A Statement of Changes in Equity Template provides a structured format to track and report changes in a company's equity over a specific period. It outlines movements such as retained earnings, share capital, and other comprehensive income, offering clear insights into the financial health and ownership structure. This template is essential for transparency and accurate financial reporting.

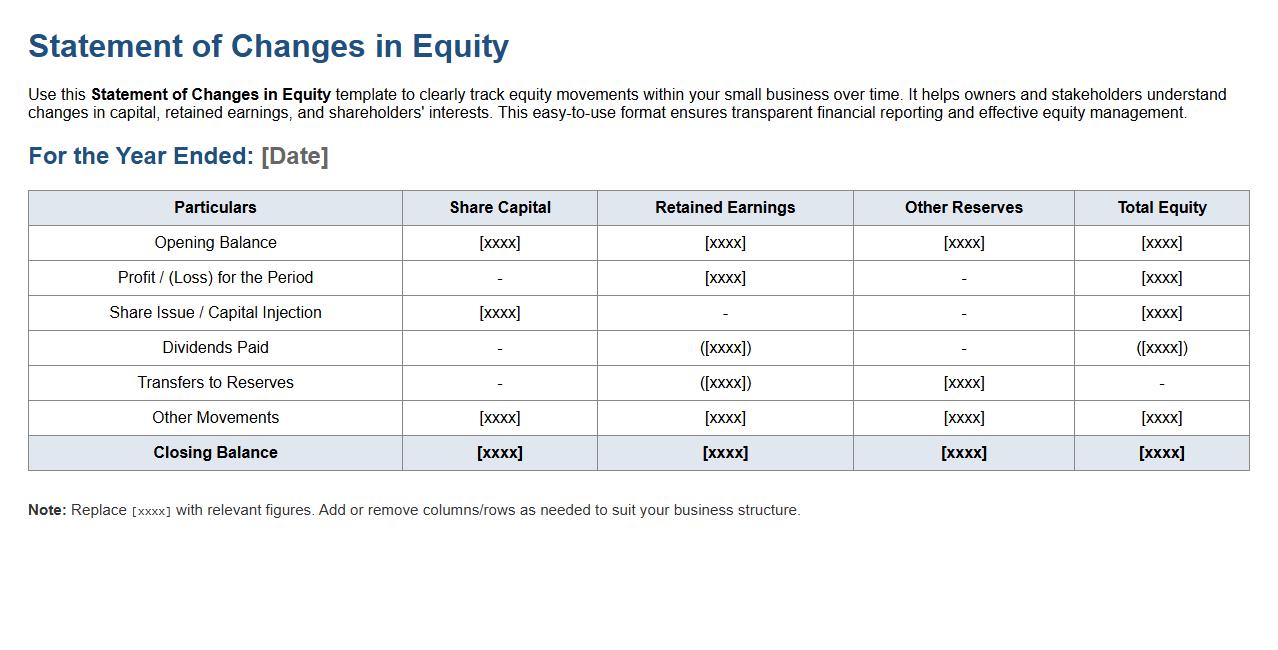

Statement of Changes in Equity template for small business

Use this Statement of Changes in Equity template to clearly track equity movements within your small business over time. It helps owners and stakeholders understand changes in capital, retained earnings, and shareholders' interests. This easy-to-use format ensures transparent financial reporting and effective equity management.

