A Credit Card Statement Template provides a structured format to organize monthly credit card transactions, balances, and payment due dates. It helps users track their spending, monitor fees and interest charges, and manage their finances effectively. Using a clear and detailed template ensures accurate record-keeping and simplifies budgeting.

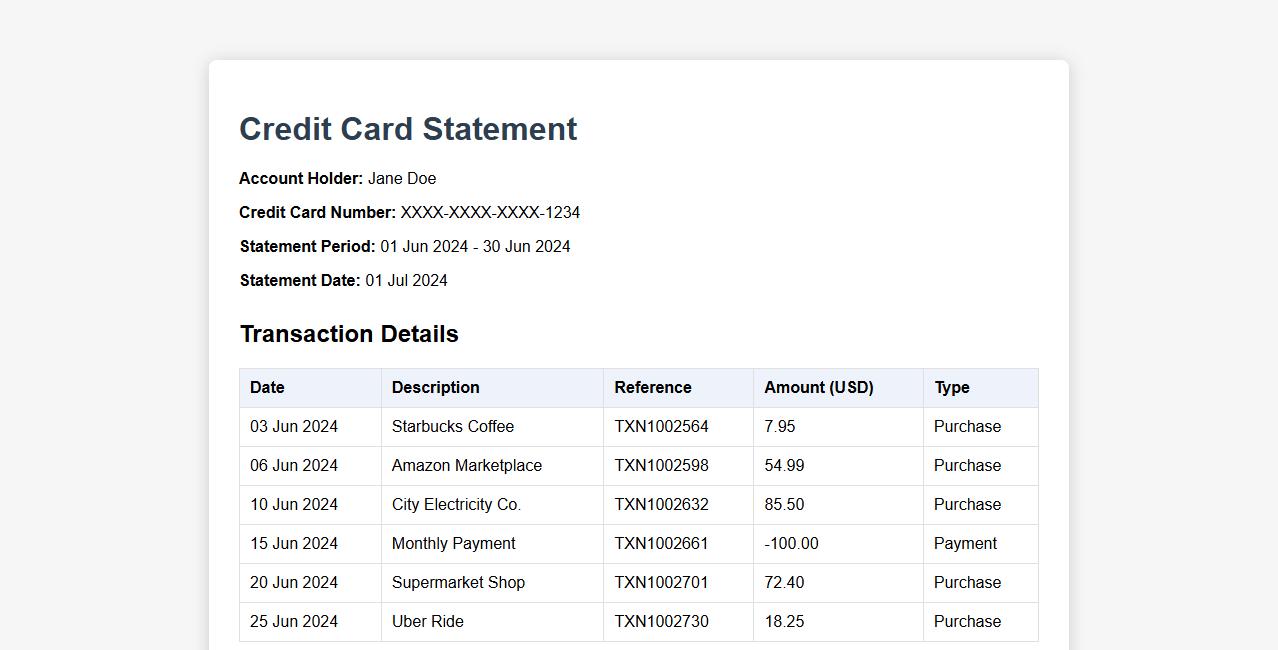

