A Lost Receipt Form Sample helps businesses and individuals document the details of a missing receipt for reimbursement or record-keeping purposes. This form typically includes fields for the date of purchase, vendor information, amount spent, and reason for the lost receipt. Using a standardized Lost Receipt Form Sample ensures accurate tracking and verification of expenses without the original receipt.

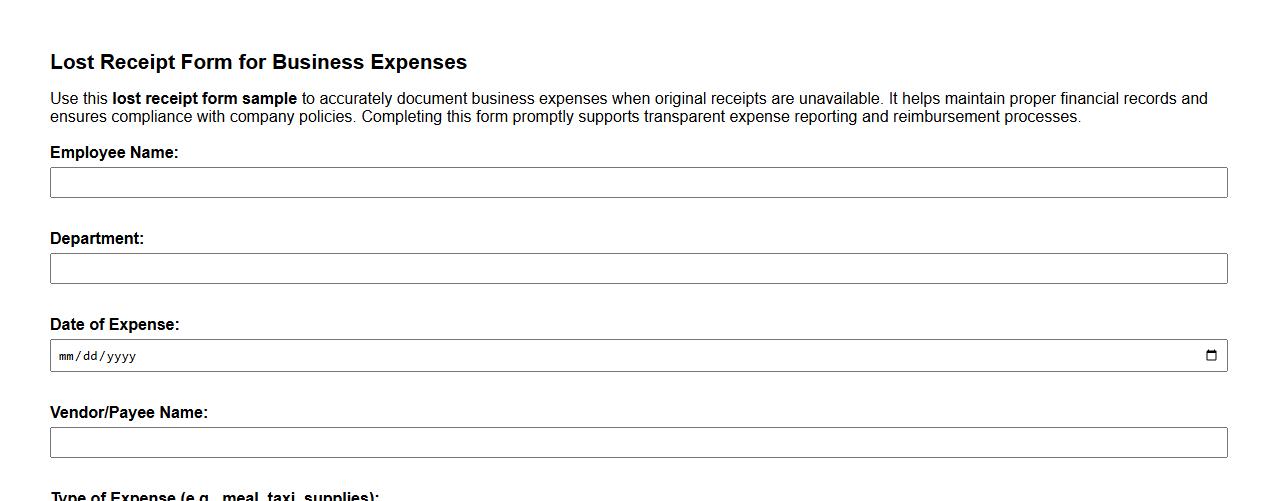

Lost receipt form sample for business expenses

Use this lost receipt form sample to accurately document business expenses when original receipts are unavailable. It helps maintain proper financial records and ensures compliance with company policies. Completing this form promptly supports transparent expense reporting and reimbursement processes.

