A Sales Receipt Form Sample serves as a detailed document used by businesses to record transactions between seller and buyer. It outlines essential details such as item descriptions, quantities, prices, and payment methods to ensure transparent and accurate financial records. This form is essential for inventory management, tax purposes, and customer service.

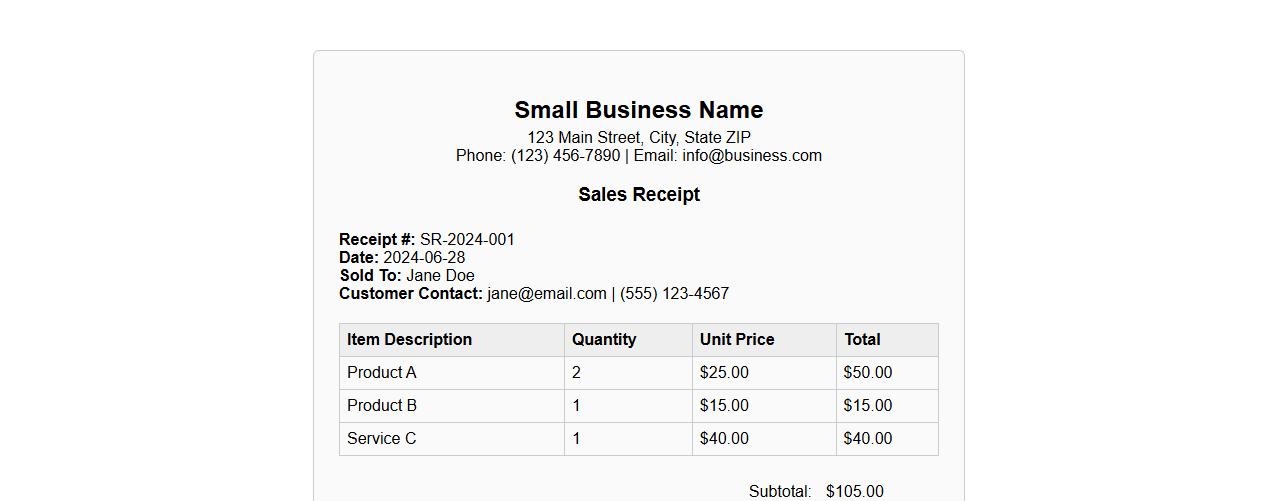

Sales receipt form sample for small business

Discover a practical sales receipt form sample designed specifically for small businesses to streamline transaction records. This template ensures clear documentation of sales, helping maintain accurate financial tracking and customer communication. Easily customizable, it supports smooth business operations and accountability.