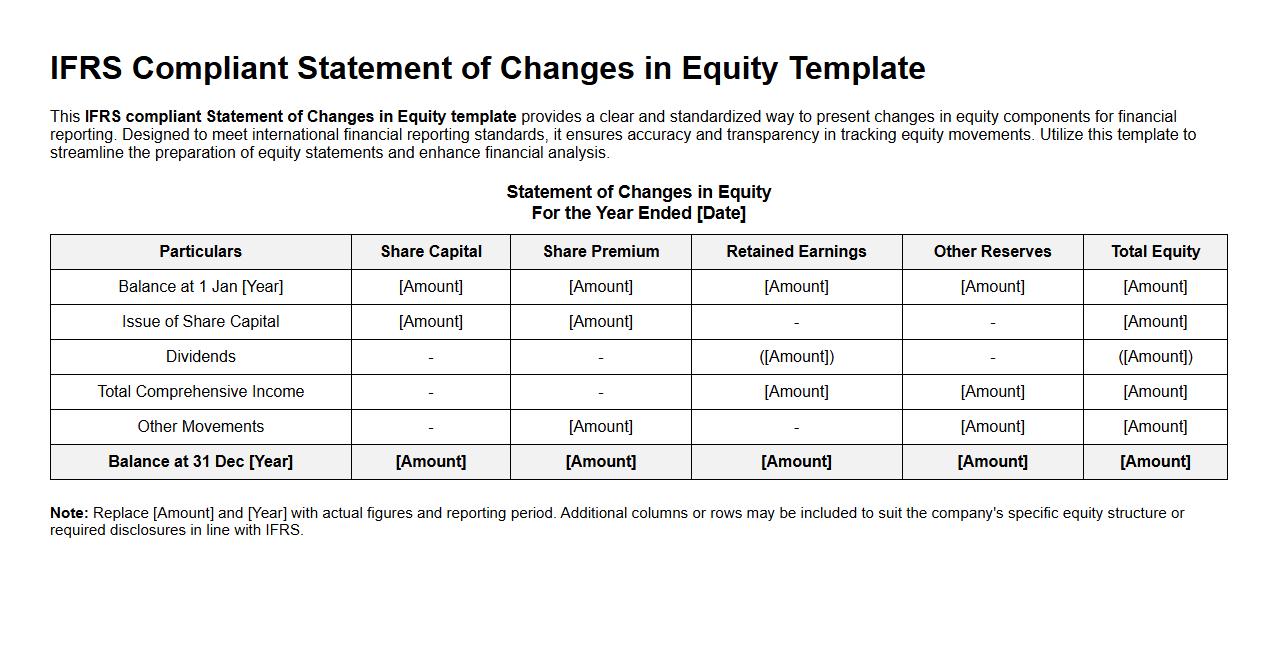

IFRS compliant Statement of Changes in Equity template

This IFRS compliant Statement of Changes in Equity template provides a clear and standardized way to present changes in equity components for financial reporting. Designed to meet international financial reporting standards, it ensures accuracy and transparency in tracking equity movements. Utilize this template to streamline the preparation of equity statements and enhance financial analysis.

