An Invoice Receipt serves as proof of payment and details the goods or services purchased, including quantities, prices, and payment terms. It helps both buyers and sellers maintain accurate financial records and ensures transparency in transactions. Businesses often use Invoice Receipts for accounting, tax reporting, and inventory management.

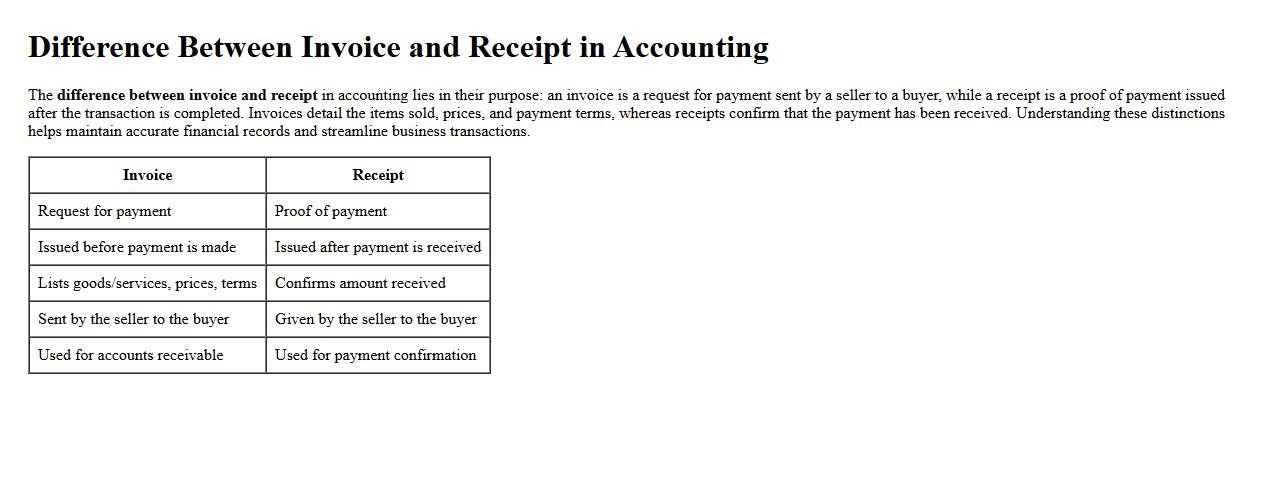

Difference between invoice and receipt in accounting

The difference between invoice and receipt in accounting lies in their purpose: an invoice is a request for payment sent by a seller to a buyer, while a receipt is a proof of payment issued after the transaction is completed. Invoices detail the items sold, prices, and payment terms, whereas receipts confirm that the payment has been received. Understanding these distinctions helps maintain accurate financial records and streamline business transactions.

