The Expense Receipt Form is a crucial document used to record and verify business expenses. It helps in maintaining accurate financial records by capturing details such as the date, amount, and purpose of each expense. Proper use of an Expense Receipt Form ensures smooth reimbursement processes and supports budget tracking.

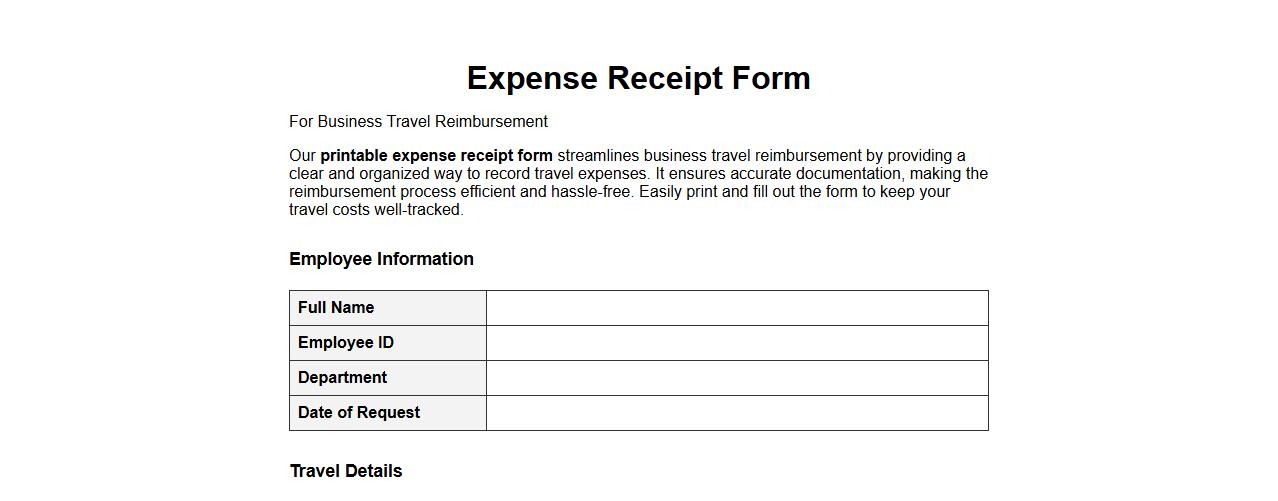

Printable expense receipt form for business travel reimbursement

Our printable expense receipt form streamlines business travel reimbursement by providing a clear and organized way to record travel expenses. It ensures accurate documentation, making the reimbursement process efficient and hassle-free. Easily print and fill out the form to keep your travel costs well-tracked.

