A Money Receipt Form Sample serves as a template to document financial transactions, providing proof of payment between parties. It typically includes details such as the payer's information, amount paid, date, and purpose of the transaction to ensure transparency and record-keeping. Using a clear and well-structured Money Receipt Form Sample helps prevent disputes and supports accurate accounting.

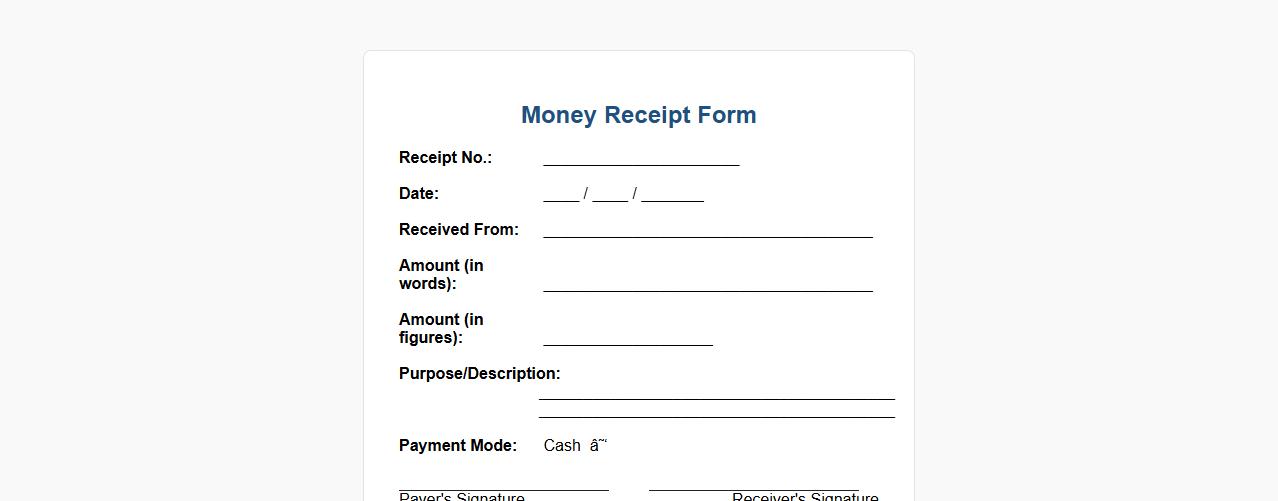

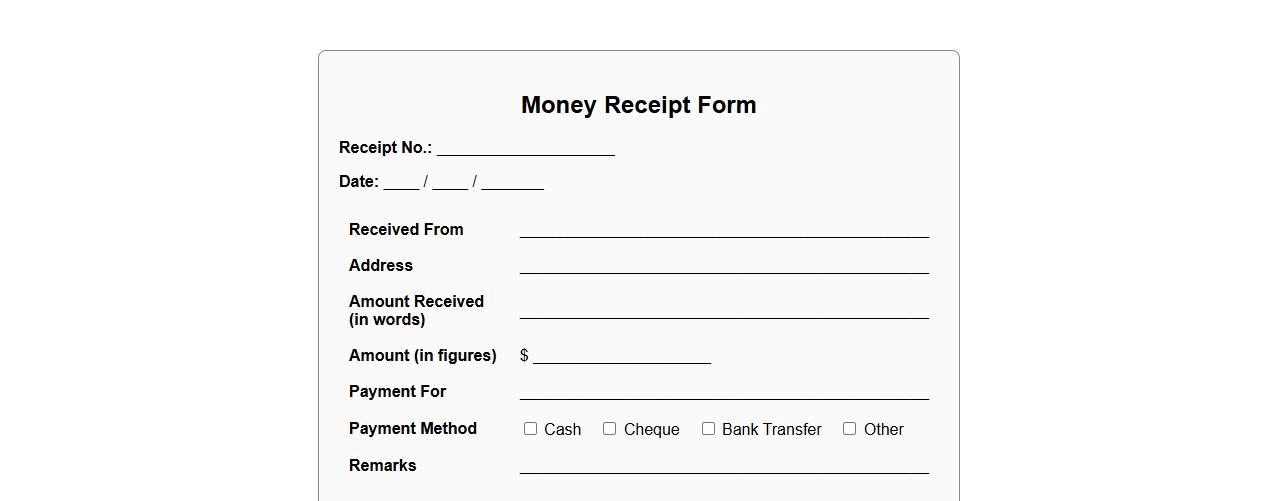

Money receipt form sample for cash payment

A money receipt form sample for cash payment serves as a crucial document that records the transaction details