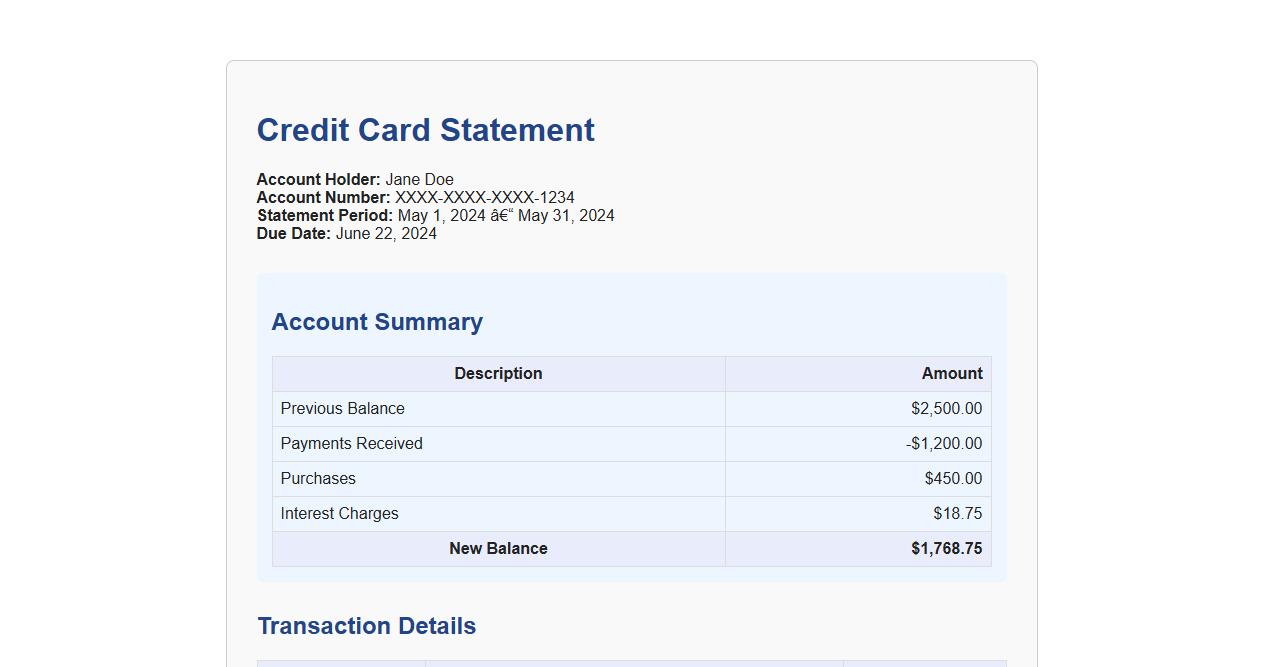

Credit card statement template with transaction details

Enhance your financial tracking with our credit card statement template that clearly displays all transaction details. This template is designed for easy readability and quick reference of your purchases and payments. Stay organized and manage your expenses effectively with this comprehensive statement layout.

