A Investment Statement Form Sample provides a clear template for detailing an individual's or entity's financial holdings, including assets, liabilities, and investment goals. This form helps streamline the process of tracking portfolio performance and making informed decisions based on accurate, organized data. Using a standardized form enhances communication between investors and financial advisors, ensuring transparency and efficiency.

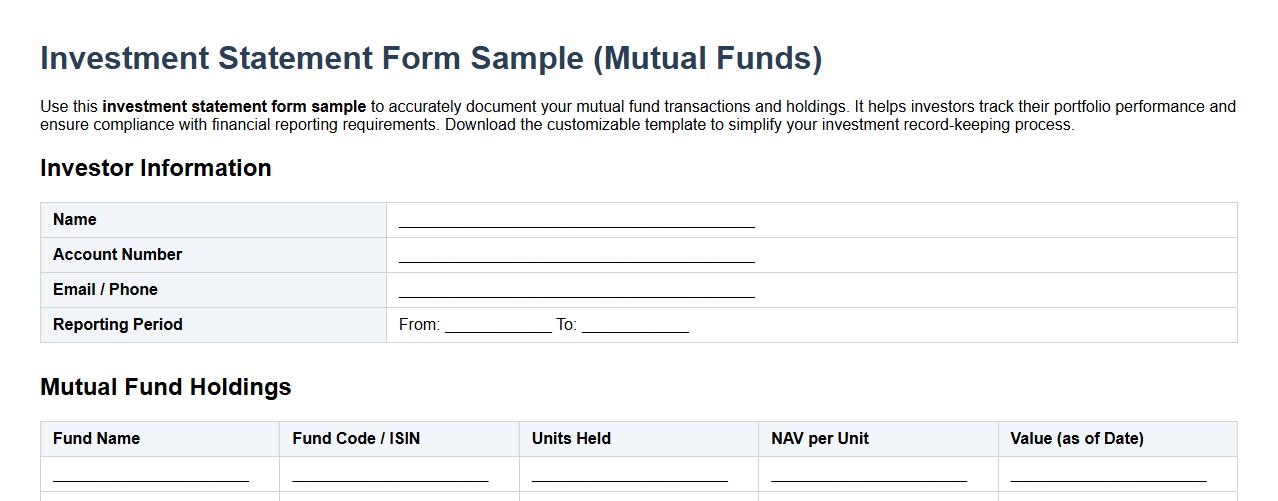

Investment statement form sample for mutual funds

Use this investment statement form sample to accurately document your mutual fund transactions and holdings. It helps investors track their portfolio performance and ensure compliance with financial reporting requirements. Download the customizable template to simplify your investment record-keeping process.

