A Donation Receipt serves as an official document acknowledging a contribution made to a charitable organization. It typically includes important details such as the donor's name, donation amount, date, and the recipient organization's information. This receipt is essential for tax deduction purposes and helps maintain transparency in charitable giving.

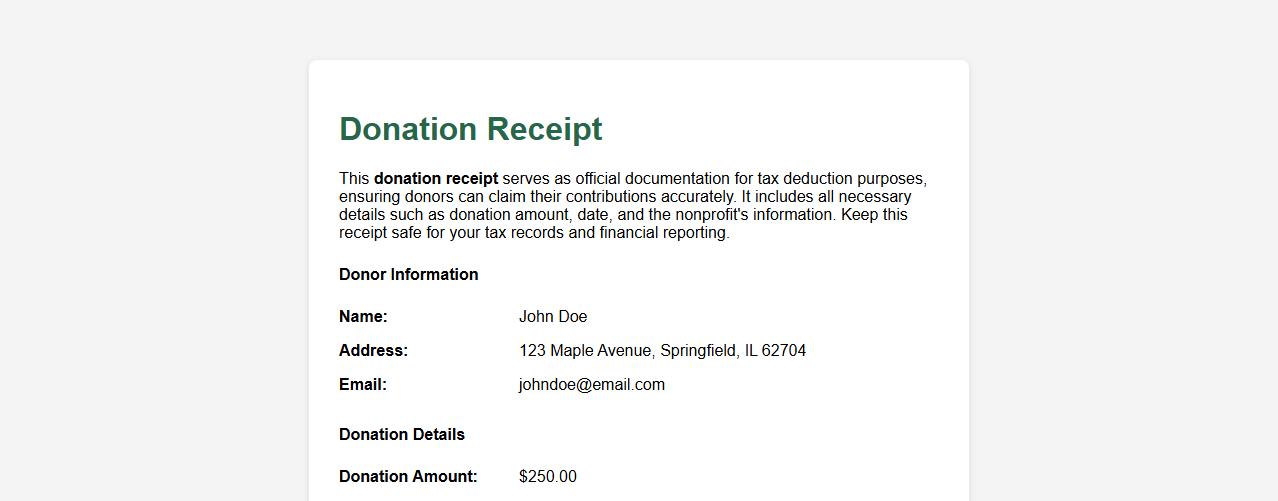

Donation receipt for tax deduction purposes

This donation receipt serves as official documentation for tax deduction purposes, ensuring donors can claim their contributions accurately. It includes all necessary details such as donation amount, date, and the nonprofit's information. Keep this receipt safe for your tax records and financial reporting.

