A Salary Statement Form Sample provides a detailed breakdown of an employee's earnings, including basic salary, allowances, deductions, and net pay. This document serves as proof of income and is essential for payroll management and tax filing. Employers use it to ensure transparency and accuracy in salary disbursement.

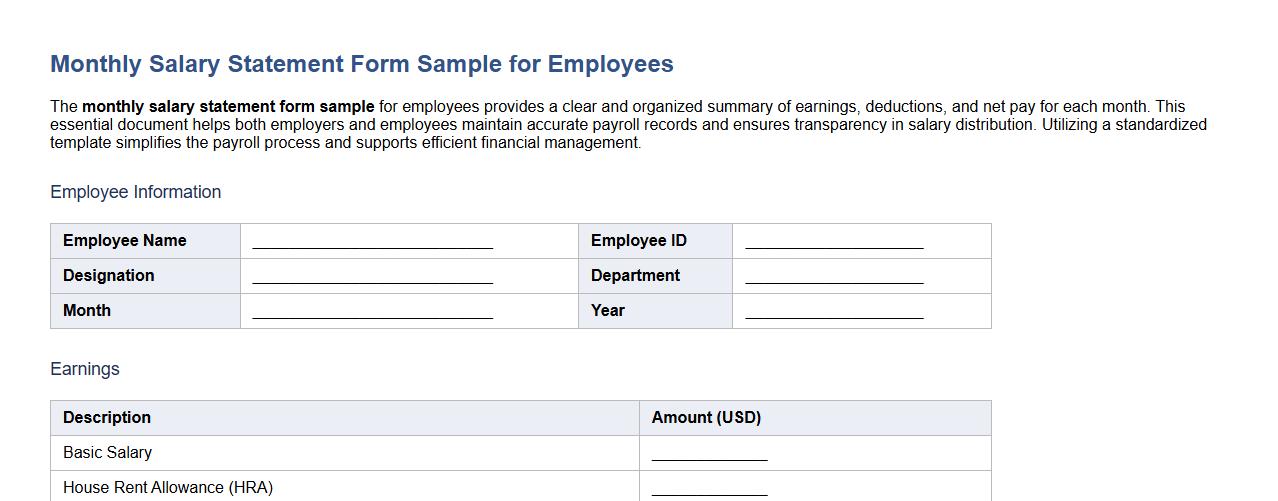

Monthly salary statement form sample for employees

The monthly salary statement form sample for employees provides a clear and organized summary of earnings, deductions, and net pay for each month. This essential document helps both employers and employees maintain accurate payroll records and ensures transparency in salary distribution. Utilizing a standardized template simplifies the payroll process and supports efficient financial management.

Downloadable salary statement form sample in pdf

Download our salary statement form sample in PDF format to efficiently document employee earnings and deductions. This template ensures clear financial records and aids in transparent payroll management. Easily customizable, it suits various organizational needs.