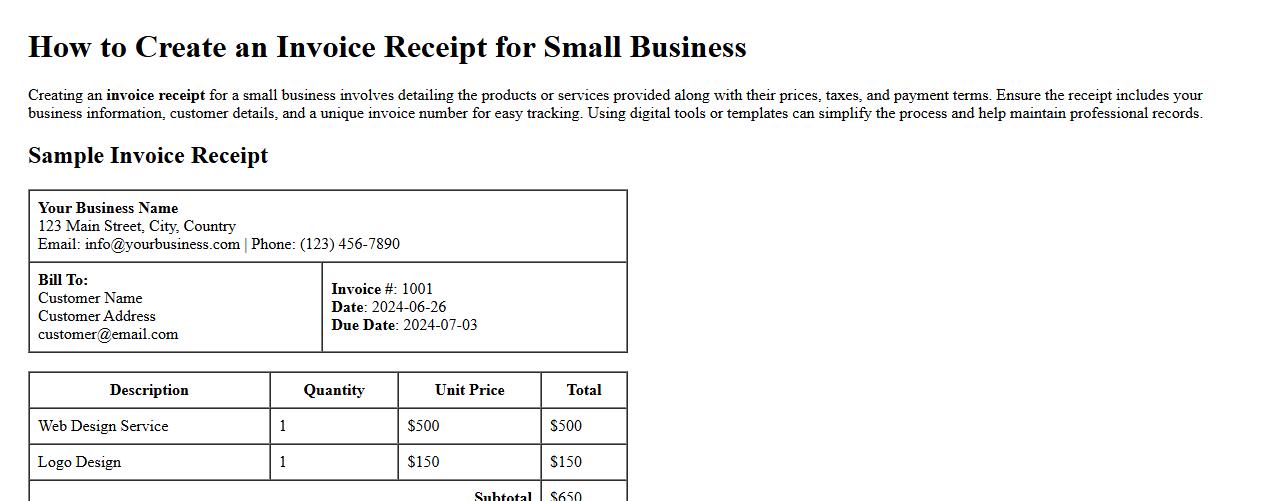

How to create an invoice receipt for small business

Creating an invoice receipt for a small business involves detailing the products or services provided along with their prices, taxes, and payment terms. Ensure the receipt includes your business information, customer details, and a unique invoice number for easy tracking. Using digital tools or templates can simplify the process and help maintain professional records.

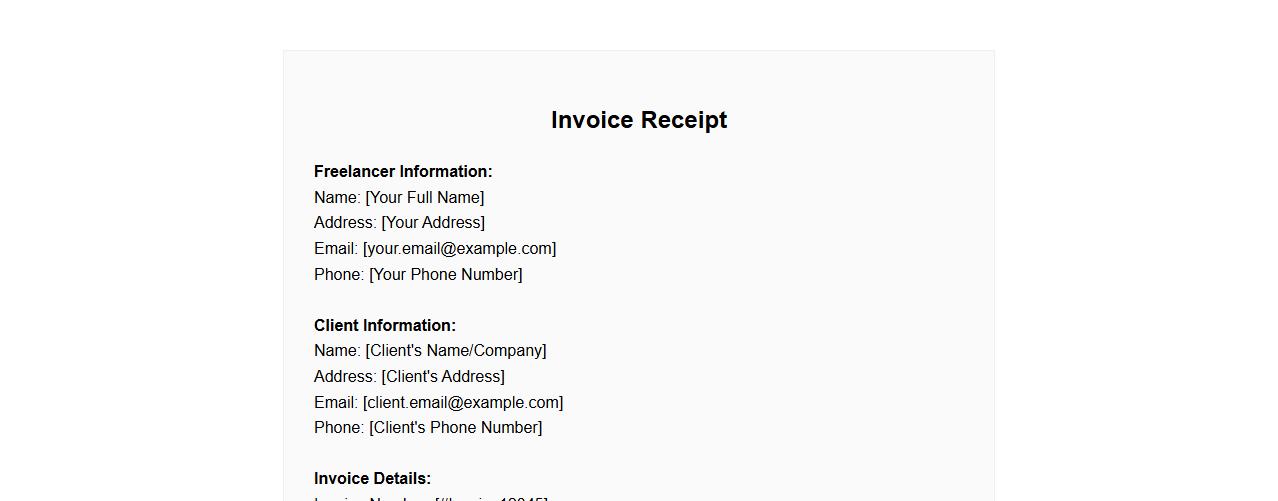

Sample format of invoice receipt for freelancers

A sample format of invoice receipt for freelancers helps streamline payment tracking by clearly outlining services rendered, payment terms, and client details. This format ensures professionalism and accuracy in documenting transactions, making financial management efficient. Utilizing a standardized template simplifies the invoicing process and supports timely payments.

