A Income Statement Form Sample provides a structured template to document a company's revenues, expenses, and net profit or loss over a specific period. It helps businesses analyze financial performance and make informed decisions by clearly presenting key financial data. Using this form ensures consistency and accuracy in financial reporting.

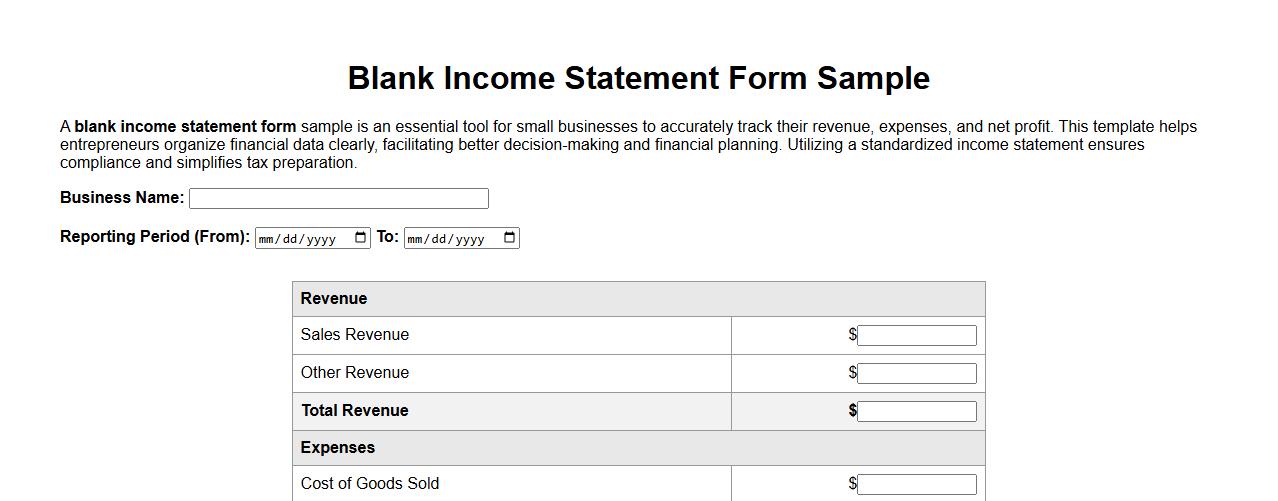

Blank income statement form sample for small business

A blank income statement form sample is an essential tool for small businesses to accurately track their revenue, expenses, and net profit. This template helps entrepreneurs organize financial data clearly, facilitating better decision-making and financial planning. Utilizing a standardized income statement ensures compliance and simplifies tax preparation.

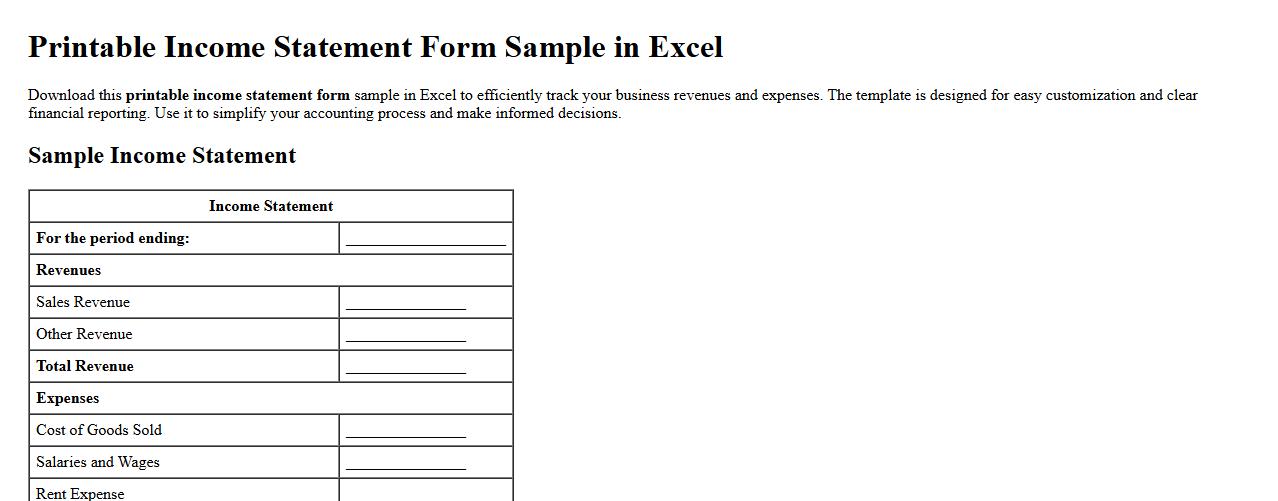

Printable income statement form sample in Excel

Download this printable income statement form sample in Excel to efficiently track your business revenues and expenses. The template is designed for easy customization and clear financial reporting. Use it to simplify your accounting process and make informed decisions.