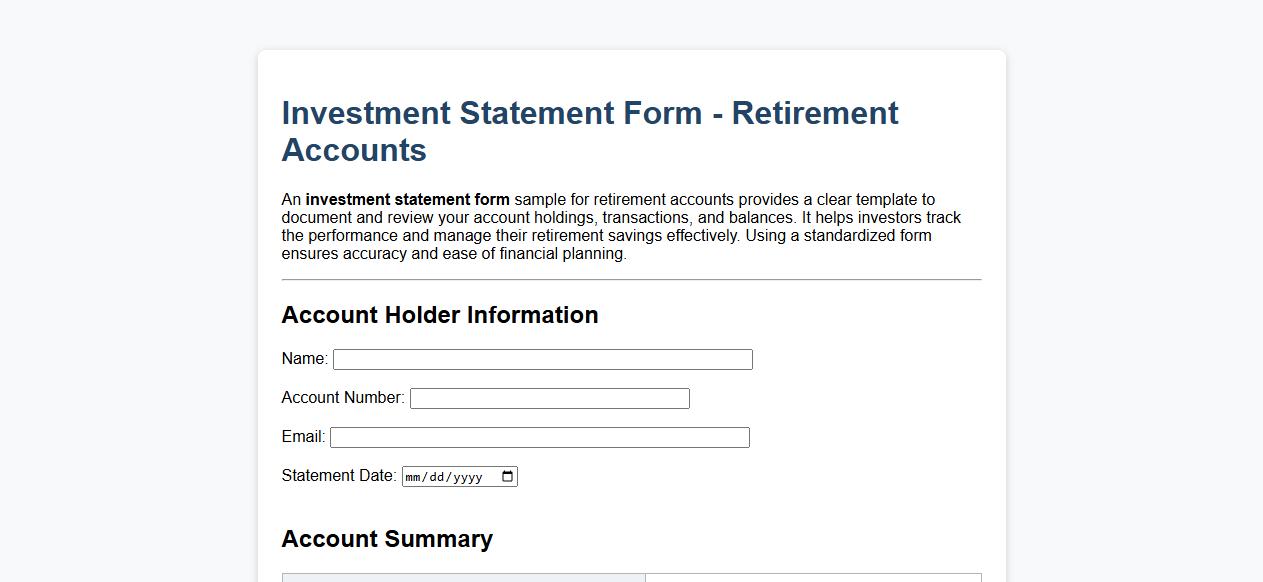

Investment statement form sample for retirement accounts

An investment statement form sample for retirement accounts provides a clear template to document and review your account holdings, transactions, and balances. It helps investors track the performance and manage their retirement savings effectively. Using a standardized form ensures accuracy and ease of financial planning.

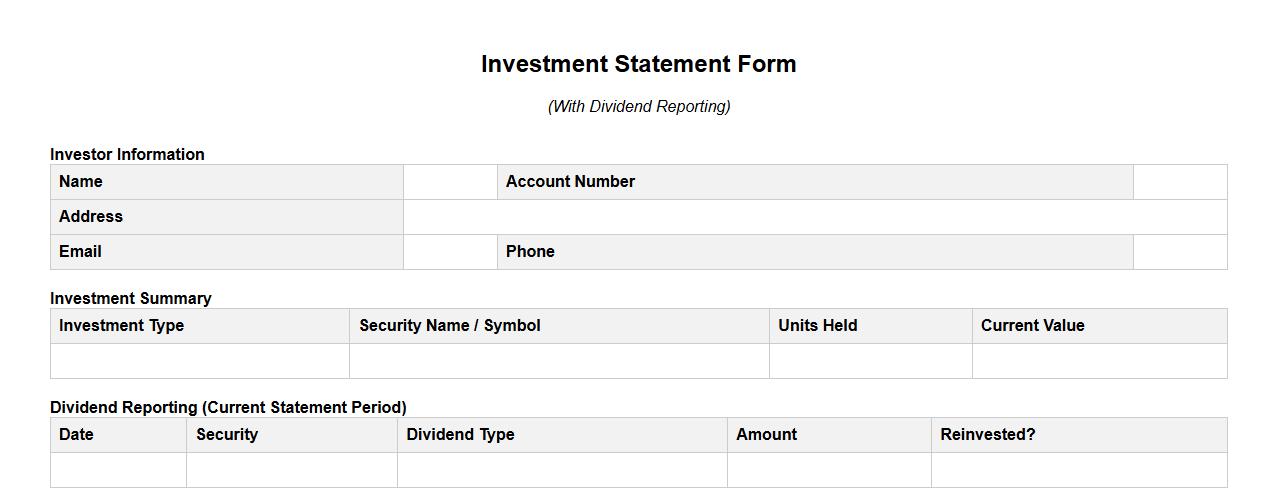

Investment statement form sample with dividend reporting

An investment statement form sample provides a clear template for reporting dividends and tracking earnings. This document ensures accurate financial records and aids in transparent investment management. Using standardized forms simplifies tax reporting and financial analysis for investors.

