A Credit Card Statement Form Sample provides a clear template for detailing monthly transactions, including purchases, payments, and interest charges. This form helps users track their spending patterns and manage their finances effectively. It typically includes essential fields such as account number, statement period, balance, and minimum payment due.

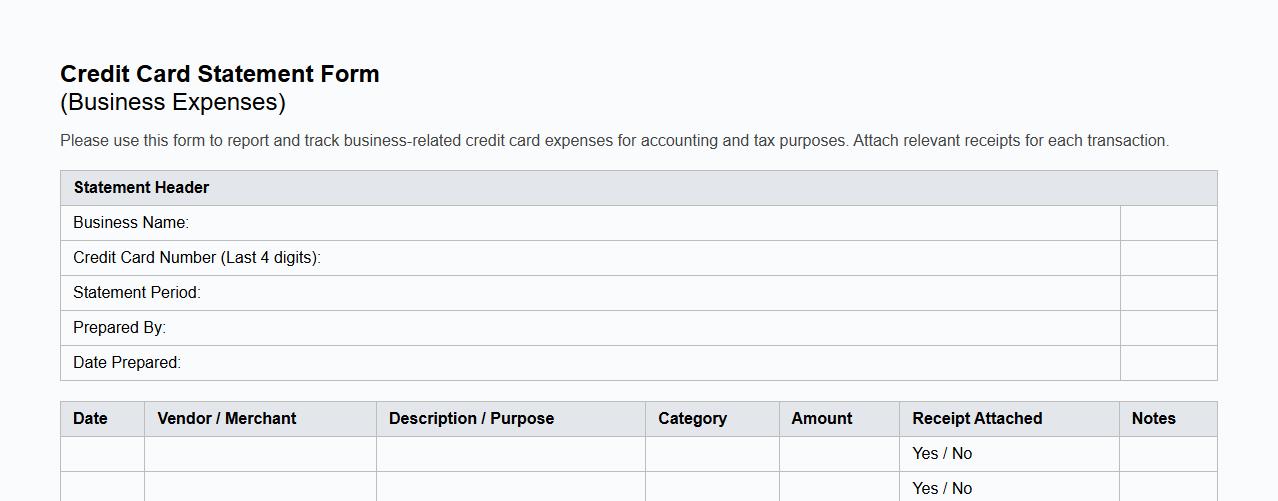

Credit card statement form sample for business expenses

The credit card statement form sample for business expenses provides a clear template to track and organize financial transactions efficiently. It helps businesses maintain accurate records for accounting and tax purposes. Using this form ensures transparency and simplifies expense management.

