A Petty Cash Receipt is a document used to record small, incidental expenses paid out of a company's petty cash fund. It serves as proof of payment and helps maintain accurate financial records by tracking minor expenditures. These receipts are essential for auditing and reconciling the petty cash balance effectively.

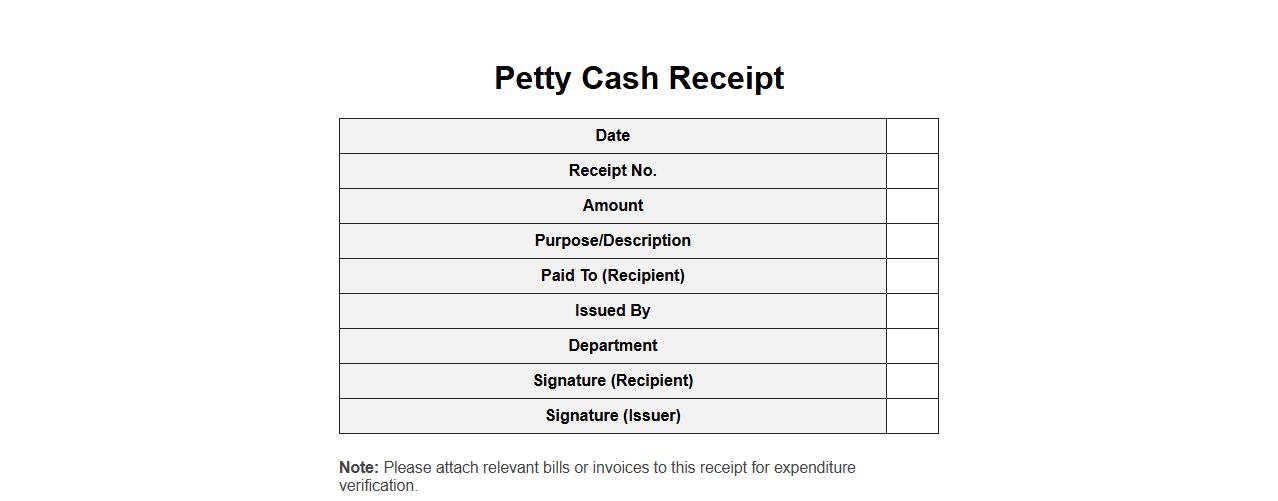

Petty cash receipt format for small businesses

The petty cash receipt format for small businesses is essential for tracking minor expenses efficiently and maintaining transparent financial records. This format includes details such as date, amount, purpose, and recipient, ensuring accountability and easy reconciliation. Using a standardized receipt helps small businesses manage their cash flow and avoid discrepancies.

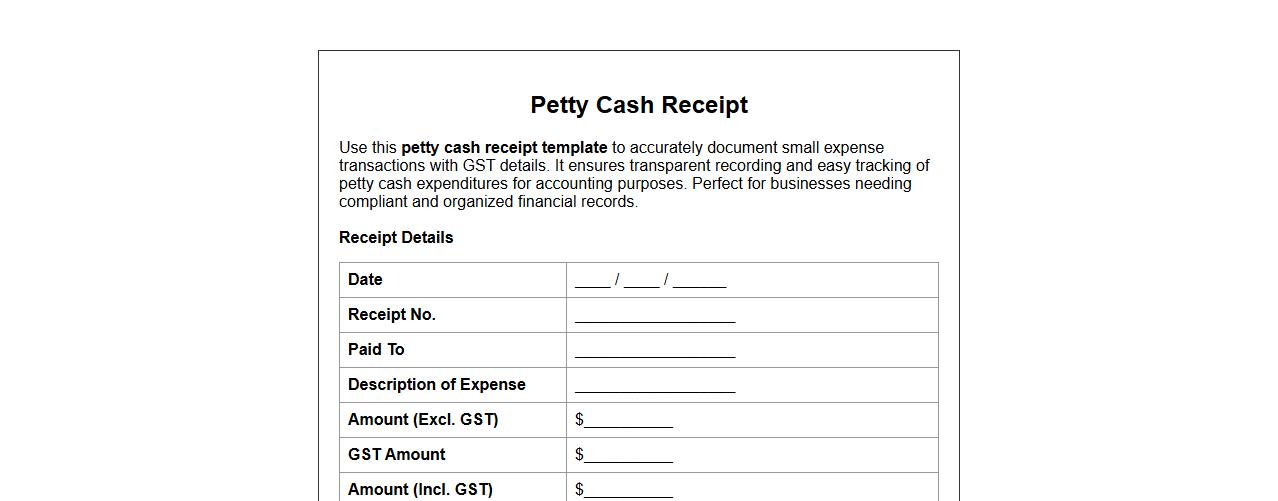

Petty cash receipt template with GST details

Use this petty cash receipt template to accurately document small expense transactions with GST details. It ensures transparent recording and easy tracking of petty cash expenditures for accounting purposes. Perfect for businesses needing compliant and organized financial records.

