A Statement of Retained Earnings Template simplifies the process of tracking changes in retained earnings over a specific period. It clearly outlines beginning retained earnings, net income, dividends paid, and the ending retained earnings balance. This template ensures accurate financial reporting and helps businesses monitor their accumulated profits effectively.

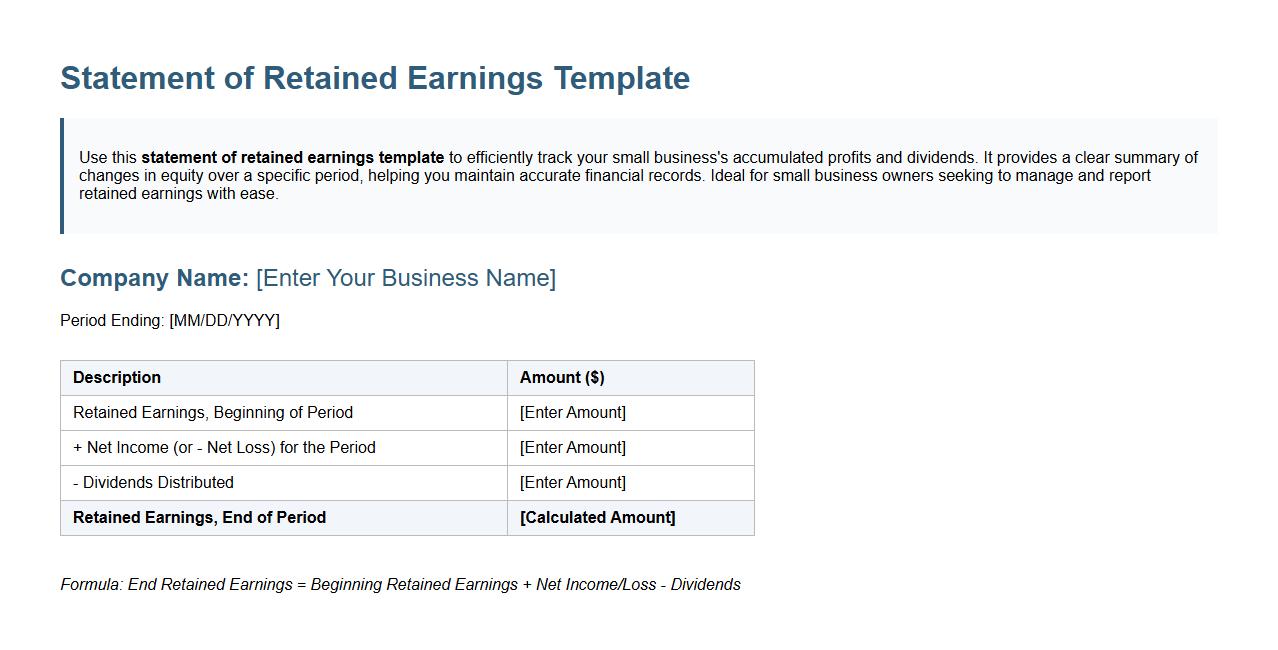

Statement of retained earnings template for small business

Use this statement of retained earnings template to efficiently track your small business's accumulated profits and dividends. It provides a clear summary of changes in equity over a specific period, helping you maintain accurate financial records. Ideal for small business owners seeking to manage and report retained earnings with ease.