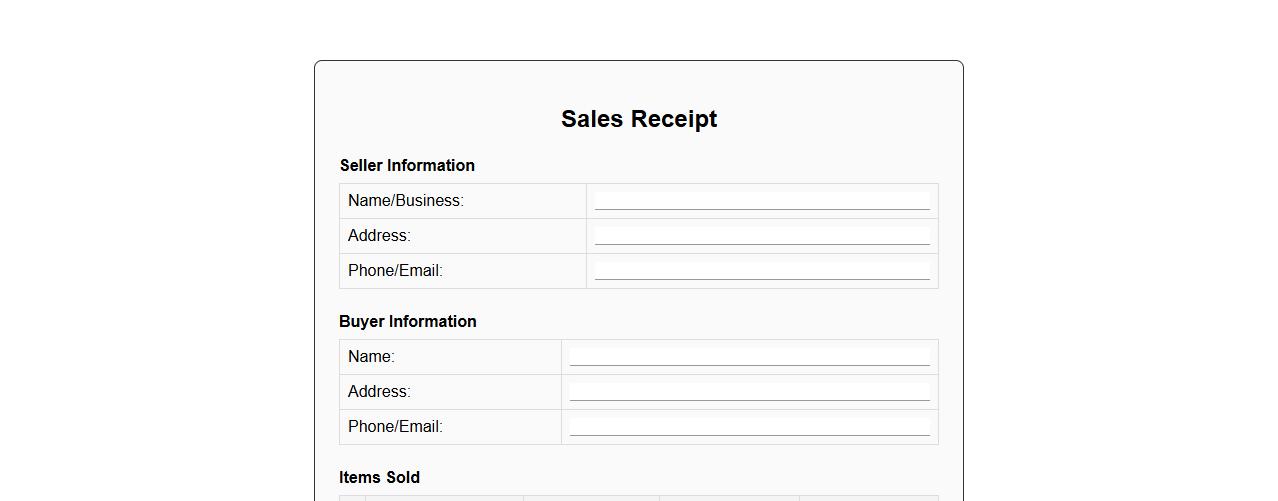

Printable sales receipt form sample template

This printable sales receipt form sample template provides a clear and professional layout to document transactions efficiently. It includes key sections for buyer and seller details, item descriptions, prices, and payment methods. Easily customizable, it ensures accurate record-keeping for businesses and customers alike.

