A Itemized Receipt Form Sample provides a detailed breakdown of purchased items, including descriptions, quantities, prices, and total amounts. This sample form helps businesses and customers keep accurate records for accounting, reimbursement, or tax purposes. Using an itemized receipt ensures transparency and simplifies expense tracking.

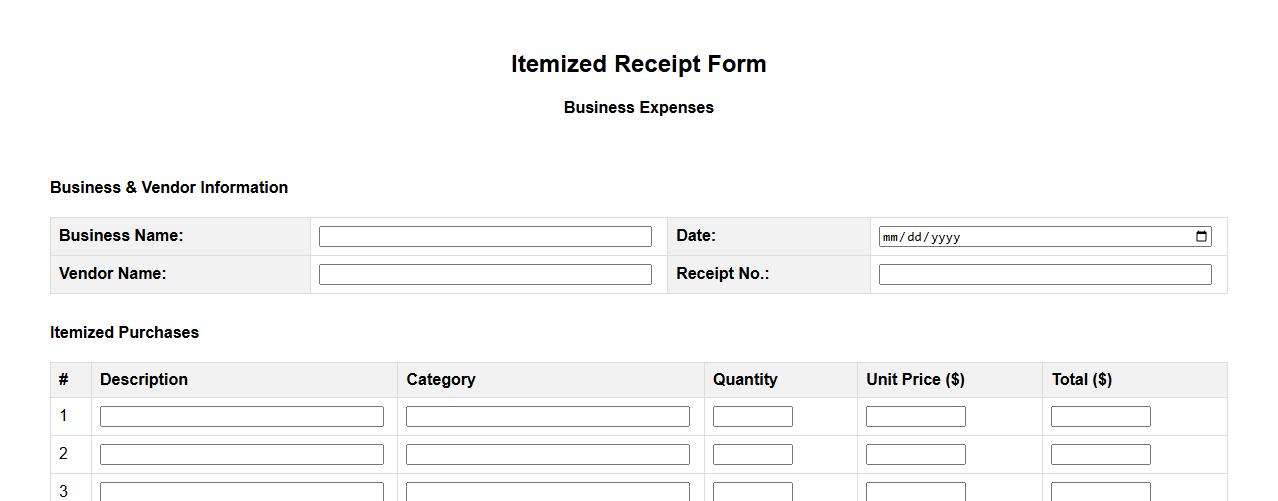

Itemized receipt form sample for business expenses

An itemized receipt form sample for business expenses provides a clear and organized way to document all transaction details. It helps ensure accurate tracking and reimbursement by listing each purchased item along with its cost. Using this form enhances financial record-keeping and simplifies expense reporting for businesses.

