A Donation Receipt Form Sample serves as a standardized template for documenting charitable contributions, ensuring donors receive official acknowledgment for their generosity. This form typically includes essential details such as the donor's name, donation amount, date, and purpose of the gift, which helps both the organization and donor maintain accurate records. Utilizing a well-structured Donation Receipt Form Sample enhances transparency and supports tax deduction claims.

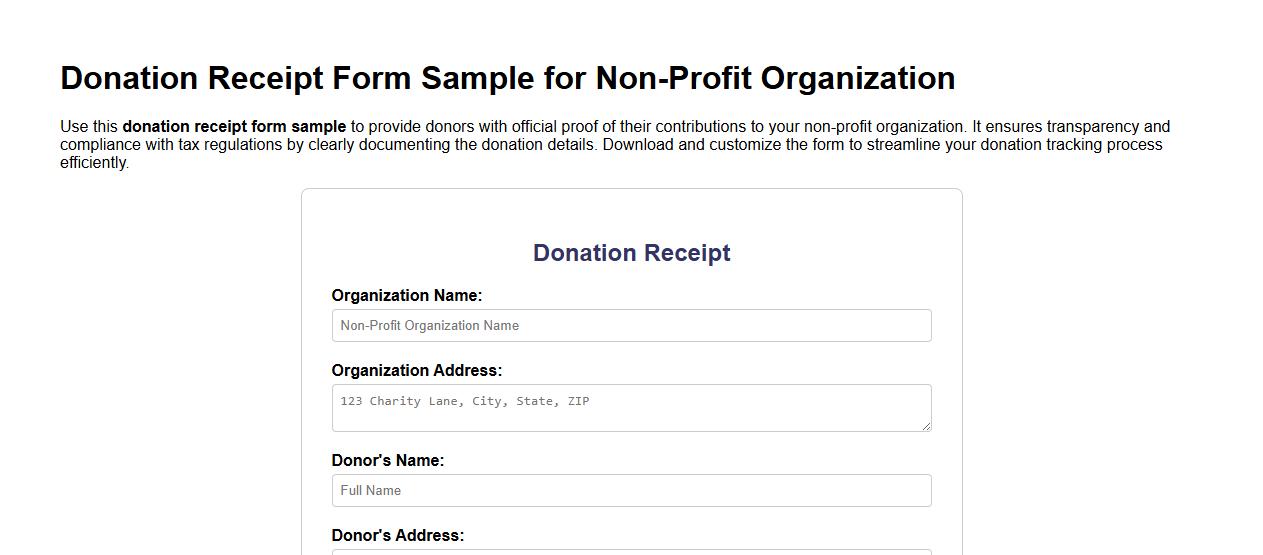

Donation receipt form sample for non-profit organization

Use this donation receipt form sample to provide donors with official proof of their contributions to your non-profit organization. It ensures transparency and compliance with tax regulations by clearly documenting the donation details. Download and customize the form to streamline your donation tracking process efficiently.

