A Payroll Form Sample serves as a practical template to document employee wages, taxes, and deductions efficiently. It helps streamline the payroll process, ensuring accurate record-keeping and compliance with tax regulations. Businesses use it to simplify payroll calculations and maintain organized financial records.

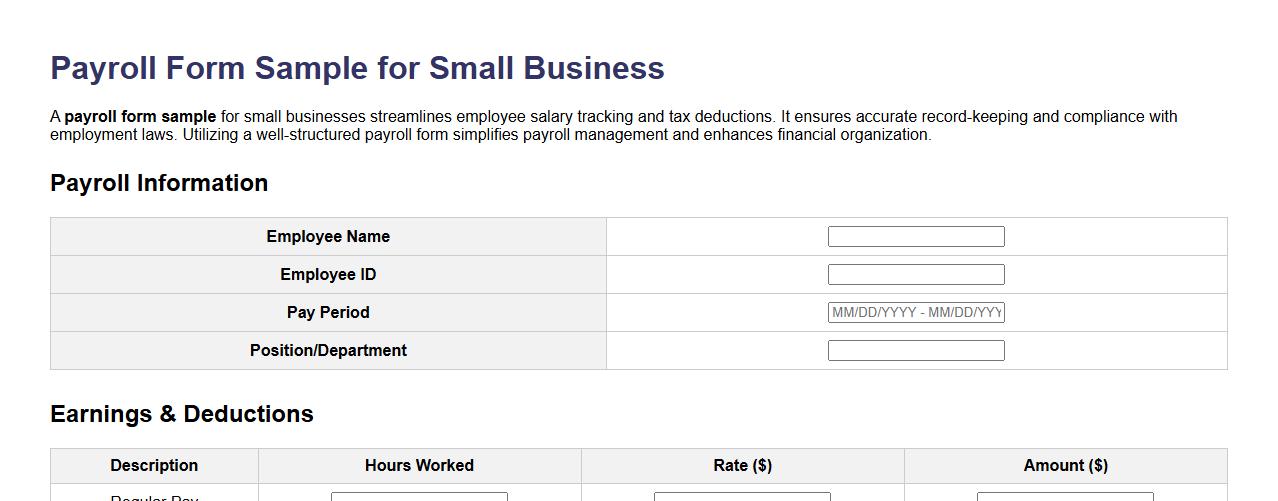

Payroll form sample for small business

A payroll form sample for small businesses streamlines employee salary tracking and tax deductions. It ensures accurate record-keeping and compliance with employment laws. Utilizing a well-structured payroll form simplifies payroll management and enhances financial organization.

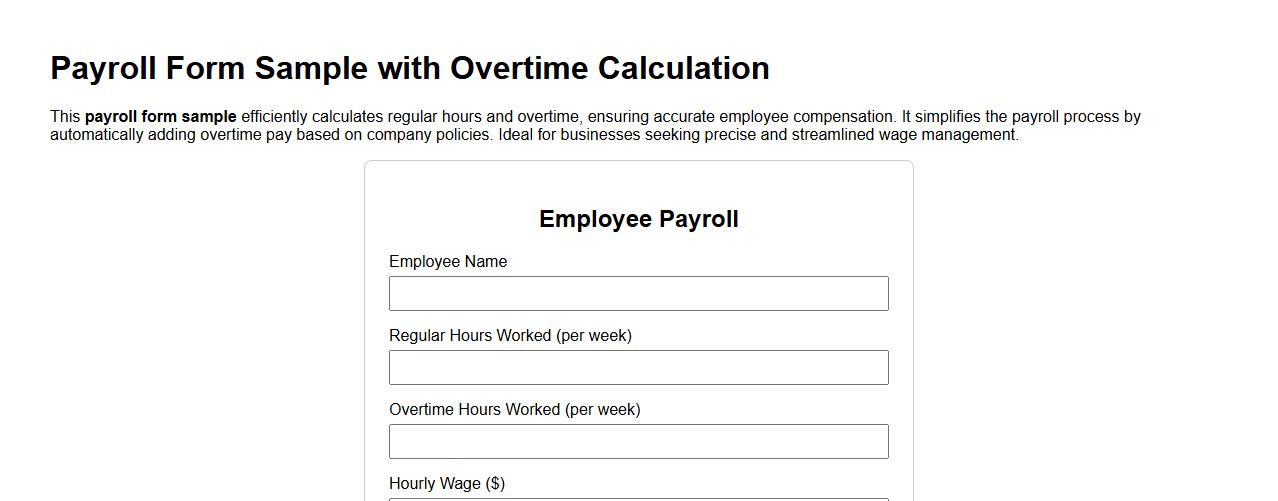

Payroll form sample with overtime calculation

This payroll form sample efficiently calculates regular hours and overtime, ensuring accurate employee compensation. It simplifies the payroll process by automatically adding overtime pay based on company policies. Ideal for businesses seeking precise and streamlined wage management.