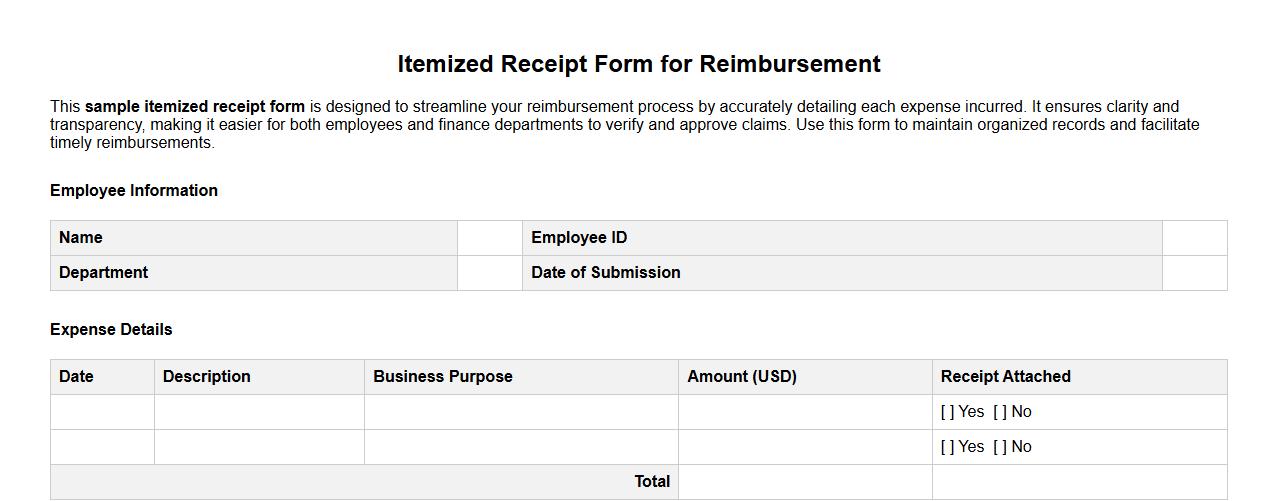

Sample itemized receipt form for reimbursement

This sample itemized receipt form is designed to streamline your reimbursement process by accurately detailing each expense incurred. It ensures clarity and transparency, making it easier for both employees and finance departments to verify and approve claims. Use this form to maintain organized records and facilitate timely reimbursements.

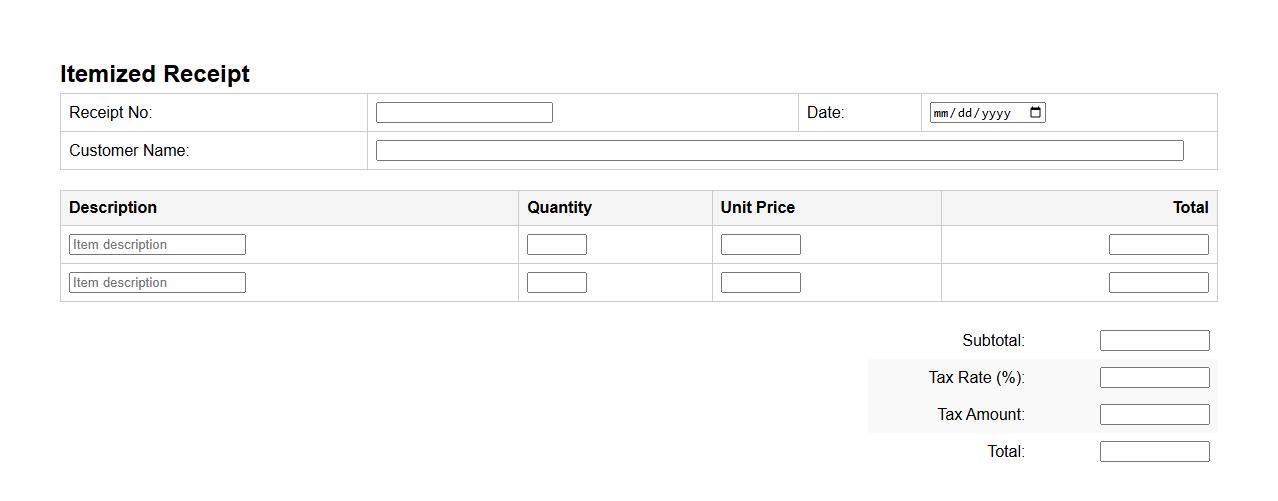

Itemized receipt form template with tax breakdown

Use this itemized receipt form template to clearly list purchased items along with their prices and quantities. It includes a detailed tax breakdown section to ensure transparency and accuracy in financial transactions. Perfect for businesses seeking organized and professional documentation.

