A rent receipt is an official document issued by a landlord to a tenant as proof of payment for rent. It typically includes details such as the amount paid, date of payment, and the rental period covered. Maintaining a rent receipt is essential for both parties to avoid payment disputes and ensure transparency.

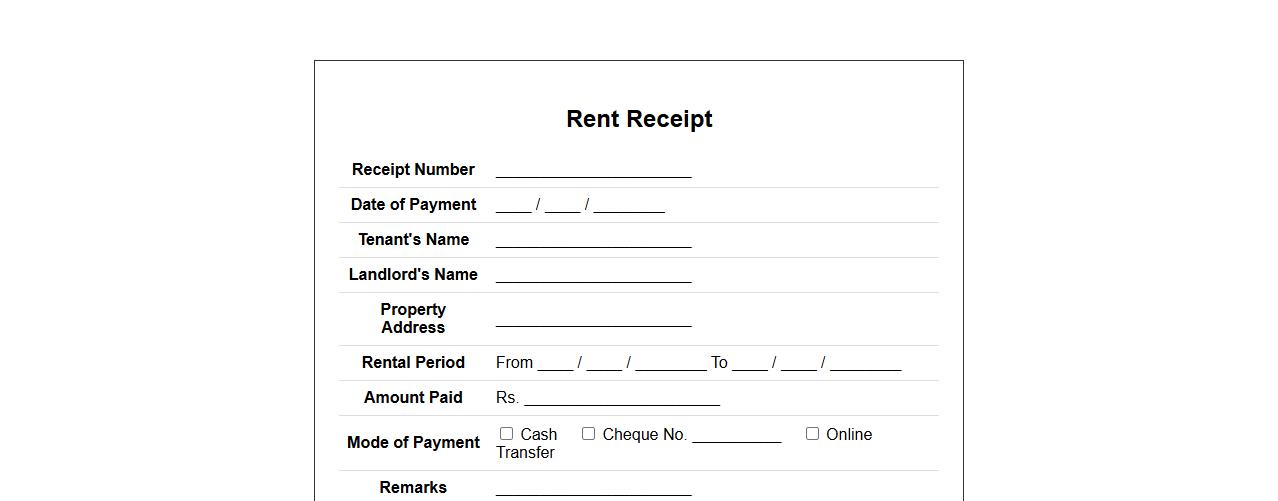

Rent receipt format for monthly rental payments

A rent receipt format is essential for documenting monthly rental payments, ensuring clarity and legal proof of transactions between landlords and tenants. It typically includes details such as payment date, amount paid, rental period covered, and signatures. Using a standardized format helps prevent disputes and maintains transparent financial records.