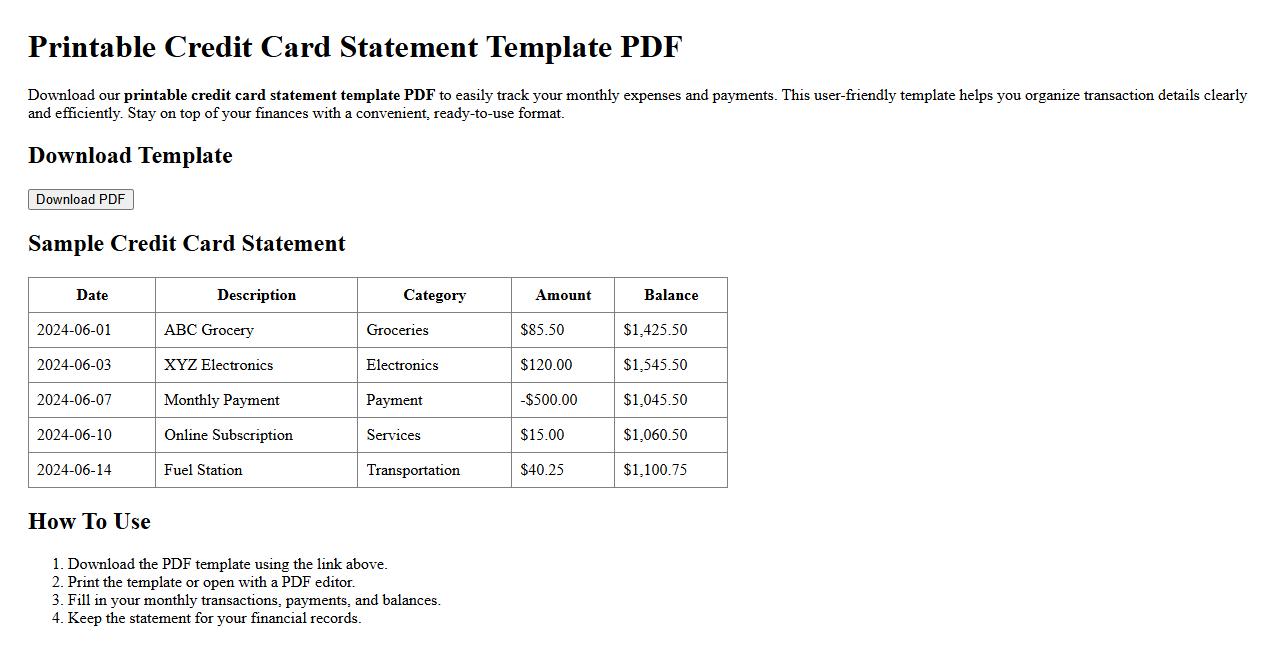

Printable credit card statement template PDF

Download our printable credit card statement template PDF to easily track your monthly expenses and payments. This user-friendly template helps you organize transaction details clearly and efficiently. Stay on top of your finances with a convenient, ready-to-use format.

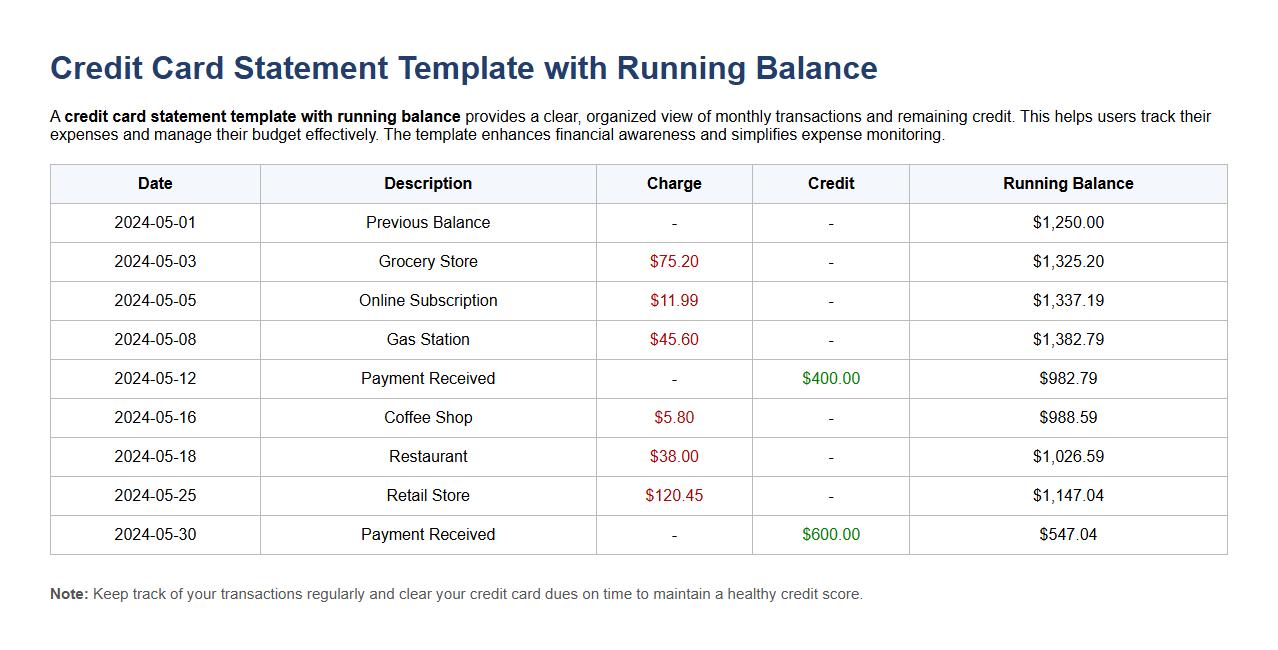

Credit card statement template with running balance

A credit card statement template with running balance provides a clear, organized view of monthly transactions and remaining credit. This helps users track their expenses and manage their budget effectively. The template enhances financial awareness and simplifies expense monitoring.