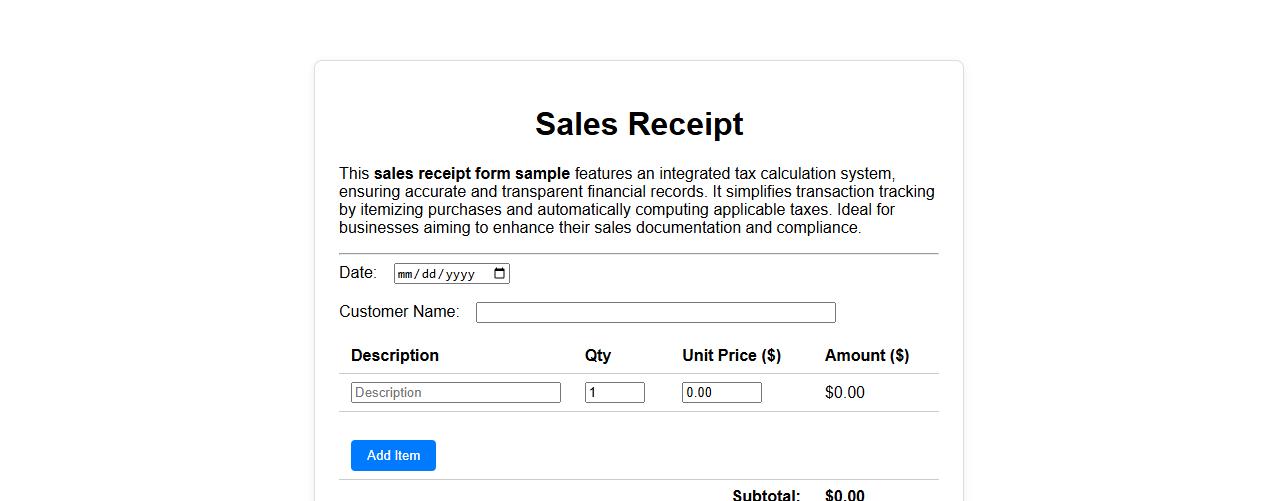

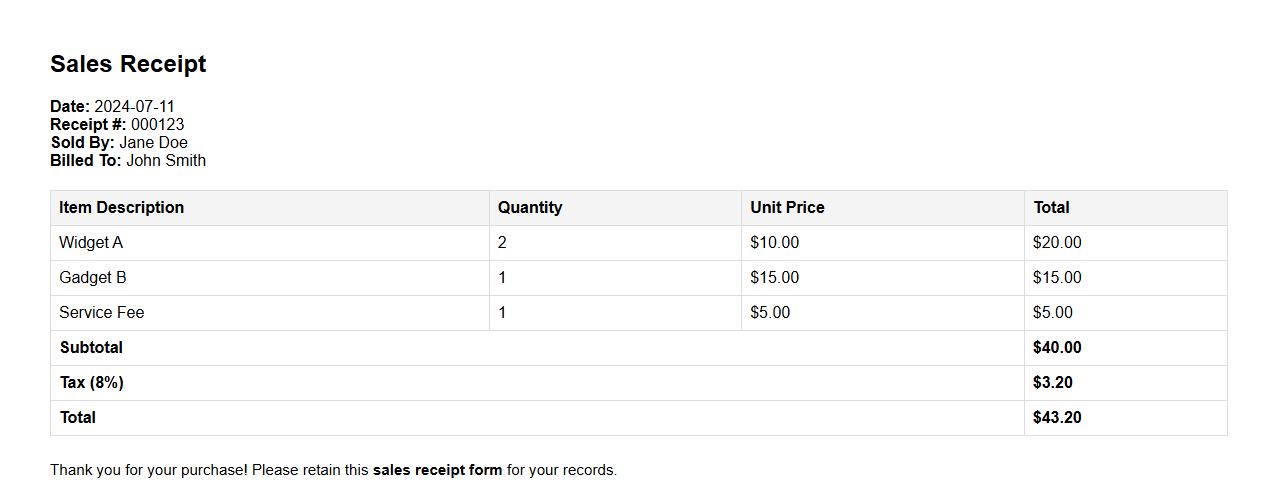

Sales receipt form sample with tax calculation

This sales receipt form sample features an integrated tax calculation system, ensuring accurate and transparent financial records. It simplifies transaction tracking by itemizing purchases and automatically computing applicable taxes. Ideal for businesses aiming to enhance their sales documentation and compliance.

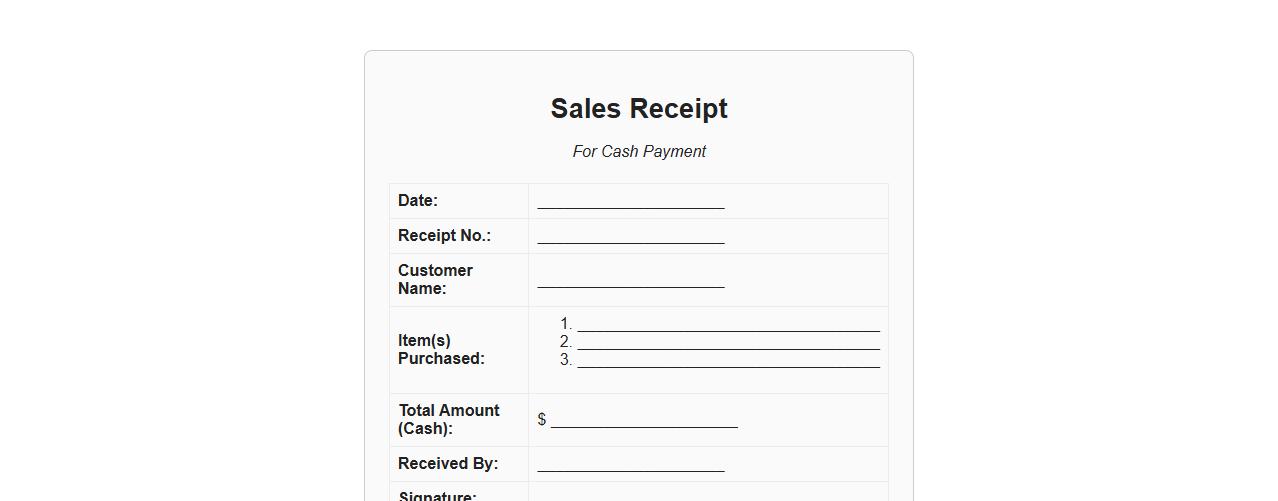

Sales receipt form sample for cash payment

This sales receipt form sample for cash payment provides a clear and concise way to document transactions. It includes essential details such as the item purchased, payment amount, and date, ensuring accurate record-keeping. This form is ideal for small businesses and retail environments to confirm cash sales securely.