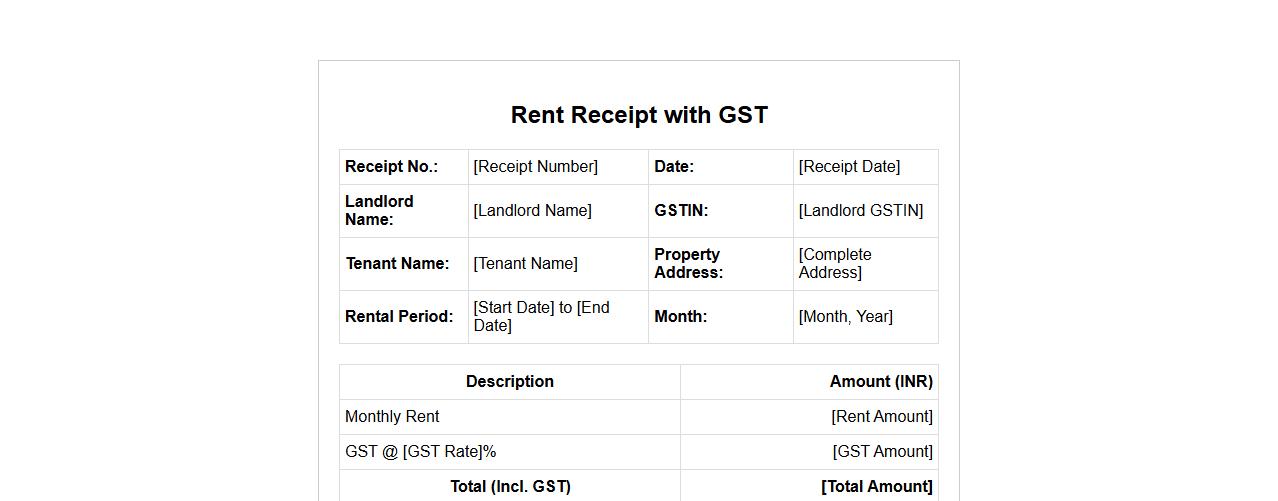

Rent receipt with GST for landlords

Providing a rent receipt with GST is essential for landlords to ensure transparency and legal compliance. It clearly outlines the rental payment and applicable GST, protecting both parties in the transaction. This document serves as a valid proof of payment and GST charge for accounting and tax purposes.

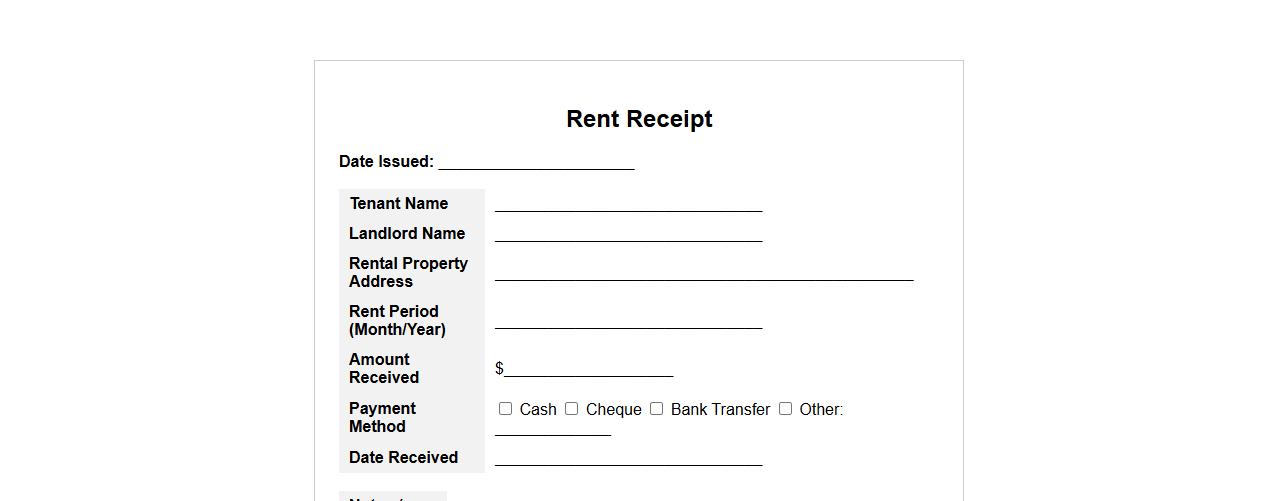

Rent receipt template for house rent

Use this rent receipt template to easily document house rent payments and provide tenants with a clear proof of transaction. The template is designed for simplicity and accuracy, ensuring all necessary details are included. Perfect for landlords and property managers to keep organized records.

