A Service Receipt is a document provided by a service provider to confirm the completion and payment of a service. It typically includes details such as the service description, date, cost, and the provider's contact information. This receipt serves as proof of transaction and can be used for record-keeping or warranty claims.

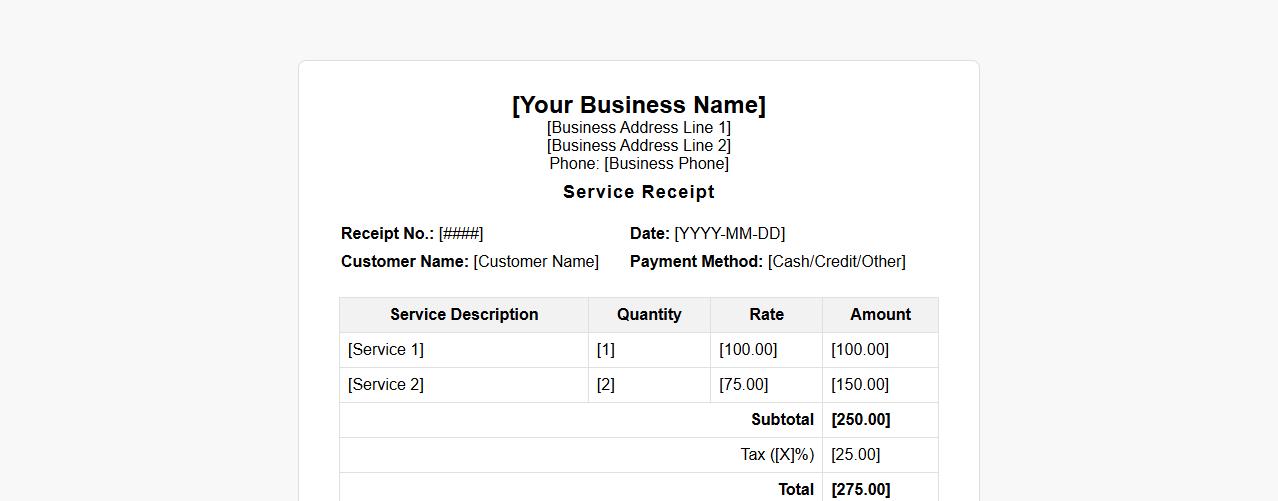

Service receipt format for small businesses

Our service receipt format for small businesses provides a clear and professional way to document transactions, ensuring accurate record-keeping and customer satisfaction. This template includes essential details such as service description, date, amount, and payment method. Using a standardized receipt format helps small businesses maintain transparency and streamline their financial processes.

Downloadable service receipt template PDF

Download our service receipt template PDF to easily document transactions and provide proof of service. This template is fully customizable, making it ideal for various business needs. Save time and ensure professionalism with this convenient download.

Service receipt requirements according to IRS

To comply with the IRS, a service receipt must include the date, description of services performed, and the total amount charged. It should also contain the service provider's name and contact information, ensuring proper documentation for tax purposes. Keeping accurate records helps in case of audits and supports legitimate business deductions.

Customizable digital service receipt generator

Our customizable digital service receipt generator allows businesses to create professional and tailored receipts quickly. It simplifies transaction tracking by providing clear, editable templates that match your brand. Enhance customer experience with easy-to-use, digital documentation solutions.