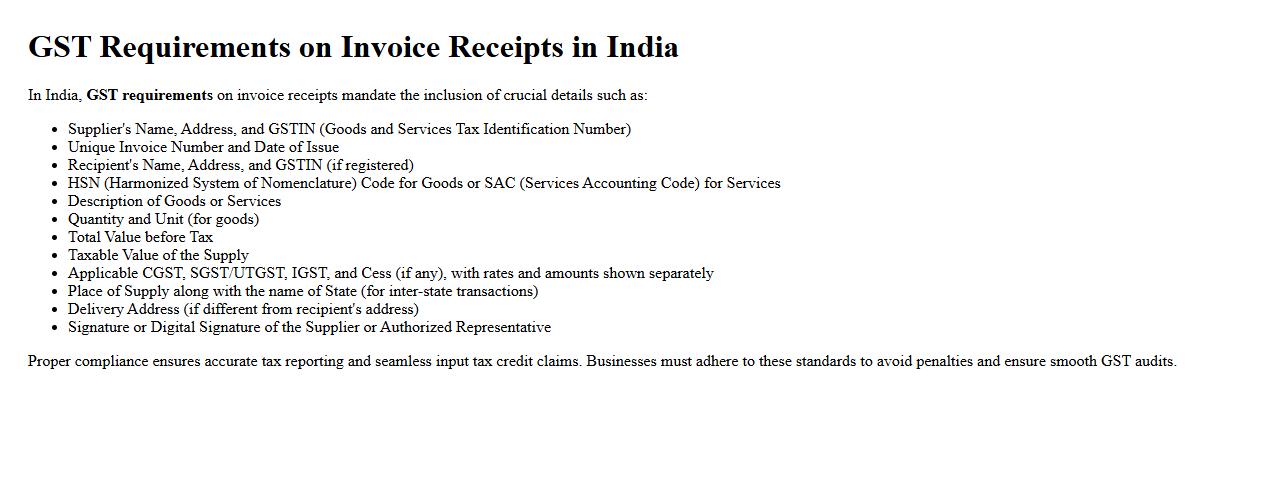

GST requirements on invoice receipts in India

In India, GST requirements on invoice receipts mandate the inclusion of crucial details such as the supplier's GSTIN, invoice number, date, and tax rates applicable. Proper compliance ensures accurate tax reporting and seamless input tax credit claims. Businesses must adhere to these standards to avoid penalties and ensure smooth GST audits.

Digital invoice receipt solutions for e-commerce

Our digital invoice receipt solutions for e-commerce streamline the payment process by providing automated, secure, and customizable receipts. These solutions enhance customer experience and improve financial record-keeping. Easily integrate with your online store to reduce errors and boost efficiency.

