A Personal Financial Statement Template is a useful tool for individuals to organize their assets, liabilities, income, and expenses in one clear document. It helps to provide a comprehensive overview of an individual's financial health, making it easier to apply for loans or track net worth. This template ensures accurate and organized financial reporting for personal or professional use.

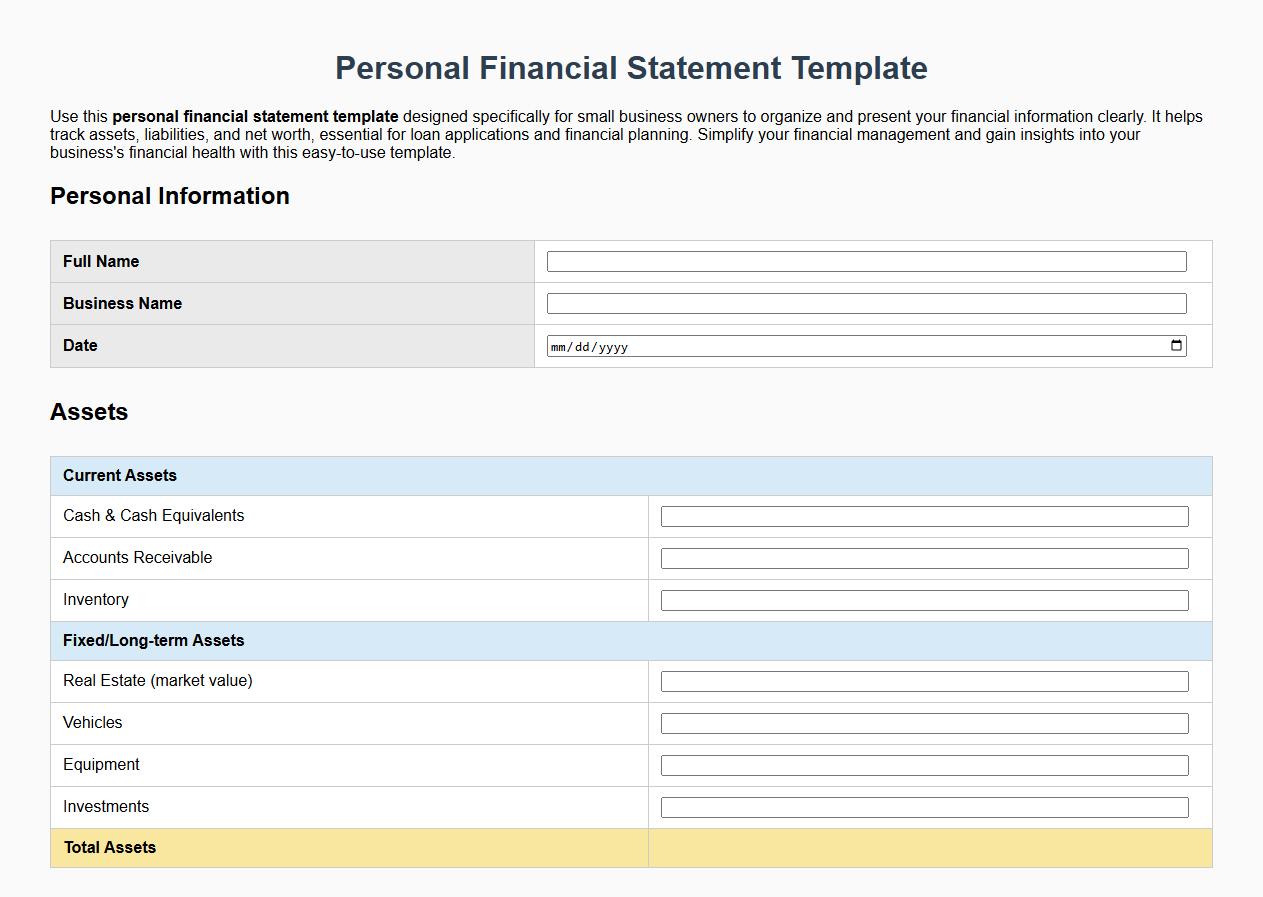

Personal financial statement template for small business owners

Use this personal financial statement template designed specifically for small business owners to organize and present your financial information clearly. It helps track assets, liabilities, and net worth, essential for loan applications and financial planning. Simplify your financial management and gain insights into your business's financial health with this easy-to-use template.