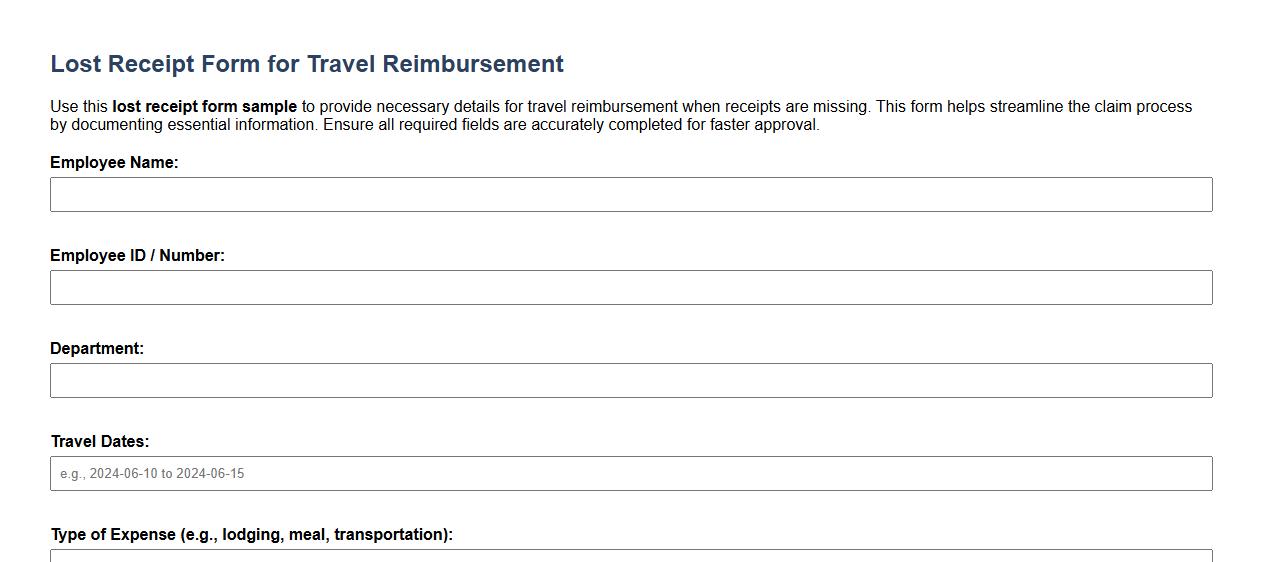

Lost receipt form sample for travel reimbursement

Use this lost receipt form sample to provide necessary details for travel reimbursement when receipts are missing. This form helps streamline the claim process by documenting essential information. Ensure all required fields are accurately completed for faster approval.

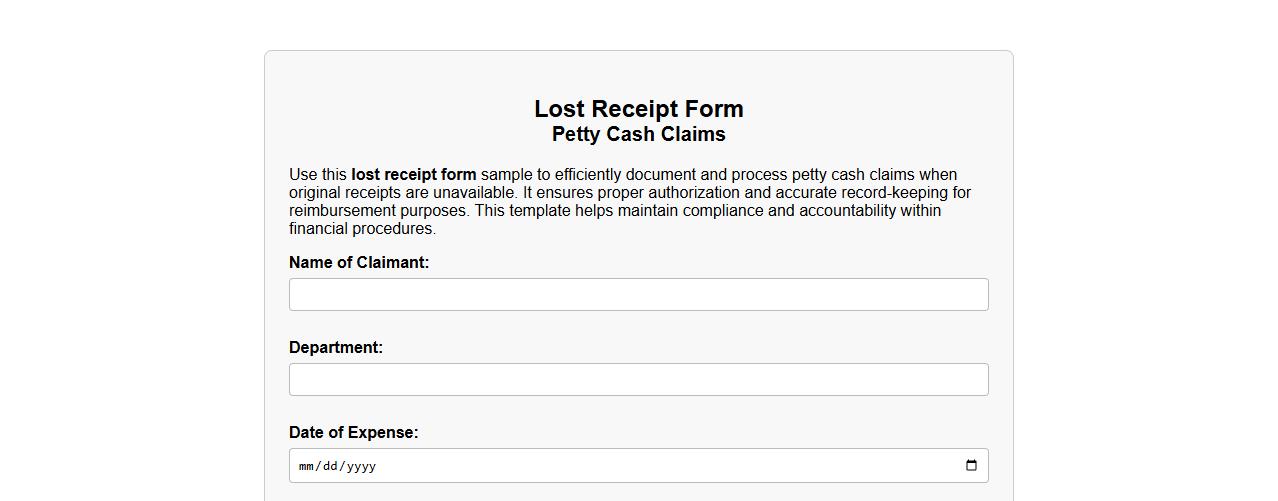

Lost receipt form sample for petty cash claims

Use this lost receipt form sample to efficiently document and process petty cash claims when original receipts are unavailable. It ensures proper authorization and accurate record-keeping for reimbursement purposes. This template helps maintain compliance and accountability within financial procedures.

