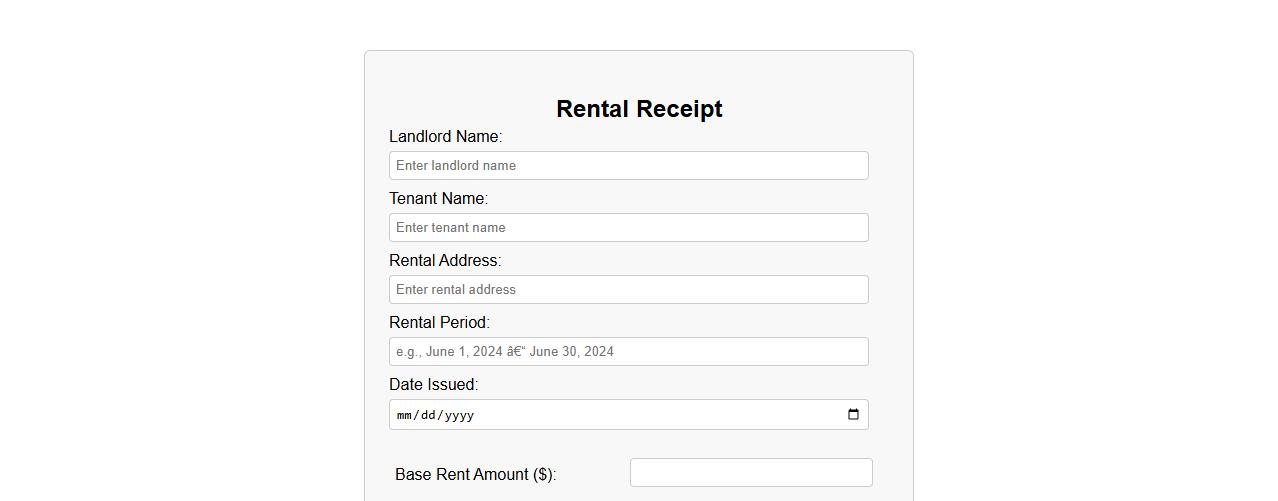

A Rental Receipt Form Sample provides a clear template for landlords and tenants to document rental payments accurately. This form typically includes essential details such as the tenant's name, payment amount, date, and property address, ensuring both parties have proof of transaction. Using a standardized receipt form helps prevent disputes by maintaining transparent and organized rental payment records.