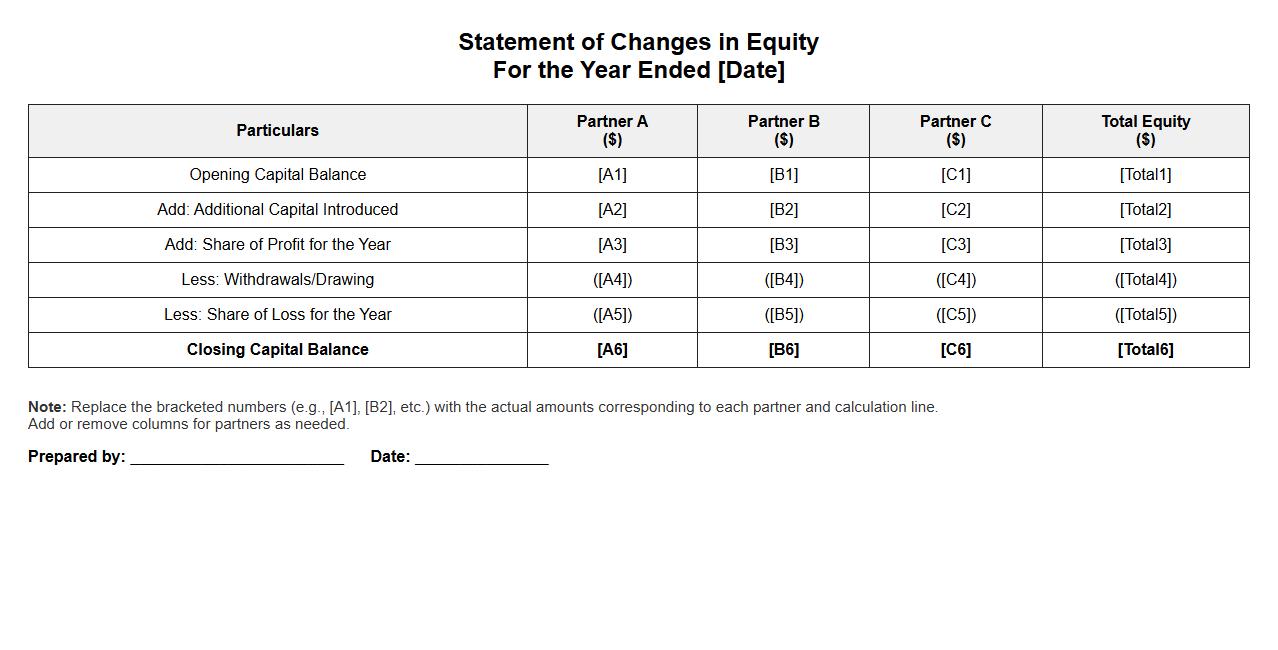

Statement of Changes in Equity template for partnership

Use this Statement of Changes in Equity template to clearly detail the equity movements within a partnership over a specified period. It summarizes capital contributions, withdrawals, and profit allocations, ensuring transparent financial reporting. Ideal for maintaining accurate and organized partnership records.

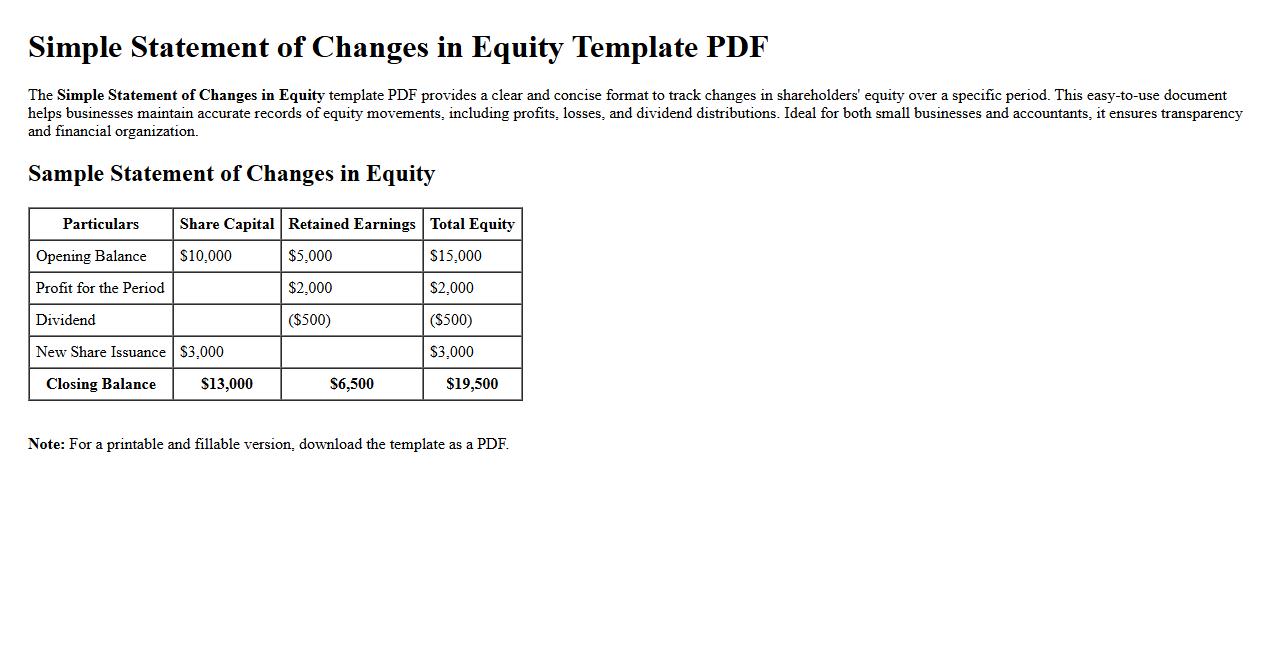

Simple Statement of Changes in Equity template PDF

The Simple Statement of Changes in Equity template PDF provides a clear and concise format to track changes in shareholders' equity over a specific period. This easy-to-use document helps businesses maintain accurate records of equity movements, including profits, losses, and dividend distributions. Ideal for both small businesses and accountants, it ensures transparency and financial organization.

