An Invoice Receipt Template provides a structured format for businesses to document transactions clearly and professionally. This template ensures all essential details such as payment amount, date, and vendor information are accurately recorded. Using an Invoice Receipt Template streamlines the billing process and improves record-keeping efficiency.

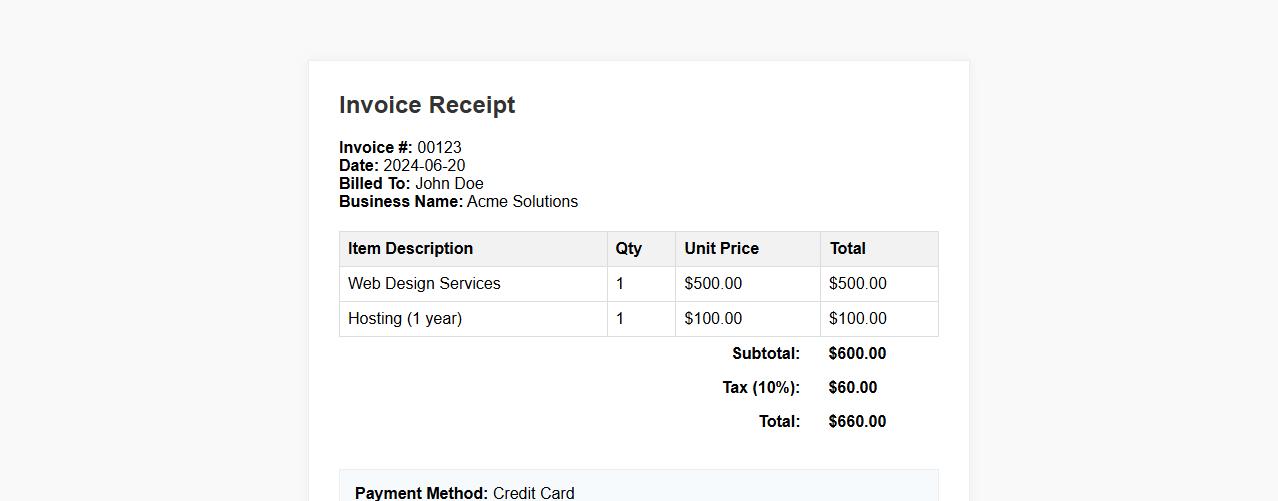

Free downloadable invoice receipt template in Excel

Download our free invoice receipt template in Excel to streamline your billing process with ease and accuracy. This customizable template helps you track payments and manage transactions efficiently. Perfect for freelancers, small businesses, and entrepreneurs looking for a professional solution.

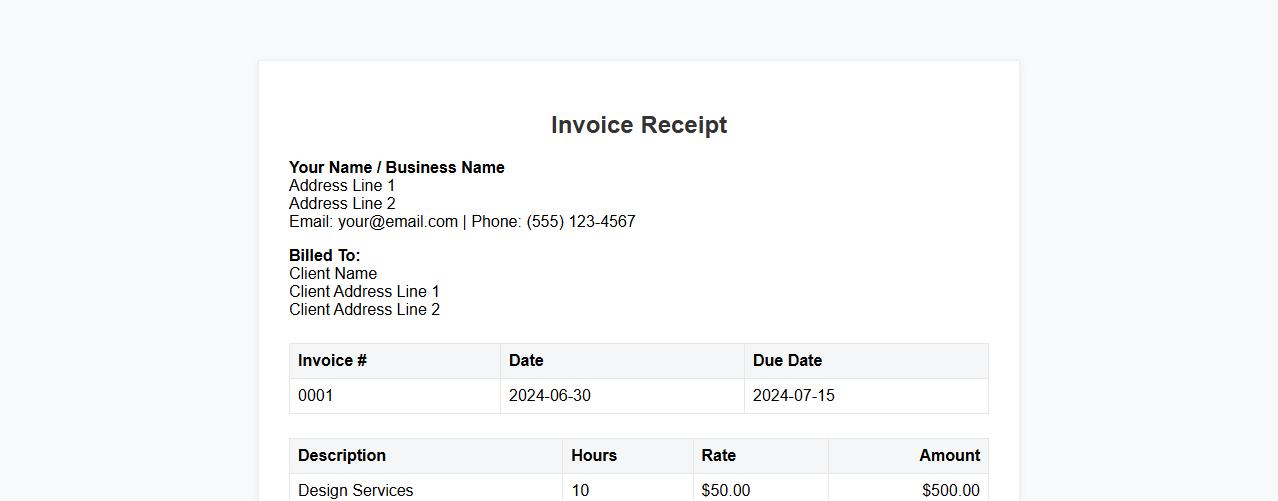

Printable invoice receipt template for freelancers

Enhance your billing process with this printable invoice receipt template designed specifically for freelancers. It offers a clean, professional layout that makes tracking payments simple and efficient. Download and customize the template to streamline your invoicing today.

