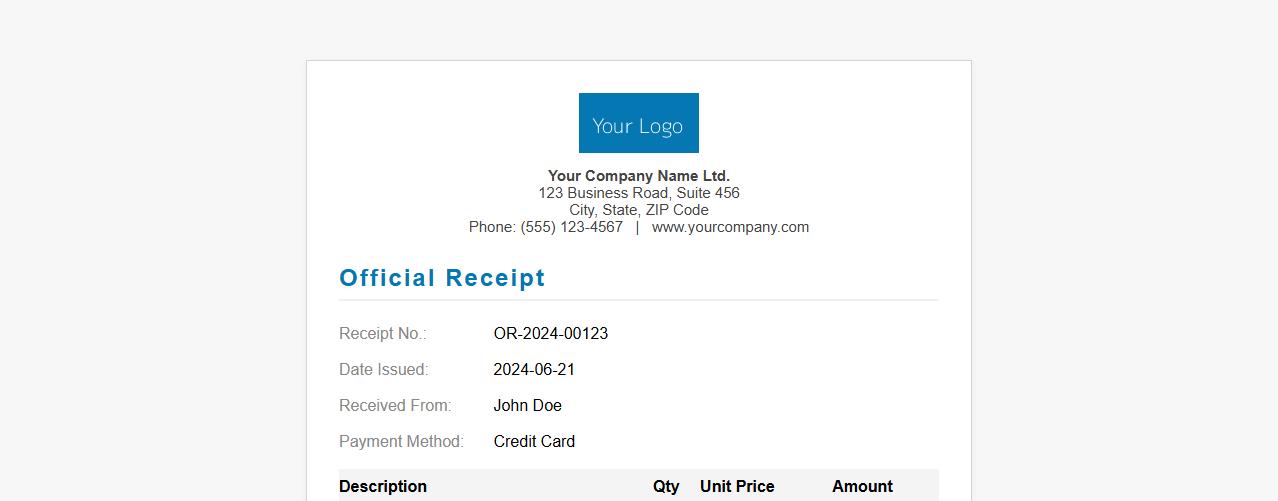

An Official Receipt Sample provides a clear example of how a legitimate proof of transaction should appear, including essential details such as the seller's information, buyer's name, date, and amount paid. This sample helps businesses create accurate receipts that comply with legal standards and ensure transparency in financial dealings. Using an Official Receipt Sample guarantees consistency and professionalism in documenting sales or services rendered.

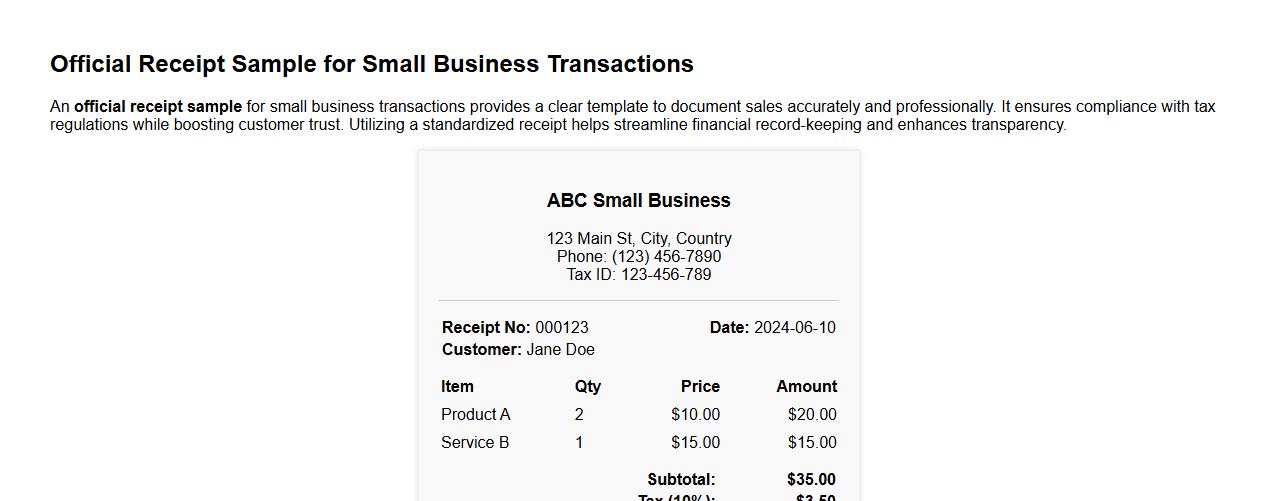

Official receipt sample for small business transactions

An official receipt sample for small business transactions provides a clear template to document sales accurately and professionally. It ensures compliance with tax regulations while boosting customer trust. Utilizing a standardized receipt helps streamline financial record-keeping and enhances transparency.