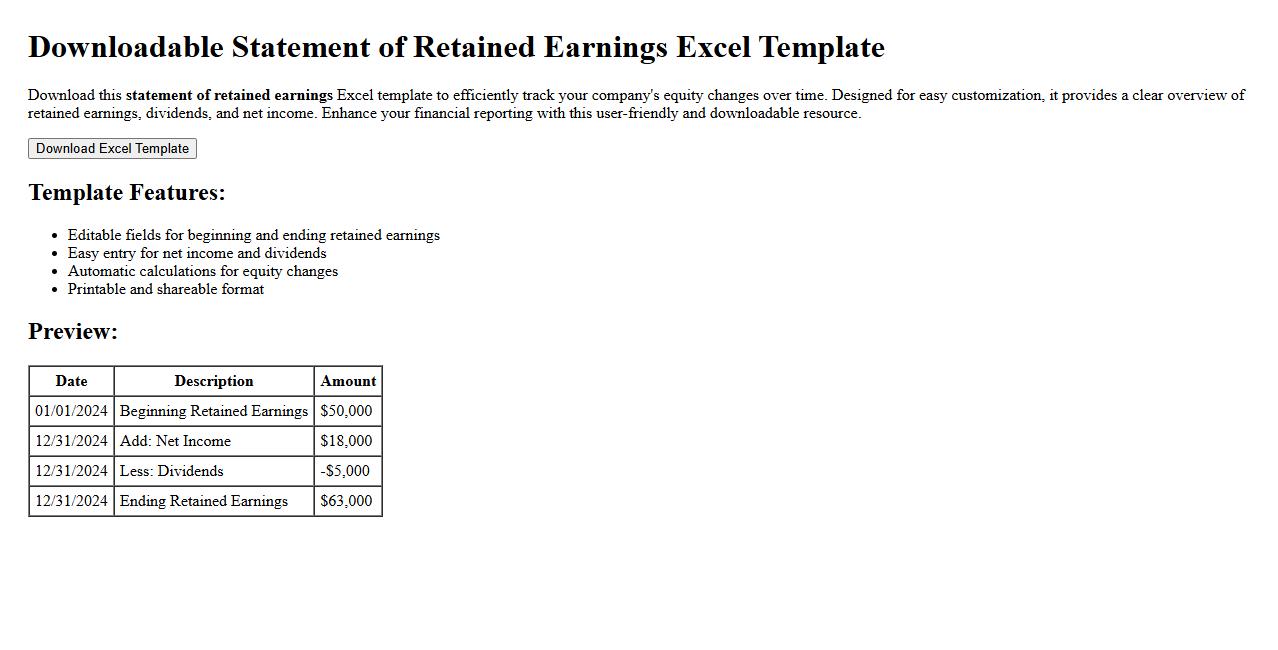

Downloadable statement of retained earnings excel template

Download this statement of retained earnings Excel template to efficiently track your company's equity changes over time. Designed for easy customization, it provides a clear overview of retained earnings, dividends, and net income. Enhance your financial reporting with this user-friendly and downloadable resource.