How to create a petty cash receipt for office expenses

To create a petty cash receipt for office expenses, ensure you include the date, amount, purpose of the expense, and the recipient's signature. This document helps maintain accurate financial records and supports transparent cash handling. Properly formatted receipts streamline office accounting and auditing processes.

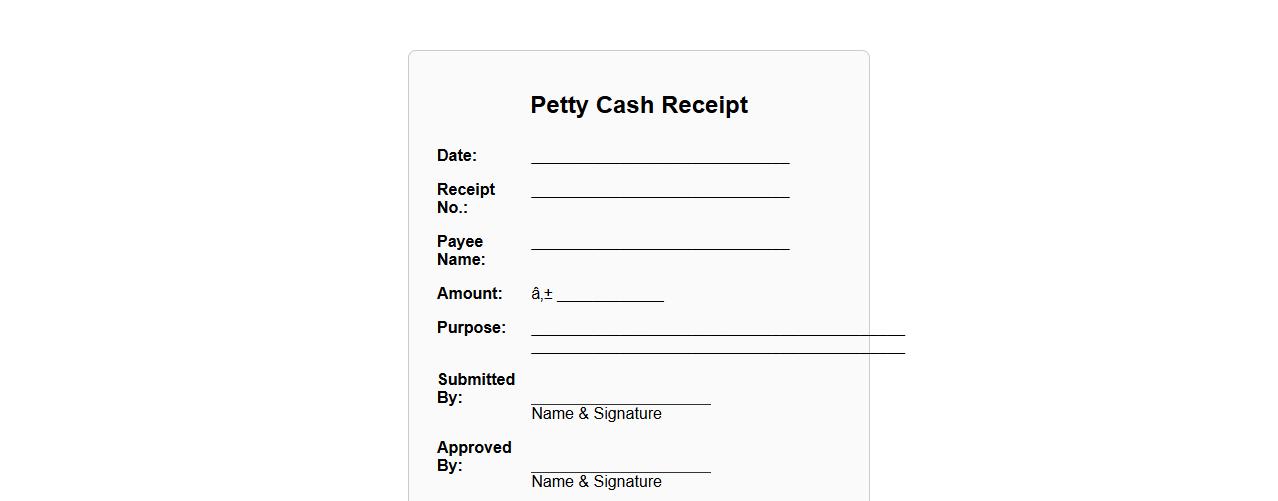

Petty cash receipt sample for reimbursement

This petty cash receipt sample is designed to simplify the reimbursement process by providing a clear record of small expenses. It includes essential details like date, amount, purpose, and approval signature to ensure accountability. Using this template helps maintain accurate financial tracking and supports efficient expense management.

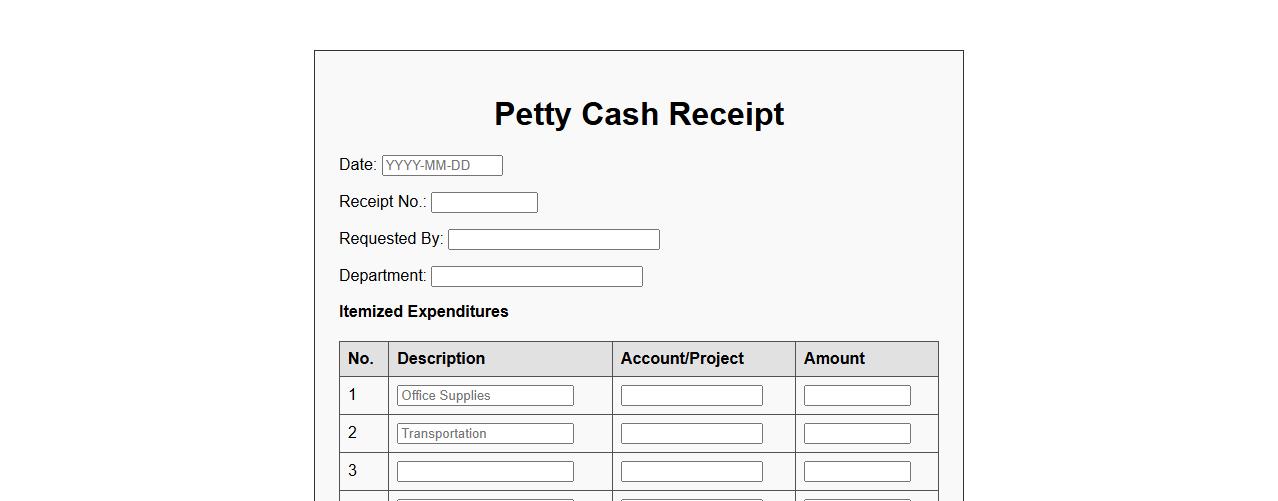

Printable petty cash receipt with itemized expenditures

This printable petty cash receipt provides a clear record of itemized expenditures for accurate budgeting and auditing. It helps track small cash transactions efficiently, ensuring transparency and accountability. Ideal for businesses and organizations managing daily expenses.

