A Refund Receipt is an official document provided to customers when money is returned for a returned product or canceled service. It serves as proof of the transaction reversal and details the amount refunded, date, and method of refund. Maintaining a Refund Receipt is essential for accurate financial records and customer service transparency.

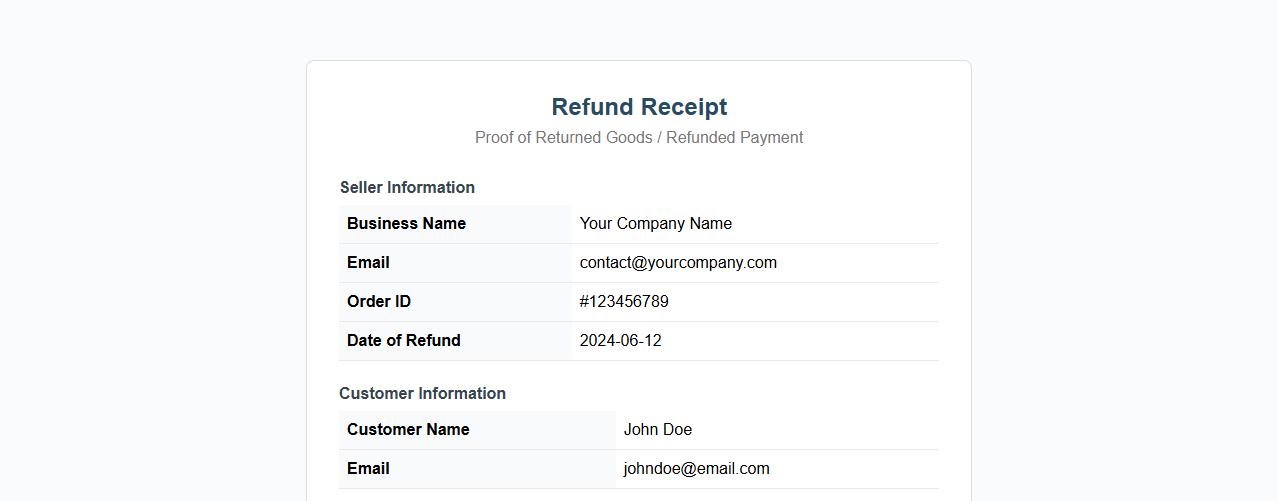

Refund receipt template for online purchases

Use this refund receipt template to provide clear proof of returned goods or refunded payments for online purchases. It ensures transparency and trust between the seller and customer by detailing transaction and refund information. Customize it easily to match your brand's style and communication needs.

How to issue a refund receipt in QuickBooks

To issue a refund receipt in QuickBooks, navigate to the Sales menu and select Refund Receipt. Enter the customer details, the amount to be refunded, and the payment method, then save the transaction. This ensures accurate tracking of returned funds and maintains proper financial records.

Difference between refund receipt and credit note

The difference between a refund receipt and a credit note lies in their purpose and usage: a refund receipt confirms the reimbursement of money to a customer, while a credit note serves as a voucher for future purchases. Both documents are essential for accurate financial record-keeping and customer service. Understanding their distinct roles helps businesses maintain transparent and efficient transaction processes.