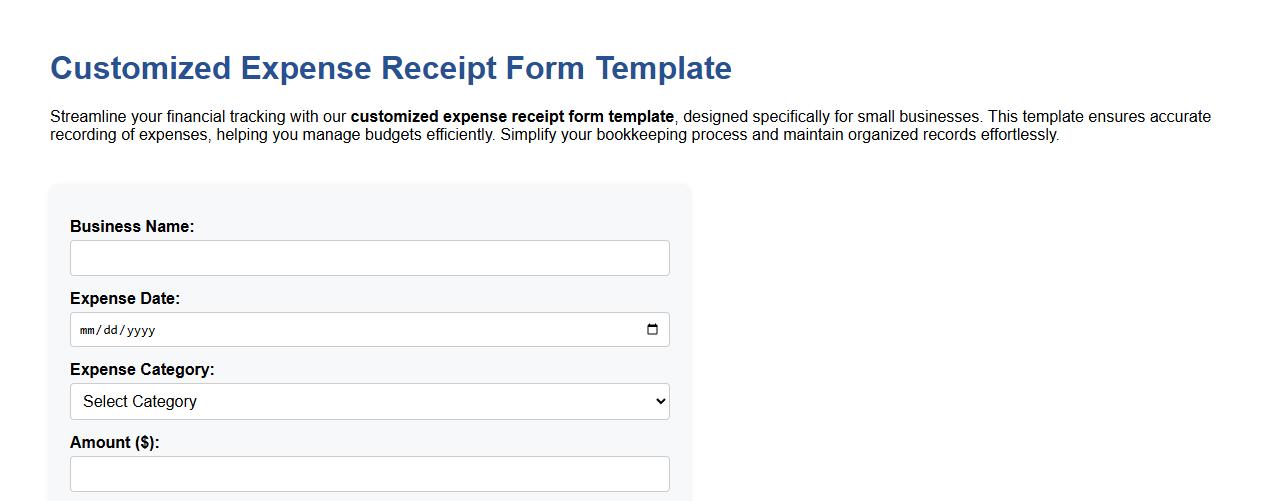

Customized expense receipt form template for small businesses

Streamline your financial tracking with our customized expense receipt form template, designed specifically for small businesses. This template ensures accurate recording of expenses, helping you manage budgets efficiently. Simplify your bookkeeping process and maintain organized records effortlessly.

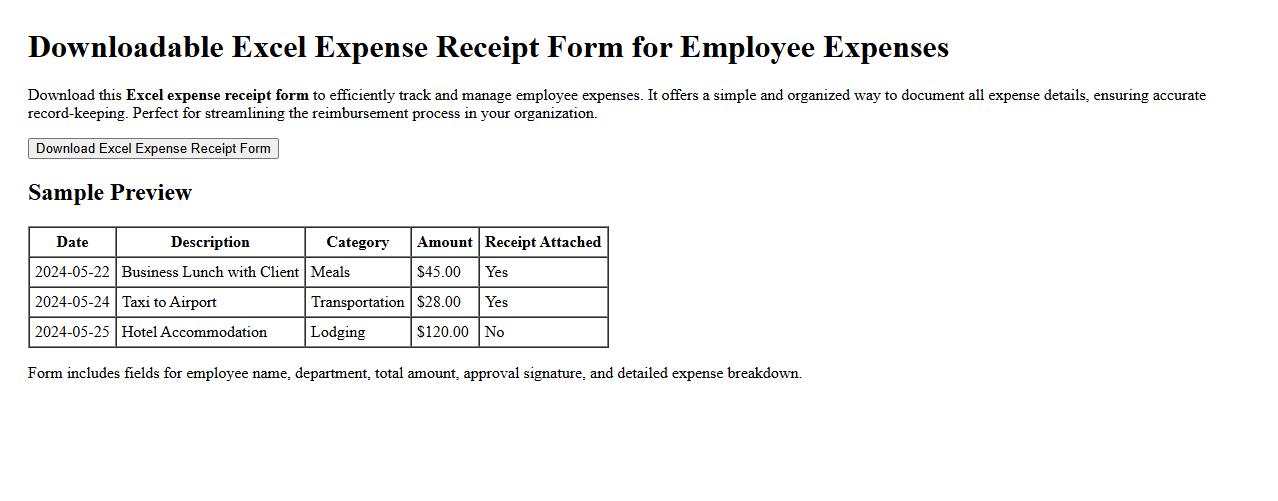

Downloadable excel expense receipt form for employee expenses

Download this Excel expense receipt form to efficiently track and manage employee expenses. It offers a simple and organized way to document all expense details, ensuring accurate record-keeping. Perfect for streamlining the reimbursement process in your organization.

