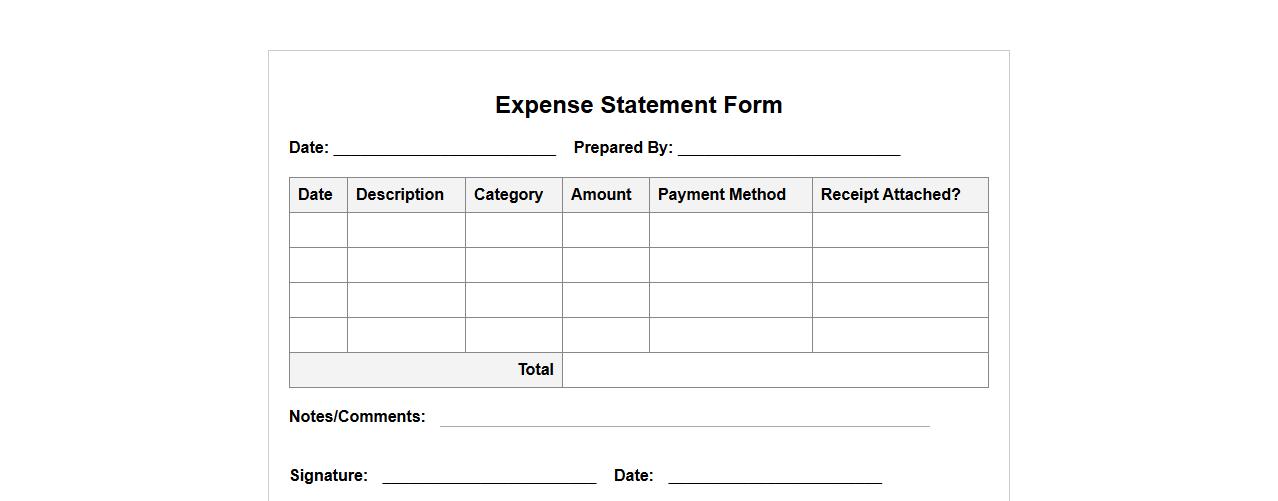

The Expense Statement Form Sample provides a clear template for documenting business or personal expenditures accurately. It includes fields for date, description, amount, and receipts to ensure thorough financial tracking. Using this form helps streamline reimbursement processes and maintain organized financial records.