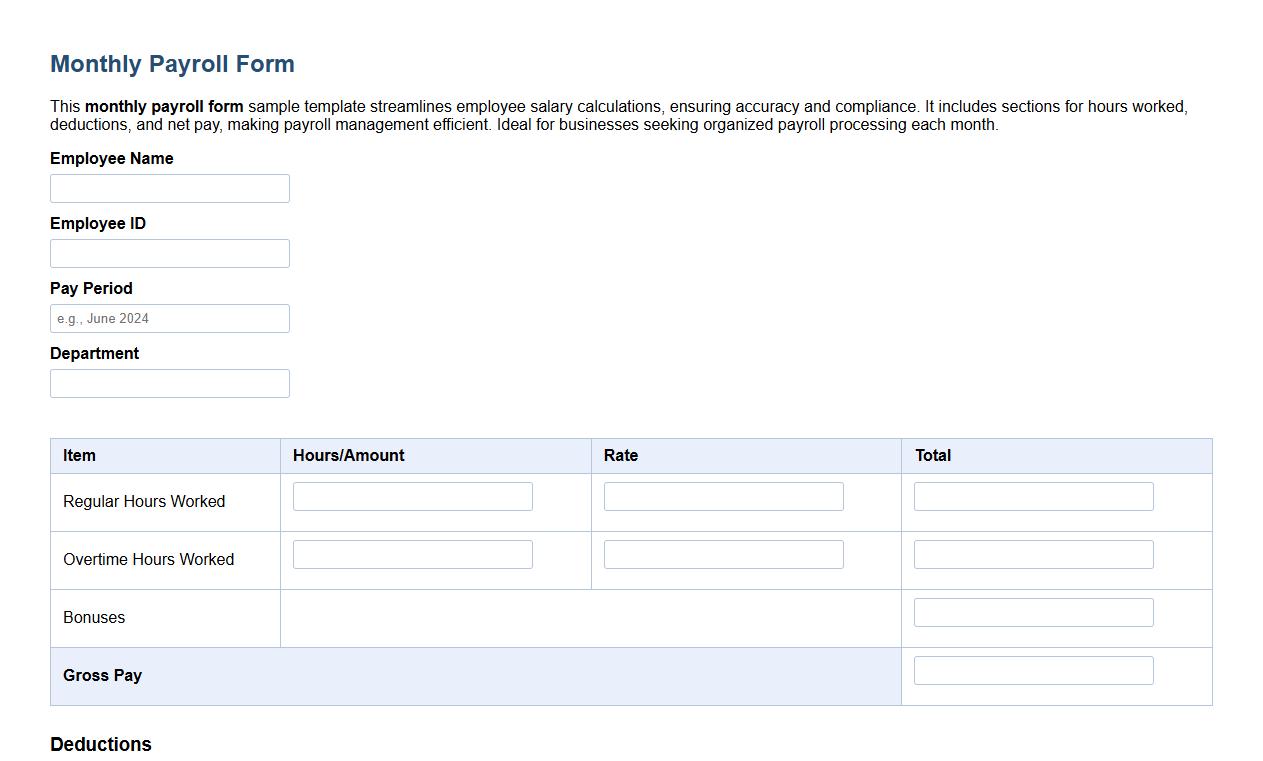

Monthly payroll form sample template

This monthly payroll form sample template streamlines employee salary calculations, ensuring accuracy and compliance. It includes sections for hours worked, deductions, and net pay, making payroll management efficient. Ideal for businesses seeking organized payroll processing each month.