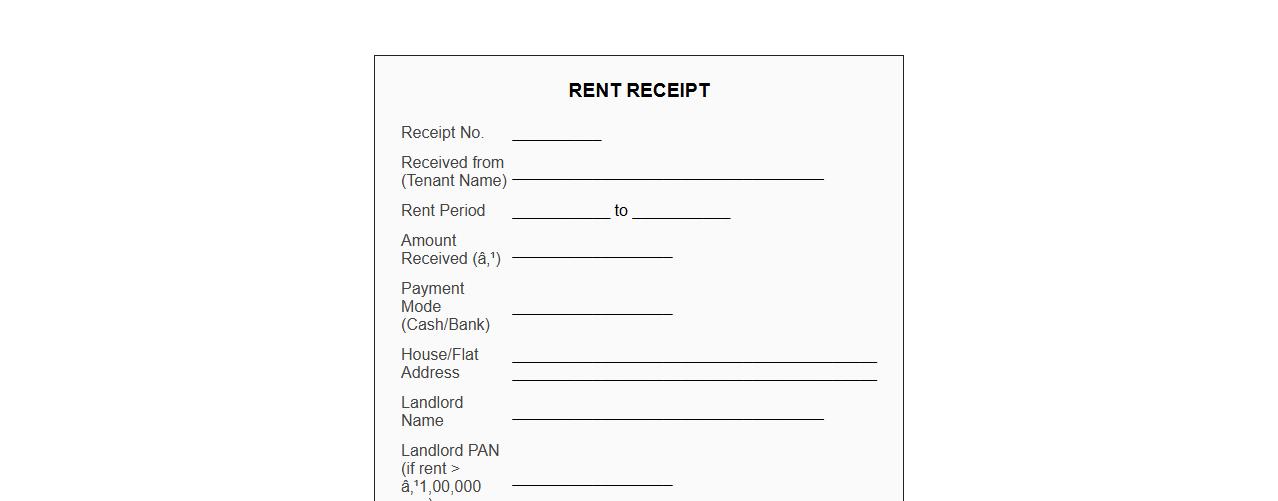

Rent receipt sample for HRA exemption

Download a rent receipt sample to claim HRA exemption efficiently. This template helps tenants provide necessary details for tax benefits. Ensure the receipt includes landlord details, rent amount, and payment dates for smooth processing.

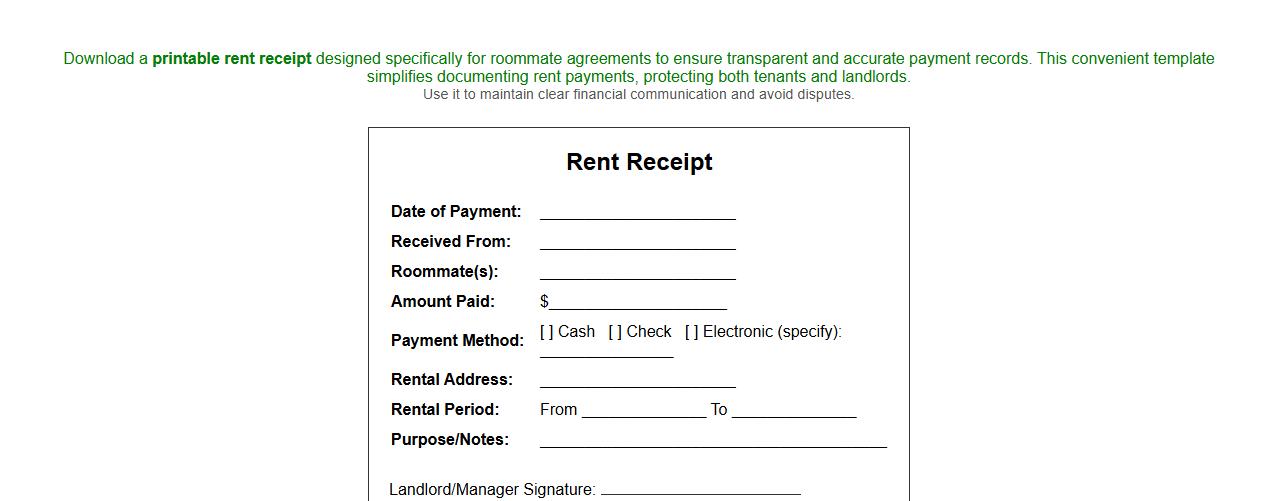

Printable rent receipt for roommate agreement

Download a printable rent receipt designed specifically for roommate agreements to ensure transparent and accurate payment records. This convenient template simplifies documenting rent payments, protecting both tenants and landlords. Use it to maintain clear financial communication and avoid disputes.

