A Bank Statement Form Sample provides a clear template illustrating how transaction details, balances, and account information are organized for easy review. This sample helps individuals and businesses verify financial activities, track expenses, and maintain accurate records. Using a standardized form enhances transparency and simplifies the reconciliation process with bank accounts.

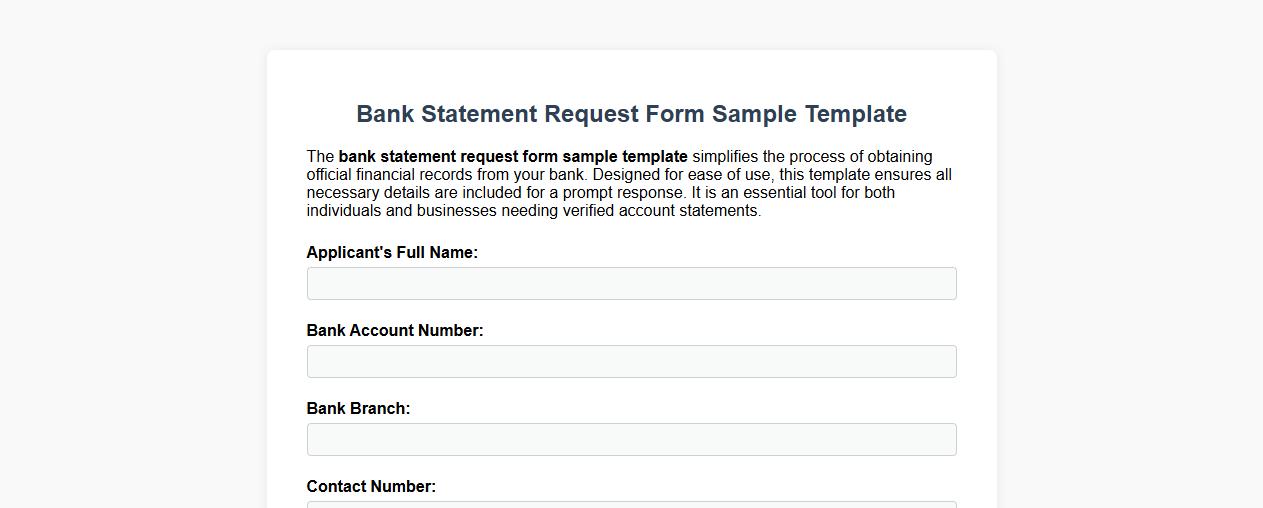

Bank statement request form sample template

The bank statement request form sample template simplifies the process of obtaining official financial records from your bank. Designed for ease of use, this template ensures all necessary details are included for a prompt response. It is an essential tool for both individuals and businesses needing verified account statements.

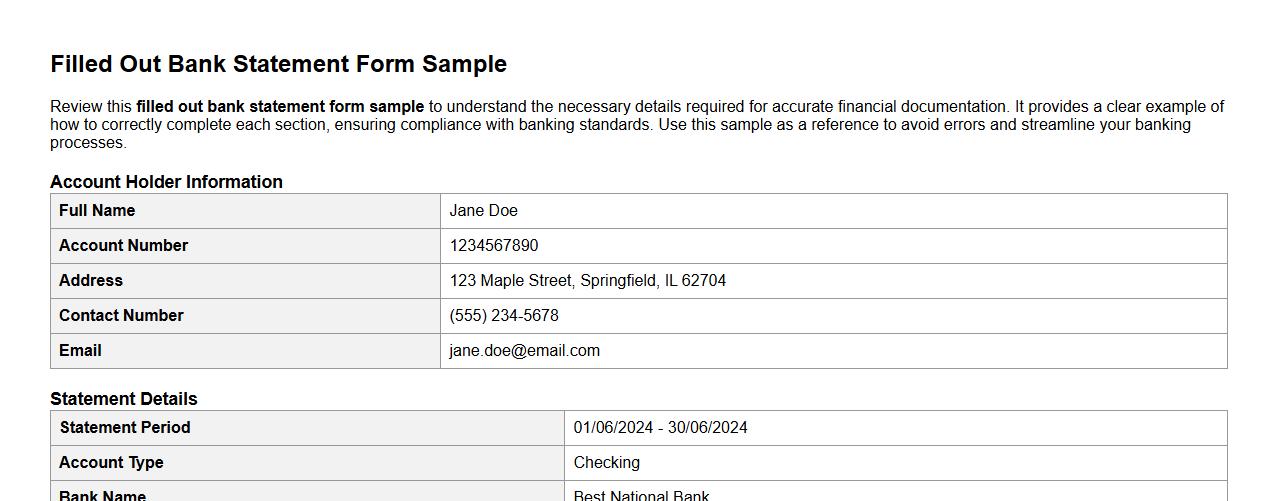

Filled out bank statement form sample

Review this filled out bank statement form sample to understand the necessary details required for accurate financial documentation. It provides a clear example of how to correctly complete each section, ensuring compliance with banking standards. Use this sample as a reference to avoid errors and streamline your banking processes.