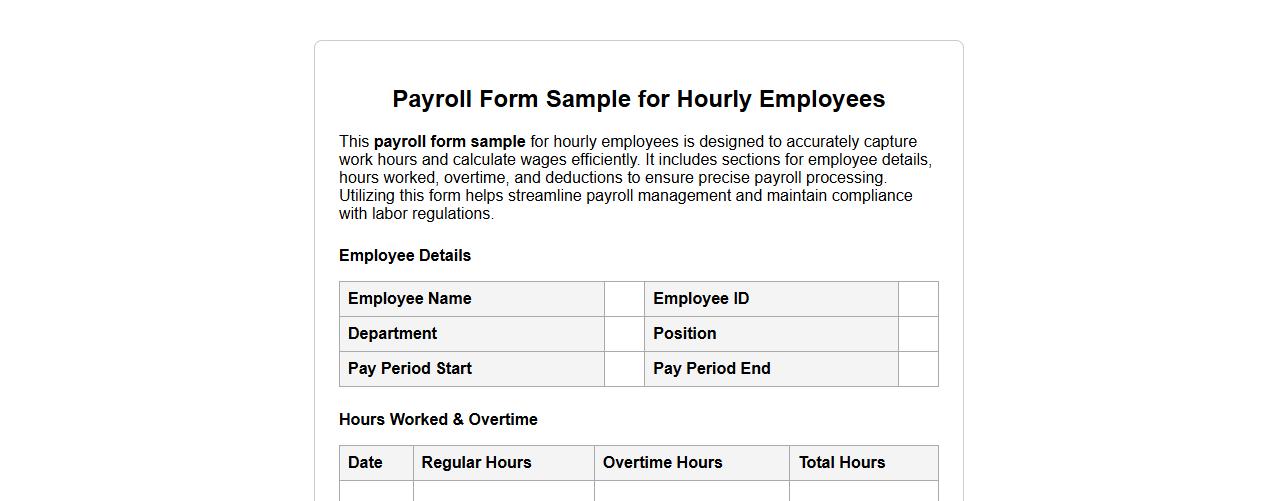

Payroll form sample for hourly employees

This payroll form sample for hourly employees is designed to accurately capture work hours and calculate wages efficiently. It includes sections for employee details, hours worked, overtime, and deductions to ensure precise payroll processing. Utilizing this form helps streamline payroll management and maintain compliance with labor regulations.

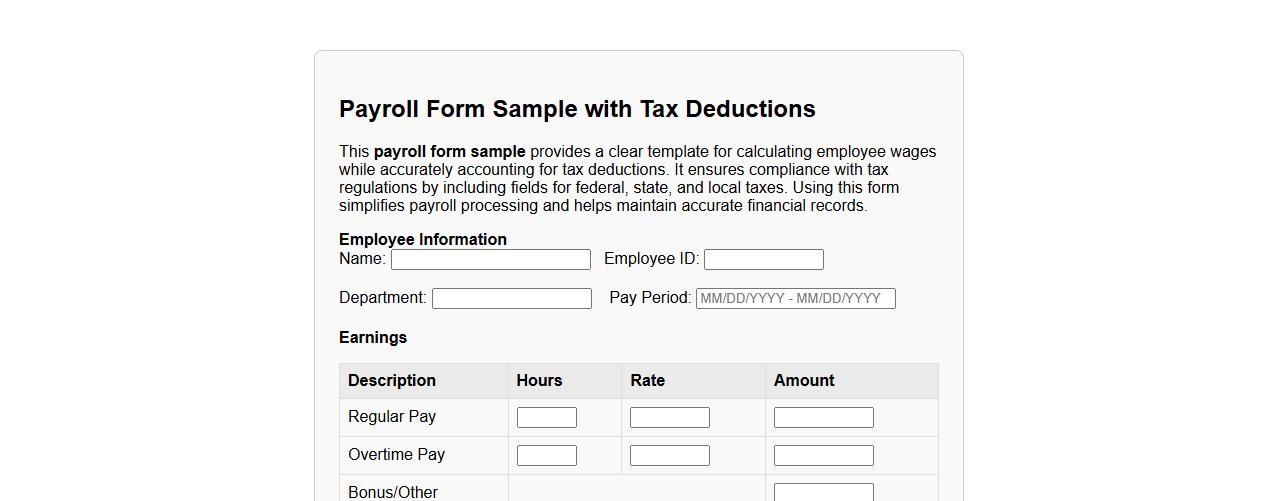

Payroll form sample with tax deductions

This payroll form sample provides a clear template for calculating employee wages while accurately accounting for tax deductions. It ensures compliance with tax regulations by including fields for federal, state, and local taxes. Using this form simplifies payroll processing and helps maintain accurate financial records.

