A Earnings Statement Form Sample provides a clear template for detailing an employee's income, including wages, bonuses, and deductions. This form ensures accurate record-keeping and helps employees verify their compensation. Employers use it to maintain transparency and comply with payroll regulations.

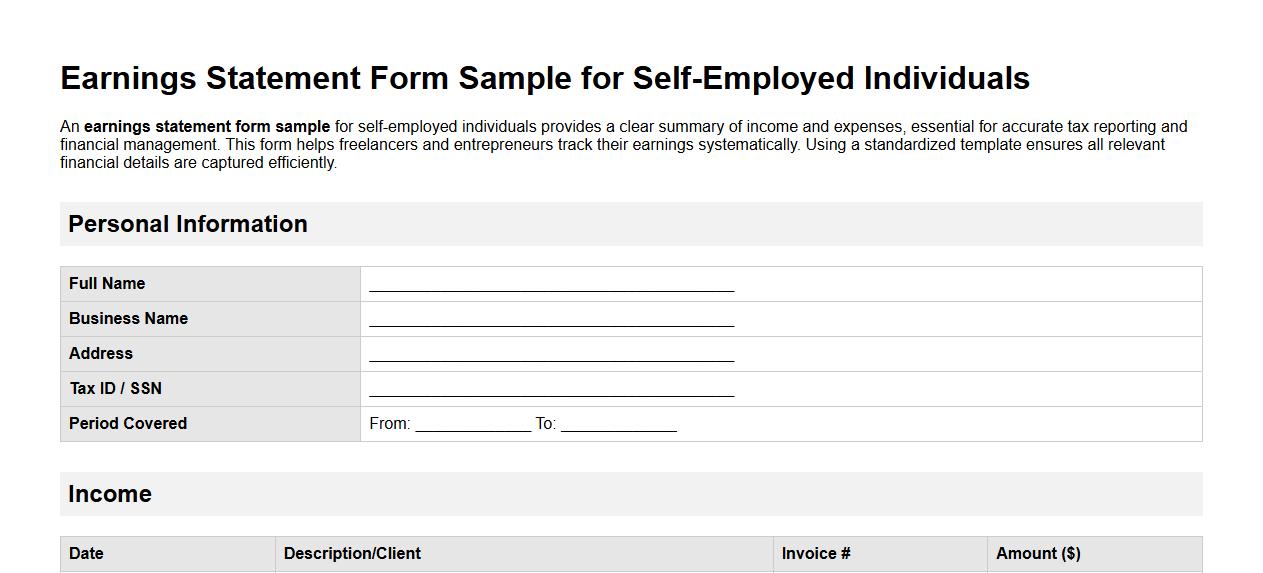

Earnings statement form sample for self-employed

An earnings statement form sample for self-employed individuals provides a clear summary of income and expenses, essential for accurate tax reporting and financial management. This form helps freelancers and entrepreneurs track their earnings systematically. Using a standardized template ensures all relevant financial details are captured efficiently.