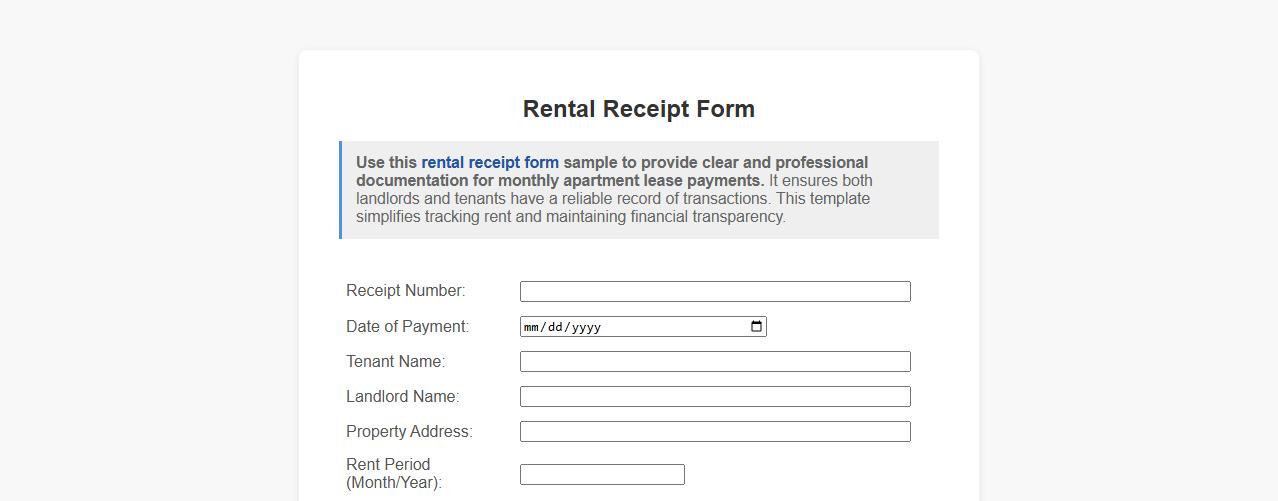

Rental receipt form sample for monthly apartment lease

Use this rental receipt form sample to provide clear and professional documentation for monthly apartment lease payments. It ensures both landlords and tenants have a reliable record of transactions. This template simplifies tracking rent and maintaining financial transparency.

Rental receipt form sample with security deposit details

This rental receipt form sample includes detailed security deposit information to ensure transparent transaction records between landlords and tenants. It outlines payment amounts, dates, and deposit conditions clearly for easy reference. Using this template helps maintain accurate documentation and protects both parties' interests.

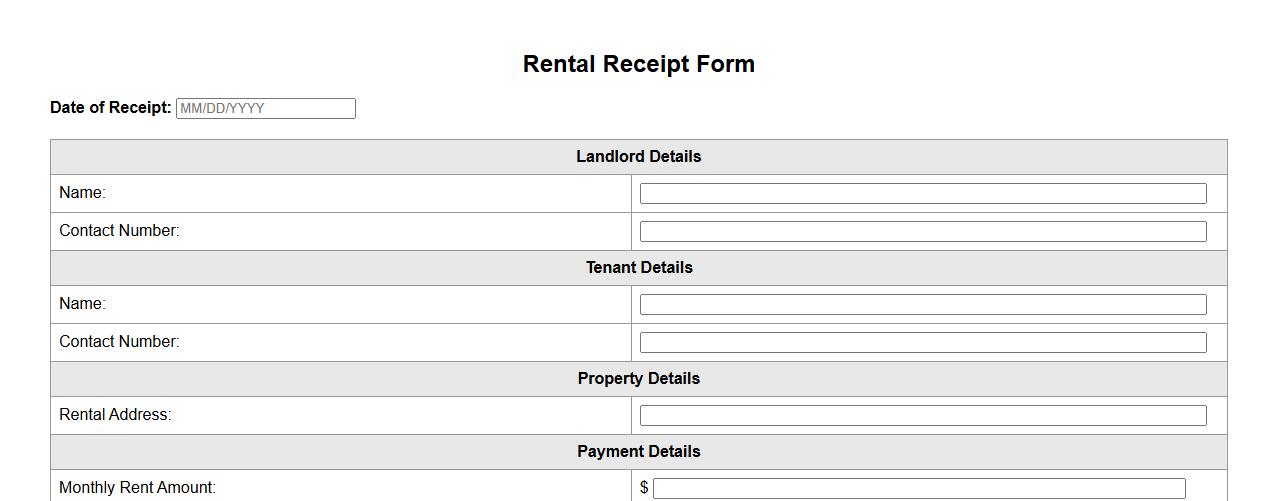

Printable rental receipt form sample for landlords

This printable rental receipt form sample provides landlords with a convenient and professional way to document rent payments. It ensures clear record-keeping and helps avoid disputes by detailing payment amounts and dates. Easily customizable, this form is essential for efficient property management.

