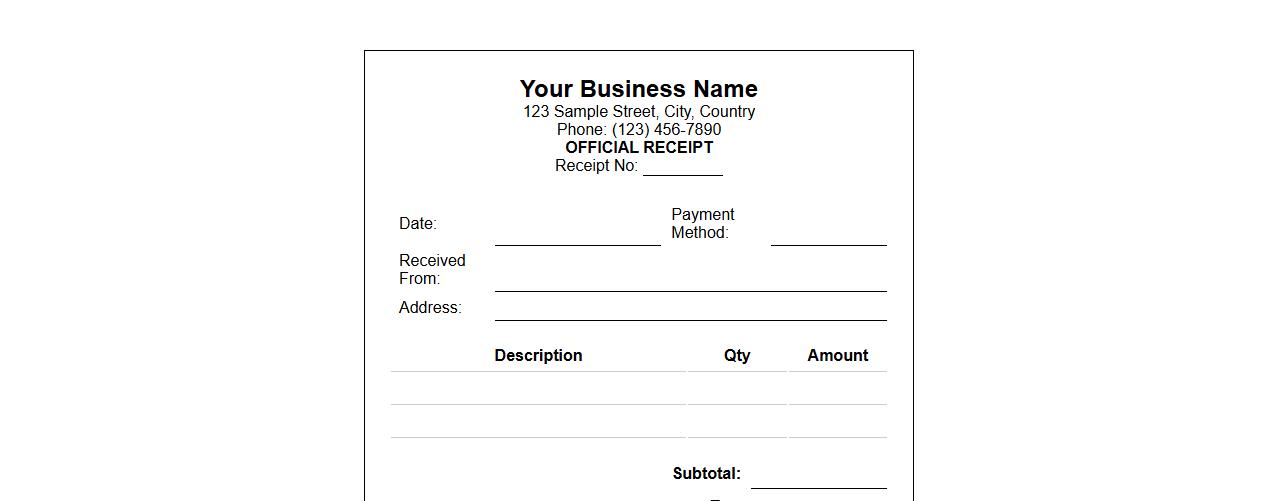

A Official Receipt Form Sample is a template used by businesses to provide proof of payment for goods or services. It includes essential details such as the payer's name, transaction date, amount paid, and a unique receipt number. Using this form ensures accurate record-keeping and enhances financial transparency for both parties.

Official receipt form sample for small business

An official receipt form sample for small business helps streamline transaction documentation and ensures compliance with tax regulations. This template includes essential details like business name, transaction date, and payment amount, enhancing professionalism and record-keeping. Using an official receipt form boosts customer trust and simplifies financial audits.

