A Simple Receipt Template provides a clear and organized format for recording sales transactions, including essential details such as item descriptions, quantities, prices, and totals. It streamlines the process of issuing receipts, making it easy for both businesses and customers to track purchases and payments. Designed for ease of use, this template ensures accuracy and professionalism in every transaction.

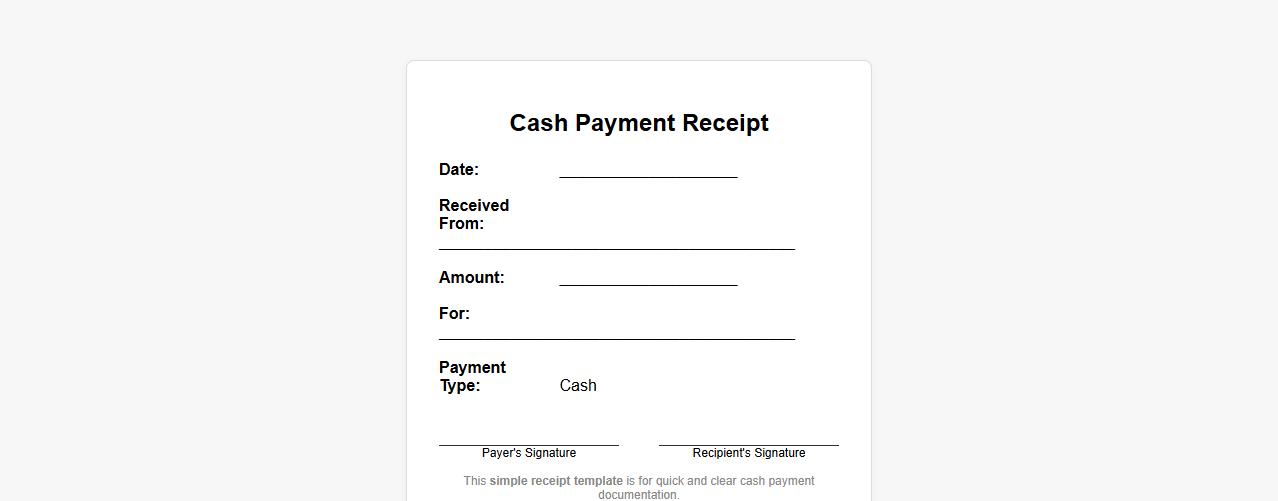

Simple receipt template for cash payment

This simple receipt template is designed for quick and clear cash payment documentation. It includes essential fields such as date, amount, and payer information for easy tracking. The straightforward layout ensures efficient transaction recording and verification.