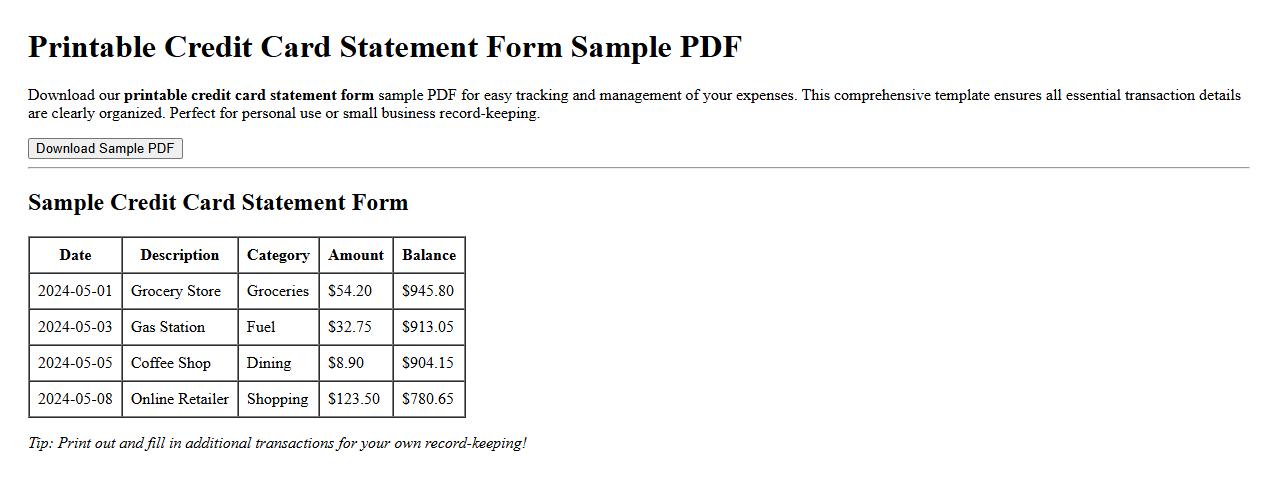

Printable credit card statement form sample PDF

Download our printable credit card statement form sample PDF for easy tracking and management of your expenses. This comprehensive template ensures all essential transaction details are clearly organized. Perfect for personal use or small business record-keeping.

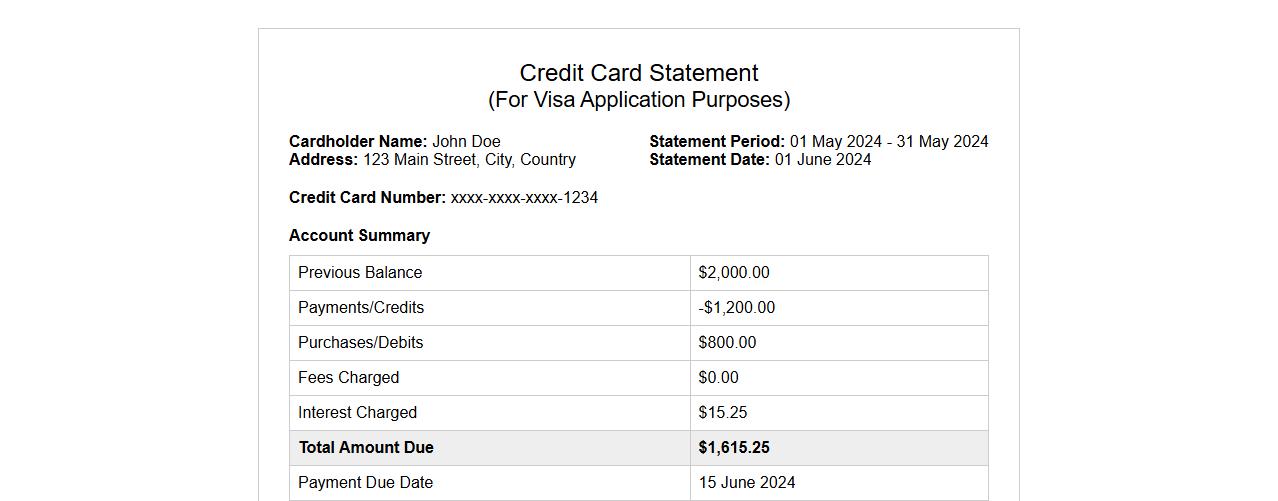

Credit card statement form sample for visa application

The credit card statement form sample for visa application provides a clear template to showcase your financial transactions and balance. It helps consulates verify your financial stability and supports the authenticity of your visa request. Using this sample ensures you include all necessary details for a smooth application process.