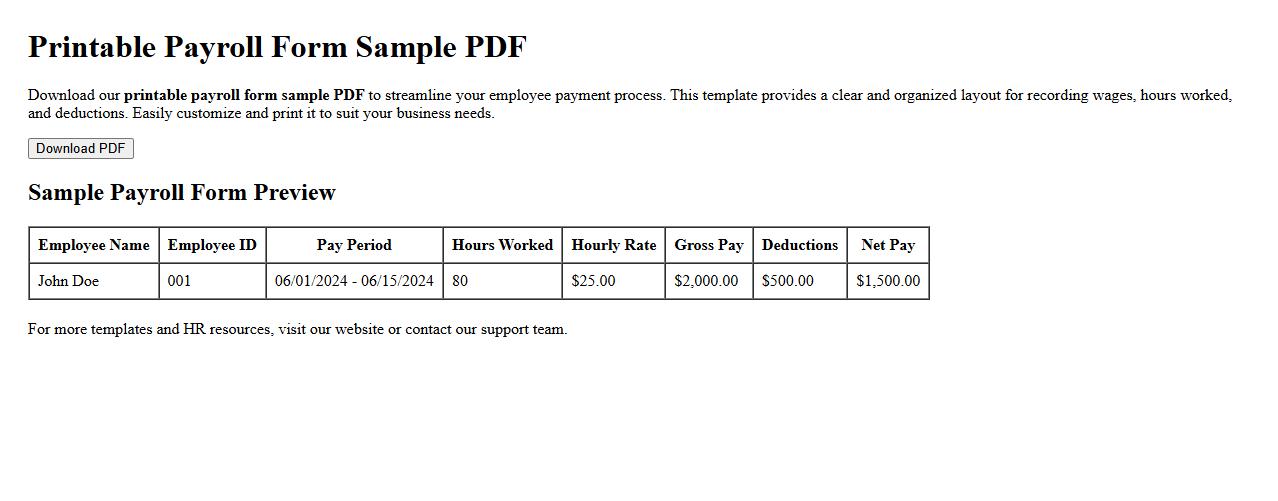

Printable payroll form sample PDF

Download our printable payroll form sample PDF to streamline your employee payment process. This template provides a clear and organized layout for recording wages, hours worked, and deductions. Easily customize and print it to suit your business needs.

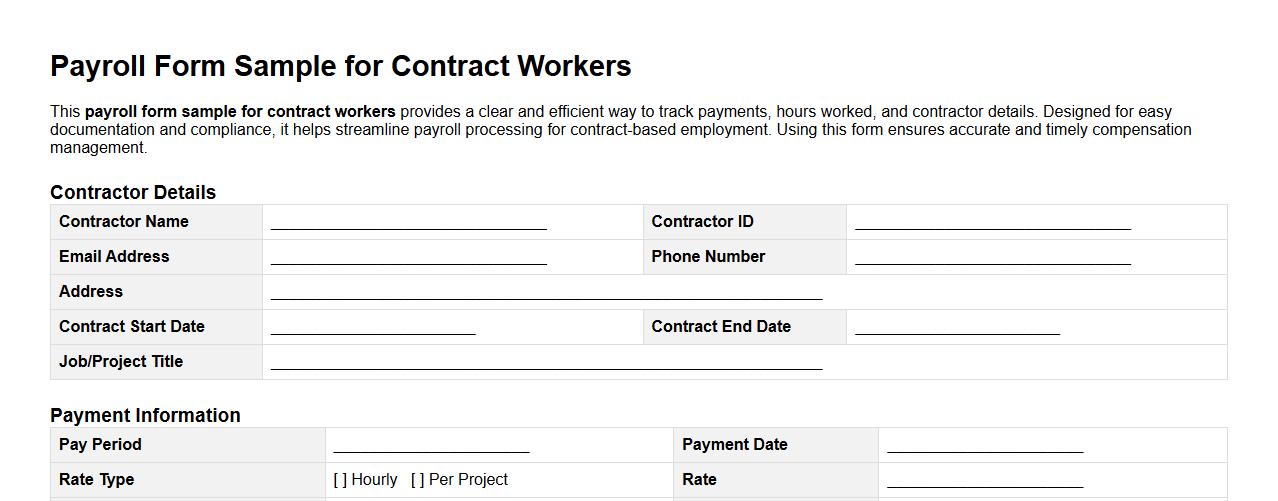

Payroll form sample for contract workers

This payroll form sample for contract workers provides a clear and efficient way to track payments, hours worked, and contractor details. Designed for easy documentation and compliance, it helps streamline payroll processing for contract-based employment. Using this form ensures accurate and timely compensation management.