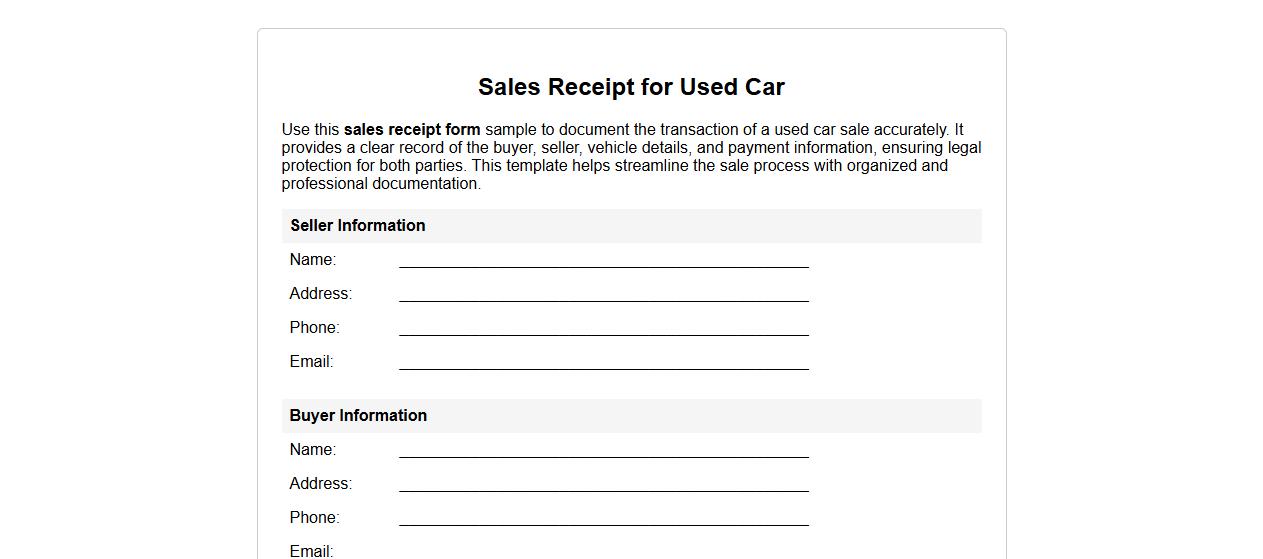

Sales receipt form sample for used car sale

Use this sales receipt form sample to document the transaction of a used car sale accurately. It provides a clear record of the buyer, seller, vehicle details, and payment information, ensuring legal protection for both parties. This template helps streamline the sale process with organized and professional documentation.

Sales receipt form sample with itemized list

This sales receipt form sample provides a clear, itemized list detailing each purchased product or service. It ensures accurate record-keeping, helping both sellers and buyers verify transactions efficiently. Use this template to streamline sales processing and enhance customer transparency.