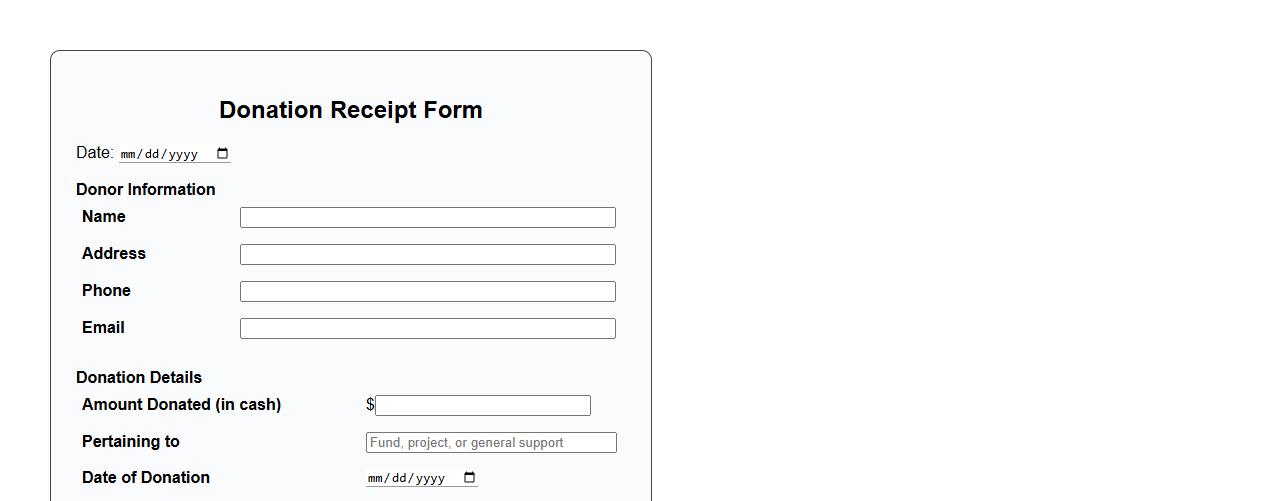

Donation receipt form sample for cash donations

This donation receipt form sample is designed to provide clear documentation for cash contributions, ensuring transparency and accountability. It includes essential details such as donor information, amount donated, and acknowledgment of the gift. Using this form helps nonprofits maintain accurate records and provide donors with official proof of their generosity.

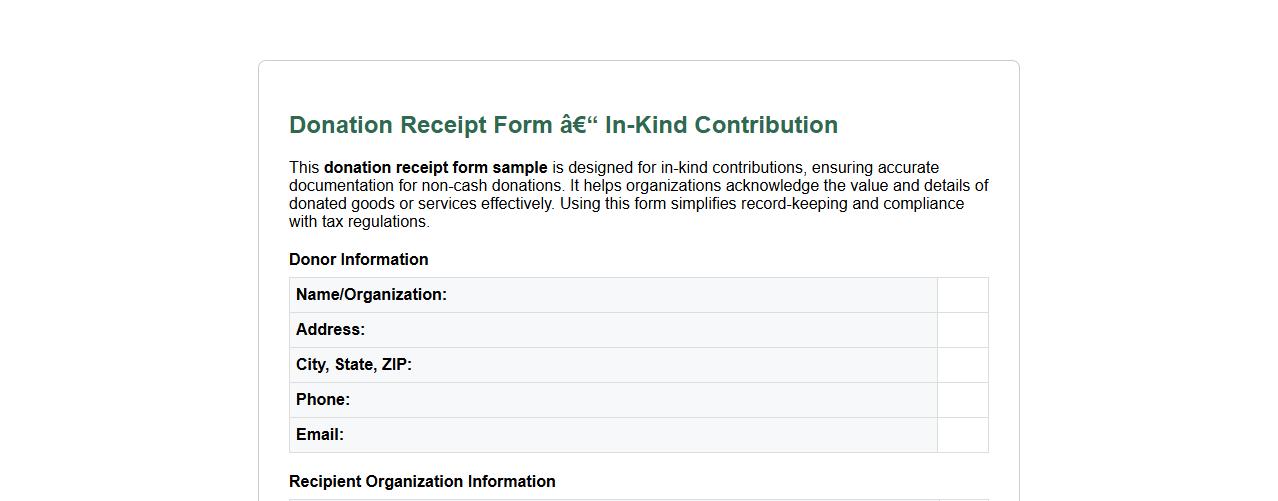

Donation receipt form sample for in-kind contributions

This donation receipt form sample is designed for in-kind contributions, ensuring accurate documentation for non-cash donations. It helps organizations acknowledge the value and details of donated goods or services effectively. Using this form simplifies record-keeping and compliance with tax regulations.