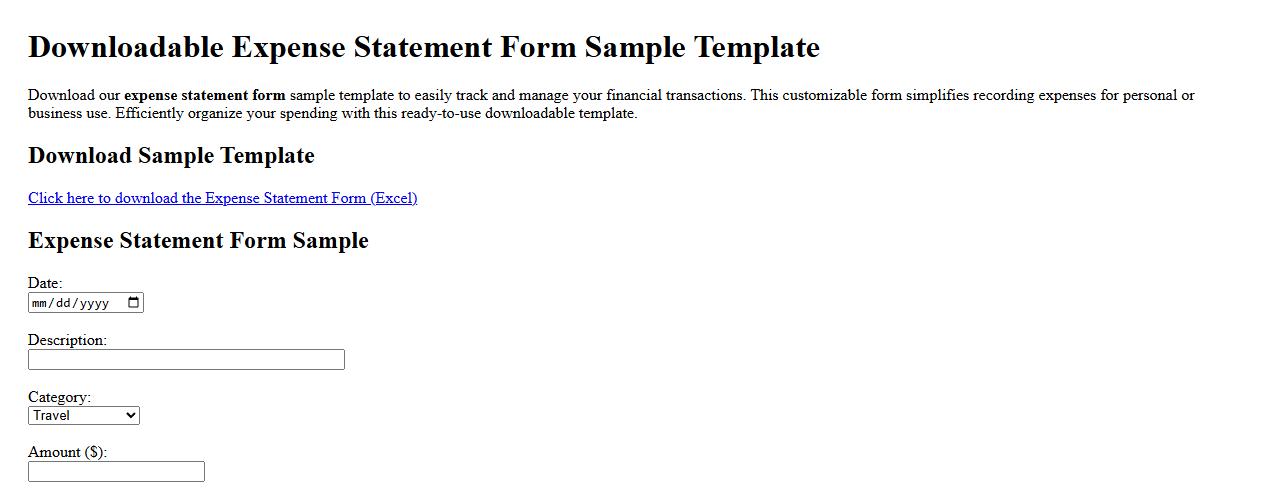

Downloadable expense statement form sample template

Download our expense statement form sample template to easily track and manage your financial transactions. This customizable form simplifies recording expenses for personal or business use. Efficiently organize your spending with this ready-to-use downloadable template.

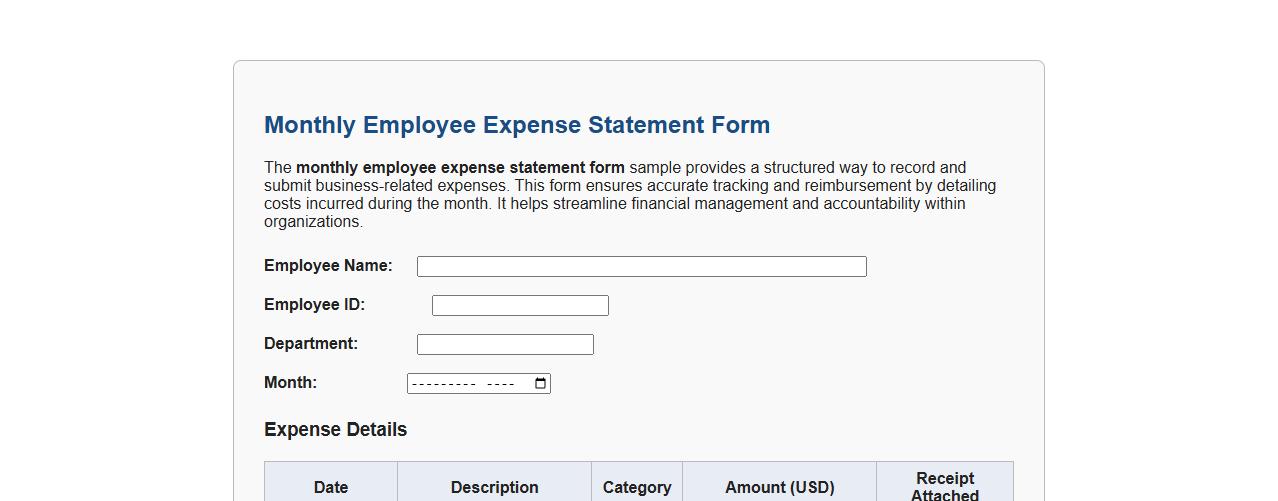

Monthly employee expense statement form sample

The monthly employee expense statement form sample provides a structured way to record and submit business-related expenses. This form ensures accurate tracking and reimbursement by detailing costs incurred during the month. It helps streamline financial management and accountability within organizations.