Free downloadable credit card statement template for reconciliation

Download our free credit card statement template to easily reconcile your expenses and payments. This user-friendly template helps track transactions efficiently and ensures accurate financial management. Simplify your monthly reconciliation process with this customizable and downloadable tool.

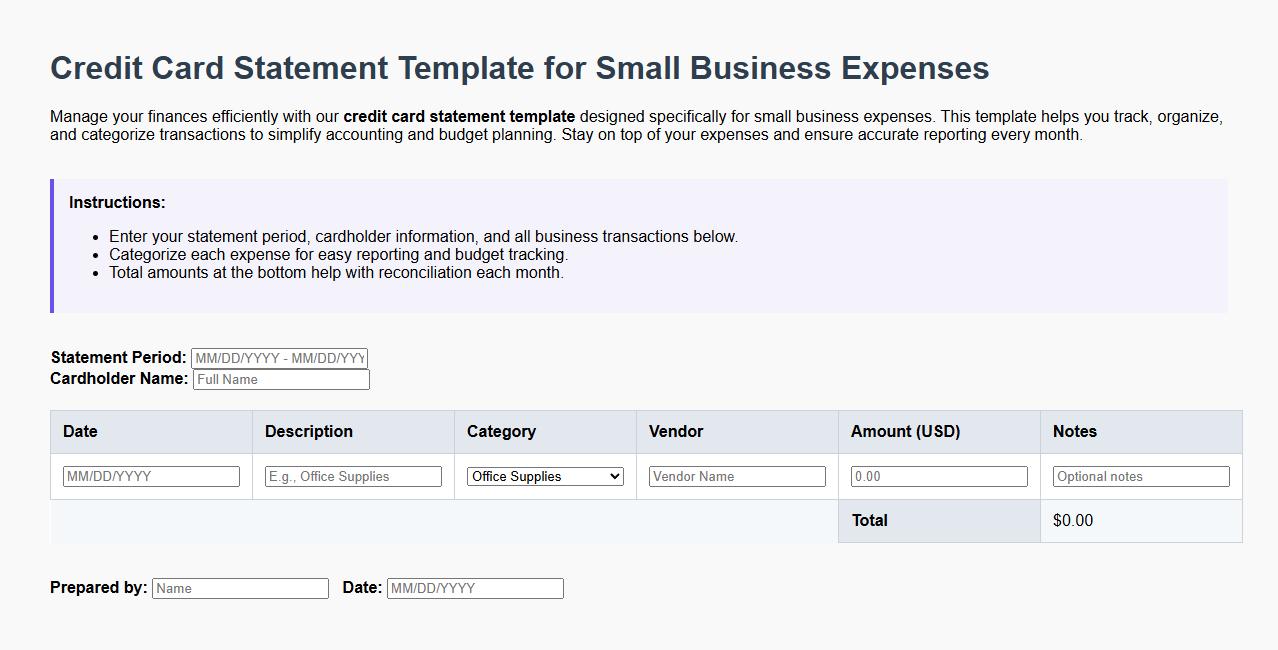

Credit card statement template for small business expenses

Manage your finances efficiently with our credit card statement template designed specifically for small business expenses. This template helps you track, organize, and categorize transactions to simplify accounting and budget planning. Stay on top of your expenses and ensure accurate reporting every month.

Customizable credit card statement template in Google Sheets

Create a customizable credit card statement template in Google Sheets to easily track your expenses and payments. This template allows you to personalize categories, dates, and amounts for efficient financial management. Stay organized and monitor your credit card usage with a user-friendly, editable spreadsheet.