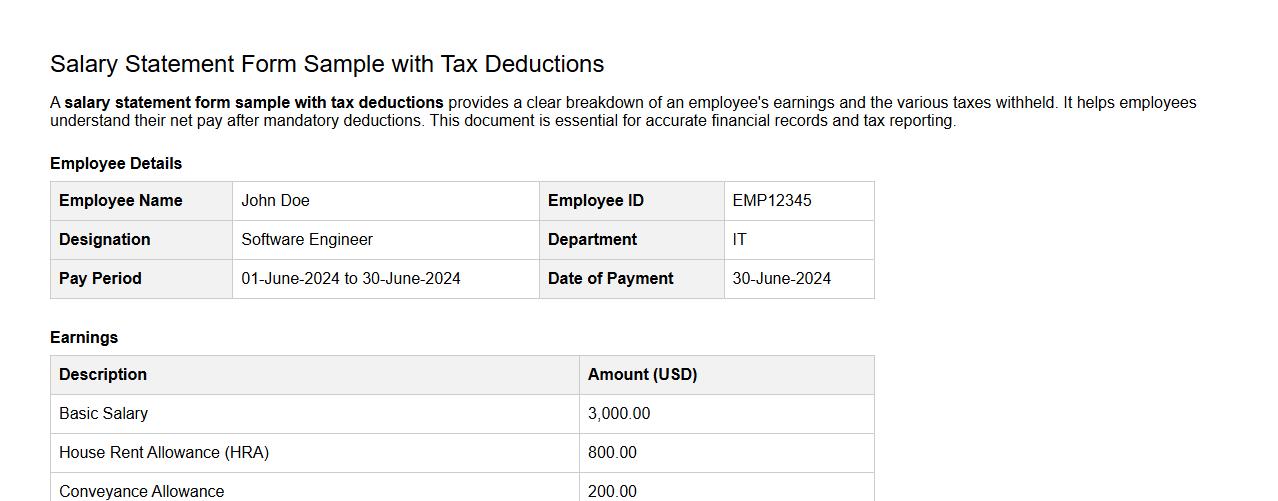

Salary statement form sample with tax deductions

A salary statement form sample with tax deductions provides a clear breakdown of an employee's earnings and the various taxes withheld. It helps employees understand their net pay after mandatory deductions. This document is essential for accurate financial records and tax reporting.

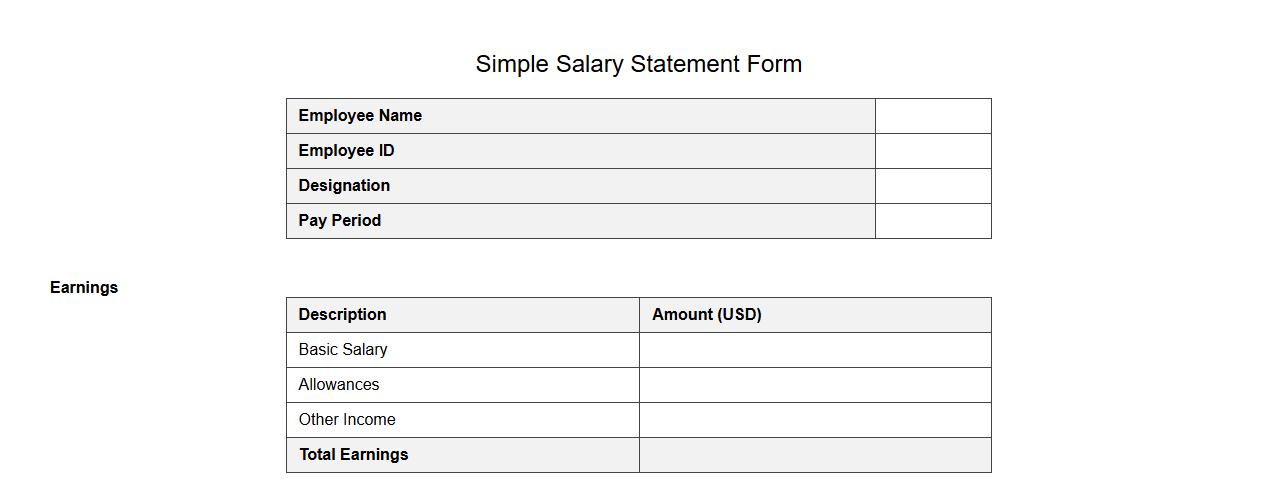

Simple salary statement form sample for small business

A simple salary statement form sample is essential for small businesses to efficiently document employee earnings and deductions. This clear and concise template helps streamline payroll processing while ensuring transparency and accuracy. It is designed to meet the basic needs of small business payroll management.