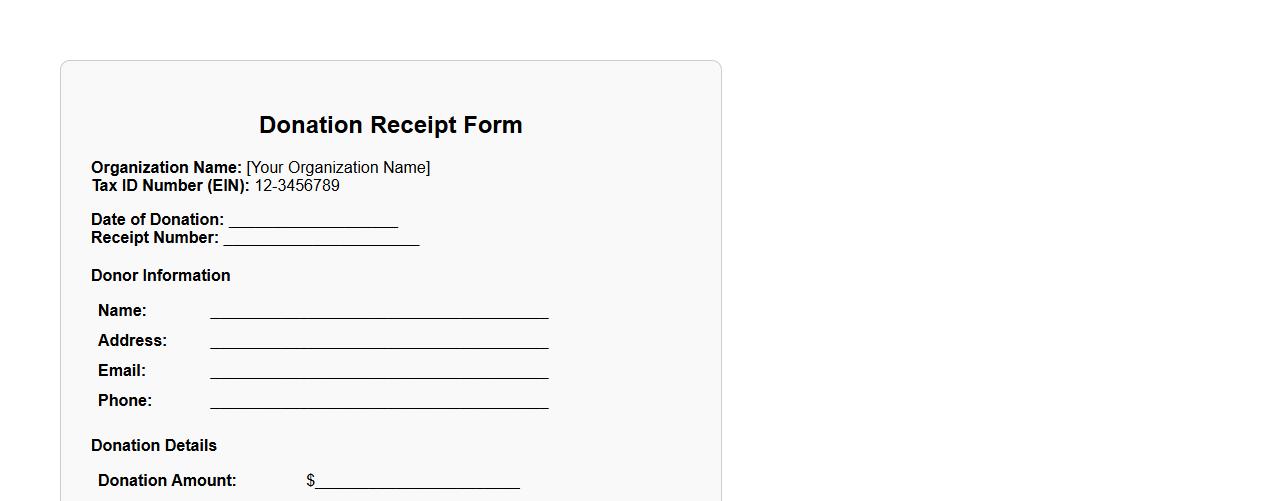

Donation receipt form sample with tax ID number

This donation receipt form sample includes a tax ID number for proper documentation and tax deduction purposes. It ensures donors receive an official acknowledgment of their contribution. Use this form to maintain transparency and compliance with tax regulations.

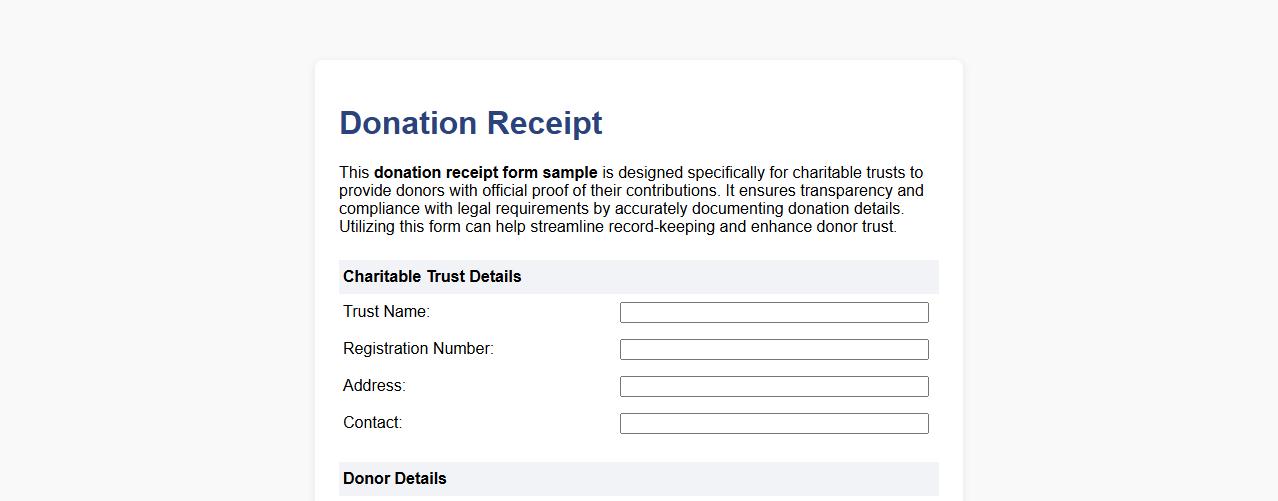

Donation receipt form sample for charitable trusts

This donation receipt form sample is designed specifically for charitable trusts to provide donors with official proof of their contributions. It ensures transparency and compliance with legal requirements by accurately documenting donation details. Utilizing this form can help streamline record-keeping and enhance donor trust.