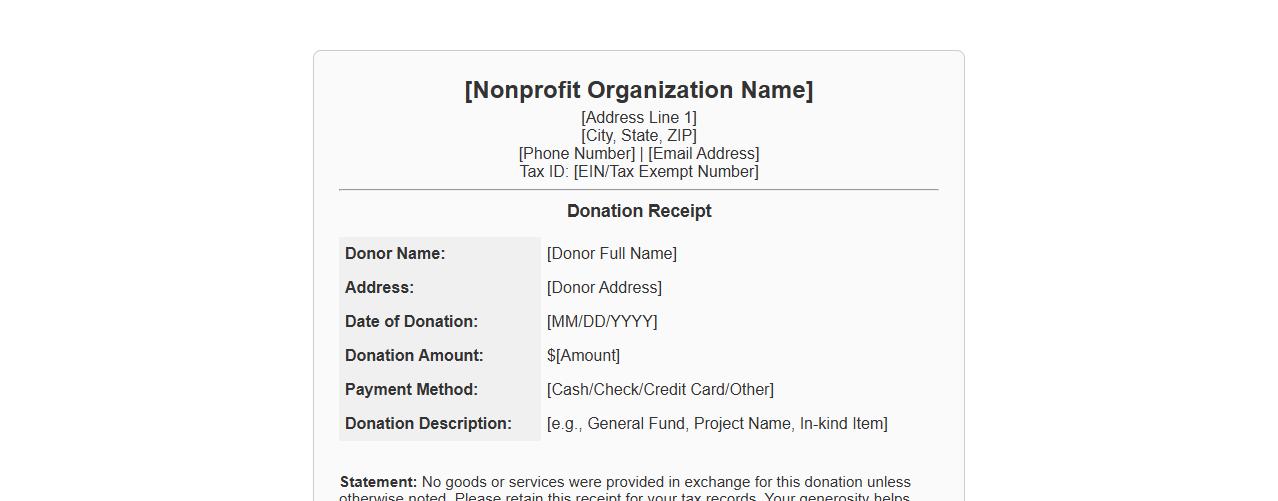

Nonprofit organization donation receipt template

This nonprofit organization donation receipt template provides a clear and professional format for acknowledging contributions. It ensures transparency and trust by detailing donor information, donation amount, and date for tax purposes. Utilize this template to simplify record-keeping and enhance donor relations.

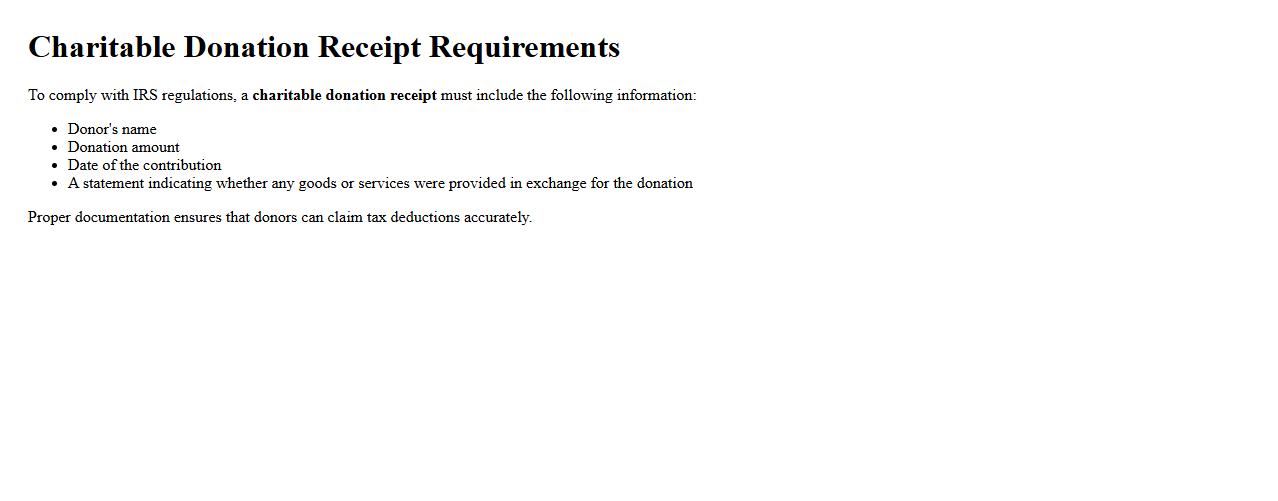

Charitable donation receipt requirements IRS

To comply with IRS regulations, a charitable donation receipt must include the donor's name, the donation amount, and the date of the contribution. The receipt should also state whether any goods or services were provided in exchange for the donation. Proper documentation ensures that donors can claim tax deductions accurately.