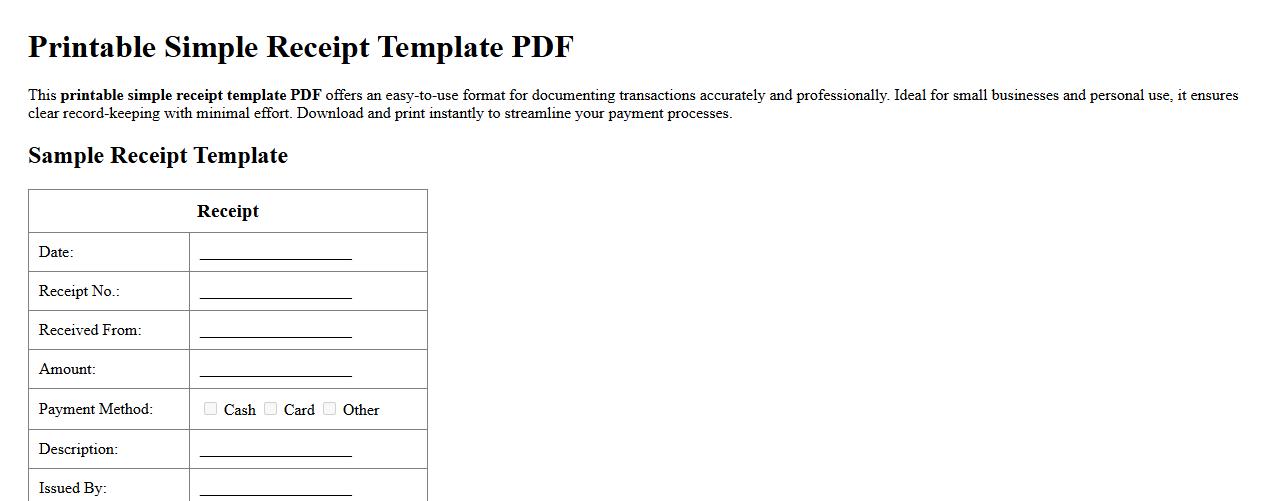

Printable simple receipt template PDF

This printable simple receipt template PDF offers an easy-to-use format for documenting transactions accurately and professionally. Ideal for small businesses and personal use, it ensures clear record-keeping with minimal effort. Download and print instantly to streamline your payment processes.

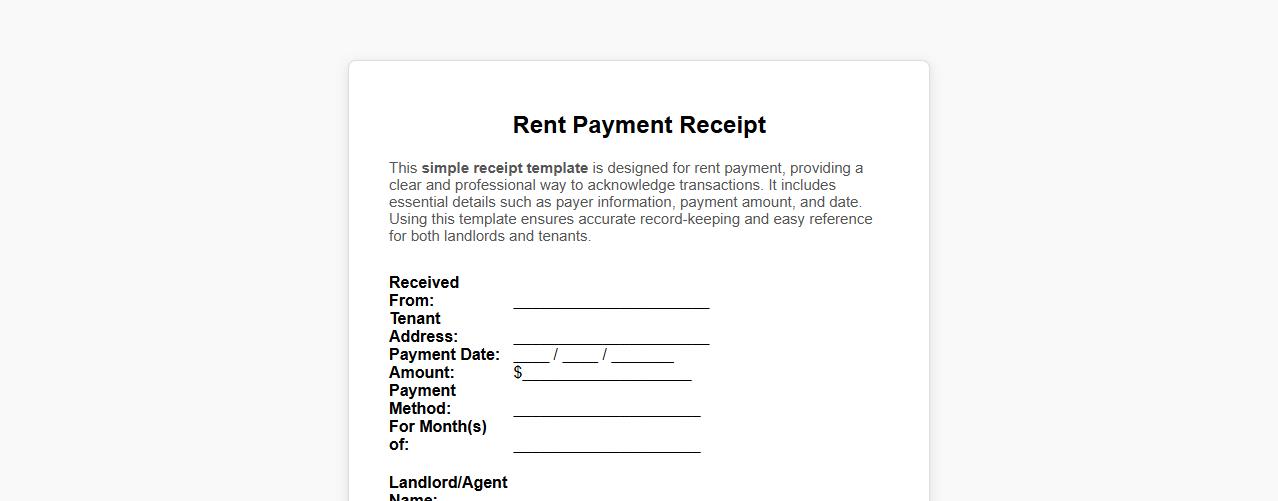

Simple receipt template for rent payment

This simple receipt template is designed for rent payment, providing a clear and professional way to acknowledge transactions. It includes essential details such as payer information, payment amount, and date. Using this template ensures accurate record-keeping and easy reference for both landlords and tenants.