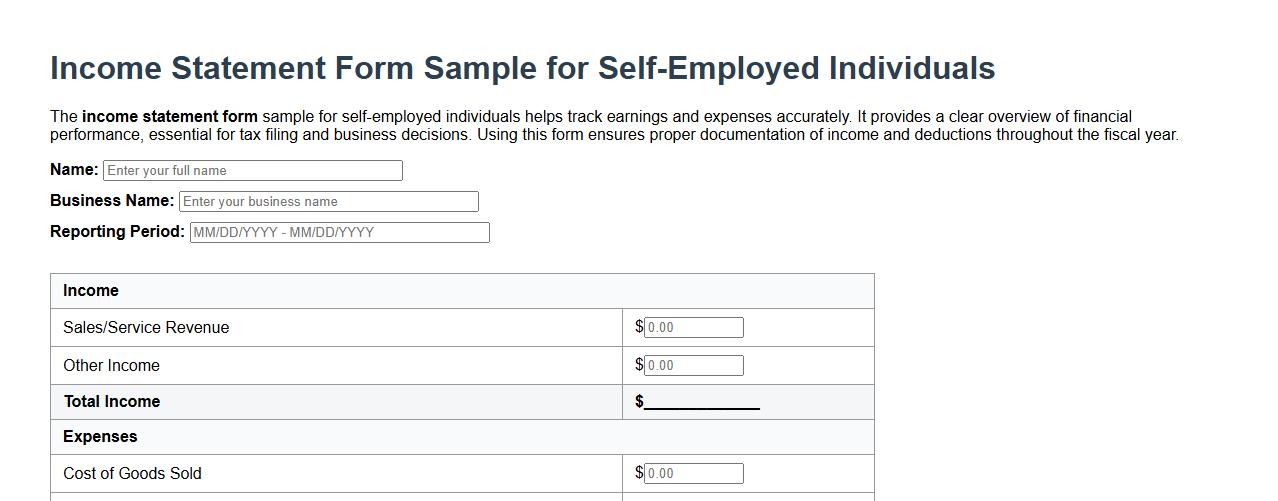

Income statement form sample for self-employed individuals

The income statement form sample for self-employed individuals helps track earnings and expenses accurately. It provides a clear overview of financial performance, essential for tax filing and business decisions. Using this form ensures proper documentation of income and deductions throughout the fiscal year.

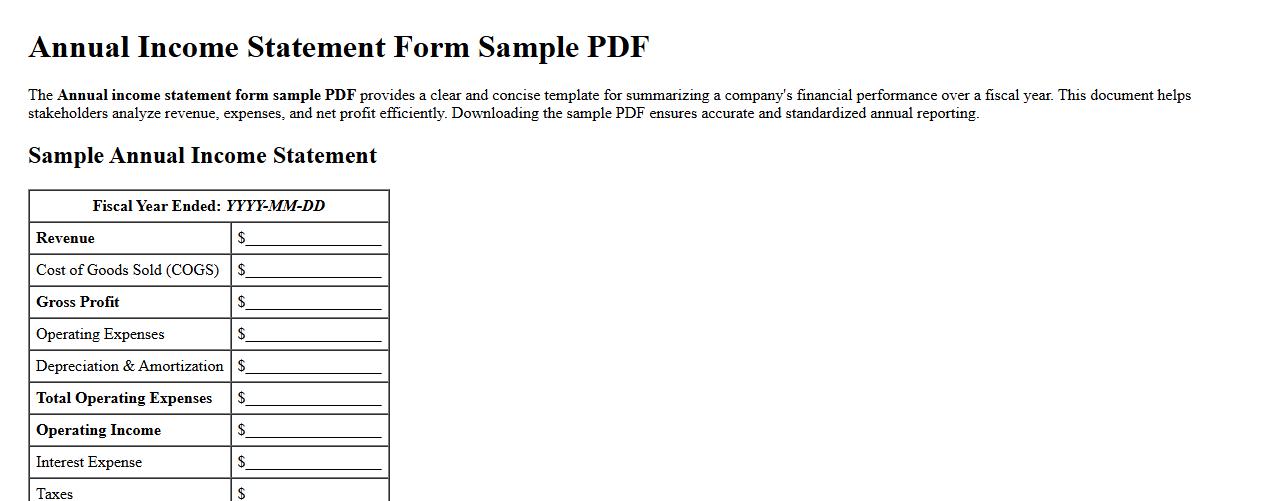

Annual income statement form sample PDF

The Annual income statement form sample PDF provides a clear and concise template for summarizing a company's financial performance over a fiscal year. This document helps stakeholders analyze revenue, expenses, and net profit efficiently. Downloading the sample PDF ensures accurate and standardized annual reporting.

