A Purchase Receipt Form Sample serves as a standardized document that records details of a transaction between a buyer and a seller, including item descriptions, quantities, prices, and payment methods. This form helps both parties maintain accurate financial records and ensures clarity in the purchasing process. Utilizing a well-designed sample can streamline accounting procedures and enhance transparency in business operations.

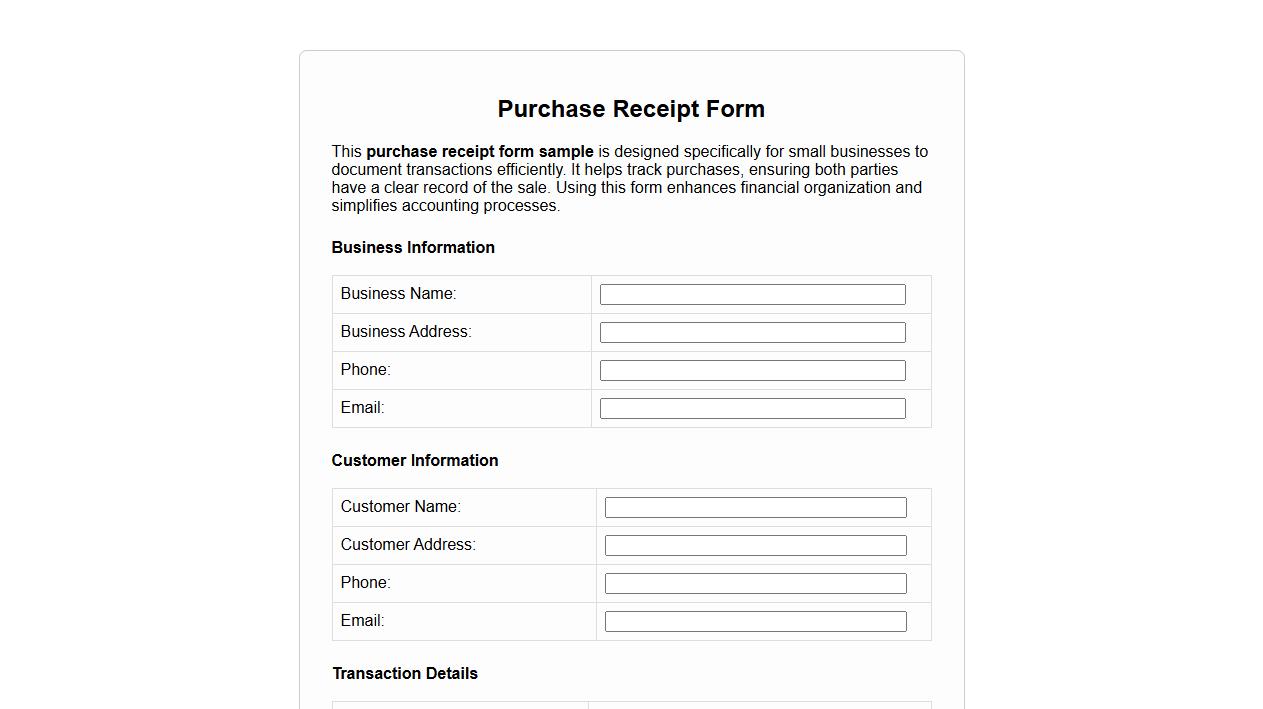

Purchase receipt form sample for small business

This purchase receipt form sample is designed specifically for small businesses to document transactions efficiently. It helps track purchases, ensuring both parties have a clear record of the sale. Using this form enhances financial organization and simplifies accounting processes.

Downloadable purchase receipt form sample PDF

Download our purchase receipt form sample in PDF format to easily document your transactions. This downloadable template ensures clear and professional record-keeping for all your purchases. Access and customize the receipt form to suit your business needs effortlessly.