between the payer and the payee. It ensures transparency and provides proof of payment, including information such as the amount received, date, and payer's details. Utilizing a well-structured receipt form helps in maintaining accurate financial records for both parties.

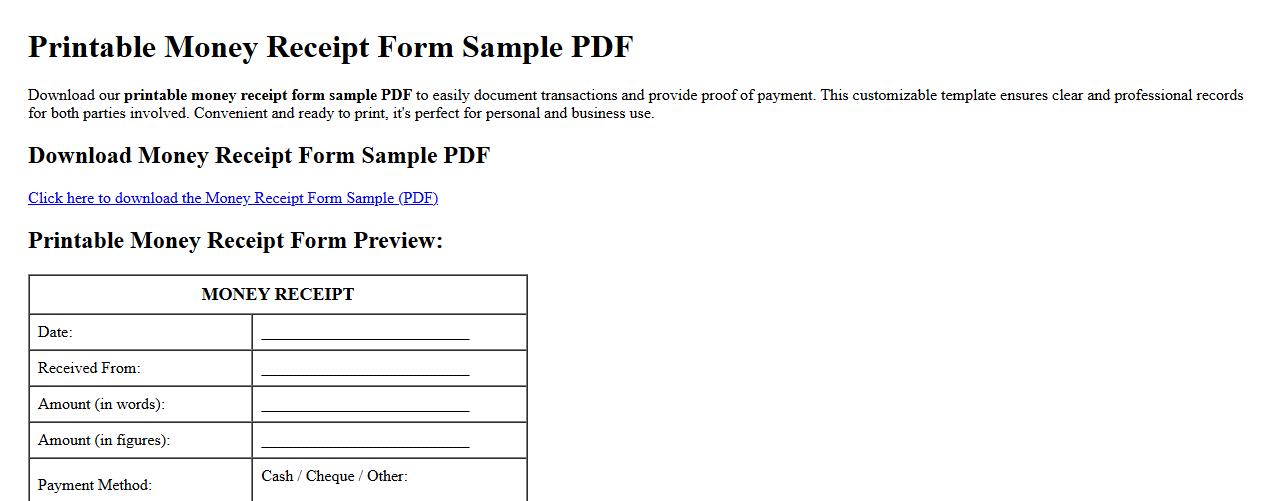

Printable money receipt form sample PDF

Download our printable money receipt form sample PDF to easily document transactions and provide proof of payment. This customizable template ensures clear and professional records for both parties involved. Convenient and ready to print, it's perfect for personal and business use.