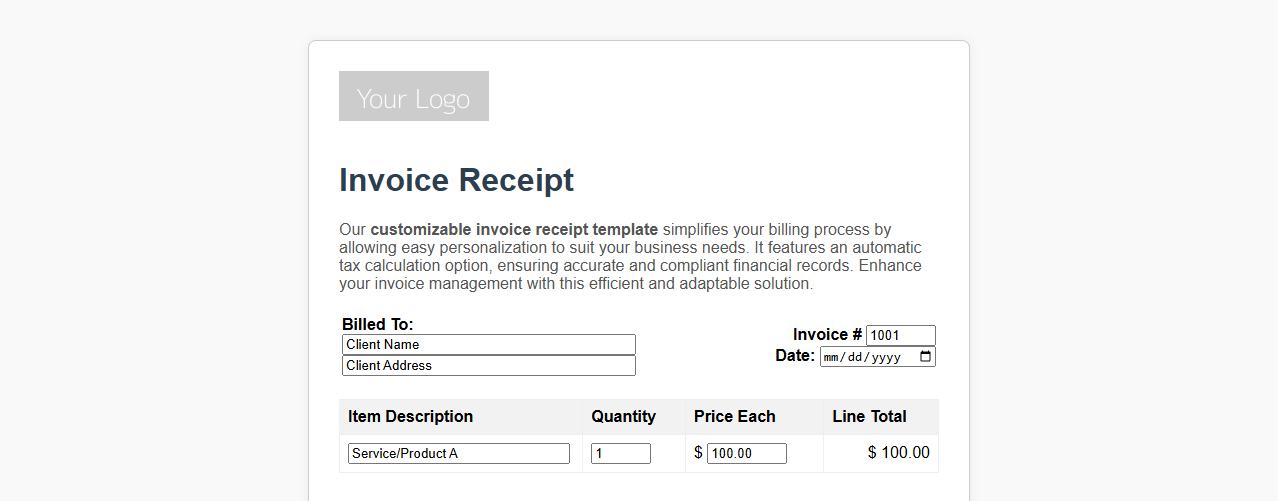

Customizable invoice receipt template with tax calculation

Our customizable invoice receipt template simplifies your billing process by allowing easy personalization to suit your business needs. It features an automatic tax calculation option, ensuring accurate and compliant financial records. Enhance your invoice management with this efficient and adaptable solution.

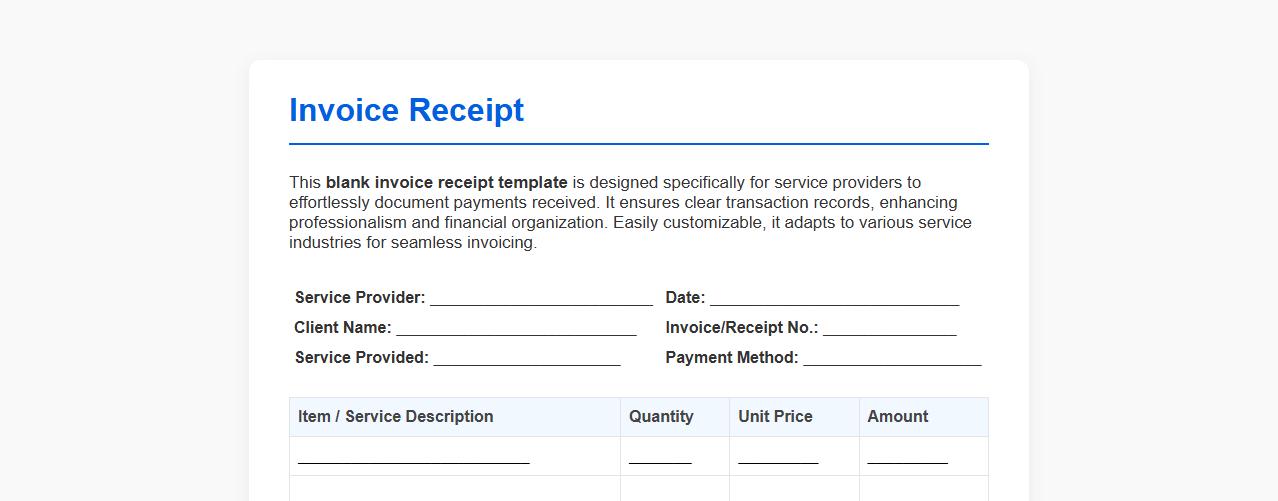

Blank invoice receipt template for service providers

This blank invoice receipt template is designed specifically for service providers to effortlessly document payments received. It ensures clear transaction records, enhancing professionalism and financial organization. Easily customizable, it adapts to various service industries for seamless invoicing.

