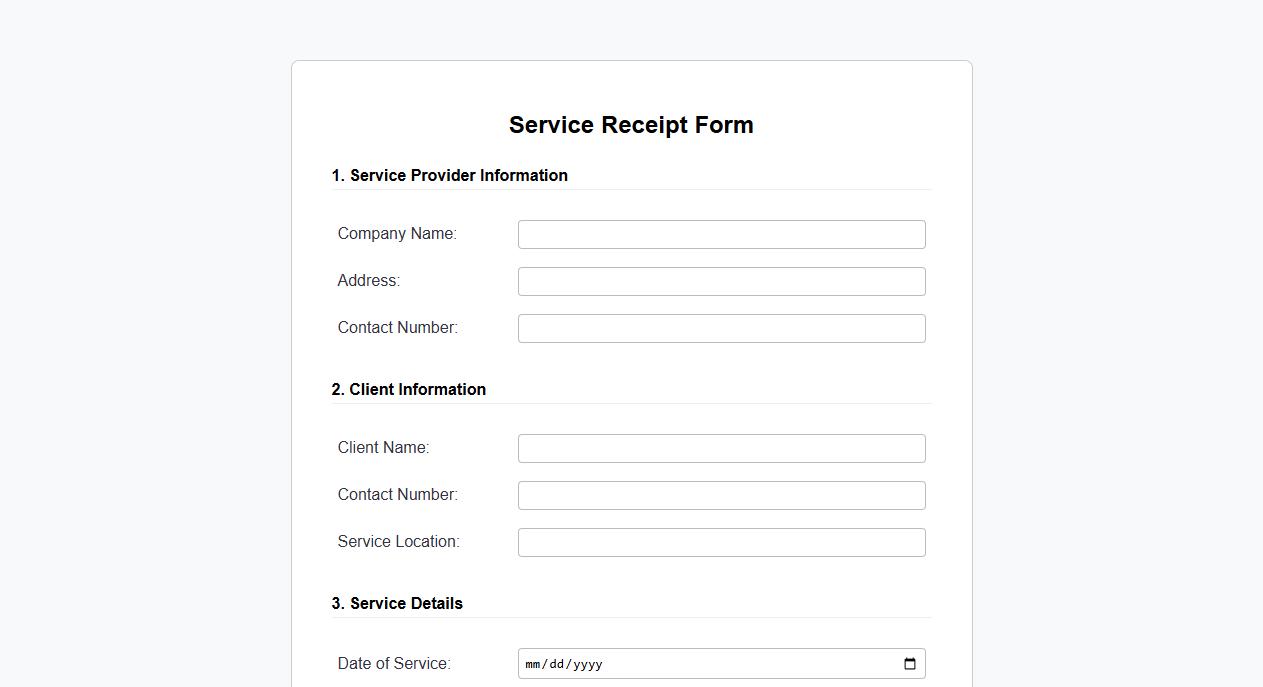

A Service Receipt Form Sample provides a clear template for documenting the completion of services rendered. It includes essential details such as service descriptions, dates, client information, and payment confirmation to ensure accuracy and accountability. This form enhances communication between service providers and clients while maintaining proper records.