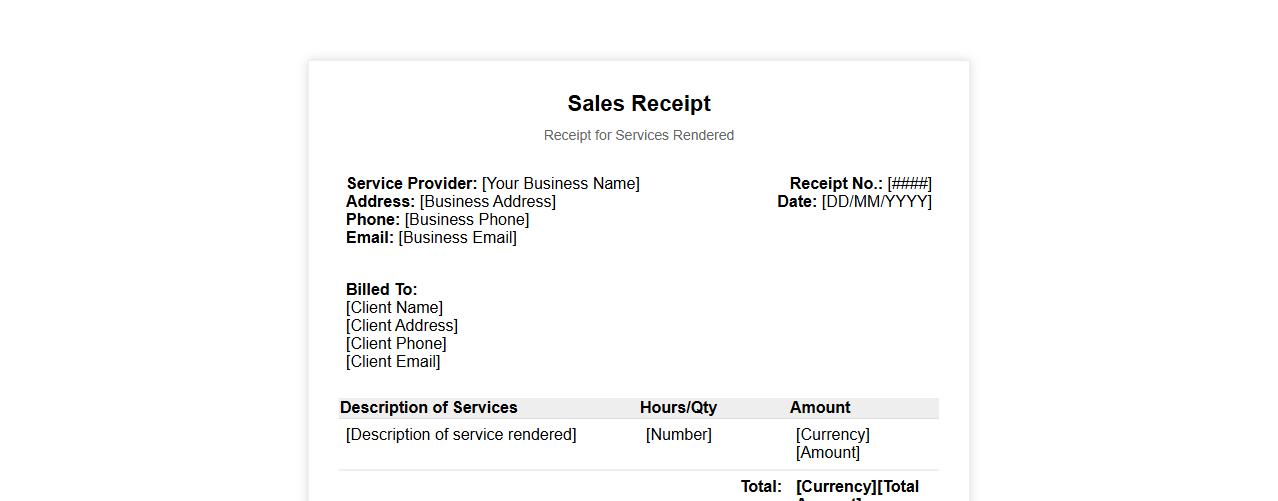

Sales receipt form sample for services rendered

A sales receipt form for services rendered provides a clear record of the transaction between a service provider and their client. It details the services performed, payment amount, and date, ensuring transparency and accountability. This document is essential for both business and client for accurate financial tracking.

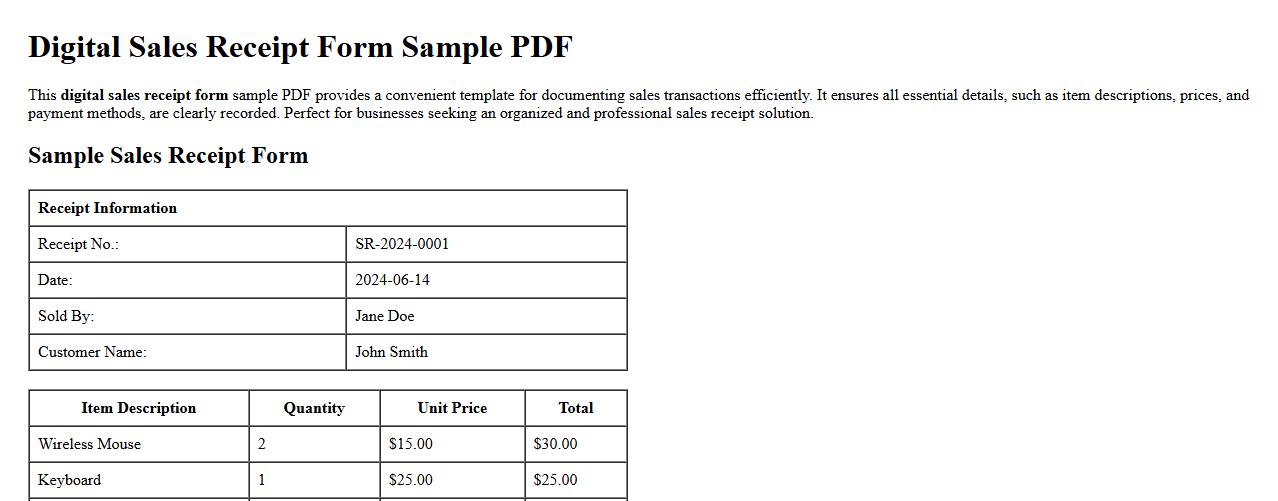

Digital sales receipt form sample PDF

This digital sales receipt form sample PDF provides a convenient template for documenting sales transactions efficiently. It ensures all essential details, such as item descriptions, prices, and payment methods, are clearly recorded. Perfect for businesses seeking an organized and professional sales receipt solution.