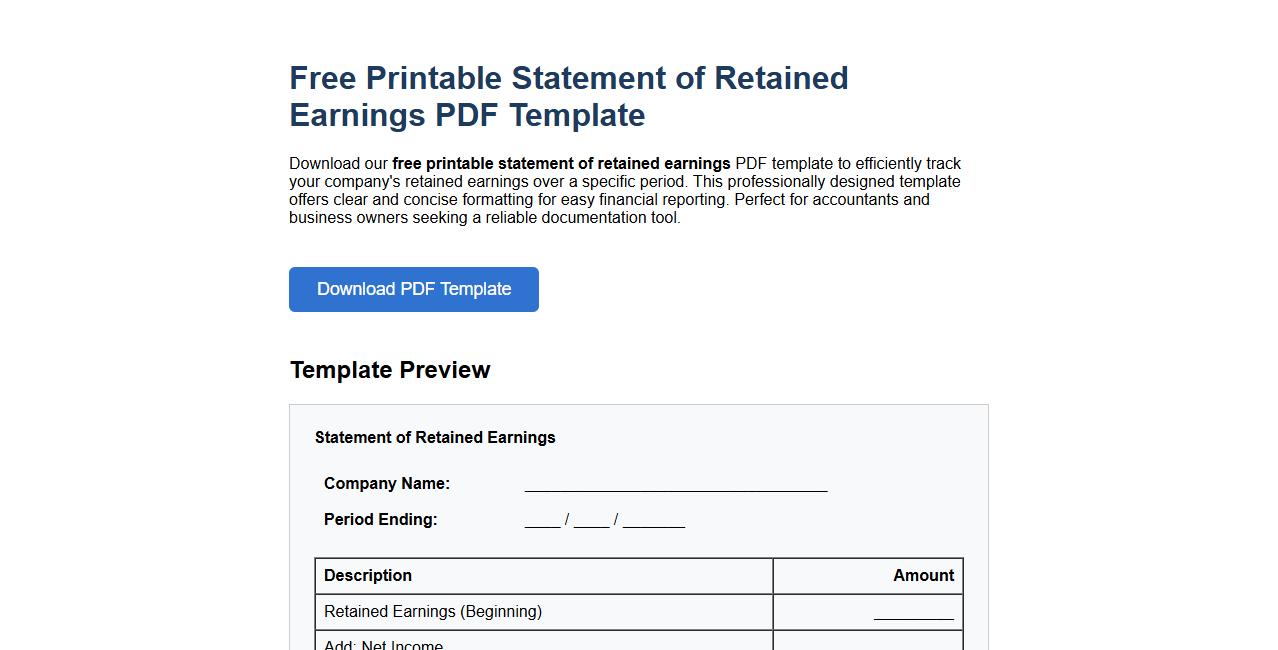

Free printable statement of retained earnings pdf template

Download our free printable statement of retained earnings PDF template to efficiently track your company's retained earnings over a specific period. This professionally designed template offers clear and concise formatting for easy financial reporting. Perfect for accountants and business owners seeking a reliable documentation tool.

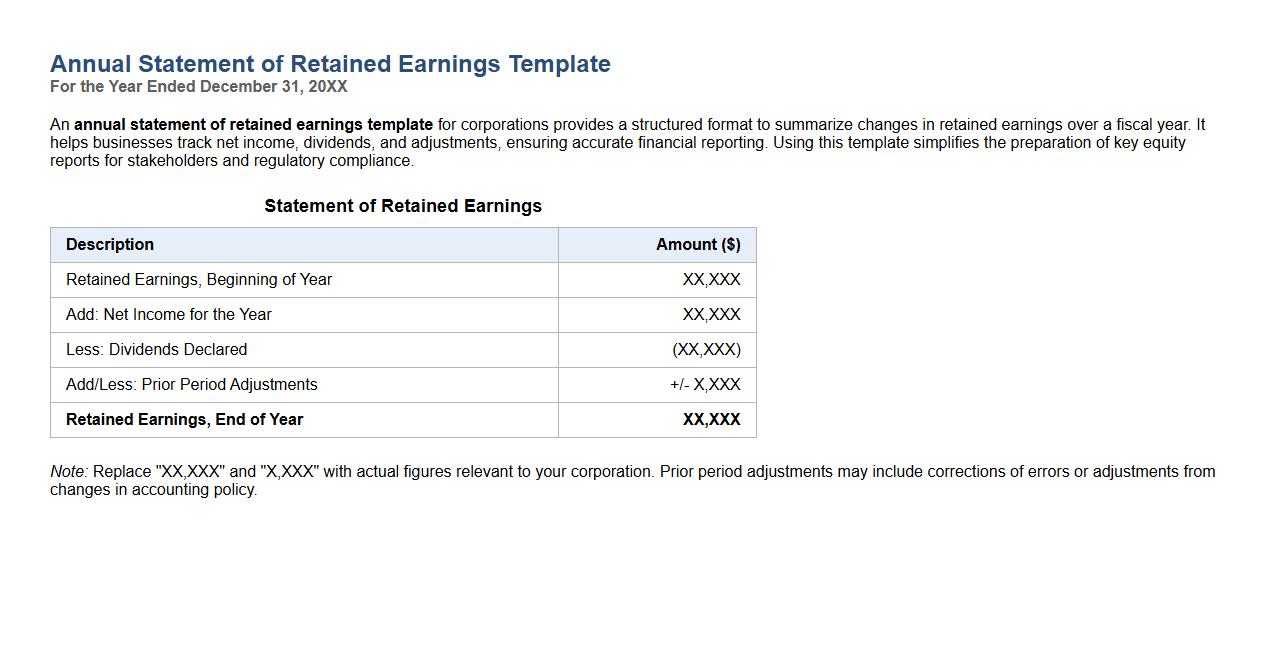

Annual statement of retained earnings template for corporations

An annual statement of retained earnings template for corporations provides a structured format to summarize changes in retained earnings over a fiscal year. It helps businesses track net income, dividends, and adjustments, ensuring accurate financial reporting. Using this template simplifies the preparation of key equity reports for stakeholders and regulatory compliance.