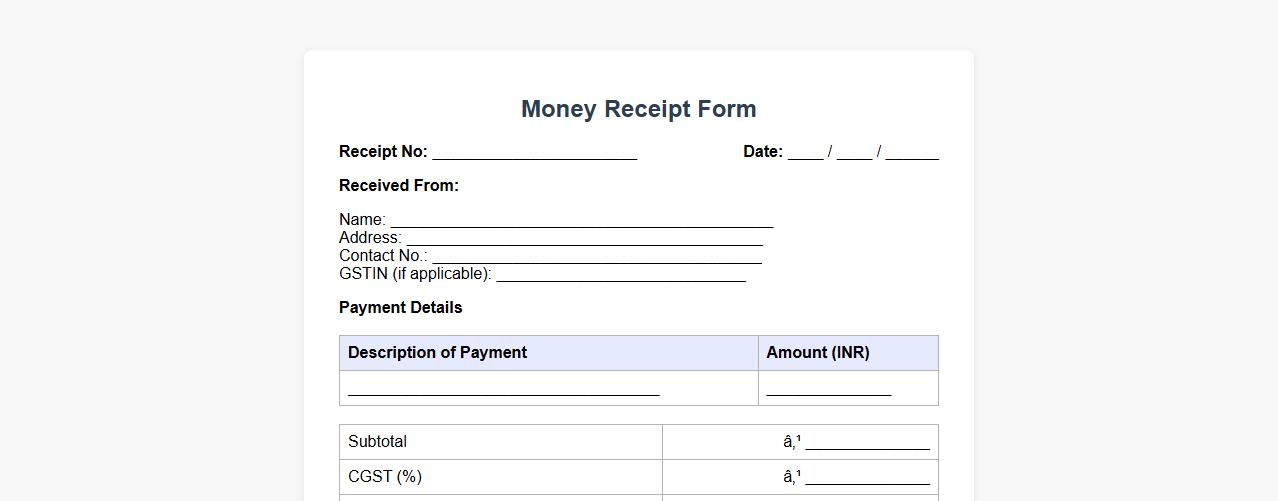

Money receipt form sample with GST details

Download our money receipt form sample with GST details to ensure accurate and compliant financial documentation. This template includes all necessary fields for GST information, making it easy to record transactions transparently. Perfect for businesses and individuals aiming for professional and lawful receipts.

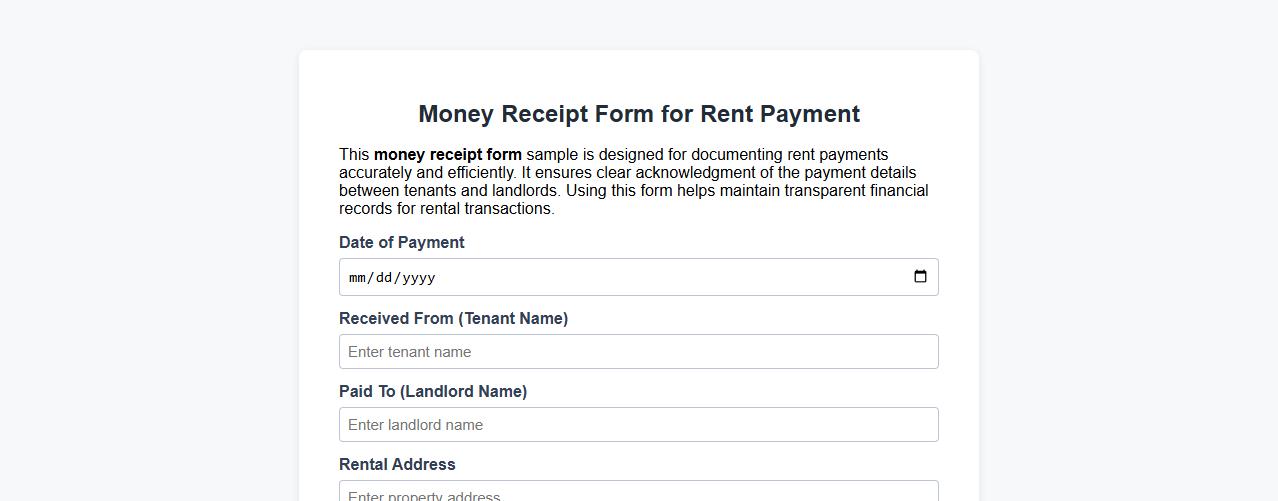

Money receipt form sample for rent payment

This money receipt form sample is designed for documenting rent payments accurately and efficiently. It ensures clear acknowledgment of the payment details between tenants and landlords. Using this form helps maintain transparent financial records for rental transactions.

Money receipt form sample for business transactions

A money receipt form sample is an essential document for recording business transactions, ensuring accurate payment tracking and accountability. It provides a clear record of the amount received, date, and details of the payer, promoting transparency in financial dealings. Using a standardized receipt form helps businesses maintain organized and professional financial records.