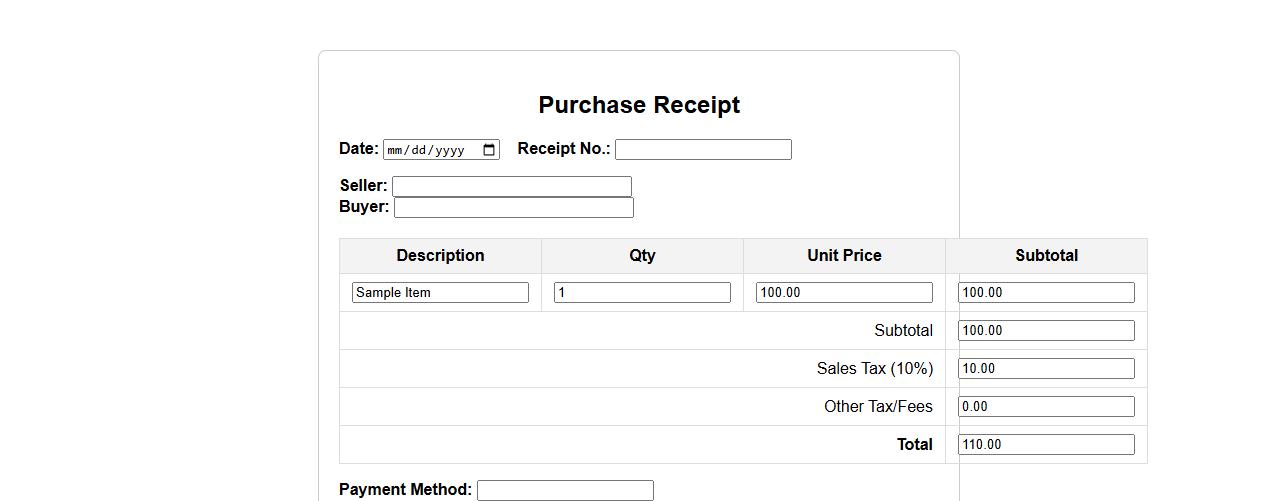

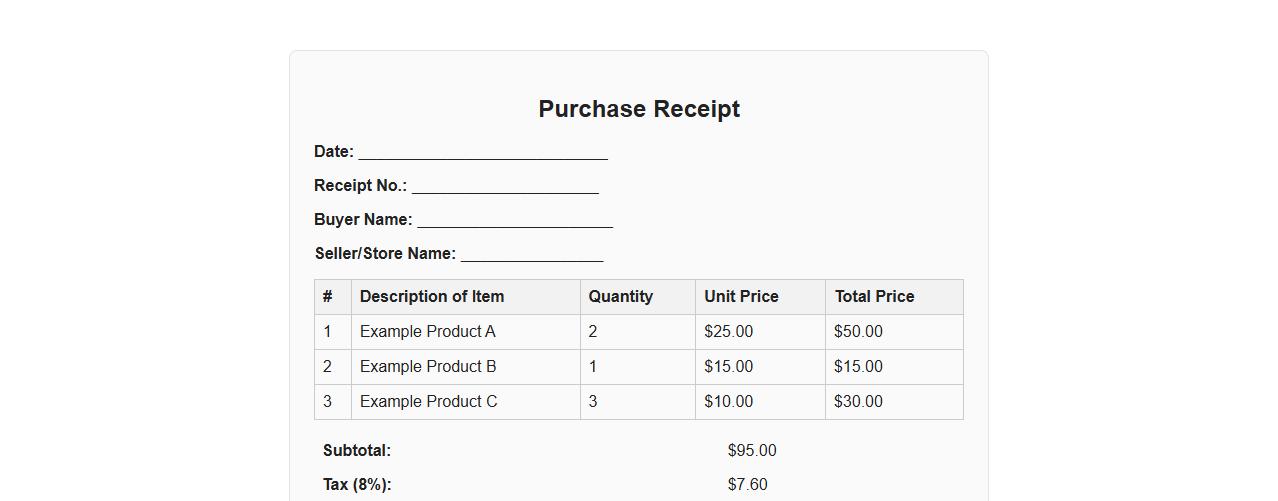

Purchase receipt form sample with tax breakdown

Use this purchase receipt form sample to clearly document transactions with a detailed tax breakdown. It ensures transparency and accuracy for both buyers and sellers. Customize the form to fit your business needs effortlessly.