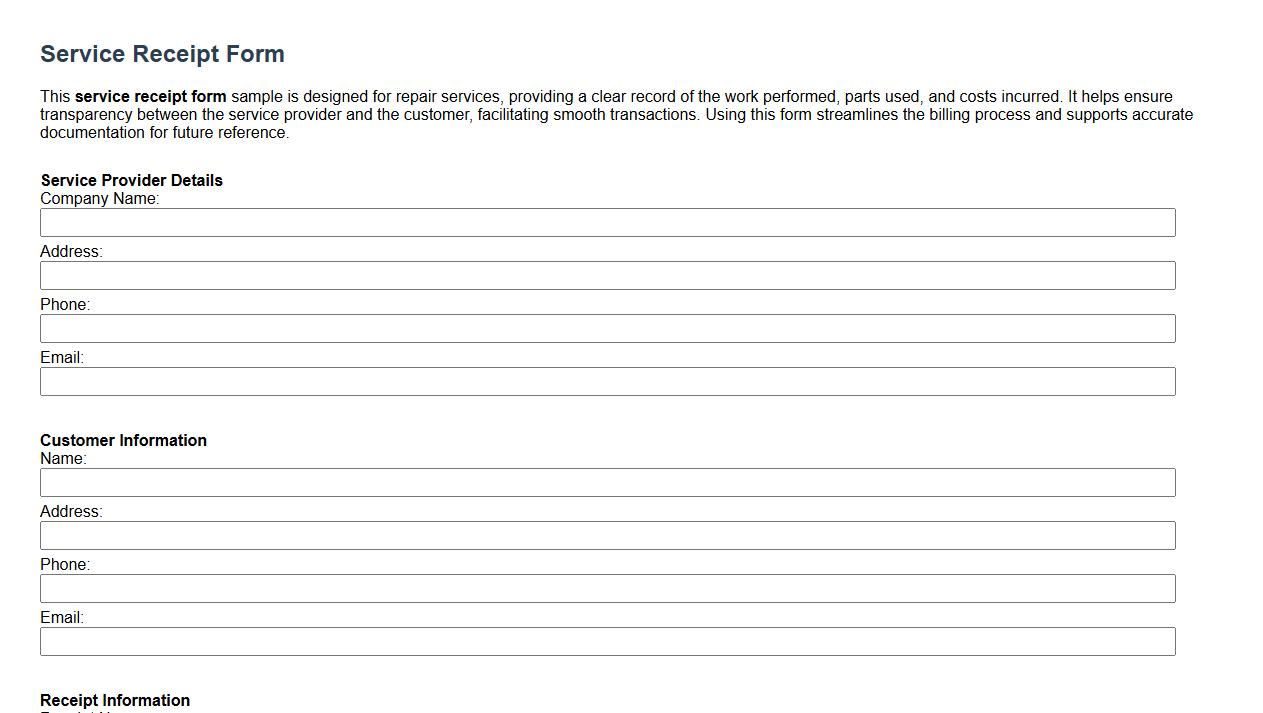

Service receipt form sample for repair services

This service receipt form sample is designed for repair services, providing a clear record of the work performed, parts used, and costs incurred. It helps ensure transparency between the service provider and the customer, facilitating smooth transactions. Using this form streamlines the billing process and supports accurate documentation for future reference.

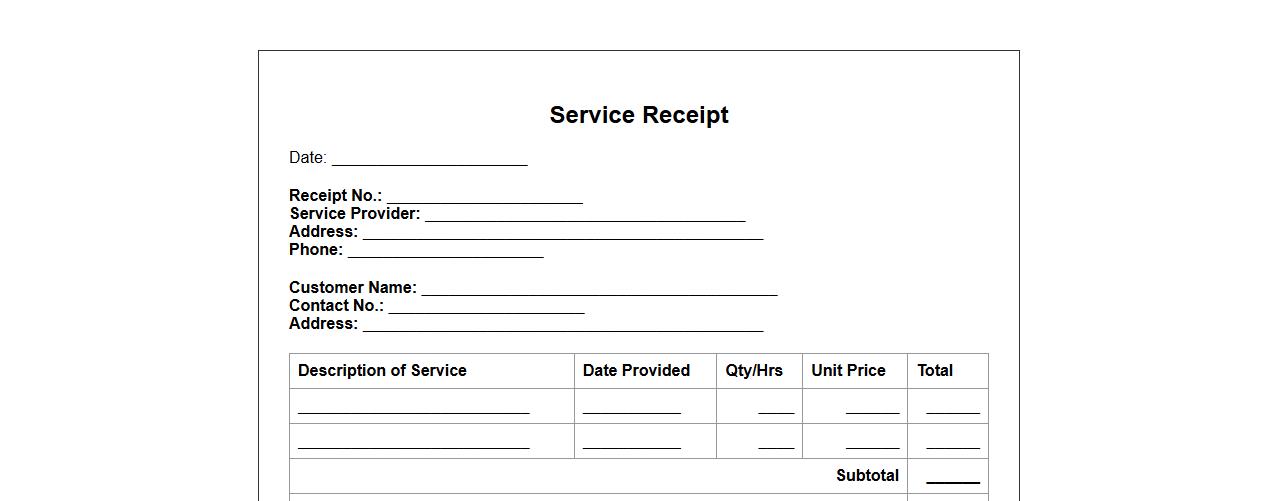

Printable service receipt form sample template

This printable service receipt form sample template provides a clear and professional layout for documenting transactions and services rendered. It is designed for easy customization and quick printing, ensuring accurate record-keeping. Use this template to streamline your billing process and maintain organized financial records.

