The Payroll Summary Report provides a comprehensive overview of employee wages, deductions, and net pay for a specified period. It consolidates payroll data to assist in financial analysis and compliance with tax regulations. This report is essential for accurate payroll management and auditing purposes.

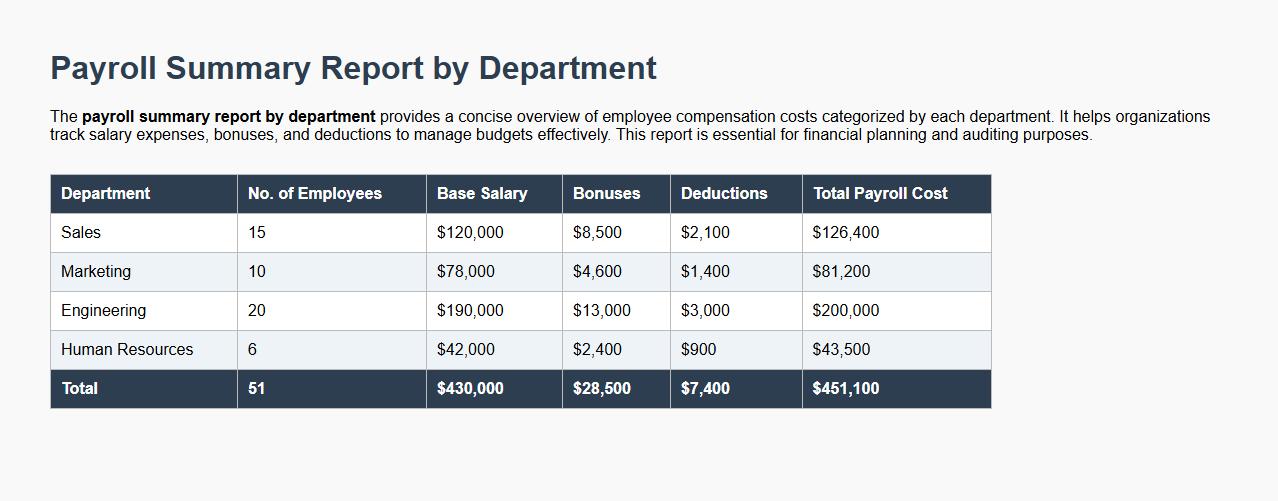

Payroll summary report by department

The payroll summary report by department provides a concise overview of employee compensation costs categorized by each department. It helps organizations track salary expenses, bonuses, and deductions to manage budgets effectively. This report is essential for financial planning and auditing purposes.

