A Invoice and Receipt Form Sample serves as a standardized template for documenting sales transactions, detailing the products or services provided along with their prices and payment information. It ensures clear communication between the seller and buyer by itemizing quantities, dates, and total amounts due or paid. Utilizing a well-designed form enhances record-keeping accuracy and streamlines financial management processes.

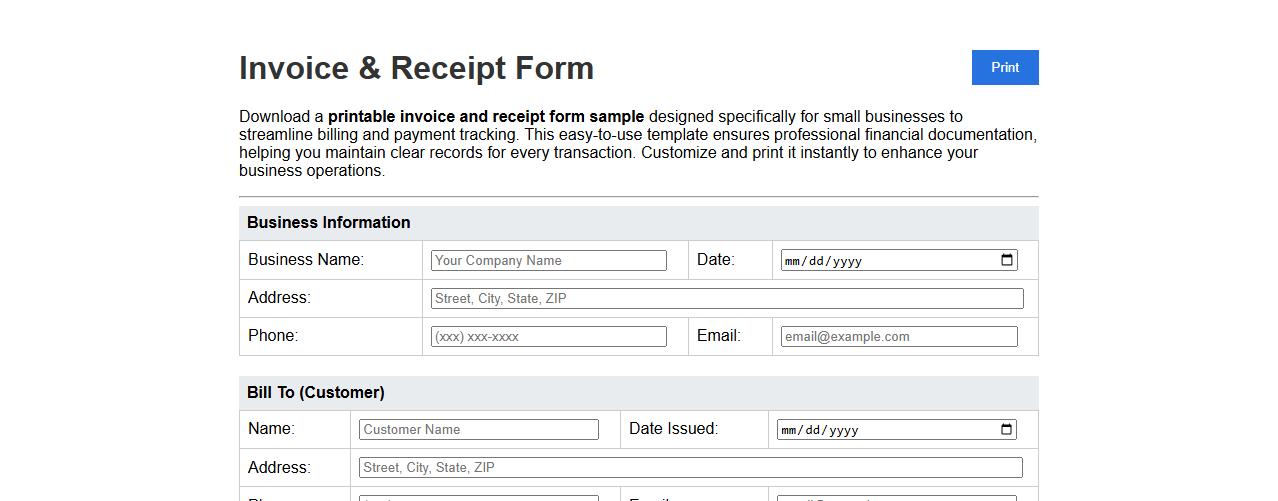

Printable invoice and receipt form sample for small businesses

Download a printable invoice and receipt form sample designed specifically for small businesses to streamline billing and payment tracking. This easy-to-use template ensures professional financial documentation, helping you maintain clear records for every transaction. Customize and print it instantly to enhance your business operations.

