A Expense Claim Form Sample helps employees accurately report and request reimbursement for business-related expenses. It typically includes sections for date, expense type, amount, and receipts to ensure clear documentation. Using a standardized form streamlines the approval process and maintains financial transparency.

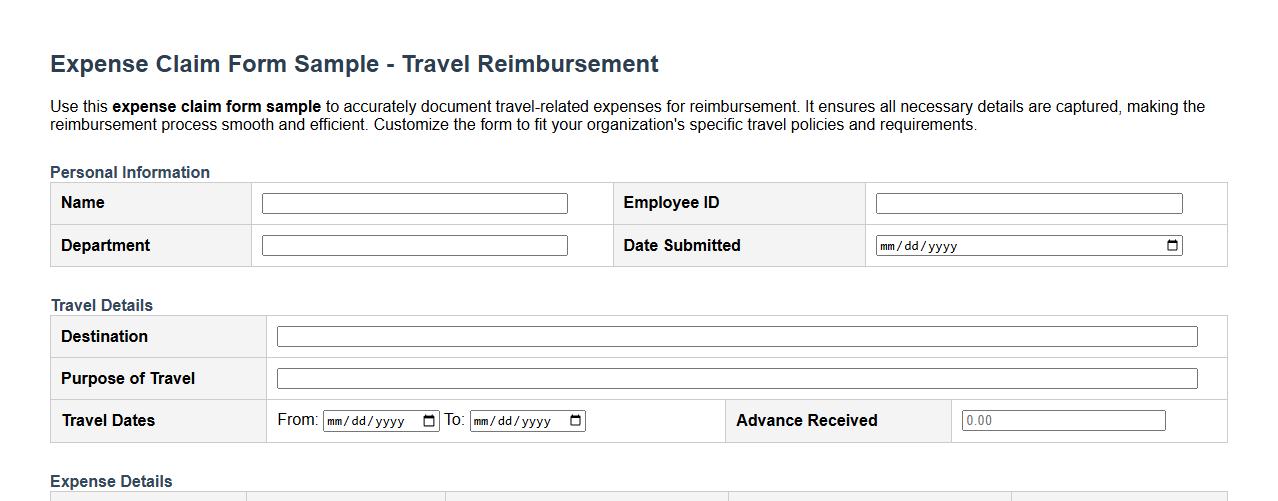

Expense claim form sample for travel reimbursement

Use this expense claim form sample to accurately document travel-related expenses for reimbursement. It ensures all necessary details are captured, making the reimbursement process smooth and efficient. Customize the form to fit your organization's specific travel policies and requirements.