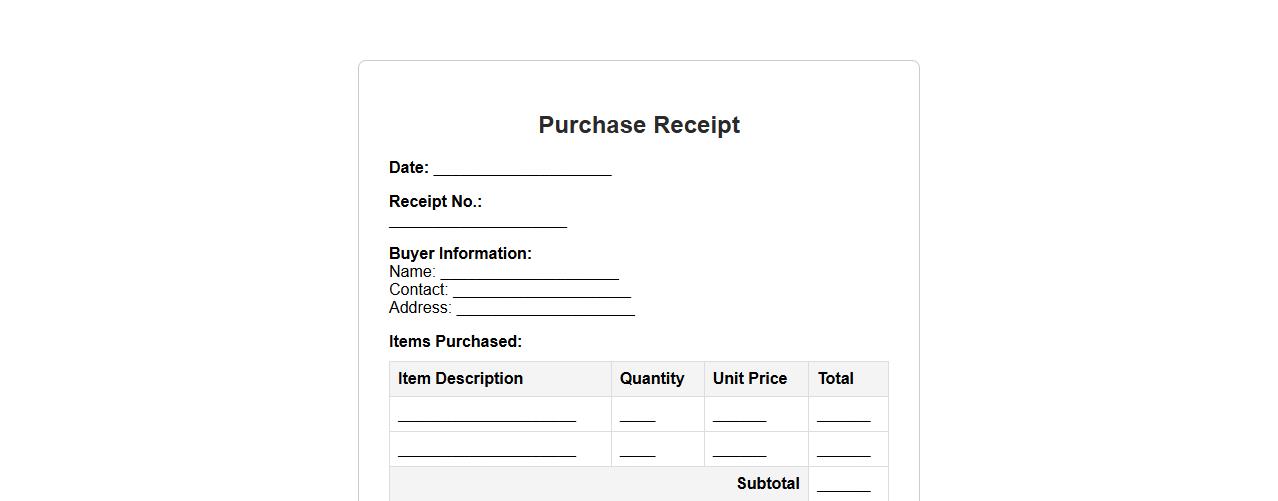

Simple purchase receipt form sample template

This simple purchase receipt form sample template is designed for easy documentation of transactions, ensuring clear and organized record-keeping. It captures essential details such as buyer information, items purchased, and payment method for seamless processing. Ideal for small businesses, it enhances transparency and accountability in every sale.

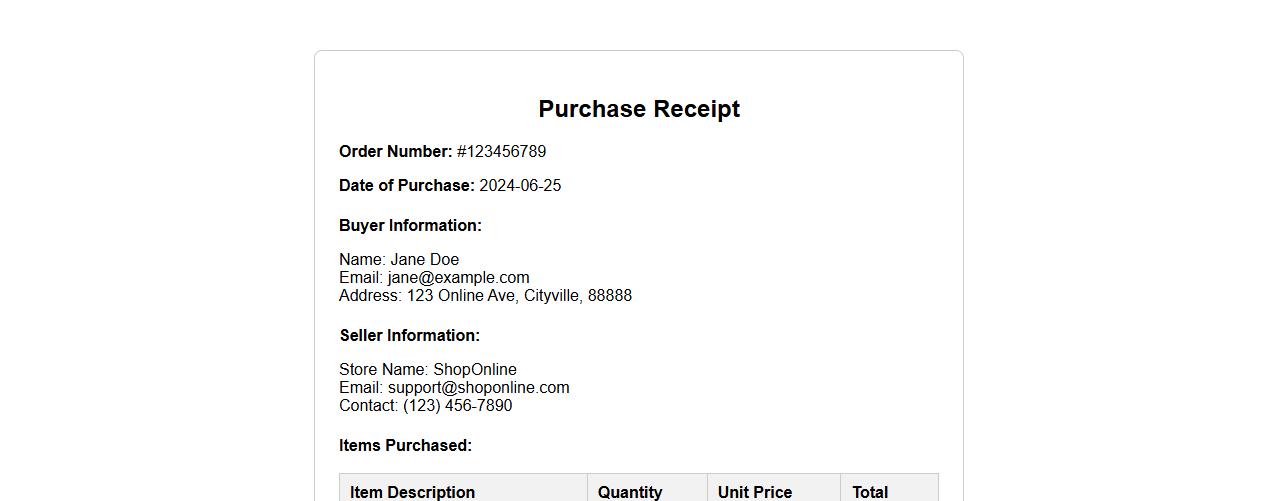

Purchase receipt form sample for online transactions

A purchase receipt form for online transactions serves as a detailed record of the items bought and payment made. It ensures transparency and provides proof of purchase for both sellers and buyers. Utilizing a standardized form helps streamline online sales processes and facilitates easy returns or exchanges.