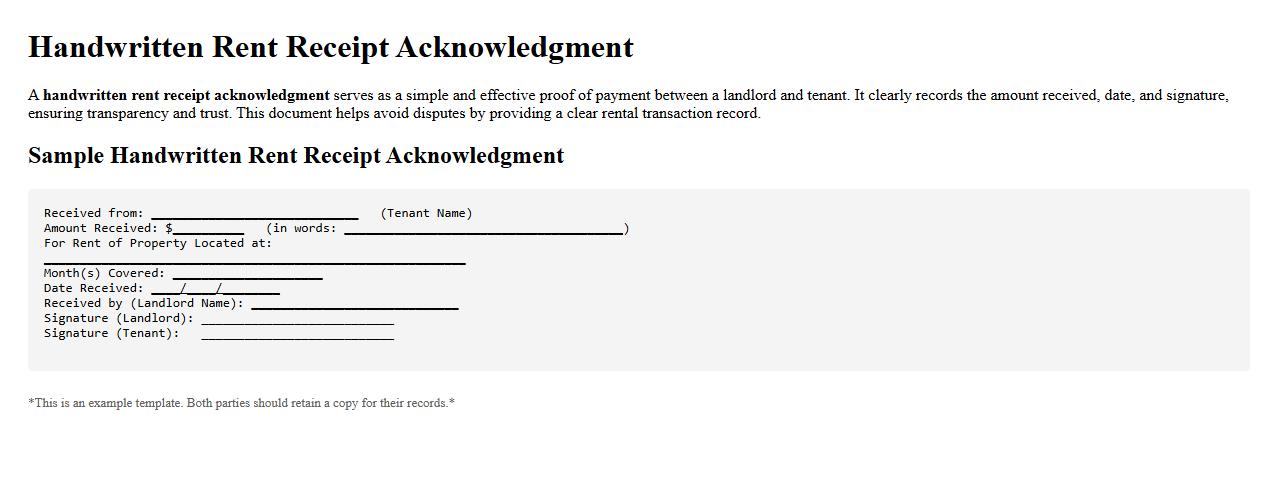

Handwritten rent receipt acknowledgment

A handwritten rent receipt acknowledgment serves as a simple and effective proof of payment between a landlord and tenant. It clearly records the amount received, date, and signature, ensuring transparency and trust. This document helps avoid disputes by providing a clear rental transaction record.

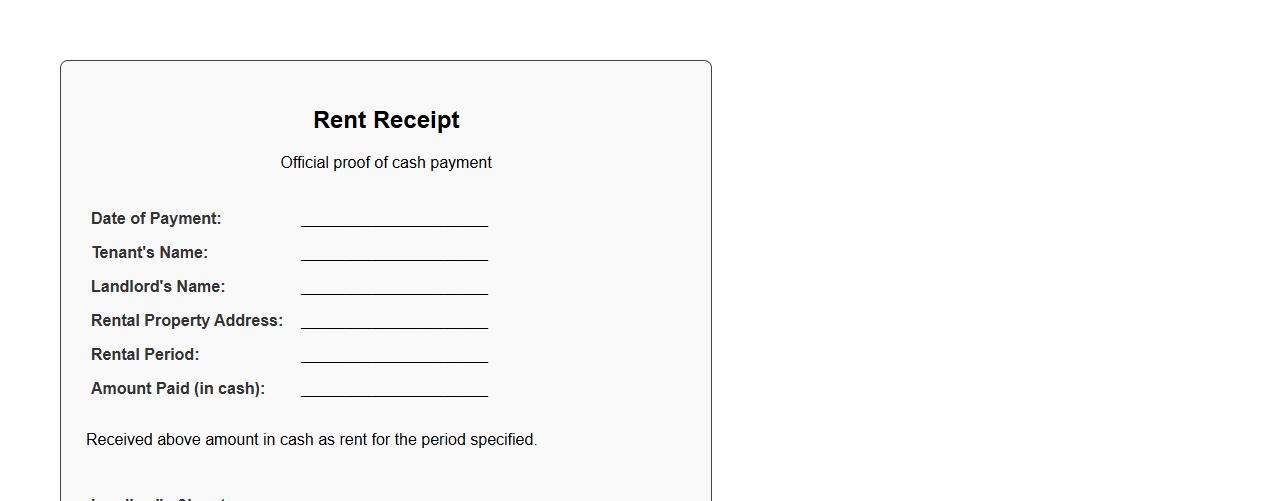

Rent receipt for cash payment to landlord

A rent receipt for cash payment to the landlord serves as official proof that rent has been paid in cash for a specified period. It includes essential details such as the amount paid, date of payment, and landlord's acknowledgment. This document helps maintain clear financial records and prevents potential disputes.