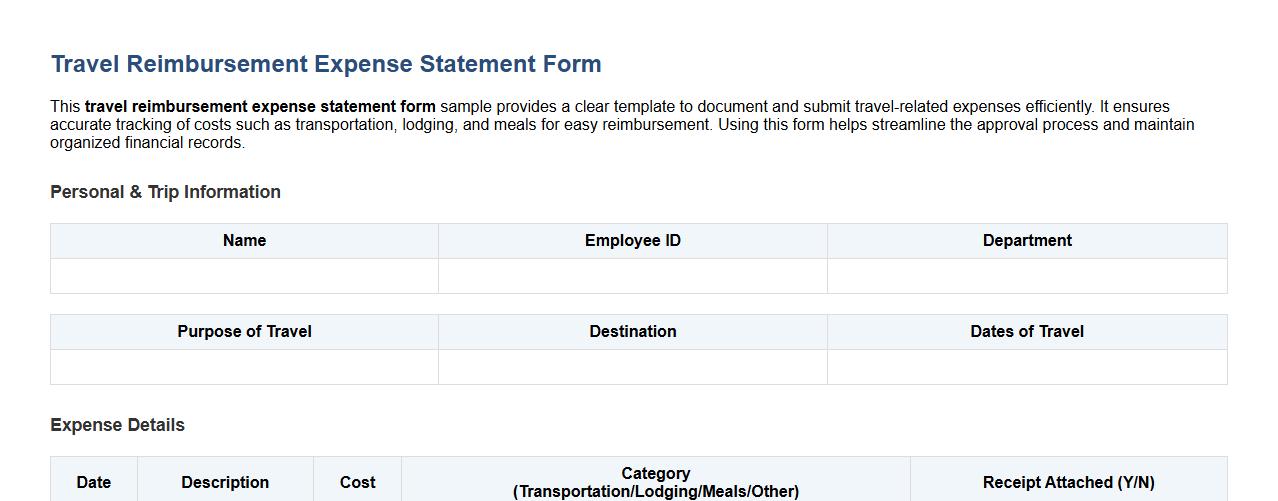

Travel reimbursement expense statement form sample

This travel reimbursement expense statement form sample provides a clear template to document and submit travel-related expenses efficiently. It ensures accurate tracking of costs such as transportation, lodging, and meals for easy reimbursement. Using this form helps streamline the approval process and maintain organized financial records.

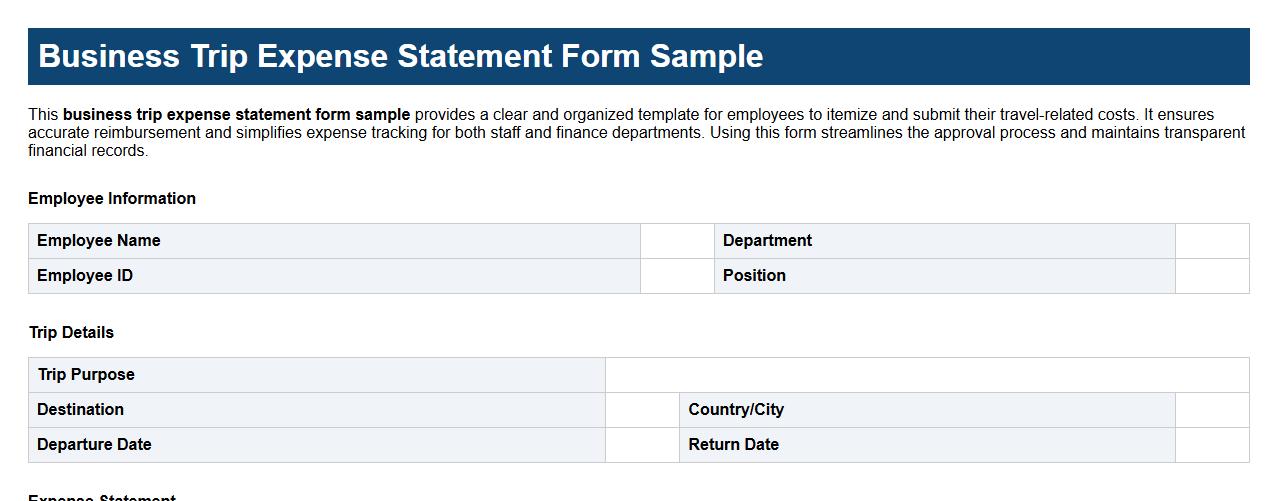

Business trip expense statement form sample

This business trip expense statement form sample provides a clear and organized template for employees to itemize and submit their travel-related costs. It ensures accurate reimbursement and simplifies expense tracking for both staff and finance departments. Using this form streamlines the approval process and maintains transparent financial records.