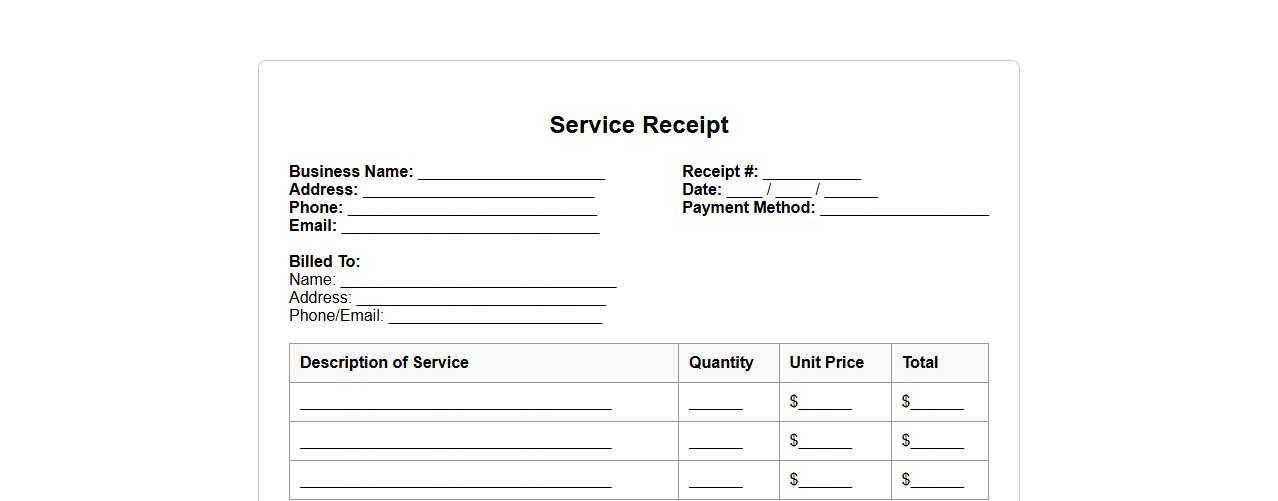

Printable itemized receipt form sample for services

This printable itemized receipt form sample provides a clear and organized way to document services rendered, including detailed descriptions, quantities, and prices. It is ideal for small businesses and freelancers to ensure accurate record-keeping and client transparency. Easily printable and customizable, this form helps maintain professionalism in all service transactions.

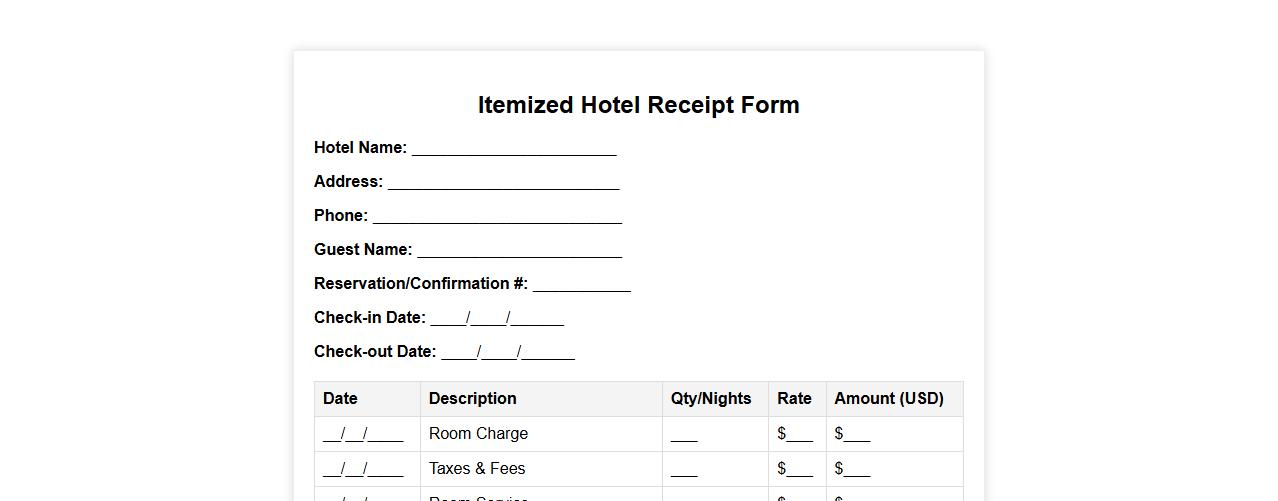

Itemized hotel receipt form sample for insurance claims

An itemized hotel receipt form sample is essential for accurately documenting expenses when filing insurance claims. This form provides a detailed breakdown of charges, including room rates, taxes, and additional services. It ensures transparency and simplifies the reimbursement process for travelers.