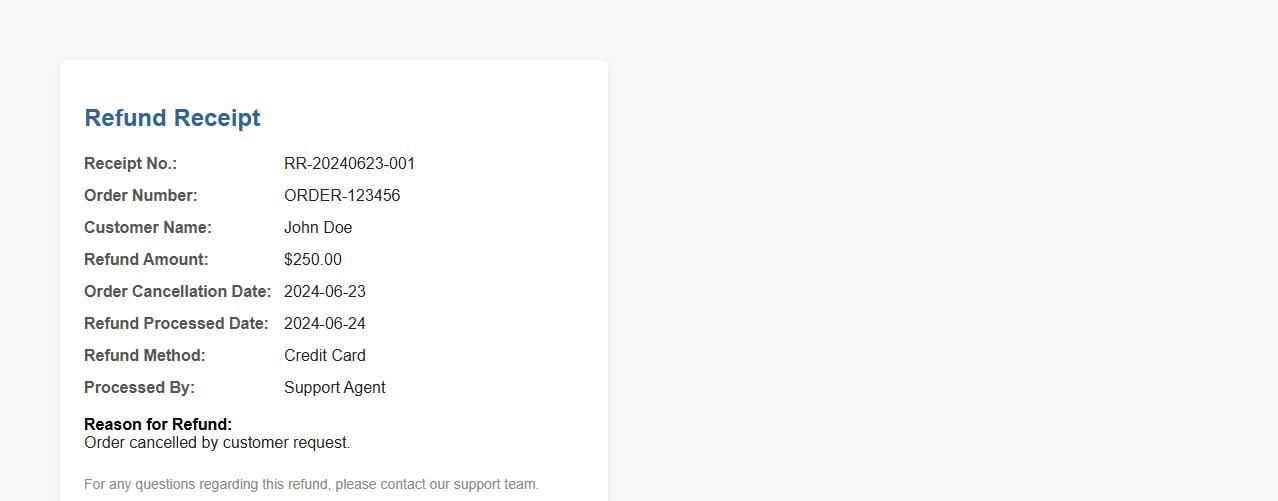

Refund receipt format for cancelled orders

The refund receipt format for cancelled orders provides a clear and concise record of the transaction reversal. It includes essential details such as order number, refund amount, and cancellation date to ensure transparency and customer trust. This format helps streamline communication between businesses and customers regarding refunds.

Refund receipt requirements for tax purposes

To comply with tax regulations, a refund receipt must include the original transaction details, the reason for the refund, and the date of the refund. It serves as official documentation to support adjustments in taxable income and inventory records. Properly issued refund receipts help ensure accurate tax reporting and auditing compliance.

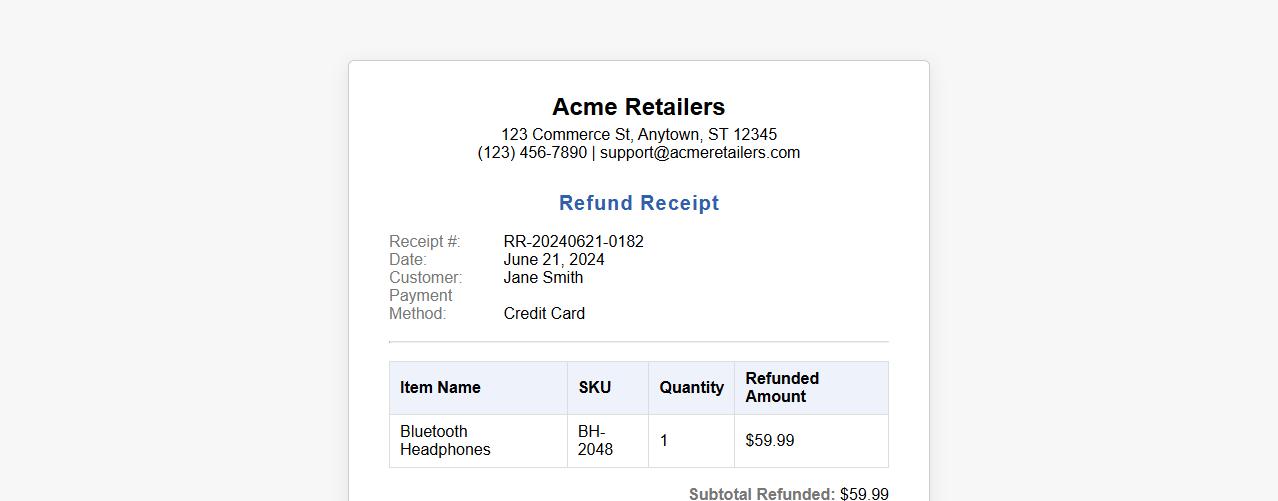

Refund receipt example for returned merchandise

This refund receipt example demonstrates the proper documentation for returned merchandise, ensuring transparency and accuracy in transaction records. It outlines important details such as the item refunded, the amount returned, and the date of the transaction. Utilizing this format helps maintain clear communication between the merchant and customer.

Customize refund receipt layout in accounting software

Enhance your financial documentation by learning how to customize refund receipt layout in accounting software, ensuring clarity and professionalism. Tailoring the layout to your business needs improves communication with clients and streamlines record-keeping. This feature helps maintain accurate and visually appealing receipts for all refund transactions.