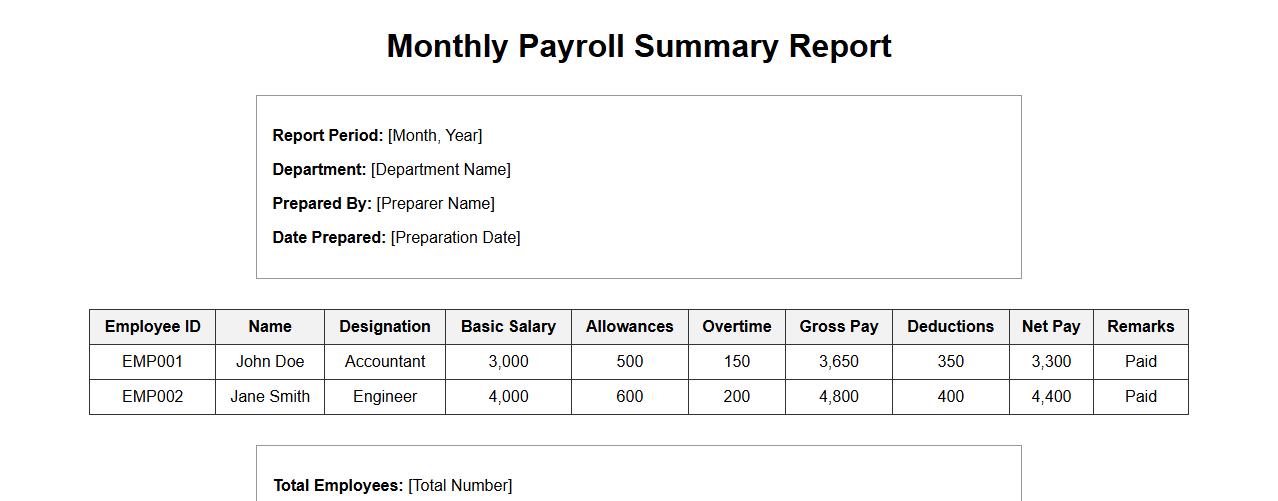

Monthly payroll summary report format

The monthly payroll summary report format provides a clear overview of employee salaries, deductions, and net pay for each month. It ensures accurate record-keeping and simplifies financial audits by consolidating payroll details into an easy-to-read format. This report is essential for maintaining compliance with tax regulations and budgeting purposes.

Year-end payroll summary report for employees

The year-end payroll summary report provides a comprehensive overview of all employee earnings, deductions, and taxes for the entire fiscal year. It is essential for accurate tax filing and financial record-keeping. This report ensures transparency and aids in payroll reconciliation for both employers and employees.

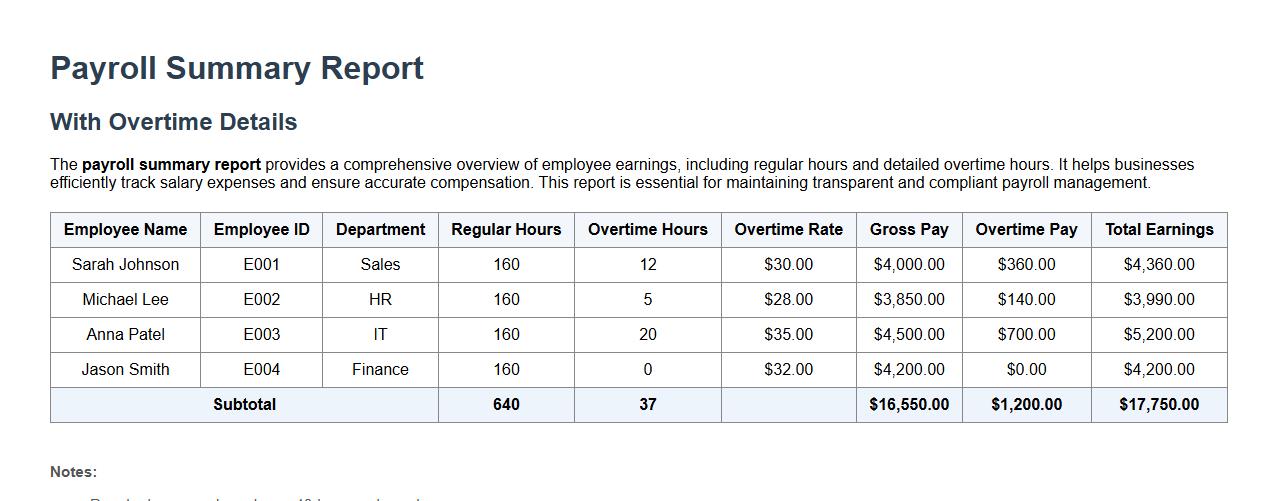

Payroll summary report with overtime details

The payroll summary report provides a comprehensive overview of employee earnings, including regular hours and detailed overtime hours. It helps businesses efficiently track salary expenses and ensure accurate compensation. This report is essential for maintaining transparent and compliant payroll management.