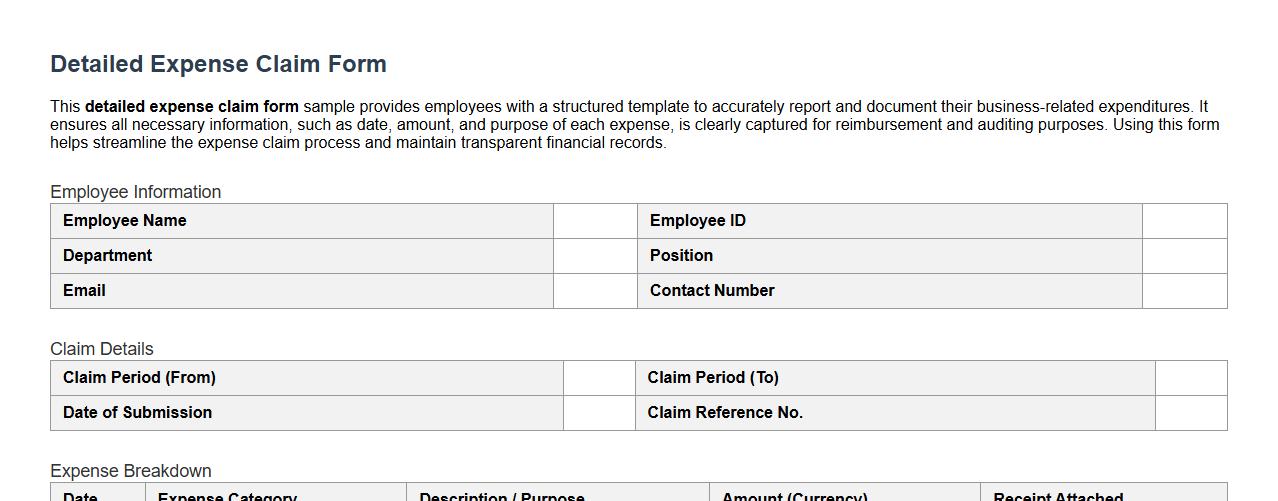

Detailed expense claim form sample for employees

This detailed expense claim form sample provides employees with a structured template to accurately report and document their business-related expenditures. It ensures all necessary information, such as date, amount, and purpose of each expense, is clearly captured for reimbursement and auditing purposes. Using this form helps streamline the expense claim process and maintain transparent financial records.

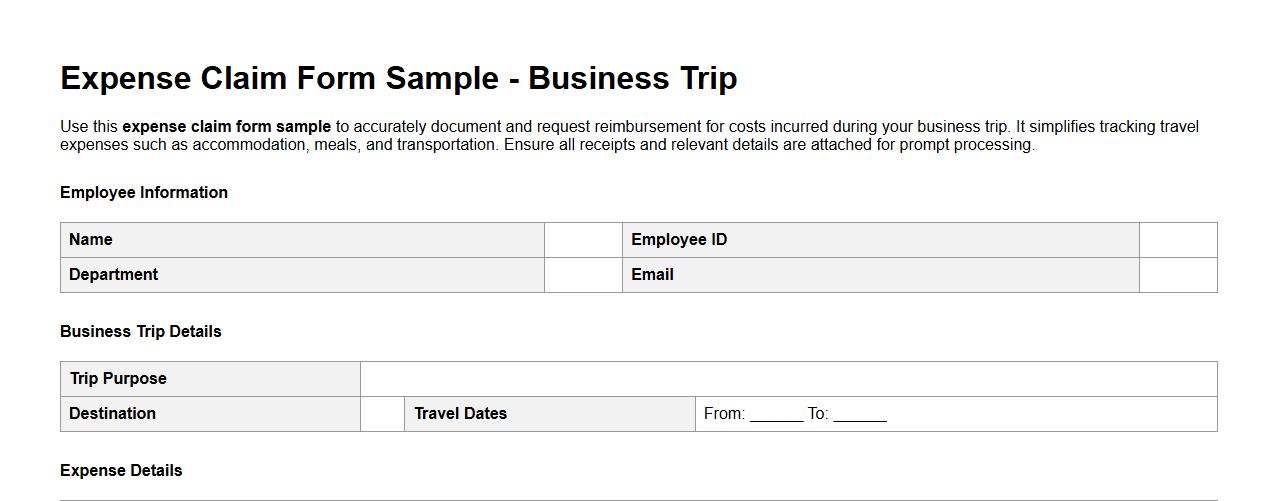

Expense claim form sample for business trip

Use this expense claim form sample to accurately document and request reimbursement for costs incurred during your business trip. It simplifies tracking travel expenses such as accommodation, meals, and transportation. Ensure all receipts and relevant details are attached for prompt processing.

