A Sales Receipt is an essential document that verifies a transaction between a buyer and a seller by detailing the products or services purchased, quantities, prices, and total amount paid. It serves as proof of purchase and is crucial for record-keeping, returns, and warranty claims. Businesses rely on sales receipts to track sales performance and ensure accurate financial reporting.

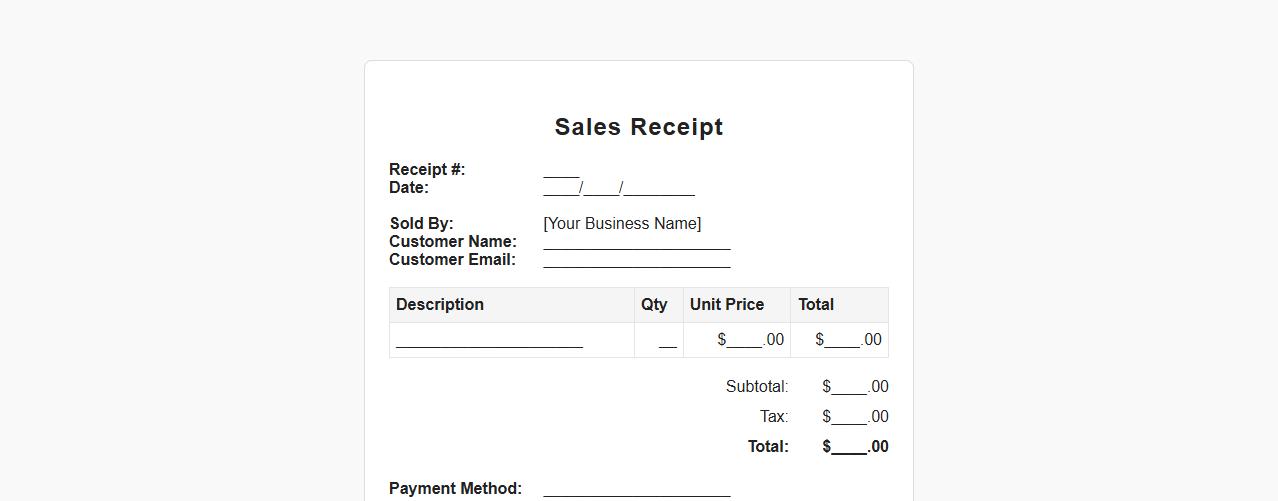

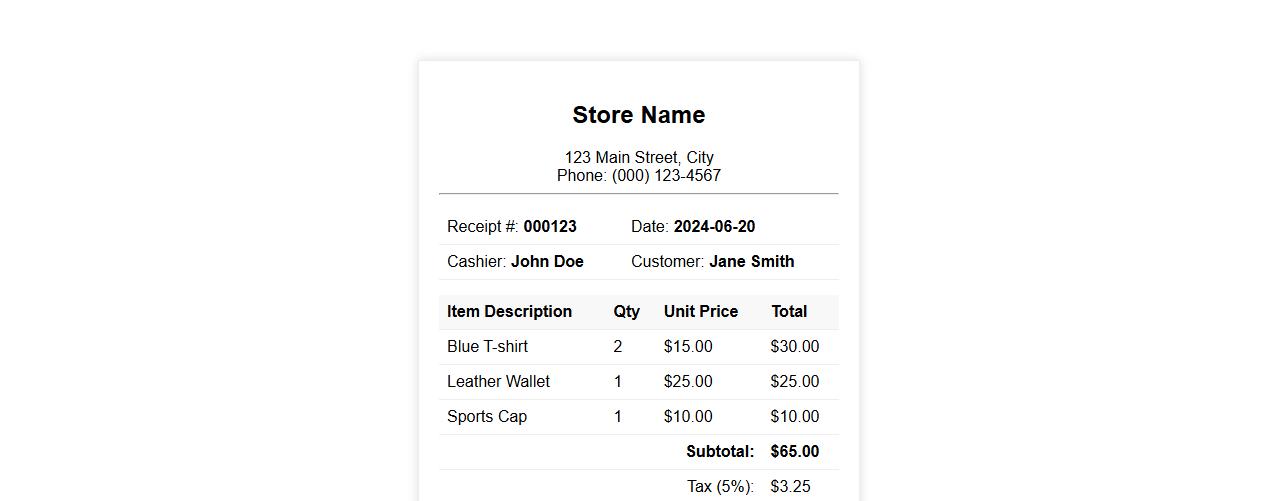

Sales receipt template for small business

Use this sales receipt template designed specifically for small businesses to streamline transaction records and enhance customer trust. It provides a clear, professional layout that simplifies documenting sales details and payment information. Perfect for improving your business's financial organization and customer service experience.