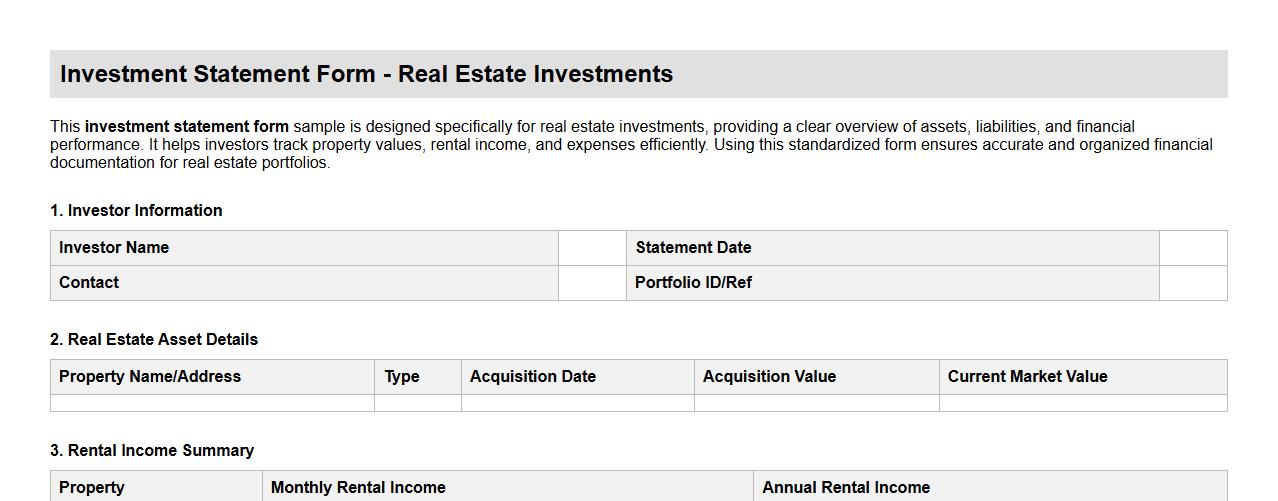

Investment statement form sample for real estate investments

This investment statement form sample is designed specifically for real estate investments, providing a clear overview of assets, liabilities, and financial performance. It helps investors track property values, rental income, and expenses efficiently. Using this standardized form ensures accurate and organized financial documentation for real estate portfolios.

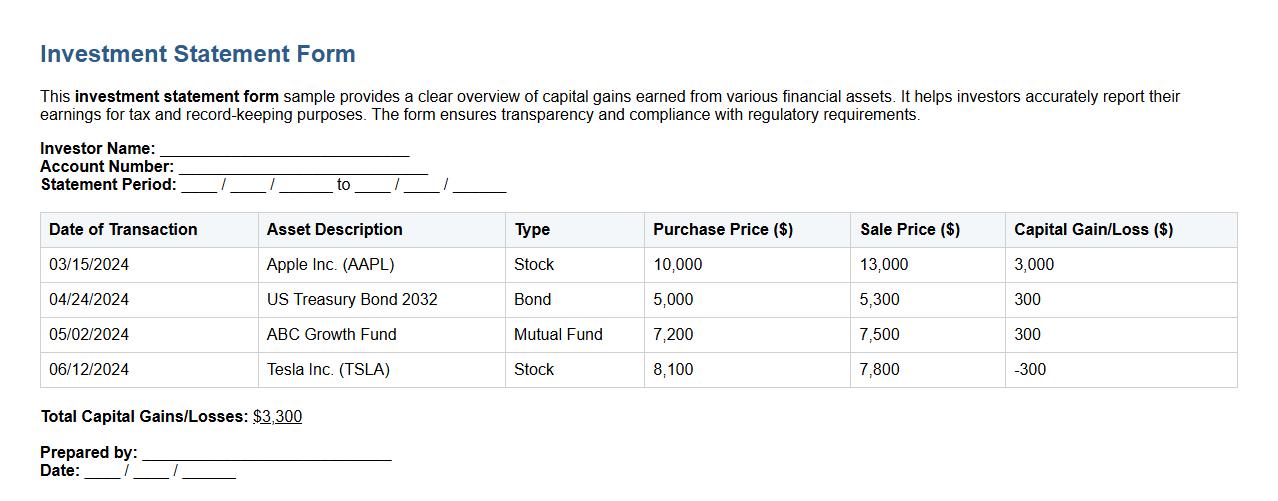

Investment statement form sample showing capital gains

This investment statement form sample provides a clear overview of capital gains earned from various financial assets. It helps investors accurately report their earnings for tax and record-keeping purposes. The form ensures transparency and compliance with regulatory requirements.