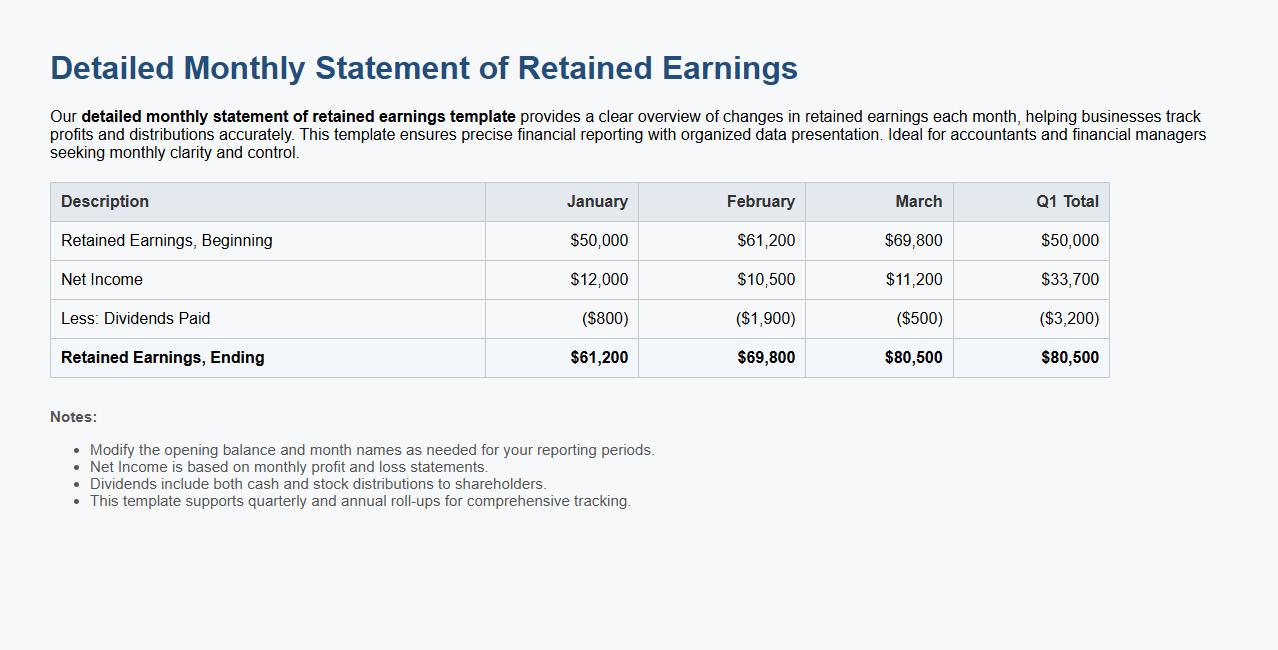

Detailed monthly statement of retained earnings template

Our detailed monthly statement of retained earnings template provides a clear overview of changes in retained earnings each month, helping businesses track profits and distributions accurately. This template ensures precise financial reporting with organized data presentation. Ideal for accountants and financial managers seeking monthly clarity and control.