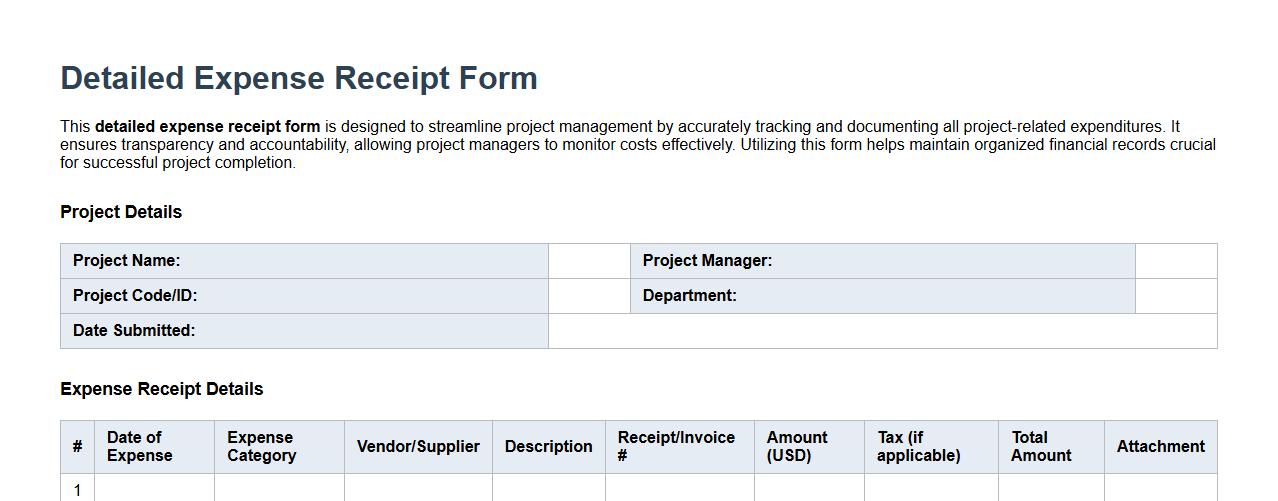

Detailed expense receipt form for project management

This detailed expense receipt form is designed to streamline project management by accurately tracking and documenting all project-related expenditures. It ensures transparency and accountability, allowing project managers to monitor costs effectively. Utilizing this form helps maintain organized financial records crucial for successful project completion.

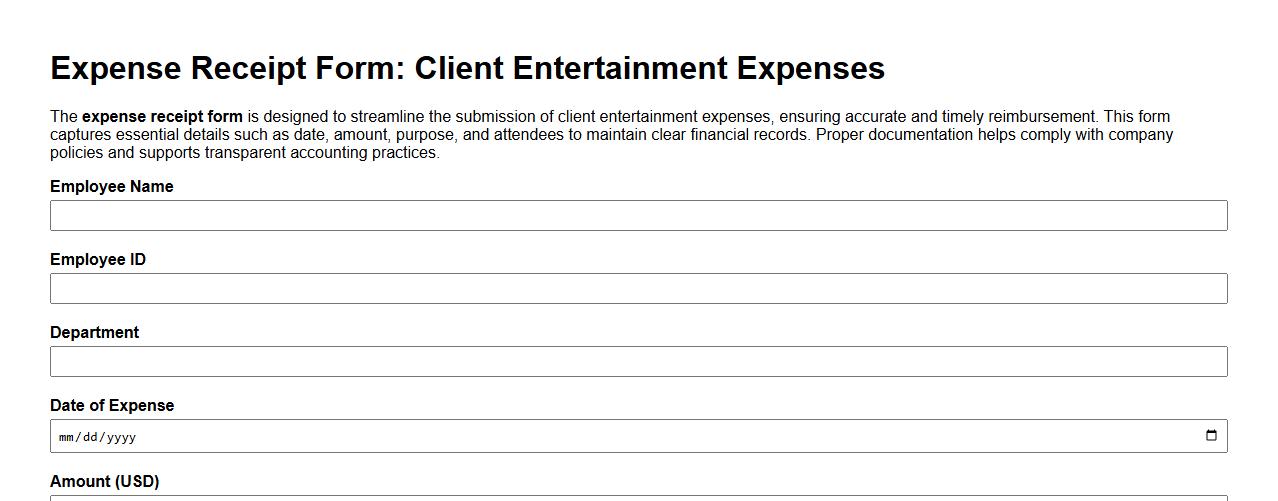

Expense receipt form for client entertainment expenses

The expense receipt form is designed to streamline the submission of client entertainment expenses, ensuring accurate and timely reimbursement. This form captures essential details such as date, amount, purpose, and attendees to maintain clear financial records. Proper documentation helps comply with company policies and supports transparent accounting practices.