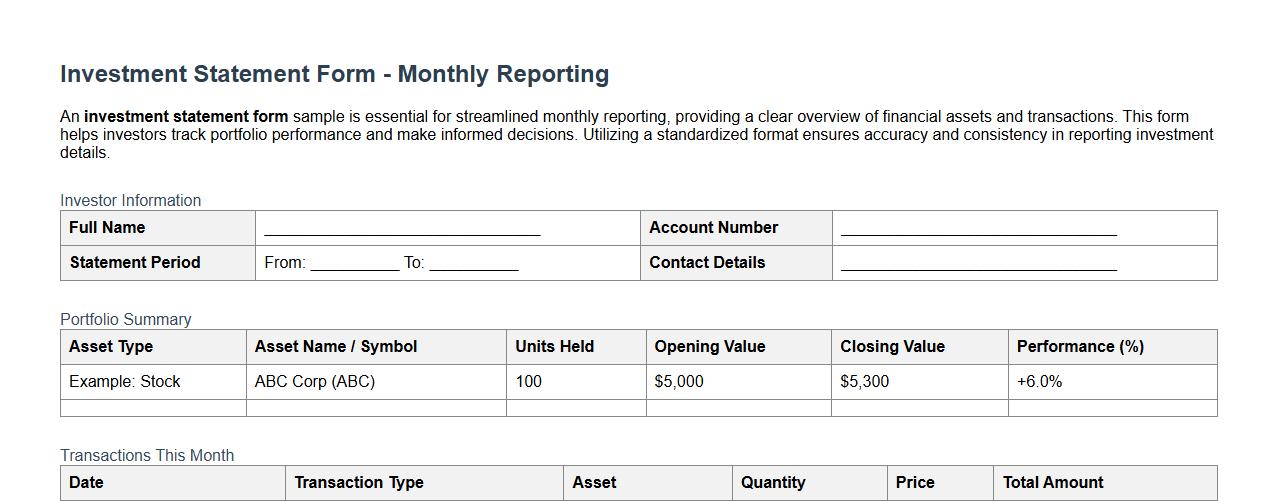

Investment statement form sample for monthly reporting

An investment statement form sample is essential for streamlined monthly reporting, providing a clear overview of financial assets and transactions. This form helps investors track portfolio performance and make informed decisions. Utilizing a standardized format ensures accuracy and consistency in reporting investment details.

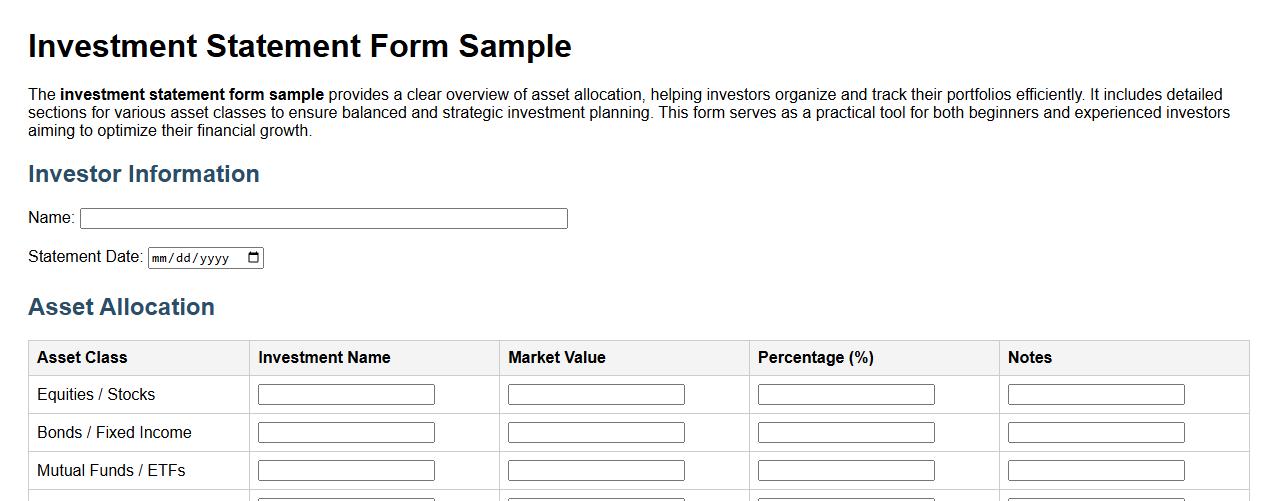

Investment statement form sample with detailed asset allocation

The investment statement form sample provides a clear overview of asset allocation, helping investors organize and track their portfolios efficiently. It includes detailed sections for various asset classes to ensure balanced and strategic investment planning. This form serves as a practical tool for both beginners and experienced investors aiming to optimize their financial growth.

