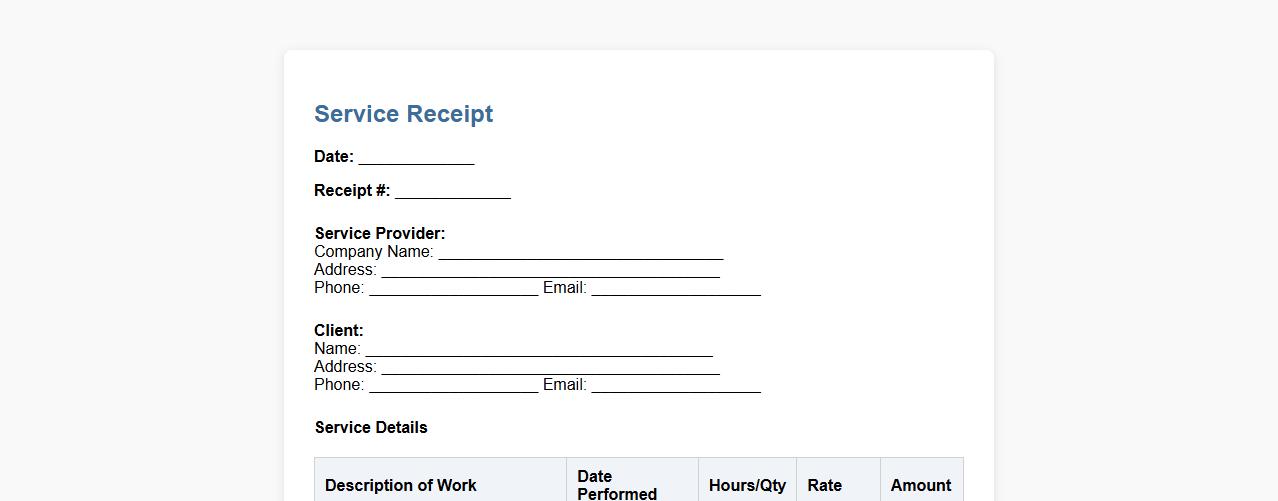

A Service Receipt Template simplifies documenting transactions by providing a clear format for recording services rendered, payment details, and client information. It ensures accuracy and professionalism in billing, helping both service providers and customers maintain proper records. Easy to customize, this template enhances business operations by streamlining the receipt issuance process.

Free downloadable service receipt template in Excel

Download our free service receipt template in Excel to easily document transactions and improve your record-keeping. This customizable template is designed for efficiency, helping businesses track payments and services rendered with clarity. Simplify your billing process today with this user-friendly, downloadable receipt format.