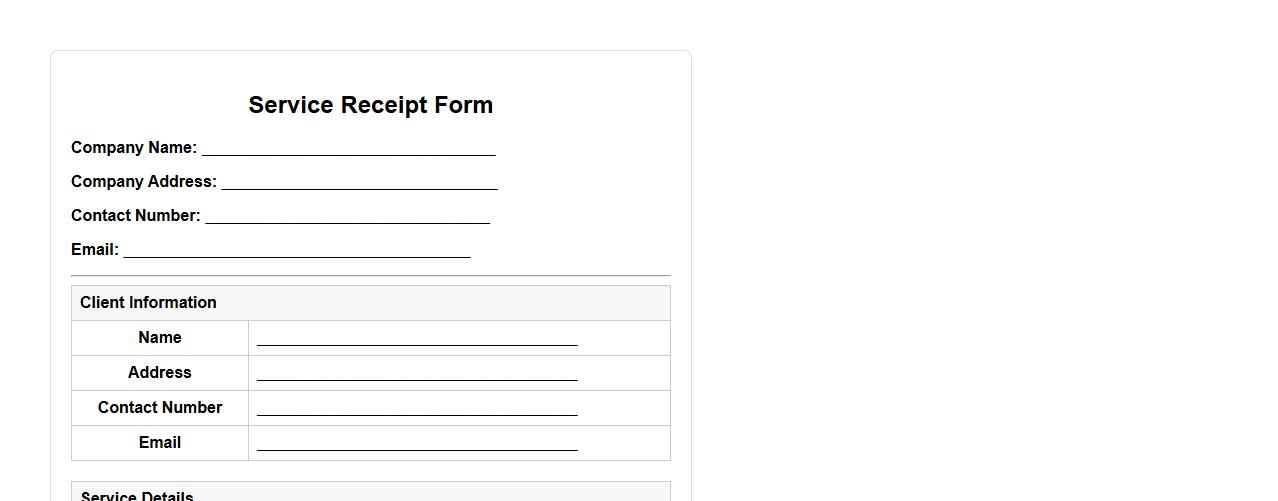

Service receipt form sample for cleaning companies

A service receipt form sample for cleaning companies provides a clear and professional record of services rendered, including details such as the date, description of cleaning tasks, and payment information. This form helps ensure transparency and client satisfaction by documenting the agreement between the cleaning service provider and the customer. Using a well-structured receipt form simplifies accounting and enhances business credibility.