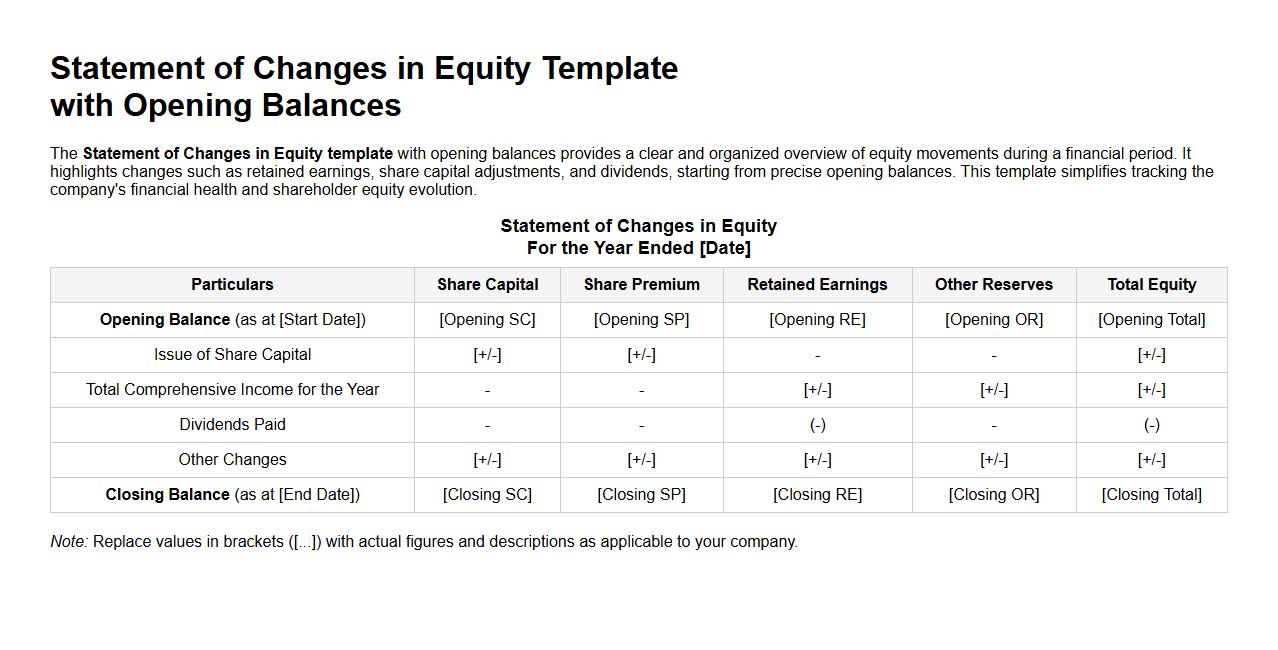

Statement of Changes in Equity template with opening balances

The Statement of Changes in Equity template with opening balances provides a clear and organized overview of equity movements during a financial period. It highlights changes such as retained earnings, share capital adjustments, and dividends, starting from precise opening balances. This template simplifies tracking the company's financial health and shareholder equity evolution.