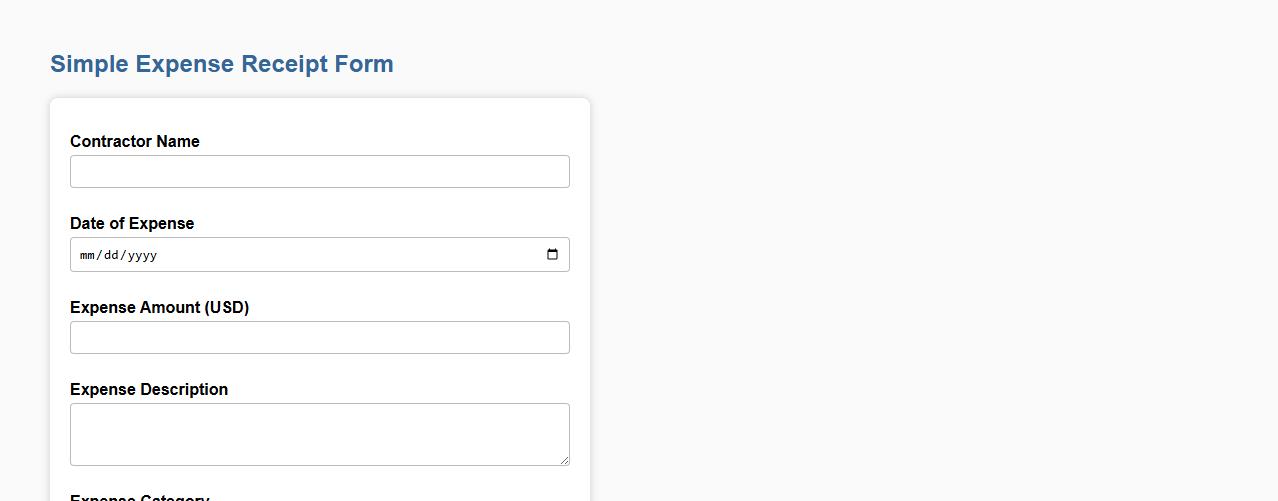

Simple expense receipt form for freelance contractors

This simple expense receipt form is designed specifically for freelance contractors to easily document and submit their business expenses. It streamlines the process of tracking costs, ensuring accurate reimbursement and financial management. The form is user-friendly and includes essential fields for date, amount, and expense description.

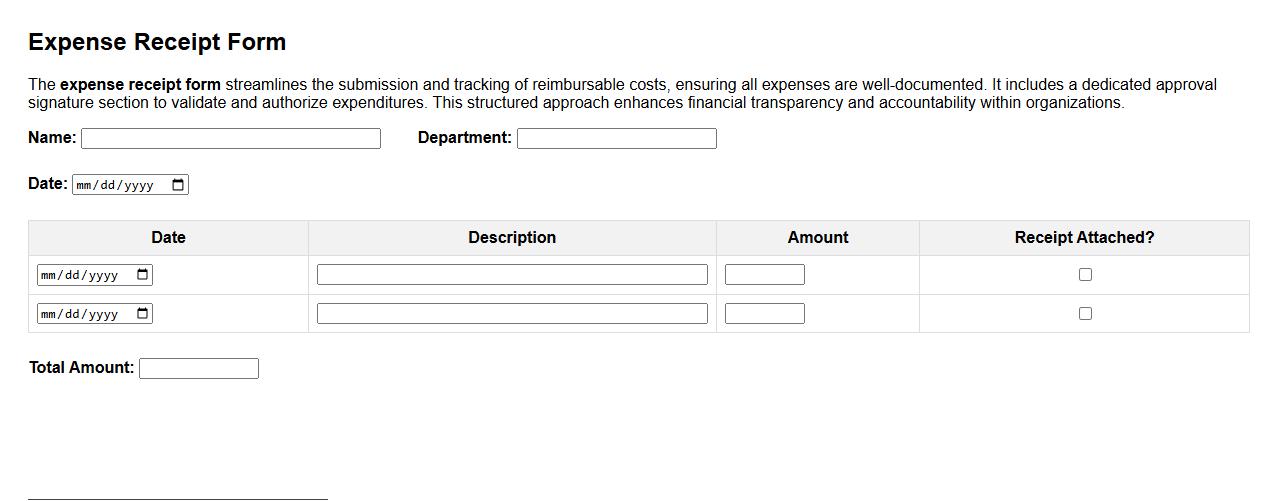

Expense receipt form with approval signature section

The expense receipt form streamlines the submission and tracking of reimbursable costs, ensuring all expenses are well-documented. It includes a dedicated approval signature section to validate and authorize expenditures. This structured approach enhances financial transparency and accountability within organizations.