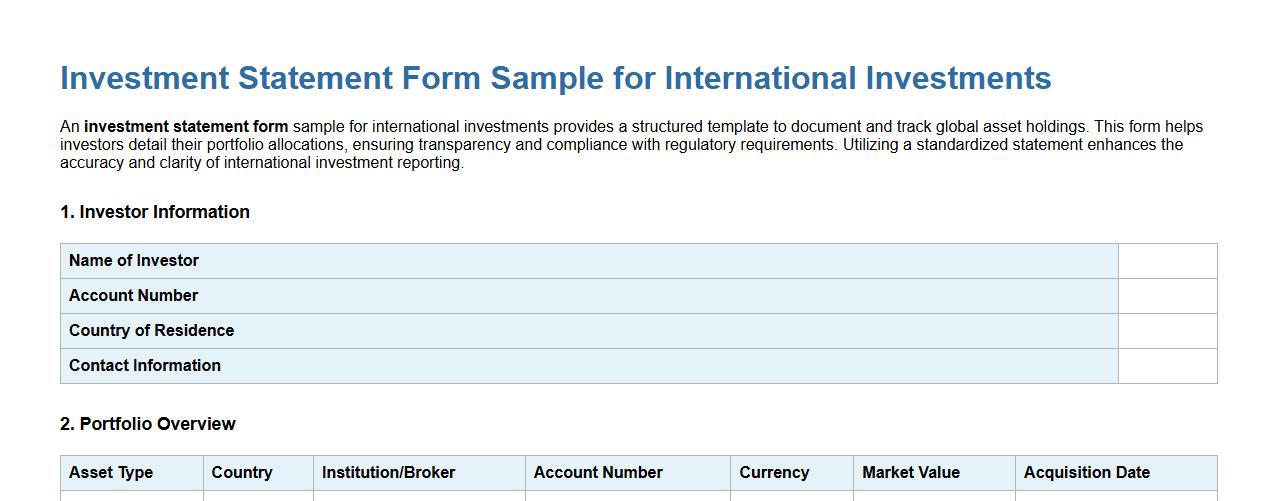

Investment statement form sample for international investments

An investment statement form sample for international investments provides a structured template to document and track global asset holdings. This form helps investors detail their portfolio allocations, ensuring transparency and compliance with regulatory requirements. Utilizing a standardized statement enhances the accuracy and clarity of international investment reporting.

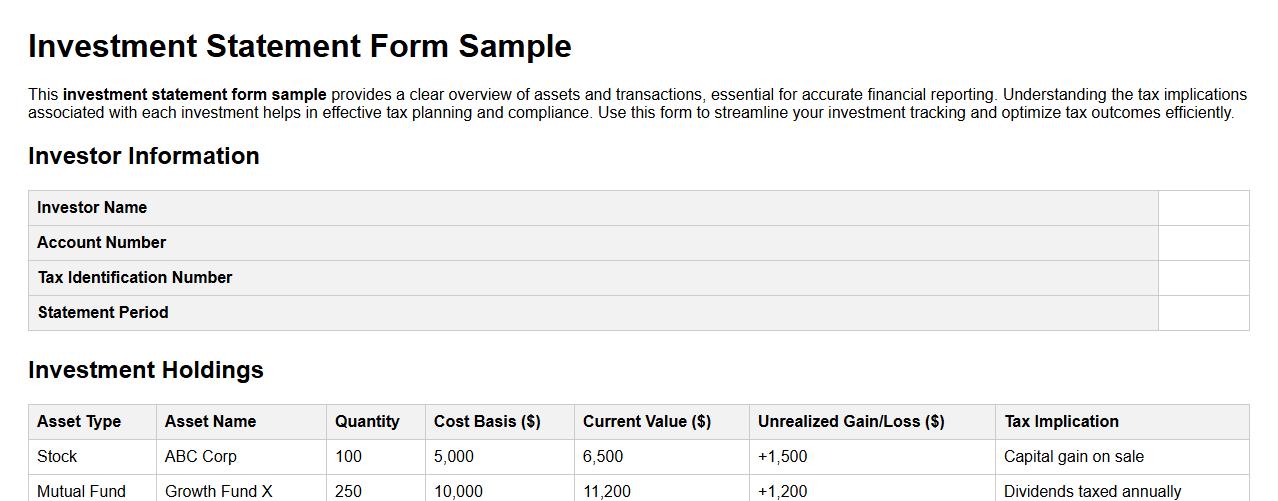

Investment statement form sample with tax implications

This investment statement form sample provides a clear overview of assets and transactions, essential for accurate financial reporting. Understanding the tax implications associated with each investment helps in effective tax planning and compliance. Use this form to streamline your investment tracking and optimize tax outcomes efficiently.