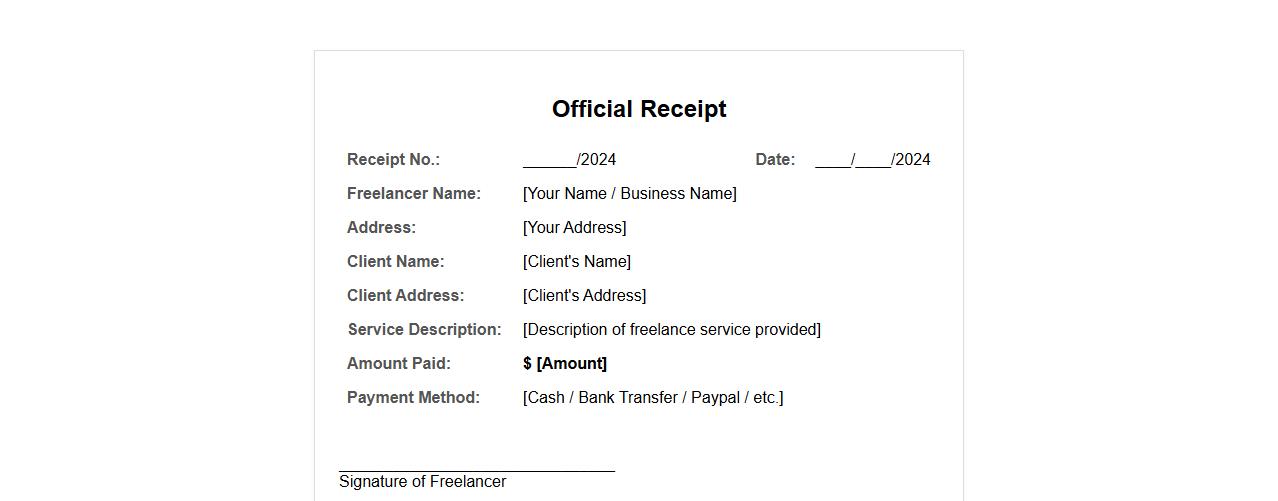

Official receipt sample for freelance services

Download an official receipt sample designed specifically for freelance services to ensure proper documentation of your transactions. This template helps freelancers maintain clear records and present professional proof of payment to clients. Using an accurate receipt format enhances trust and facilitates smooth financial management.