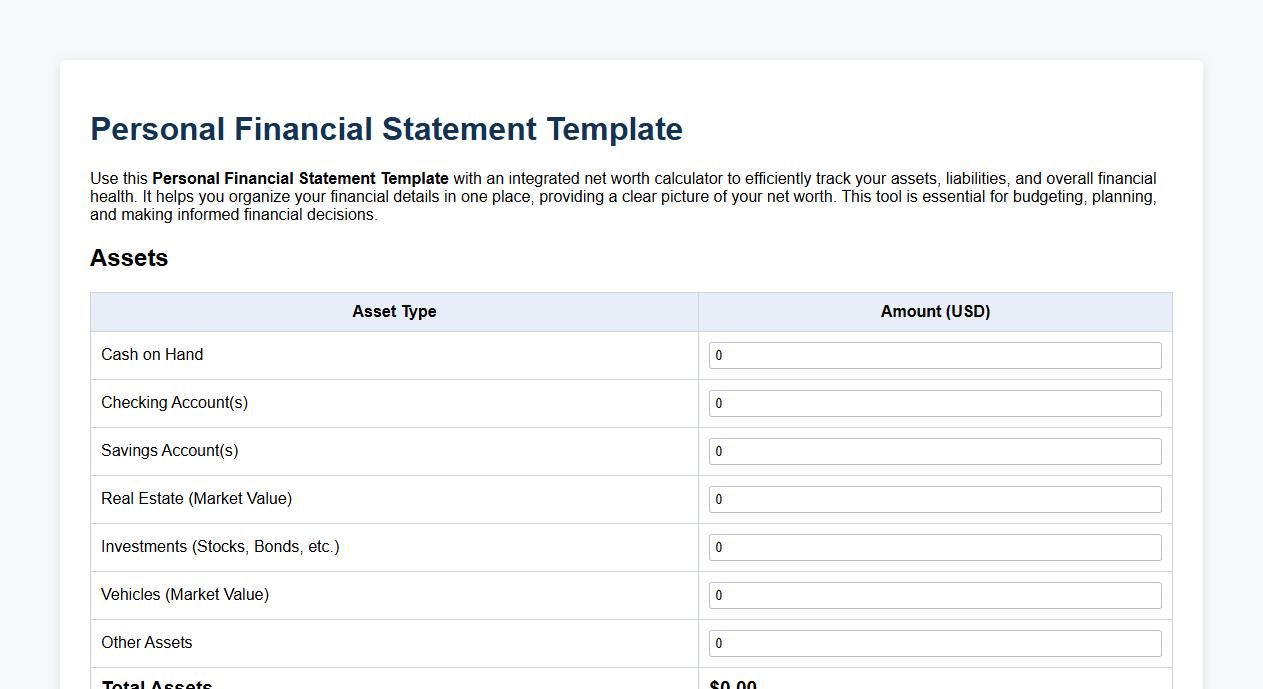

Personal financial statement template with net worth calculator

Use this Personal Financial Statement Template with an integrated net worth calculator to efficiently track your assets, liabilities, and overall financial health. It helps you organize your financial details in one place, providing a clear picture of your net worth. This tool is essential for budgeting, planning, and making informed financial decisions.