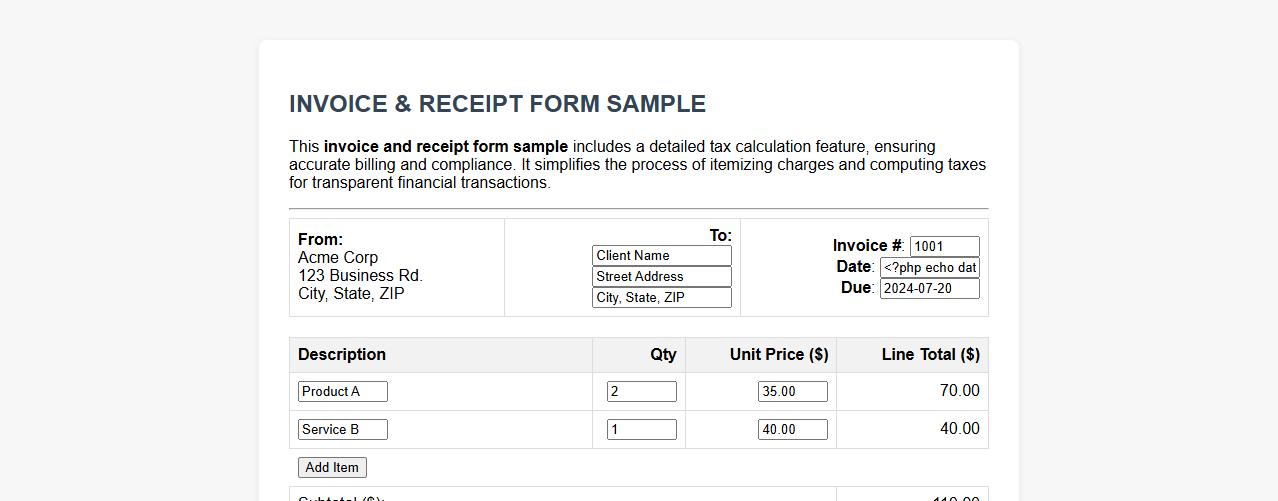

Invoice and receipt form sample with tax calculation

This invoice and receipt form sample includes a detailed tax calculation feature, ensuring accurate billing and compliance. It simplifies the process of itemizing charges and computing taxes for transparent financial transactions. Perfect for businesses aiming to streamline their invoicing and receipt management.