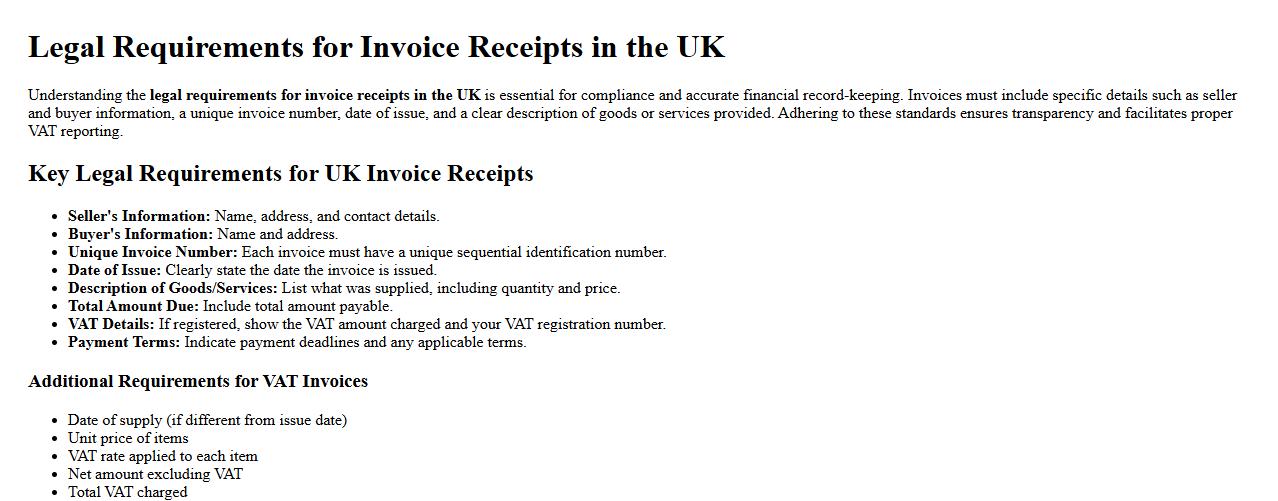

Legal requirements for invoice receipts in UK

Understanding the legal requirements for invoice receipts in the UK is essential for compliance and accurate financial record-keeping. Invoices must include specific details such as seller and buyer information, a unique invoice number, date of issue, and a clear description of goods or services provided. Adhering to these standards ensures transparency and facilitates proper VAT reporting.

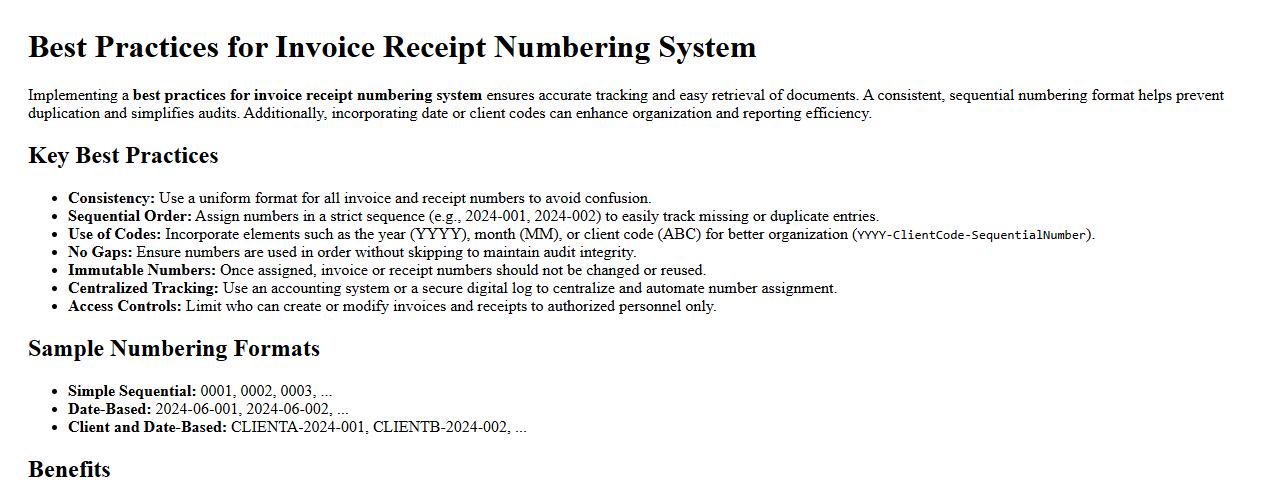

Best practices for invoice receipt numbering system

Implementing a best practices for invoice receipt numbering system ensures accurate tracking and easy retrieval of documents. A consistent, sequential numbering format helps prevent duplication and simplifies audits. Additionally, incorporating date or client codes can enhance organization and reporting efficiency.