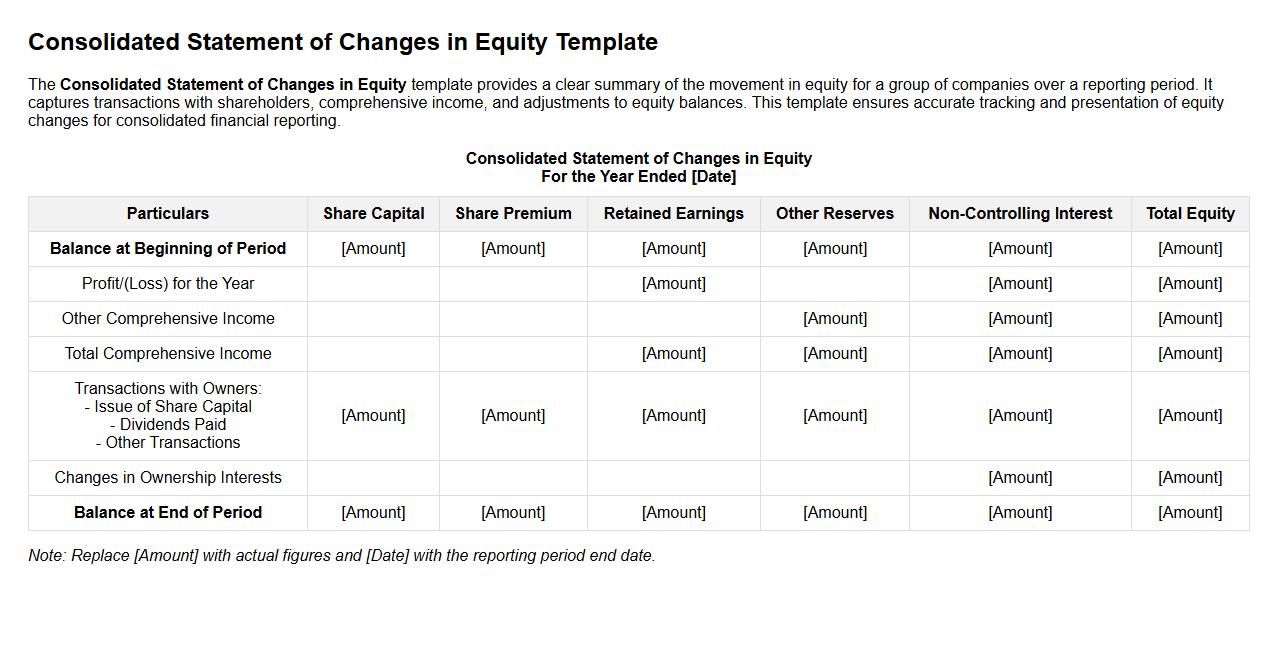

Consolidated Statement of Changes in Equity template

The Consolidated Statement of Changes in Equity template provides a clear summary of the movement in equity for a group of companies over a reporting period. It captures transactions with shareholders, comprehensive income, and adjustments to equity balances. This template ensures accurate tracking and presentation of equity changes for consolidated financial reporting.