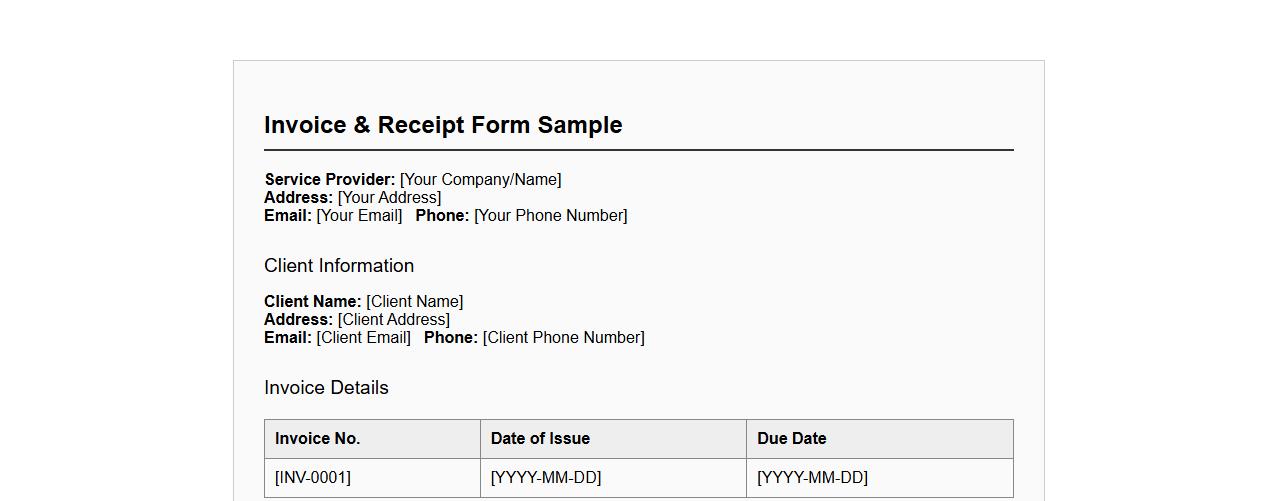

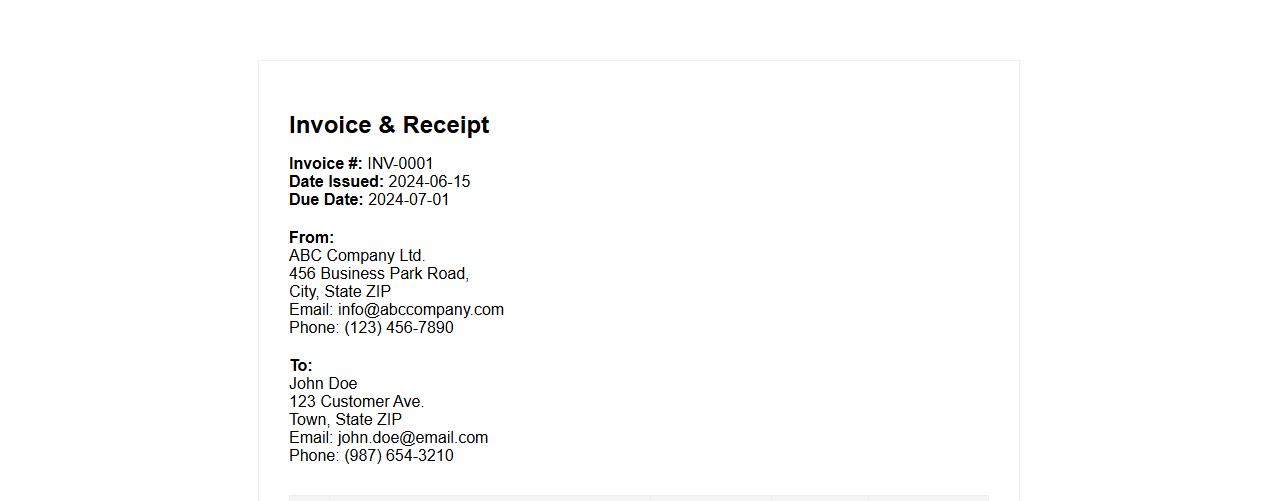

Invoice and receipt form sample for service providers

Discover a practical invoice and receipt form sample tailored for service providers, designed to streamline billing and payment documentation. This template ensures clear, professional records for both providers and clients, enhancing transaction transparency. Use it to efficiently manage your service charges and payment confirmations.

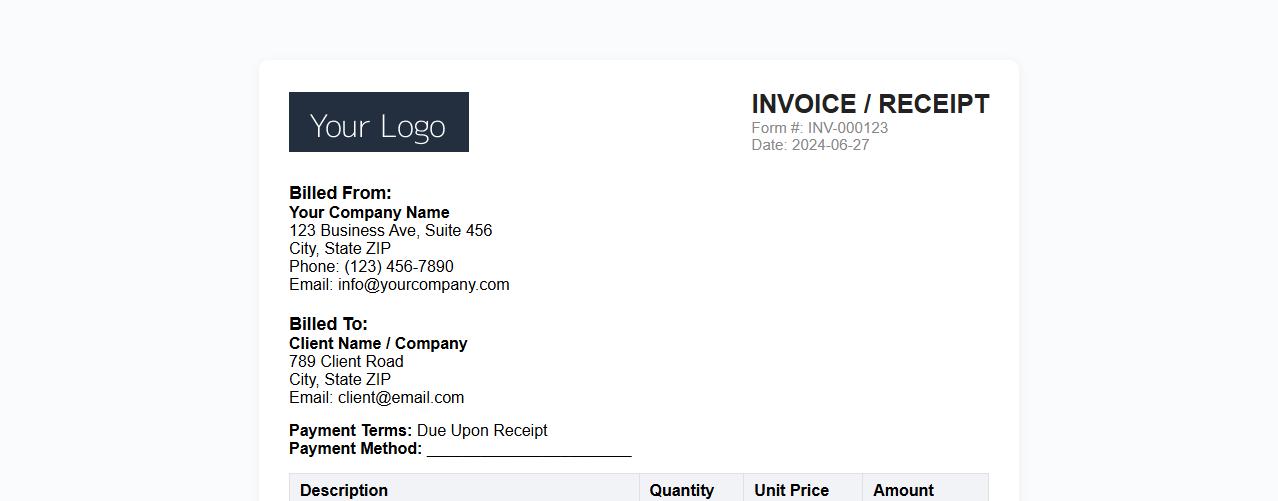

Invoice and receipt form sample with company logo

Download our invoice and receipt form sample featuring a customizable company logo for professional billing and payment records. This template ensures clear documentation for transactions while enhancing your brand identity. Perfect for businesses seeking organized and branded financial paperwork.