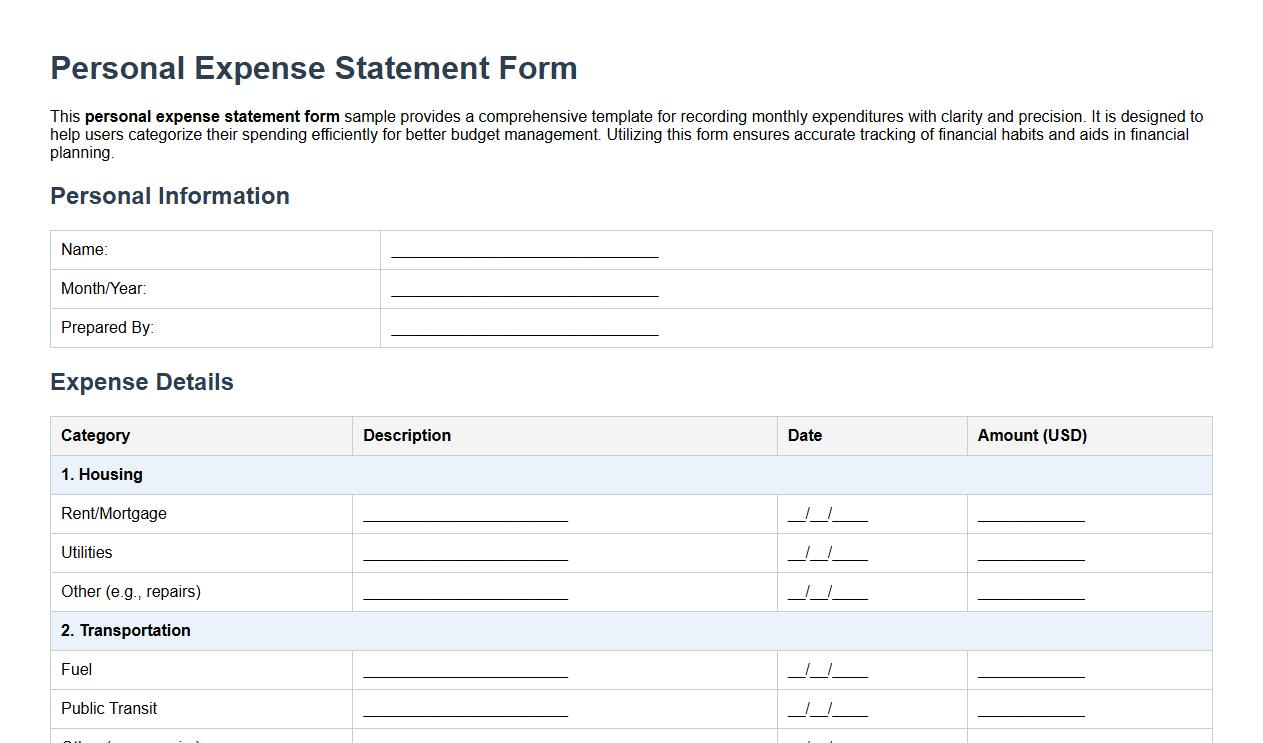

Detailed personal expense statement form sample

This personal expense statement form sample provides a comprehensive template for recording monthly expenditures with clarity and precision. It is designed to help users categorize their spending efficiently for better budget management. Utilizing this form ensures accurate tracking of financial habits and aids in financial planning.