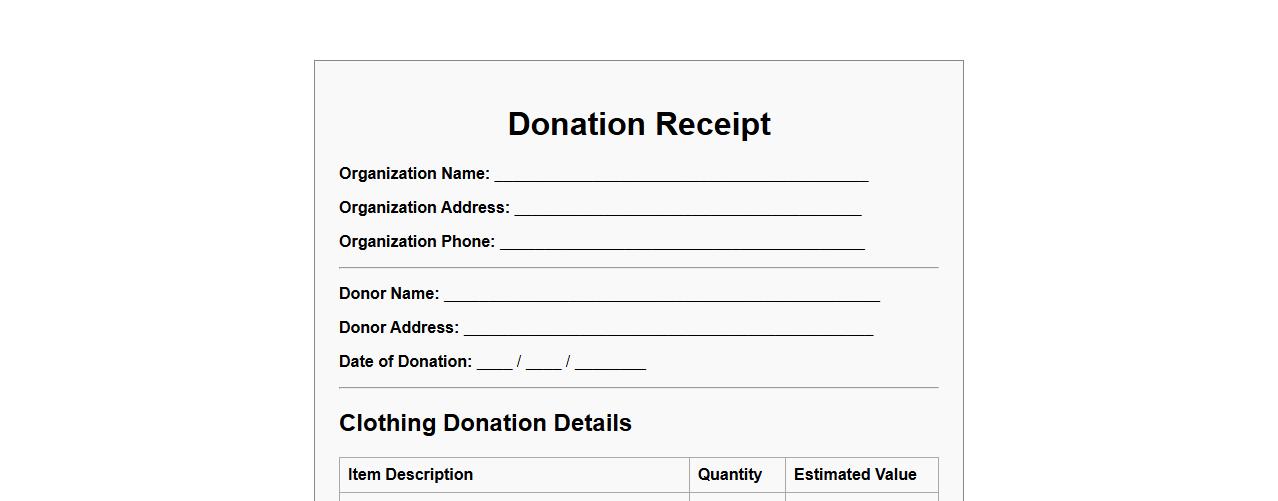

Printable donation receipt for clothing donations

Generate a printable donation receipt for clothing donations to ensure proper documentation and tax benefits. This receipt provides a detailed record of the donated items and their estimated value. It is essential for both donors and organizations to maintain transparency and accountability.

Online donation receipt for recurring gifts

Receive an organized and detailed online donation receipt for your recurring gifts, ensuring transparency and easy record-keeping. This receipt provides clear information about each contribution, helping you track your generosity over time. Conveniently access and download your donation history anytime for tax and personal use.

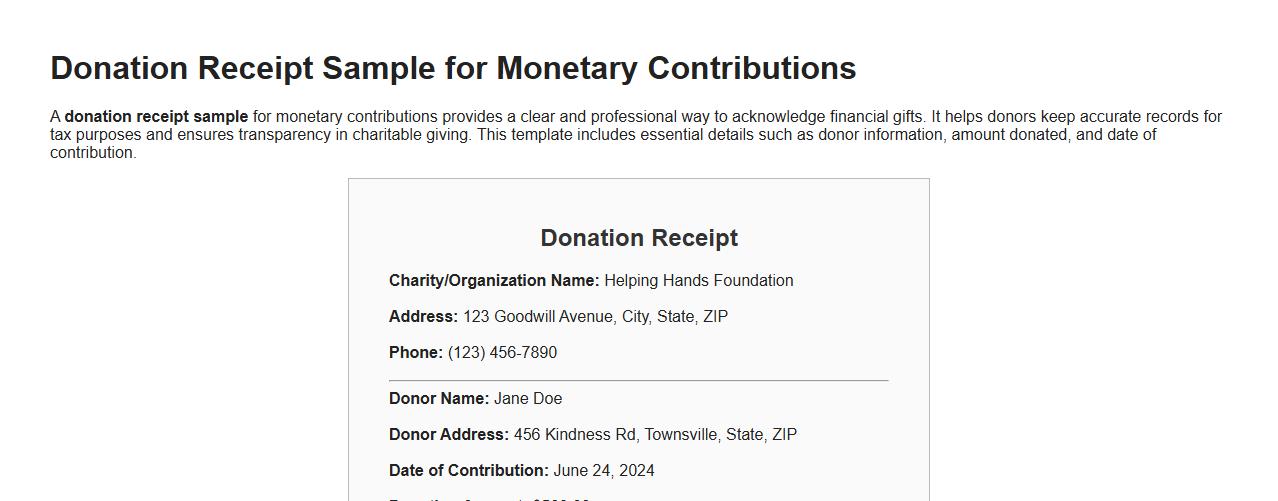

Donation receipt sample for monetary contributions

A donation receipt sample for monetary contributions provides a clear and professional way to acknowledge financial gifts. It helps donors keep accurate records for tax purposes and ensures transparency in charitable giving. This template includes essential details such as donor information, amount donated, and date of contribution.