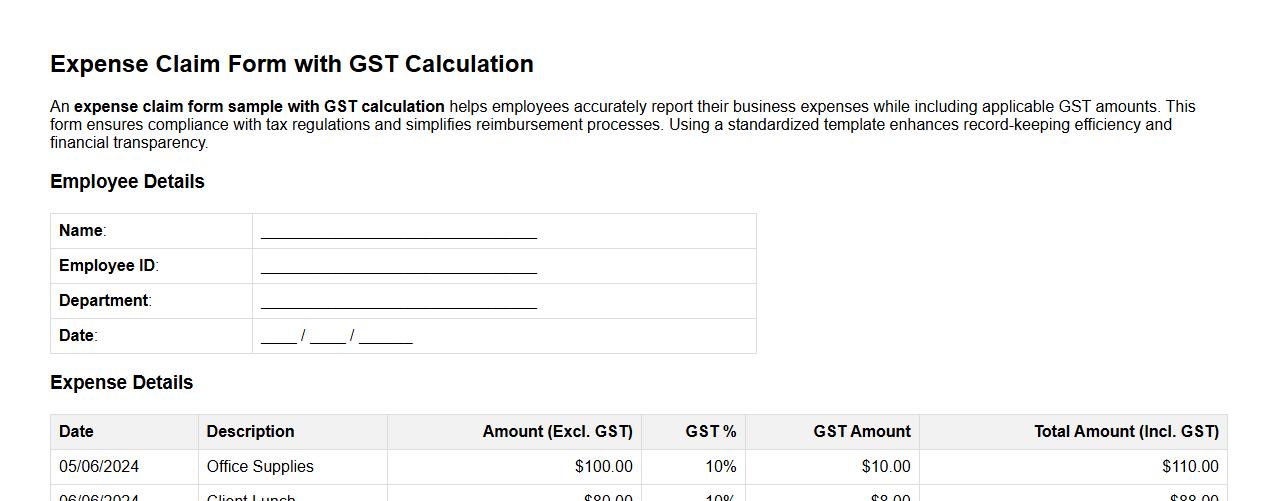

Expense claim form sample with gst calculation

An expense claim form sample with GST calculation helps employees accurately report their business expenses while including applicable GST amounts. This form ensures compliance with tax regulations and simplifies reimbursement processes. Using a standardized template enhances record-keeping efficiency and financial transparency.

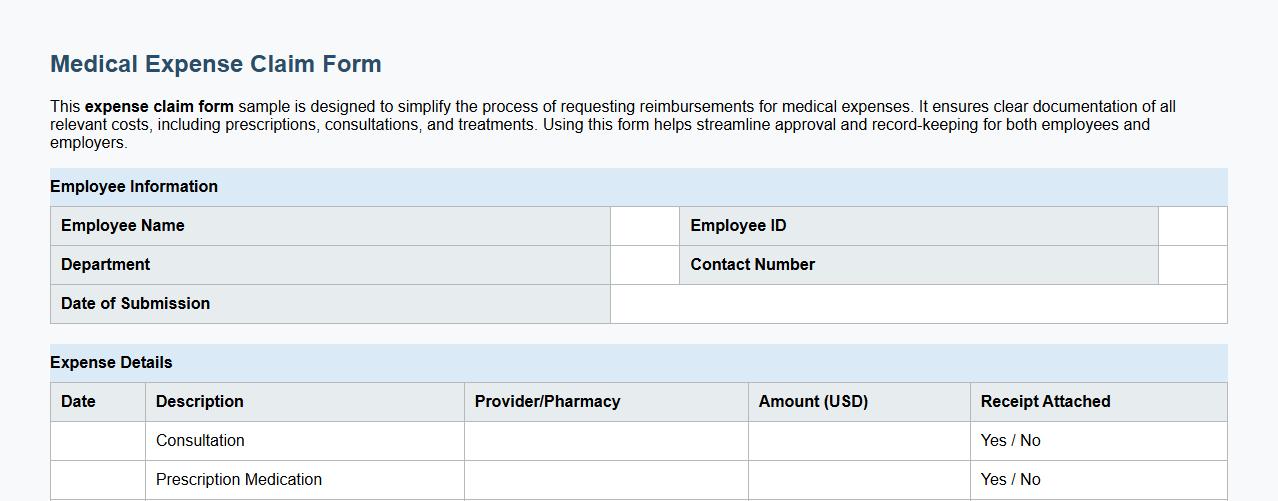

Expense claim form sample for medical expenses

This expense claim form sample is designed to simplify the process of requesting reimbursements for medical expenses. It ensures clear documentation of all relevant costs, including prescriptions, consultations, and treatments. Using this form helps streamline approval and record-keeping for both employees and employers.