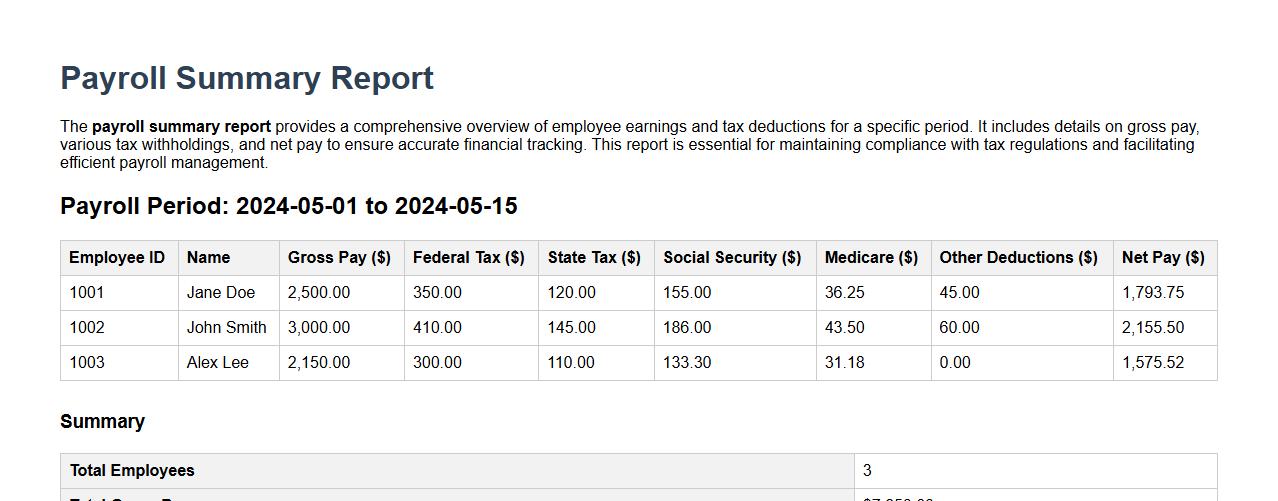

Payroll summary report including tax deductions

The payroll summary report provides a comprehensive overview of employee earnings and tax deductions for a specific period. It includes details on gross pay, various tax withholdings, and net pay to ensure accurate financial tracking. This report is essential for maintaining compliance with tax regulations and facilitating efficient payroll management.

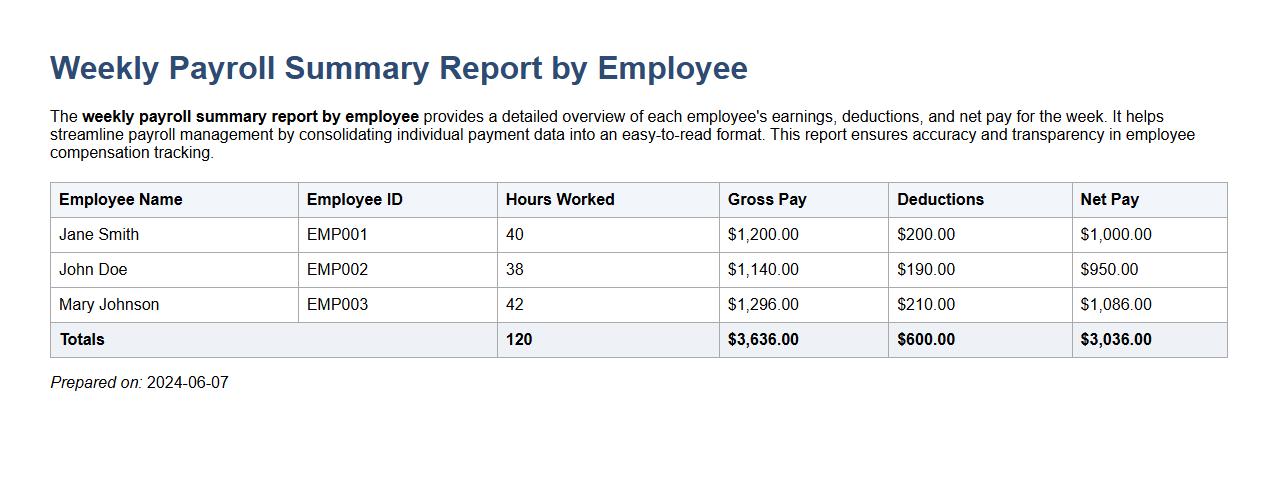

Weekly payroll summary report by employee

The weekly payroll summary report by employee provides a detailed overview of each employee's earnings, deductions, and net pay for the week. It helps streamline payroll management by consolidating individual payment data into an easy-to-read format. This report ensures accuracy and transparency in employee compensation tracking.