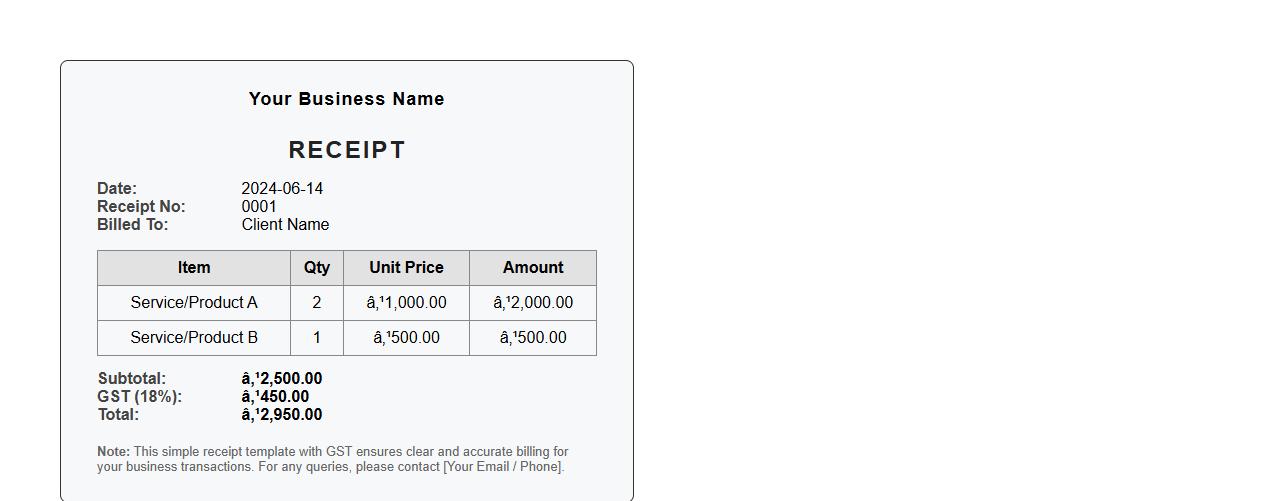

Simple receipt template with GST

This simple receipt template with GST ensures clear and accurate billing for your business transactions. It includes essential fields like item details, GST amount, and total cost, making tax calculation straightforward. Ideal for small businesses aiming for professional and compliant receipts.

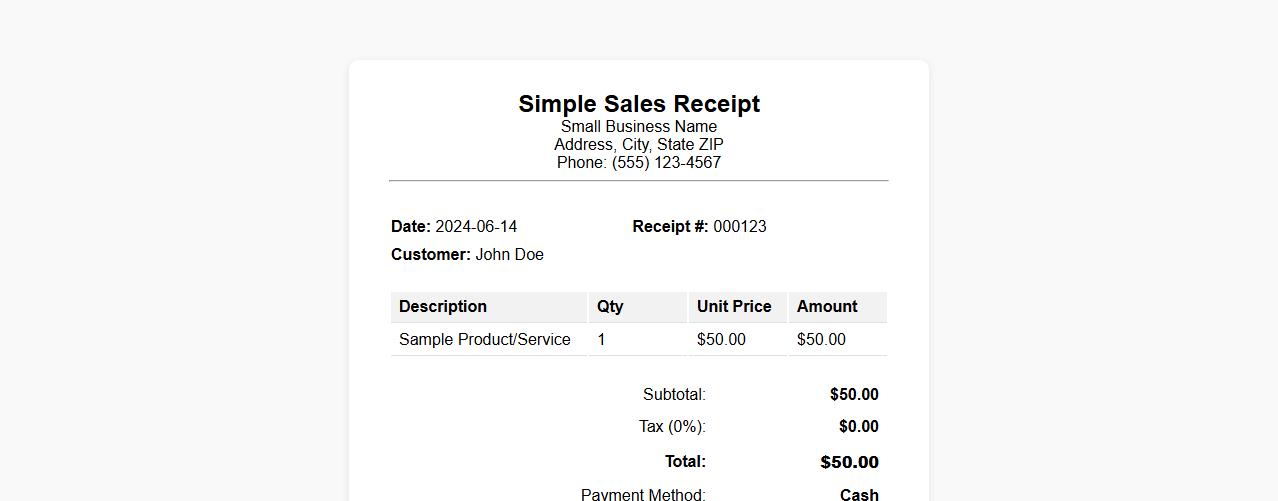

Simple sales receipt template for small business

This simple sales receipt template is designed specifically for small businesses, providing a clean and professional layout that's easy to customize. It efficiently captures all essential sales details, ensuring accurate transaction records. Ideal for retailers and service providers seeking a straightforward, printable receipt format.

