A restaurant receipt serves as an official document detailing the items ordered, their prices, and the total amount paid by the customer. It helps ensure accuracy in billing and provides proof of purchase for both the diner and the establishment. This receipt often includes important information such as the date, time, and the restaurant's contact details.

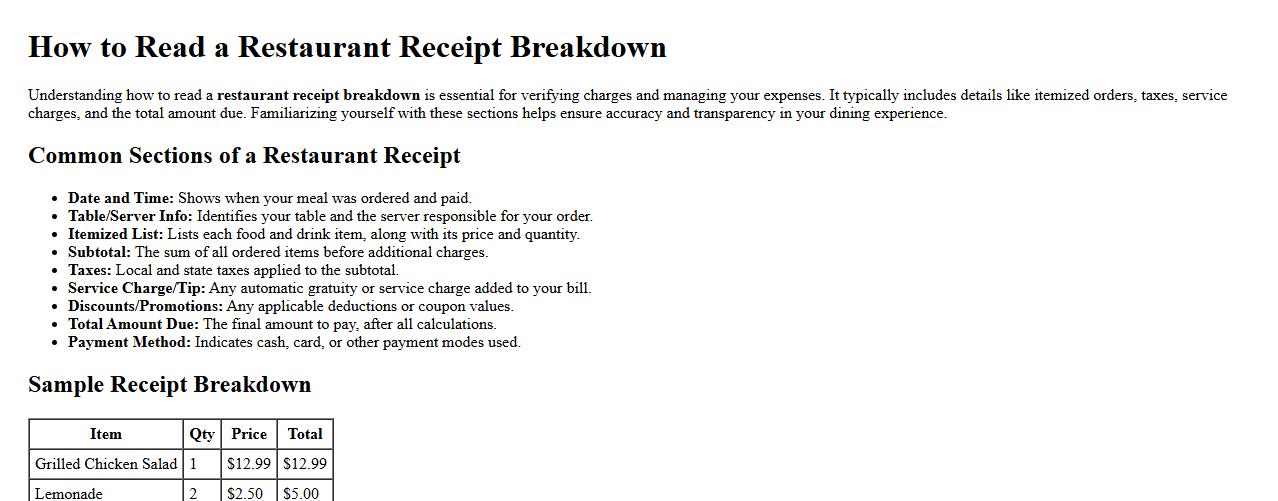

How to read a restaurant receipt breakdown

Understanding how to read a restaurant receipt breakdown is essential for verifying charges and managing your expenses. It typically includes details like itemized orders, taxes, service charges, and the total amount due. Familiarizing yourself with these sections helps ensure accuracy and transparency in your dining experience.

