A Donation Receipt Sample provides a clear template for documenting charitable contributions and ensuring accurate record-keeping for donors. It typically includes essential details such as the donor's name, donation amount, date, and the nonprofit organization's information. Using a well-structured Donation Receipt Sample helps maintain transparency and compliance with tax regulations.

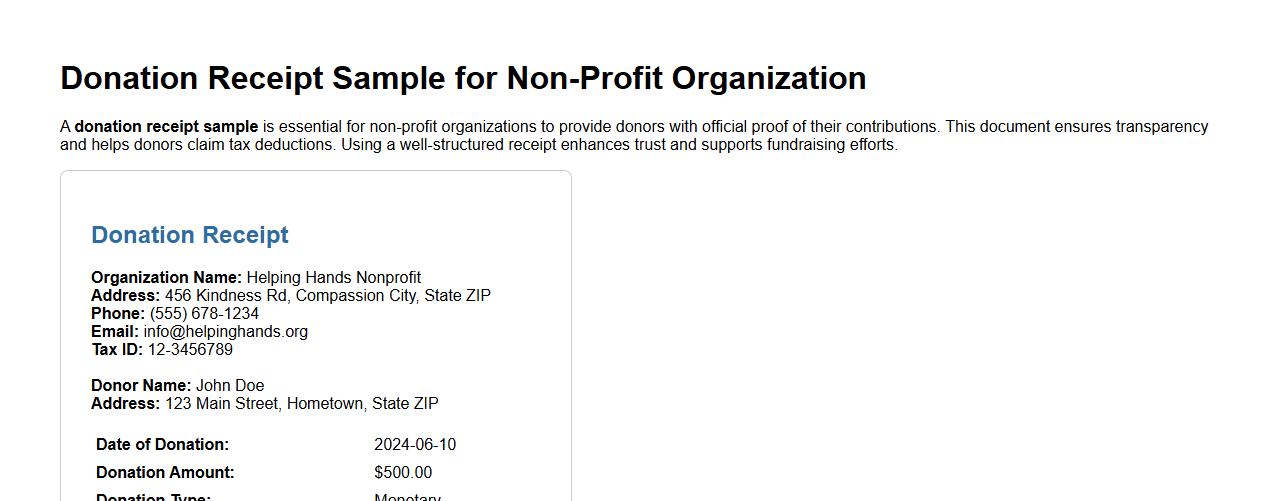

Donation receipt sample for non profit organization

A donation receipt sample is essential for non-profit organizations to provide donors with official proof of their contributions. This document ensures transparency and helps donors claim tax deductions. Using a well-structured receipt enhances trust and supports fundraising efforts.