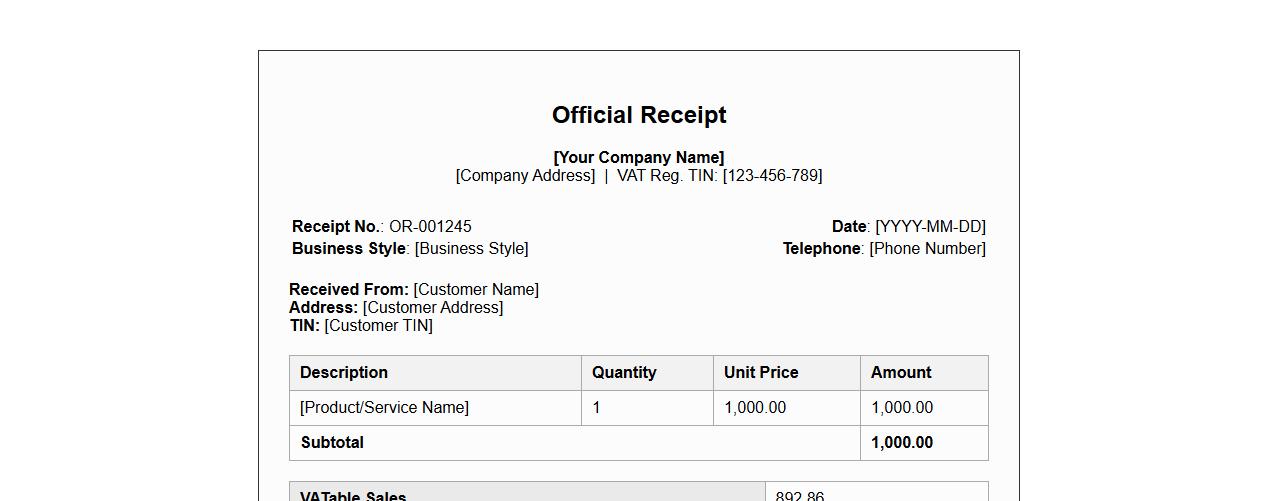

Official receipt form sample with VAT details

Download our official receipt form sample featuring comprehensive VAT details to ensure accurate tax documentation. This template simplifies the recording of sales transactions while complying with VAT regulations. Perfect for businesses aiming to maintain clear and professional financial records.

Downloadable official receipt form sample PDF

Download the official receipt form sample PDF to ensure accurate and professional documentation for your transactions. This template provides a clear layout, making it easy to fill out and customize for business use. Access and print the form instantly for efficient record-keeping and compliance.

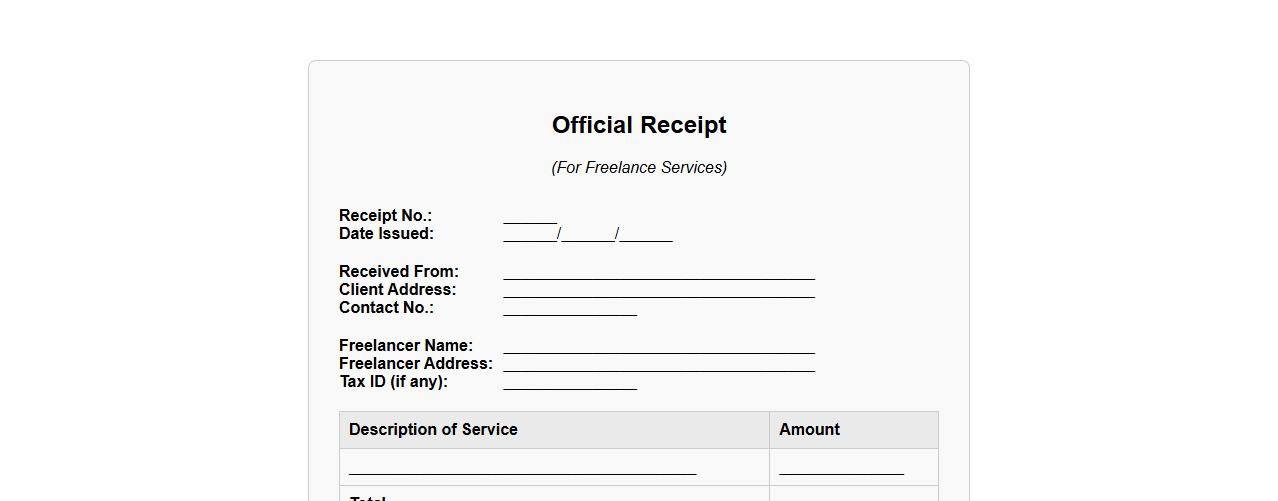

Official receipt form sample for freelance services

An official receipt form sample for freelance services serves as a documented proof of payment between freelancers and their clients. This form typically includes essential details such as the freelancer's information, service description, payment amount, and date of transaction. Using a standardized receipt helps ensure transparency and professionalism in freelance business transactions.