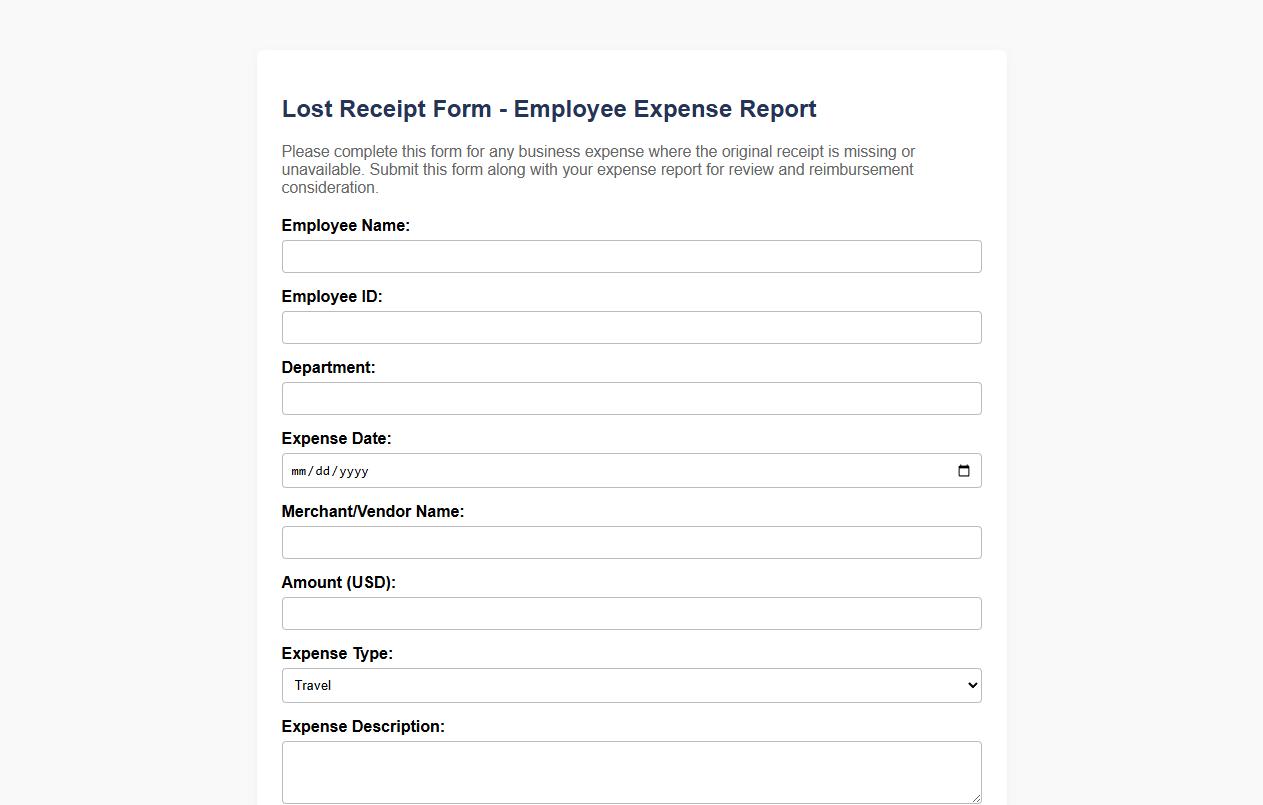

Lost receipt form sample for employee expense report

Use this lost receipt form sample to accurately document and report employee expenses when the original receipt is unavailable. It helps streamline the reimbursement process by providing necessary details like date, amount, and reason for the lost receipt. Ensuring proper documentation minimizes discrepancies and maintains financial accountability within the organization.

