A Loan Payment Receipt is an official document provided by the lender confirming that a borrower's payment has been received and credited toward their loan balance. This receipt includes details such as the payment amount, date of transaction, and remaining loan balance. It serves as proof of payment and helps borrowers keep track of their loan repayment history.

How to request a loan payment receipt from bank

To request a loan payment receipt from your bank, contact the bank's customer service either via phone, email, or by visiting a branch in person. Ensure you provide your loan account details and the date of payment for efficient processing. Receiving this receipt helps maintain accurate records and proves successful repayment.

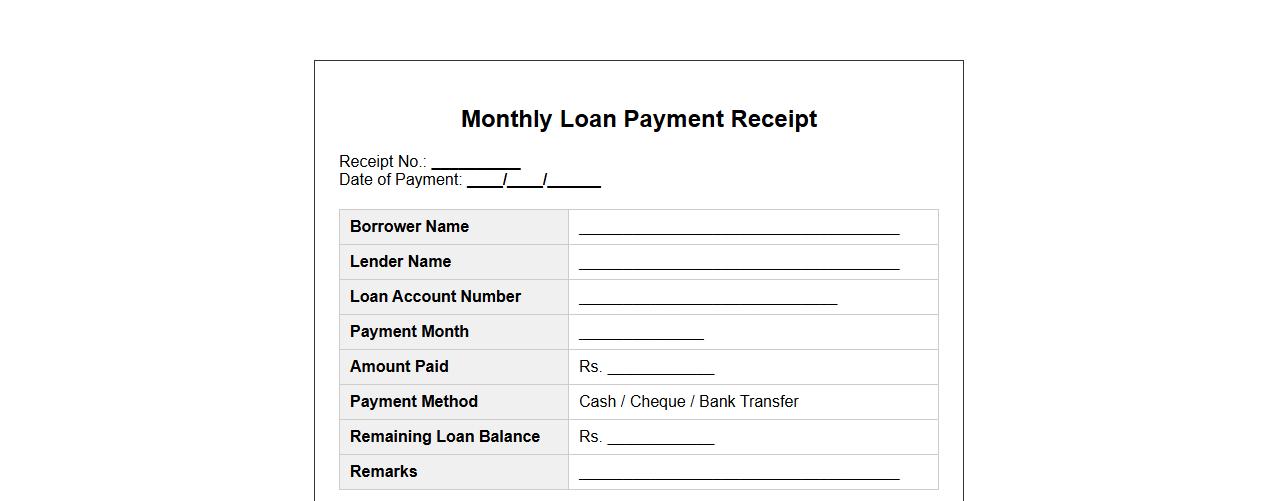

Sample of monthly loan payment receipt format

This monthly loan payment receipt format provides a clear record of payments made towards a loan, ensuring transparency between the borrower and lender. It includes essential details such as payment date, amount, and remaining balance. Using this template helps maintain accurate financial documentation and facilitates easy reference for both parties.