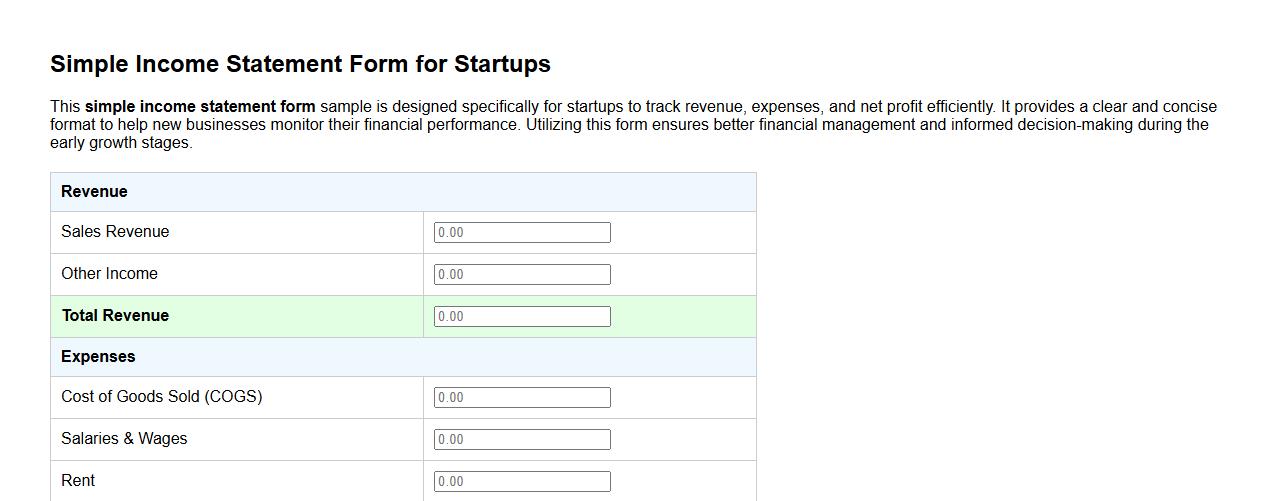

Simple income statement form sample for startups

This simple income statement form sample is designed specifically for startups to track revenue, expenses, and net profit efficiently. It provides a clear and concise format to help new businesses monitor their financial performance. Utilizing this form ensures better financial management and informed decision-making during the early growth stages.

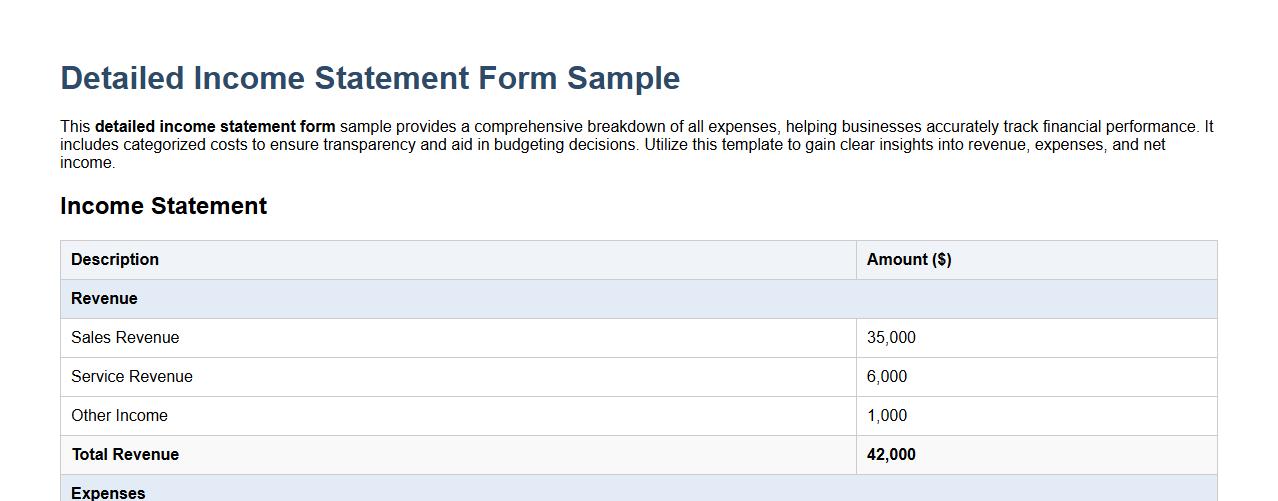

Detailed income statement form sample with expenses breakdown

This detailed income statement form sample provides a comprehensive breakdown of all expenses, helping businesses accurately track financial performance. It includes categorized costs to ensure transparency and aid in budgeting decisions. Utilize this template to gain clear insights into revenue, expenses, and net income.