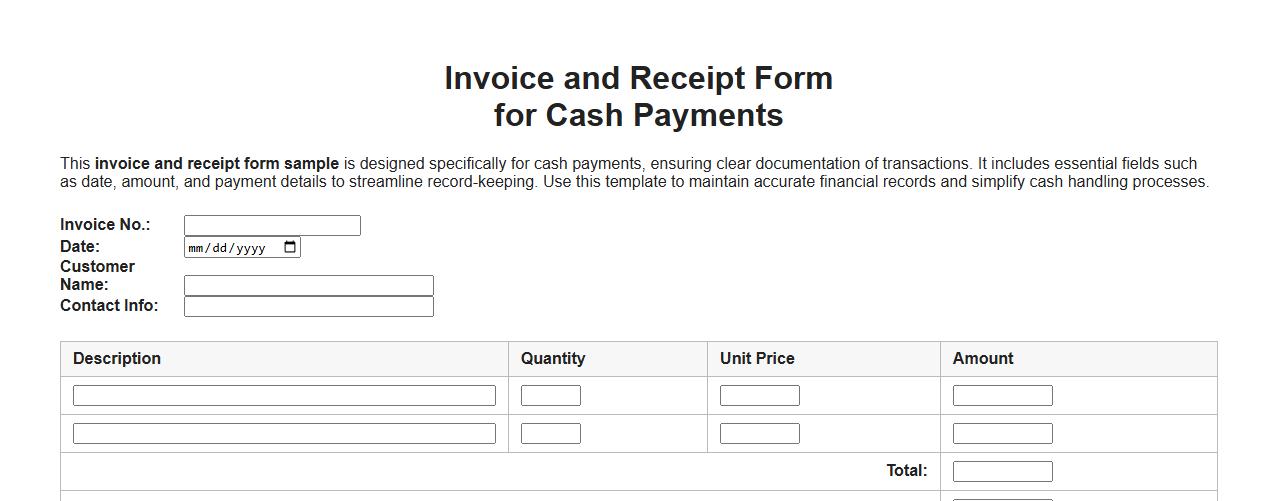

Invoice and receipt form sample for cash payments

This invoice and receipt form sample is designed specifically for cash payments, ensuring clear documentation of transactions. It includes essential fields such as date, amount, and payment details to streamline record-keeping. Use this template to maintain accurate financial records and simplify cash handling processes.

