A Purchase Receipt is a vital document that confirms the transaction between a buyer and a seller, detailing the items purchased, their quantities, prices, and the total amount paid. This receipt serves as proof of purchase, facilitating returns, exchanges, and warranty claims. Maintaining accurate Purchase Receipt records is essential for both personal budgeting and business accounting purposes.

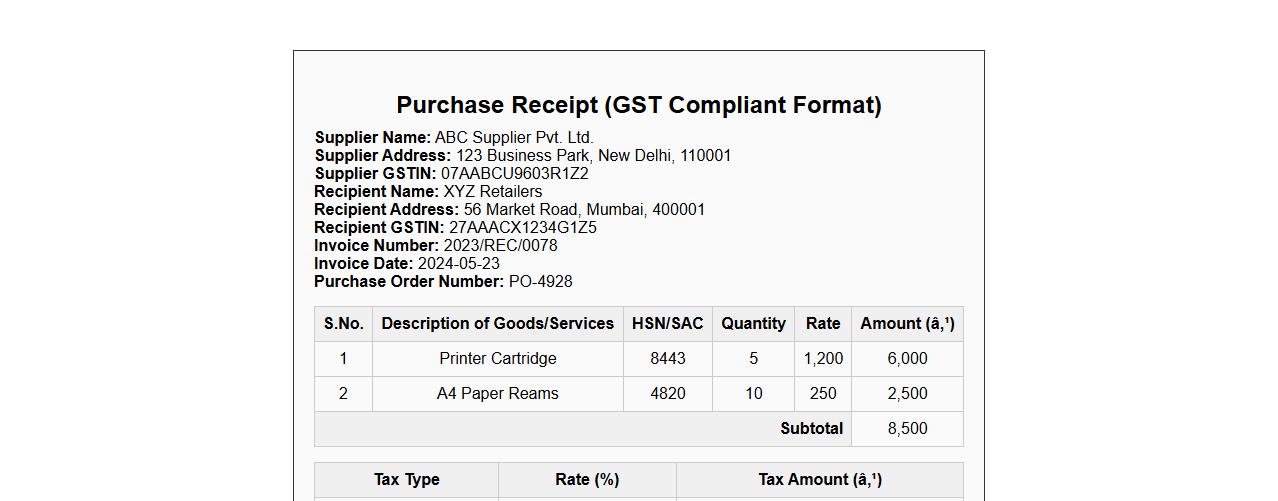

Purchase receipt format for GST compliance

Ensure your purchase receipt format meets all GST compliance requirements by including essential details such as supplier information, GSTIN, invoice number, date, and tax breakdown. A well-structured receipt facilitates seamless tax filing and audit processes. Adopting this format minimizes errors and enhances financial transparency.

Digital purchase receipt template for small business

Streamline your transaction records with this digital purchase receipt template designed specifically for small businesses. Easily customize and send professional receipts to customers, enhancing your business's credibility. This template simplifies bookkeeping and ensures clear, organized documentation of every sale.