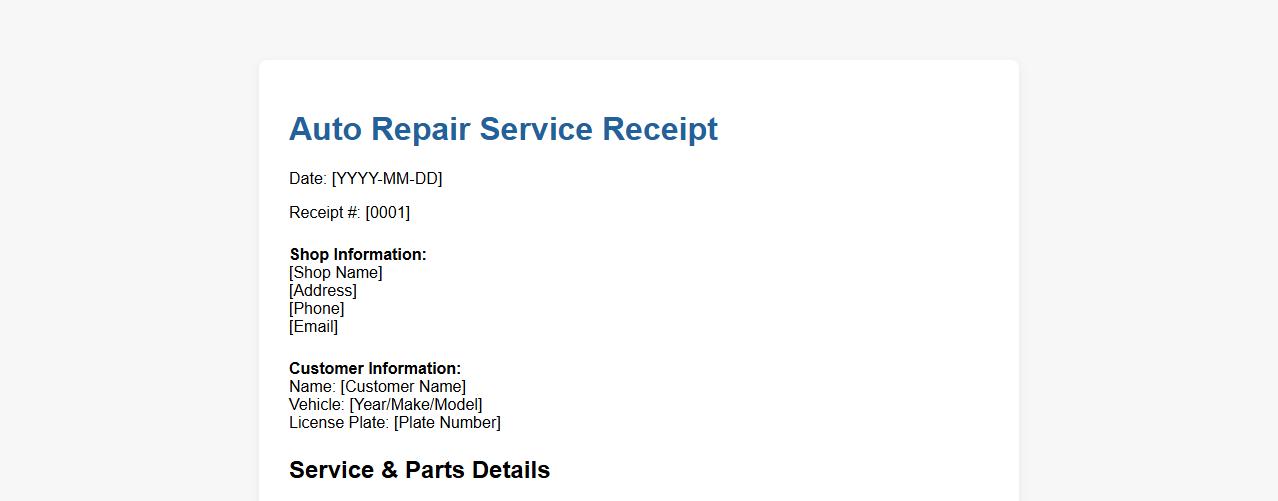

PDF auto repair service receipt template

Our PDF auto repair service receipt template provides a professional and easy-to-use format for documenting vehicle repairs. It ensures clear communication between mechanics and customers by detailing services, parts, and costs. Perfect for auto shops seeking efficient and accurate record-keeping.

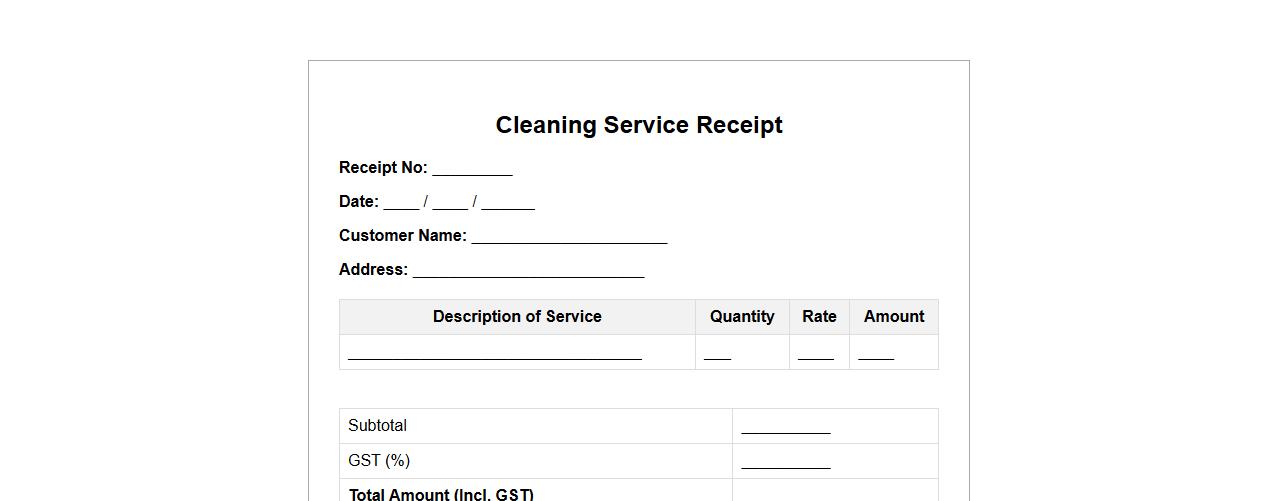

Printable cleaning service receipt template with GST

This printable cleaning service receipt template includes GST details, making it perfect for transparent and accurate billing. Designed for easy customization, it helps cleaning service providers maintain professional records. Simplify your invoicing with this user-friendly receipt template.