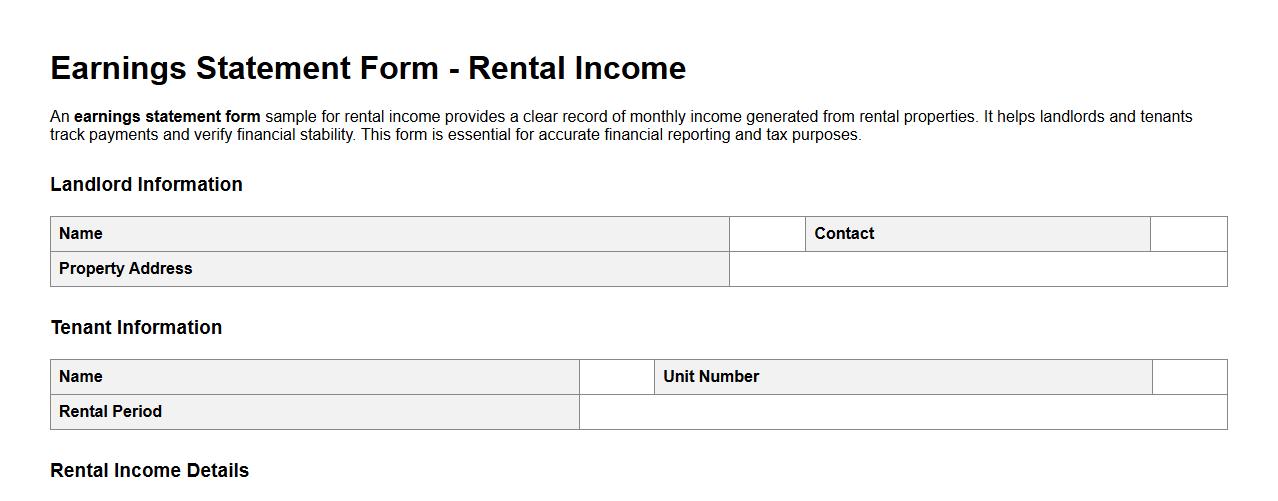

Earnings statement form sample for rental income

An earnings statement form sample for rental income provides a clear record of monthly income generated from rental properties. It helps landlords and tenants track payments and verify financial stability. This form is essential for accurate financial reporting and tax purposes.

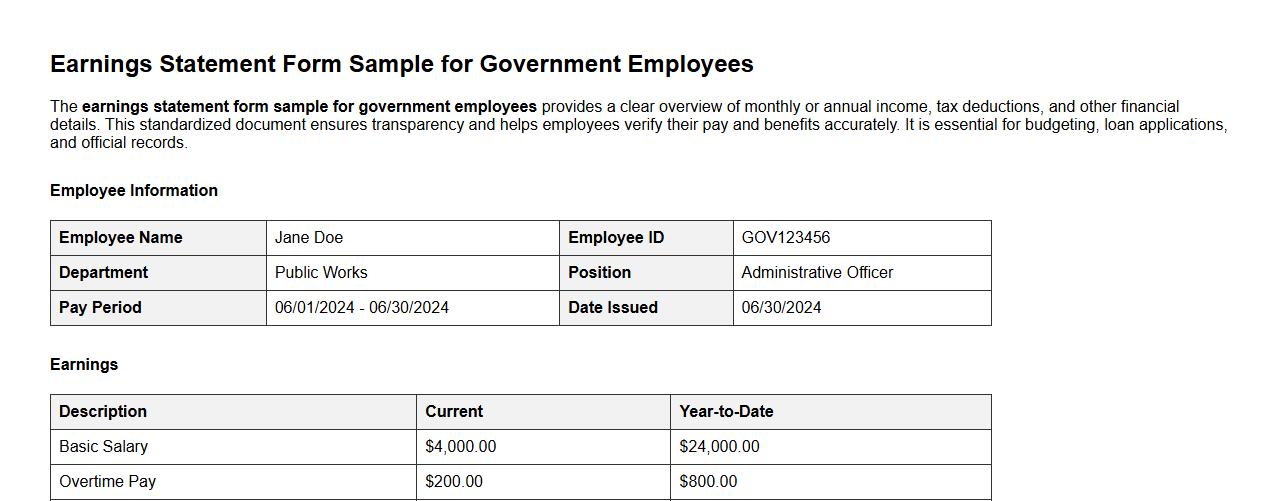

Earnings statement form sample for government employees

The earnings statement form sample for government employees provides a clear overview of monthly or annual income, tax deductions, and other financial details. This standardized document ensures transparency and helps employees verify their pay and benefits accurately. It is essential for budgeting, loan applications, and official records.