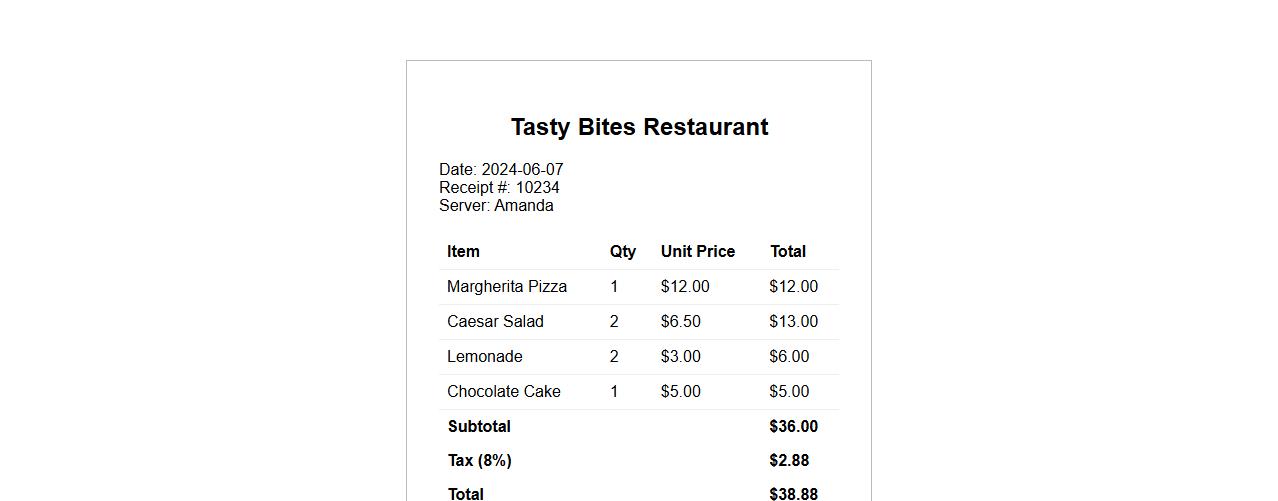

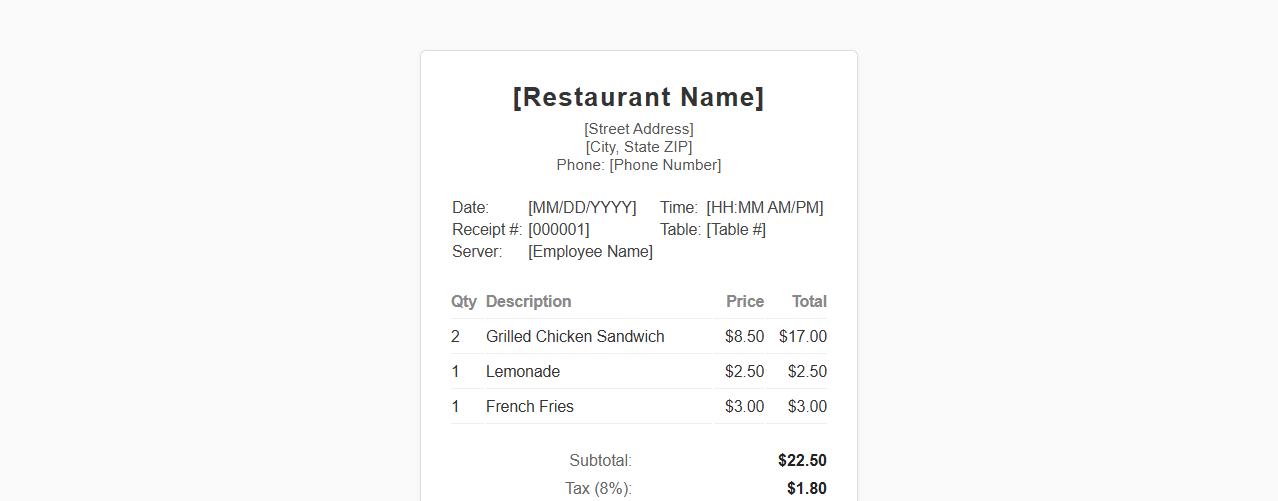

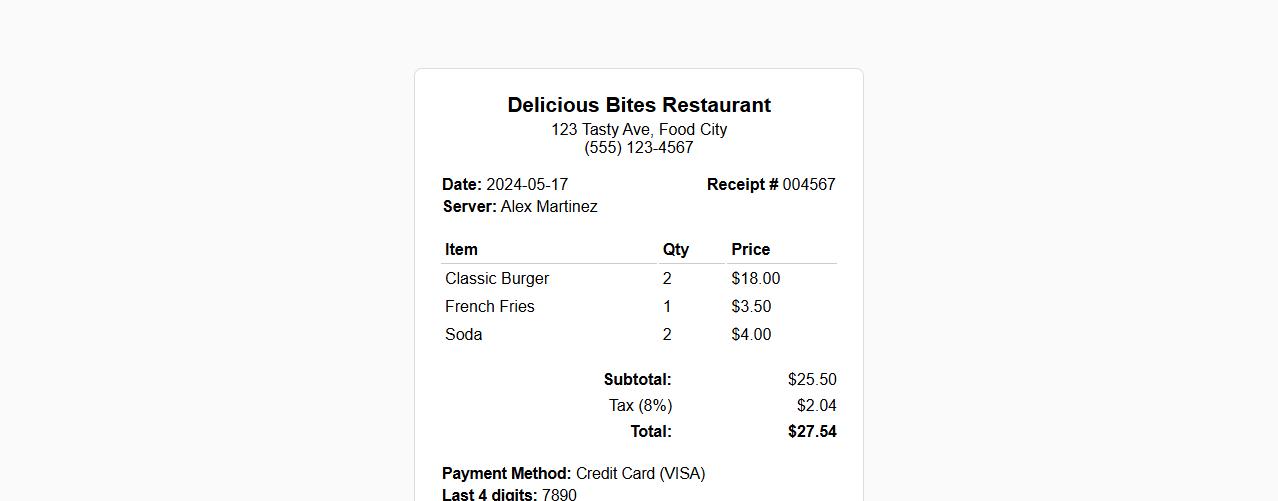

Restaurant receipt with itemized charges

A restaurant receipt with itemized charges provides a detailed breakdown of each menu item ordered, including quantities and prices. It ensures transparency and helps customers verify their bill accurately. This receipt format enhances trust and simplifies payment processing.