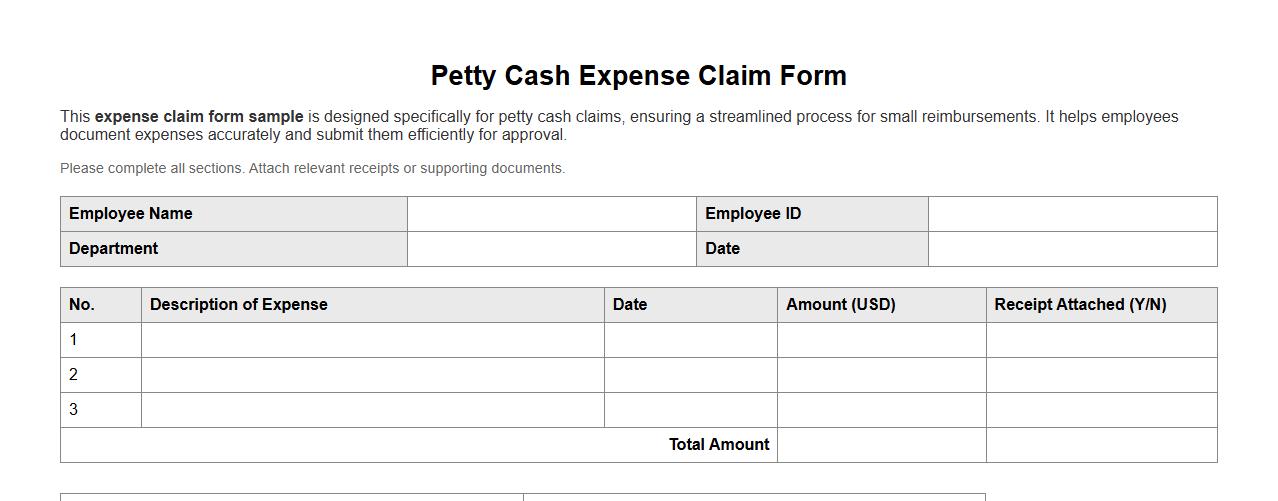

Expense claim form sample for petty cash claims

This expense claim form sample is designed specifically for petty cash claims, ensuring a streamlined process for small reimbursements. It helps employees document expenses accurately and submit them efficiently for approval. Using this template improves financial tracking and accountability within the organization.

