A Claim Form Sample provides a clear example of how to properly complete a claim form for insurance or reimbursement purposes. It outlines essential fields such as personal details, claim details, and supporting documentation required for processing. Using a sample helps ensure accurate and efficient submission, reducing the likelihood of delays or rejections.

Health insurance claim form sample

A health insurance claim form sample serves as a valuable reference for accurately completing your insurance reimbursement requests. It outlines the necessary fields and documentation required to ensure a smooth and timely claim process. Utilizing a sample form can help avoid errors and expedite your health insurance claims effectively.

Car accident claim form sample

Filling out a car accident claim form sample helps ensure accurate and complete information is provided for insurance purposes. This form guides you through reporting essential details such as accident description, involved parties, and damages. Using a sample form can simplify the claim process and speed up compensation.

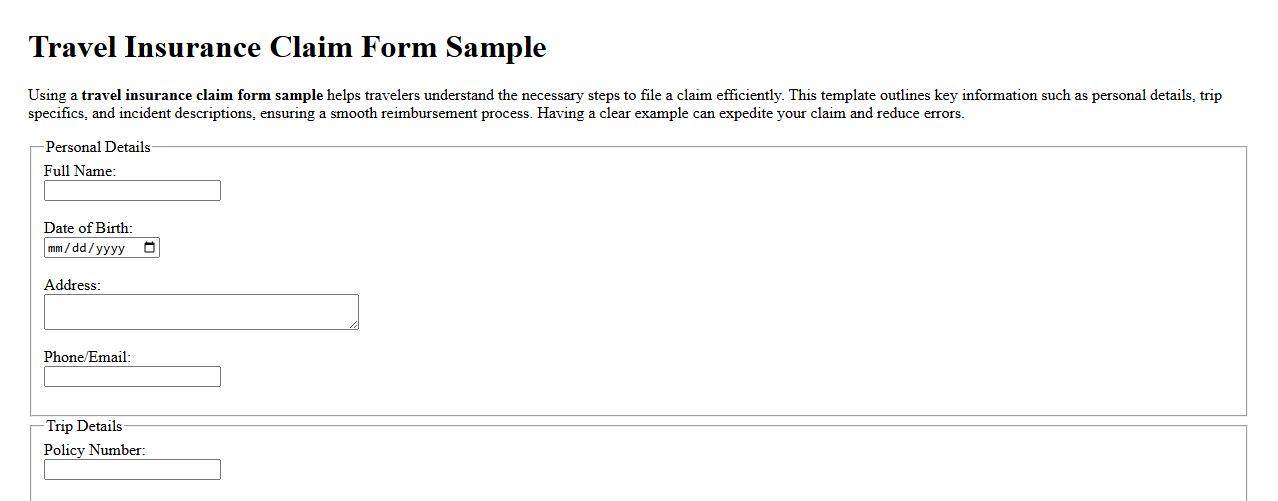

Travel insurance claim form sample

Using a travel insurance claim form sample helps travelers understand the necessary steps to file a claim efficiently. This template outlines key information such as personal details, trip specifics, and incident descriptions, ensuring a smooth reimbursement process. Having a clear example can expedite your claim and reduce errors.

Medical reimbursement claim form sample

The medical reimbursement claim form sample serves as a template for employees to request refunds for medical expenses incurred. It streamlines the submission process by detailing necessary personal and treatment information. Using this form ensures accurate and timely reimbursement from the employer or insurance provider.