Petty cash receipt book for monthly tracking

Keep your finances organized with a petty cash receipt book designed for monthly tracking. This essential tool helps accurately document small expenses, ensuring transparent and efficient cash management. Simplify bookkeeping and maintain financial control effortlessly every month.

Digital petty cash receipt solution for remote teams

Our digital petty cash receipt solution streamlines expense tracking for remote teams by providing an efficient, paperless method for managing petty cash transactions. This innovative tool enhances transparency and accountability, ensuring all receipts are securely stored and easily accessible. Empower your remote workforce with a seamless financial management experience.

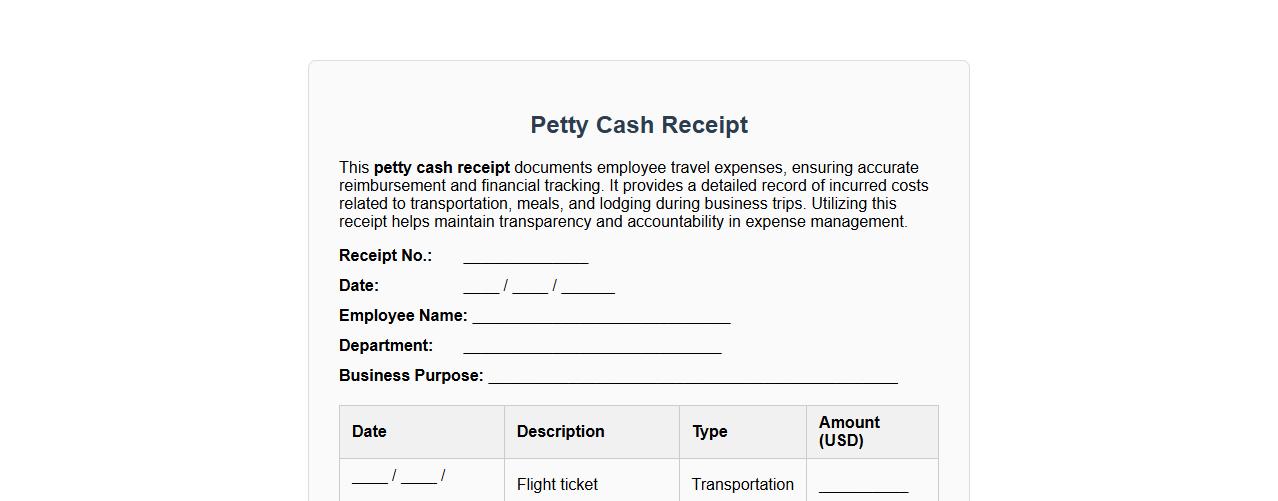

Petty cash receipt for employee travel expenses

This petty cash receipt documents employee travel expenses, ensuring accurate reimbursement and financial tracking. It provides a detailed record of incurred costs related to transportation, meals, and lodging during business trips. Utilizing this receipt helps maintain transparency and accountability in expense management.