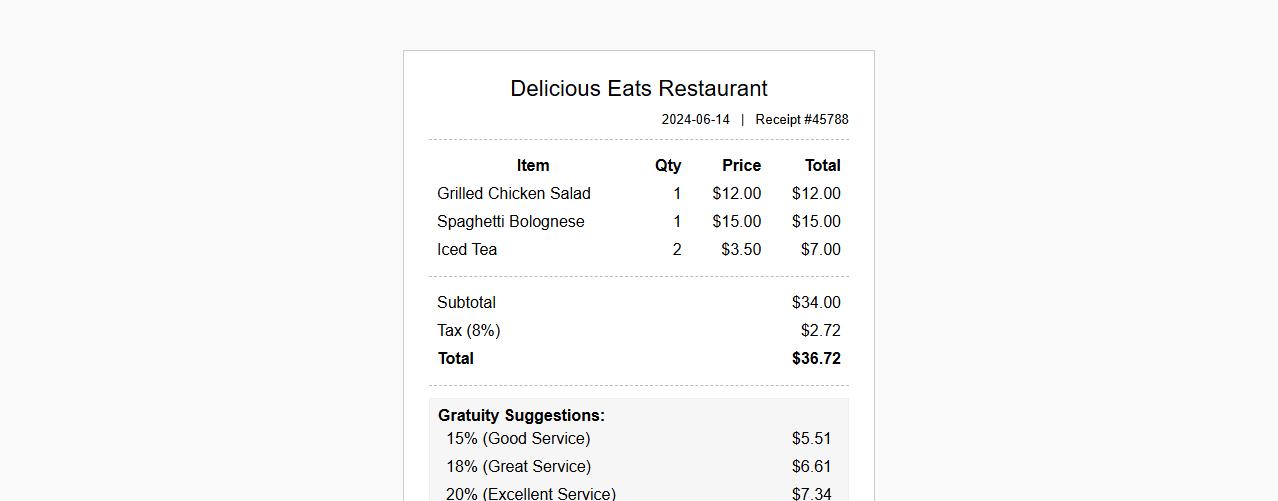

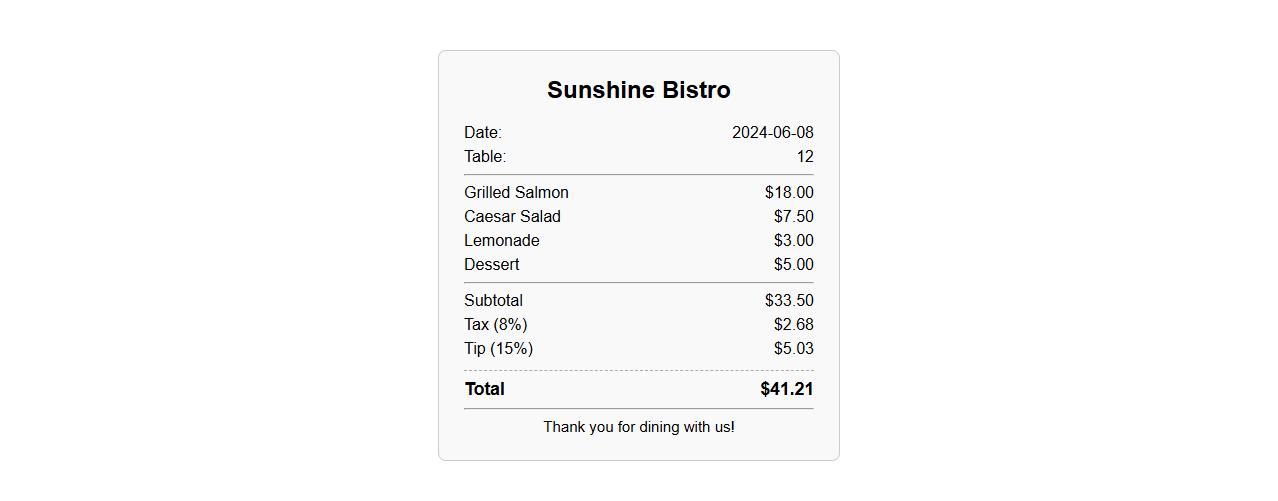

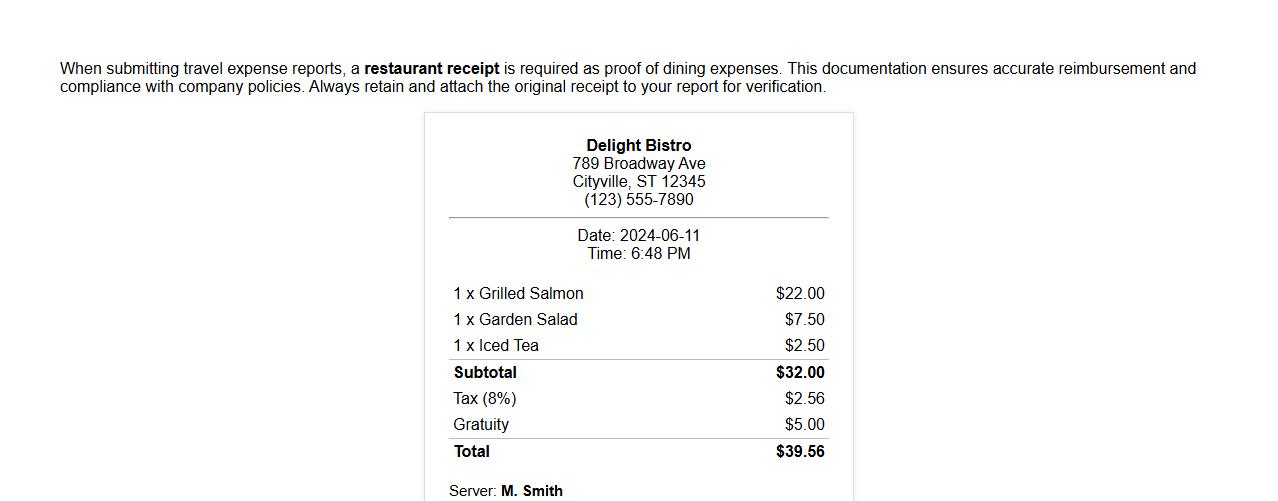

Restaurant receipt including gratuity calculation

A restaurant receipt provides a detailed summary of your dining expenses, including the cost of meals and beverages. It often features a gratuity calculation to help you determine the appropriate tip amount based on the service quality. This receipt ensures transparency and accuracy for both customers and restaurant staff.