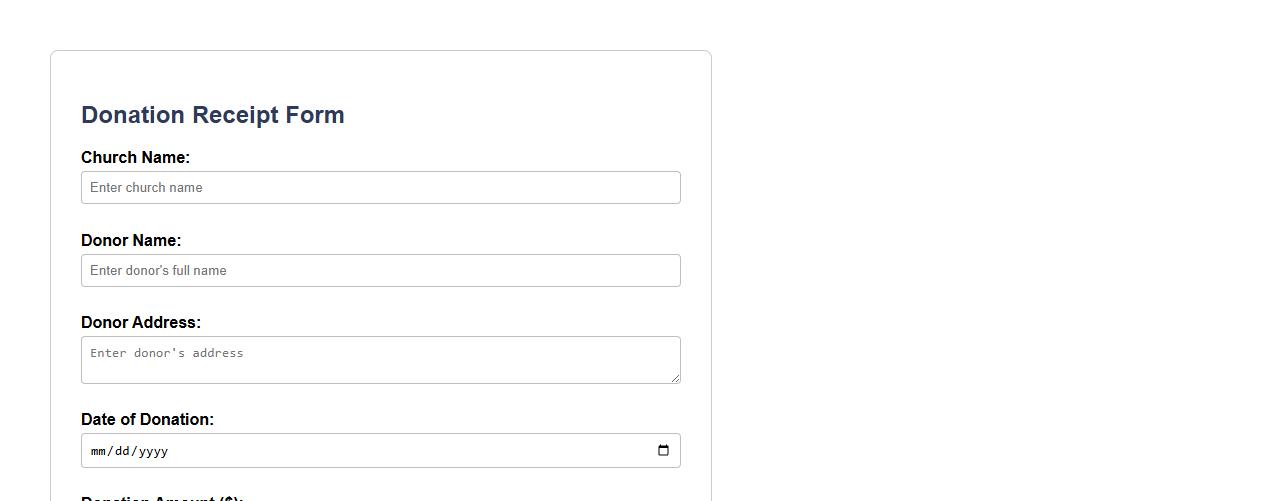

Donation receipt form sample for church donations

Use this donation receipt form sample to provide clear and accurate records for church donations. It ensures transparent acknowledgment of contributions, helping both the church and donors maintain proper documentation. Convenient and customizable, it supports efficient donation tracking and thank-you communications.

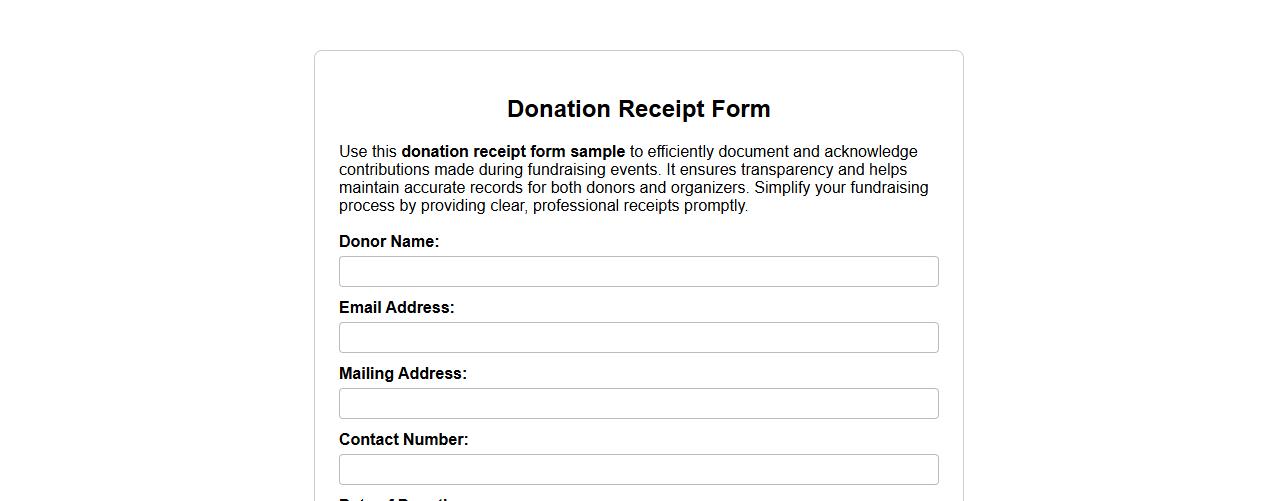

Donation receipt form sample for fundraising events

Use this donation receipt form sample to efficiently document and acknowledge contributions made during fundraising events. It ensures transparency and helps maintain accurate records for both donors and organizers. Simplify your fundraising process by providing clear, professional receipts promptly.