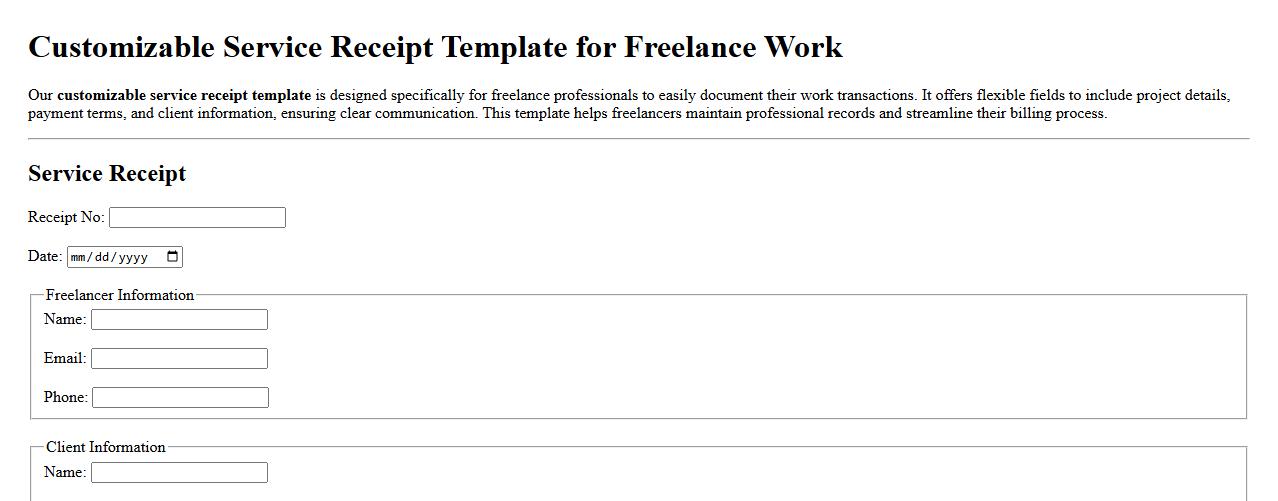

Customizable service receipt template for freelance work

Our customizable service receipt template is designed specifically for freelance professionals to easily document their work transactions. It offers flexible fields to include project details, payment terms, and client information, ensuring clear communication. This template helps freelancers maintain professional records and streamline their billing process.

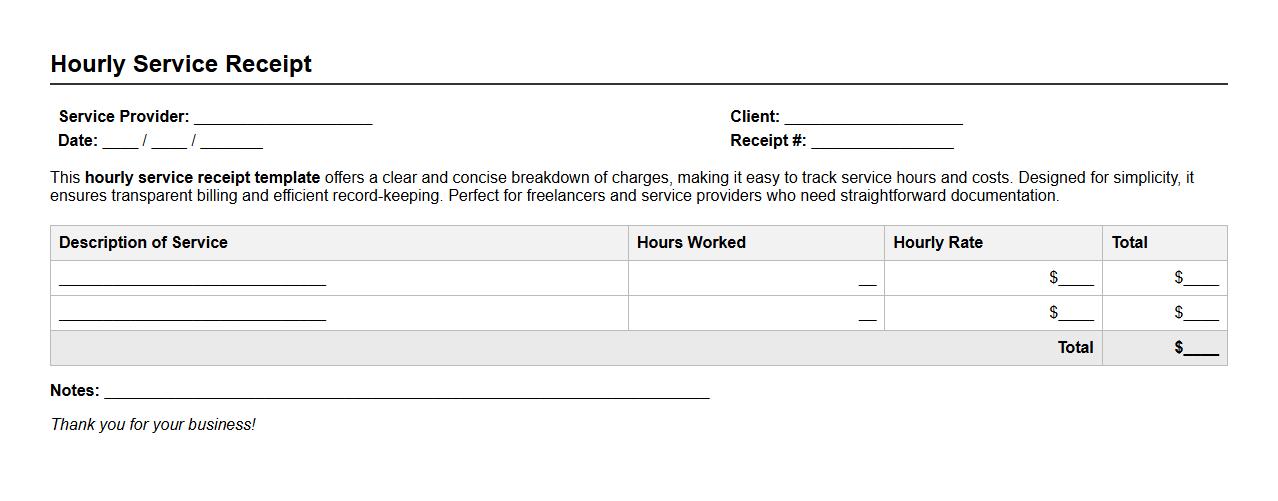

Simple hourly service receipt template with breakdown

This hourly service receipt template offers a clear and concise breakdown of charges, making it easy to track service hours and costs. Designed for simplicity, it ensures transparent billing and efficient record-keeping. Perfect for freelancers and service providers who need straightforward documentation.