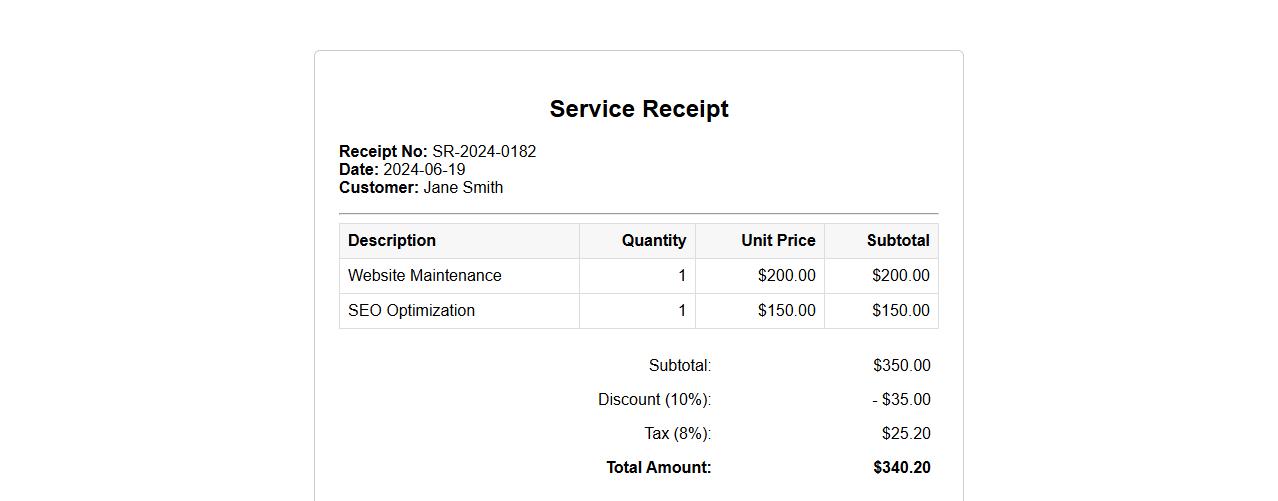

Service receipt including tax and discount details

A service receipt provides a clear summary of the transaction, including detailed tax calculations and any applied discounts. It ensures transparency by itemizing the service charges alongside the respective taxes and discount amounts. This document is essential for both customer reference and accounting purposes.

Printable service receipt form with logo

Download a printable service receipt form featuring your company logo for a professional and organized transaction record. This customizable template ensures clear documentation of services rendered and payment details. Enhance your business credibility with a branded, easy-to-use receipt.

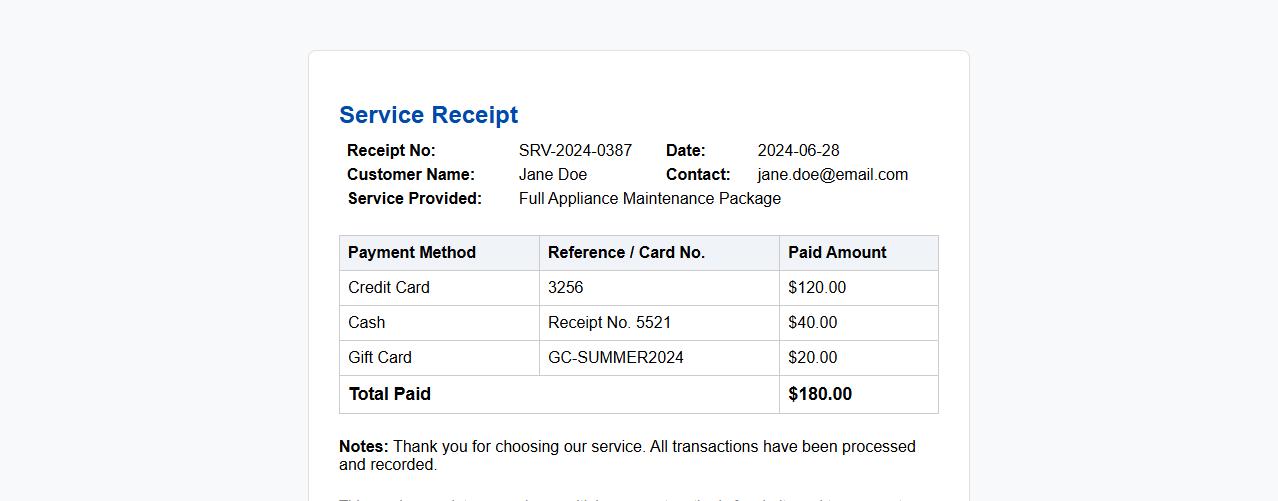

Service receipt with multiple payment methods

This service receipt provides a clear summary of transactions, accommodating multiple payment methods for convenience and flexibility. It ensures accurate record-keeping by detailing each payment type used. Customers benefit from transparent and organized billing information in a single document.