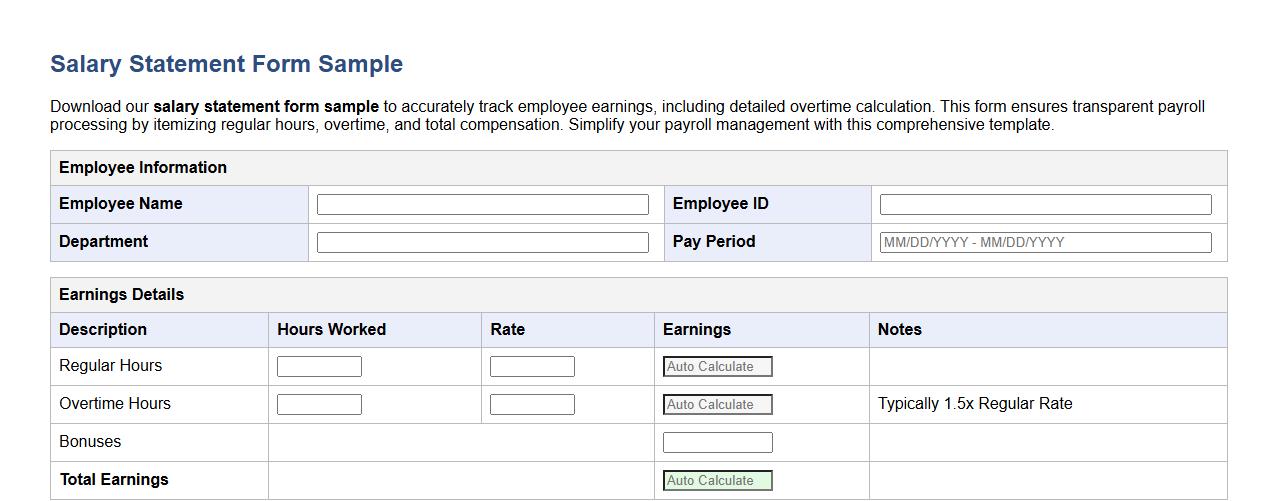

Salary statement form sample with overtime calculation

Download our salary statement form sample to accurately track employee earnings, including detailed overtime calculation. This form ensures transparent payroll processing by itemizing regular hours, overtime, and total compensation. Simplify your payroll management with this comprehensive template.

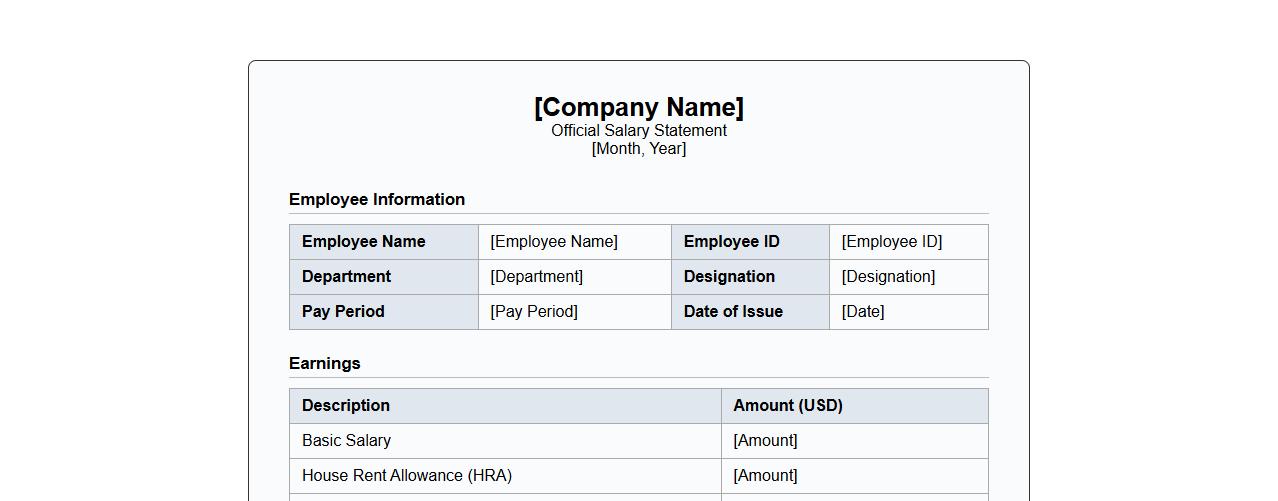

Official company salary statement form sample template

This official company salary statement form sample template provides a clear and professional format for detailing employee earnings and deductions. It ensures transparency and accuracy in payroll documentation for both employers and employees. Easily customizable, this template meets standard accounting and HR requirements.