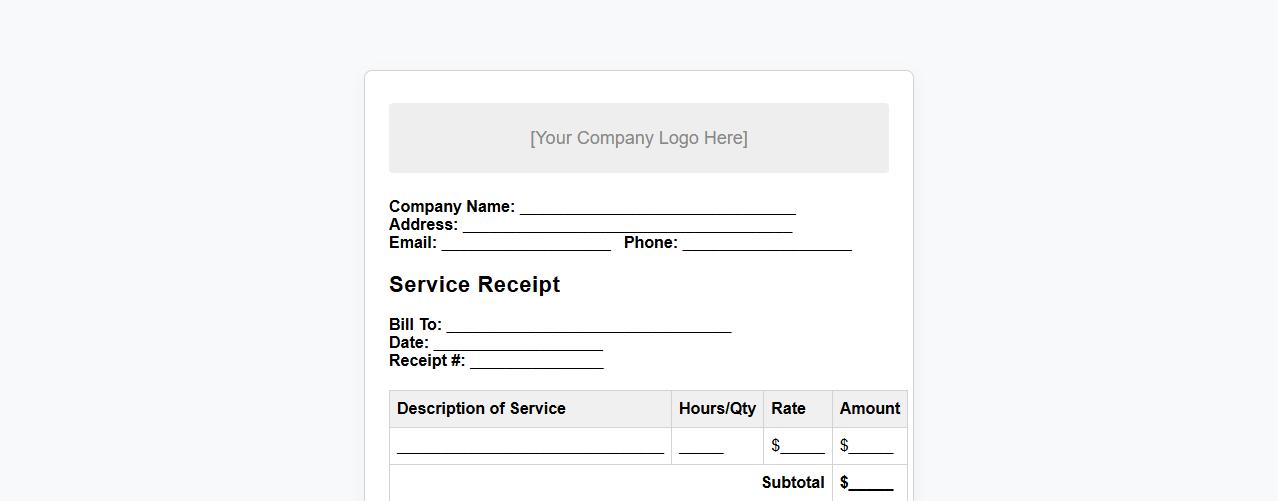

Service receipt template with company logo option

Enhance your business professionalism with our service receipt template featuring an easy-to-add company logo option. This customizable template ensures clear documentation of services rendered while reinforcing brand identity. Simplify your transaction processes and leave a lasting impression on clients.

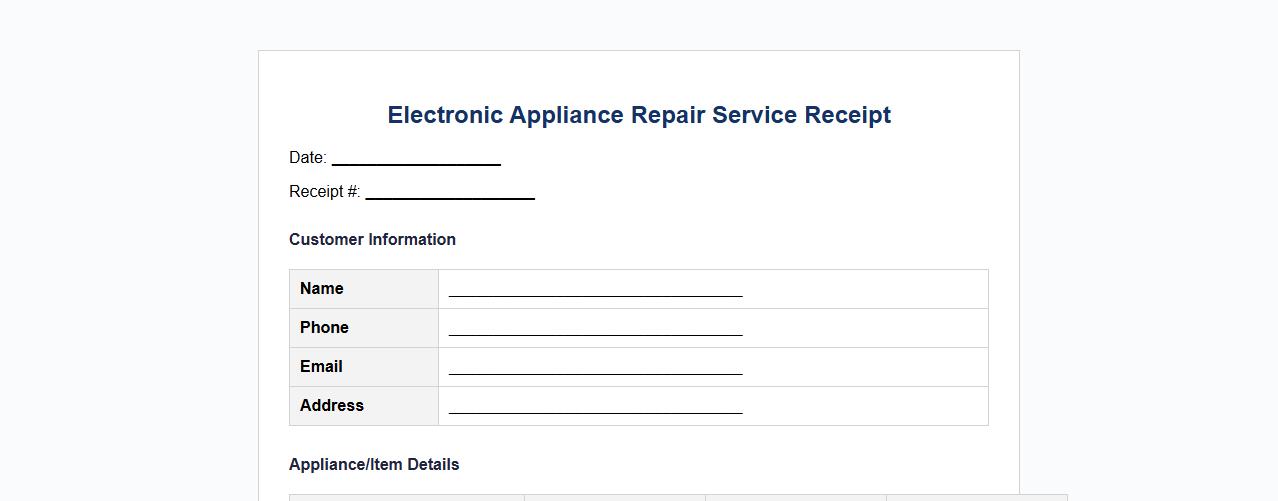

Electronic appliance repair service receipt template

This electronic appliance repair service receipt template provides a clear and professional layout for documenting repair services. It includes sections for item details, service description, cost, and customer information to ensure accurate record-keeping. Ideal for repair businesses to streamline transaction processes and maintain organized records.