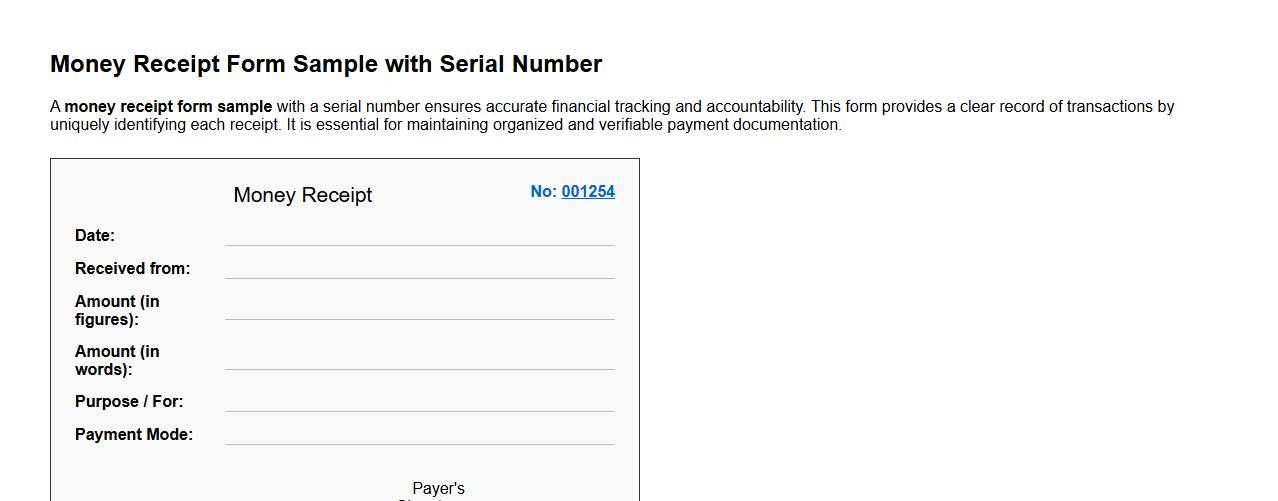

Money receipt form sample with serial number

A money receipt form sample with a serial number ensures accurate financial tracking and accountability. This form provides a clear record of transactions by uniquely identifying each receipt. It is essential for maintaining organized and verifiable payment documentation.

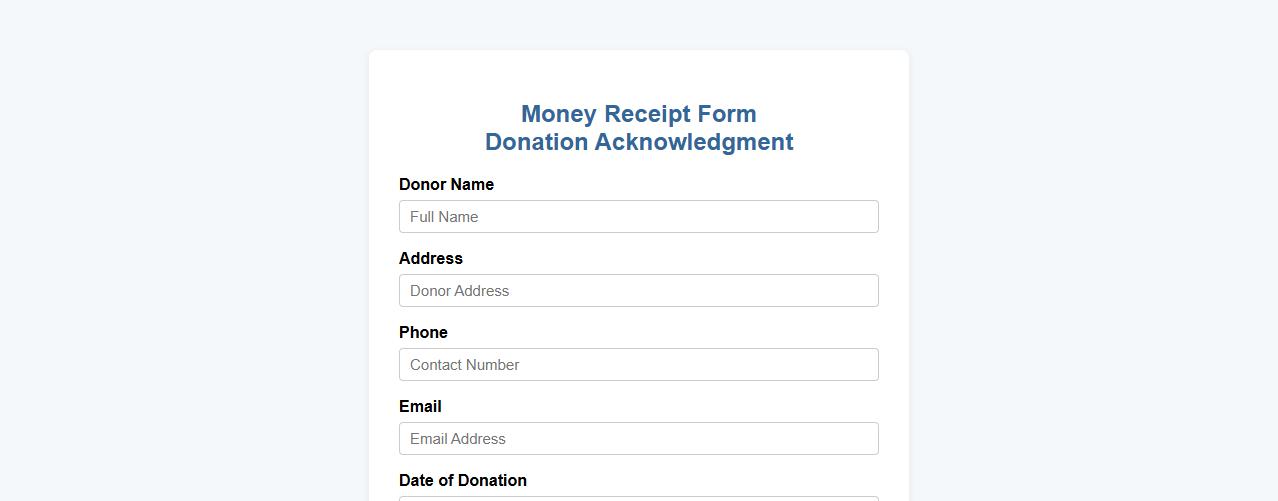

Simple money receipt form sample for donation

This money receipt form sample is designed for straightforward documentation of donations, ensuring clarity and proper acknowledgment. It includes essential fields such as donor information, donation amount, and date for accurate record-keeping. Ideal for nonprofits and charitable organizations to maintain transparent financial transactions.