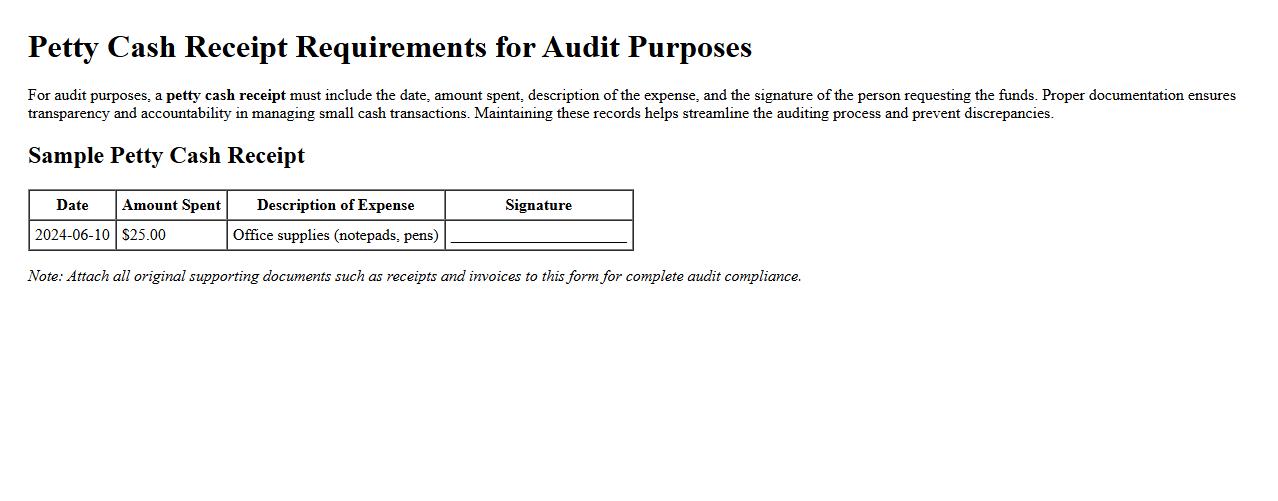

Petty cash receipt requirements for audit purposes

For audit purposes, a petty cash receipt must include the date, amount spent, description of the expense, and the signature of the person requesting the funds. Proper documentation ensures transparency and accountability in managing small cash transactions. Maintaining these records helps streamline the auditing process and prevent discrepancies.

Petty cash receipt form with approval signature

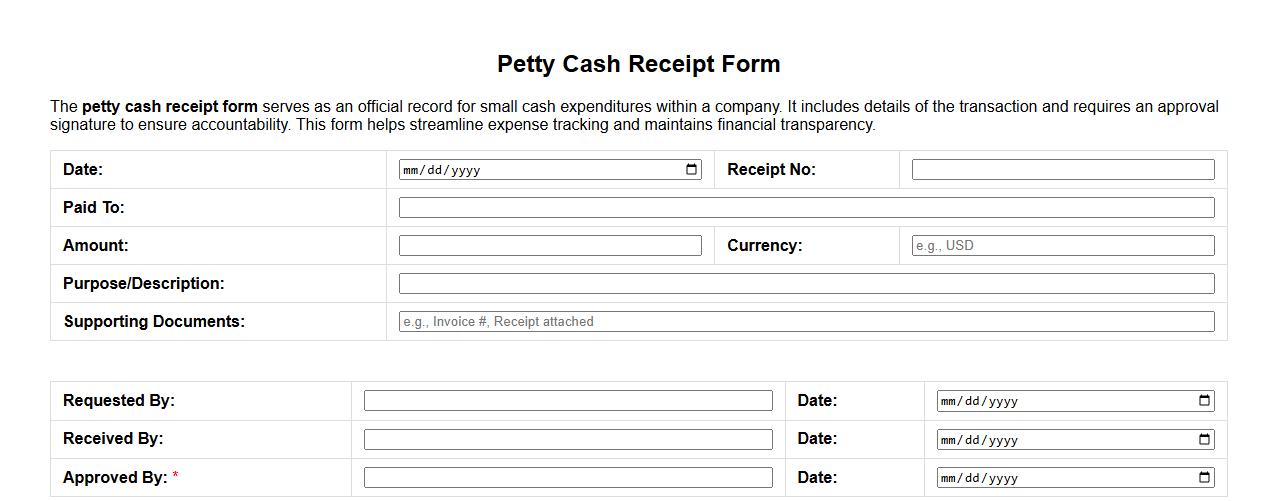

The petty cash receipt form serves as an official record for small cash expenditures within a company. It includes details of the transaction and requires an approval signature to ensure accountability. This form helps streamline expense tracking and maintains financial transparency.

What essential details must be included on a compliant petty cash receipt?

A compliant petty cash receipt must include the date of the transaction to ensure proper tracking. It should clearly state the amount disbursed and a detailed description of the expense. Additionally, the receipt must have the signature of the person receiving the cash for accountability.

How can petty cash receipts be authenticated for internal audits?

Petty cash receipts can be authenticated by verifying the original signature of the recipient and the approver. Cross-checking the expense description against company policy ensures legitimacy. Implementing a sequential numbering system on receipts further enhances audit traceability.

Which accounting codes are typically assigned on a petty cash receipt?

Typically, petty cash receipts are assigned specific expense codes related to office supplies, travel, or miscellaneous expenses. These codes help categorize and simplify financial reporting. Proper coding ensures alignment with the organization's chart of accounts for accurate bookkeeping.

What are common errors to avoid when documenting petty cash disbursements?

Common errors include failing to attach original receipts, which compromises expense validation. Another mistake is incomplete or vague expense descriptions, leading to audit discrepancies. Additionally, neglecting to record the date or recipient's signature can cause issues during reconciliations.

How should digital petty cash receipts be securely stored and backed up?

Digital petty cash receipts should be stored in a secured, access-controlled repository to protect sensitive financial data. Regular backups using cloud storage or external drives prevent data loss. Implementing encryption and audit logs further enhances security and compliance.