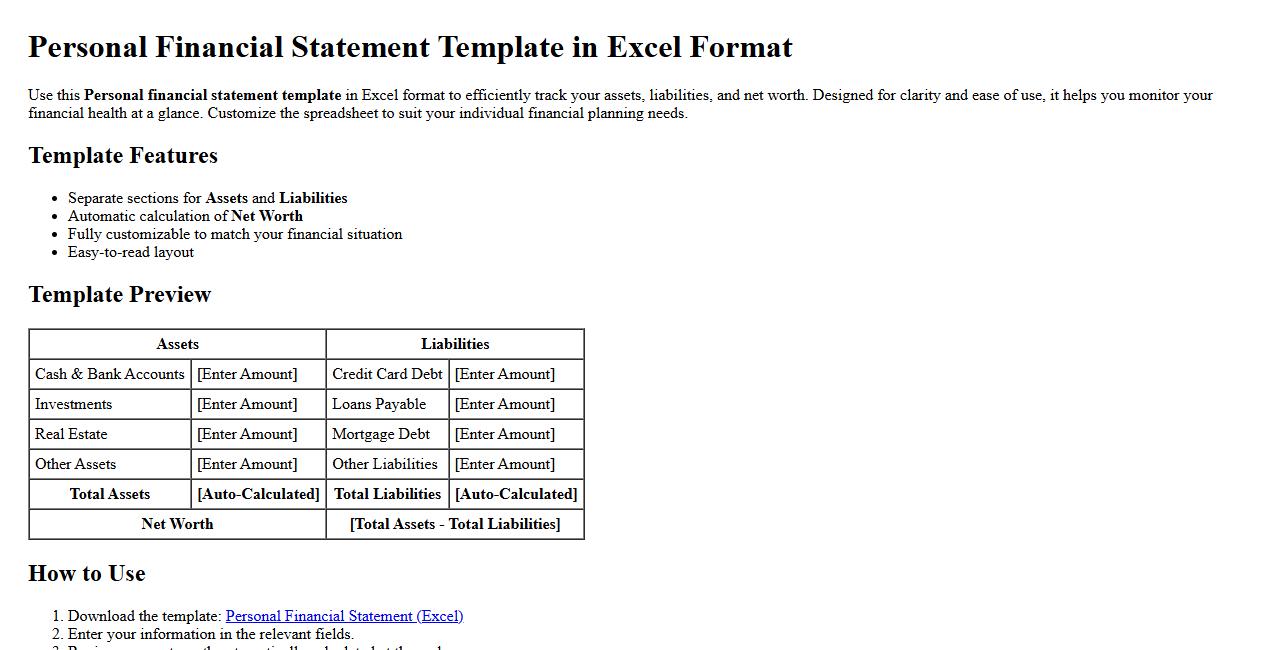

Personal financial statement template in Excel format

Use this Personal financial statement template in Excel format to efficiently track your assets, liabilities, and net worth. Designed for clarity and ease of use, it helps you monitor your financial health at a glance. Customize the spreadsheet to suit your individual financial planning needs.