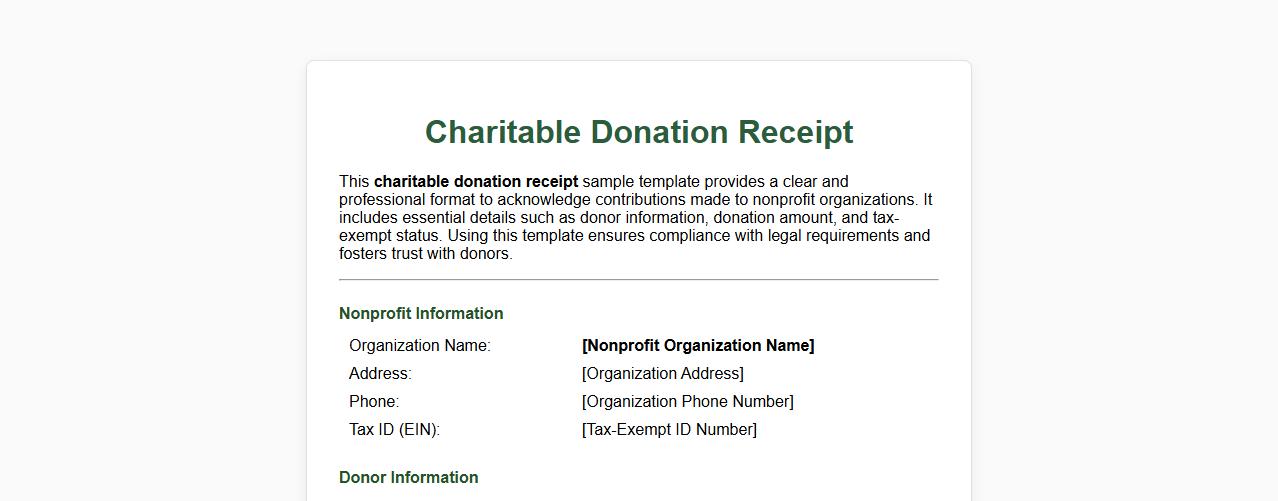

Charitable donation receipt sample template

This charitable donation receipt sample template provides a clear and professional format to acknowledge contributions made to nonprofit organizations. It includes essential details such as donor information, donation amount, and tax-exempt status. Using this template ensures compliance with legal requirements and fosters trust with donors.

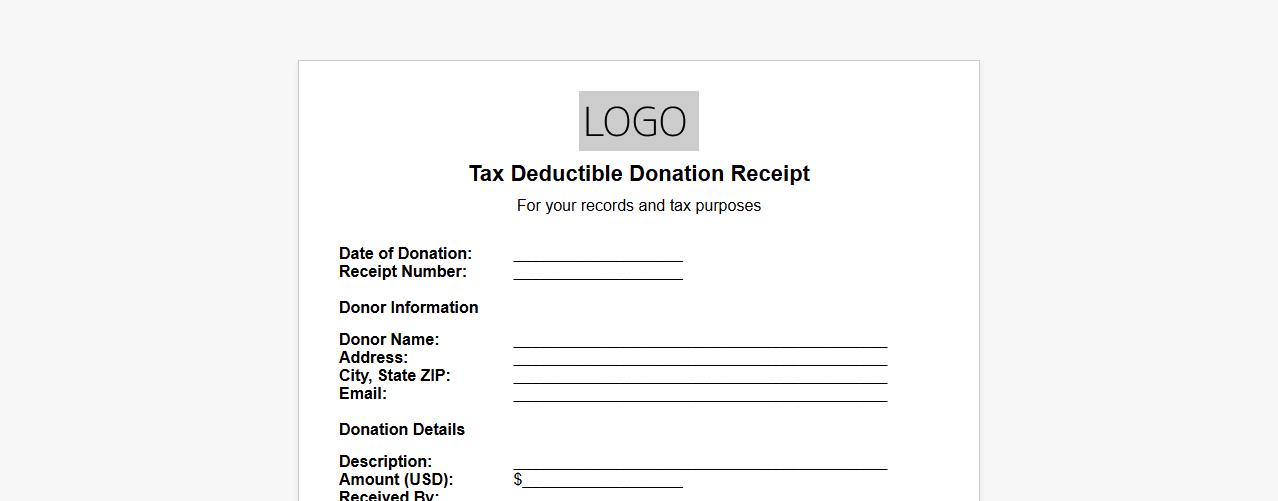

Tax deductible donation receipt sample

Download a tax deductible donation receipt sample to ensure proper documentation for your charitable contributions. This receipt template includes all essential details required for IRS compliance and donor records. Use it to provide clear proof of donations for tax reporting purposes.