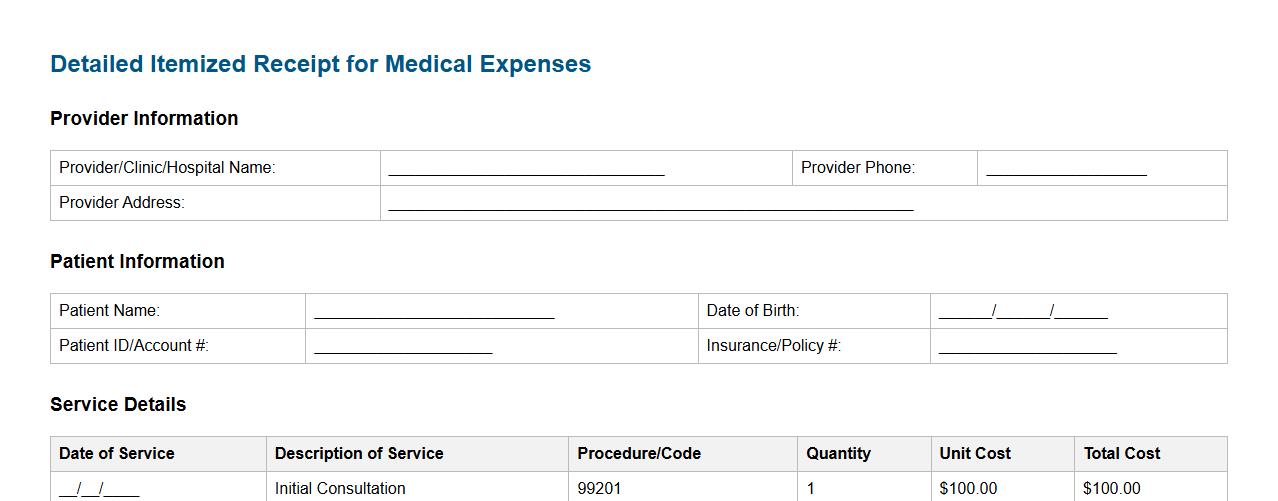

Detailed itemized receipt form example for medical expenses

This detailed itemized receipt form example for medical expenses provides a clear and organized format to document all healthcare charges. It includes sections for patient information, service dates, descriptions, quantities, and costs for accurate record-keeping and insurance claims. Using this form helps ensure transparency and simplifies the reimbursement process for medical costs.