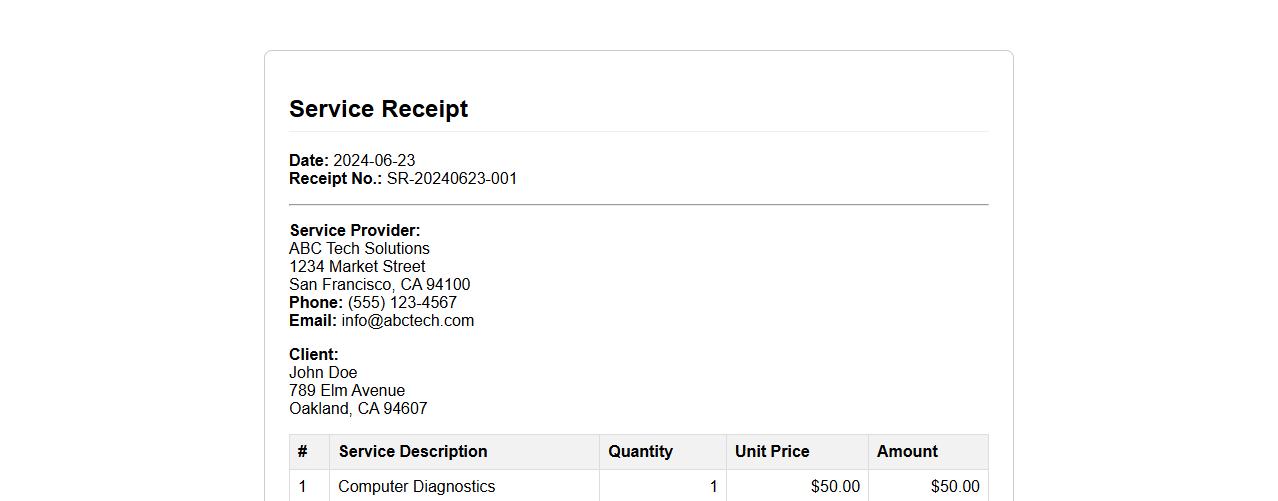

Service receipt form sample with itemized charges

A service receipt form sample with itemized charges provides a clear and detailed breakdown of services rendered, ensuring transparency and accuracy in billing. This form helps both service providers and clients keep track of each service item and its corresponding cost. It is an essential document for maintaining organized financial records and facilitating smooth transactions.

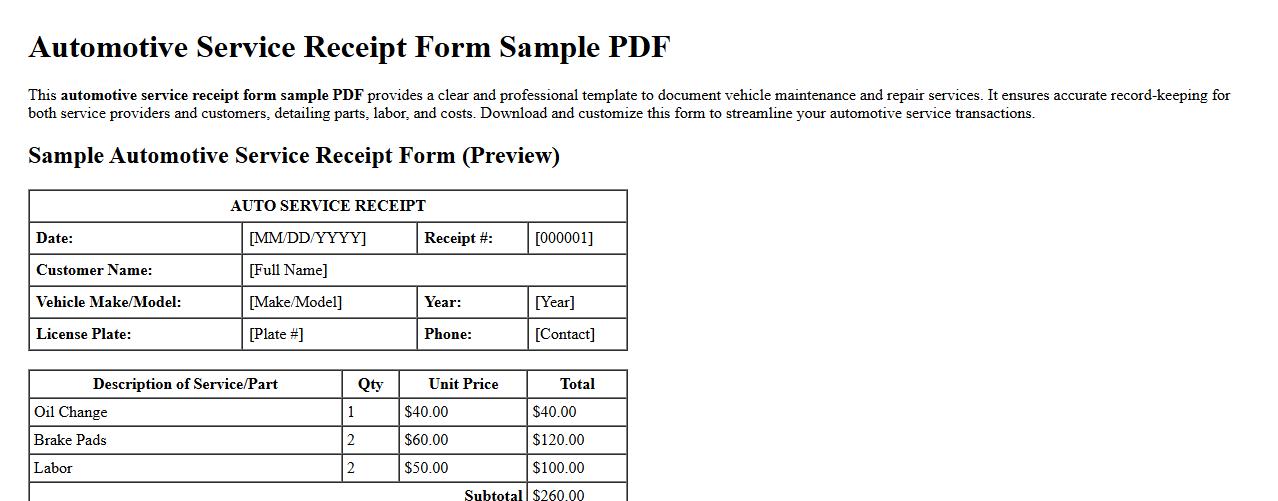

Automotive service receipt form sample PDF

This automotive service receipt form sample PDF provides a clear and professional template to document vehicle maintenance and repair services. It ensures accurate record-keeping for both service providers and customers, detailing parts, labor, and costs. Download and customize this form to streamline your automotive service transactions.