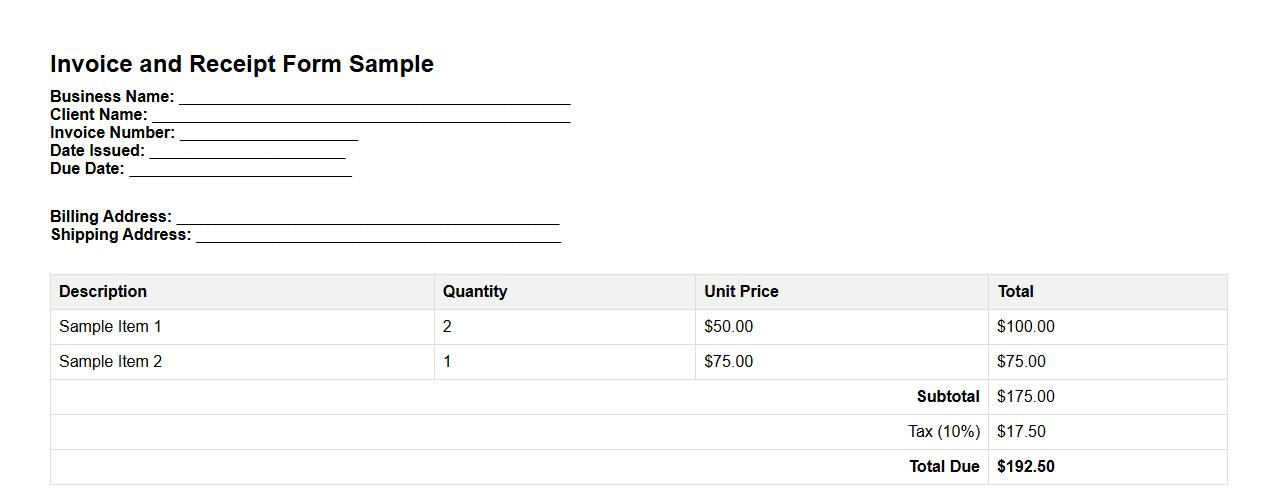

Invoice and receipt form sample with itemized breakdown

This invoice and receipt form sample provides a clear itemized breakdown of charges, ensuring transparency and easy record-keeping. It is designed to help businesses and customers track payments accurately. The format is simple yet comprehensive, making financial documentation efficient.

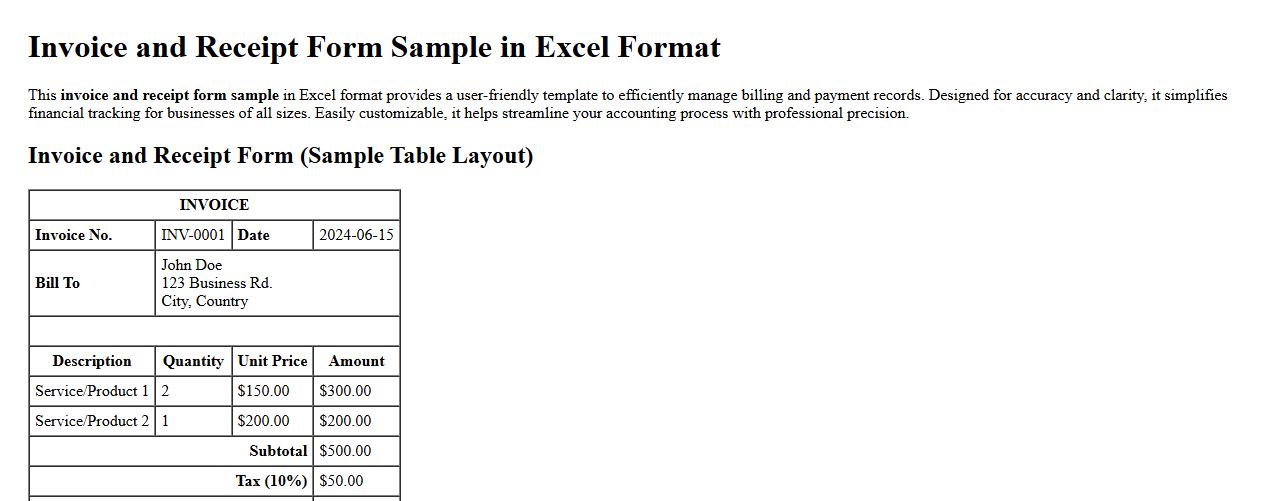

Invoice and receipt form sample in excel format

This invoice and receipt form sample in Excel format provides a user-friendly template to efficiently manage billing and payment records. Designed for accuracy and clarity, it simplifies financial tracking for businesses of all sizes. Easily customizable, it helps streamline your accounting process with professional precision.

Invoice and receipt form sample with payment terms

This invoice and receipt form sample includes clear payment terms to ensure smooth financial transactions between businesses and clients. It provides a professional layout to record itemized charges, payment methods, and due dates. Using this template helps maintain accurate records and timely payments.