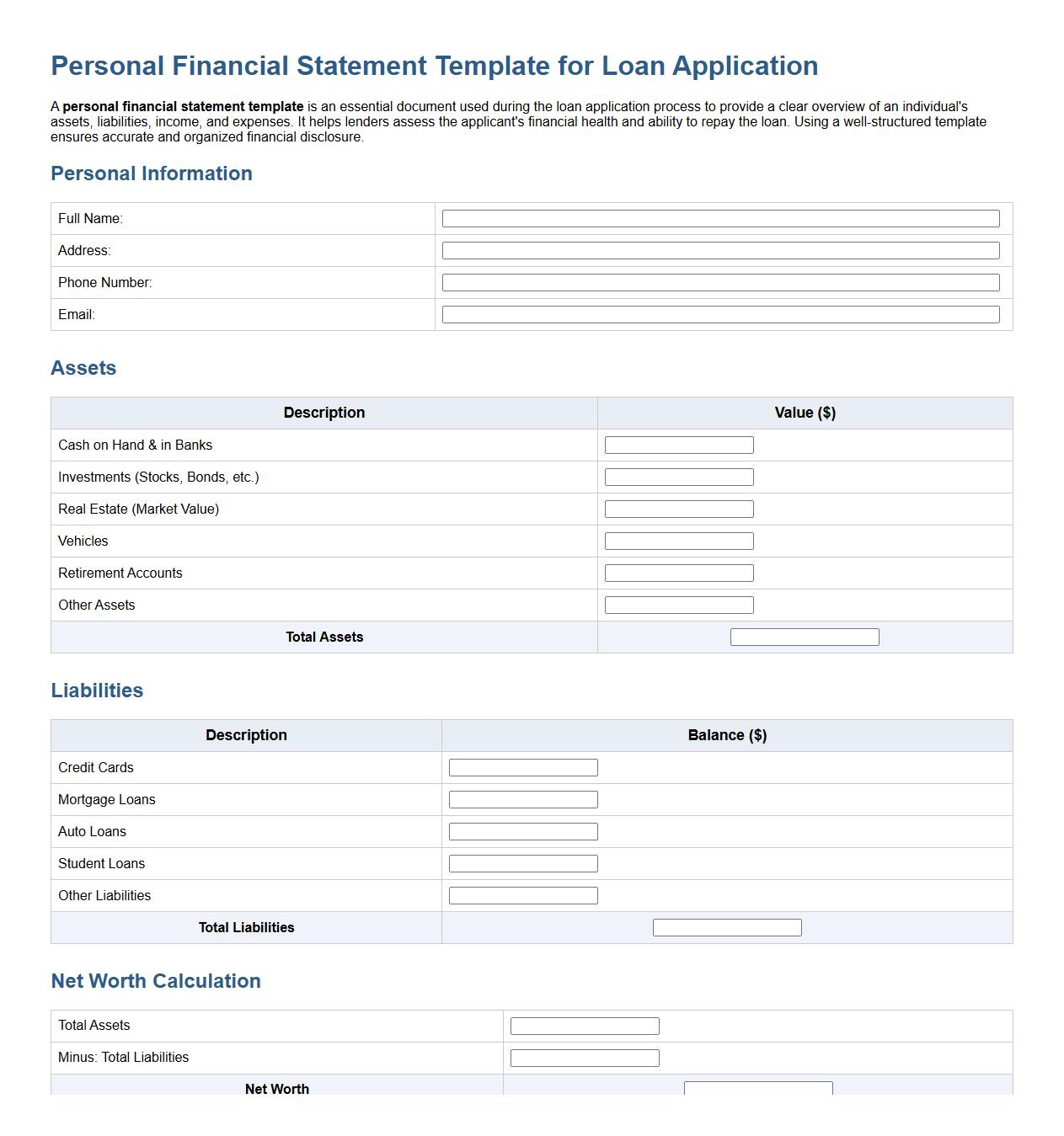

Personal financial statement template for loan application

A personal financial statement template is an essential document used during the loan application process to provide a clear overview of an individual's assets, liabilities, income, and expenses. It helps lenders assess the applicant's financial health and ability to repay the loan. Using a well-structured template ensures accurate and organized financial disclosure.