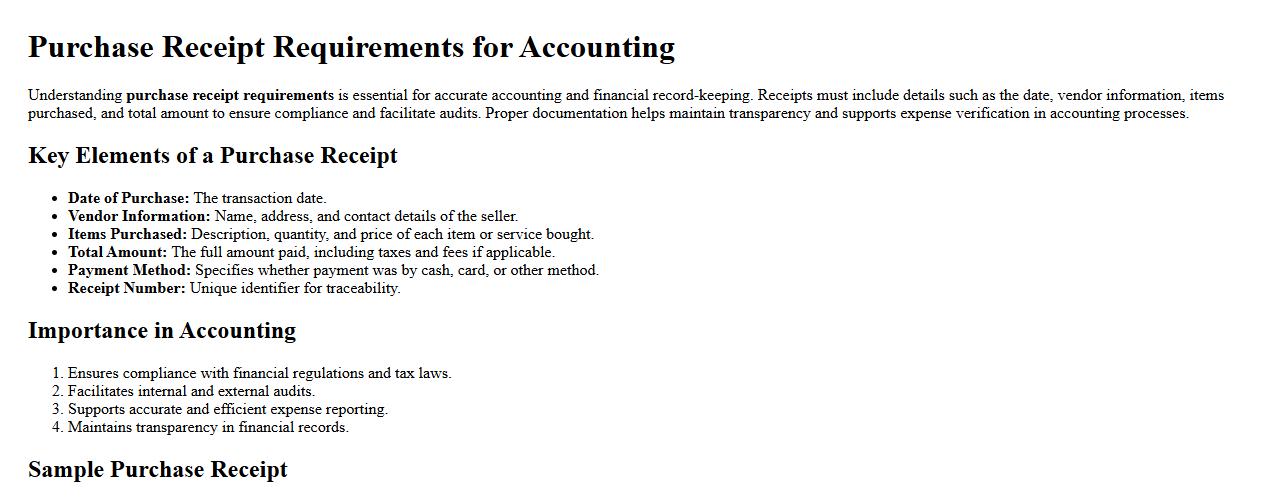

Purchase receipt requirements for accounting

Understanding purchase receipt requirements is essential for accurate accounting and financial record-keeping. Receipts must include details such as the date, vendor information, items purchased, and total amount to ensure compliance and facilitate audits. Proper documentation helps maintain transparency and supports expense verification in accounting processes.

How to verify authenticity of a purchase receipt

To verify the authenticity of a purchase receipt, carefully examine the receipt details such as date, store information, and itemized list for consistency. Cross-check the receipt against your bank statement or transaction history to confirm the purchase. Additionally, look for security features like watermarks or QR codes that indicate a legitimate document.

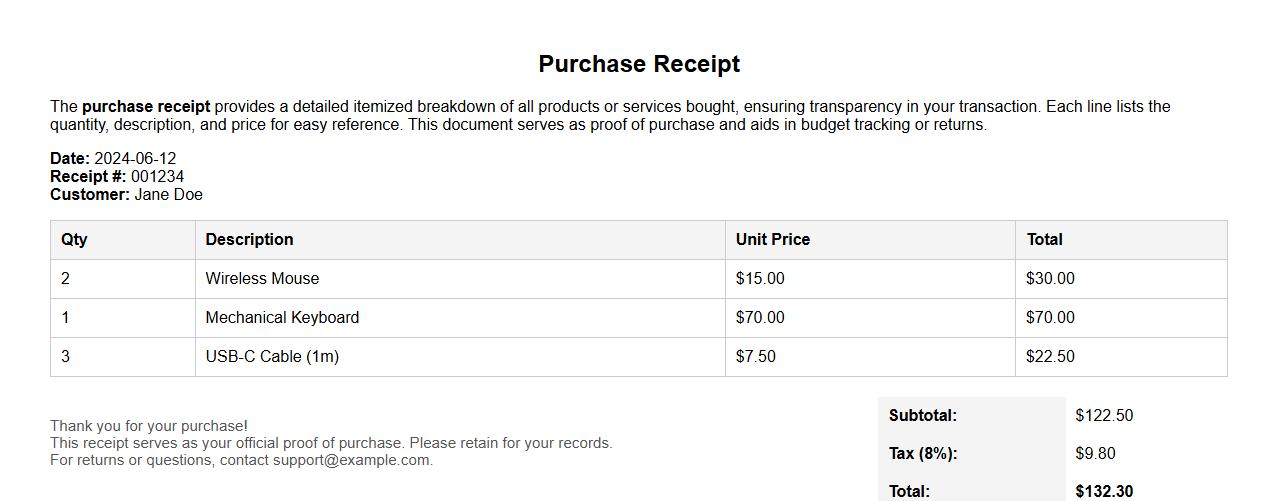

Purchase receipt with itemized breakdown

The purchase receipt provides a detailed itemized breakdown of all products or services bought, ensuring transparency in your transaction. Each line lists the quantity, description, and price for easy reference. This document serves as proof of purchase and aids in budget tracking or returns.

Lost purchase receipt recovery process

The lost purchase receipt recovery process helps customers retrieve proof of their transactions efficiently. By verifying purchase details, companies can reissue receipts or provide necessary documentation. This service ensures smooth processing of returns, warranties, and expense claims.