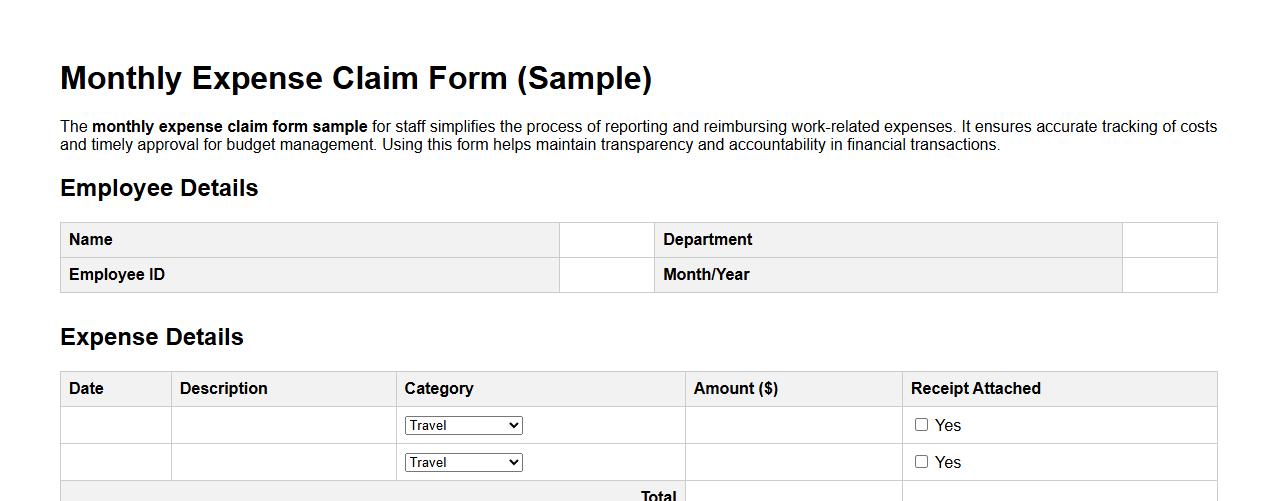

Monthly expense claim form sample for staff

The monthly expense claim form sample for staff simplifies the process of reporting and reimbursing work-related expenses. It ensures accurate tracking of costs and timely approval for budget management. Using this form helps maintain transparency and accountability in financial transactions.

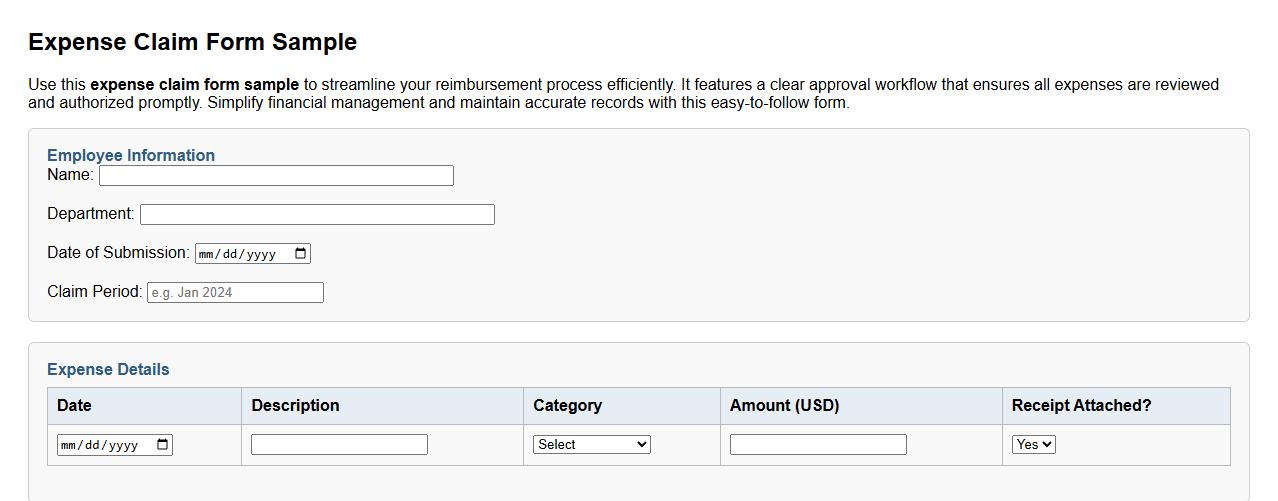

Expense claim form sample with approval workflow

Use this expense claim form sample to streamline your reimbursement process efficiently. It features a clear approval workflow that ensures all expenses are reviewed and authorized promptly. Simplify financial management and maintain accurate records with this easy-to-follow form.