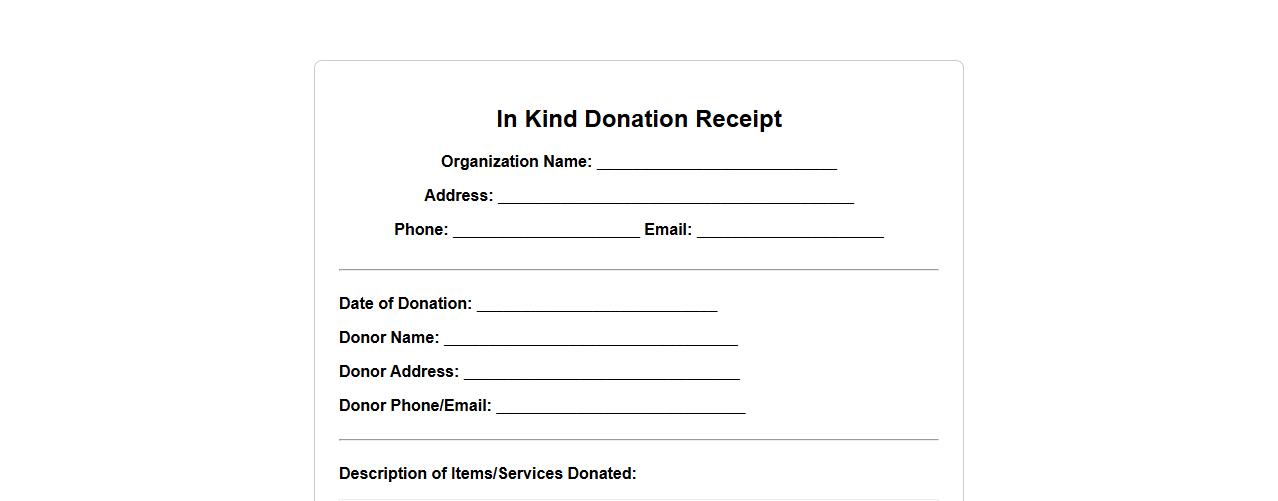

In kind donation receipt sample format

An in kind donation receipt sample format provides a structured template for acknowledging non-cash contributions. It ensures clear documentation of donated goods or services, facilitating transparency and tax purposes. Using a standardized receipt helps both donors and organizations maintain accurate records.

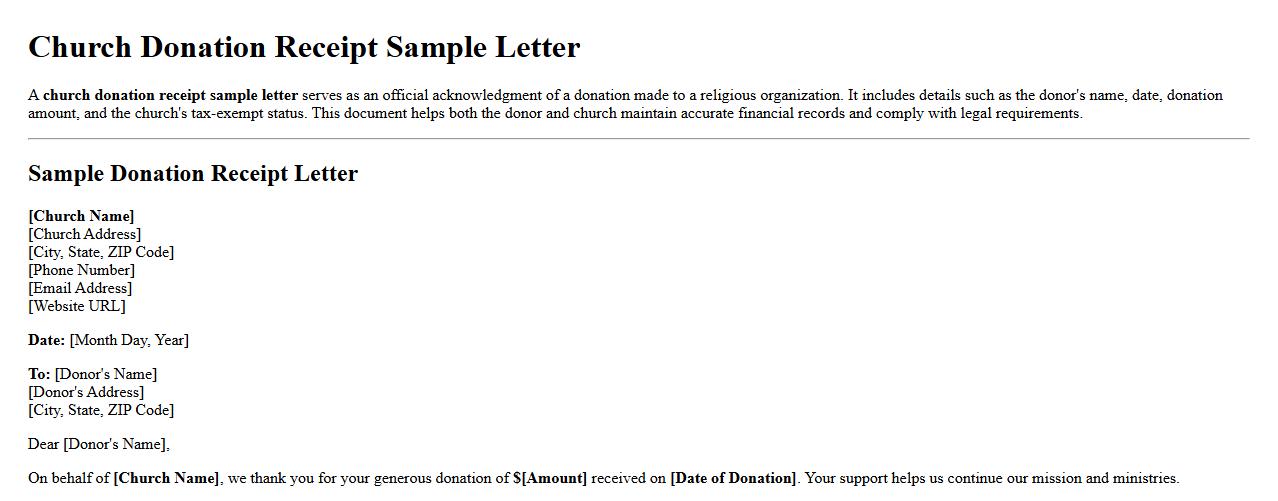

Church donation receipt sample letter

A church donation receipt sample letter serves as an official acknowledgment of a donation made to a religious organization. It includes details such as the donor's name, date, donation amount, and the church's tax-exempt status. This document helps both the donor and church maintain accurate financial records and comply with legal requirements.