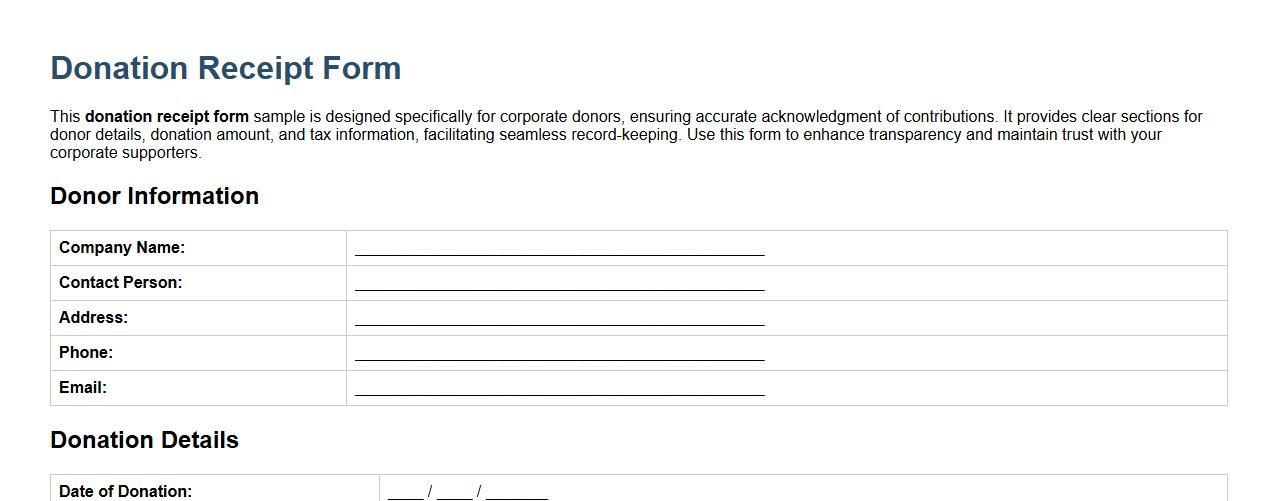

Donation receipt form sample for corporate donors

This donation receipt form sample is designed specifically for corporate donors, ensuring accurate acknowledgment of contributions. It provides clear sections for donor details, donation amount, and tax information, facilitating seamless record-keeping. Use this form to enhance transparency and maintain trust with your corporate supporters.