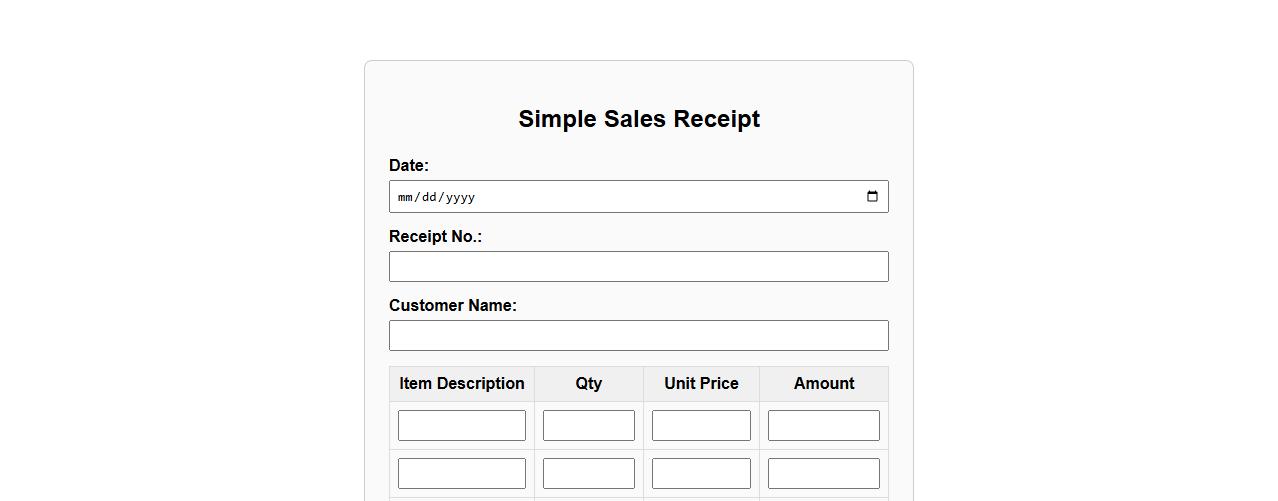

Simple sales receipt form sample for retail store

This simple sales receipt form sample is designed specifically for retail stores to streamline transaction record-keeping. It includes essential fields for item description, quantity, price, and total amount, ensuring clarity and accuracy. Using this form helps maintain organized sales documentation and improves customer service efficiency.

How do you customize tax fields on a digital Sales Receipt Form?

To customize tax fields on a digital Sales Receipt Form, start by accessing the settings or configuration panel within your sales software. You can add, remove, or modify tax rates to reflect applicable local, state, or federal taxes. Make sure to save changes and preview the form to verify that the tax fields display correctly and calculate accurately.

What are the legal retention periods for sales receipts in different jurisdictions?

Legal retention periods for sales receipts vary widely by jurisdiction, usually ranging from three to seven years. Many countries require businesses to keep records for tax audits or legal verification within this timeframe. It's essential to consult local regulations or a legal advisor to ensure compliance with specific retention requirements.

Which security features prevent tampering on electronic Sales Receipt Forms?

Electronic Sales Receipt Forms utilize security features such as digital signatures, encryption, and audit trails to prevent tampering. These features ensure data integrity and provide legal proof of authenticity in case of disputes. Implementing secure access controls and regular software updates further enhance protection against unauthorized modifications.

How to automate itemized product entries in a Sales Receipt Form?

To automate itemized product entries in a Sales Receipt Form, integrate your sales platform with an inventory management system that syncs product details automatically. Use barcodes or QR codes scanned at the point of sale to add items accurately and swiftly. Automating this process reduces errors and improves transaction speed.

What is the best format for exporting Sales Receipt Forms to accounting software?

The best export format for Sales Receipt Forms to accounting software is typically CSV or XML, depending on the software's compatibility. These formats preserve detailed transaction data while ensuring easy import and integration. Always confirm the preferred file type with your accounting software before exporting to avoid data loss.