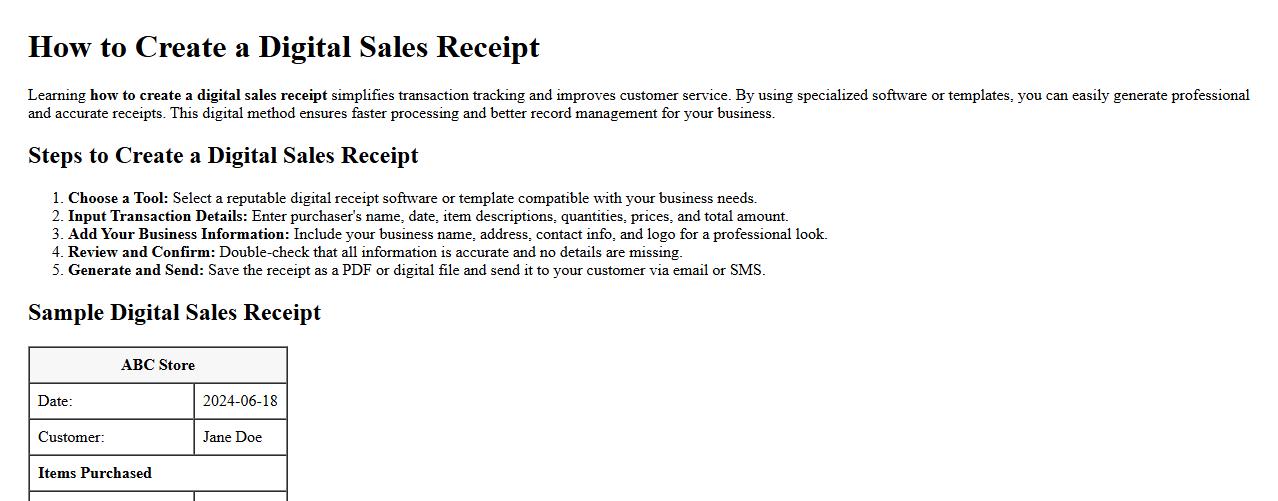

How to create a digital sales receipt

Learning how to create a digital sales receipt simplifies transaction tracking and improves customer service. By using specialized software or templates, you can easily generate professional and accurate receipts. This digital method ensures faster processing and better record management for your business.

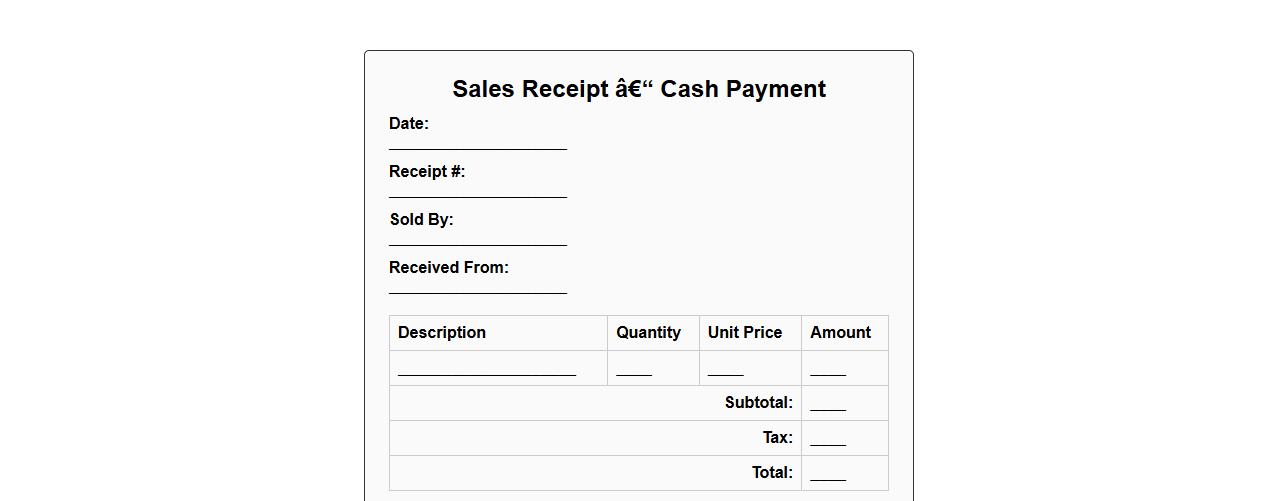

Free printable sales receipt for cash payments

Download a free printable sales receipt designed specifically for cash payments to ensure accurate and professional transaction records. This template helps small businesses and individuals maintain organized financial documentation effortlessly. Easily customize and print receipts to suit your sales needs.