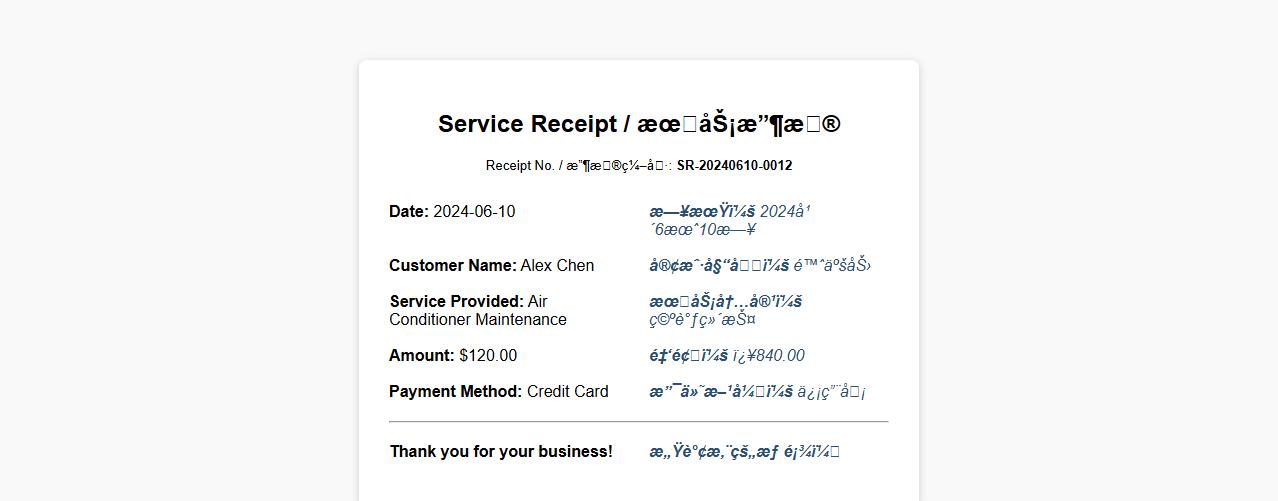

Bilingual service receipt example for customers

Providing a bilingual service receipt ensures clear communication for all customers by displaying transaction details in two languages. This enhances customer satisfaction and reduces misunderstandings during purchases. Bilingual receipts are an essential tool for businesses serving diverse communities.

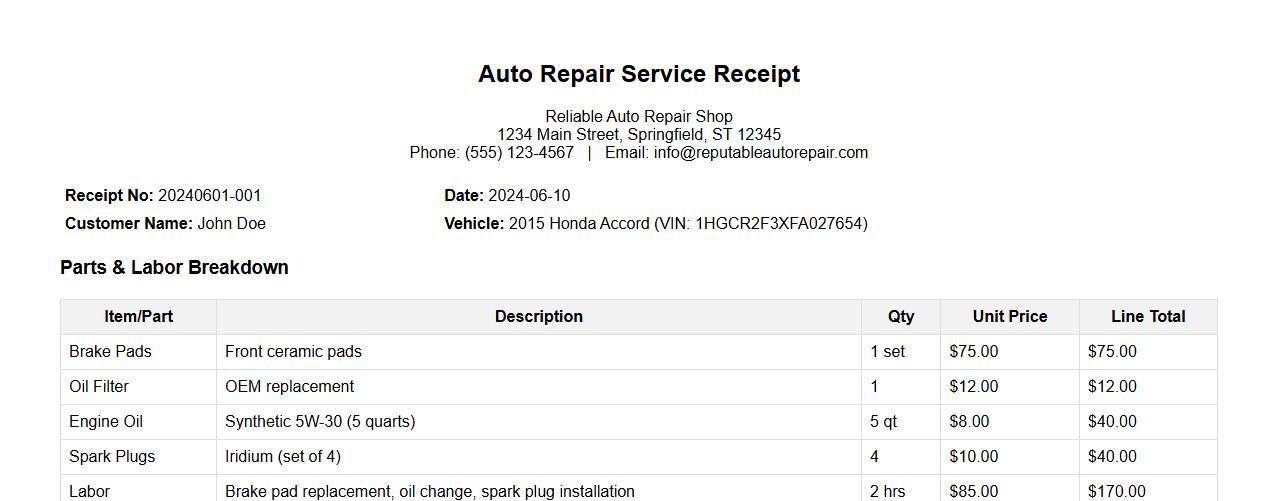

Auto repair service receipt with parts breakdown

This auto repair service receipt provides a detailed breakdown of all parts used during the repair, ensuring transparency and accuracy. It itemizes each component along with its cost, helping customers understand the total charges. The receipt serves as a reliable record for both the service provider and the vehicle owner.

Service receipt tracking software for freelancers

Our service receipt tracking software is designed specifically for freelancers to simplify expense management and ensure accurate financial records. It enables seamless organization, storage, and retrieval of receipts, saving valuable time and reducing errors. Stay on top of your finances effortlessly with this intuitive tool tailored for freelance professionals.

What are the essential legal elements of a valid service receipt letter?

A valid service receipt letter must clearly state the names and addresses of both the service provider and the client. It should include a detailed description of the services rendered, along with the date and duration of the service. Additionally, the letter must contain the date of issuance and the authorized signatures to ensure legal authenticity.

How should confidential client information be structured in a service receipt letter?

Confidential client information should be included in a dedicated section, where sensitive details like client ID, contact information, and service specifics are clearly separated. Use clear labels and secure formatting to emphasize the confidentiality of the data. It is essential to follow privacy laws and avoid unnecessary disclosure of personal information.

What tax-related details must be included in a service receipt letter for compliance?

The service receipt letter should include the tax identification number (TIN) of both the service provider and the client, if applicable. It must clearly show the service fees, applicable taxes, and the total amount due. Additionally, mention the tax rate and any relevant tax codes to meet government compliance standards.

Which digital signature practices are accepted for electronic service receipt letters?

Accepted digital signature practices for electronic service receipt letters include using certified digital certificates issued by trusted certification authorities. Signatures must be verifiable and tamper-evident to enhance security. Furthermore, the process should comply with local electronic transaction laws for legal recognition.

How should service disputes be referenced in a service receipt acknowledgment letter?

Service disputes should be clearly addressed with a specific dispute resolution clause in the acknowledgment letter. This clause must outline the steps for raising concerns and the timeframe for resolution. Including contact information for dispute management helps maintain transparency and trust between parties.