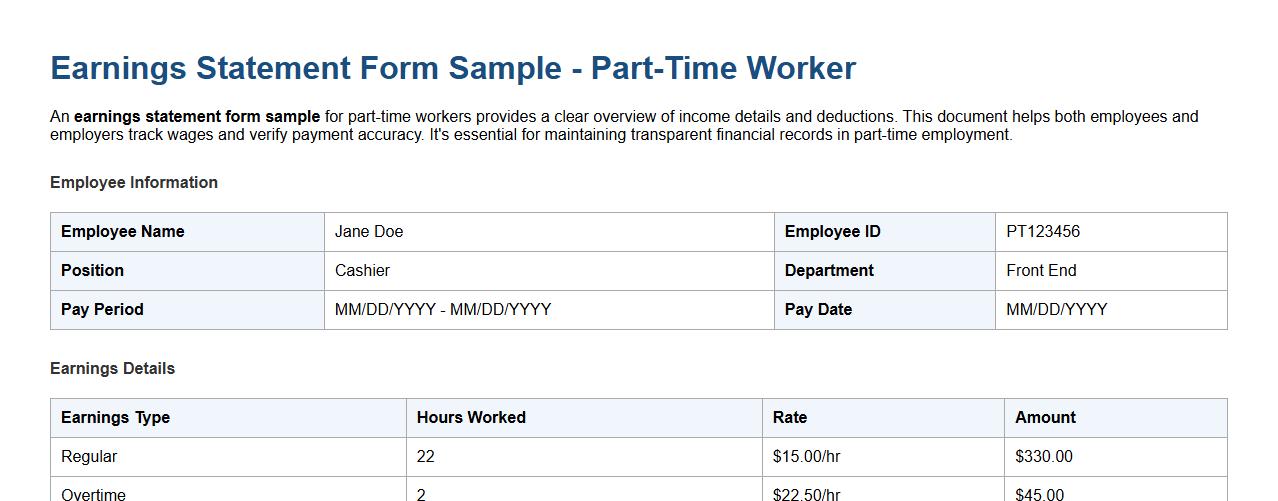

Earnings statement form sample for part-time workers

An earnings statement form sample for part-time workers provides a clear overview of income details and deductions. This document helps both employees and employers track wages and verify payment accuracy. It's essential for maintaining transparent financial records in part-time employment.