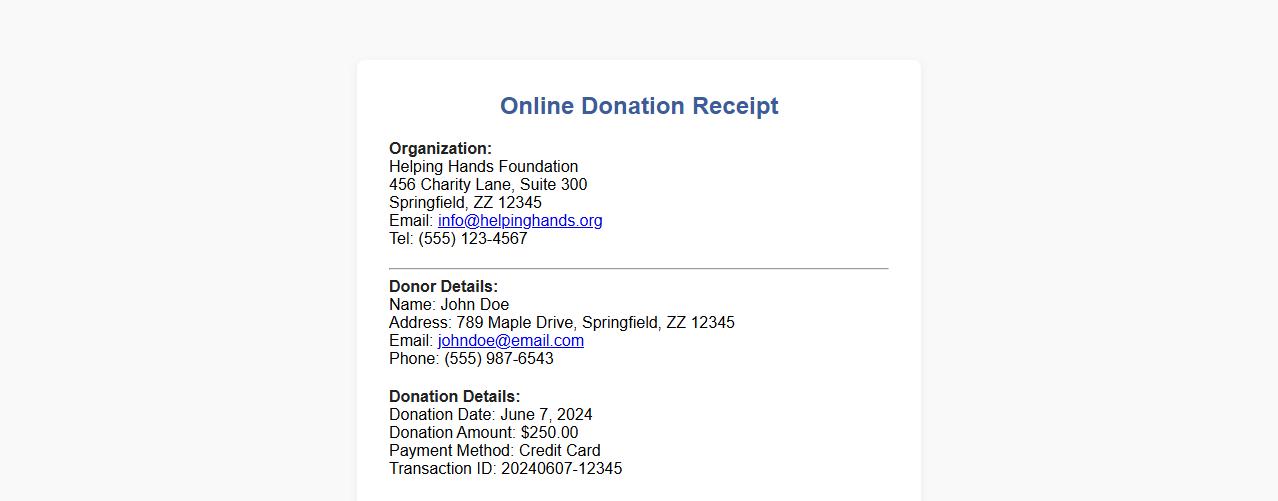

Online donation receipt sample with donor details

This online donation receipt sample includes essential donor details for accurate record-keeping and transparency. It ensures donors receive a clear acknowledgment of their contributions with dates, amounts, and contact information. Utilizing this format helps organizations maintain trust and comply with legal requirements.