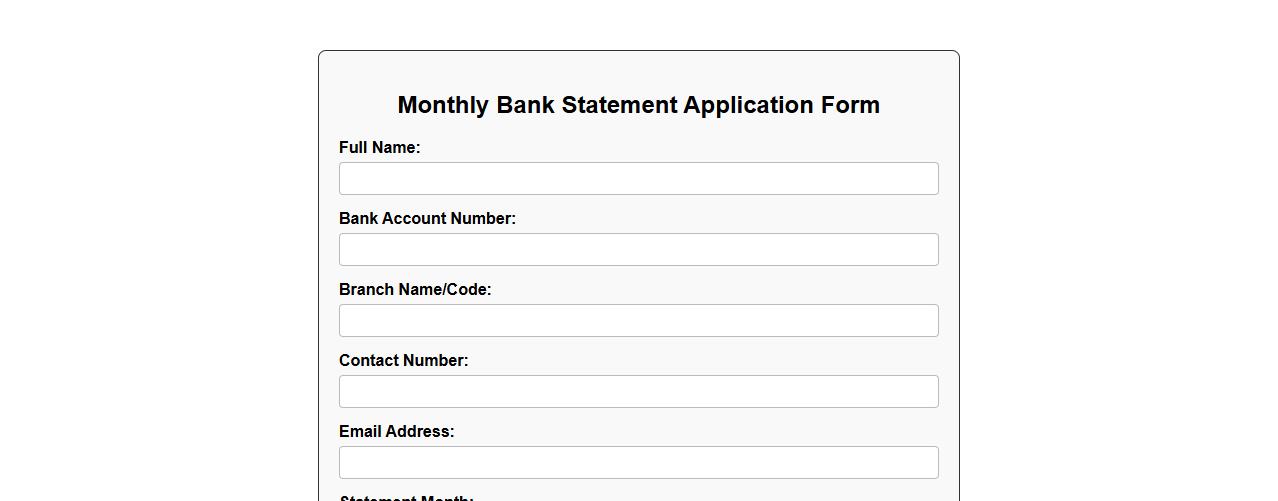

Monthly bank statement application form sample

This monthly bank statement application form sample provides a clear and organized template for requesting bank statements. It ensures all necessary details are included for a smooth and efficient process. Use this form to simplify and expedite your bank statement requests each month.

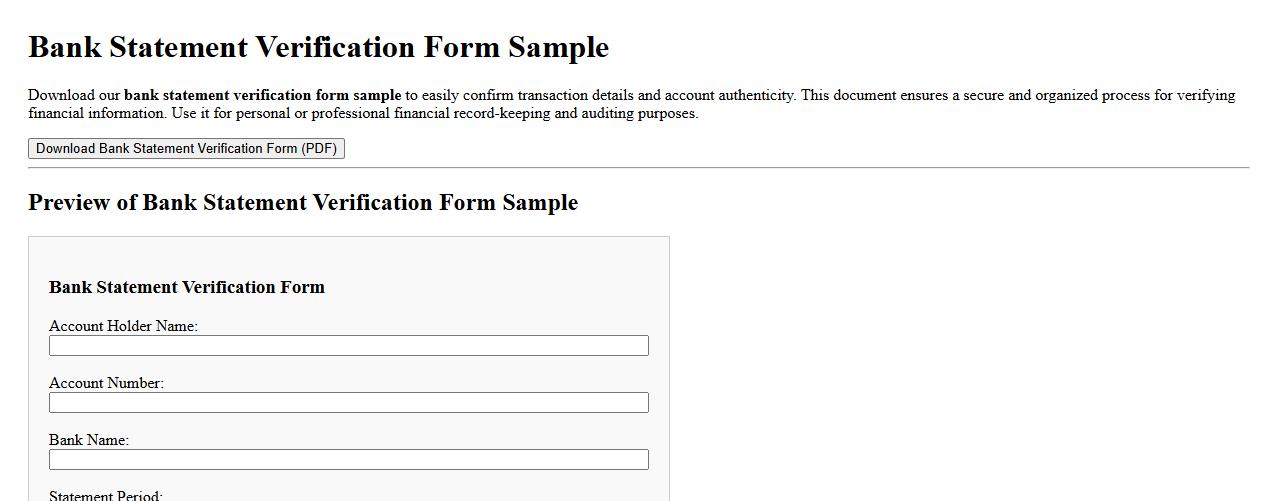

Downloadable bank statement verification form sample

Download our bank statement verification form sample to easily confirm transaction details and account authenticity. This document ensures a secure and organized process for verifying financial information. Use it for personal or professional financial record-keeping and auditing purposes.