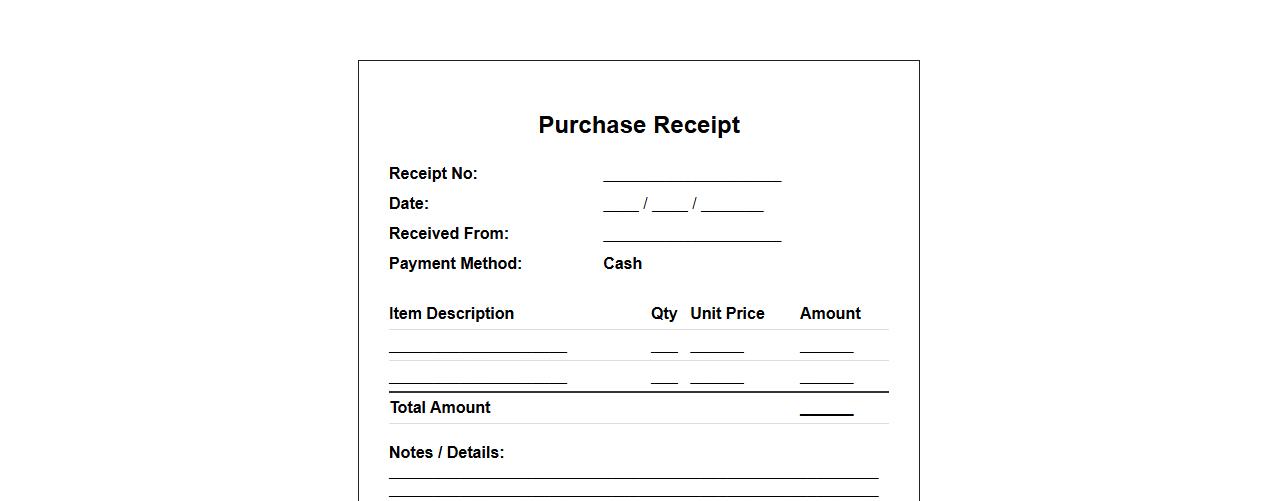

Printable purchase receipt for cash transactions

This printable purchase receipt is designed specifically for cash transactions, providing an easy and clear record of your payment. It includes all essential details such as the date, amount, and items purchased, ensuring transparency and accountability. Keeping this receipt helps both buyers and sellers maintain accurate financial records.

Purchase receipt policy for employee reimbursements

Our purchase receipt policy ensures all employee reimbursements are supported by valid receipts to maintain transparency and accountability. Employees must submit itemized receipts within the specified timeframe for approval. This process helps streamline expense verification and compliance with company financial regulations.

Purchase receipt with QR code for tracking

Receive your purchase receipt featuring a QR code for effortless tracking and verification of your order. Simply scan the code to access real-time updates and detailed information about your purchase. This convenient system ensures a smooth and transparent shopping experience.

Automated purchase receipt generation software

Our automated purchase receipt generation software streamlines the process of creating and sending purchase receipts instantly. This efficient tool reduces manual errors and saves time by generating accurate receipts with minimal input. Ideal for businesses seeking to enhance transaction transparency and customer satisfaction.

How do you verify the authenticity of a digital purchase receipt?

To verify the authenticity of a digital purchase receipt, check for unique identifiers such as transaction IDs and digital signatures. Confirm the receipt details against the vendor's official records or payment gateway. Additionally, ensure the receipt includes accurate timestamps and corresponds to the actual purchased item or service.

What key legal elements must a purchase receipt document include?

A valid purchase receipt must contain the date of purchase, the seller's identity, and the description of goods or services sold. It should clearly state the total price paid, including any taxes or fees. Lastly, the receipt must include payment method details to establish proof of transaction legally.

How should sensitive buyer information be redacted on shared purchase receipts?

When sharing purchase receipts, sensitive buyer information such as full credit card numbers or personal addresses should be carefully redacted. Use digital tools to blur or mask such data without altering the receipt's validity. This protects privacy while maintaining proof of purchase for necessary verification.

What are the common errors found in handwritten purchase receipts?

Common errors in handwritten purchase receipts include missing or unclear date entries, incorrect or illegible item descriptions, and inconsistent pricing details. Additionally, signatures may be absent or questionable, affecting receipt validity. Such errors can lead to disputes and difficulties in record-keeping or refunds.

How does international law affect the validity of purchase receipts across borders?

International law can impact the validity of purchase receipts by imposing differing regulations on transaction documentation and consumer rights. Receipts must comply with the legal requirements of both the seller's and buyer's countries for enforceability. This ensures proper recognition in disputes and grant of warranties globally.