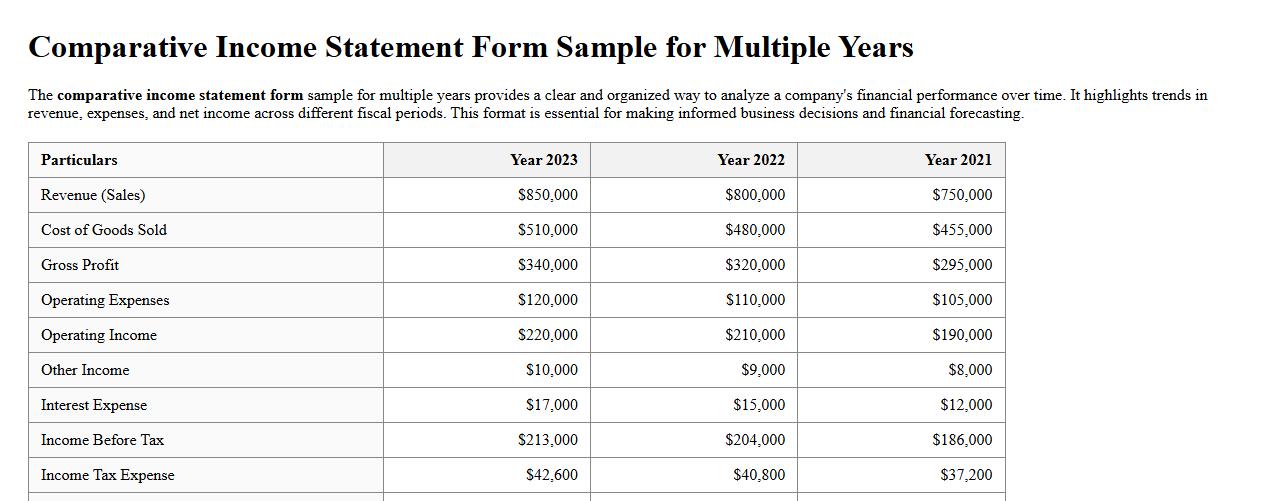

Comparative income statement form sample for multiple years

The comparative income statement form sample for multiple years provides a clear and organized way to analyze a company's financial performance over time. It highlights trends in revenue, expenses, and net income across different fiscal periods. This format is essential for making informed business decisions and financial forecasting.