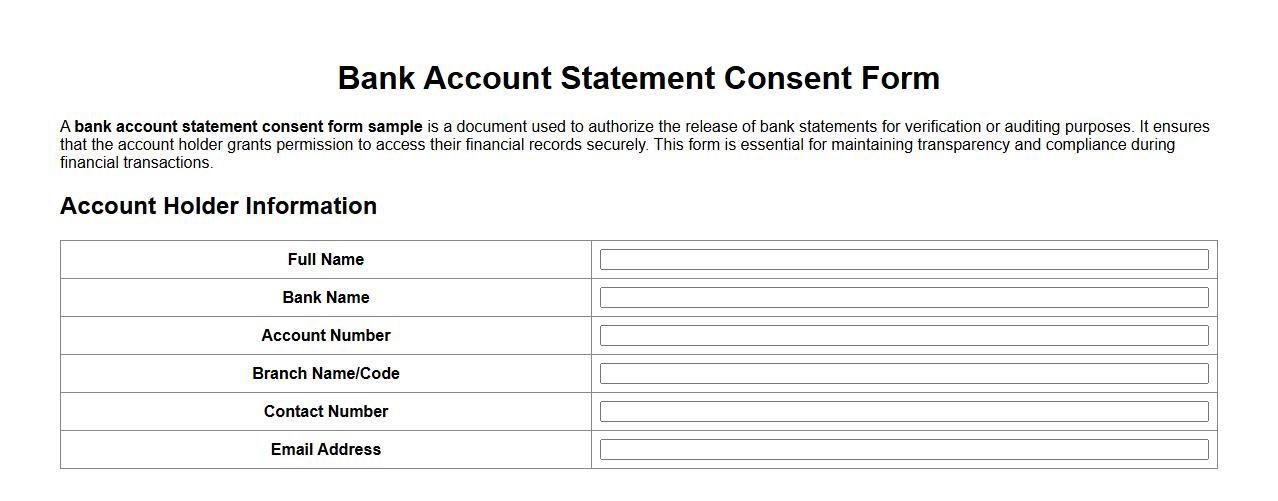

Bank account statement consent form sample

A bank account statement consent form sample is a document used to authorize the release of bank statements for verification or auditing purposes. It ensures that the account holder grants permission to access their financial records securely. This form is essential for maintaining transparency and compliance during financial transactions.

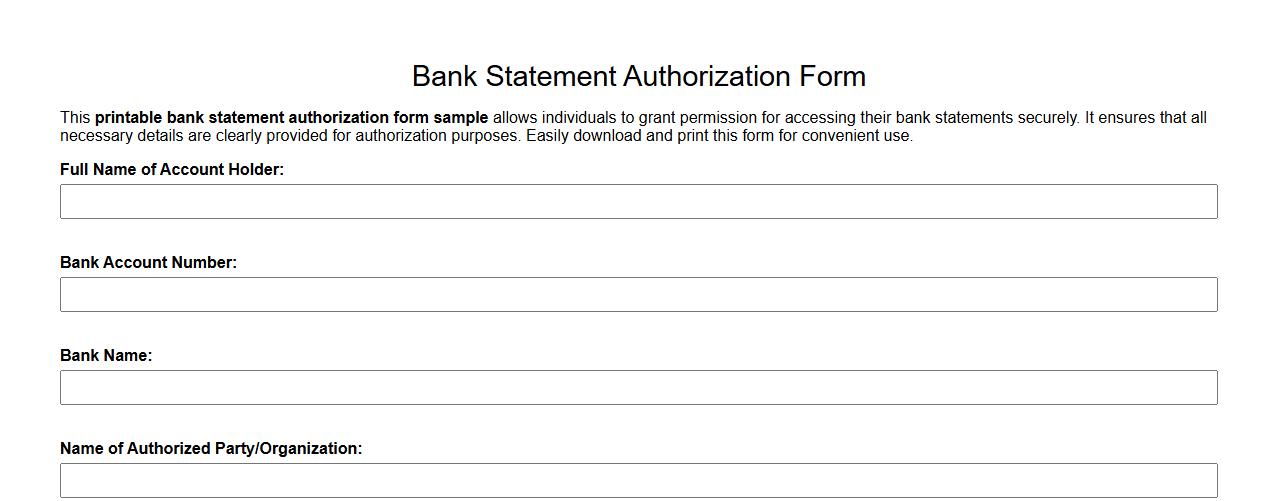

Printable bank statement authorization form sample

This printable bank statement authorization form sample allows individuals to grant permission for accessing their bank statements securely. It ensures that all necessary details are clearly provided for authorization purposes. Easily download and print this form for convenient use.