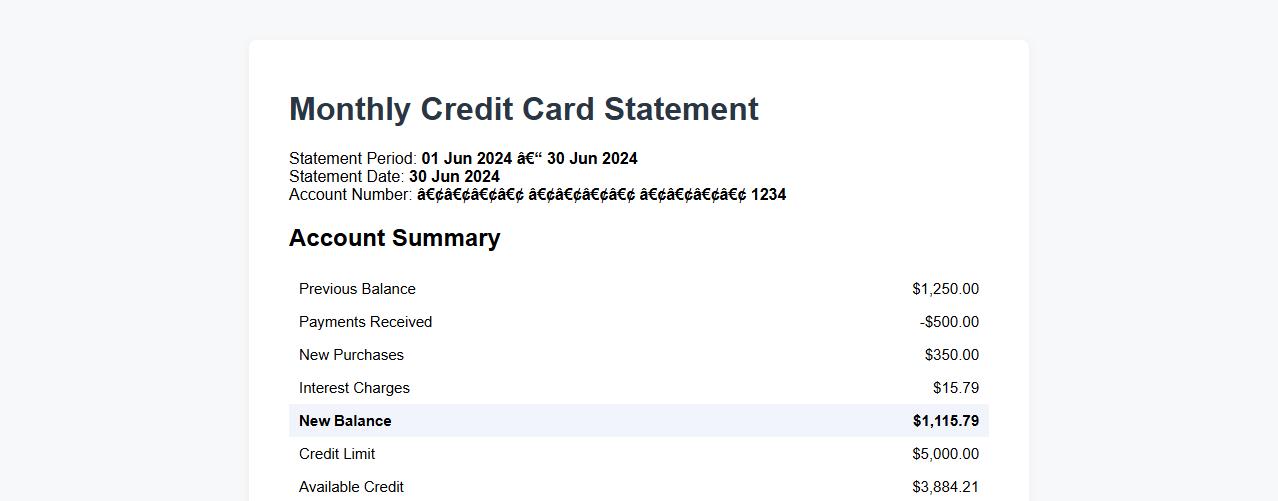

Monthly credit card statement form sample example

A monthly credit card statement form sample example provides a clear layout for reviewing your card transactions, payments, and outstanding balances. It helps users track spending and manage finances effectively. Utilizing a standardized format ensures accurate and easy-to-understand billing information.

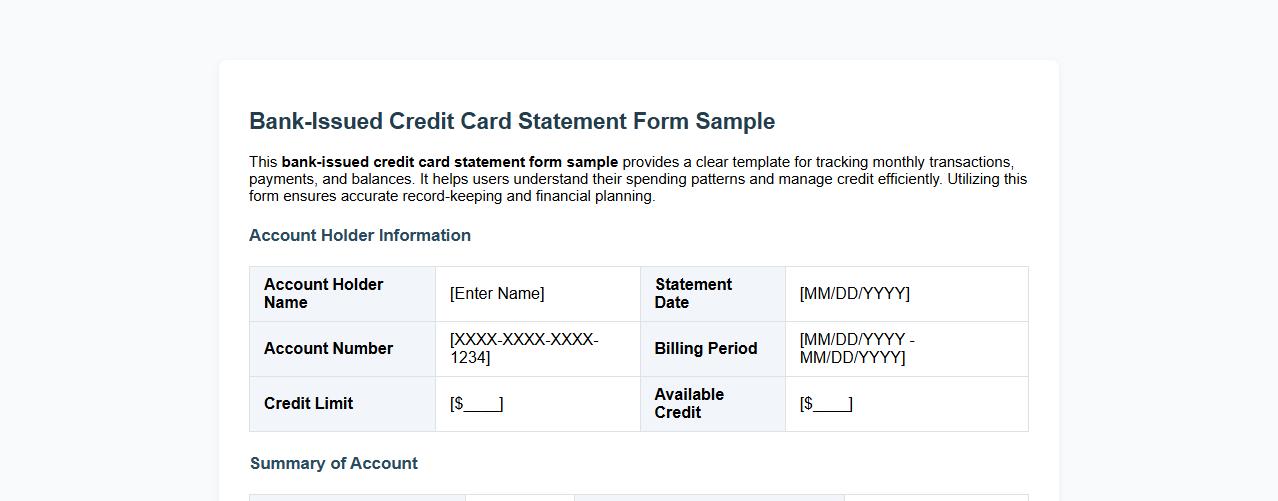

Bank-issued credit card statement form sample

This bank-issued credit card statement form sample provides a clear template for tracking monthly transactions, payments, and balances. It helps users understand their spending patterns and manage credit efficiently. Utilizing this form ensures accurate record-keeping and financial planning.

Credit card statement form sample for loan approval

Use this credit card statement form sample to accurately document your monthly transactions, which is essential for loan approval. Providing a clear and detailed statement helps lenders assess your financial stability and creditworthiness. Ensure all information is complete and up-to-date for a smooth loan application process.