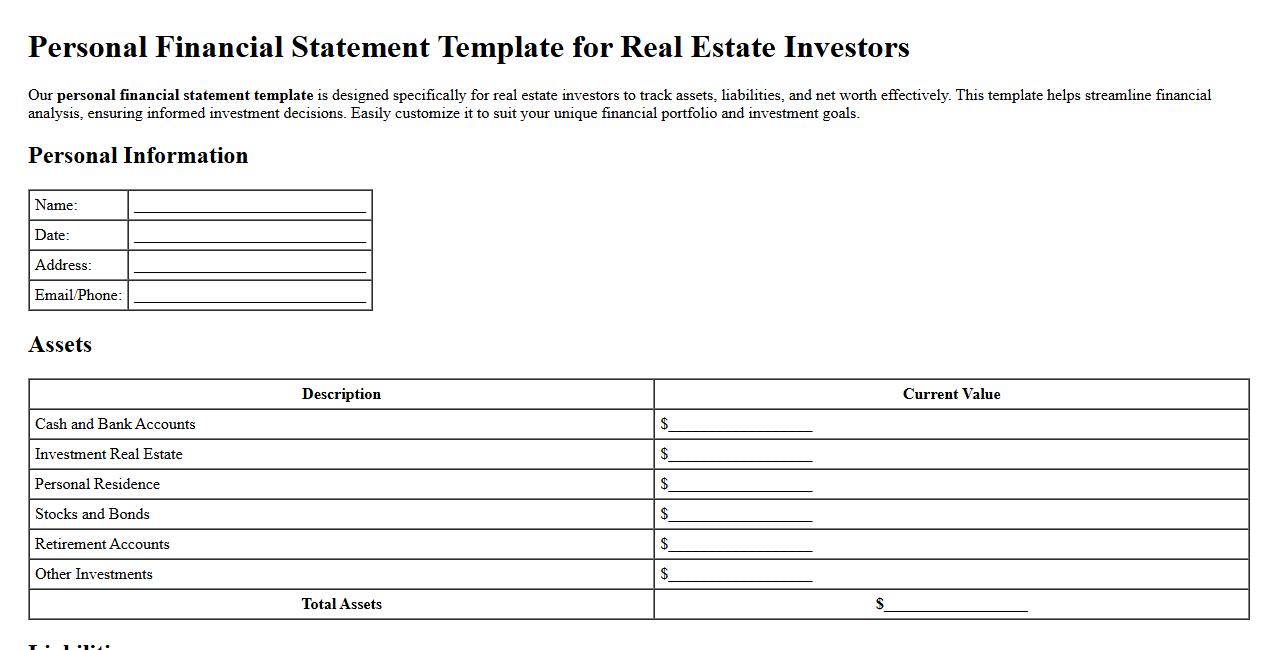

Personal financial statement template for real estate investors

Our personal financial statement template is designed specifically for real estate investors to track assets, liabilities, and net worth effectively. This template helps streamline financial analysis, ensuring informed investment decisions. Easily customize it to suit your unique financial portfolio and investment goals.

Free printable personal financial statement template PDF

Download this free printable personal financial statement template in PDF format to easily track and manage your assets, liabilities, and net worth. Designed for simplicity and clarity, this template helps you maintain a clear overview of your financial situation. Perfect for personal use or when applying for loans and financial planning.