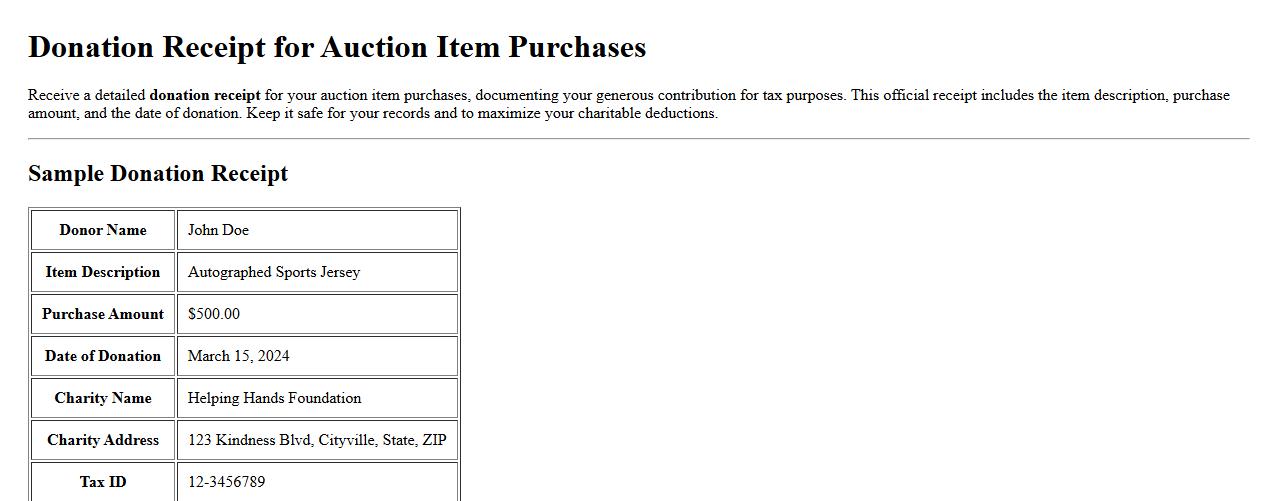

Donation receipt for auction item purchases

Receive a detailed donation receipt for your auction item purchases, documenting your generous contribution for tax purposes. This official receipt includes the item description, purchase amount, and the date of donation. Keep it safe for your records and to maximize your charitable deductions.

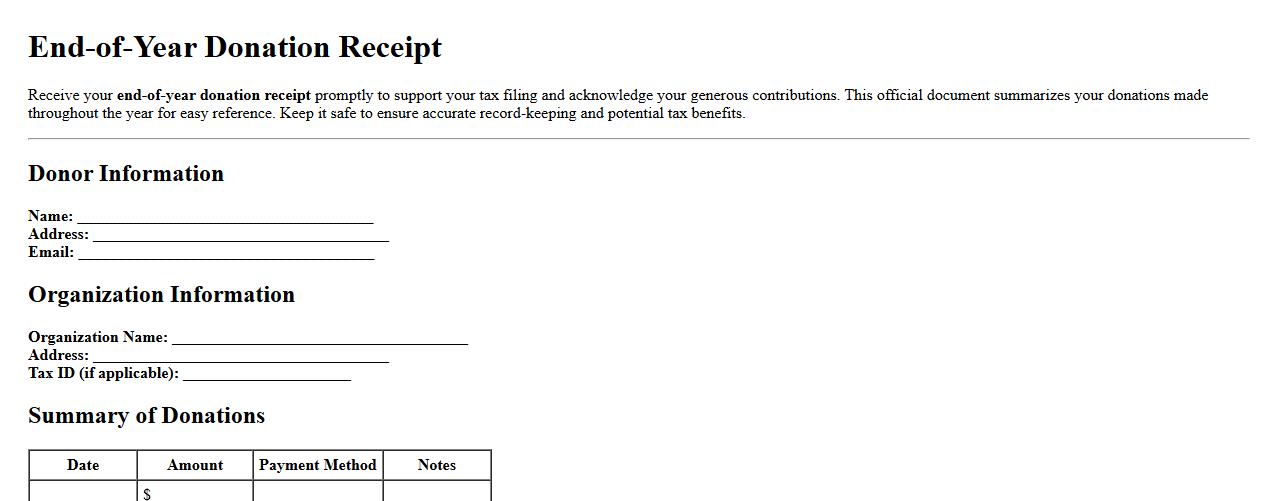

End-of-year donation receipt for donors

Receive your end-of-year donation receipt promptly to support your tax filing and acknowledge your generous contributions. This official document summarizes your donations made throughout the year for easy reference. Keep it safe to ensure accurate record-keeping and potential tax benefits.