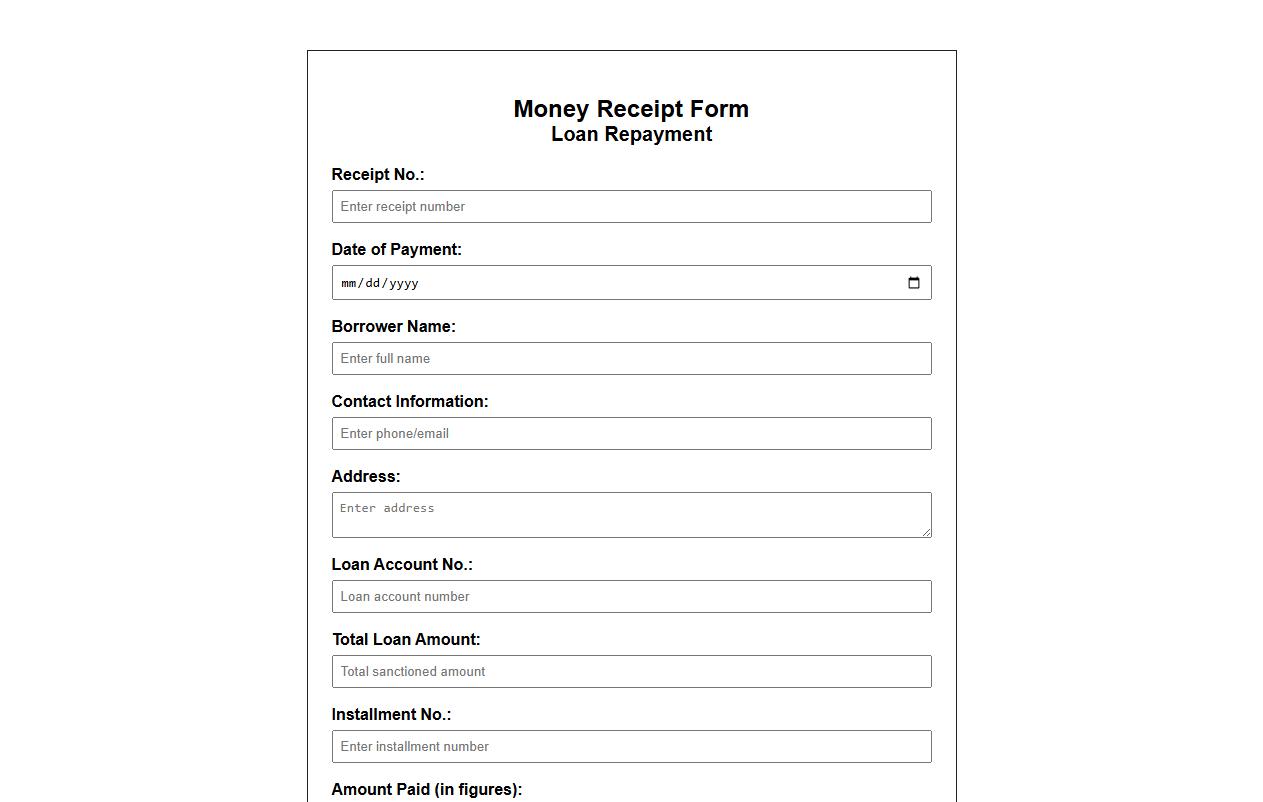

Detailed money receipt form sample for loan repayment

This money receipt form sample is designed for detailed documentation of loan repayments, ensuring clear tracking of each transaction. It includes fields for borrower information, payment amount, date, and loan details, providing a transparent and organized record. Utilizing this form helps maintain accurate financial records and simplifies future reference and auditing.