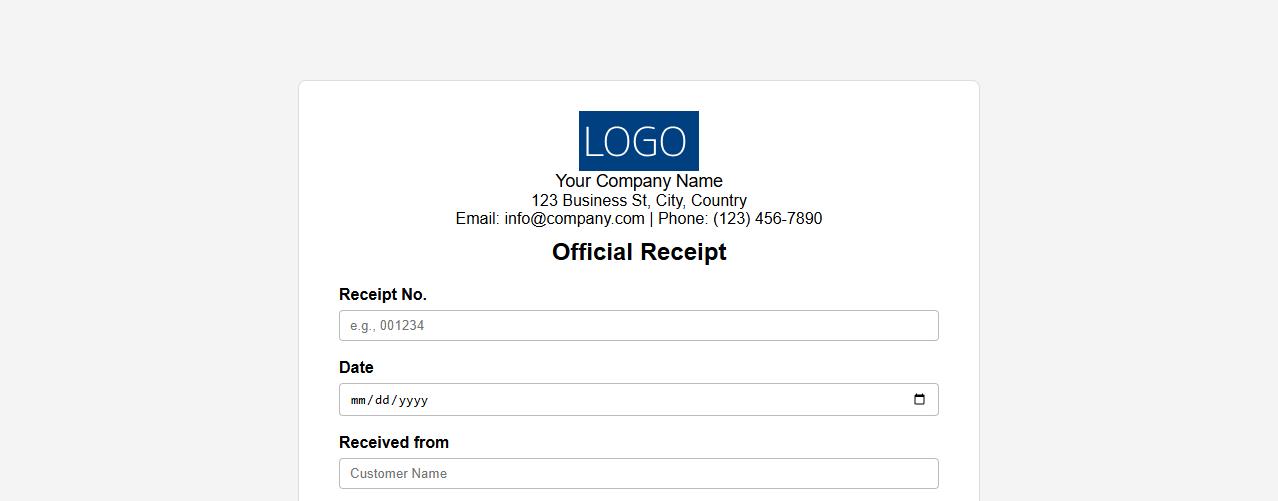

Official receipt form sample with company logo

Download an official receipt form sample featuring a customizable company logo to ensure professional and consistent documentation. This template simplifies transaction recording and enhances brand recognition. Perfect for businesses seeking organized and credible receipt management.

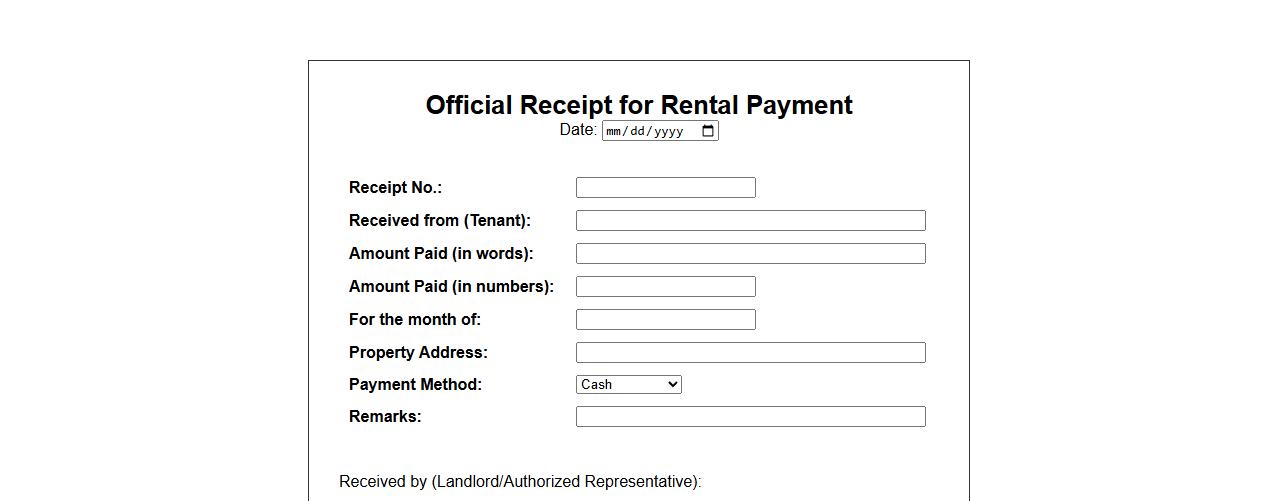

Official receipt form sample for rental payment

An official receipt form sample for rental payment serves as a template to document rental transactions accurately. It ensures clear communication between landlords and tenants by providing a standardized format for recording payment details. Using this form helps maintain transparent financial records and supports legal compliance.