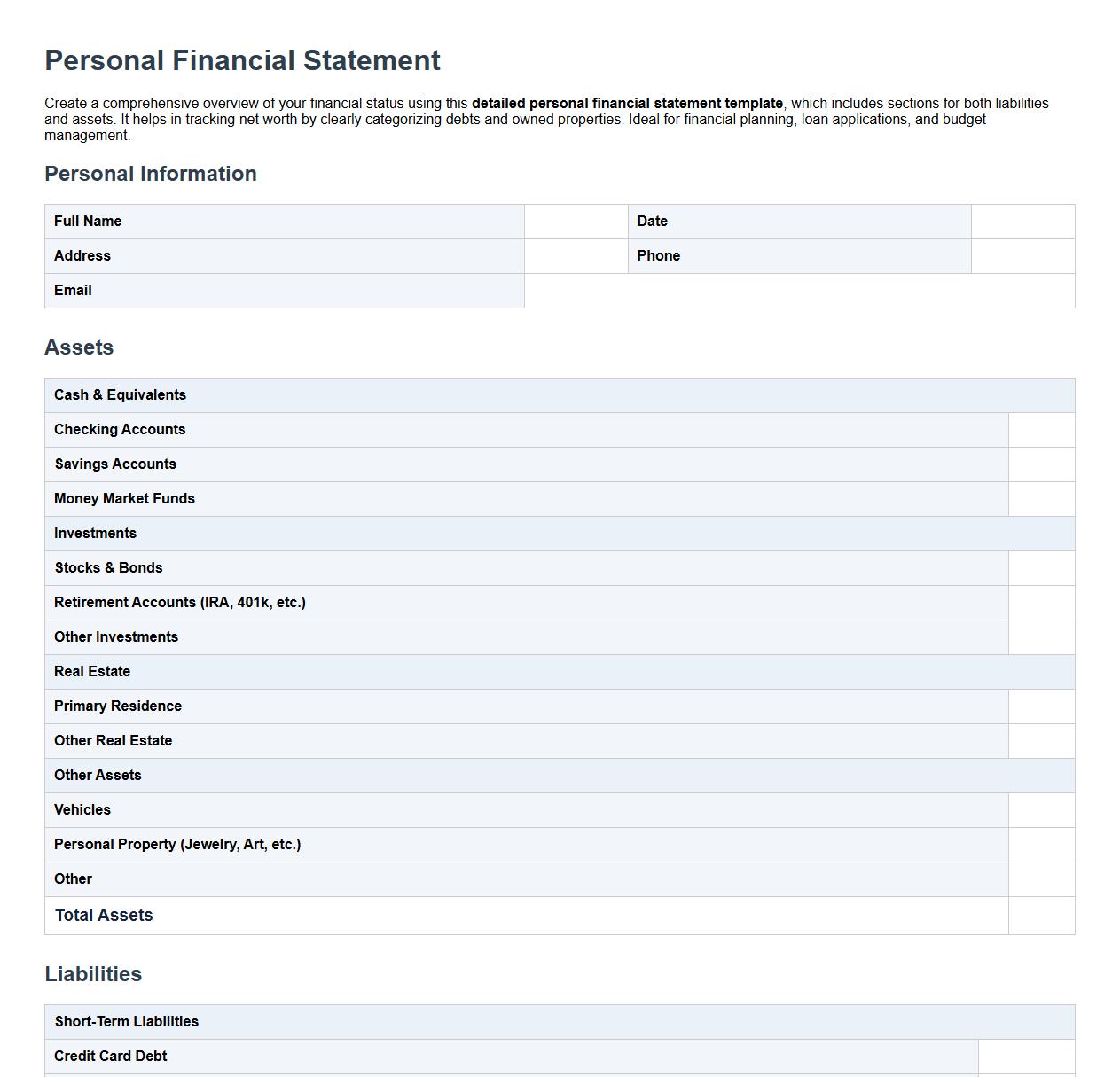

Detailed personal financial statement template with liabilities and assets

Create a comprehensive overview of your financial status using this detailed personal financial statement template, which includes sections for both liabilities and assets. It helps in tracking net worth by clearly categorizing debts and owned properties. Ideal for financial planning, loan applications, and budget management.