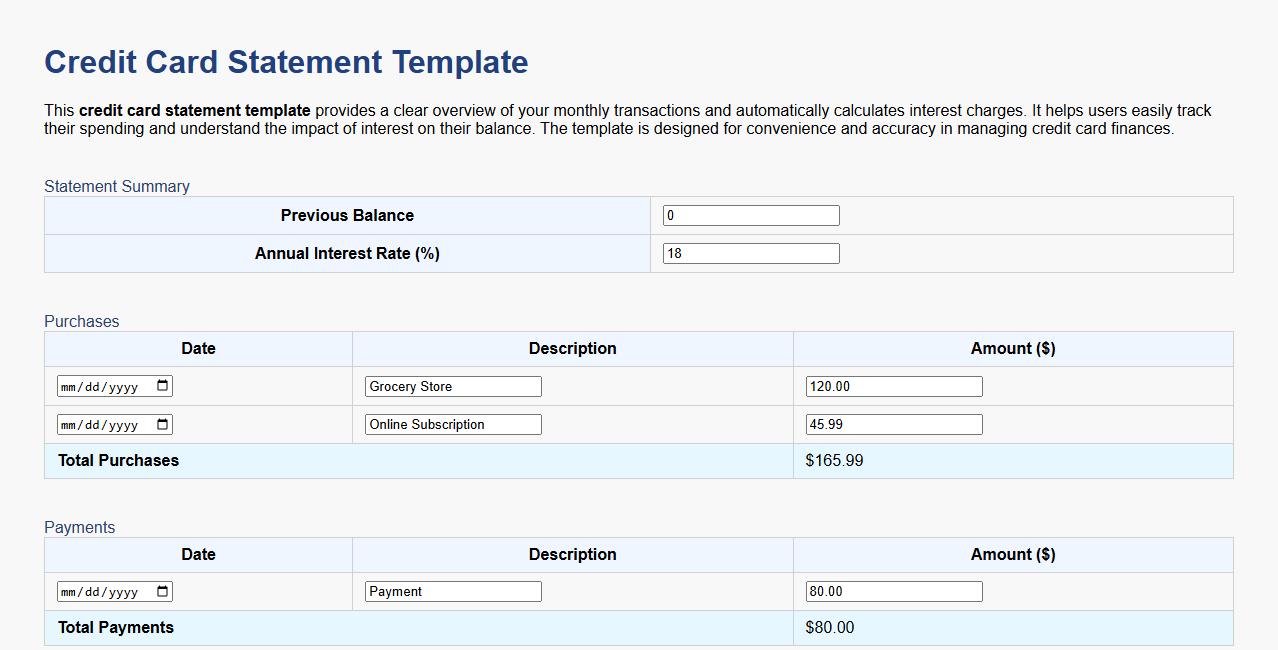

Credit card statement template including interest calculations

This credit card statement template provides a clear overview of your monthly transactions and automatically calculates interest charges. It helps users easily track their spending and understand the impact of interest on their balance. The template is designed for convenience and accuracy in managing credit card finances.

Sample credit card statement template with rewards summary

This credit card statement template provides a clear overview of your monthly charges and payments. It includes a detailed rewards summary to help you track earned points and benefits easily. Designed for simplicity and accuracy, it ensures you stay informed about your spending and rewards status.