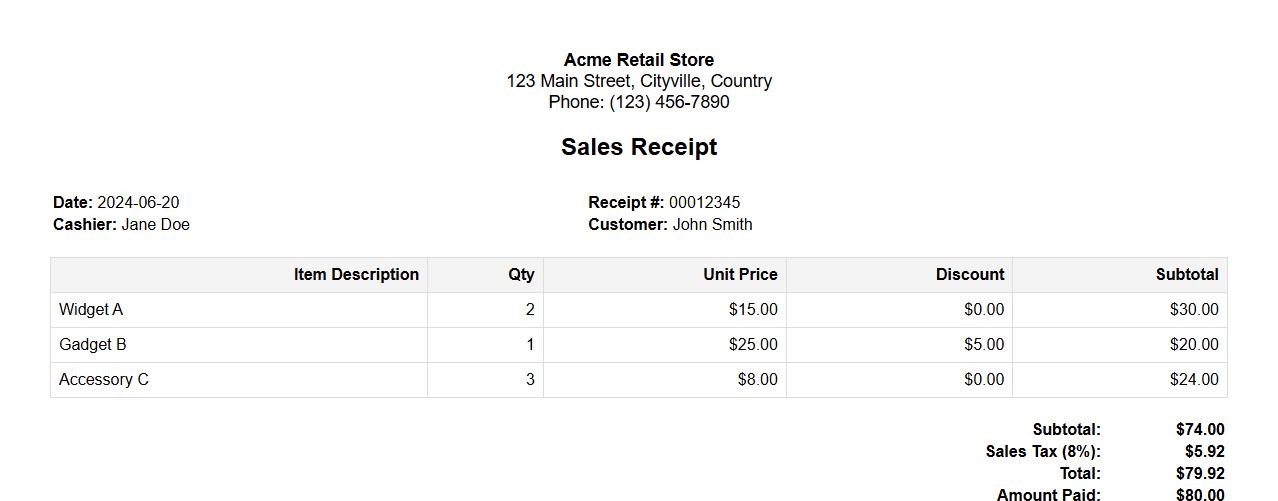

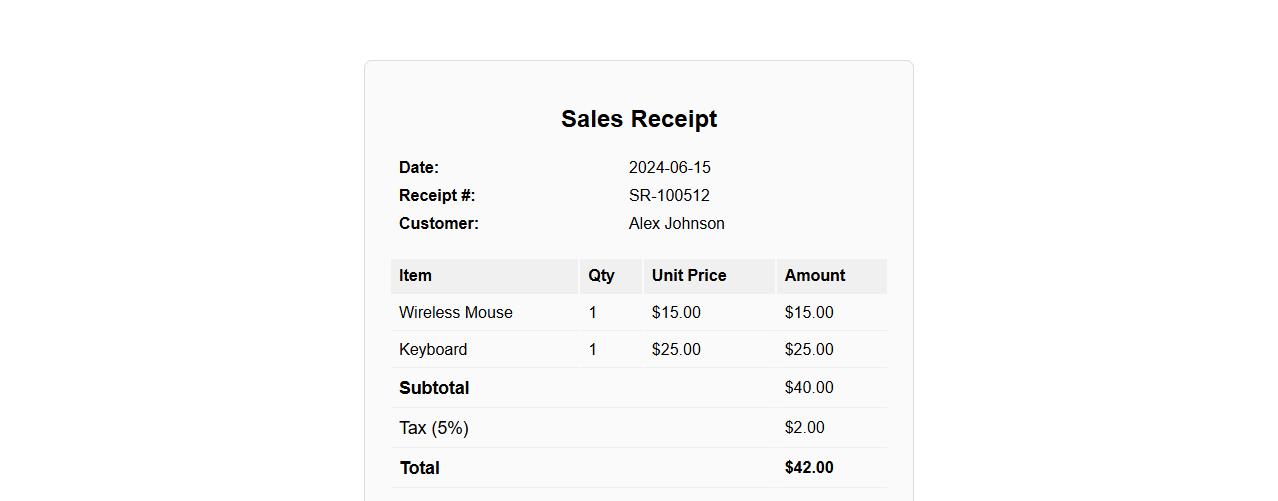

Sales receipt with itemized breakdown

A sales receipt with an itemized breakdown provides a detailed list of purchased products or services, including quantities, prices, and totals. This format enhances transparency by clearly showing each item's cost, taxes, and discounts applied. It's essential for accurate record-keeping and customer reference.