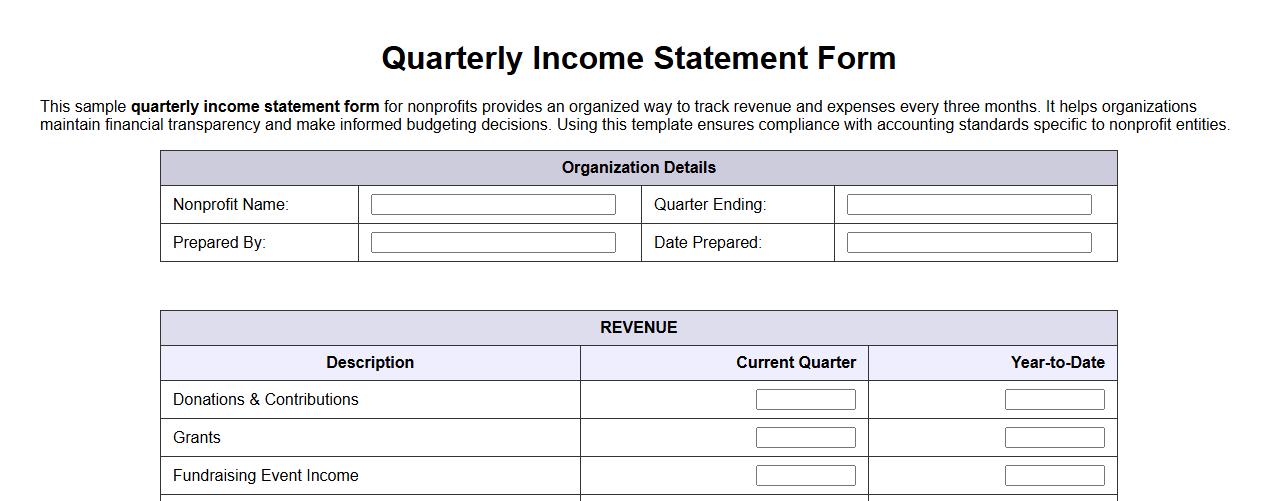

Quarterly income statement form sample for nonprofits

This sample quarterly income statement form for nonprofits provides an organized way to track revenue and expenses every three months. It helps organizations maintain financial transparency and make informed budgeting decisions. Using this template ensures compliance with accounting standards specific to nonprofit entities.

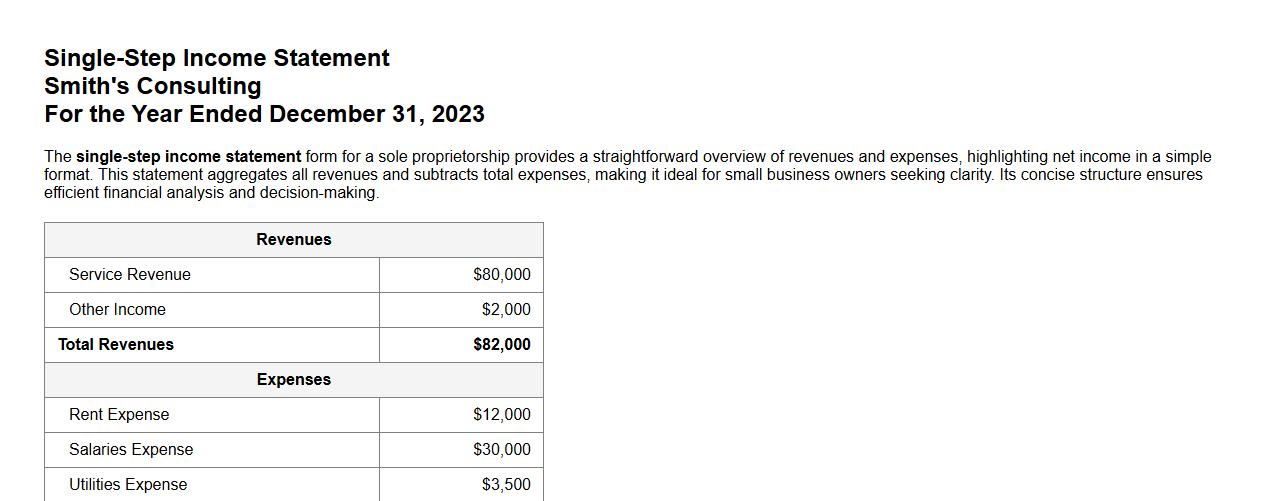

Single-step income statement form sample for sole proprietorship

The single-step income statement form for a sole proprietorship provides a straightforward overview of revenues and expenses, highlighting net income in a simple format. This statement aggregates all revenues and subtracts total expenses, making it ideal for small business owners seeking clarity. Its concise structure ensures efficient financial analysis and decision-making.

Which line items are mandatory on an Income Statement Form for nonprofit organizations?

The mandatory line items on a nonprofit Income Statement typically include revenues, expenses, and changes in net assets. It is essential to report program service revenues, contributions, and operating expenses clearly. These core components provide a transparent overview of the organization's financial activities.

How should depreciation expenses be documented in the Income Statement Form?

Depreciation expenses must be recorded as a separate line item under operating expenses in the Income Statement. This allocation helps in accurately reflecting the cost allocation for long-term assets over their useful life. Documenting depreciation transparently assists donors and regulators in understanding asset utilization.

What supporting documents are required to validate revenue entries on the form?

Revenue entries must be supported by donor acknowledgments, grant agreements, and sales receipts to ensure accuracy. These documents provide concrete evidence of the income sources and ensure compliance with accounting standards. Proper documentation enhances credibility and audit readiness.

Are there specific tax considerations reflected in the Income Statement Form layout?

The Income Statement should reflect exempt and non-exempt income in compliance with tax regulations governing nonprofits. Tax considerations may include tracking unrelated business income separately to maintain tax-exempt status. Proper classification helps in financial reporting and regulatory adherence.

How are irregular or one-time gains reported in the Income Statement Form?

Irregular or one-time gains should be listed separately as non-recurring items to distinguish them from regular operational income. This separation allows stakeholders to identify extraordinary financial events without inflating standard performance metrics. Clear reporting aids in accurate financial analysis and forecasting.