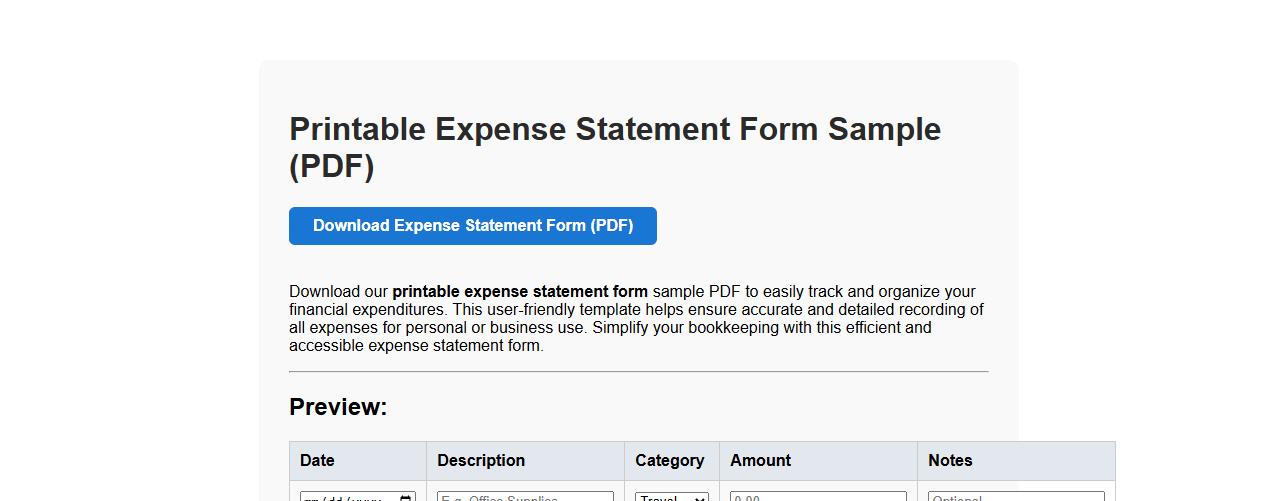

Printable expense statement form sample pdf

Download our printable expense statement form sample PDF to easily track and organize your financial expenditures. This user-friendly template helps ensure accurate and detailed recording of all expenses for personal or business use. Simplify your bookkeeping with this efficient and accessible expense statement form.

Blank expense statement form sample for small business

A blank expense statement form sample for small business helps track and manage daily expenditures effectively. It provides a structured layout for recording details like date, amount, and description of each expense. This form ensures accurate bookkeeping and simplifies financial reporting for small enterprises.

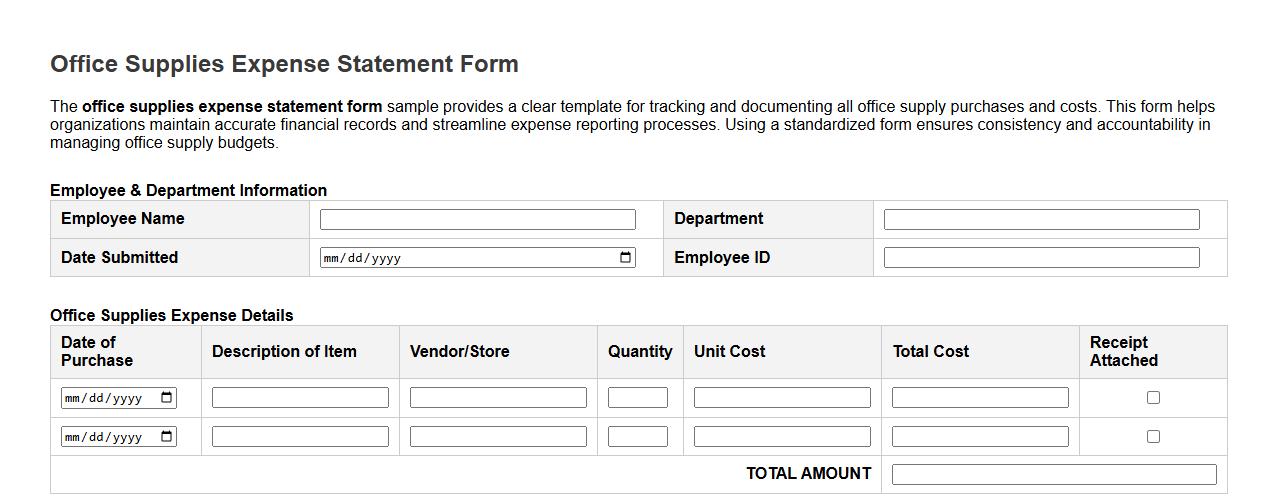

Office supplies expense statement form sample

The office supplies expense statement form sample provides a clear template for tracking and documenting all office supply purchases and costs. This form helps organizations maintain accurate financial records and streamline expense reporting processes. Using a standardized form ensures consistency and accountability in managing office supply budgets.