Credit card statement template for personal budgeting

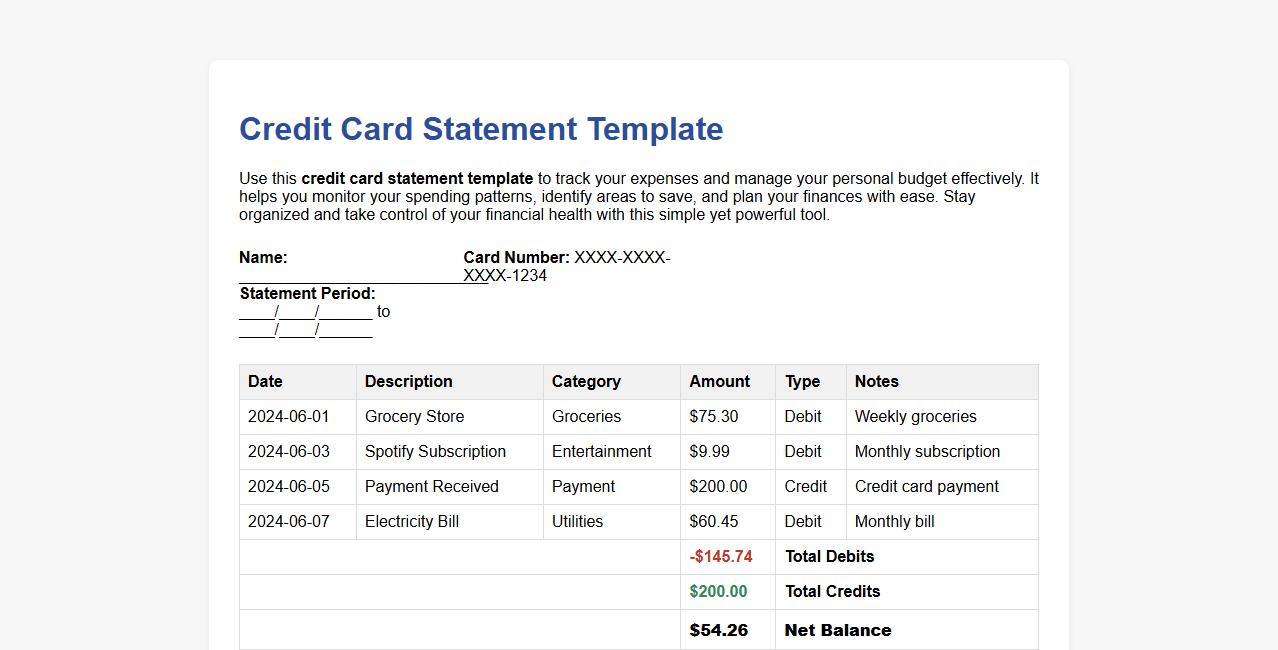

Use this credit card statement template to track your expenses and manage your personal budget effectively. It helps you monitor your spending patterns, identify areas to save, and plan your finances with ease. Stay organized and take control of your financial health with this simple yet powerful tool.

How can discrepancies in a credit card statement letter be formally disputed?

To formally dispute discrepancies in a credit card statement, the cardholder must submit a written dispute letter to the credit card issuer. The letter should clearly outline the disputed charges with supporting evidence, such as receipts or transaction records. It is critical to send the dispute via certified mail to ensure the statement is received and documented.

What specific information is mandatory in a credit card statement notification letter?

A credit card statement notification letter must include the cardholder's name, account number, and the statement period. It should detail the total balance due, minimum payment amount, and payment due date. Additionally, outlining recent transactions and any applicable fees is essential for transparency.

How should late payment warnings be communicated in a statement letter?

Late payment warnings should be clearly highlighted within the credit card statement letter to alert the cardholder. The notification must specify the late fee amount and potential impacts on the credit score. Including instructions on how to avoid future late payments enhances customer compliance.

What are the privacy requirements for mailing credit card statement letters?

Privacy requirements mandate that credit card statement letters be sent in sealed envelopes to protect sensitive financial information. The issuer must comply with regulations like the Gramm-Leach-Bliley Act to safeguard customer data. Ensuring that statements are only accessible to the intended recipient minimizes the risk of identity theft.

How to request a detailed transaction breakdown in a credit card statement letter?

Cardholders can request a detailed transaction breakdown by submitting a formal written request to the credit card issuer. This request should specify the statement period and particular transactions needing clarification. Prompt response from the issuer, typically within 30 days, is a standard requirement.