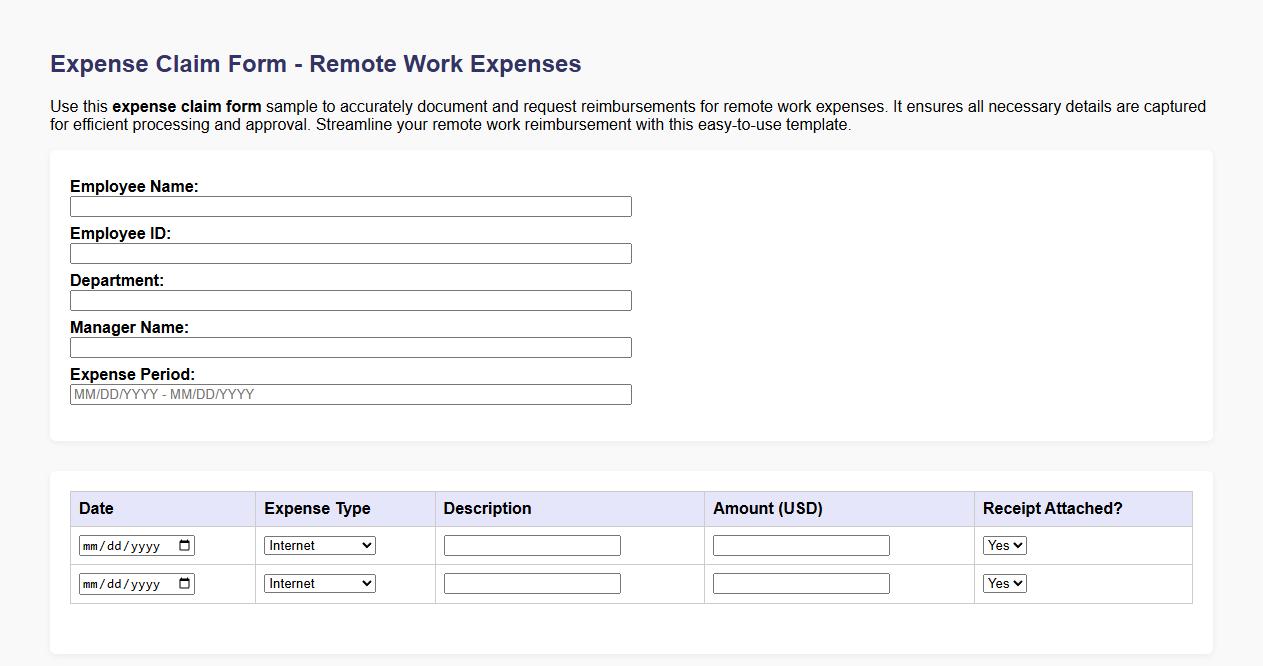

Expense claim form sample for remote work expenses

Use this expense claim form sample to accurately document and request reimbursements for remote work expenses. It ensures all necessary details are captured for efficient processing and approval. Streamline your remote work reimbursement with this easy-to-use template.

What supporting receipts are required for each expense category?

Each expense category requires specific supporting receipts to validate the claim. For travel expenses, itemized receipts for transportation, lodging, and meals must be provided. Office supplies and equipment purchases also need detailed receipts showing the date, vendor, and amount spent.

How should mileage reimbursement be calculated and documented?

Mileage reimbursement should be calculated based on the current approved rate per mile as set by the company policy. Accurate documentation includes a detailed log of dates, starting and ending locations, and total miles traveled. This mileage log must be attached to the expense claim form for verification.

Are digital signatures accepted on the Expense Claim Form?

Yes, digital signatures are accepted on the Expense Claim Form to facilitate faster processing. The digital signature must comply with the company's electronic approval standards and ensure authenticity. This acceptance helps streamline approval workflows, making expense claims more efficient.

What is the maximum claimable amount per transaction?

The maximum claimable amount per transaction varies depending on the expense category and company guidelines. Typically, there is a defined limit to control budget adherence and prevent excessive claims. Any expense exceeding this limit requires additional managerial approval before submission.

Who should approve the Expense Claim Form before submission?

The Expense Claim Form must be approved by the immediate supervisor or designated manager prior to submission. This step ensures proper review and authorization of all expenses claimed. Approval confirms that the expenses comply with organizational policies and budgetary constraints.