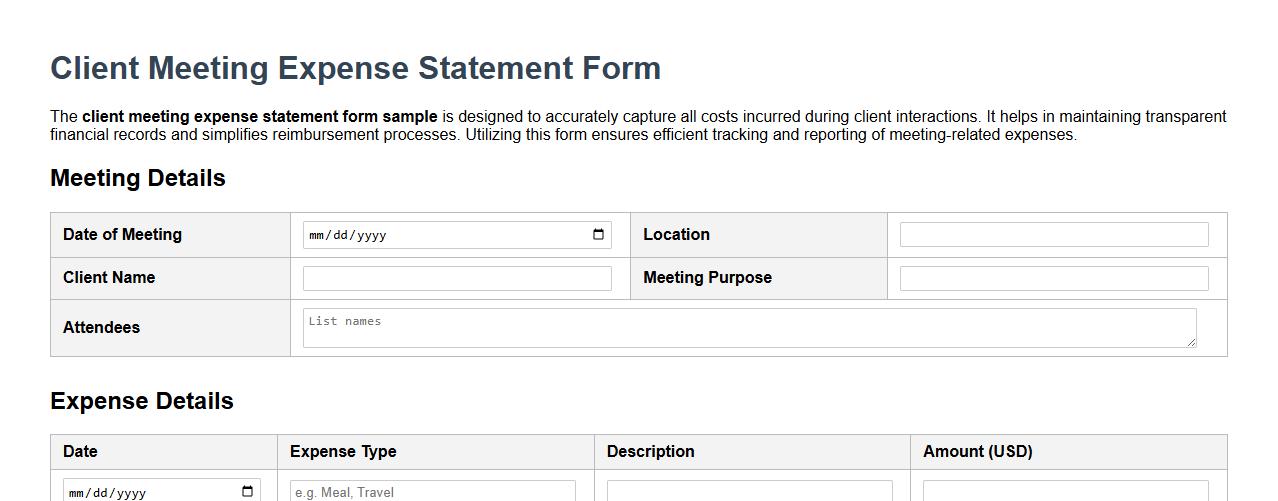

Client meeting expense statement form sample

The client meeting expense statement form sample is designed to accurately capture all costs incurred during client interactions. It helps in maintaining transparent financial records and simplifies reimbursement processes. Utilizing this form ensures efficient tracking and reporting of meeting-related expenses.

What supporting documents are required with the Expense Statement Form submission?

When submitting the Expense Statement Form, it is essential to include all original receipts and invoices that validate the expenses claimed. These documents serve as proof of purchase and ensure transparency in the reimbursement process. Additionally, any relevant approval emails or authorization slips should be attached to expedite the review.

Are digital signatures accepted on the Expense Statement Form?

Digital signatures are accepted on the Expense Statement Form, provided they comply with the organization's electronic signature policy. This method streamlines the approval workflow and enhances document security. However, the digital signature must be verifiable and compliant with legal standards.

How are mileage reimbursements calculated on the Expense Statement Form?

Mileage reimbursements are calculated based on the total number of miles driven multiplied by the organization's current per-mile reimbursement rate. Accurate documentation of the trip's purpose, distance, and dates is mandatory to support the claim. It is important to use the approved odometer readings or standardized maps for distance verification.

What is the maximum claimable amount per expense category on the form?

The maximum claimable amount per expense category is predefined by the organization's expense policy, ensuring budget control and fairness. Expense categories such as meals, travel, and accommodation each have specific ceilings to prevent excessive claims. Claimants must adhere to these limits to avoid reimbursement denial.

How should currency conversions be documented in the Expense Statement Form?

Currency conversions on the Expense Statement Form must be documented using the official exchange rate on the date the expense was incurred. It is crucial to include the source of the exchange rate, such as a financial institution or government website, in the submission. Clear documentation of the conversion rate ensures accurate reimbursement and audit compliance.