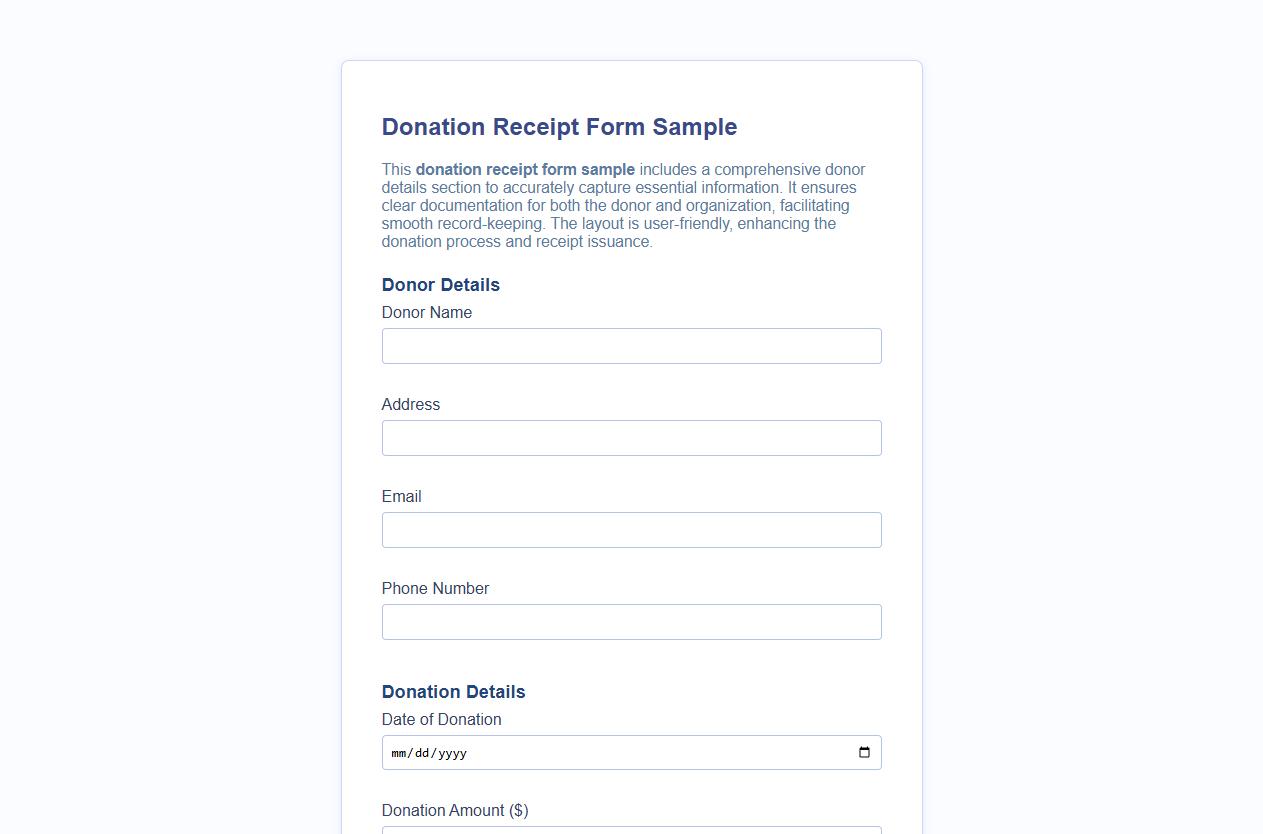

Donation receipt form sample with donor details section

This donation receipt form sample includes a comprehensive donor details section to accurately capture essential information. It ensures clear documentation for both the donor and organization, facilitating smooth record-keeping. The layout is user-friendly, enhancing the donation process and receipt issuance.

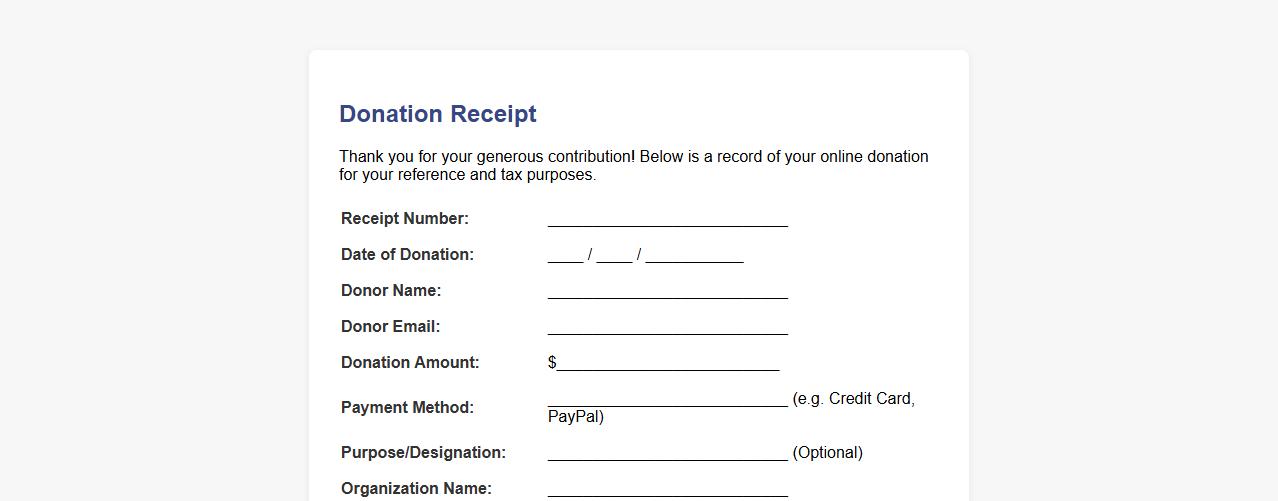

Donation receipt form sample for online donations

Use this donation receipt form sample to efficiently acknowledge online donations. It ensures all necessary details are captured for tax and record-keeping purposes. Customize it to reflect your organization's branding and donation policies.

What donor information is mandatory on a donation receipt form?

The mandatory donor information on a donation receipt form includes the full name of the donor, their address, and the date of the donation. Additionally, the receipt must specify the amount of the donation or a description of non-monetary contributions. This information ensures compliance with legal requirements and supports donor tax deduction claims.

How should non-monetary donations be described in the receipt letter?

Non-monetary donations must be described with a detailed description of the items contributed, including their condition and estimated fair market value. The receipt should clearly state that no goods or services were provided in exchange for the donation. This description helps donors accurately report gifts for tax purposes.

Is a signature required on all charity donation receipt forms?

A signature is generally required on charity donation receipt forms to validate authenticity and confirm the organization's acknowledgment of the donation. Many jurisdictions mandate a signature from an authorized representative of the charity. This signature serves as legal proof for the donor's tax records.

What specific tax language must appear on donation receipt templates?

Donation receipt templates must include a tax exemption statement affirming the charity's status and confirming that no goods or services were provided in return for the donation. The letter should also mention that the receipt can be used for income tax deduction purposes. This language is essential for donor compliance with tax regulations.

How long must organizations retain copies of issued donation receipt letters?

Organizations are typically required to retain copies of issued donation receipt letters for a minimum of seven years, though this period may vary by jurisdiction. This retention period supports audits and donor inquiries. Maintaining accurate records ensures transparency and adherence to legal obligations.