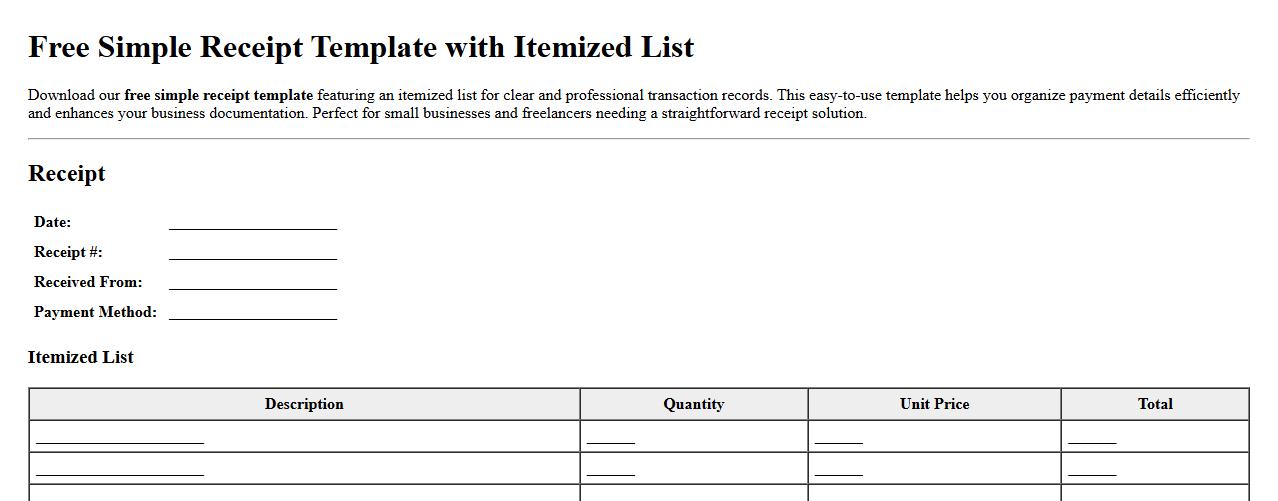

Free simple receipt template with itemized list

Download our free simple receipt template featuring an itemized list for clear and professional transaction records. This easy-to-use template helps you organize payment details efficiently and enhances your business documentation. Perfect for small businesses and freelancers needing a straightforward receipt solution.

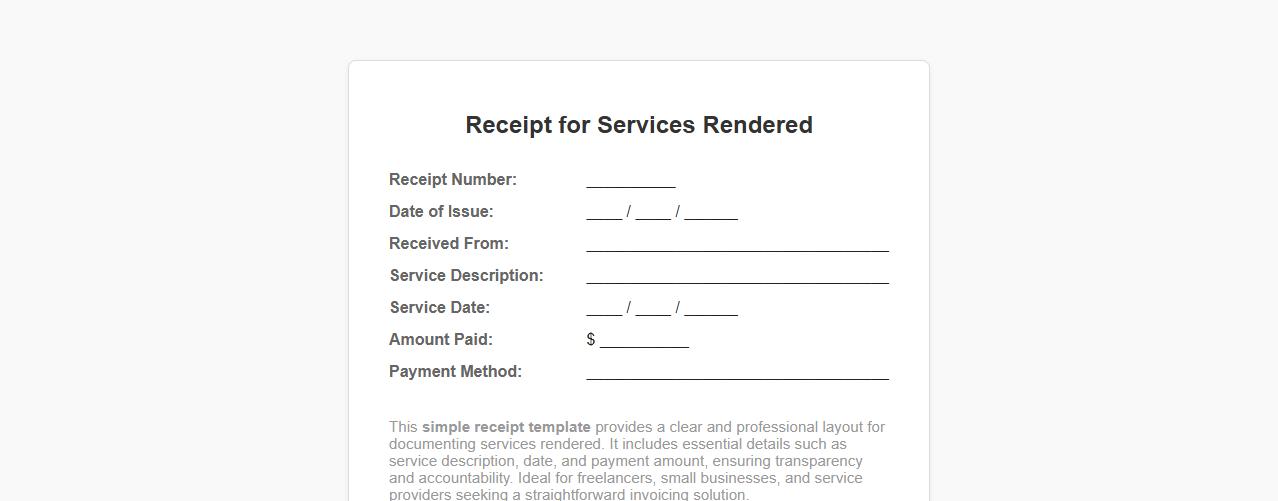

Simple receipt template for services rendered

This simple receipt template provides a clear and professional layout for documenting services rendered. It includes essential details such as service description, date, and payment amount, ensuring transparency and accountability. Ideal for freelancers, small businesses, and service providers seeking a straightforward invoicing solution.