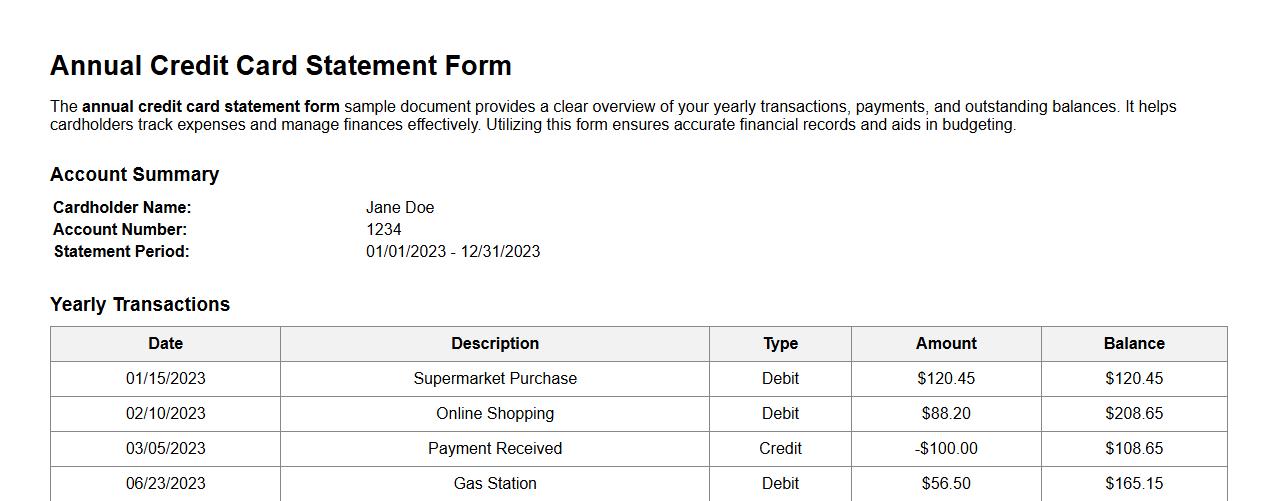

Annual credit card statement form sample document

The annual credit card statement form sample document provides a clear overview of your yearly transactions, payments, and outstanding balances. It helps cardholders track expenses and manage finances effectively. Utilizing this form ensures accurate financial records and aids in budgeting.

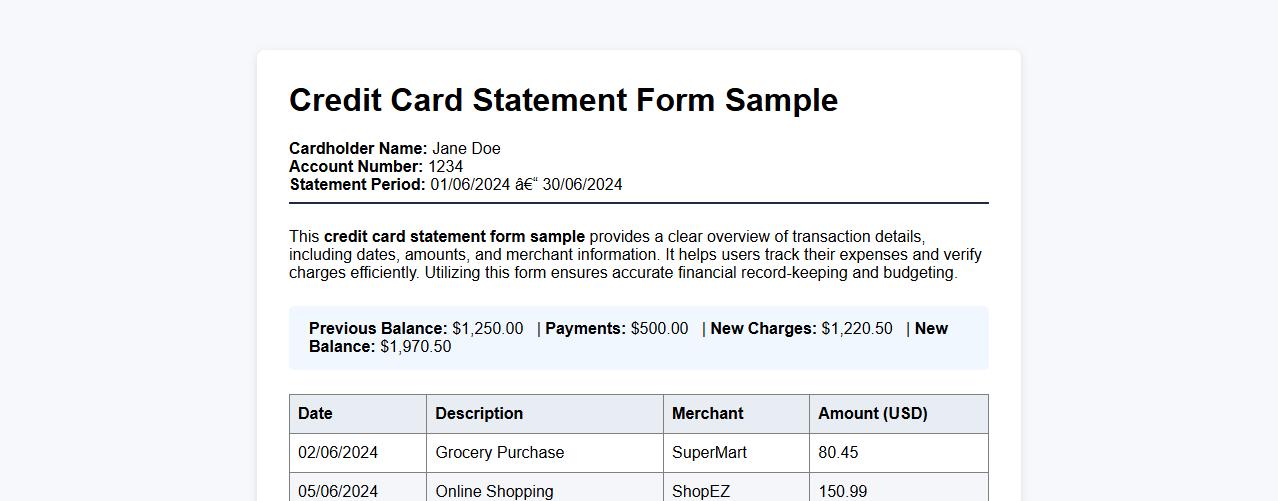

Credit card statement form sample with transaction details

This credit card statement form sample provides a clear overview of transaction details, including dates, amounts, and merchant information. It helps users track their expenses and verify charges efficiently. Utilizing this form ensures accurate financial record-keeping and budgeting.