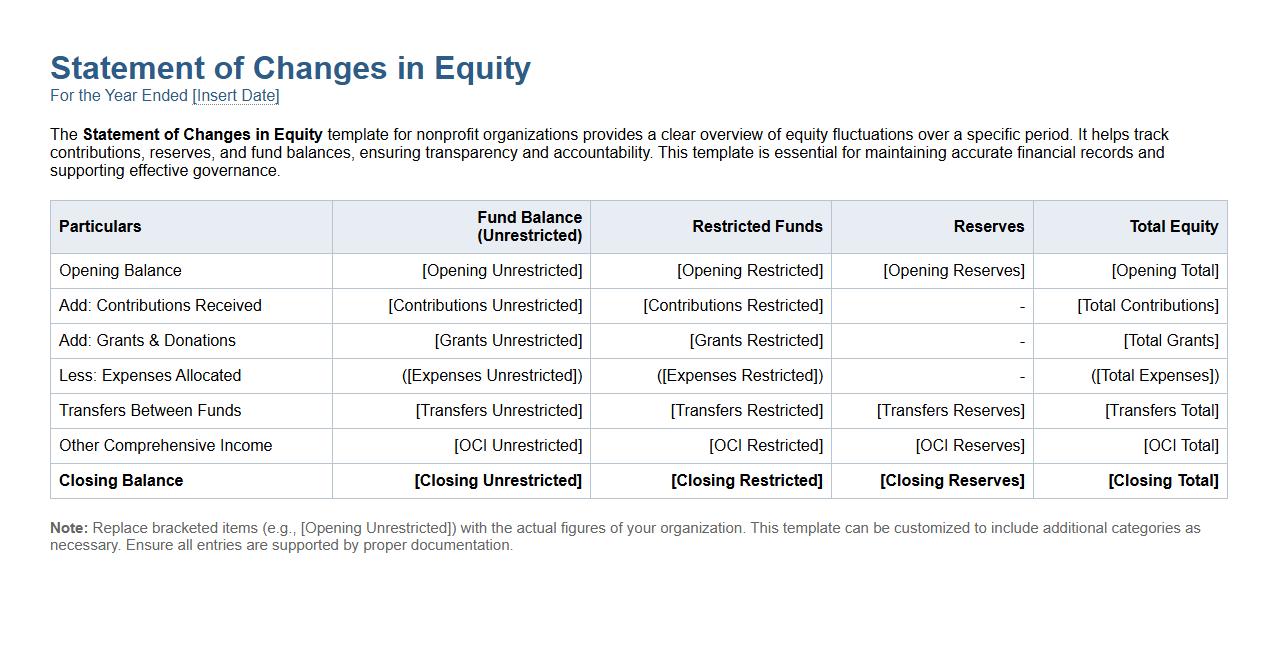

Statement of Changes in Equity template for nonprofit organizations

The Statement of Changes in Equity template for nonprofit organizations provides a clear overview of equity fluctuations over a specific period. It helps track contributions, reserves, and fund balances, ensuring transparency and accountability. This template is essential for maintaining accurate financial records and supporting effective governance.

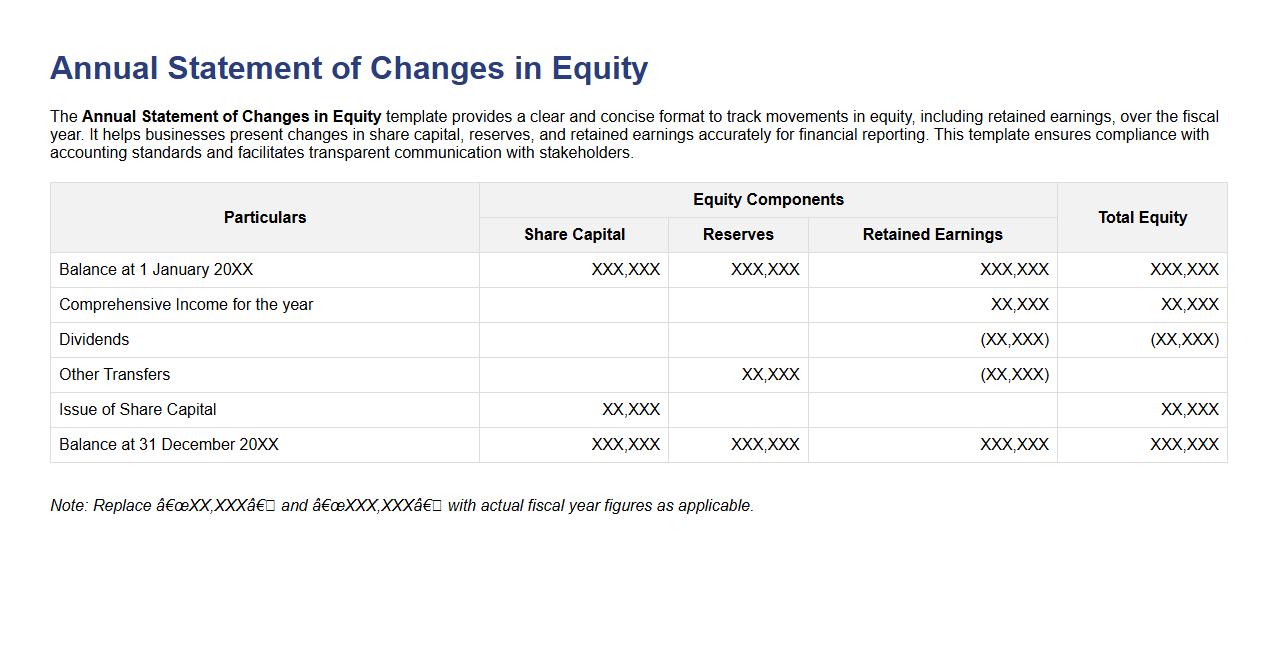

Annual Statement of Changes in Equity template with retained earnings

The Annual Statement of Changes in Equity template provides a clear and concise format to track movements in equity, including retained earnings, over the fiscal year. It helps businesses present changes in share capital, reserves, and retained earnings accurately for financial reporting. This template ensures compliance with accounting standards and facilitates transparent communication with stakeholders.