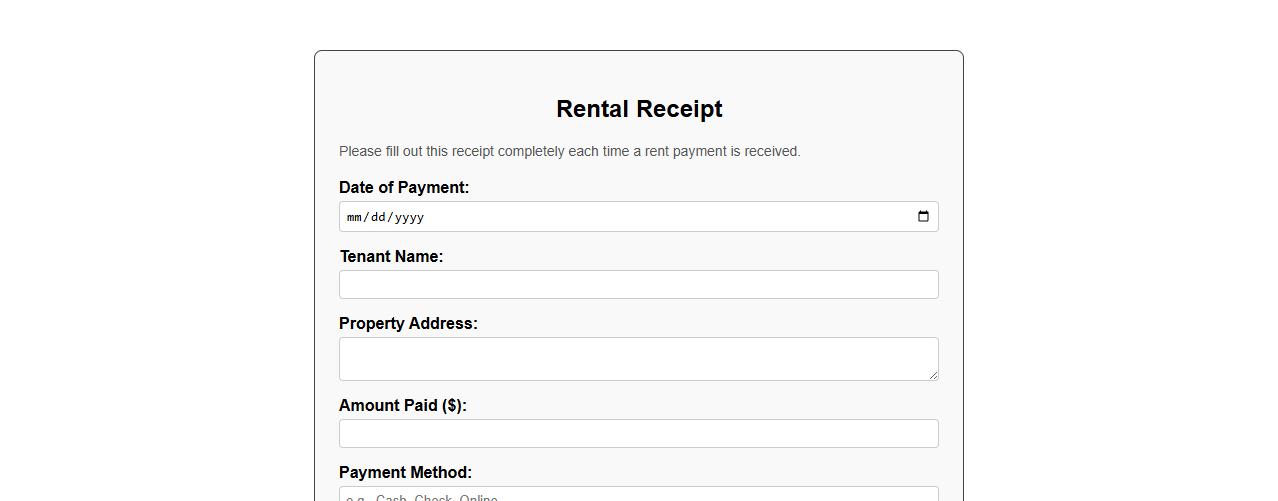

Rental receipt form sample for cash payment transactions

This rental receipt form sample is designed for cash payment transactions, ensuring a clear and professional record for both landlords and tenants. It includes essential details such as payment amount, date, and tenant information to facilitate transparent bookkeeping. Using this form helps prevent disputes and maintains accurate rental payment documentation.

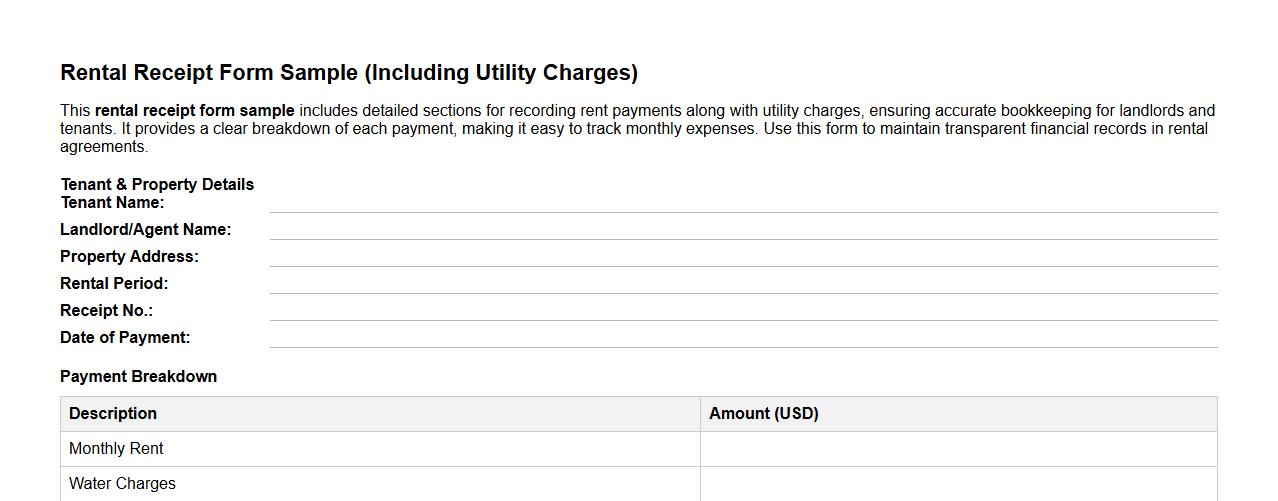

Rental receipt form sample including utility charges

This rental receipt form sample includes detailed sections for recording rent payments along with utility charges, ensuring accurate bookkeeping for landlords and tenants. It provides a clear breakdown of each payment, making it easy to track monthly expenses. Use this form to maintain transparent financial records in rental agreements.