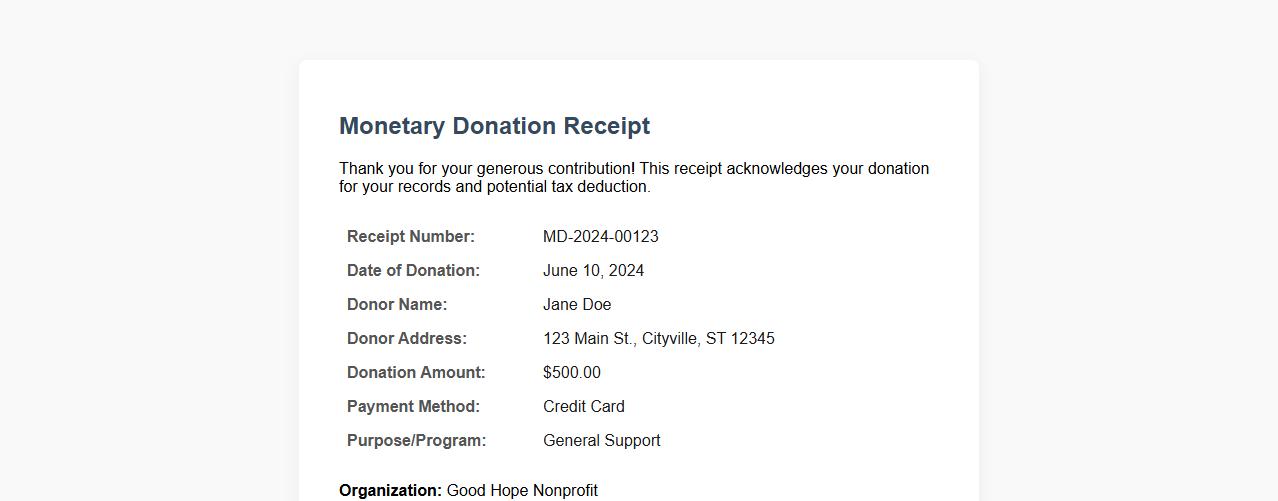

Monetary donation receipt sample PDF

This monetary donation receipt sample PDF provides a clear and professional template for acknowledging financial contributions. It ensures donors receive proper documentation for tax and record-keeping purposes. Easily customizable, it streamlines the donation acknowledgment process for nonprofits.

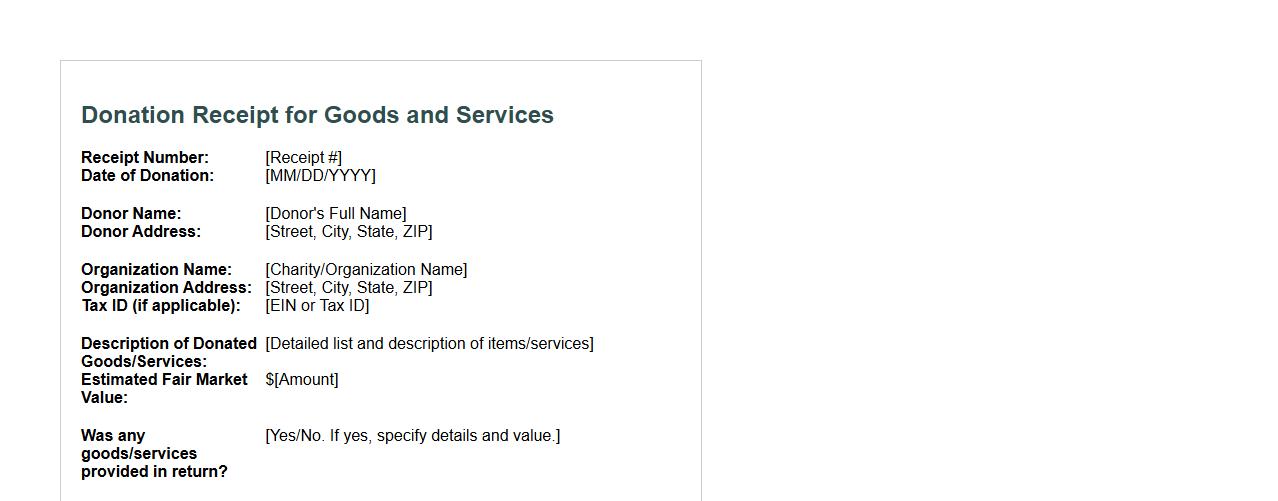

Donation receipt sample for goods and services

A donation receipt sample for goods and services provides a clear template to acknowledge contributions of tangible items or professional help. It ensures compliance with tax regulations by detailing the donor's information, description of donated goods or services, and fair market value. Using this receipt helps both donors and organizations maintain accurate records for charitable giving.