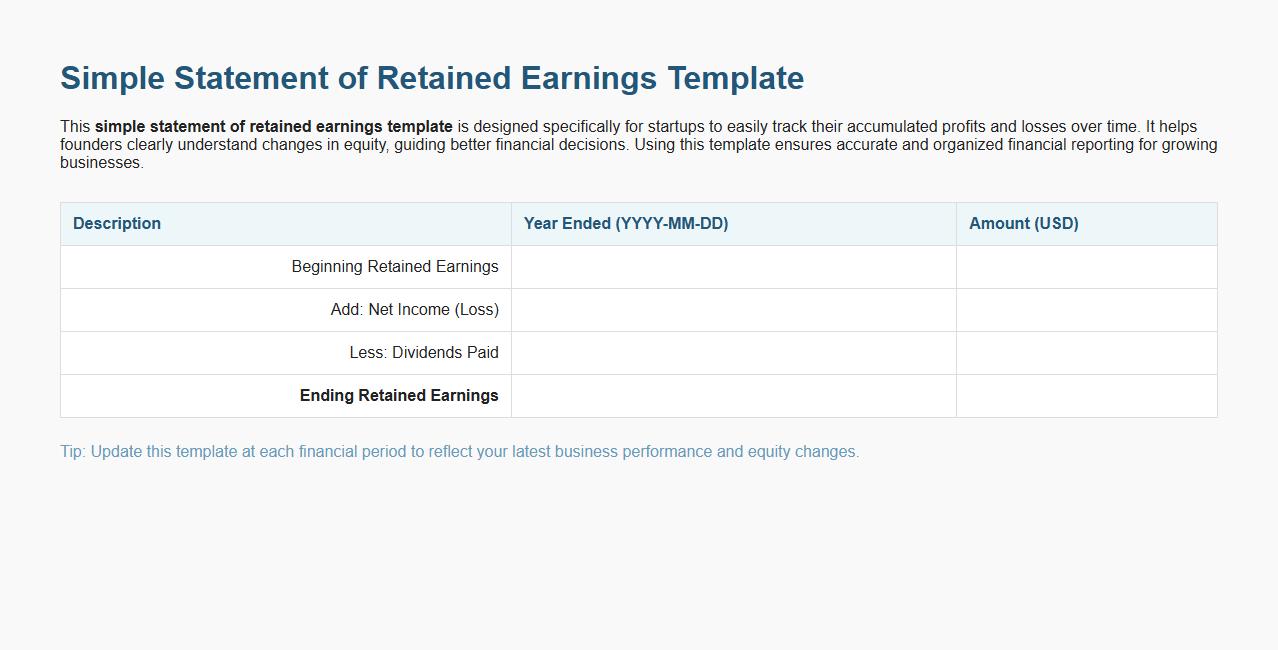

Simple statement of retained earnings template for startups

This simple statement of retained earnings template is designed specifically for startups to easily track their accumulated profits and losses over time. It helps founders clearly understand changes in equity, guiding better financial decisions. Using this template ensures accurate and organized financial reporting for growing businesses.

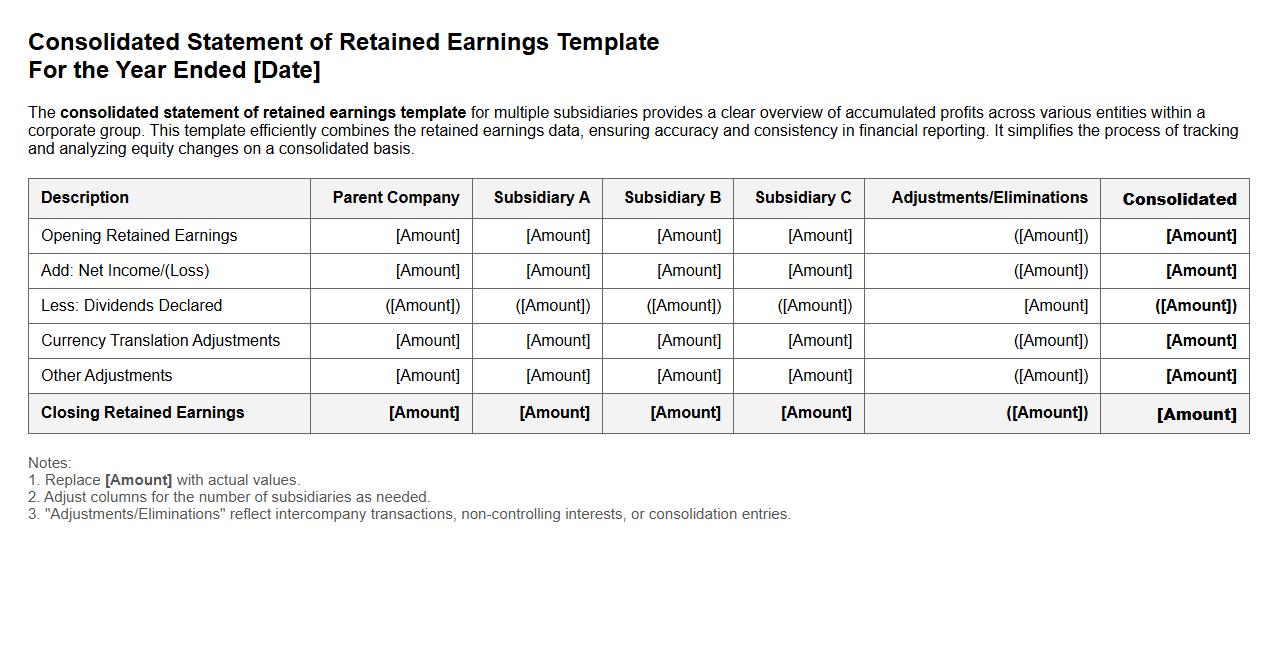

Consolidated statement of retained earnings template for multiple subsidiaries

The consolidated statement of retained earnings template for multiple subsidiaries provides a clear overview of accumulated profits across various entities within a corporate group. This template efficiently combines the retained earnings data, ensuring accuracy and consistency in financial reporting. It simplifies the process of tracking and analyzing equity changes on a consolidated basis.