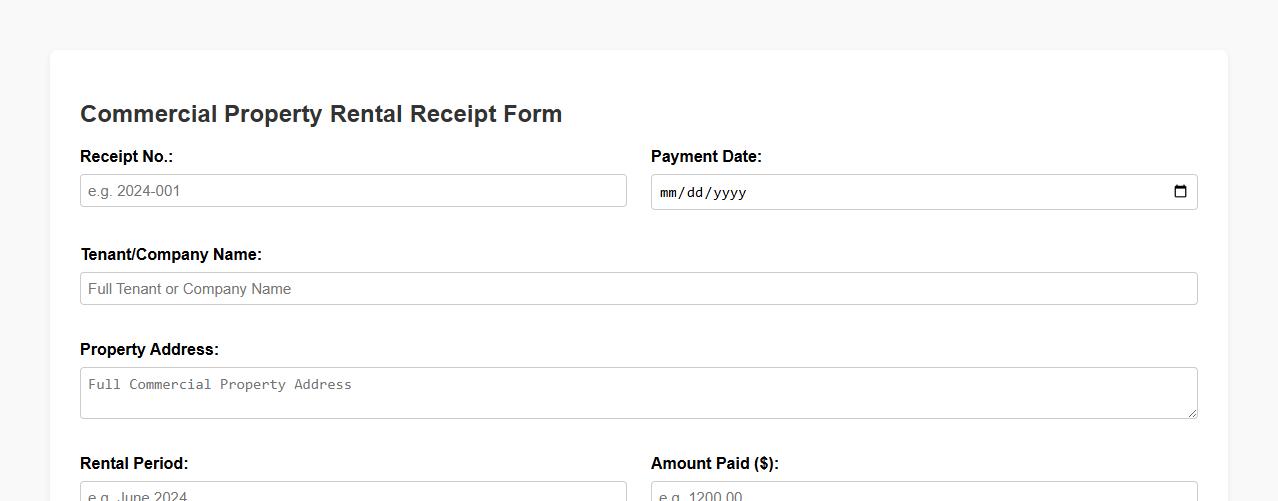

Rental receipt form sample for commercial property rental

This rental receipt form sample is designed specifically for commercial property rentals, ensuring clear documentation of payments between landlords and tenants. It captures essential details such as payment date, amount, tenant information, and property address for accurate record-keeping. Using this form helps maintain transparency and protect both parties in commercial lease agreements.