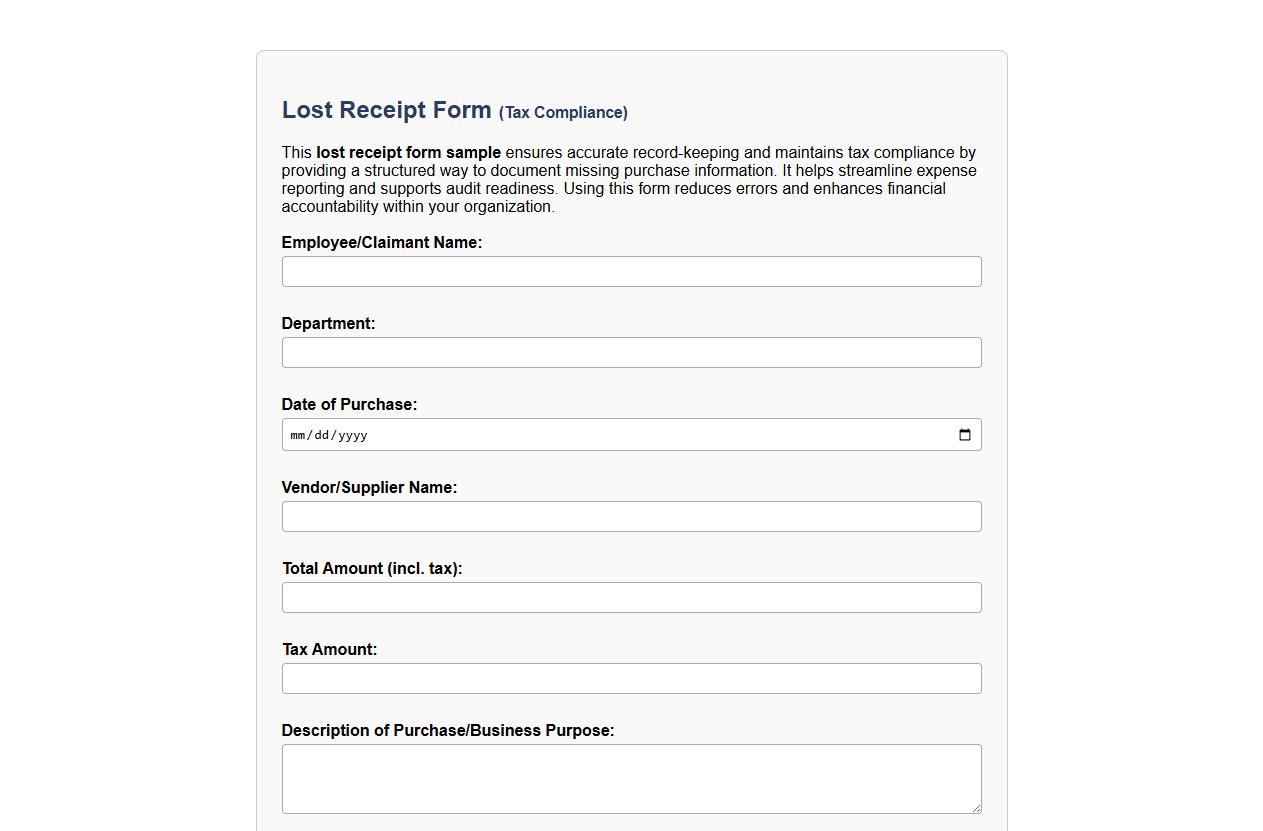

Lost receipt form sample with tax compliance

This lost receipt form sample ensures accurate record-keeping and maintains tax compliance by providing a structured way to document missing purchase information. It helps streamline expense reporting and supports audit readiness. Using this form reduces errors and enhances financial accountability within your organization.