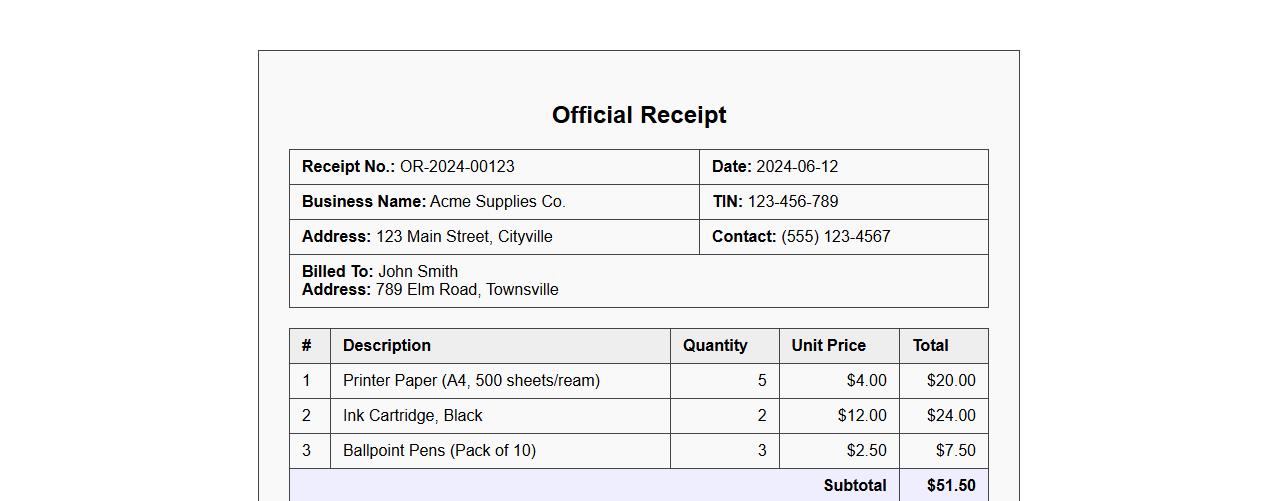

Official receipt form sample with itemized breakdown

Download the official receipt form sample with an itemized breakdown to ensure transparent and detailed documentation of all purchased items. This form helps businesses and clients maintain accurate records by listing each item separately along with prices and quantities. Using an itemized official receipt enhances financial tracking and accountability in transactions.

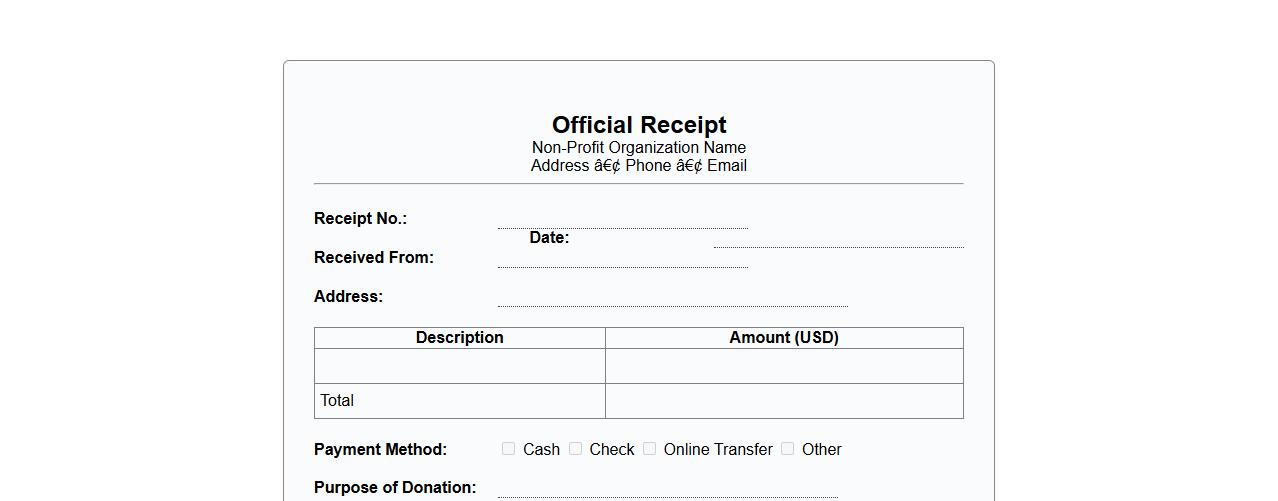

Official receipt form sample for non-profit organizations

An official receipt form sample for non-profit organizations helps ensure proper documentation of donations and financial transactions. This form is designed to meet regulatory requirements while maintaining transparency and accountability. Using a standardized receipt form simplifies record-keeping and donor communications.