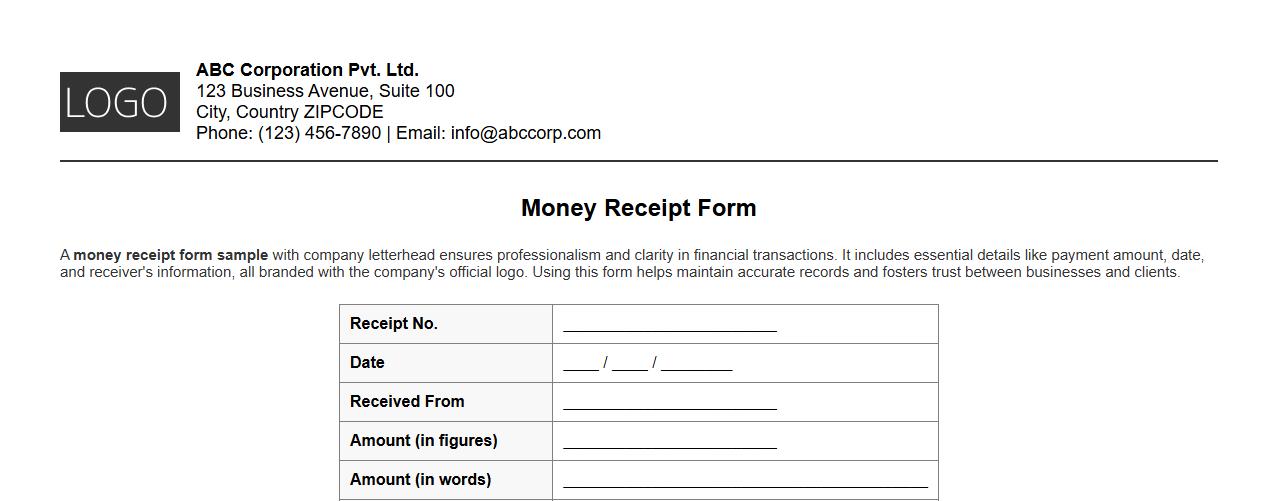

Money receipt form sample with company letterhead

A money receipt form sample with company letterhead ensures professionalism and clarity in financial transactions. It includes essential details like payment amount, date, and receiver's information, all branded with the company's official logo. Using this form helps maintain accurate records and fosters trust between businesses and clients.

What specific details are required when filling out a money receipt form for partial payments?

When filling out a money receipt form for partial payments, it is essential to specify the exact amount paid to avoid confusion. The form should distinctly mention the total amount due and the remaining balance after the partial payment. Additionally, details such as payment date, payer's information, and mode of payment are crucial for accurate record-keeping.

How can digital signatures be securely integrated into a money receipt form?

Digital signatures can be securely integrated into a money receipt form by using encrypted digital certificate systems that authenticate the signer's identity. Implementing robust security protocols like two-factor authentication enhances the reliability of the signatures. Moreover, using specialized software to apply and verify these signatures ensures the integrity and non-repudiation of the transaction document.

Which sections of a money receipt form ensure tax compliance for business transactions?

The sections including the tax identification number (TIN), tax percentage applied, and calculated tax amount are critical for tax compliance. A detailed description of the items or services, along with their taxable status, helps maintain transparent and compliant records. Additionally, the inclusion of the date and authorized signatures supports validation during tax audits.

How should a money receipt form document refund versus deposit transactions?

A money receipt form should clearly differentiate between a refund and a deposit by labeling the respective transaction type prominently. Refund sections should indicate the reason for the refund, amount returned, and reference the original payment. Deposit transactions must state the amount received, purpose, and any applicable conditions or remaining balances.

What is the best method to archive and retrieve money receipt forms for audit purposes?

The best method to archive money receipt forms involves using a secure digital document management system with indexed metadata for easy searchability. Regular backups and encryption protect the documents from loss or unauthorized access. For efficient retrieval during audits, categorizing receipts by date, client, and transaction type significantly speeds up the process.