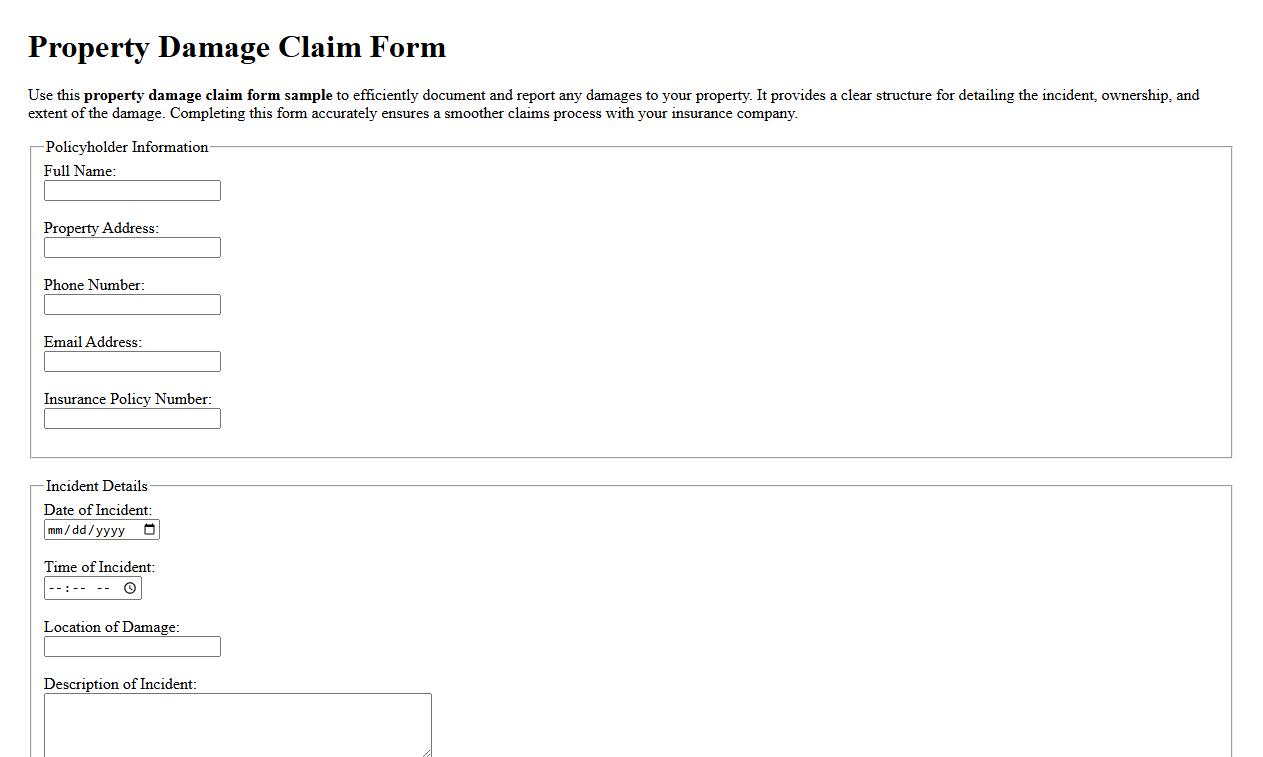

Property damage claim form sample

Use this property damage claim form sample to efficiently document and report any damages to your property. It provides a clear structure for detailing the incident, ownership, and extent of the damage. Completing this form accurately ensures a smoother claims process with your insurance company.

Vehicle insurance claim form sample

Filing a vehicle insurance claim form sample helps streamline the process of reporting damages and losses to your insurer. This document includes essential details such as personal information, accident description, and policy number. Using a well-structured form ensures timely and accurate claim processing.

Fire insurance claim form sample

Download this fire insurance claim form sample to ensure accurate and efficient documentation of damages caused by fire incidents. This template helps policyholders provide essential information for smooth processing of their insurance claims. Use it as a reference to streamline your claim submission and avoid delays.

Life insurance death claim form sample

Understanding the life insurance death claim form sample helps beneficiaries complete the necessary paperwork accurately and efficiently. This form is essential for initiating the claims process after the policyholder's death. Properly filled forms ensure timely processing and payout of the life insurance benefits.

Dental insurance claim form sample

Understanding a dental insurance claim form sample can simplify the process of submitting claims for dental treatments. This form typically includes details of the insured, treatment provided, and costs incurred, ensuring accurate and timely reimbursement. Reviewing a sample helps familiarize patients and providers with required information and documentation.

Lost luggage claim form sample

Use this lost luggage claim form sample to efficiently report and document your missing baggage. It provides a standardized format to ensure all necessary details are included for a smooth claim process. Submitting a complete form helps expedite compensation from airlines or travel insurers.

What supporting documents are required for submitting this specific claim form?

The claim form requires valid identification documents such as a driver's license or passport to verify the claimant's identity. Additionally, proof of loss or injury must be included, which can be in the form of medical reports or police records. Receipts and invoices related to the claim are also necessary to support the financial aspects of the submission.

How does the claim form address pre-existing condition exclusions?

The claim form explicitly asks for disclosure of any pre-existing medical conditions to determine the claim's validity. It includes specific sections to identify if the claimed event relates to conditions existing prior to the coverage period. Any exclusions based on these conditions are clearly outlined to prevent invalid claims.

Are electronic signatures accepted on this claim form?

The claim form accepts electronic signatures to facilitate faster and more efficient processing of claims. This modern feature ensures claimants can submit forms remotely without physical mailing. However, it specifies that the electronic signature must comply with legal standards for authenticity.

What is the maximum allowable claim amount indicated in the form?

The form clearly states the maximum allowable claim amount which varies depending on the type of claim submitted. This limit is crucial for setting expectations regarding reimbursement and coverage. Claimants must review this section to understand financial caps before submitting their documentation.

Does the claim form specify a submission deadline for claims?

The claim form includes a submission deadline, typically requiring claims to be filed within a defined time frame after the incident. Meeting this deadline is essential to ensure the claim is considered valid and eligible for processing. Late submissions may be rejected or require additional justification.