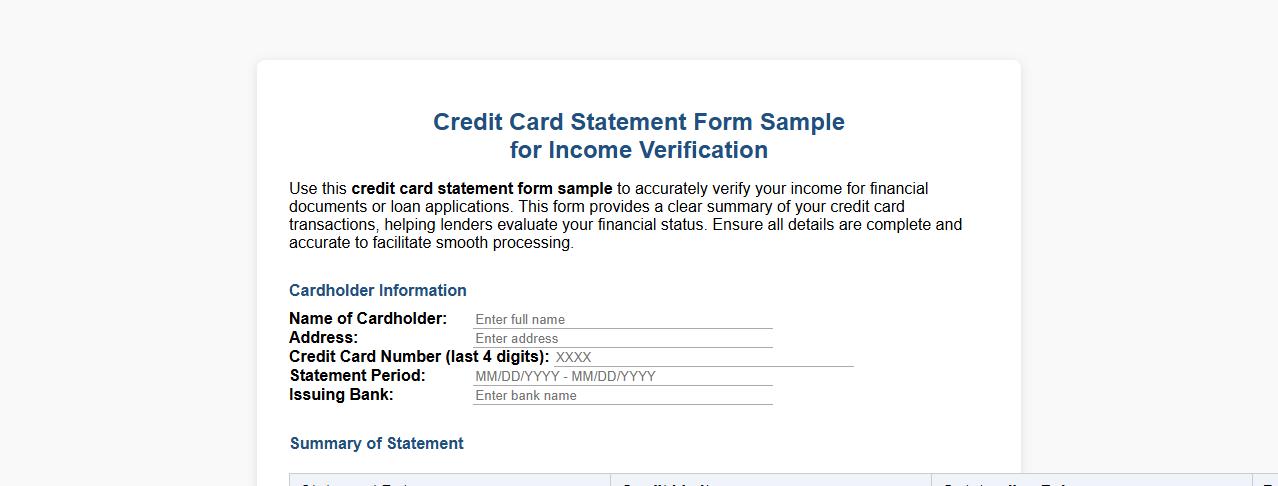

Credit card statement form sample for income verification

Use this credit card statement form sample to accurately verify your income for financial documents or loan applications. This form provides a clear summary of your credit card transactions, helping lenders evaluate your financial status. Ensure all details are complete and accurate to facilitate smooth processing.

What specific sections must be included in a compliant credit card statement form?

A compliant credit card statement form must include the account summary section, detailing the previous balance, payments, and new charges. It should also have the payment information, specifying the minimum amount due and the due date clearly. Additionally, the statement must provide a transaction summary listing all debits and credits during the billing cycle.

How does the statement format address dispute resolution instructions?

The statement format incorporates a dedicated dispute resolution section to guide cardholders. This section outlines the process for reporting errors or fraudulent charges, including timelines and contact information. It ensures consumers understand their rights under applicable credit regulations to contest charges effectively.

Which details are required for itemizing interest and fees on the statement?

The statement must itemize all interest charges by type, such as purchase interest or cash advance interest, showing the rate and period. Fees, including late payment and over-limit fees, need clear identification and amounts charged. This detailed breakdown helps ensure transparency and compliance with financial disclosure laws.

Are electronic credit card statement forms different in legal structure from paper versions?

Electronic credit card statements must comply with the same legal requirements as paper versions, maintaining identical disclosure and formatting standards. However, they may include additional features such as clickable links and digital signatures to enhance usability. Both formats ensure consumer protection through regulated content regardless of delivery method.

What privacy notices are mandated on a credit card statement form?

Credit card statements must include a privacy notice that explains how consumer data is collected, used, and protected. It typically outlines policies related to information sharing with third parties and consumer rights under privacy laws. This notice helps build trust and ensures transparency in data handling practices.