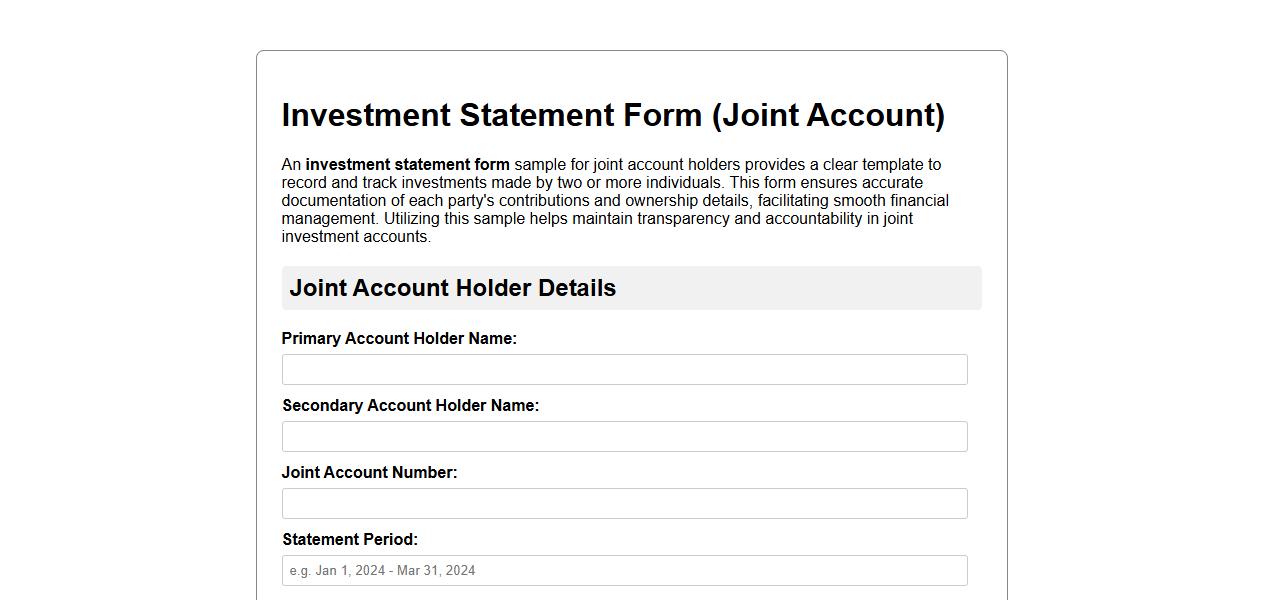

Investment statement form sample for joint account holders

An investment statement form sample for joint account holders provides a clear template to record and track investments made by two or more individuals. This form ensures accurate documentation of each party's contributions and ownership details, facilitating smooth financial management. Utilizing this sample helps maintain transparency and accountability in joint investment accounts.

What specific asset classes are detailed in the Investment Statement Form?

The Investment Statement Form specifically details various asset classes such as equities, fixed income, real estate, and cash equivalents. It provides comprehensive sections to individually report each asset class to aid in precise portfolio evaluation. This structured approach ensures clarity and facilitates effective investment analysis.

Does the form require disclosure of beneficiary information?

Yes, the form mandates the disclosure of beneficiary information to ensure proper allocation of assets upon the investor's demise. This section collects essential details including names and relationships of beneficiaries. Accurate beneficiary details help in regulatory compliance and estate planning.

Are performance benchmarks included for comparative analysis in the document?

The form includes designated areas to report performance benchmarks that allow comparative analysis against the portfolio's returns. These benchmarks help investors assess the effectiveness of their investment strategies. Including this data enhances transparency and informed decision-making.

Is there a section for outlining tax implications within the statement?

Indeed, the Investment Statement Form contains a dedicated section outlining tax implications tied to various asset holdings. This section helps investors understand potential tax liabilities and benefits. Being informed about tax effects assists in optimizing investment outcomes.

How does the form address joint account investment reporting?

The form includes specific provisions for joint account investment reporting to capture details of all account holders. It requires identification and signature information of each party involved in the joint account. This ensures accurate record-keeping and legal compliance for joint investments.