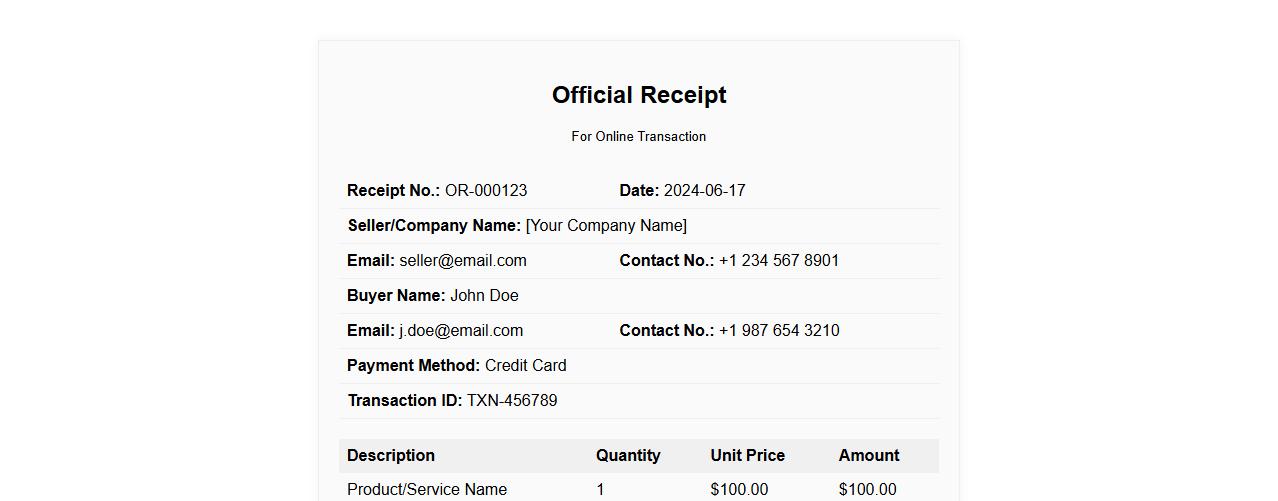

Official receipt form sample for online transactions

An official receipt form sample for online transactions provides a standardized template to document payments securely and accurately. It ensures compliance with financial regulations while facilitating smooth record-keeping for both sellers and buyers. Using this form enhances transparency and trust in digital commerce.

What legal elements must an official receipt form include for tax compliance?

An official receipt form must contain the taxpayer's identification number (TIN) to comply with tax regulations. It should also include the date of transaction and a detailed description of the goods or services provided. Additionally, the form must specify the amount paid and the applicable tax rate to ensure proper tax reporting.

How should voided official receipt forms be documented and archived?

Voided official receipt forms must be clearly marked with the word "VOID" across the entire document to prevent reuse. These forms should be sequentially numbered and logged in a voids register for audit purposes. Proper archiving requires storing voided receipts separately to maintain an accurate and traceable record.

Which security features prevent tampering in official receipt forms?

Security features include watermarks embedded in the paper to deter counterfeiting attempts. Official receipt forms often use microprinting and serial numbers to trace and verify authenticity. Additionally, special inks and holograms can be applied to further prevent unauthorized alterations.

How do electronic official receipt forms differ in validation from paper forms?

Electronic official receipt forms utilize digital signatures and encryption to ensure data integrity and authenticity. Unlike paper forms, they require validation through a secured electronic platform connected to tax authorities. This system improves real-time monitoring and reduces the risk of fraud.

What mandatory fields are required for cross-border transactions on an official receipt form?

For cross-border transactions, the form must include the exporter and importer details including their TINs. It should clearly state the currency used and indicate the country of origin and destination. Additionally, the receipt must include customs declarations and applicable tax exemptions for accurate processing.