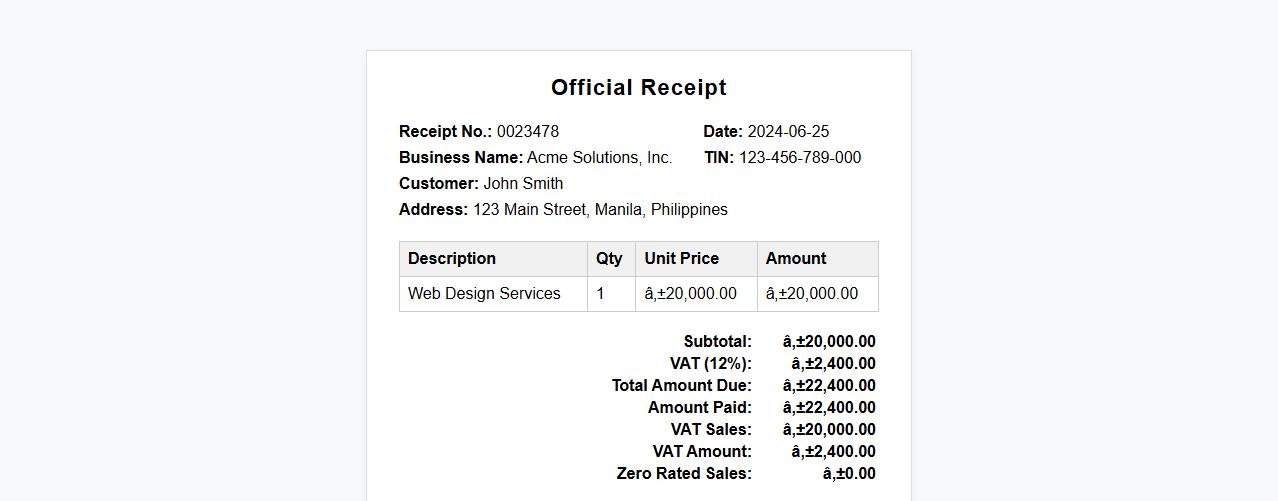

Official receipt sample with VAT inclusion

An official receipt sample with VAT inclusion clearly displays the tax amount, ensuring transparency and compliance with legal requirements. It serves as proof of payment, detailing the total cost including the value-added tax. This document is essential for both businesses and customers for accurate financial record-keeping.

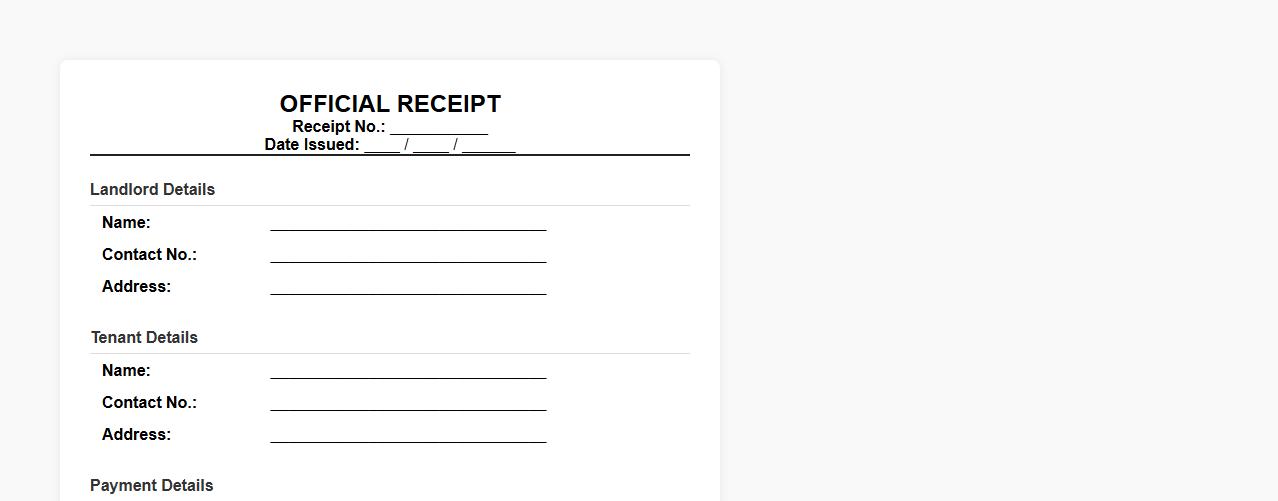

Official receipt sample for rental payments

An official receipt sample for rental payments provides a clear and professional record of transactions between landlords and tenants. It ensures transparency and serves as proof of payment for both parties. Utilizing a standardized template helps streamline the payment process and avoid disputes.