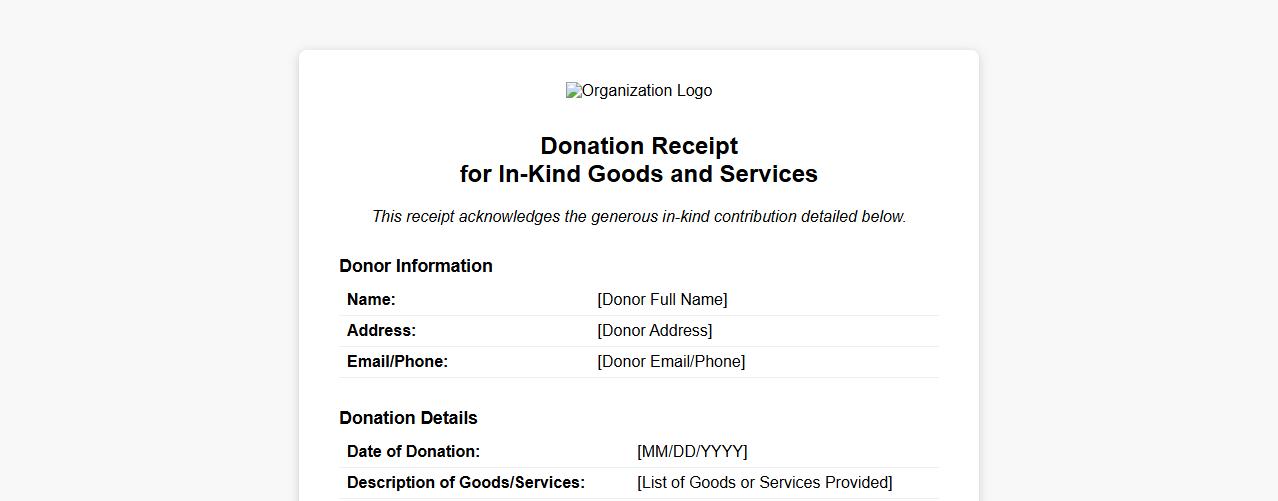

Donation receipt for in-kind goods and services

Receive a detailed donation receipt for in-kind goods and services to acknowledge your generous contribution. This receipt serves as official documentation for tax purposes and promotes transparency between donors and organizations. Ensure your charitable donations are properly recorded and appreciated.

School fundraising donation receipt with donor details

This school fundraising donation receipt provides a detailed record of the donor's contribution, including their name, contact information, and donation amount. It serves as an official acknowledgment for tax purposes and supports transparency in fundraising efforts. Keeping accurate donor details helps maintain trust and encourages continued support from the community.

What legal elements must a donation receipt include for tax deductibility?

A valid donation receipt must include the donor's name, the amount or value of the donation, and the date the donation was made. It should also clearly specify the charitable organization's name and registration number. Additionally, the receipt must contain a statement affirming that no goods or services were provided in exchange for the donation.

How should in-kind donations be described on a receipt letter?

In-kind donations should be described with an accurate description of the donated items or services. The receipt must include a fair market value estimate of these items as determined by the donor or a qualified appraiser. It is important to also note the date of donation and any relevant conditions or restrictions.

What is the recommended format for digital donation receipts?

Digital donation receipts should be formatted in a clear, readable layout and sent via email or downloadable PDF. They must contain all legally required information, including the donor and charity details, donation amount, and date. Including a digital signature or secure verification method enhances receipt authenticity.

How can recurring donations be efficiently summarized in a single receipt letter?

A single receipt for recurring donations should summarize the total amount donated during the tax year along with the number of donations made. The receipt must list the dates of each individual donation to ensure clarity and transparency. This approach simplifies record-keeping for both donors and organizations.

Is donor's tax identification number required on the donation receipt?

The donor's tax identification number is generally not required to be included on the donation receipt unless mandated by local tax authorities. Including this information can help donors with tax filing but should be handled with attention to privacy and data protection. Organizations should verify local regulations to ensure compliance.