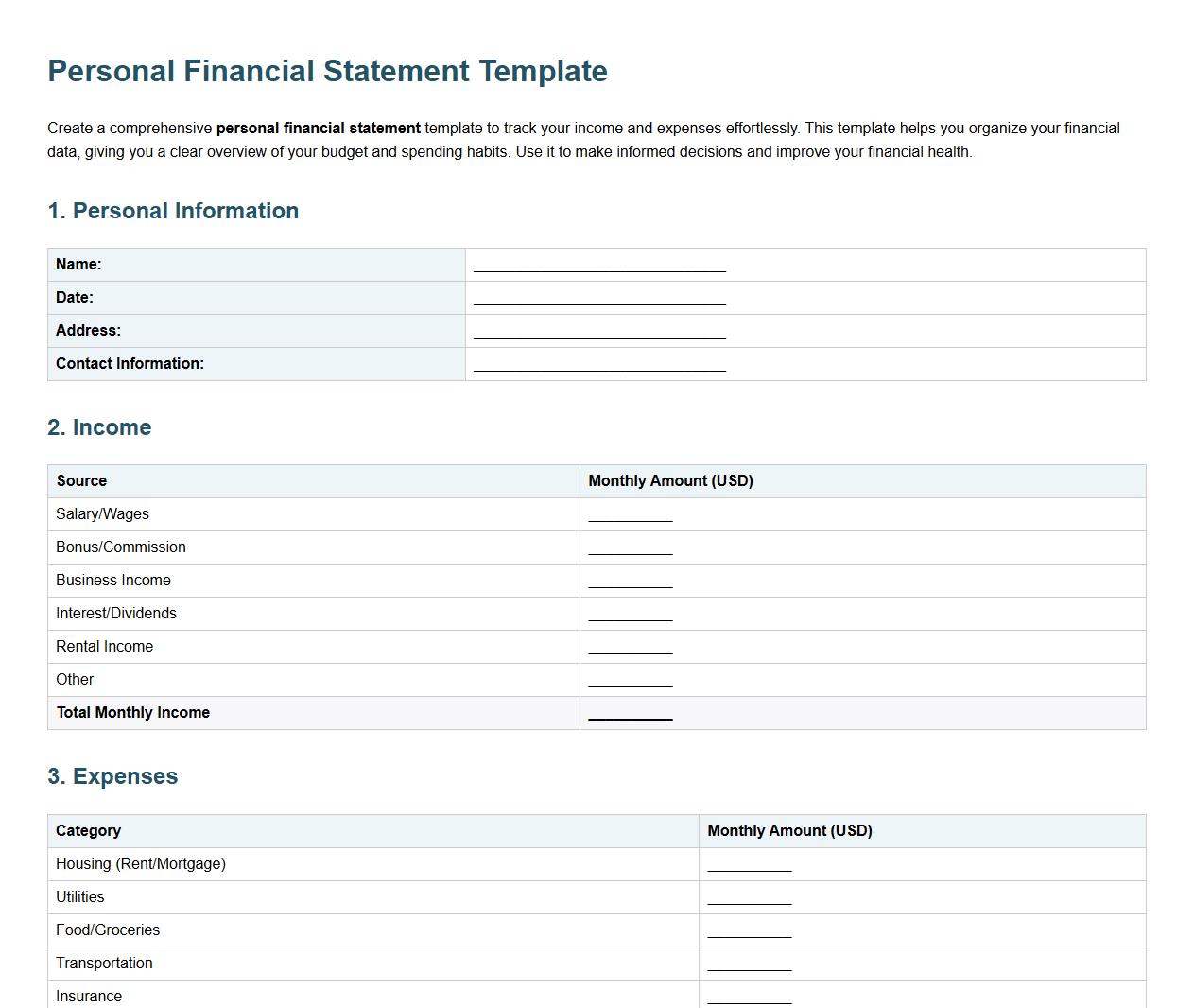

Personal financial statement template including income and expenses

Create a comprehensive personal financial statement template to track your income and expenses effortlessly. This template helps you organize your financial data, giving you a clear overview of your budget and spending habits. Use it to make informed decisions and improve your financial health.