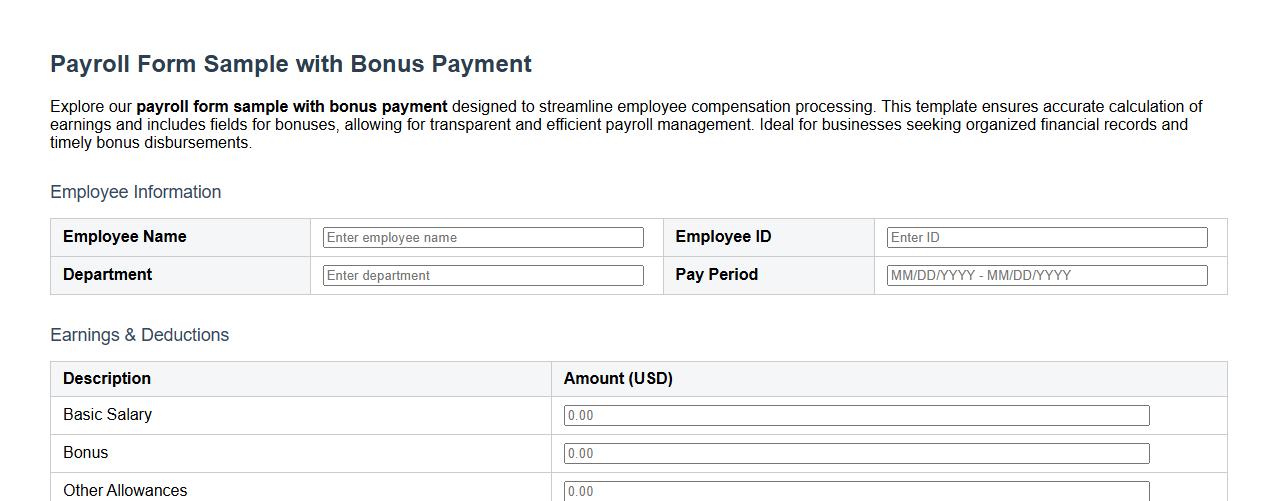

Payroll form sample with bonus payment

Explore our payroll form sample with bonus payment designed to streamline employee compensation processing. This template ensures accurate calculation of earnings and includes fields for bonuses, allowing for transparent and efficient payroll management. Ideal for businesses seeking organized financial records and timely bonus disbursements.

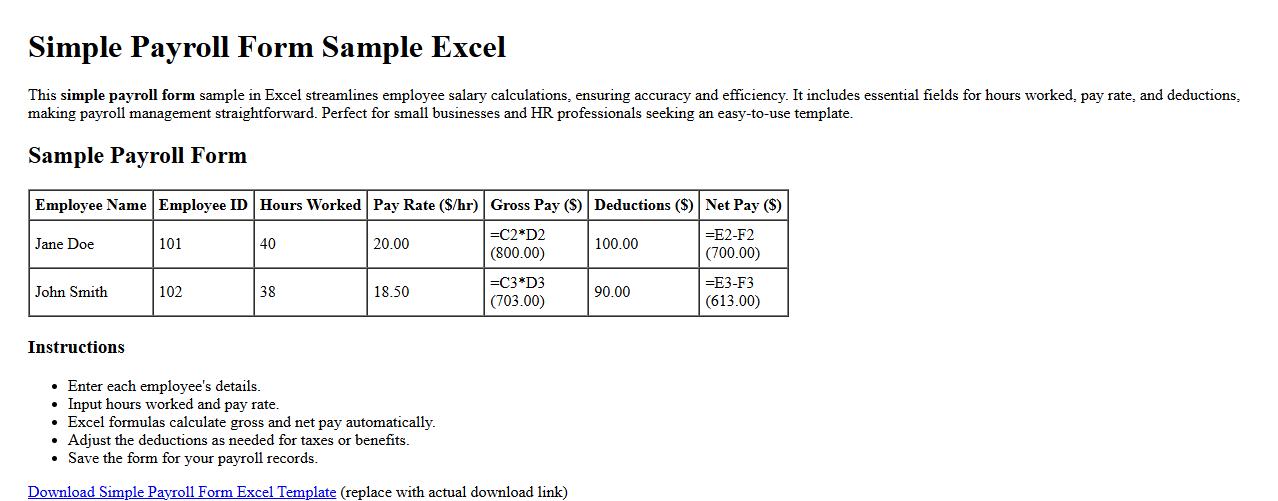

Simple payroll form sample Excel

This simple payroll form sample in Excel streamlines employee salary calculations, ensuring accuracy and efficiency. It includes essential fields for hours worked, pay rate, and deductions, making payroll management straightforward. Perfect for small businesses and HR professionals seeking an easy-to-use template.