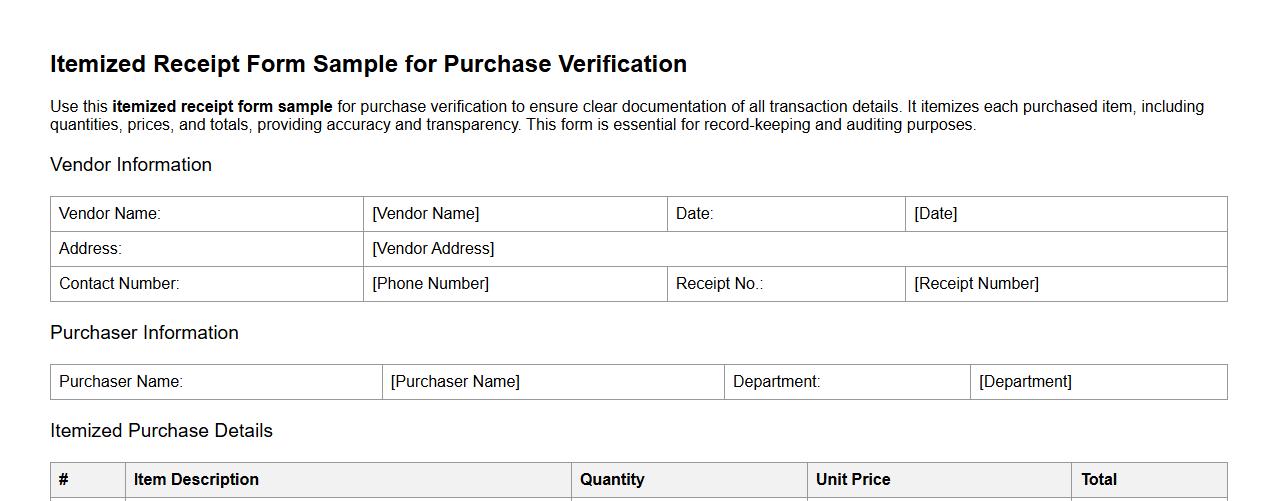

Itemized receipt form sample for purchase verification

Use this itemized receipt form sample for purchase verification to ensure clear documentation of all transaction details. It itemizes each purchased item, including quantities, prices, and totals, providing accuracy and transparency. This form is essential for record-keeping and auditing purposes.

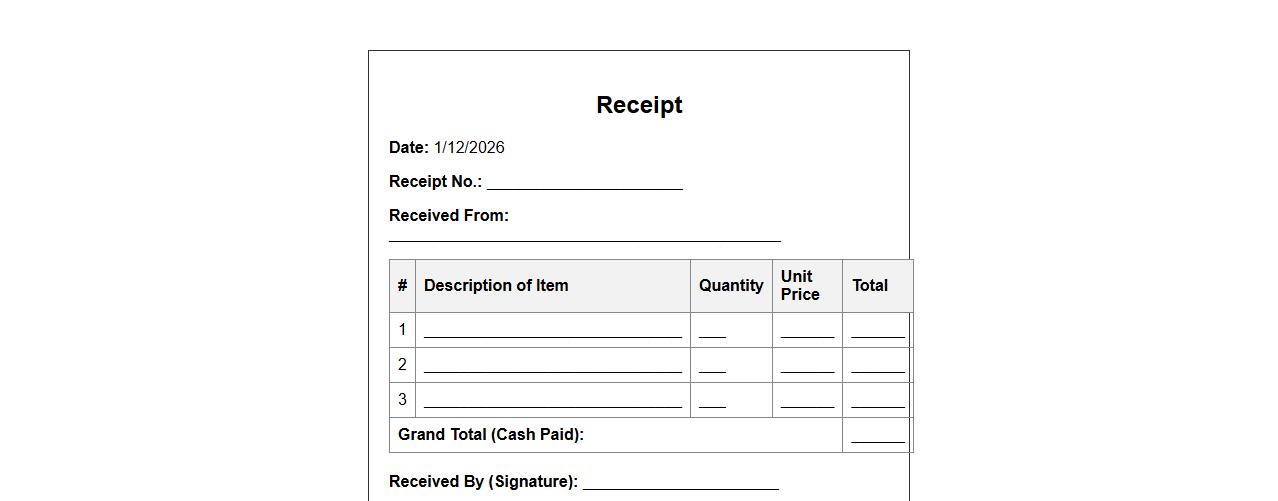

Simple itemized receipt form sample for cash payment

This simple itemized receipt form is designed for clear and efficient cash payment documentation. It lists all purchased items with their prices, ensuring transparency and ease of record-keeping. Ideal for small businesses and personal transactions, this form helps maintain organized financial records.