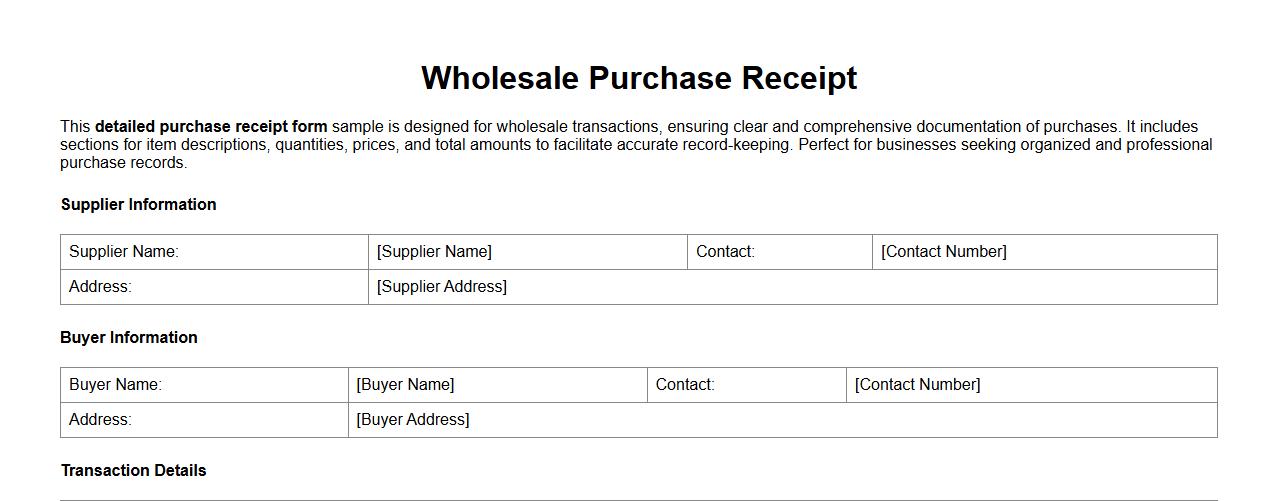

Detailed purchase receipt form sample for wholesale

This detailed purchase receipt form sample is designed for wholesale transactions, ensuring clear and comprehensive documentation of purchases. It includes sections for item descriptions, quantities, prices, and total amounts to facilitate accurate record-keeping. Perfect for businesses seeking organized and professional purchase records.

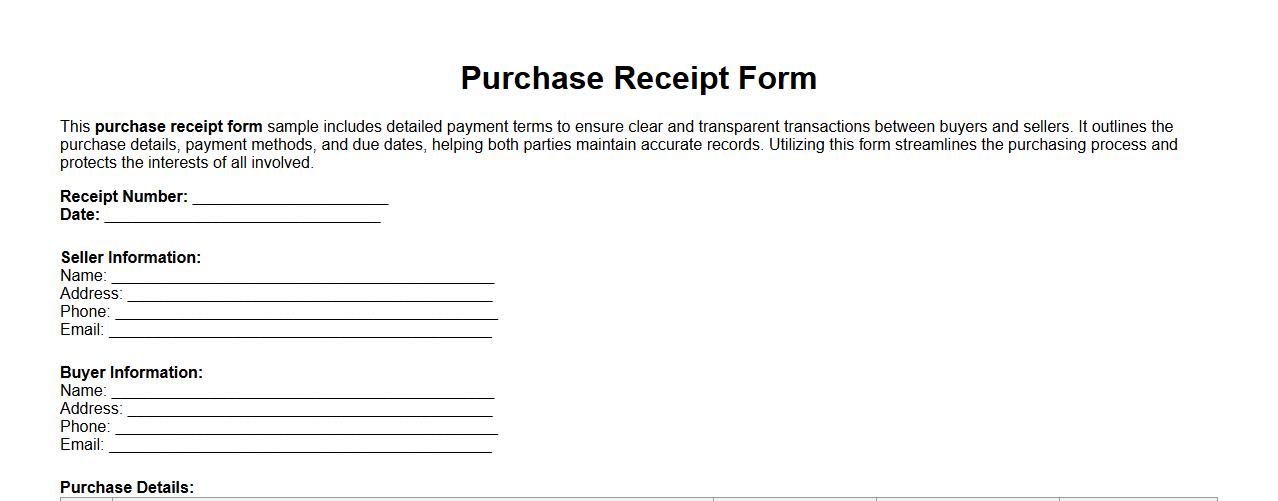

Purchase receipt form sample with payment terms

This purchase receipt form sample includes detailed payment terms to ensure clear and transparent transactions between buyers and sellers. It outlines the purchase details, payment methods, and due dates, helping both parties maintain accurate records. Utilizing this form streamlines the purchasing process and protects the interests of all involved.