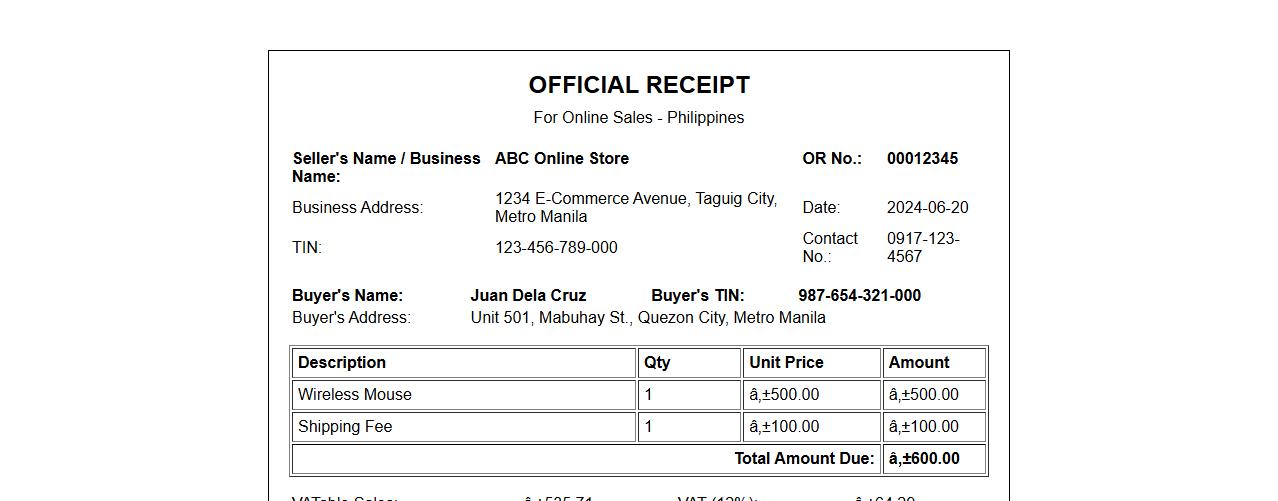

Official receipt sample for online sales Philippines

An official receipt sample for online sales in the Philippines is essential for documenting transactions and ensuring compliance with local tax regulations. This receipt typically includes details such as the seller's information, buyer's details, transaction amount, and tax identification number. Using a proper official receipt helps businesses maintain accurate records and provides proof of purchase for customers.

Printable official receipt sample PDF download

Download a printable official receipt sample PDF to ensure your transactions are properly documented. This template is designed for easy customization and professional presentation. Accessing this file simplifies record-keeping for businesses and individuals alike.

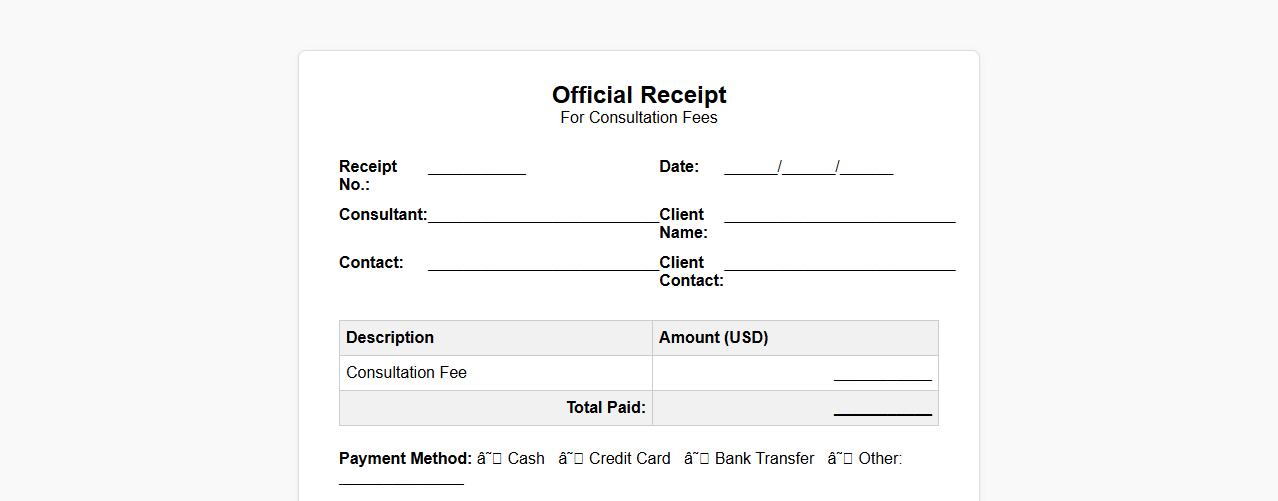

Official receipt sample for consultation fees

Download a professional official receipt sample for consultation fees to ensure accurate and compliant documentation. This template simplifies the process of recording payment details and client information effectively. Perfect for consultants seeking a clear and formal receipt format.