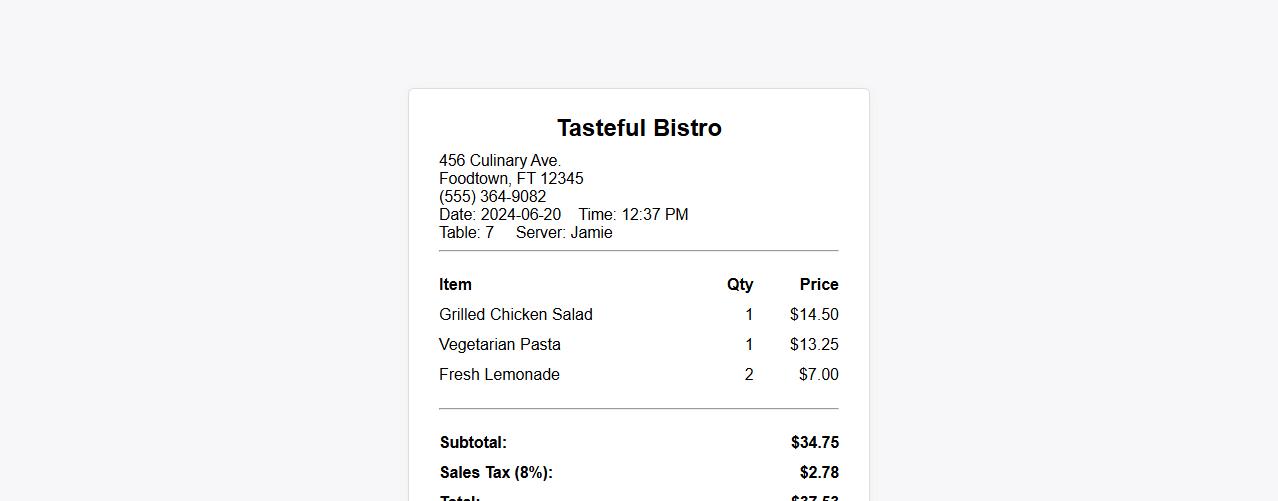

Sample restaurant receipt for business expenses

A sample restaurant receipt is essential for documenting business expenses accurately and ensuring proper accounting. It includes details such as the date, itemized orders, total amount, and payment method. Keeping these receipts helps in tax deductions and financial record-keeping.

Restaurant receipt with tax and tip shown separately

A restaurant receipt clearly displays the subtotal, tax, and tip amounts separately, ensuring transparency in the final bill. This detailed breakdown helps customers understand the exact charges and gratuity included. It promotes trust and clarity between patrons and restaurant staff.

Restaurant receipt template for small businesses

A restaurant receipt template for small businesses offers a professional and efficient way to detail customer orders and payments. It helps streamline transactions while maintaining clear records for accounting purposes. This template is customizable to suit various restaurant styles and branding needs.

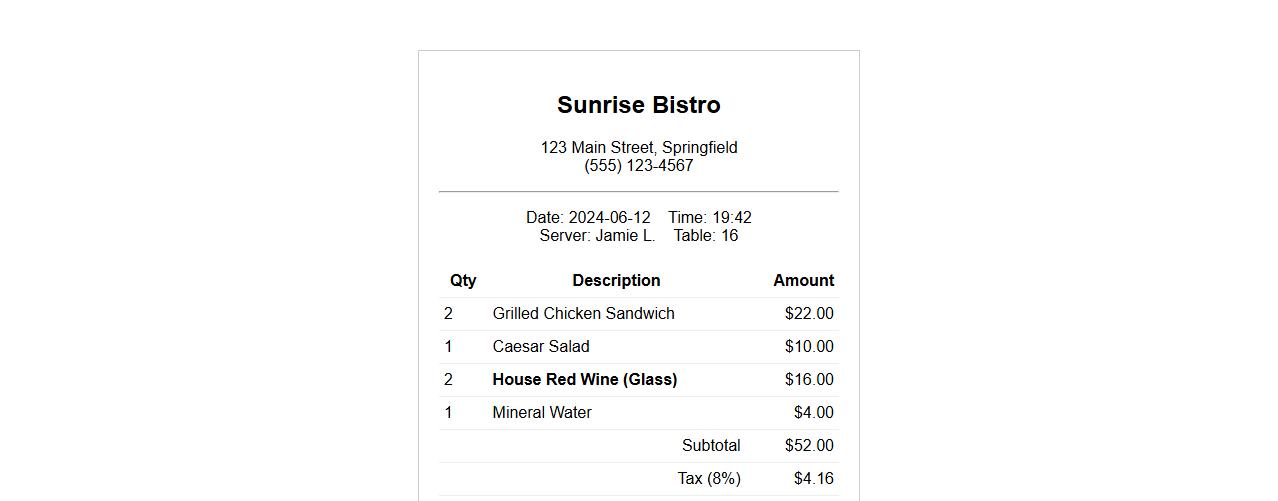

Restaurant receipt showing alcohol purchase

A restaurant receipt displays details of meals and beverages purchased, including any alcohol items. It itemizes each charge clearly, ensuring transparency for customers and staff. This document serves as proof of transaction and helps track sales for the establishment.