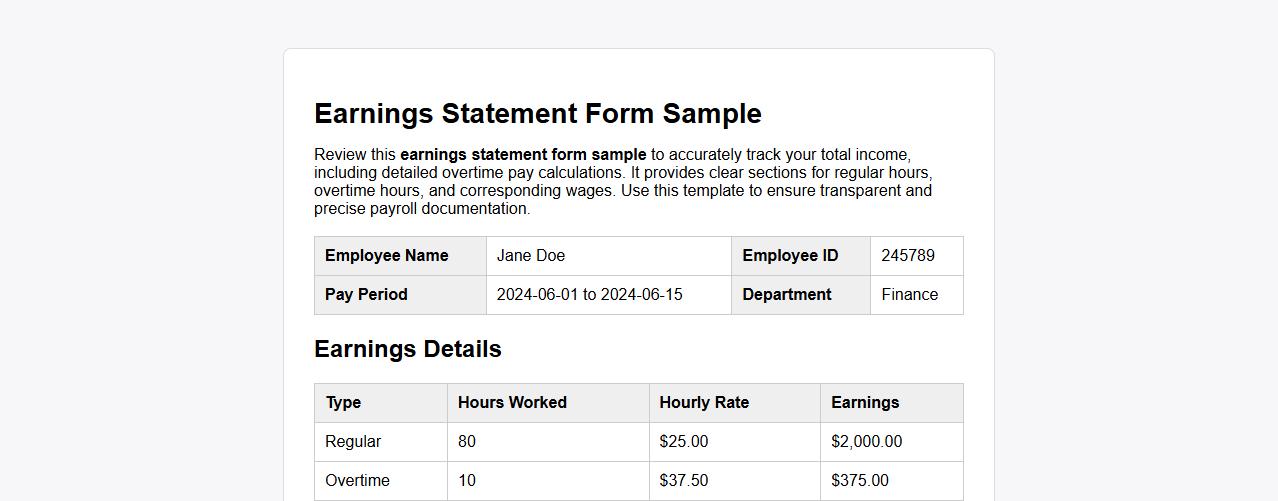

Earnings statement form sample with overtime pay details

Review this earnings statement form sample to accurately track your total income, including detailed overtime pay calculations. It provides clear sections for regular hours, overtime hours, and corresponding wages. Use this template to ensure transparent and precise payroll documentation.

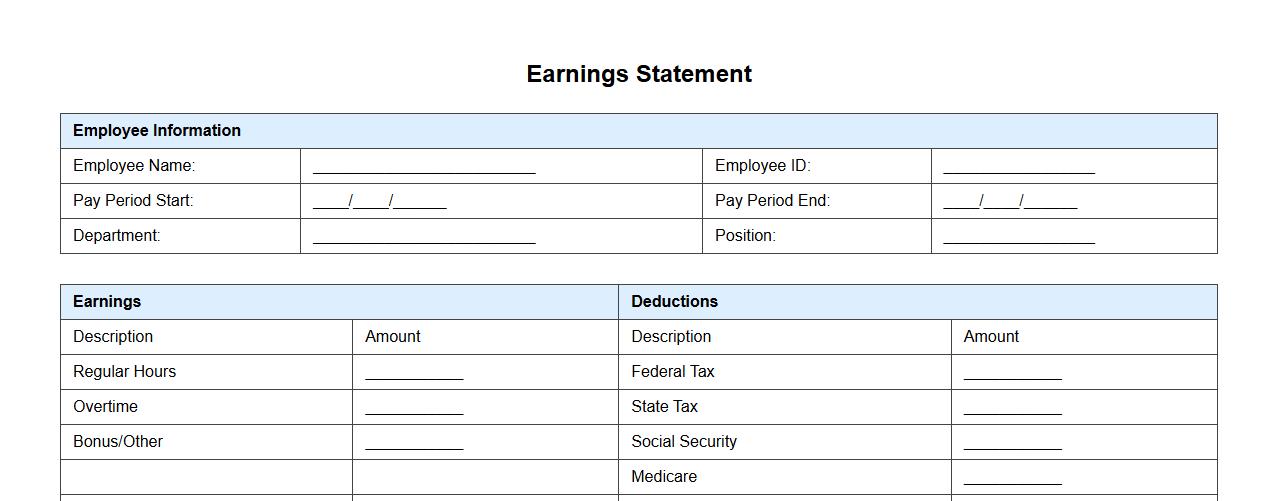

Printable earnings statement form sample with deductions

This printable earnings statement form sample provides a clear breakdown of employee wages, including deductions for taxes, benefits, and other withholdings. Designed for easy printing, it helps both employers and employees track net pay accurately. Use this sample to ensure transparent and efficient payroll documentation.