Sales receipt format for retail store

Use this sales receipt format for retail stores to ensure clear documentation of each transaction, including item details, prices, and total amount. This format helps maintain accurate sales records and enhances customer trust. Customize it to reflect your store's branding and legal requirements.

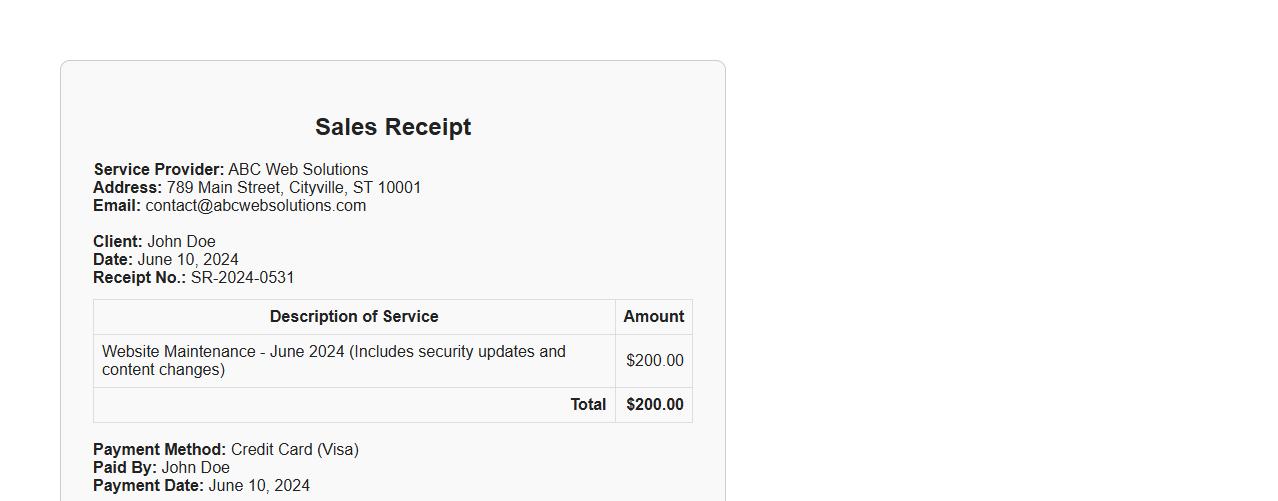

Sales receipt example for service rendered

A sales receipt example for service rendered provides a clear record of the transaction between a service provider and a client. It includes essential details such as the date, description of the service, amount charged, and payment method. This document ensures transparency and serves as proof of payment for both parties.

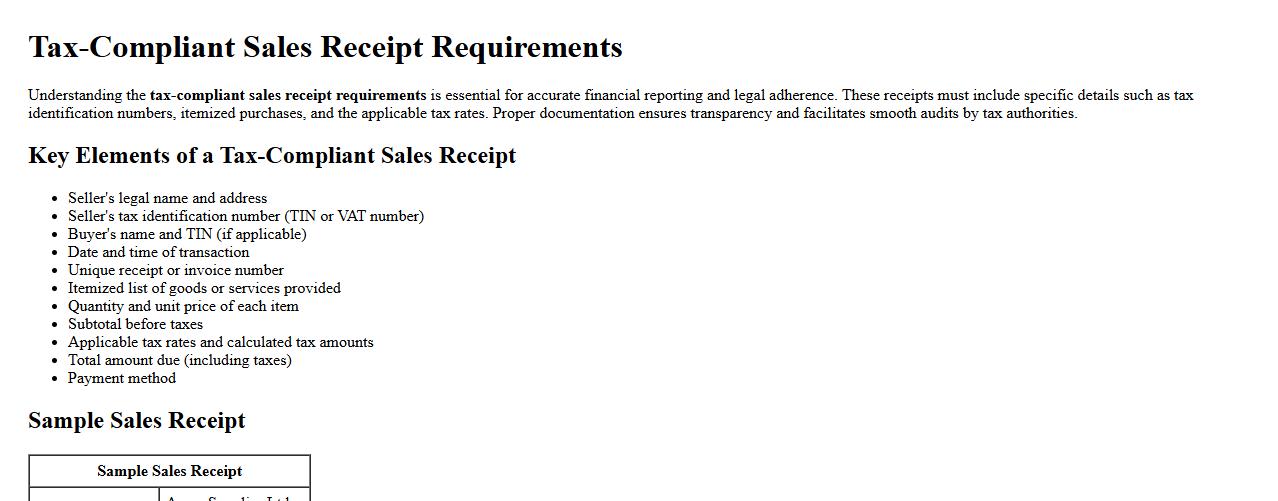

Tax-compliant sales receipt requirements

Understanding the tax-compliant sales receipt requirements is essential for accurate financial reporting and legal adherence. These receipts must include specific details such as tax identification numbers, itemized purchases, and the applicable tax rates. Proper documentation ensures transparency and facilitates smooth audits by tax authorities.

