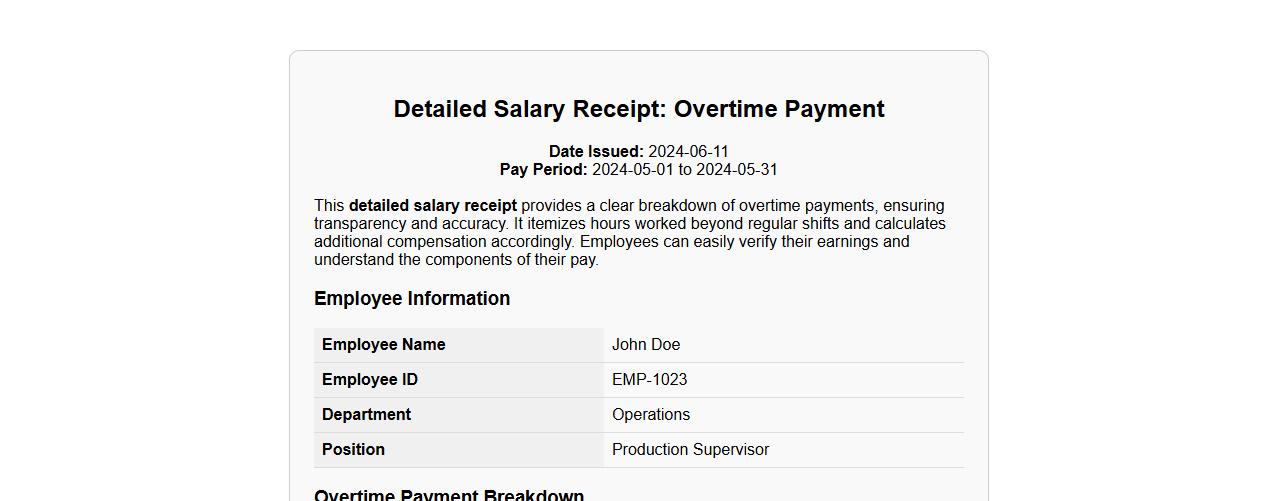

Detailed salary receipt for overtime payment

This detailed salary receipt provides a clear breakdown of overtime payments, ensuring transparency and accuracy. It itemizes hours worked beyond regular shifts and calculates additional compensation accordingly. Employees can easily verify their earnings and understand the components of their pay.