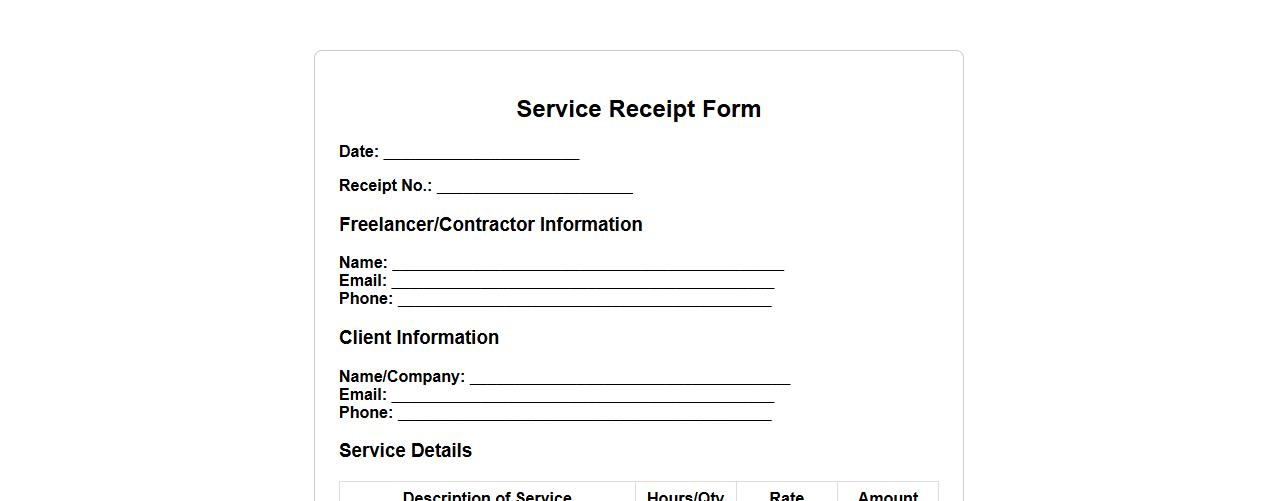

Service receipt form sample for freelance work

A service receipt form sample for freelance work helps freelancers document the services provided and payments received efficiently. This form ensures clear communication between freelancers and clients, preventing payment disputes. It is an essential tool for maintaining organized financial records in freelance projects.

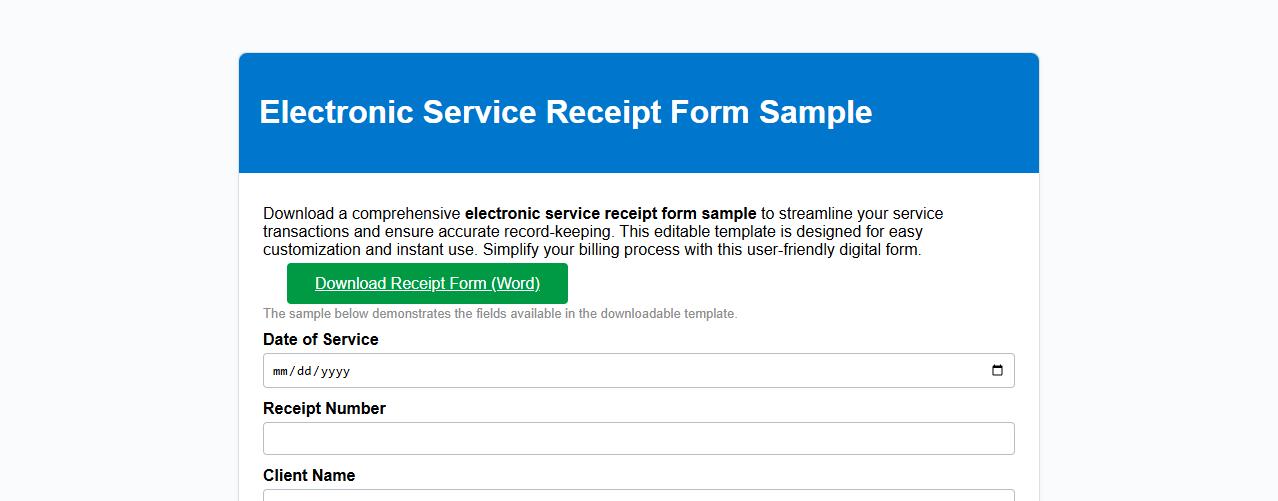

Electronic service receipt form sample download

Download a comprehensive electronic service receipt form sample to streamline your service transactions and ensure accurate record-keeping. This editable template is designed for easy customization and instant use. Simplify your billing process with this user-friendly digital form.