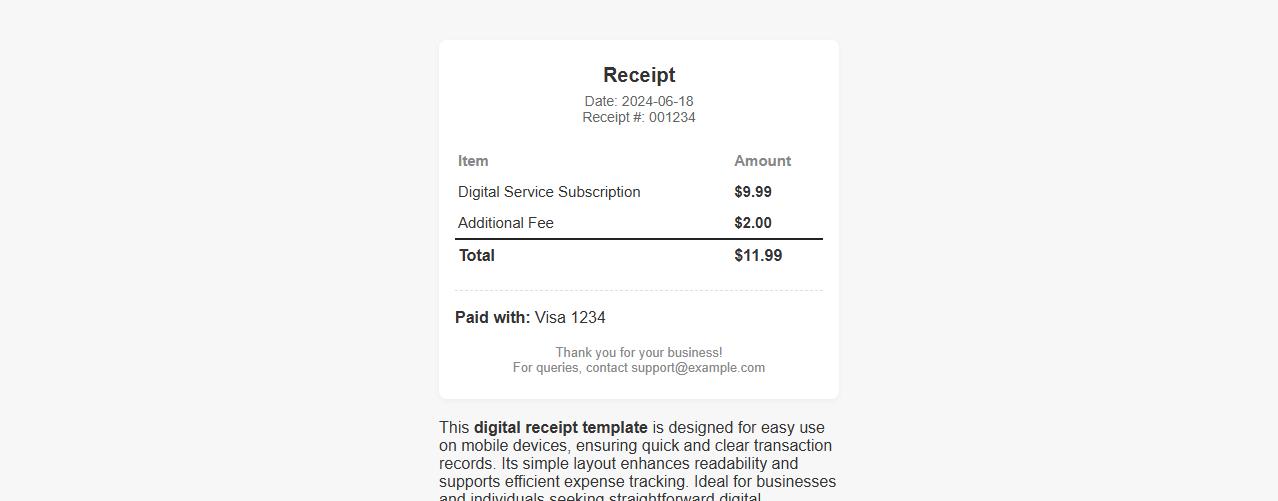

Simple digital receipt template for mobile

This digital receipt template is designed for easy use on mobile devices, ensuring quick and clear transaction records. Its simple layout enhances readability and supports efficient expense tracking. Ideal for businesses and individuals seeking straightforward digital documentation.

Simple handwritten receipt template for personal use

This handwritten receipt template offers a simple and personal way to document transactions. Designed for ease of use, it helps individuals keep accurate records without hassle. Perfect for personal use, it combines clarity with a classic handwritten style.

What essential elements must be included in a simple receipt document?

A simple receipt must include the date of the transaction, the names of both the buyer and seller, and a detailed description of the goods or services provided. It should also clearly state the amount paid, including any taxes or fees, and the method of payment. Including a unique receipt number helps in organizing and tracking transactions effectively.

How can you authenticate a handwritten simple receipt for tax purposes?

To authenticate a handwritten receipt, ensure it contains the signature of the issuer alongside the transaction details. Additionally, corroborate the receipt with supporting documents like invoices or bank statements that confirm the payment. Maintaining a consistent format and providing dated signatures enhances the validity of the receipt for tax records.

What legal implications arise from missing signatures on a simple receipt?

Missing signatures on a receipt can lead to challenges in proving the legitimacy of a transaction in legal disputes. Without a signature, the receipt may be considered invalid or non-binding as evidence of payment. This omission can complicate tax audits and reduce credibility in contractual matters.

How should payment methods be recorded in a basic receipt?

Payment methods should be clearly specified using terms like cash, credit card, bank transfer, or check, depending on the mode used. It is important to include details such as transaction reference numbers or card authorization codes where applicable. This clarity ensures transparent financial records and simplifies reconciliation processes.

What digital tools best streamline simple receipt creation and storage?

Digital tools like QuickBooks, Expensify, and Receipt Bank efficiently automate the creation and storage of simple receipts. These platforms offer features such as template customization, easy data entry, and cloud-based access for secure storage. Utilizing such tools enhances accuracy, accessibility, and compliance in managing financial documentation.