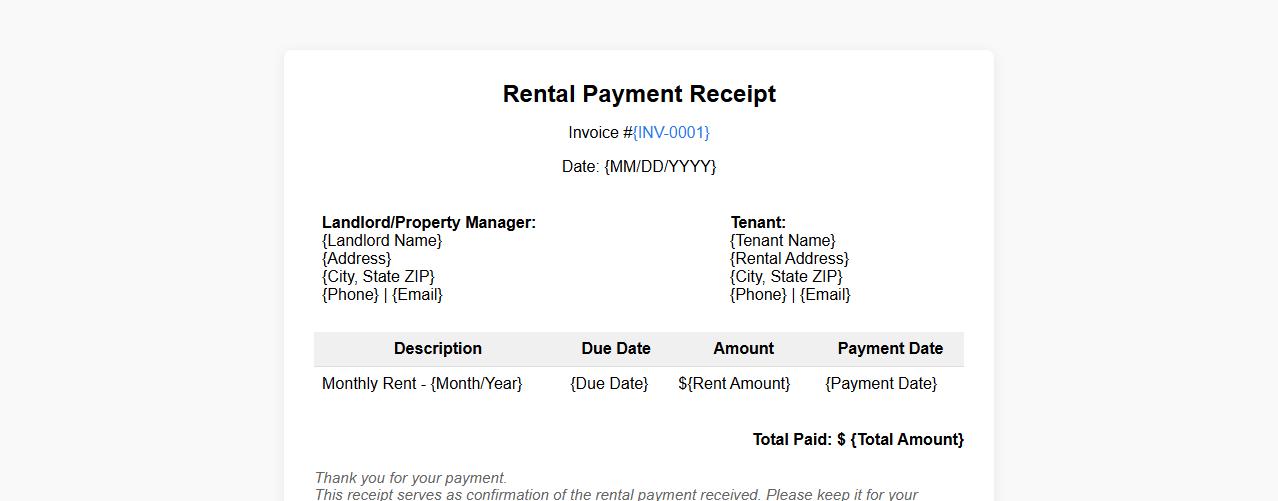

Invoice receipt template for rental payment

Our invoice receipt template for rental payment simplifies tracking rent transactions with a clear, professional design. It includes essential details such as tenant information, payment amount, and due dates to ensure accurate record-keeping. This template is perfect for landlords and property managers seeking an efficient way to document rental payments.

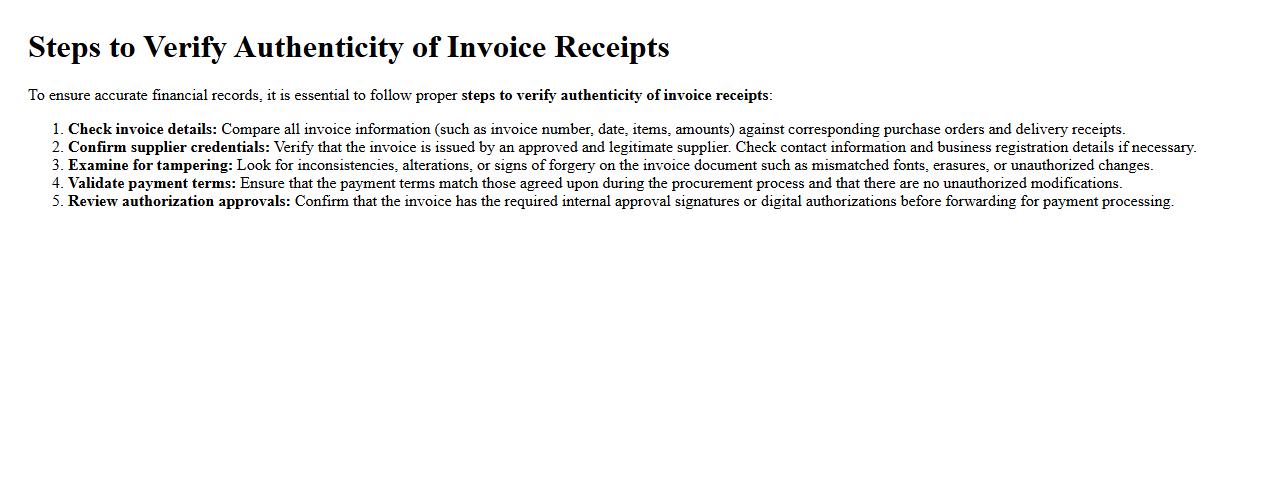

Steps to verify authenticity of invoice receipts

To ensure accurate financial records, it is essential to follow proper steps to verify authenticity of invoice receipts. Begin by checking the invoice details against purchase orders and delivery receipts, then confirm the supplier's credentials and examine the document for any signs of tampering. Finally, validate the payment terms and authorization approvals before processing the invoice.