Sales receipt with customer signature field

A sales receipt with a customer signature field provides proof of purchase and confirms the buyer's acknowledgment of the transaction. This essential document enhances accountability and streamlines return or warranty processes. Including a signature field ensures secure and verifiable sales records.

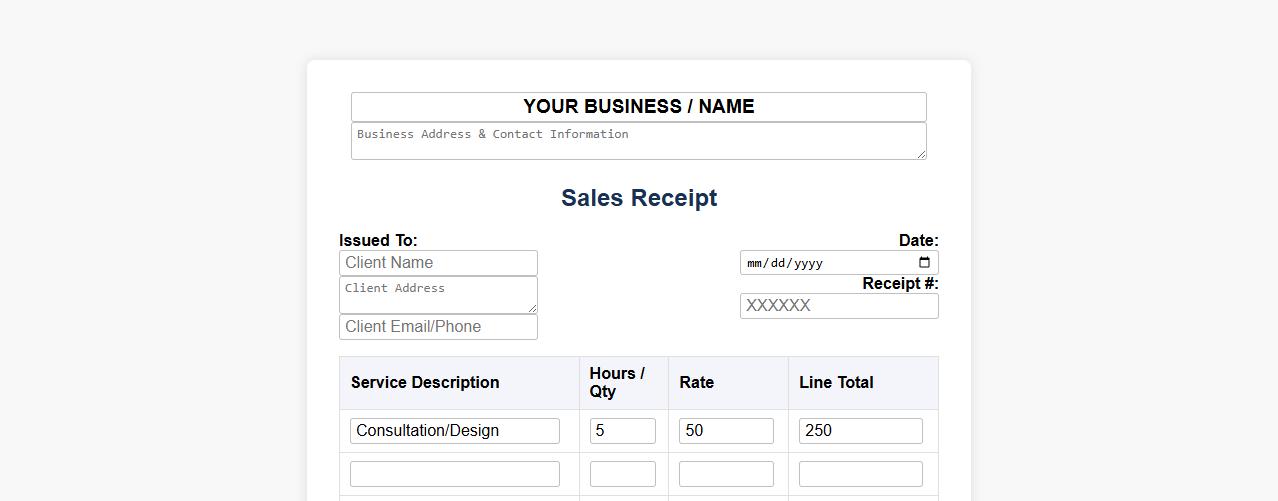

Customizable sales receipt for freelance work

Create a customizable sales receipt tailored for freelance work, allowing you to detail services provided, pricing, and client information clearly. This receipt template enhances professionalism and simplifies transaction tracking. Easily editable, it adapts to your unique business needs and branding.

What are the mandatory legal elements required on a sales receipt?

A sales receipt must include the seller's name, address, and contact information for legal compliance. It should also display the transaction date, item description, quantity, unit price, and total amount paid. Additionally, a unique receipt or invoice number is essential for proper record-keeping and auditing.

How do you digitally authenticate a sales receipt for online transactions?

Digital authentication of online sales receipts typically involves incorporating a digital signature or QR code to verify the receipt's validity. Secure encryption methods ensure that the receipt is tamper-proof and traceable back to the issuing vendor. Many systems also use third-party validation tools or blockchain technology for enhanced trustworthiness.

Which coding systems are used for itemizing products on receipts?

Common coding systems include Universal Product Codes (UPC) and European Article Numbers (EAN), which uniquely identify each product. Additionally, SKU (Stock Keeping Unit) numbers are frequently used within stores for internal inventory management. These standardized codes help streamline item tracking and facilitate quick checkout processes.

How can a sales receipt be designed for multi-currency transactions?

Designing receipts for multi-currency transactions requires displaying the currency symbols and exchange rates prominently. It is critical to show the amount in the transaction currency alongside the base or home currency to avoid confusion. Clear labeling of all amounts and applying consistent numeric formats support transparency and customer understanding.

What data privacy considerations apply when storing electronic sales receipts?

When storing electronic sales receipts, compliance with data privacy laws like GDPR or CCPA is essential to protect customer information. Sensitive data should be encrypted and access-controlled to prevent unauthorized use or breaches. Retention policies must limit the storage duration to the minimum required period while ensuring secure disposal of obsolete data.