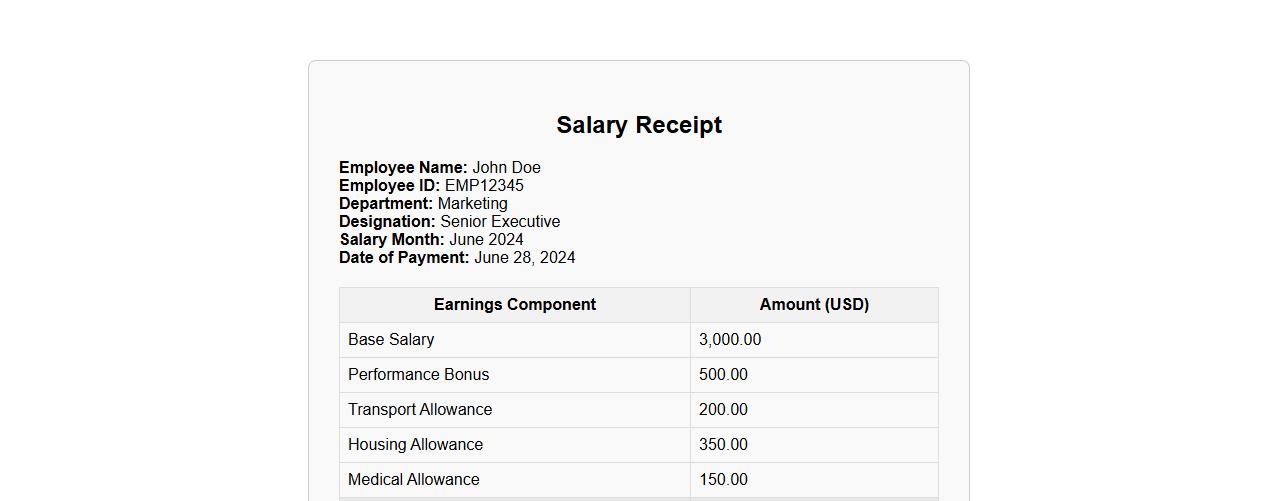

Salary receipt with bonus and allowances included

A salary receipt provides a detailed breakdown of an employee's earnings, including the base salary, bonuses, and various allowances. This document ensures transparency by itemizing each component of the total remuneration. It serves as an official record for both the employer and employee regarding compensation received.

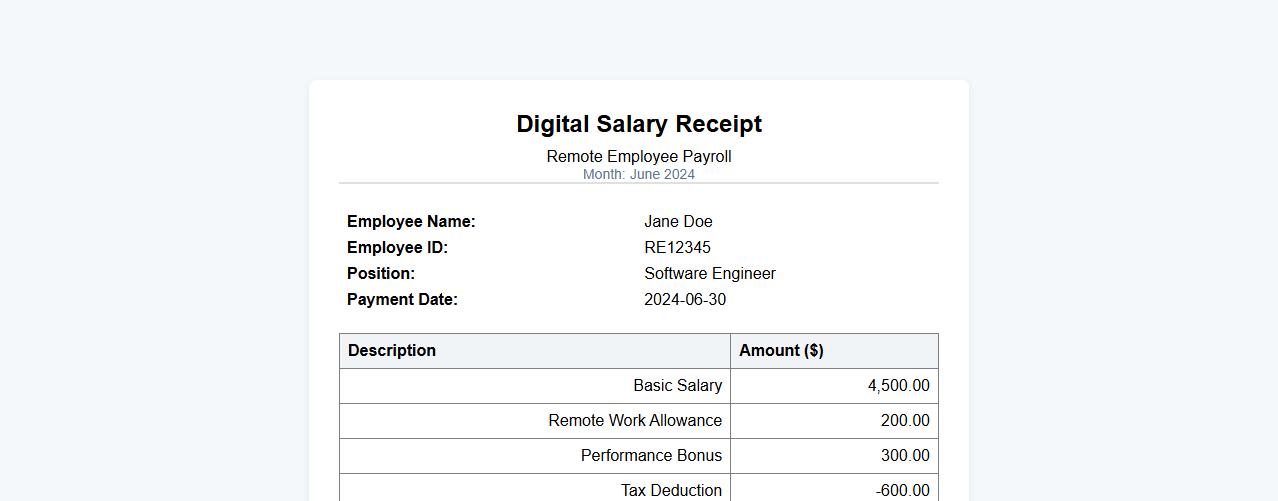

Digital salary receipt for remote employees

A digital salary receipt provides remote employees with a secure and convenient way to access their payment details online. It ensures transparency by clearly itemizing earnings, deductions, and net pay. This electronic document streamlines payroll processes and supports eco-friendly practices.