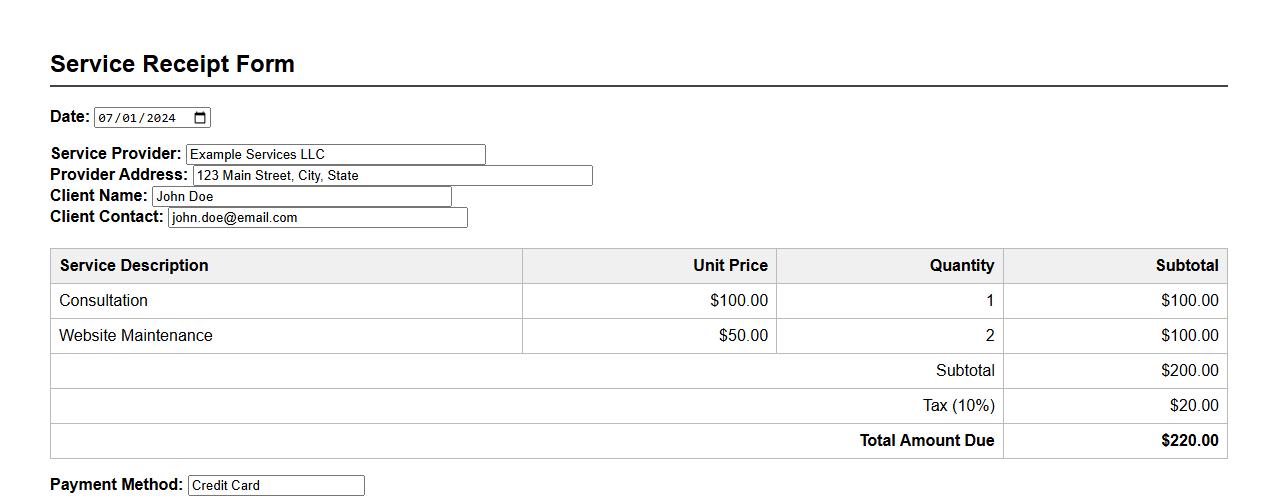

Service receipt form sample including tax calculation

A service receipt form sample provides a clear template for documenting services rendered along with accurate tax calculations. This form helps ensure transparency and compliance by itemizing services, fees, and applicable taxes. Using a standardized receipt simplifies record-keeping and client communication.

Service receipt form sample for maintenance services

This service receipt form sample is designed specifically for maintenance services, offering a clear and professional way to document service details. It includes essential fields such as service description, date, technician name, and payment details to ensure transparency and record-keeping. Utilizing this form helps streamline communication between service providers and clients while maintaining accurate transaction records.

What Mandatory Fields Must Be Included in a Compliant Service Receipt Form?

A compliant Service Receipt Form must include essential fields such as the service provider's name, date of service, and a detailed description of the service rendered. Additionally, it must have the client's information and an itemized cost breakdown to ensure transparency. Lastly, the form should contain the signatures of both parties to validate the transaction and agreement.

How Can a Service Receipt Form Facilitate Dispute Resolution Between Provider and Client?

A well-completed Service Receipt Form serves as a legal record that clearly outlines the scope and terms of the service provided. It helps prevent misunderstandings by documenting agreed-upon details like service dates, costs, and client approval. In case of disputes, this form acts as concrete evidence that can expedite resolution and support claims.

What Digital Signature Options Are Recommended for Service Receipt Forms?

For enhanced security and compliance, digital signatures such as DocuSign, Adobe Sign, and HelloSign are highly recommended for Service Receipt Forms. These platforms provide encrypted, legally binding signatures that ensure authenticity and integrity. Using electronic signatures improves workflow efficiency and reduces paper usage while maintaining compliance with regulatory standards.

How Should Confidential Information Be Handled Within a Service Receipt Form?

Confidential information in a Service Receipt Form must be protected through encryption and secure storage methods to prevent unauthorized access. It is critical to limit information exposure only to authorized personnel involved in the transaction. Furthermore, redacting sensitive details before sharing forms externally ensures compliance with privacy laws and regulations.

What Retention Period Is Legally Required for Service Receipt Forms in Your Industry?

The legally required retention period for Service Receipt Forms varies by industry but generally ranges from 3 to 7 years to meet auditing and compliance standards. It is vital to consult local regulations to determine the exact timeframe applicable to your sector. Maintaining organized records within this period supports legal claims, accounting audits, and operational transparency.