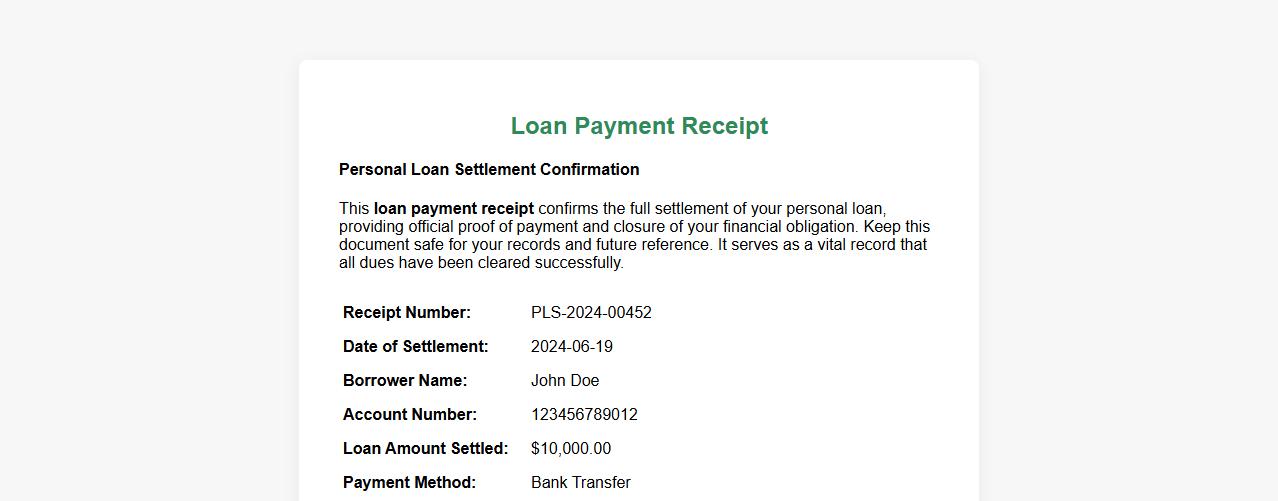

Loan payment receipt for personal loan settlement

This loan payment receipt confirms the full settlement of your personal loan, providing official proof of payment and closure of your financial obligation. Keep this document safe for your records and future reference. It serves as a vital record that all dues have been cleared successfully.

Downloadable mortgage loan payment receipt template

Streamline your financial records with our downloadable mortgage loan payment receipt template, designed for easy customization and accurate tracking. This template helps ensure clear documentation of your mortgage payments, enhancing transparency between lenders and borrowers. Download now to maintain organized and professional payment records effortlessly.

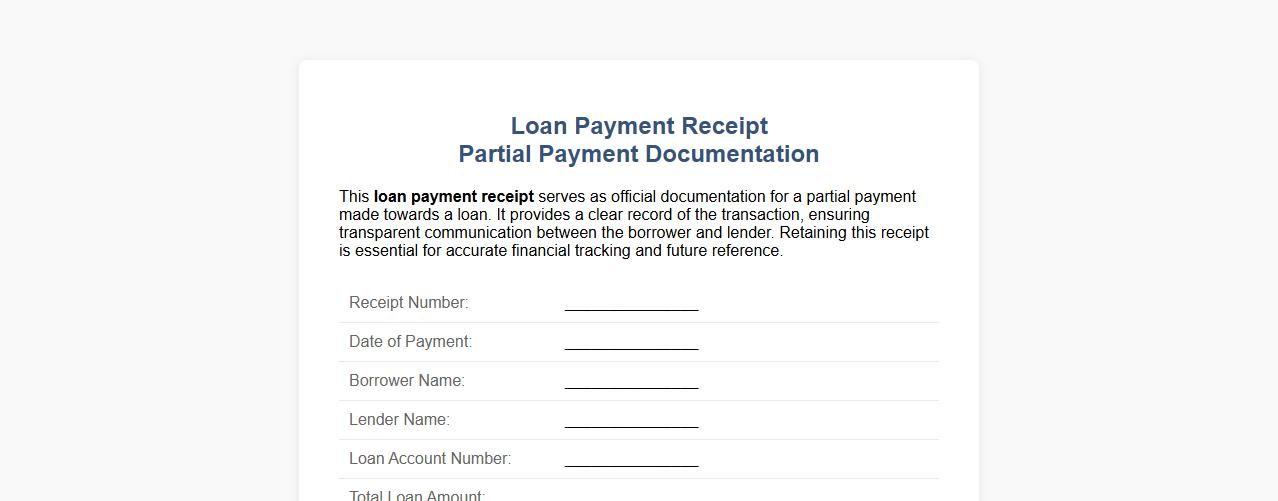

Loan payment receipt for partial payment documentation

This loan payment receipt serves as official documentation for a partial payment made towards a loan. It provides a clear record of the transaction, ensuring transparent communication between the borrower and lender. Retaining this receipt is essential for accurate financial tracking and future reference.