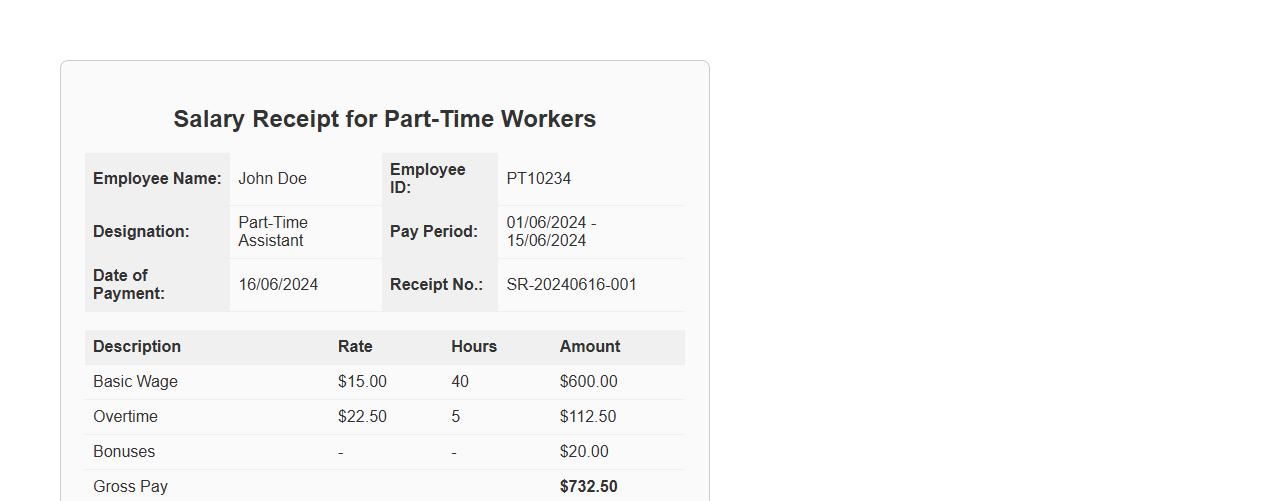

Salary receipt for part-time workers

A salary receipt for part-time workers provides a detailed record of earnings, hours worked, and deductions. It ensures transparency and helps employees track their income and benefits accurately. This document is essential for both employers and part-time employees to maintain clear financial records.

Salary receipt showing provident fund contributions

A salary receipt details an employee's earnings along with deductions such as provident fund contributions. It provides a clear record of the amount contributed towards the retirement fund for the given salary period. This document is essential for financial transparency and future reference.

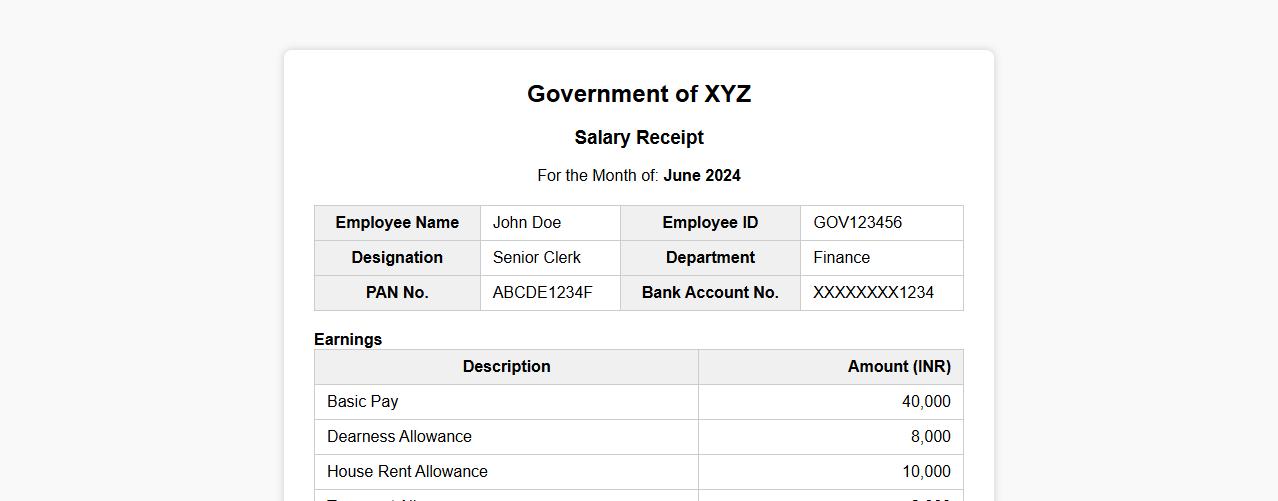

Salary receipt for government employees

A salary receipt for government employees provides a detailed record of monthly earnings, including basic pay, allowances, and deductions. This document serves as an official proof of income and is essential for financial verification and tax purposes. Ensuring accuracy in the salary receipt helps maintain transparency between the employee and the government payroll department.