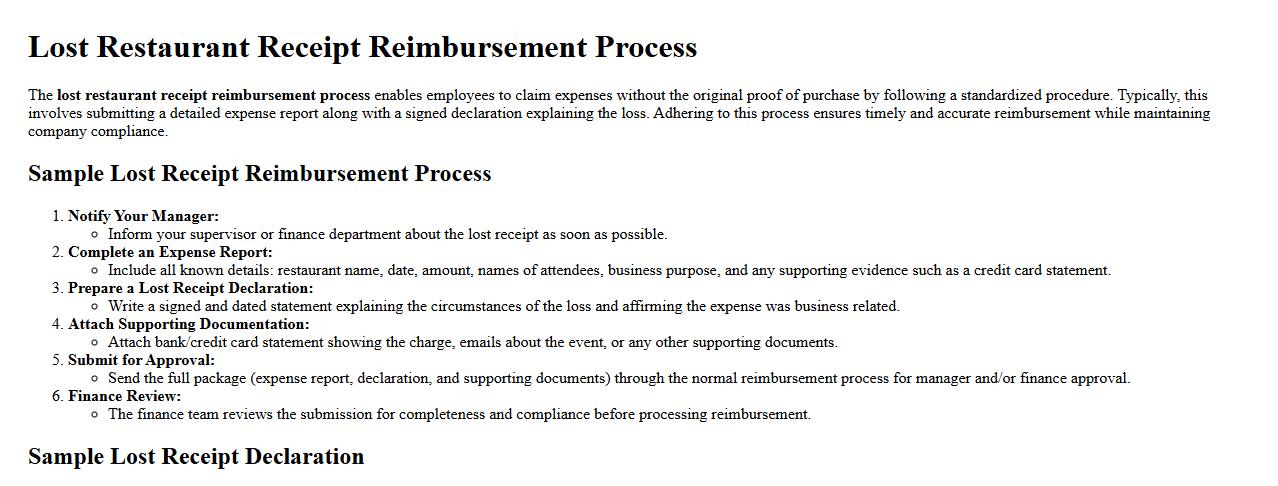

Lost restaurant receipt reimbursement process

The lost restaurant receipt reimbursement process enables employees to claim expenses without the original proof of purchase by following a standardized procedure. Typically, this involves submitting a detailed expense report along with a signed declaration explaining the loss. Adhering to this process ensures timely and accurate reimbursement while maintaining company compliance.

Digital restaurant receipt format for accounting

The digital restaurant receipt format streamlines accounting by organizing transaction details clearly and efficiently. This format includes essential information such as itemized orders, taxes, and payment methods, aiding accurate financial tracking. Implementing digital receipts enhances record-keeping and simplifies the auditing process for restaurant management.

Restaurant receipt required for travel expense reports

When submitting travel expense reports, a restaurant receipt is required as proof of dining expenses. This documentation ensures accurate reimbursement and compliance with company policies. Always retain and attach the original receipt to your report for verification.

How can I validate the authenticity of a restaurant receipt document?

To validate the authenticity of a restaurant receipt, check for the presence of the restaurant's official logo, address, and contact number. Verify the transaction date and time match the dining experience. Cross-reference payment methods and total amounts with bank or card statements for confirmation.

What key data fields are required on a compliant restaurant receipt for business reimbursement?

A compliant restaurant receipt must include the restaurant's name and address for clear identification. It should show the date of service, detailed list of purchased items with individual prices, and the total amount paid. For business reimbursement, the payment method and tax breakdown are also essential.

How should special dietary requests be itemized on a restaurant receipt?

Special dietary requests should be clearly itemized on the receipt as separate line items or annotations next to meal descriptions. This ensures transparency regarding any additional charges or modifications. It also helps in expense tracking and compliance with dietary-related reimbursements.

What details indicate a split bill or group payment on a restaurant receipt?

A split bill or group payment is typically indicated by multiple payment entries or subtotals that correspond to different payers. Receipts may also list the names or initials of individuals responsible for each part of the payment. Some receipts show itemized divisions or notes specifying how the bill was shared.

How are promotional discounts and tax calculations represented on a digital restaurant receipt?

Promotional discounts are reflected as deductions listed under the itemized charges or as separate discount lines. Tax calculations appear clearly, showing the tax rate applied and the corresponding tax amount for transparency. The final total incorporates all discounts and taxes to reflect the exact payment made.