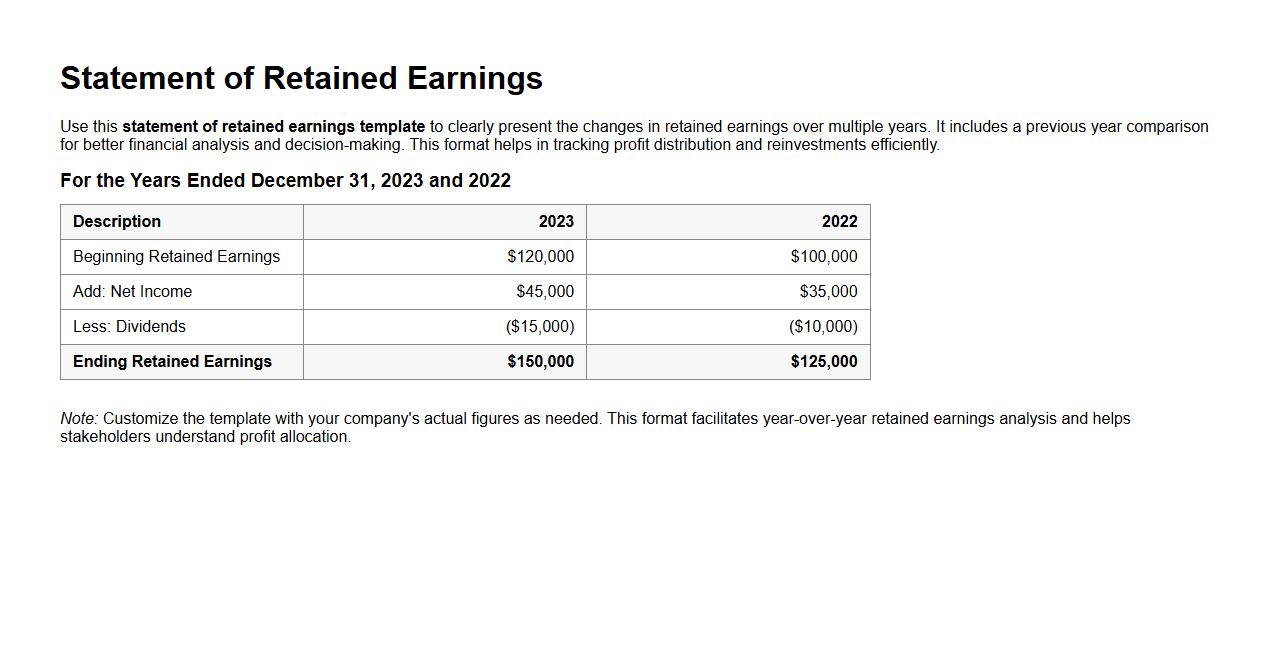

Statement of retained earnings template with previous year comparison

Use this statement of retained earnings template to clearly present the changes in retained earnings over multiple years. It includes a previous year comparison for better financial analysis and decision-making. This format helps in tracking profit distribution and reinvestments efficiently.