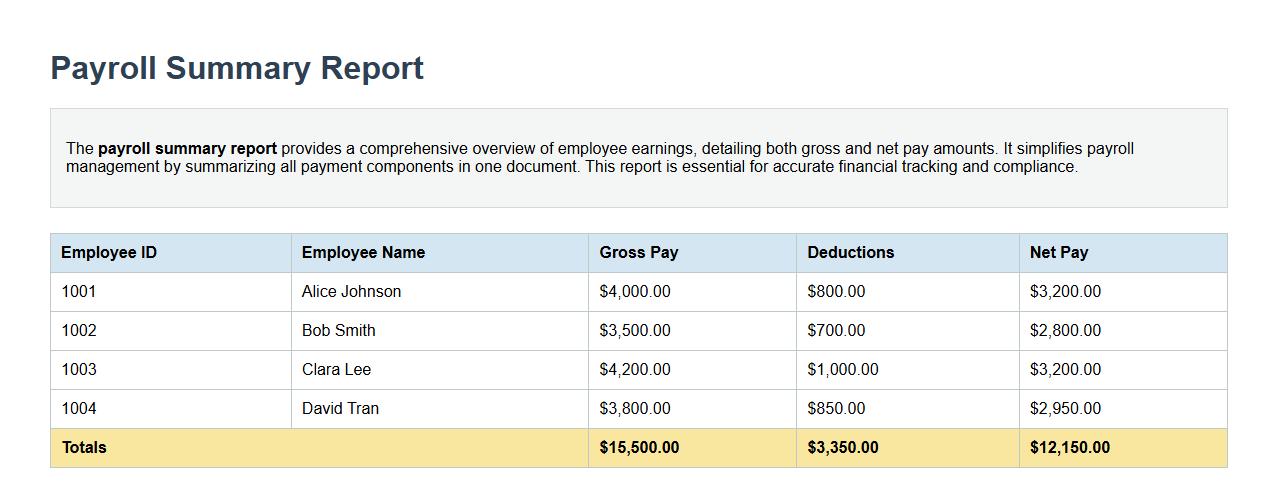

Payroll summary report with gross and net pay

The payroll summary report provides a comprehensive overview of employee earnings, detailing both gross and net pay amounts. It simplifies payroll management by summarizing all payment components in one document. This report is essential for accurate financial tracking and compliance.

Customized payroll summary report for small businesses

Our customized payroll summary report is tailored specifically for small businesses to streamline payroll management. It provides clear, concise insights into employee earnings, deductions, and taxes all in one easy-to-understand document. This report helps small business owners make informed decisions while maintaining payroll accuracy and compliance.

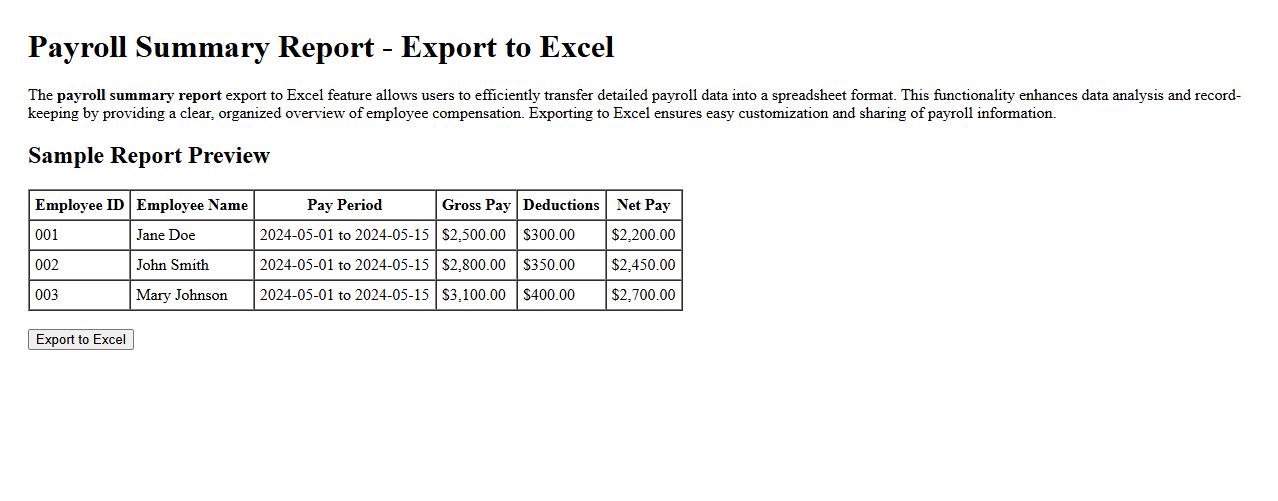

Payroll summary report export to excel

The payroll summary report export to Excel feature allows users to efficiently transfer detailed payroll data into a spreadsheet format. This functionality enhances data analysis and record-keeping by providing a clear, organized overview of employee compensation. Exporting to Excel ensures easy customization and sharing of payroll information.