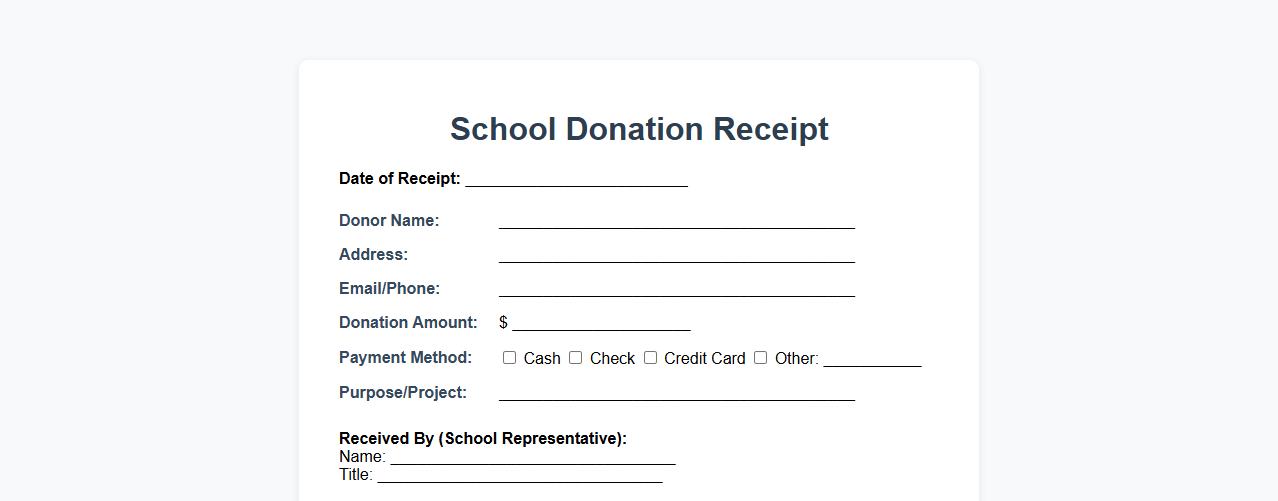

School donation receipt sample form

This school donation receipt sample form provides a clear and organized way to acknowledge charitable contributions made to educational institutions. It ensures transparency and compliance with tax regulations by documenting donor details and donation amounts. Utilizing this form helps schools maintain accurate records and fosters trust with supporters.

Blood donation receipt sample for hospitals

This blood donation receipt sample for hospitals serves as an official acknowledgment of a donor's valuable contribution. It includes essential details such as donor information, donation date, and blood type to ensure accurate record-keeping. Hospitals use this receipt to maintain transparency and encourage future donations.

What specific details must a donation receipt include for tax deduction eligibility?

A donation receipt must include the donor's name and the nonprofit organization's name. It should clearly state the date of the donation and the amount given or a detailed description of donated property. Additionally, the receipt must include a statement confirming whether any goods or services were provided in exchange.

How should non-cash donation values be documented in the receipt?

Non-cash donation receipts should provide a description of the donated items and their fair market value at the time of donation. The donor is responsible for valuing the property, but the receipt must reflect this valuation accurately. For high-value items, additional documentation or appraisal may be required to support the declared value.

Are electronic donation receipts legally valid for charitable contributions?

Electronic donation receipts are legally valid as long as they contain all required information and can be stored and reproduced for recordkeeping. IRS guidelines accept electronic records, provided the donor has access to the receipt. This modern approach facilitates easier tracking and verification of donations.

What language is required to confirm "no goods or services were provided" in exchange for donations?

The receipt must include a clear statement such as "No goods or services were provided in exchange for this donation" or specify the goods/services' fair market value. This language confirms the full deductibility of the donation for tax purposes. If goods or services were provided, the receipt must disclose their value.

How long should nonprofit organizations retain donation receipt records?

Nonprofit organizations should retain donation receipts and related records for at least seven years to comply with tax regulations. This period aligns with IRS audit guidelines and supports verification if questions arise. Proper recordkeeping ensures transparency and accountability for both donors and the organization.