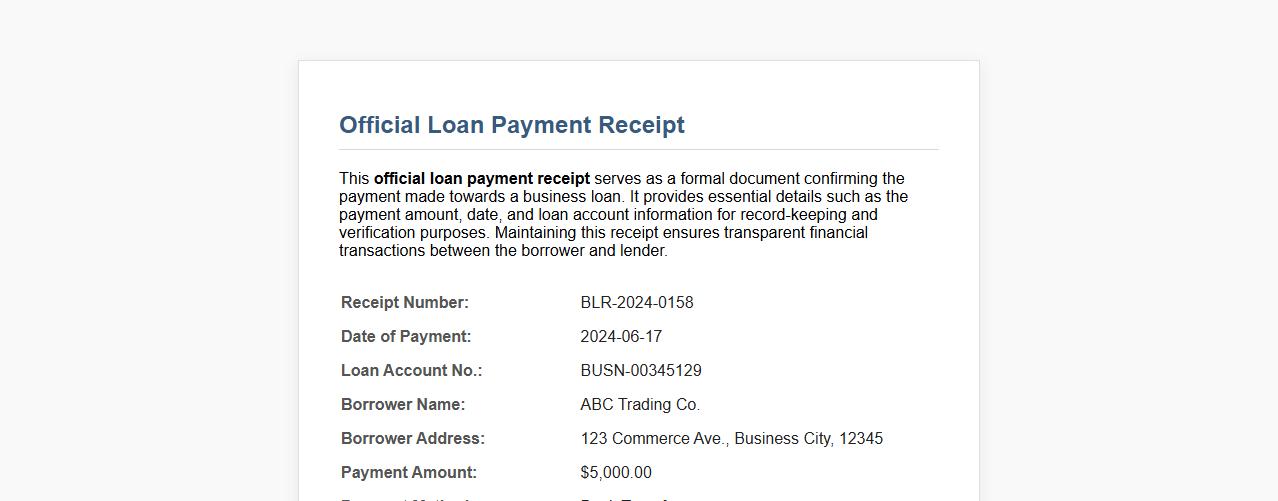

Official loan payment receipt for business loan

This official loan payment receipt serves as a formal document confirming the payment made towards a business loan. It provides essential details such as the payment amount, date, and loan account information for record-keeping and verification purposes. Maintaining this receipt ensures transparent financial transactions between the borrower and lender.

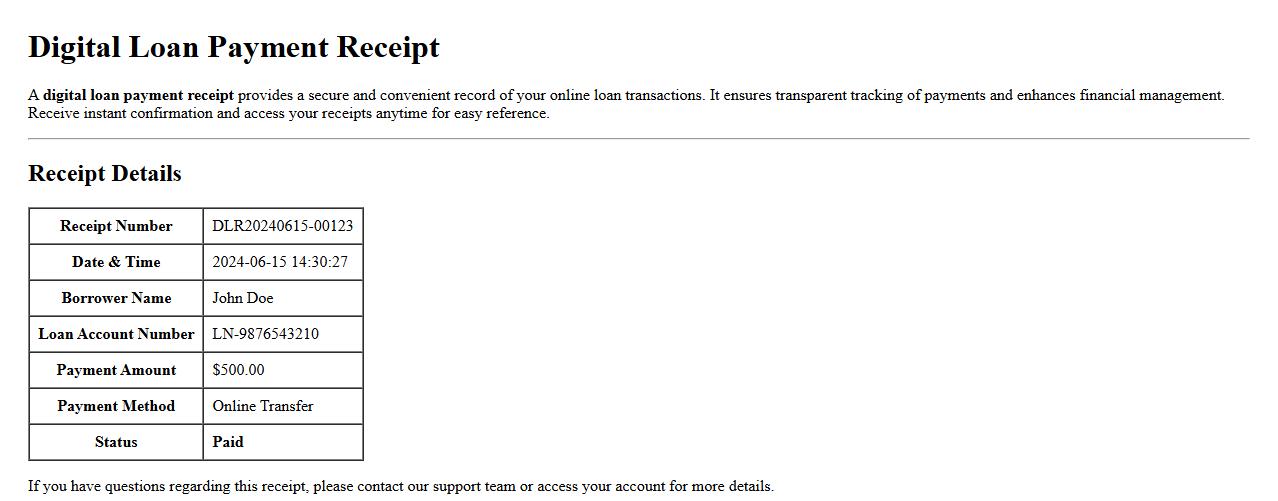

Digital loan payment receipt for online loans

A digital loan payment receipt provides a secure and convenient record of your online loan transactions. It ensures transparent tracking of payments and enhances financial management. Receive instant confirmation and access your receipts anytime for easy reference.