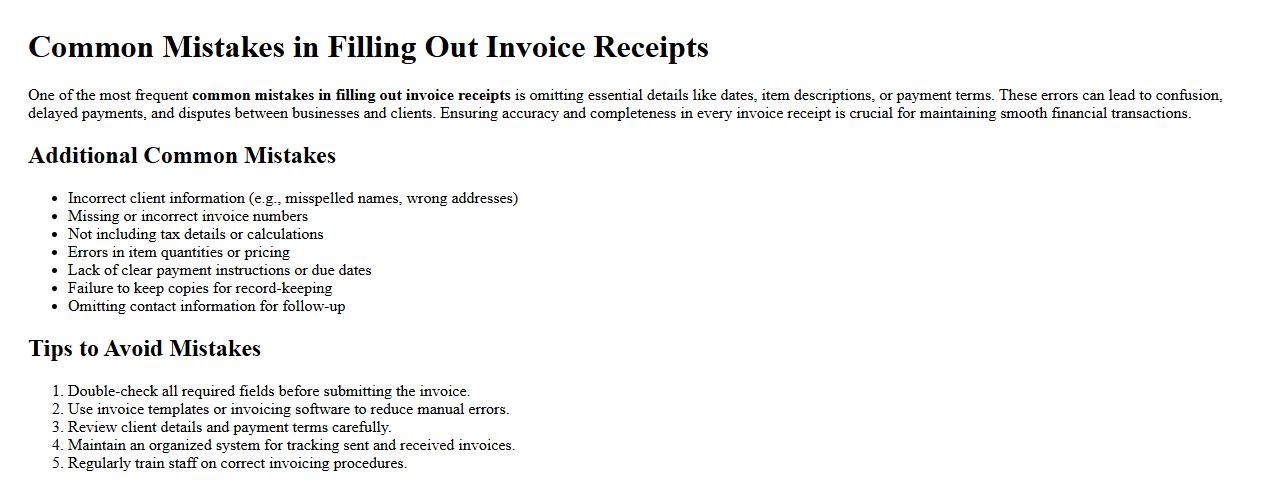

Common mistakes in filling out invoice receipts

One of the most frequent common mistakes in filling out invoice receipts is omitting essential details like dates, item descriptions, or payment terms. These errors can lead to confusion, delayed payments, and disputes between businesses and clients. Ensuring accuracy and completeness in every invoice receipt is crucial for maintaining smooth financial transactions.

What are the key differences between an invoice and a receipt for tax purposes?

An invoice is a document issued before payment, detailing goods or services provided, and the amount owed. A receipt confirms that payment has been received and serves as proof of the transaction. For tax purposes, invoices are used to claim deductions or credits, while receipts validate actual payment.

How should digital invoice receipts be securely stored for audits?

Digital invoice receipts must be stored in a secure, encrypted format to ensure data integrity and confidentiality. Employing cloud-based solutions with regular backups helps in protecting against data loss and unauthorized access. Additionally, implementing strict access controls and audit trails is critical for compliance during audits.

What essential metadata should be included in an invoice receipt for compliance?

Essential metadata includes invoice number, date of issuance, supplier and buyer details, tax identification numbers, and payment status. Including the breakdown of taxes applied and the total amount paid is also crucial. This metadata ensures full compliance with tax regulations and facilitates easy auditing.

How can invoice receipts be automatically validated using OCR technology?

OCR technology extracts textual information from invoice receipts and converts it into machine-readable data. Automated systems can then verify this data against purchase orders or payment records to ensure accuracy. This process reduces manual errors and speeds up the validation workflow for accounting.

What legal requirements govern electronic invoice receipts in cross-border transactions?

Electronic invoice receipts in cross-border transactions must comply with international tax laws and digital signature regulations. They often require adherence to standards such as eIDAS in the EU or IRS guidelines in the US for authenticity and integrity. Ensuring interoperability and acceptance across jurisdictions is vital to legal compliance.