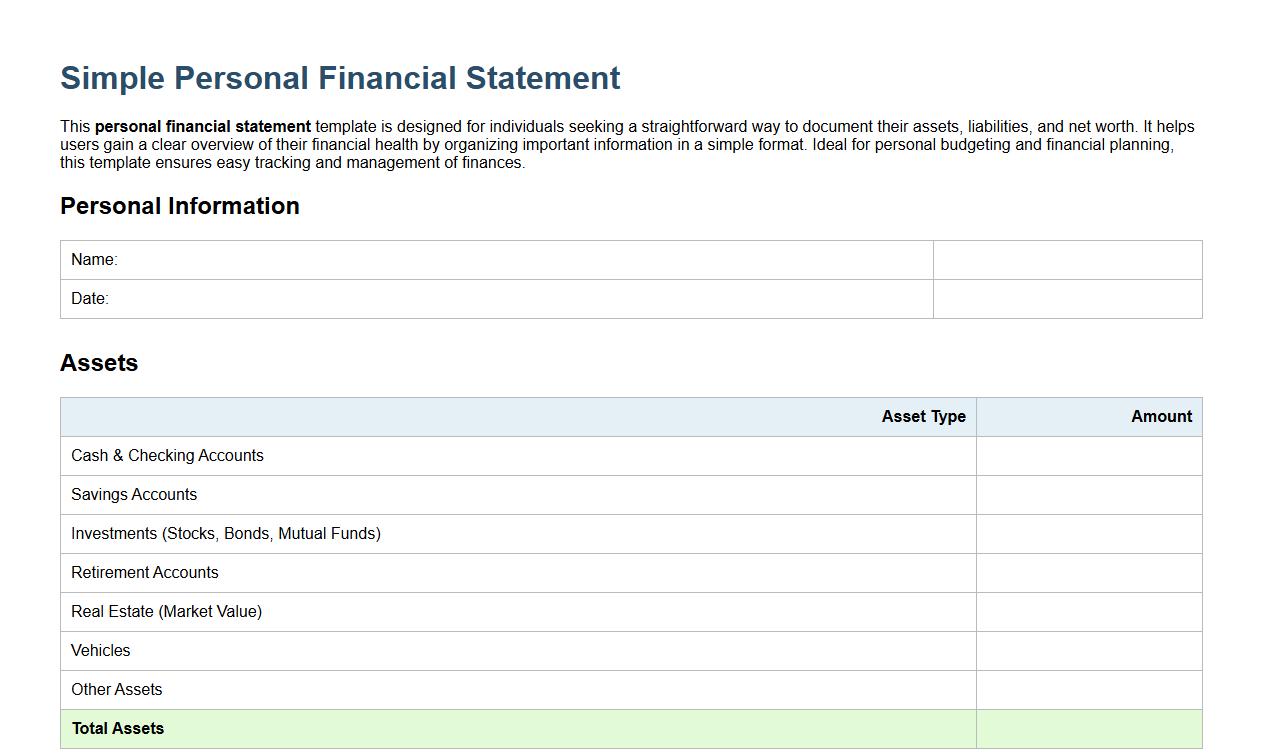

Simple personal financial statement template for individuals

This personal financial statement template is designed for individuals seeking a straightforward way to document their assets, liabilities, and net worth. It helps users gain a clear overview of their financial health by organizing important information in a simple format. Ideal for personal budgeting and financial planning, this template ensures easy tracking and management of finances.

What supporting documents should accompany a Personal Financial Statement letter?

When submitting a Personal Financial Statement letter, it is essential to include supporting documents such as recent bank statements, tax returns, and investment account summaries. These documents provide a clear and accurate representation of the individual's financial status. Including proof of liabilities like loan statements and credit card balances also strengthens the credibility of the statement.

How should irregular income be reported in a Personal Financial Statement letter?

Irregular income must be clearly identified and reported with a detailed explanation in the Personal Financial Statement letter. It is important to include the source, frequency, and average amount received to ensure transparency. Providing documentation or history of this income enhances the reliability of the reported figures.

What language clarifies ownership of jointly held assets in the letter?

The letter should explicitly state the ownership status of jointly held assets using clear language such as "jointly owned with right of survivorship" or "tenants in common." This clarifies each party's rights and responsibilities regarding the asset. Precise terms ensure there is no ambiguity about the ownership structure in the Personal Financial Statement.

How are contingent liabilities disclosed in a Personal Financial Statement letter?

Contingent liabilities are disclosed by clearly listing potential obligations that may arise, along with an explanation of the conditions triggering those liabilities. The statement should describe the nature, amount, and likelihood of the contingent liability becoming an actual obligation. Proper disclosure ensures the risk assessment is transparent and comprehensive.

What details are essential for listing restricted or pledged assets in the letter?

When listing restricted or pledged assets, the letter must specify the asset type, amount, and the terms of restriction or pledge. It is crucial to include the name of the entity holding the restriction or pledge and any relevant dates. These details provide a complete understanding of the asset's availability in the Personal Financial Statement.