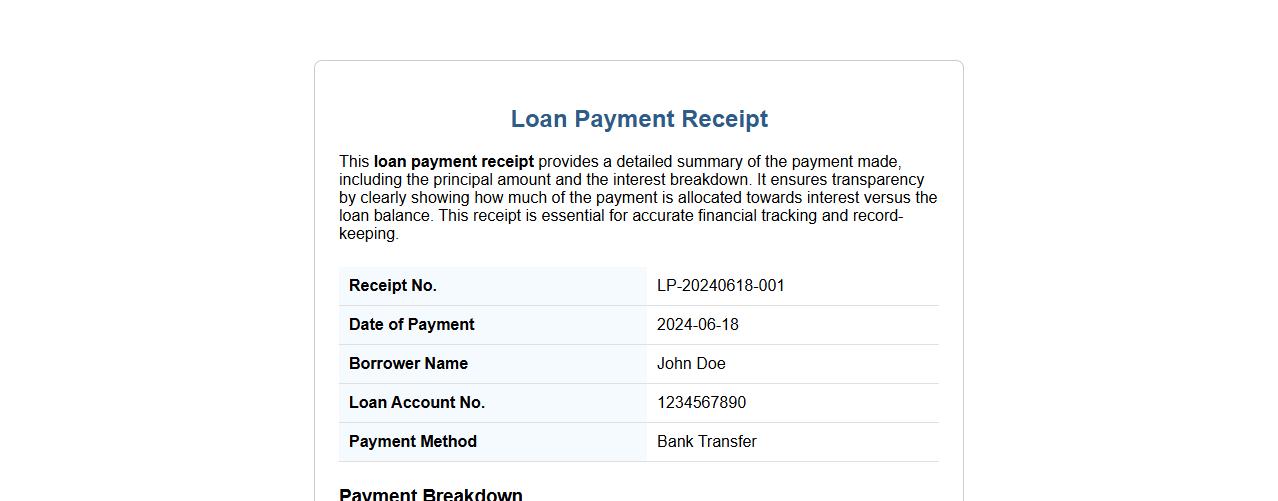

Loan payment receipt with interest breakdown

This loan payment receipt provides a detailed summary of the payment made, including the principal amount and the interest breakdown. It ensures transparency by clearly showing how much of the payment is allocated towards interest versus the loan balance. This receipt is essential for accurate financial tracking and record-keeping.

Home loan payment receipt verification process

The home loan payment receipt verification process ensures that all payments made towards the loan are accurately recorded and validated. This process helps borrowers confirm their payment status and avoid discrepancies. It typically involves matching receipts with payment records maintained by the lender.

Loan payment receipt required for tax purposes

Ensure you keep your loan payment receipt as it is essential for accurate tax documentation. This receipt serves as proof of payment, helping to validate your financial records during tax filing. Retaining this document can simplify audits and support your claims for deductions or exemptions.

What legal information must be included in a loan payment receipt letter?

A loan payment receipt letter must include the borrower's and lender's full names to establish identity. It should clearly state the amount paid and the date of payment to document the transaction. Additionally, details of the loan agreement, such as the loan number or contract reference, must be referenced to ensure legal clarity.

How should partial payments be documented in a loan payment receipt?

Partial payments must be explicitly labeled as partial payments to avoid confusion with full settlement. The receipt should specify the amount paid, the remaining balance, and the date the payment was made. This ensures transparency and provides an accurate record for both borrower and lender.

What format is recommended for digital loan payment receipt letters?

The recommended format for digital loan payment receipt letters is a PDF document to maintain integrity and prevent unauthorized edits. It should include all essential elements like borrower details, payment amount, and transaction date for completeness. Using clear digital signatures enhances authenticity and legal validation of the receipt.

How to address late payment penalties in a receipt letter?

Late payment penalties must be clearly stated in the receipt letter if applicable, detailing the penalty amount and the reason for its imposition. This ensures the borrower is fully informed of any extra charges due to delayed payments. Including a brief explanation helps prevent disputes and supports legal enforceability.

Which parties need to sign a loan payment receipt for legal validity?

For legal validity, the receipt must be signed by the lender or authorized representative who received the payment. It is also advisable for the borrower to acknowledge the receipt by signing. Dual signatures strengthen the document's credibility and serve as proof of the transaction.