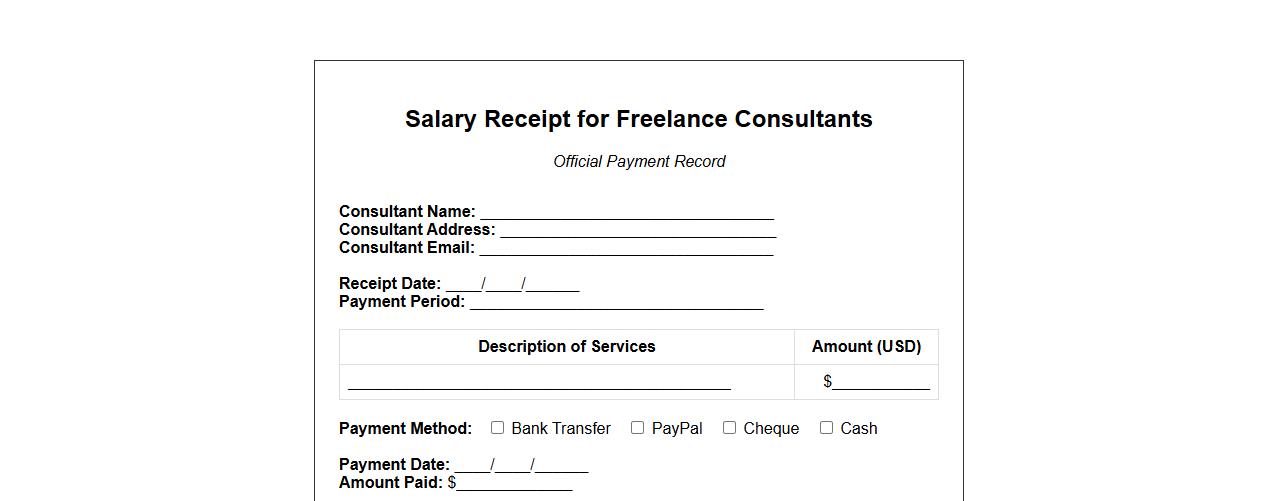

Salary receipt for freelance consultants

A salary receipt for freelance consultants is an official document that details the payment made to independent contractors for their services. It includes essential information such as the consultant's name, payment date, amount, and payment method. This receipt ensures transparency and serves as proof of income for both parties.

What legal details must be included in a salary receipt letter for compliance?

A legal salary receipt letter must include the employee's name, designation, and employee ID to ensure clear identification. It should detail the payment period, amount paid, and the date of payment for transparency. Additionally, including tax deductions, social security contributions, and other statutory details is essential for full compliance.

How do you address salary adjustments or deductions in a receipt letter?

Salary adjustments or deductions must be clearly itemized in the receipt letter to provide complete transparency. Each deduction should specify its nature such as taxes, loans, or benefits, along with the corresponding amounts. This clarity helps in avoiding disputes and ensures accurate record keeping.

What format is recommended for digital salary receipt letters?

A digital salary receipt letter should be in PDF format to ensure compatibility and preserve the document's integrity. It is advisable to include a company header, employee details, payment breakdown, and a digital signature for authenticity. Proper formatting and encryption further enhance security and accessibility.

How can confidentiality be ensured when issuing salary receipt letters?

Confidentiality is maintained by distributing salary receipt letters through secure channels such as encrypted email or protected employee portals. Access should be restricted exclusively to the employee and authorized HR personnel. Implementing password protection and data encryption significantly reduces the risk of unauthorized access.

Which supporting documents should accompany a salary receipt letter?

Supporting documents like payslips, tax deduction statements, and social security contribution proofs should accompany the salary receipt letter. These documents provide detailed verification and audit trails required for financial and legal purposes. Including them enhances the transparency and reliability of the salary payment process.