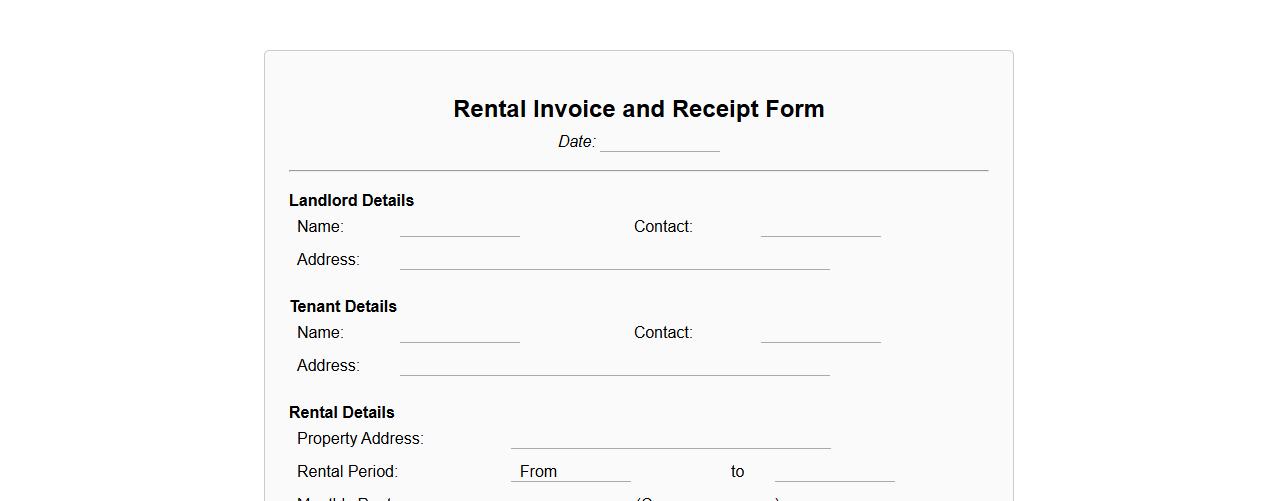

Invoice and receipt form sample for rental transactions

Use this invoice and receipt form sample to streamline rental transactions, ensuring clear documentation for both landlords and tenants. It simplifies the process by providing designated fields for payment details, dates, and rental terms. This template helps maintain accurate financial records and enhances transparency in rental agreements.

How do you differentiate between an invoice and a receipt on official letterhead?

An invoice is a document issued by a seller to request payment and outlines the goods or services provided with their respective prices. A receipt, on the other hand, is proof of payment that confirms the buyer has paid the amount due. On official letterhead, the invoice usually contains payment terms and outstanding balances, while the receipt shows payment confirmation and date.

What legal elements must be present in a compliant invoice form?

A compliant invoice must include essential legal elements such as the seller's and buyer's identification details, a unique invoice number, and the date of issue. It should clearly state a detailed description of goods or services, quantities, unit prices, and the total amount payable. Additionally, a compliant invoice must incorporate the applicable tax registration number and tax amounts calculated according to regulatory standards.

How should tax calculations be itemized on a digital invoice document?

Tax calculations on a digital invoice should be itemized separately to enhance clarity and compliance. This includes showing the taxable base amount, the percentage rate applied, and the exact tax value calculated. Itemizing taxes ensures transparency and facilitates easier verification by tax authorities during audits.

Which security features help authenticate a physical receipt form?

Physical receipt forms can be authenticated using security features such as watermarks, holograms, and microprinting. These elements prevent counterfeiting and guarantee the receipt's legitimacy. Additionally, unique serial numbers and barcodes contribute to tracking and verification processes.

What are best practices for archiving invoice and receipt forms for audits?

Best practices for archiving invoices and receipts include storing documents in a secure, organized, and accessible manner for a minimum period required by law. Digital archiving systems should use encrypted backups and include indexing for quick retrieval. Maintaining detailed records supports efficient audit compliance and reduces risk of data loss.