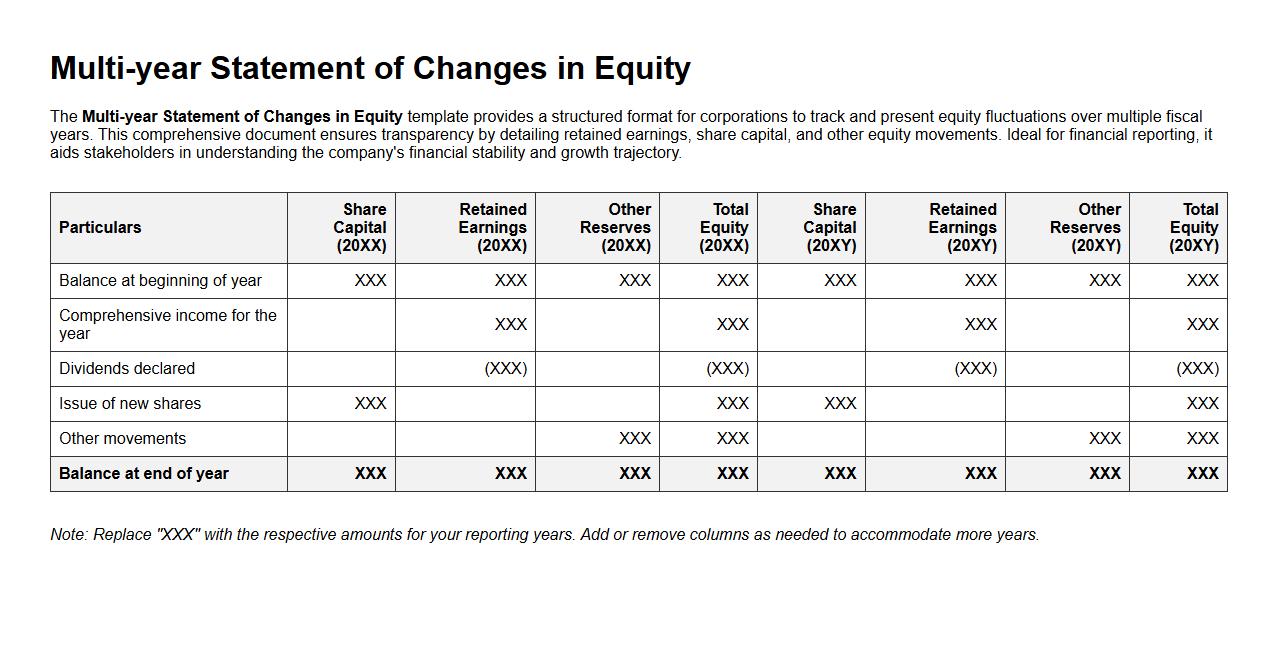

Multi-year Statement of Changes in Equity template for corporations

The Multi-year Statement of Changes in Equity template provides a structured format for corporations to track and present equity fluctuations over multiple fiscal years. This comprehensive document ensures transparency by detailing retained earnings, share capital, and other equity movements. Ideal for financial reporting, it aids stakeholders in understanding the company's financial stability and growth trajectory.

How are revaluation surplus movements reflected in the Statement of Changes in Equity?

Revaluation surplus movements are recorded in the Statement of Changes in Equity as adjustments to the revaluation reserve. These movements reflect the increase or decrease in the carrying amount of assets following a revaluation. The statement clearly distinguishes revaluation surpluses from other equity changes, ensuring transparent reporting.

What disclosures are required for share-based payment reserves?

Disclosures for share-based payment reserves must include the nature and extent of the arrangements. Entities should detail the number and weighted average exercise prices of share options granted, exercised, or expired. The fair value measurement method and assumptions used are also essential disclosures for transparency.

How does the statement address prior period error corrections?

The Statement of Changes in Equity addresses prior period error corrections by restating opening retained earnings for the earliest period presented. This adjustment ensures that the financial statements provide a true and fair view. Corrections are separately disclosed to inform users of the error's impact on equity.

In what section are dividends to owners shown and reconciled?

Dividends to owners are shown in the financing activities section and reconciled within the Statement of Changes in Equity. They represent distributions reducing retained earnings or other reserves. Proper reconciliation ensures clarity on how dividends impact the overall equity balance.

How are changes in ownership interests without loss of control presented?

Changes in ownership interests without loss of control are presented as equity transactions in the Statement of Changes in Equity. These changes do not affect the profit or loss but adjust the equity attributable to owners. Such transactions are clearly disclosed to highlight their impact on ownership structure.