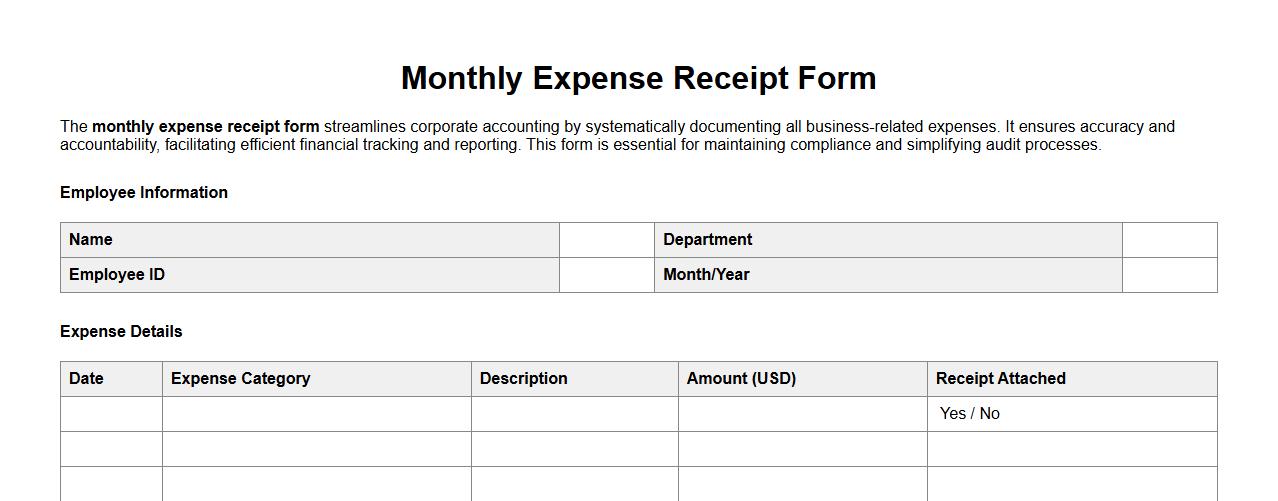

Monthly expense receipt form for corporate accounting

The monthly expense receipt form streamlines corporate accounting by systematically documenting all business-related expenses. It ensures accuracy and accountability, facilitating efficient financial tracking and reporting. This form is essential for maintaining compliance and simplifying audit processes.

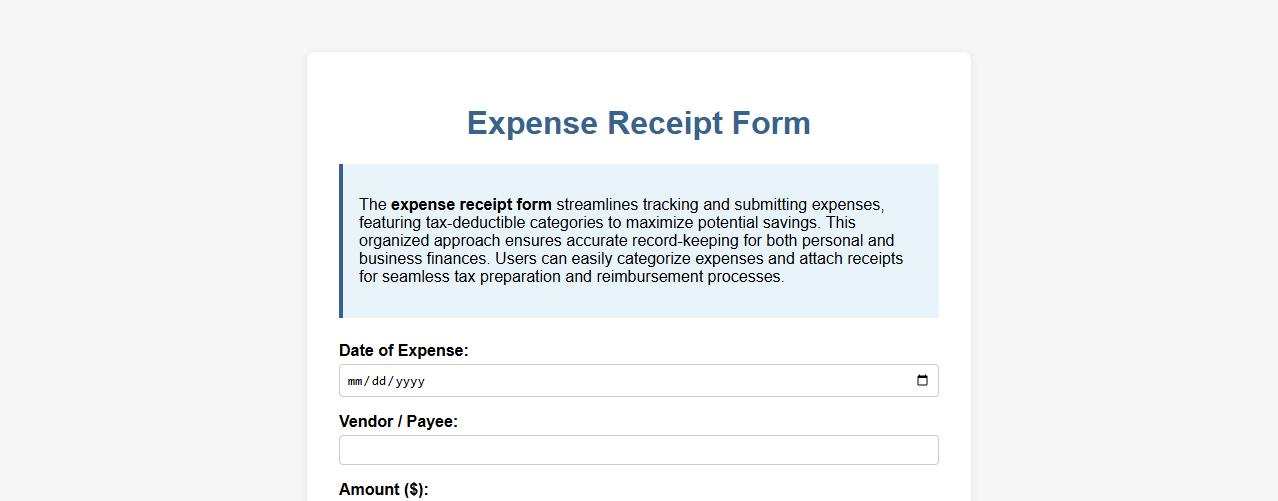

Expense receipt form with tax-deductible expense categories

The expense receipt form streamlines tracking and submitting expenses, featuring tax-deductible categories to maximize potential savings. This organized approach ensures accurate record-keeping for both personal and business finances. Users can easily categorize expenses and attach receipts for seamless tax preparation and reimbursement processes.