Simple invoice receipt template with payment details

This simple invoice receipt template provides a clear layout for payment details, making transactions easy to track. Designed for simplicity and efficiency, it includes sections for itemized charges, payment methods, and totals. Perfect for small businesses and freelancers seeking an organized receipt format.

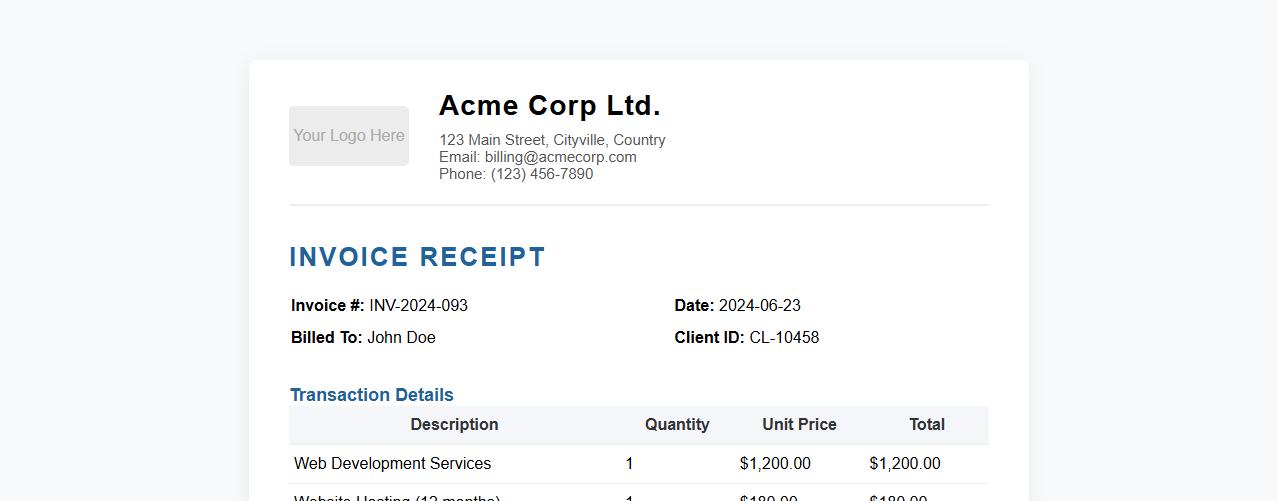

Invoice receipt template with company logo option

Enhance your billing process with this invoice receipt template, featuring an easy-to-add company logo option for professional branding. Designed for clarity and efficiency, it ensures all transaction details are neatly organized and clearly visible. Customize the template to reflect your brand's identity and provide clients with a polished and trustworthy receipt.

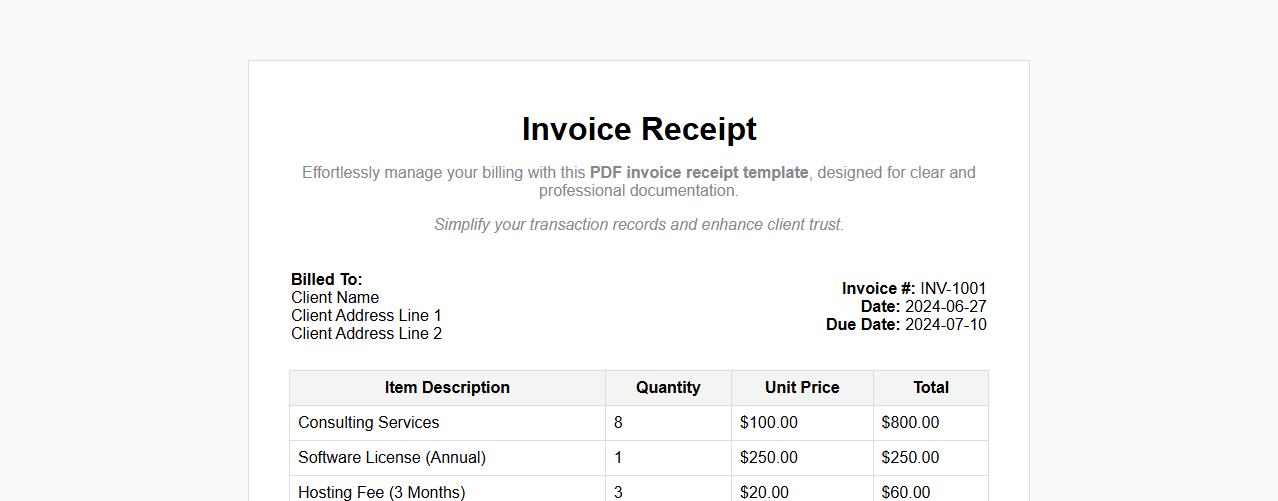

PDF invoice receipt template with itemized list

Effortlessly manage your billing with this PDF invoice receipt template, designed for clear and professional documentation. It features an itemized list that details every charge to ensure transparency and accuracy. Simplify your transaction records and enhance client trust with this easy-to-use template.