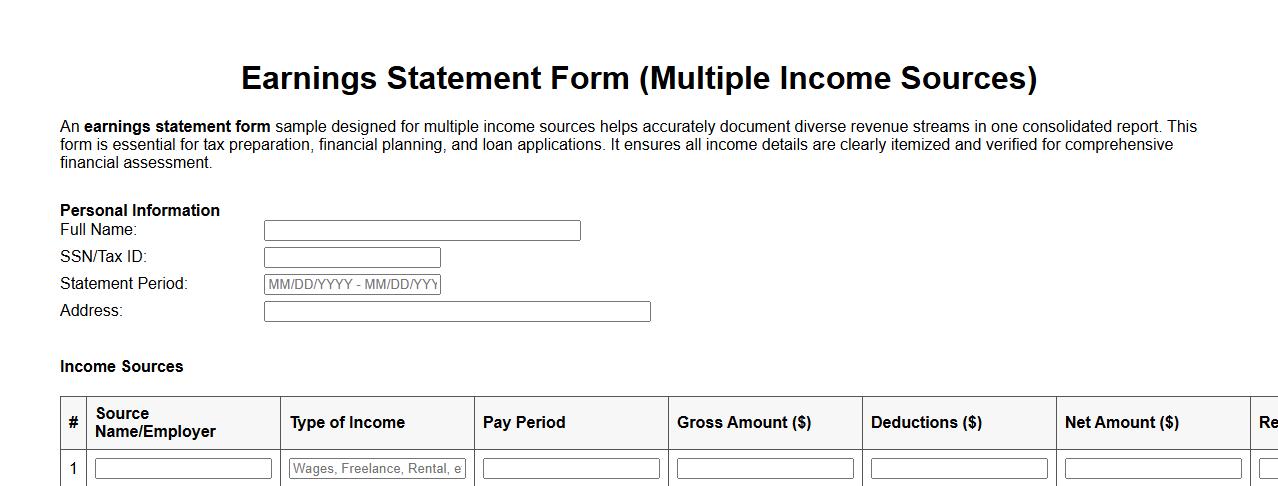

Earnings statement form sample for multiple income sources

An earnings statement form sample designed for multiple income sources helps accurately document diverse revenue streams in one consolidated report. This form is essential for tax preparation, financial planning, and loan applications. It ensures all income details are clearly itemized and verified for comprehensive financial assessment.

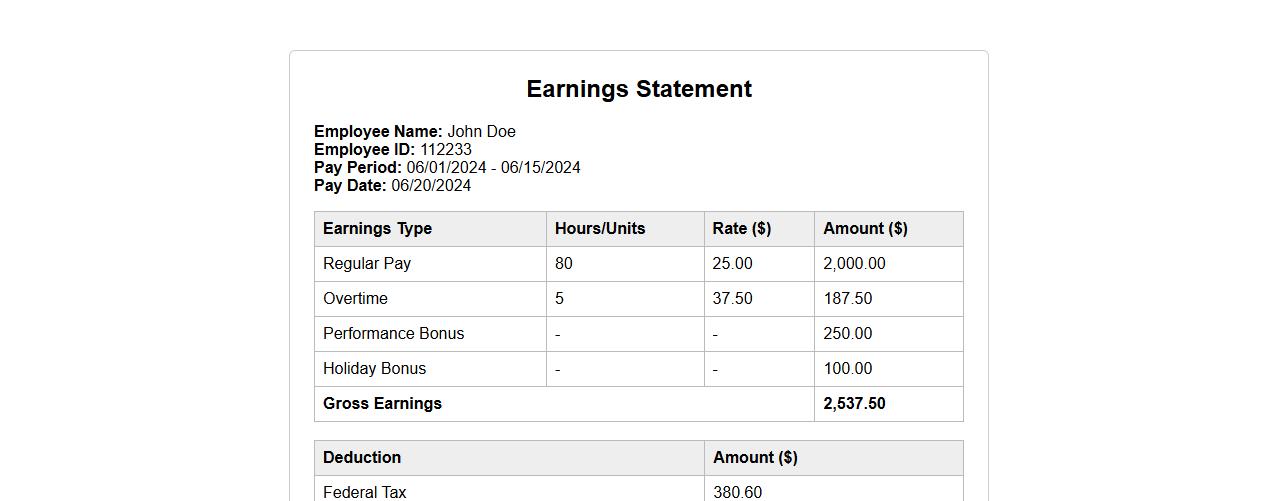

Earnings statement form sample including bonuses

The earnings statement form sample provides a clear breakdown of an employee's total compensation, including regular wages and additional bonuses. This document is essential for accurate payroll processing and financial record-keeping. It ensures transparency by clearly detailing all components of earnings for each pay period.