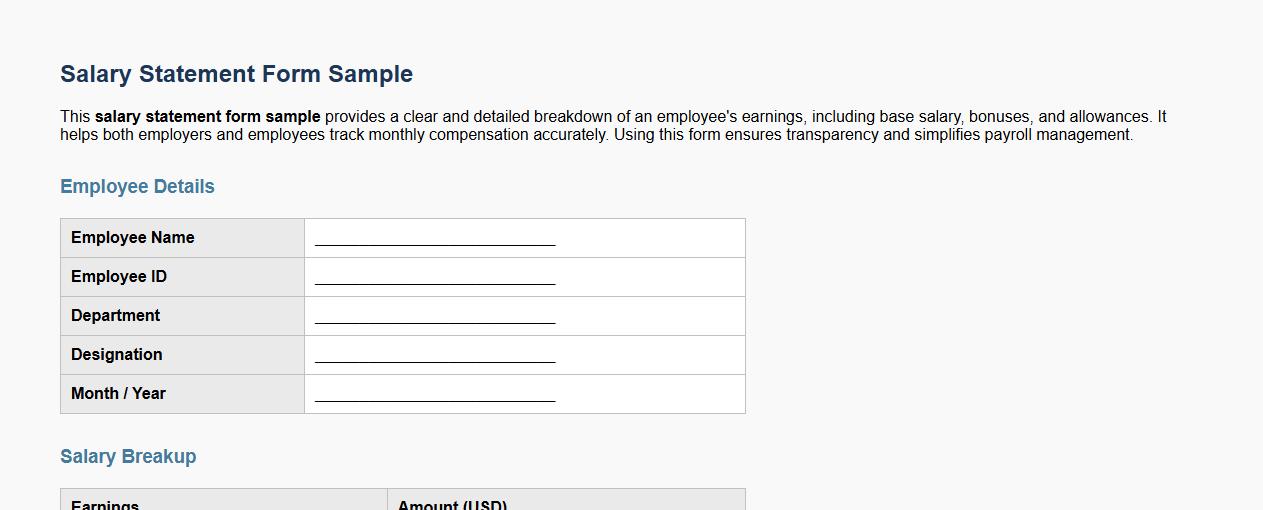

Salary statement form sample including bonuses and allowances

This salary statement form sample provides a clear and detailed breakdown of an employee's earnings, including base salary, bonuses, and allowances. It helps both employers and employees track monthly compensation accurately. Using this form ensures transparency and simplifies payroll management.

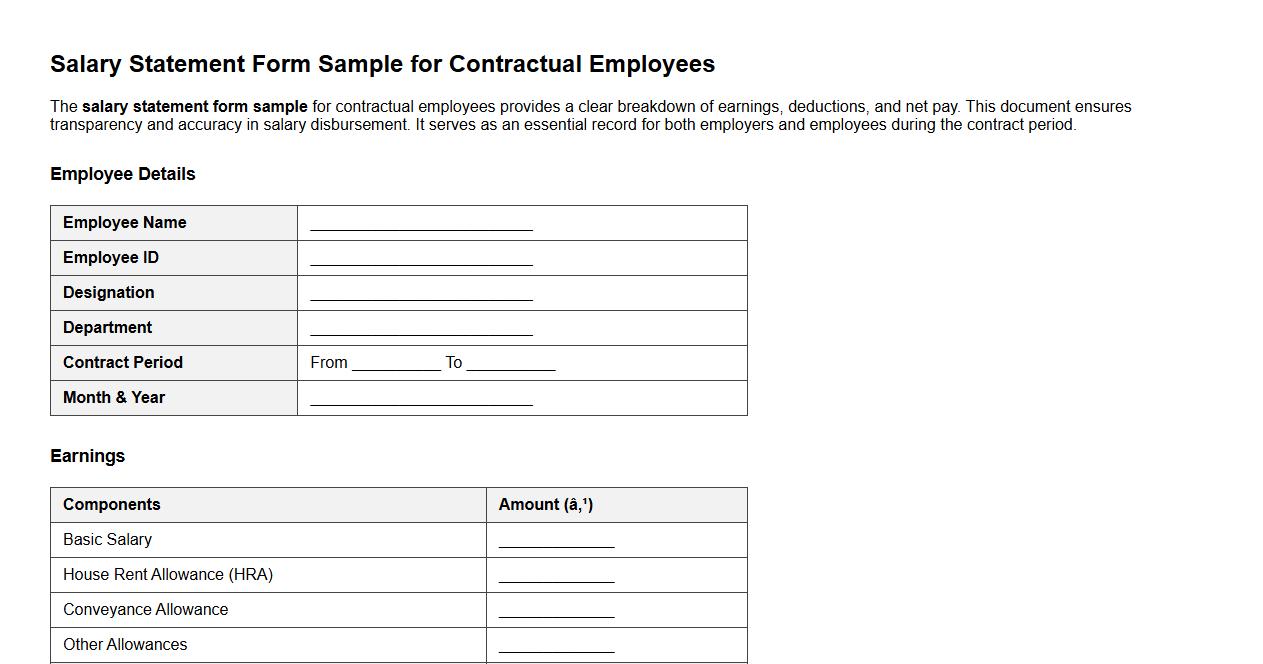

Salary statement form sample for contractual employees

The salary statement form sample for contractual employees provides a clear breakdown of earnings, deductions, and net pay. This document ensures transparency and accuracy in salary disbursement. It serves as an essential record for both employers and employees during the contract period.