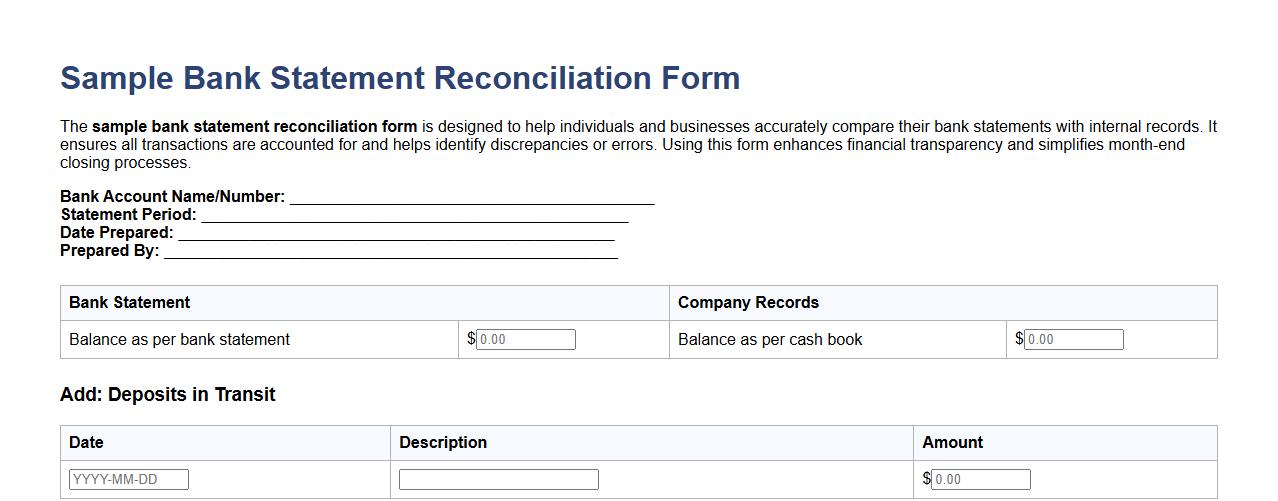

Sample bank statement reconciliation form

The sample bank statement reconciliation form is designed to help individuals and businesses accurately compare their bank statements with internal records. It ensures all transactions are accounted for and helps identify discrepancies or errors. Using this form enhances financial transparency and simplifies month-end closing processes.