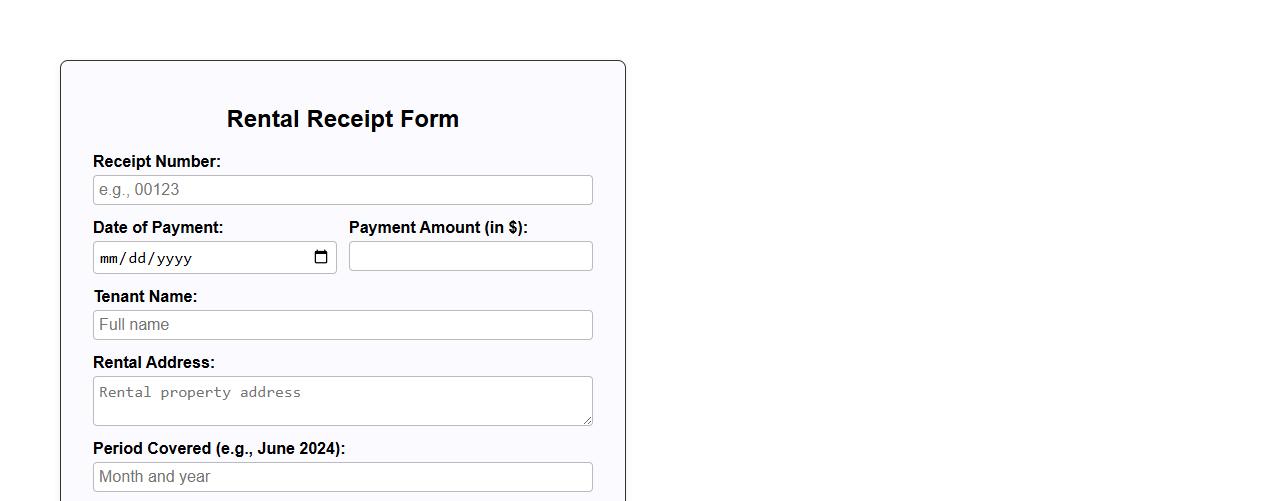

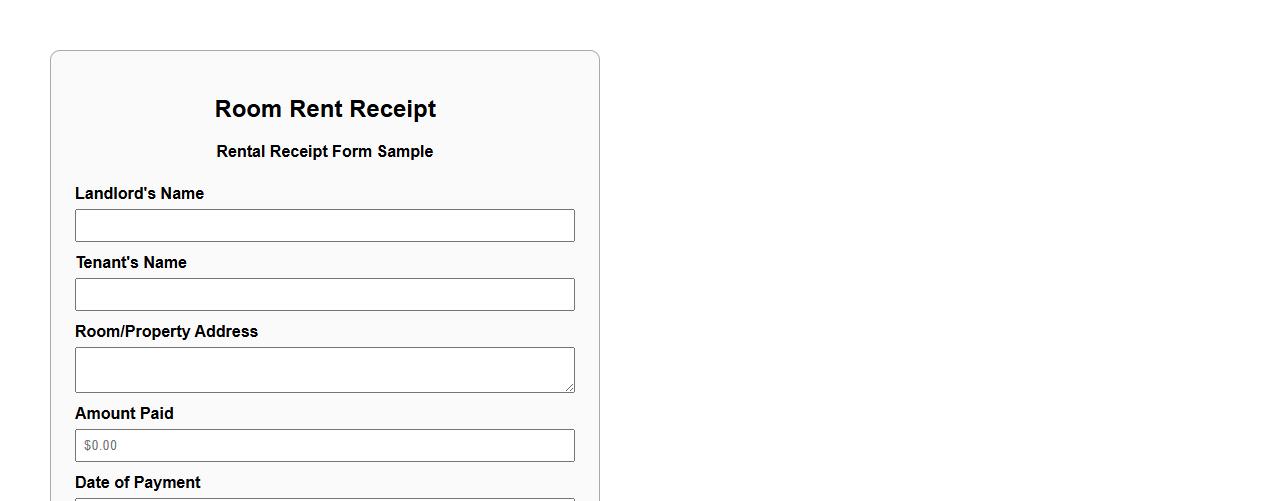

Simple rental receipt form sample for room rent

This rental receipt form sample provides a straightforward template for documenting room rent payments, ensuring transparency between tenants and landlords. It includes essential details such as payment amount, date, and renter information. Using this form helps maintain accurate financial records and fosters clear communication.