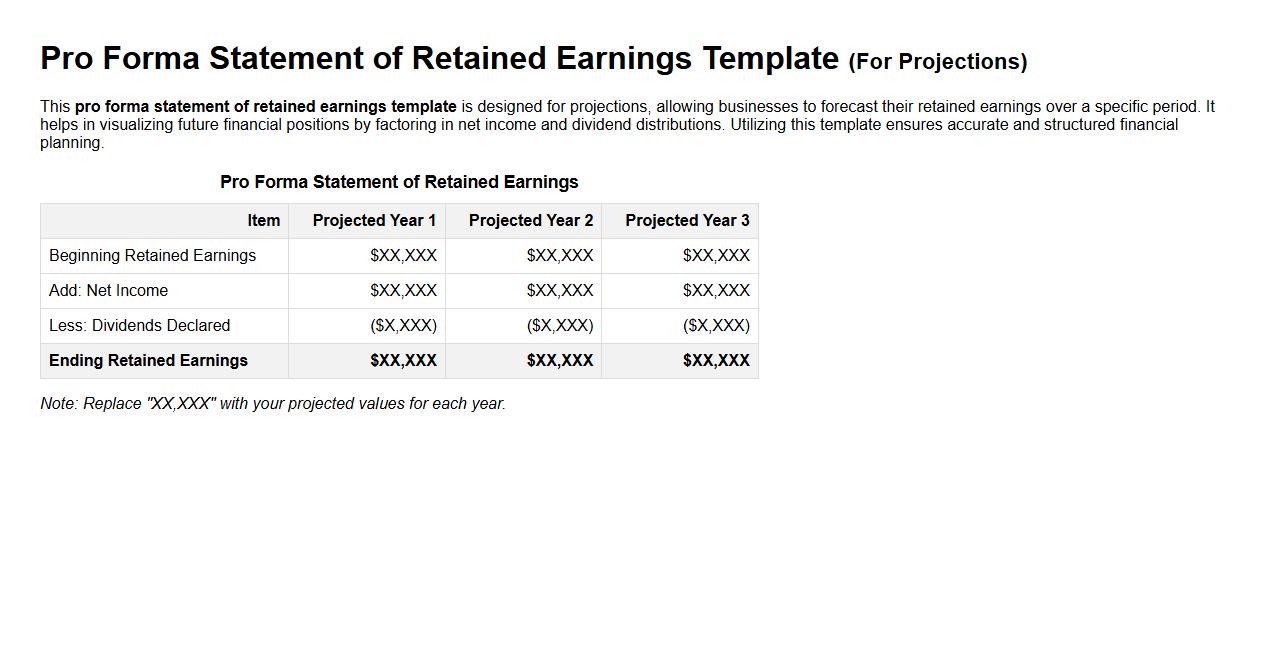

Pro forma statement of retained earnings template for projections

This pro forma statement of retained earnings template is designed for projections, allowing businesses to forecast their retained earnings over a specific period. It helps in visualizing future financial positions by factoring in net income and dividend distributions. Utilizing this template ensures accurate and structured financial planning.

What specific disclosures are required in a nonprofit organization's Statement of Retained Earnings?

The Statement of Retained Earnings for a nonprofit organization must disclose the beginning balance, additions, and deductions clearly. It should also include details about any net income or loss for the period and any distributions or transfers to other funds. Transparency about changes in retained earnings ensures stakeholders understand the organization's financial health and operational results.

How does a prior period adjustment impact the Statement of Retained Earnings?

A prior period adjustment corrects errors from previous financial statements and is reflected directly in the beginning retained earnings balance. This adjustment ensures that retained earnings accurately represent accumulated earnings after correcting past mistakes. As a result, the Statement of Retained Earnings shows both the adjustment and its impact on the opening balance for the reporting period.

Can treasury stock transactions be reflected in the Statement of Retained Earnings?

Treasury stock transactions are not typically reflected in the Statement of Retained Earnings because they affect shareholders' equity but not retained earnings. Such transactions are recorded in the equity section under treasury stock accounts. However, disclosures about treasury stock purchases or reissuances are necessary in the equity section or notes of the financial statements.

What are the implications of issuing stock dividends on the Statement of Retained Earnings?

Issuing stock dividends results in a transfer from retained earnings to paid-in capital, reducing retained earnings by the fair value of the stock issued. The Statement of Retained Earnings must reflect this decrease, showing the dividend's impact on accumulated earnings. This treatment helps maintain accurate records of earnings that remain available for future use.

How should cumulative preferred dividends in arrears be reported on the Statement of Retained Earnings?

Cumulative preferred dividends in arrears are disclosed in the notes but generally not deducted from retained earnings until declared. The Statement of Retained Earnings should indicate the amount of dividends in arrears to inform stakeholders of future obligations. This disclosure is crucial as it affects the residual interest available to common shareholders.