Digital rent receipt for online rent payment

Manage your rent transactions effortlessly with our digital rent receipt feature, designed for seamless online rent payment tracking. Receive instant, secure receipts that simplify record-keeping and ensure transparent communication between tenants and landlords. This smart solution enhances convenience and accountability in every rental payment process.

Rent receipt including security deposit details

A rent receipt provides a detailed record of the rent payment, including the amount paid and the date of transaction. It also includes information about the security deposit, specifying the deposit amount and any deductions made. This document ensures transparency and serves as proof of payment for both landlords and tenants.

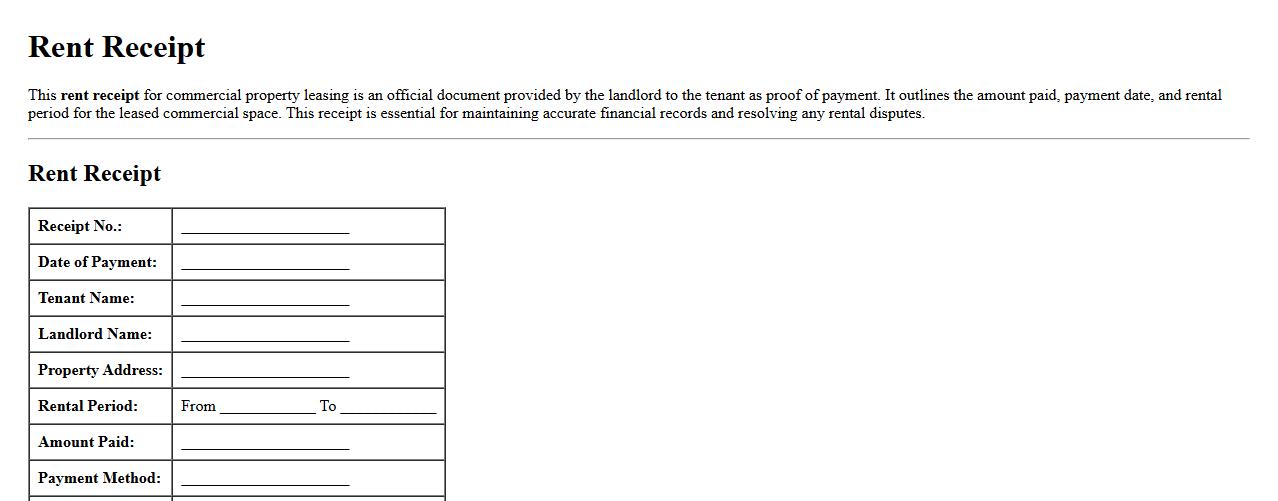

Rent receipt for commercial property leasing

A rent receipt for commercial property leasing is an official document provided by the landlord to the tenant as proof of payment. It outlines the amount paid, payment date, and rental period for the leased commercial space. This receipt is essential for maintaining accurate financial records and resolving any rental disputes.

What essential details must a rent receipt include for legal validity?

A legally valid rent receipt must contain the tenant's name, the amount of rent paid, and the date of payment. It should also specify the rental property's address and the payment period covered. Including the landlord's signature or official stamp is crucial for authenticity.

How can digital rent receipts be authenticated for tenant-landlord disputes?

Digital rent receipts can be authenticated through secure platforms that generate unique transaction IDs or QR codes. Utilizing electronic signatures and encrypted payment records enhances their legal credibility. Additionally, timestamping the digital receipt helps verify payment timing in disputes.

What are common mistakes to avoid when issuing a rent receipt?

One common mistake is omitting critical details such as the payment date or amount, which can invalidate the receipt. Using unclear or handwritten receipts without a signature reduces legal reliability. It's also important to avoid issuing receipts before payment is fully received to prevent fraud claims.

How should rent receipts be stored for tax and audit purposes?

Rent receipts should be organized chronologically and stored securely for at least five years to comply with tax regulations. Both physical and digital copies must be easily accessible during audits. Employing cloud storage solutions with backup features ensures protection against loss or damage.

Can rent receipts be used as proof of residency for official documentation?

Rent receipts are often accepted as proof of residency for various official purposes, including utility connections and government ID applications. However, the receipt must include detailed property information and a landlord's contact for verification. It is advisable to confirm specific requirements with the requesting authority beforehand.