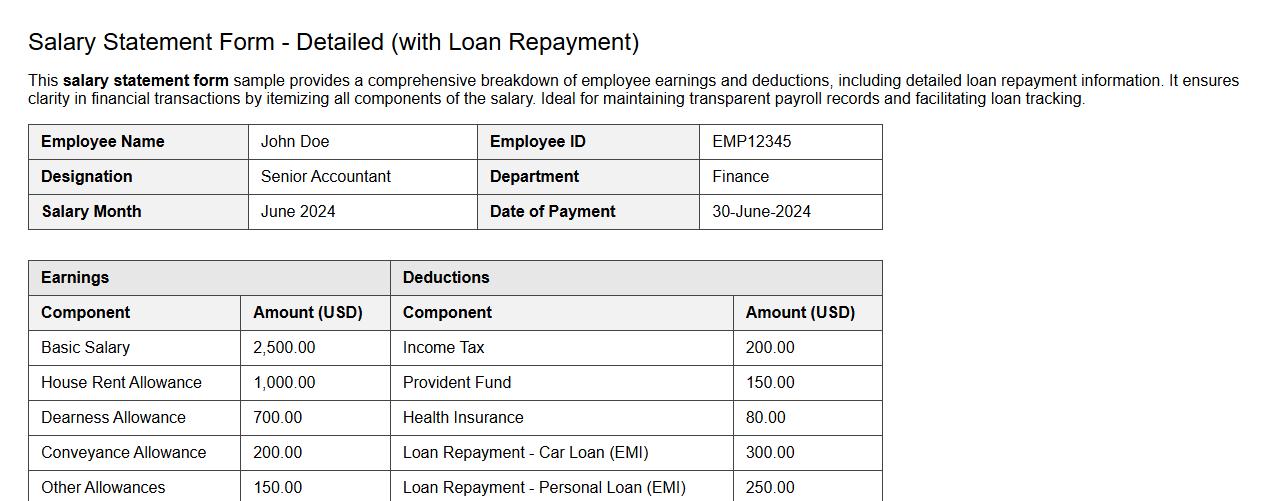

Detailed salary statement form sample with loan repayment

This salary statement form sample provides a comprehensive breakdown of employee earnings and deductions, including detailed loan repayment information. It ensures clarity in financial transactions by itemizing all components of the salary. Ideal for maintaining transparent payroll records and facilitating loan tracking.

What supporting documents are required when submitting a Salary Statement Form?

When submitting a Salary Statement Form, it is essential to provide pay slips as proof of income. Additionally, official employment contracts or appointment letters are typically required to validate job status. Bank statements may also be requested to confirm salary deposits.

How should discrepancies in reported earnings be addressed on the form?

Any discrepancies in reported earnings must be clearly explained in the designated remarks section of the form. Submitters should attach supporting documentation to clarify differences, such as corrected pay slips or HR notifications. Timely communication with the payroll or HR department is crucial for resolving inconsistencies.

Which sections of the Salary Statement Form must be verified by HR?

The salary details, including base pay, allowances, and deductions, must be verified by the HR department. HR is also responsible for confirming the accuracy of the employee's personal information and job title. Finally, HR approval or official stamping ensures the form's authenticity.

What is the deadline for submitting an annual Salary Statement Form?

The annual Salary Statement Form must be submitted by December 31st of each fiscal year. Employers often set an internal deadline a few weeks earlier for administrative processing. Late submissions may result in delays or penalties depending on organizational policies.

Are allowances and bonuses included in the Salary Statement Form declaration?

Yes, all allowances and bonuses must be included in the Salary Statement Form to provide a complete earnings report. This ensures accurate tax calculations and compliance with labor regulations. Omitting these components can lead to misrepresentation of true salary figures.