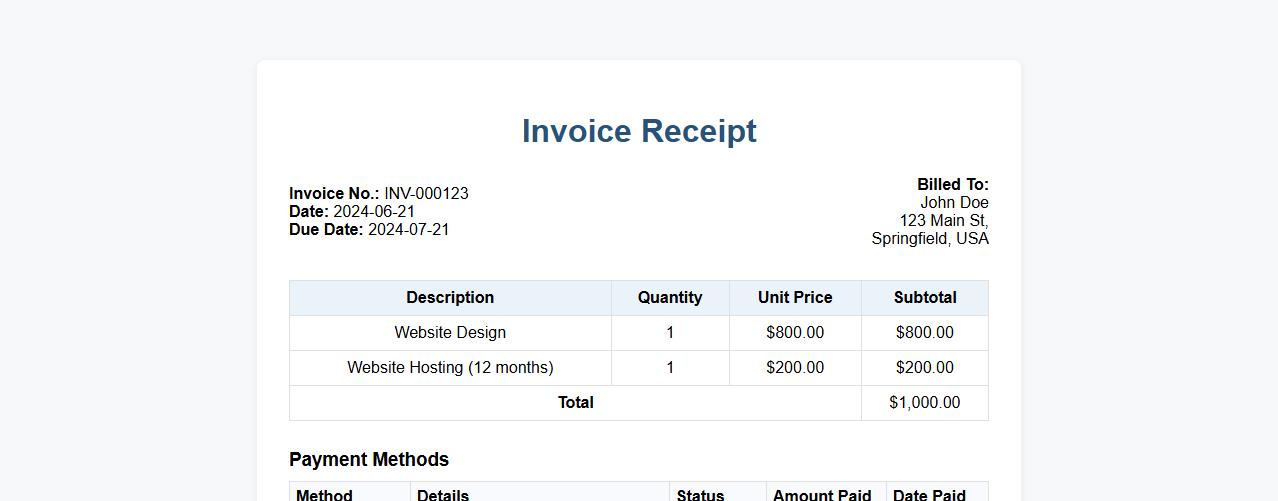

Invoice receipt template including multiple payment methods

This invoice receipt template is designed to streamline your billing process by accommodating multiple payment methods. It ensures clear documentation of transactions for both businesses and customers. Easily customize it to suit various payment options and improve record-keeping efficiency.

Automated invoice receipt template for recurring payments

An automated invoice receipt template streamlines the process of documenting recurring payments, ensuring accuracy and consistency. This template is designed to save time by automatically generating receipts for each transaction, improving financial record-keeping. Ideal for businesses managing subscriptions or regular billing cycles, it enhances professionalism and customer trust.

What metadata distinguishes an invoice letter from a standard receipt document?

Invoice letters include metadata such as invoice number, due date, and payment terms, which are absent in standard receipts. A standard receipt mainly contains transaction date, amount paid, and payment method without obligations or deadlines. This distinct metadata ensures clarity in financial and legal documentation.

Which digital signatures are legally recognized on e-invoice receipts?

Legally recognized digital signatures on e-invoice receipts typically include those certified by trusted Certificate Authorities (CAs). Qualified electronic signatures (QES) comply with regulations such as eIDAS in the EU and are widely accepted. These signatures guarantee authenticity and non-repudiation in electronic invoicing.

How do color codes or watermarks authenticate invoice receipts for legal compliance?

Color codes and watermarks serve as visible security features that prevent forgery or tampering of invoice receipts. They provide immediate visual authentication and help verify that the document complies with regulatory standards. Such features enhance the trustworthiness and legal acceptability of invoices.

What file formats best preserve invoice receipt integrity for audits?

PDF/A is widely preferred for preserving invoice receipt integrity due to its long-term archiving capabilities. TIFF and certified PDF formats also maintain document fidelity and prevent unauthorized edits. Choosing the right file format is essential for audit-readiness and compliance.

Which fields are mandatory on a VAT-compliant invoice receipt?

Mandatory fields on a VAT-compliant invoice include the VAT number, invoice date, seller and buyer information, description of goods or services, and VAT rate applied. Additionally, the invoice must specify the total amount and the VAT amount separately. These requirements ensure compliance with tax authorities.