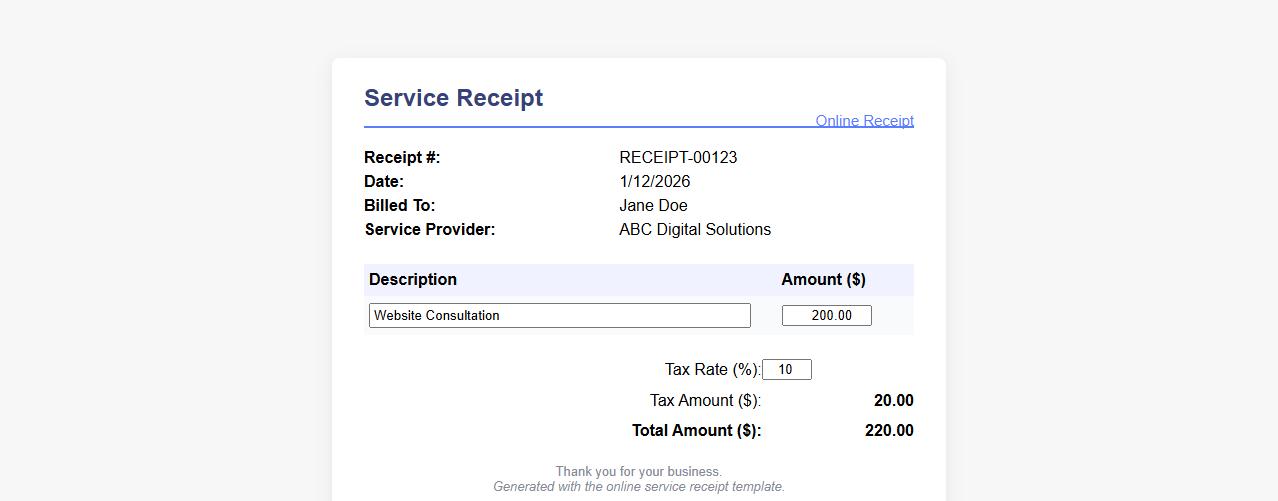

Online service receipt template with tax calculation

Streamline your billing process with this online service receipt template featuring automatic tax calculation. Designed for easy customization, it ensures accurate financial records and professional presentation. Save time and enhance your business's efficiency with every transaction documented perfectly.

Service receipt template for home maintenance services

Use this service receipt template to provide clear and professional documentation for home maintenance services. It ensures transparent communication of service details, costs, and terms between service providers and clients. Perfect for electricians, plumbers, and general home repair professionals.

What are the mandatory details required on a service receipt for tax compliance?

A service receipt must include the service provider's name, address, and tax identification number to ensure compliance with tax regulations. Additionally, the receipt should detail the date of service, description of the service provided, and the total amount charged, including applicable taxes. Including the client's information and a unique receipt number is also essential for accurate record keeping and audit trails.

How to differentiate between a service receipt and a service invoice?

A service receipt confirms that payment has been received for services rendered, while a service invoice is a request for payment issued before the service is paid for. Receipts typically include payment details and a statement of completion, whereas invoices contain payment terms and due dates. Understanding this difference is crucial for proper financial documentation and accounting processes.

Which digital tools can automate service receipt generation and management?

Popular digital tools like QuickBooks, Zoho Invoice, and FreshBooks offer automated service receipt generation, simplifying tax compliance and bookkeeping. These platforms can automatically record payment details and generate professional receipts that comply with tax standards. Integration with payment gateways also enhances efficiency by syncing payments with receipt issuance.

What legal implications arise from missing signatures on service receipts?

The absence of a signature on a service receipt can question its authenticity and weaken its legal standing during disputes or audits. Signatures serve as proof of agreement and acceptance of services rendered and payment received. Without them, tax authorities or courts may reject the document, leading to compliance penalties or legal challenges.

How long should service receipts be retained for audit purposes?

Service receipts must be retained for at least 5 to 7 years, depending on jurisdictional tax laws and audit requirements. Maintaining organized records during this period ensures readiness for any governmental audits or financial reviews. Proper retention protects businesses from penalties and facilitates accurate financial reporting.