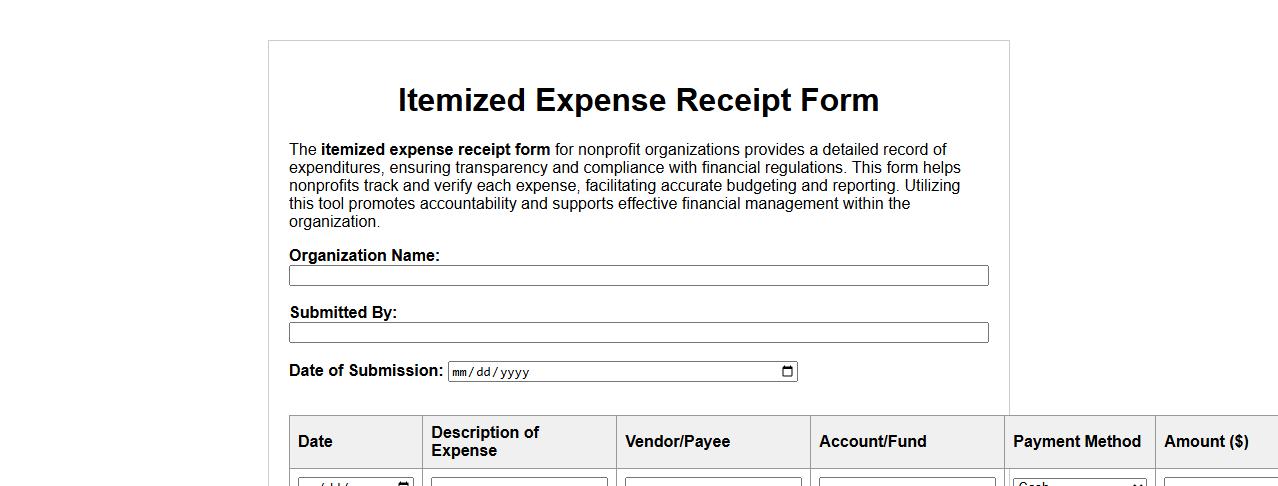

Itemized expense receipt form for nonprofit organizations

The itemized expense receipt form for nonprofit organizations provides a detailed record of expenditures, ensuring transparency and compliance with financial regulations. This form helps nonprofits track and verify each expense, facilitating accurate budgeting and reporting. Utilizing this tool promotes accountability and supports effective financial management within the organization.

What key details are mandatory on an expense receipt form for audit compliance?

An expense receipt form must include the date of the transaction, the vendor's name, and the total amount spent to ensure audit compliance. It should also specify the purpose of the expense and include the employee's name or ID for proper tracking. Finally, authorized signatures or approval marks are crucial for validating the expense.

How can expense receipt forms be digitized for remote approval workflows?

Expense receipt forms can be digitized by using scanning tools or mobile apps that capture receipts in real-time. Integrating these digital forms with cloud-based approval platforms allows for seamless remote review and authorization. Automated notifications and audit trails further streamline compliance and accountability.

What common errors are found on manual expense receipt submissions?

Manual expense receipt submissions frequently contain illegible handwriting and missing critical details like dates or amounts, which hinder processing. Duplicate submissions and improperly categorized expenses also cause reconciliation errors. Additionally, missing receipts or signatures often result in non-compliance during audits.

How do multi-currency expenses get recorded on standard receipt forms?

Multi-currency expenses require showing the original currency amount alongside the converted local currency value based on the exchange rate at the purchase date. The receipt form should specify the exchange rate used and date for transparency. This dual-recording facilitates accurate bookkeeping and audit verification.

What data privacy concerns exist when storing expense receipts electronically?

Storing expense receipts electronically introduces risks of unauthorized access to sensitive financial and personal information. There is also concern over data breaches and improper data retention periods that violate privacy regulations. Implementing strong encryption and access controls is essential to mitigate these risks.