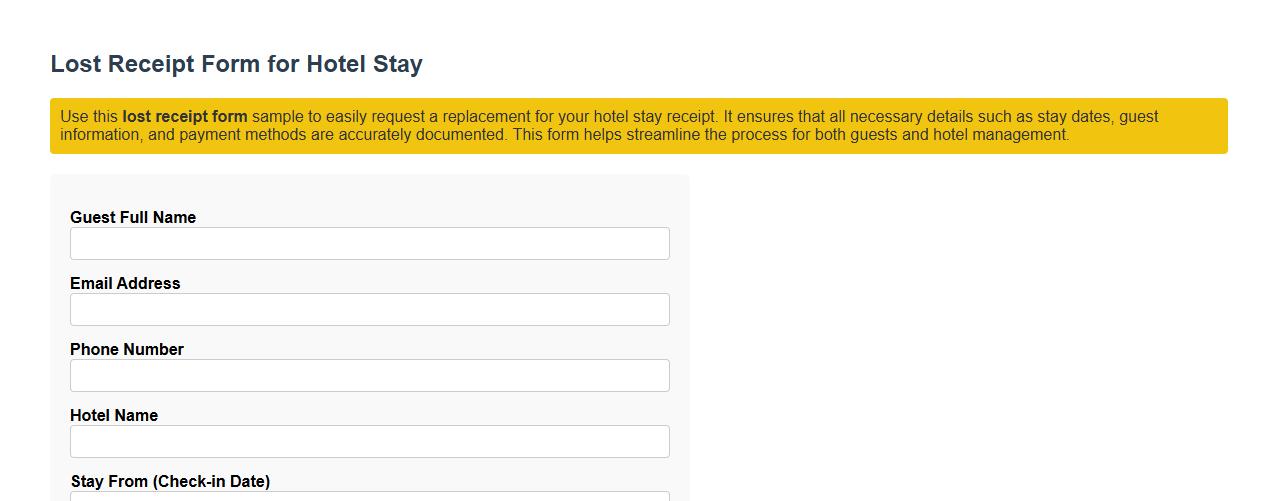

Lost receipt form sample for hotel stay

Use this lost receipt form sample to easily request a replacement for your hotel stay receipt. It ensures that all necessary details such as stay dates, guest information, and payment methods are accurately documented. This form helps streamline the process for both guests and hotel management.

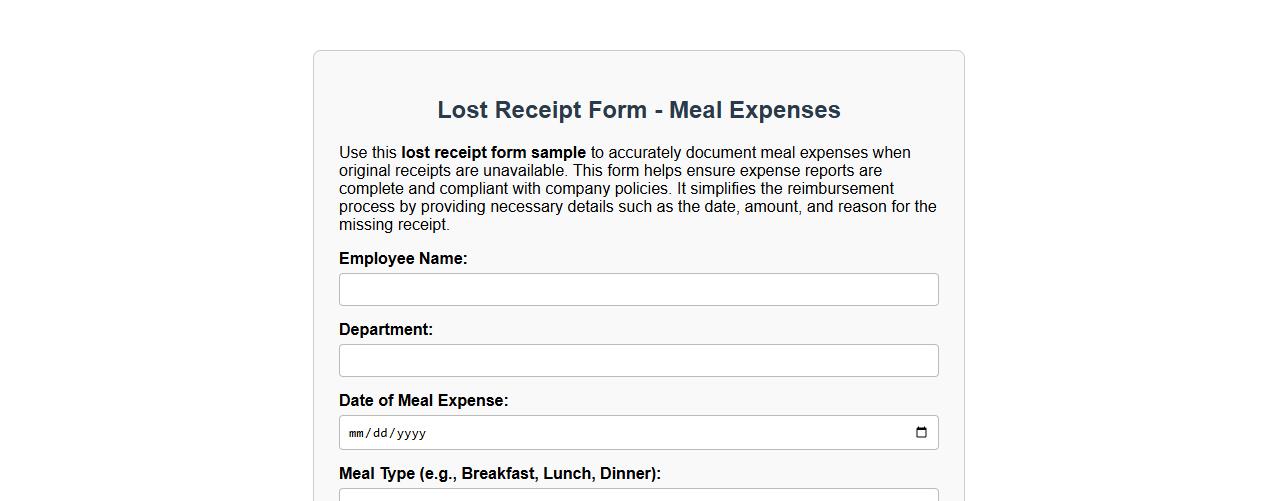

Lost receipt form sample for meal expenses

Use this lost receipt form sample to accurately document meal expenses when original receipts are unavailable. This form helps ensure expense reports are complete and compliant with company policies. It simplifies the reimbursement process by providing necessary details such as the date, amount, and reason for the missing receipt.

Lost receipt form sample including reason for loss

Use this lost receipt form sample to report and document missing purchase receipts efficiently. It includes fields to specify the reason for loss, ensuring accurate record-keeping and financial accountability. This form helps streamline reimbursement and audit processes by providing clear and concise information.

Lost receipt form sample for credit card transaction

Use this lost receipt form sample to report and document missing credit card transaction receipts efficiently. It helps streamline the process of reconciling expenses and resolving discrepancies with your credit card provider. Complete the form with accurate transaction details to ensure timely reimbursement and record-keeping.