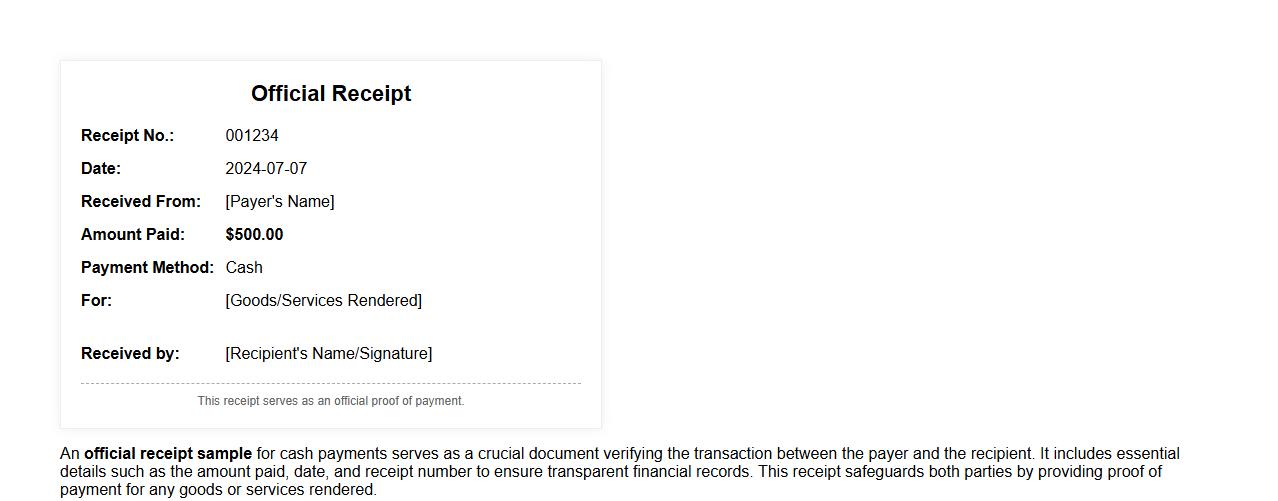

Official receipt sample for cash payments

An official receipt sample for cash payments serves as a crucial document verifying the transaction between the payer and the recipient. It includes essential details such as the amount paid, date, and receipt number to ensure transparent financial records. This receipt safeguards both parties by providing proof of payment for any goods or services rendered.

Customizable official receipt sample with company logo

Design your customizable official receipt with your company logo to enhance brand identity and professionalism. Easily personalize templates to match your business needs and ensure accurate record-keeping. Suitable for all types of transactions, these receipts streamline your payment process efficiently.

What legal elements must be present in an official receipt for tax compliance?

An official receipt must include the business name and tax identification number (TIN) to ensure proper tax documentation. It should also have the date of transaction and a detailed description of the goods or services rendered. Additionally, the receipt must display the amount received and the authorized signature of the issuer to validate the transaction legally.

How can digital signatures be validated on electronic official receipts?

Digital signatures on electronic official receipts are validated through public key infrastructure (PKI) which ensures authenticity and integrity. The recipient can verify the signature by checking the digital certificate issued by a trusted certificate authority (CA). This process confirms that the receipt has not been altered and the issuer is legitimate.

What are the standard retention periods for official receipt documents?

Official receipt documents generally have a mandatory retention period of 5 to 10 years depending on local tax laws. This period allows tax authorities to audit and verify compliance effectively. Businesses should securely store these documents to avoid penalties and facilitate future reference.

How is confidentiality ensured when issuing official receipts to clients?

Confidentiality is maintained by limiting access to official receipts to authorized personnel only through secure data storage systems. Digital receipts often use encryption to protect client information during transmission and storage. Implementing strict privacy policies and access controls helps prevent unauthorized disclosure.

What are the most common errors found in official receipt formatting?

Common errors in official receipt formatting include missing or incorrect tax identification numbers and incomplete transaction details. Another frequent mistake is the absence of an authorized signature or using an outdated template. Consistently reviewing and updating the receipt format ensures compliance and avoids confusion.