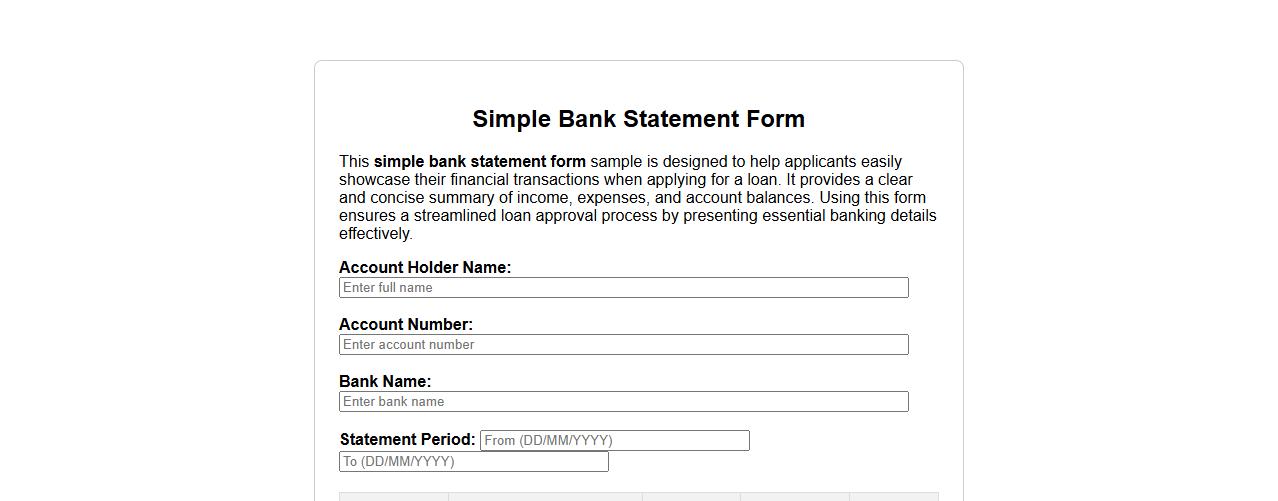

Simple bank statement form sample for loan

This simple bank statement form sample is designed to help applicants easily showcase their financial transactions when applying for a loan. It provides a clear and concise summary of income, expenses, and account balances. Using this form ensures a streamlined loan approval process by presenting essential banking details effectively.

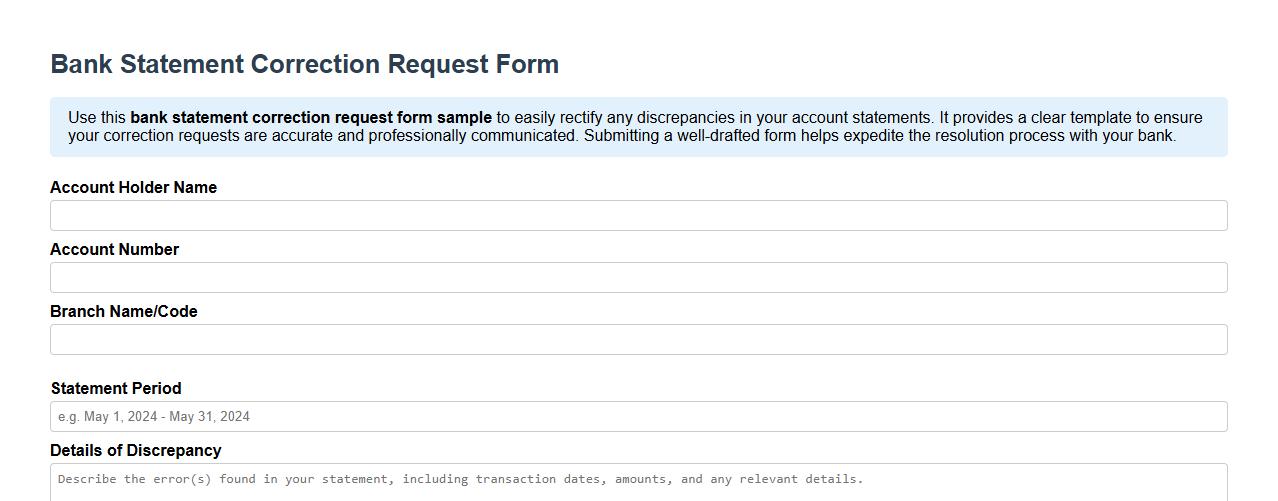

Bank statement correction request form sample

Use this bank statement correction request form sample to easily rectify any discrepancies in your account statements. It provides a clear template to ensure your correction requests are accurate and professionally communicated. Submitting a well-drafted form helps expedite the resolution process with your bank.

What supporting documents are required to validate a bank statement form submission?

To validate a bank statement form submission, essential documents include a government-issued ID, proof of address, and recent utility bills. These ensure the authenticity of the applicant's identity and address. Additionally, some institutions may require account opening forms or transaction receipts for further confirmation.

How can discrepancies in transaction details on a bank statement form be reconciled?

Discrepancies in transaction details can be resolved by contacting the bank's customer service for clarification. Supporting evidence such as receipts or transaction authorizations should be submitted to verify correct entries. Banks often conduct internal audits to reconcile and correct any inconsistencies.

Which security features authenticate an official bank statement form?

An official bank statement form typically contains security features such as watermarks, microtext, and encrypted QR codes. These elements prevent forgery and ensure the document's legitimacy. Furthermore, electronic statements often include digital signatures for added verification.

What is the typical processing time for a bank statement form request?

The processing time for a bank statement form request usually ranges from 1 to 5 business days. This varies depending on the bank's policies and whether the request is for physical or digital statements. Urgent requests may incur additional fees for expedited processing.

How does a digital versus physical bank statement form impact legal acceptability?

Both digital and physical bank statement forms are legally acceptable if they contain verifiable security features and adhere to regulatory standards. Digital statements must be obtained from secure online banking portals to maintain authenticity. Physical statements, however, may be preferred in scenarios requiring original hard copies for legal proceedings.