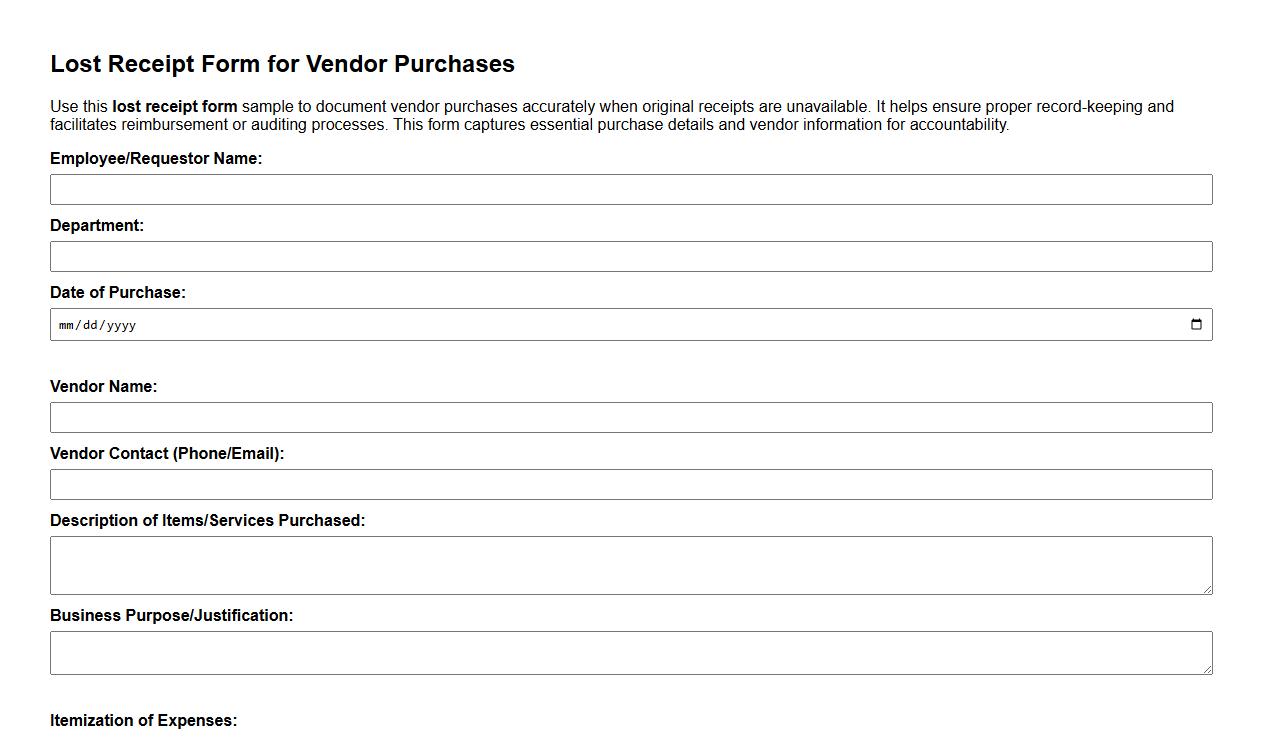

Lost receipt form sample for vendor purchases

Use this lost receipt form sample to document vendor purchases accurately when original receipts are unavailable. It helps ensure proper record-keeping and facilitates reimbursement or auditing processes. This form captures essential purchase details and vendor information for accountability.

What specific details are required on a Lost Receipt Form for reimbursement?

The Lost Receipt Form must include transaction date, vendor name, and the amount spent to process reimbursement. Clear descriptions of the purchase purpose and method of payment are also essential. Including these details ensures accurate verification and smooth approval.

How should digital versus physical lost receipts be documented in the form?

For digital receipts, attach screenshots or email confirmations alongside the form as electronic evidence. Physical receipts require a detailed explanation of the loss and any available backup documentation. Proper documentation guarantees transparency in receipt verification regardless of format.

Are there departmental approval signatures needed for a Lost Receipt Form?

Most organizations require departmental manager or supervisor signatures to authorize the reimbursement without a receipt. These approvals serve as internal controls and accountability measures. Signature requirements vary by company policy but are typically mandatory.

What supporting evidence substitutes are accepted on a Lost Receipt Form?

Common substitutes include credit card statements, bank transaction records, vendor invoices, or email confirmations verifying the purchase. These documents help validate the expense in place of the original receipt. Acceptable substitutes reduce fraudulent claims and maintain financial integrity.

How does a Lost Receipt Form impact audit or compliance processes?

Using a Lost Receipt Form introduces additional scrutiny during audits as auditors verify the legitimacy of unrecoverable receipts. It creates a traceable record ensuring compliance with company policies and financial regulations. Proper use of the form helps minimize compliance risks and documentation gaps.