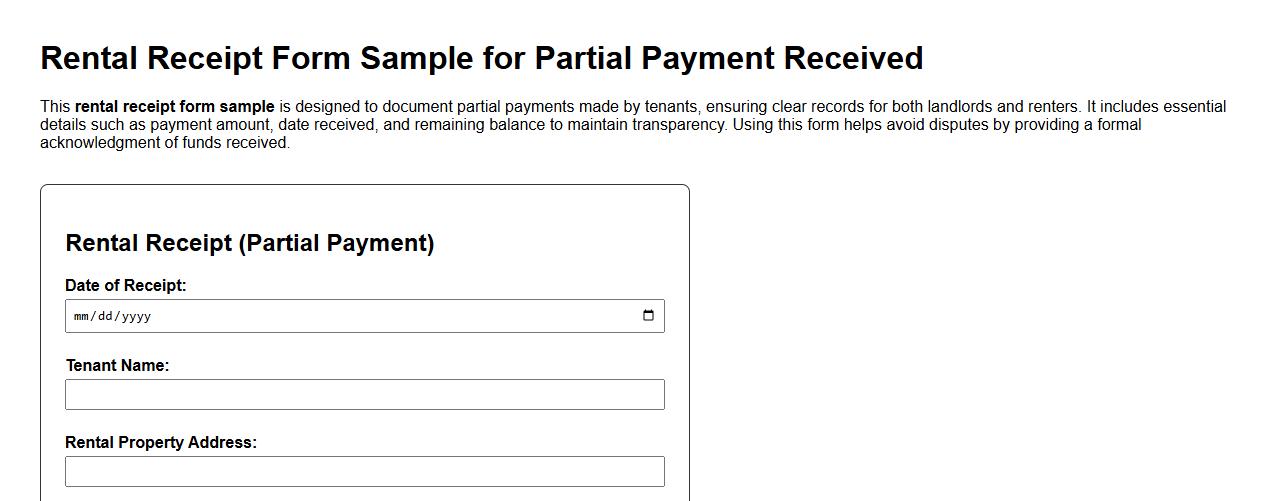

Rental receipt form sample for partial payment received

This rental receipt form sample is designed to document partial payments made by tenants, ensuring clear records for both landlords and renters. It includes essential details such as payment amount, date received, and remaining balance to maintain transparency. Using this form helps avoid disputes by providing a formal acknowledgment of funds received.

Rental receipt form sample with tax calculation included

Download our rental receipt form sample featuring easy-to-use tax calculation included, ensuring accurate and professional documentation for landlords and tenants. This template simplifies rent transactions by automatically computing applicable taxes, saving time and reducing errors. Perfect for maintaining clear financial records and compliance with tax regulations.

What legal details must be included on a Rental Receipt Form for tenant-landlord protection?

A Rental Receipt Form must include the date of payment, the amount received, and the name of the tenant to ensure clear documentation. It should also specify the rental period the payment covers to avoid any disputes. Including the landlord's signature or an authorized agent's signature helps verify the receipt's authenticity.

How does a Rental Receipt Form differ for commercial versus residential leases?

Commercial Rental Receipt Forms often include detailed terms related to business operations, such as lease codes or zoning references, unlike residential forms. Residential receipts focus more on tenant and landlord information along with payment confirmation for living spaces. Additionally, commercial receipts may involve clauses related to maintenance or taxes specific to commercial properties.

Are digital signatures valid on Rental Receipt Forms in most jurisdictions?

In most jurisdictions, digital signatures on Rental Receipt Forms are legally recognized provided they comply with electronic signature laws. These laws require that the signature verifies the intent to sign and the integrity of the document. Landlords and tenants benefit from digital signatures due to their convenience and security features.

What tax information should be present on a Rental Receipt Form for deductible purposes?

The receipt should clearly state the total payment amount and the rental period covered to aid in tax deductions. Including the landlord's tax identification number or business registration number is crucial for official tax documentation. A description indicating whether the payment is for rent or additional charges helps clarify deductible expenses.

How often should a landlord issue Rental Receipt Forms to tenants--monthly, quarterly, or per payment?

Rental Receipt Forms are typically issued per payment to provide precise proof of each transaction. Monthly issuance aligns with most residential lease agreements that are paid monthly. For commercial leases, receipts could be issued quarterly if payments are made on a longer cycle, but per payment is most secure for record-keeping.