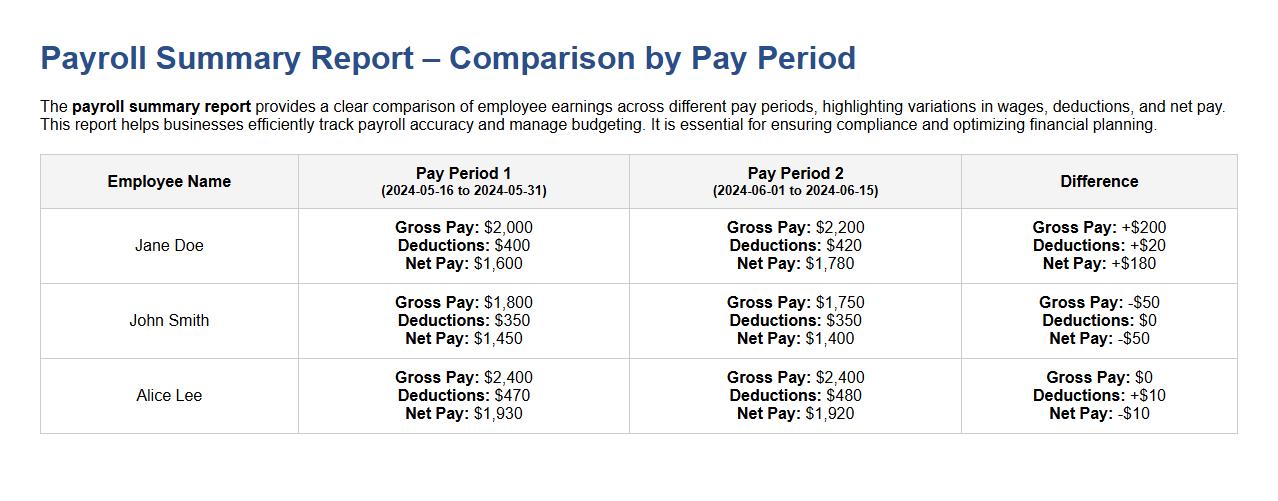

Payroll summary report comparing pay periods

The payroll summary report provides a clear comparison of employee earnings across different pay periods, highlighting variations in wages, deductions, and net pay. This report helps businesses efficiently track payroll accuracy and manage budgeting. It is essential for ensuring compliance and optimizing financial planning.

What key metrics should a Payroll Summary Report letter highlight for audit compliance?

A Payroll Summary Report letter for audit compliance must emphasize total gross wages, tax deductions, and net pay to ensure transparency. It should also detail employer contributions to social security and benefits. These metrics establish a clear trail for auditors to verify payroll accuracy and regulatory adherence.

How can a Payroll Summary Report letter be formatted for multi-department organizations?

For multi-department organizations, the Payroll Summary Report letter should be organized by department with clear subheadings. Each section must summarize payroll costs, hours worked, and employee counts per department. Using tables and charts enhances readability and allows for quick comparative analysis across departments.

Which employee identifiers must be included in a Payroll Summary Report letter for GDPR compliance?

To maintain GDPR compliance, a Payroll Summary Report letter should include only necessary employee identifiers such as employee ID numbers and role titles. Personal data like social security numbers or home addresses must be excluded or anonymized. This minimizes privacy risks while enabling payroll verification.

What supporting documents should accompany a Payroll Summary Report letter for grant applications?

Supporting documents for grant applications should include payroll registers, tax payment receipts, and timesheets as evidence backing the Payroll Summary Report. These materials demonstrate proper use of grant funds and payroll accuracy. Including authorization approvals enhances credibility and regulatory confidence.

How should payroll discrepancies be addressed in a summary report letter to management?

Payroll discrepancies in a summary report letter must be clearly identified, explained, and linked to corrective actions. Highlight the nature of the discrepancy, impacted employees, and steps taken to resolve it. Transparency in addressing issues fosters trust and supports ongoing payroll process improvements.