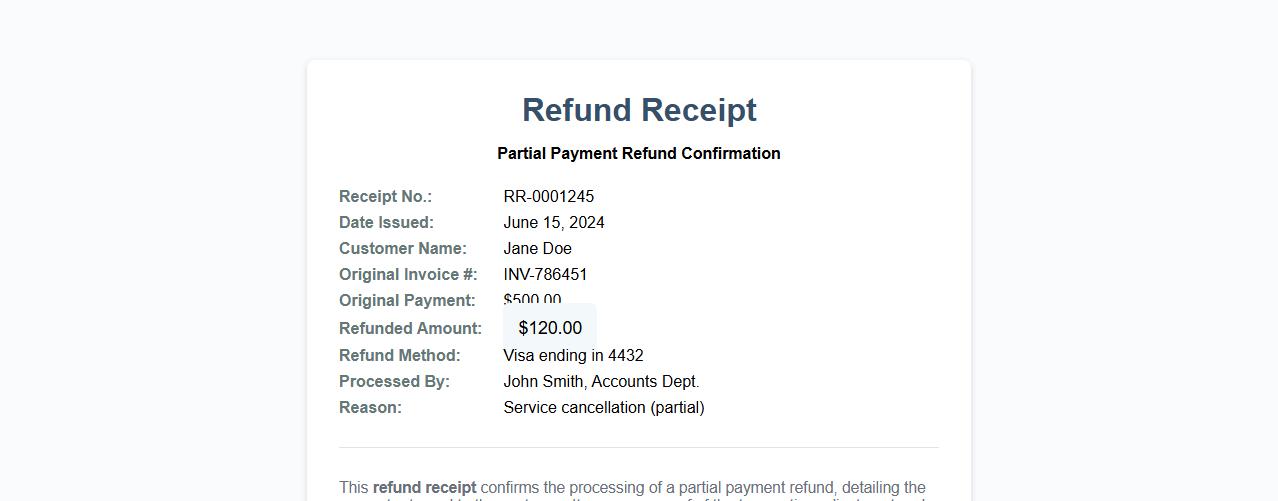

Refund receipt for partial payment refunds

This refund receipt confirms the processing of a partial payment refund, detailing the amount returned to the customer. It serves as proof of the transaction adjustment and helps maintain accurate financial records. Customers can use this receipt for their personal accounting and verification purposes.

Digital vs paper refund receipt for e-commerce

Choosing between a digital refund receipt and a paper receipt in e-commerce impacts convenience and record-keeping efficiency. Digital receipts offer instant access and easy storage, while paper receipts provide a tangible proof of transaction. Both methods ensure transparency and help in managing returns and refunds effectively.

Refund receipt policy for small businesses

Our refund receipt policy ensures transparency and trust between small businesses and their customers by clearly outlining the conditions under which refunds are issued. It helps maintain accurate financial records and simplifies the refund process. Adopting a clear policy protects both parties and enhances customer satisfaction.

What are the mandatory fields for a valid refund receipt document?

A valid refund receipt document must include the transaction date, refund amount, and customer details to ensure traceability. Including the original purchase reference and payment method is also essential for clarity. Lastly, the reason for refund should be clearly stated to maintain transparency.

How is the refund transaction reference number included in the letter?

The refund transaction reference number should be prominently displayed near the top of the receipt for easy identification. It is typically labeled as "Refund Transaction ID" or "Reference Number". Including this number helps link the refund to the original purchase in accounting systems.

What language should be used for refund reason justification?

The refund reason justification must be written in clear and concise language that is easily understandable by both the customer and the company. Using formal business language eliminates ambiguity and supports legal validity. Avoid jargon or subjective language to maintain professionalism.

How do you address partial versus full refunds in the receipt letter?

The receipt letter should explicitly state whether the refund is a partial or full refund by mentioning the refunded amount relative to the original purchase price. For partial refunds, details on the remaining balance or retained charges must be included. This clarity prevents misunderstandings and supports accurate record-keeping.

Which signatures or digital authorizations are required for legal compliance?

Legal compliance requires the refund receipt to include an authorized signature or a verified digital authorization from a responsible company representative. This approval confirms the refund's legitimacy and protects against fraud. Electronic signatures are increasingly accepted, provided they meet local regulatory standards.