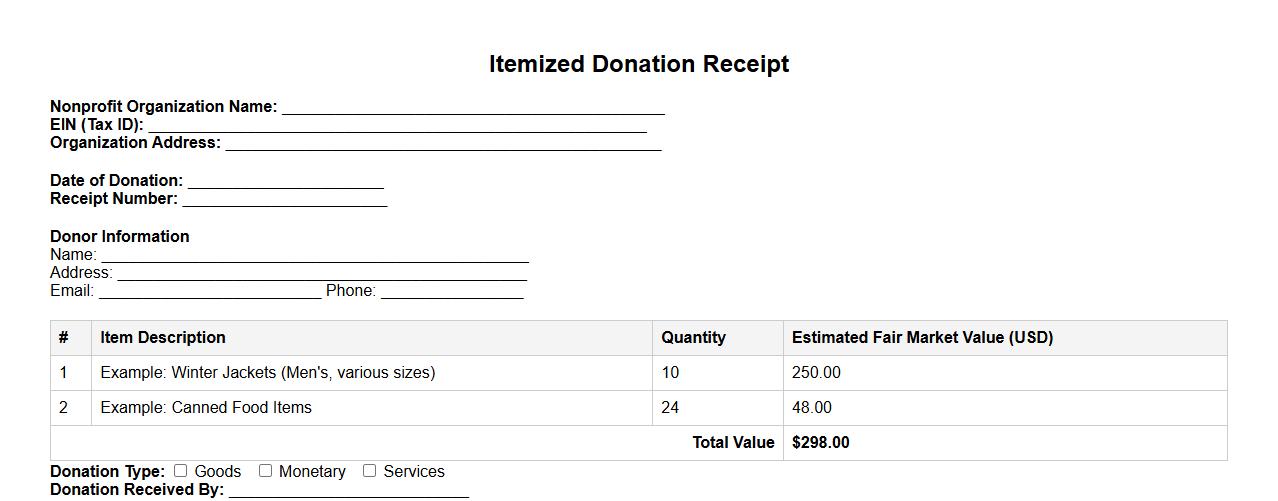

Itemized donation receipt form sample for nonprofit

Download our itemized donation receipt form sample to provide clear and detailed records for your nonprofit's donors. This template ensures transparency by listing each donated item with its description and value. Simplify your donation tracking while maintaining trust and compliance.

What sections are mandatory on an itemized receipt form for medical expenses?

An itemized receipt form for medical expenses must include detailed information such as the patient's name, date of service, and a description of each medical service or product provided. It is essential to list the quantity, unit price, and total cost for clarity and accountability. Additionally, the receipt should display the provider's contact information and address to ensure authenticity and traceability.

How does an itemized receipt form support warranty claims?

An itemized receipt form serves as proof of purchase and details the specific items covered under a warranty. It helps confirm the purchase date and product details, which are crucial for validating warranty eligibility. The detailed breakdown ensures transparency and supports efficient resolution of warranty disputes.

What data privacy measures should be included on a digital itemized receipt?

Digital itemized receipts must incorporate encryption to protect sensitive customer and transaction data during transmission and storage. They should also include anonymization features to minimize exposure of personal information. Additionally, compliance with data protection regulations such as GDPR or HIPAA is mandatory to safeguard user privacy.

Which tax details must appear on an itemized receipt for business reimbursements?

For business reimbursements, the itemized receipt must clearly display the applicable tax identification number (TIN) and a breakdown of taxes charged, such as VAT or sales tax. It should include the total pre-tax amount, the tax rate applied, and the total amount including tax. This ensures compliance with tax regulations and facilitates accurate accounting and reimbursement.

How to validate the authenticity of an itemized receipt form for insurance purposes?

To validate an itemized receipt for insurance claims, verify the legitimacy of the provider through their official details and cross-check the receipt against the services or products claimed. Authentic receipts typically contain unique identifiers such as invoice numbers and official stamps or signatures. Additionally, contacting the issuer directly can confirm the receipt's validity and prevent fraudulent claims.