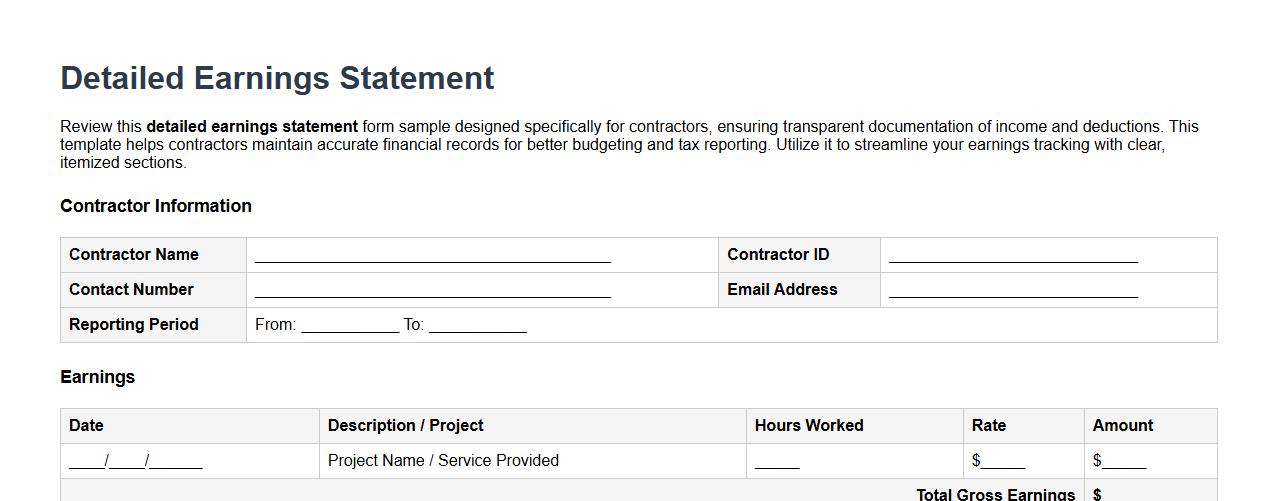

Detailed earnings statement form sample for contractors

Review this detailed earnings statement form sample designed specifically for contractors, ensuring transparent documentation of income and deductions. This template helps contractors maintain accurate financial records for better budgeting and tax reporting. Utilize it to streamline your earnings tracking with clear, itemized sections.

How can discrepancies in an earnings statement be formally disputed?

To formally dispute discrepancies in an earnings statement, employees should first review the document thoroughly and identify specific errors. The next step is to submit a written complaint to the payroll or human resources department detailing the discrepancies. It is important to keep copies of all correspondence for record keeping and follow up until the issue is resolved.

Which specific payroll codes are mandatory on an official earnings statement form?

An official earnings statement must include mandatory payroll codes such as earnings codes, tax withholding codes, and deduction codes. These codes ensure transparency and accurate interpretation of pay details by employees and auditors. Including standardized payroll codes helps maintain compliance with legal and regulatory requirements.

What legal retention period applies to employee earnings statement forms?

Employee earnings statement forms are generally required to be retained for a minimum of three to seven years depending on local labor laws. This retention period supports both employer compliance and employee rights for audits or disputes. Employers must store these records securely in either physical or digital formats to prevent unauthorized access or loss.

How do non-taxable deductions appear on an earnings statement document?

Non-taxable deductions on an earnings statement are typically listed separately from taxable deductions to clearly differentiate their impact on net pay. These deductions might include healthcare contributions or retirement plan payments that do not affect taxable income. Clearly labeling them ensures employees understand how their earnings are distributed and taxed.

Which digital tools ensure compliance when generating electronic earnings statements?

Digital tools such as payroll software with built-in tax compliance features and document management systems ensure compliance when generating electronic earnings statements. These tools automate calculations, tax deductions, and retention policies while maintaining secure access controls. Integration with government reporting portals further guarantees adherence to legal standards.