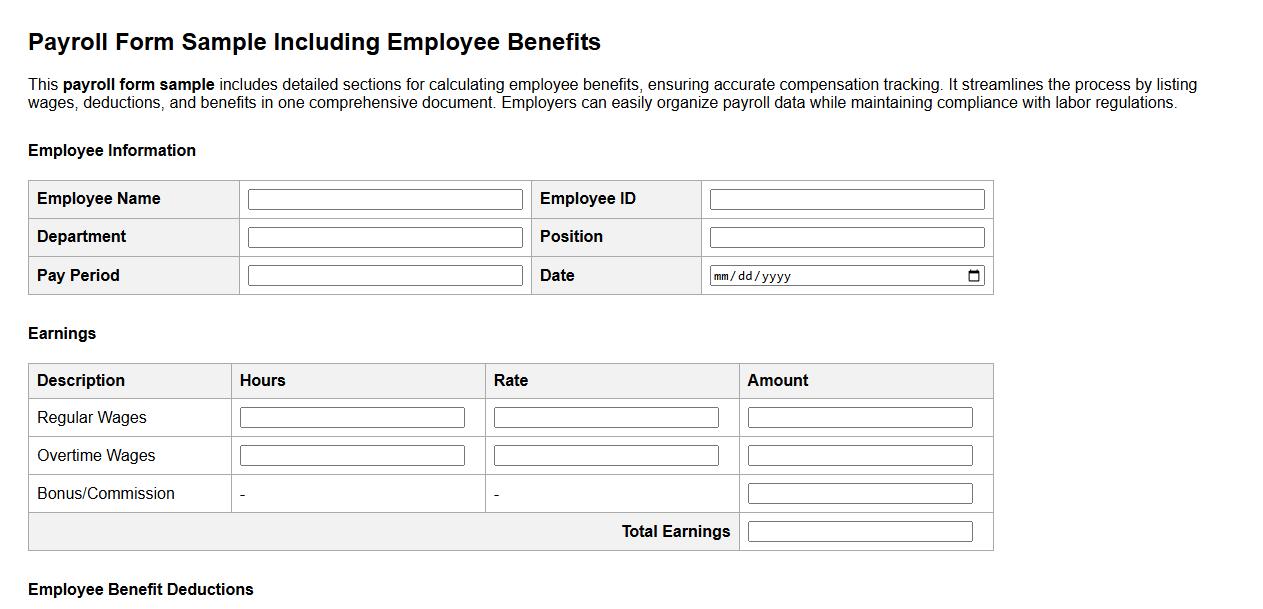

Payroll form sample including employee benefits

This payroll form sample includes detailed sections for calculating employee benefits, ensuring accurate compensation tracking. It streamlines the process by listing wages, deductions, and benefits in one comprehensive document. Employers can easily organize payroll data while maintaining compliance with labor regulations.

What supporting documents are required when submitting a Payroll Form?

When submitting a Payroll Form, it is essential to include timesheets as proof of hours worked. Additionally, employees' attendance records and approved leave forms must be attached for verification. Supporting documents ensure accuracy and compliance with company payroll policies.

How is overtime calculated and reflected on the Payroll Form?

Overtime is typically calculated based on the number of hours worked beyond the standard work schedule at a predetermined premium rate. This calculation is clearly reflected in specific sections of the Payroll Form dedicated to additional compensation. Proper documentation of overtime ensures transparent and fair employee remuneration.

Which codes on the Payroll Form indicate non-taxable allowances?

Non-taxable allowances on the Payroll Form are identified using designated allowance codes such as "NTA" or specific numeric identifiers. These codes help in separating taxable income from non-taxable benefits for accurate tax reporting. Correct coding is crucial for compliance with tax regulations and to avoid discrepancies.

What approval signatures are mandatory on the Payroll Form?

The Payroll Form must include approval signatures from the employee's immediate supervisor and the payroll department head. Additionally, final authorization from the finance or human resources manager is often required. These signatures verify that the payroll data has been reviewed and approved for processing.

How are payroll corrections tracked and documented in the Payroll Form?

Payroll corrections must be recorded using amendment sections or correction logs within the Payroll Form. Each change should include details such as the reason for correction, date, and authorized signature. This systematic tracking ensures transparency and maintains the integrity of payroll records.