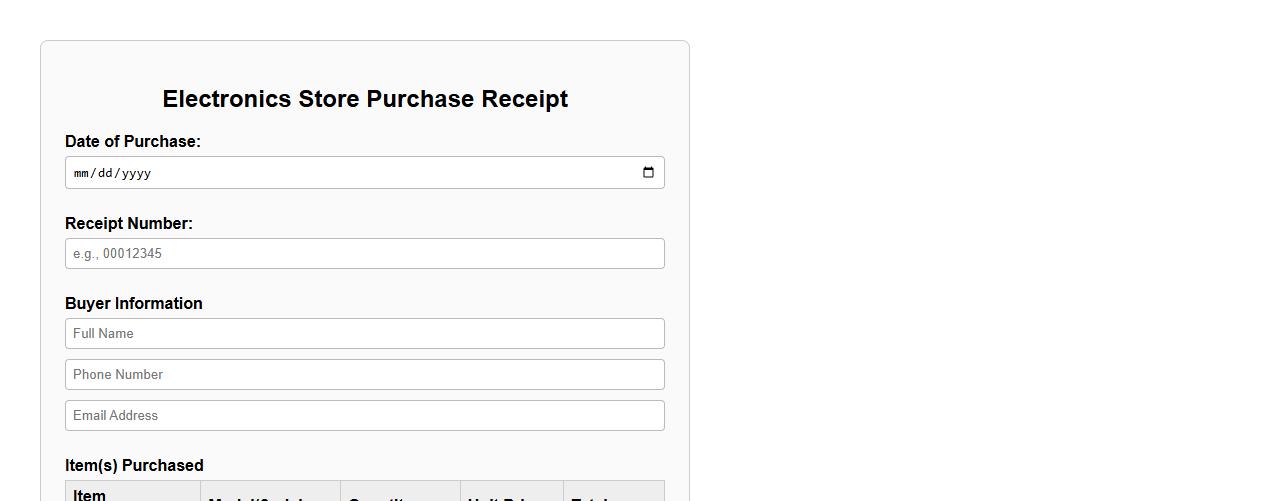

Purchase receipt form sample for electronics store

Download a purchase receipt form sample designed specifically for electronics stores, ensuring accurate record-keeping of all transactions. This template includes essential details such as buyer information, item descriptions, prices, and payment methods for efficient customer service. Use this form to maintain organized sales documentation and streamline your store's accounting process.

Purchase receipt form sample with itemized list

Use this purchase receipt form sample to clearly document transactions with an itemized list for accurate record-keeping. It ensures transparency by detailing each purchased item, price, and quantity. This format simplifies financial tracking for both buyers and sellers.

Required Fields for Tax-Compliant Purchase Receipt Forms

Every tax-compliant purchase receipt form must include the seller's and buyer's identification details. It should clearly state the date of transaction and a unique receipt number. Additionally, the form must itemize the goods or services provided along with the corresponding amounts and applicable taxes.

Accepted Digital Signatures on Purchase Receipt Forms

Trusted digital signatures typically include those generated through Public Key Infrastructure (PKI) systems. These electronic signatures ensure authenticity and are compliant with legal standards like eIDAS or ESIGN. Many jurisdictions accept digitally signed receipts if the signature meets verification and tamper-evidence criteria.

Document Retention Period for Purchase Receipt Forms

Purchase receipt forms should be retained for a minimum of five to seven years, depending on local tax laws. This retention period ensures compliance during potential tax audits or legal scrutiny. Proper archival of these documents can be electronic or physical but must allow easy access when required.

Integration Options with Accounting Software

Modern purchase receipt forms can be integrated with popular accounting software through APIs or import functionalities. Platforms like QuickBooks, Xero, and SAP support importing receipt data to automate bookkeeping. This integration reduces manual data entry errors and improves financial workflow efficiency.

Common Errors in Purchase Receipt Form Submission

Common errors include incomplete or missing taxpayer identification numbers and incorrect date entries. Submission of forms without proper signatures or with unreadable digital signatures often leads to rejection. Additionally, failing to detail taxes or item descriptions can result in non-compliance issues.