A Rental Payment Receipt serves as an official document confirming the payment of rent from a tenant to a landlord. It typically includes details such as payment amount, date, rental period, and the parties involved. This receipt helps maintain clear financial records and protects both parties in rental agreements.

Rental payment receipt for monthly apartment rent

This rental payment receipt serves as proof of monthly apartment rent payment, detailing the amount paid, payment date, and tenant information. It ensures transparency and keeps a record for both landlord and tenant. Maintaining this receipt helps avoid disputes and facilitates smooth rental transactions.

Rental payment receipt with late fee included

This rental payment receipt includes a detailed breakdown of the rental amount and the applicable late fee. It serves as an official acknowledgment of payment made by the tenant, ensuring transparency and record-keeping. The receipt helps landlords track financial transactions accurately.

Rental payment receipt for cash payment

This rental payment receipt confirms the cash payment made by the tenant for the specified rental period. It serves as proof of transaction and includes essential details such as the amount paid, date, and property information. Retaining this receipt ensures transparency and helps resolve any future payment inquiries.

Rental payment receipt for security deposit refund

This rental payment receipt confirms the refund of the security deposit for the leased property. It details the amount returned and serves as proof of the transaction between the landlord and tenant. Keeping this receipt ensures transparency and legal protection for both parties.

Rental payment receipt for commercial property lease

This rental payment receipt confirms the payment made for the lease of a commercial property. It serves as proof of transaction between the tenant and the property owner, detailing the amount paid and the payment date. Such receipts are essential for maintaining accurate financial records and ensuring transparency in commercial leasing agreements.

Rental payment receipt with utility charges

This rental payment receipt includes detailed information about the monthly rent along with any applicable utility charges. It serves as a formal acknowledgment of payment made by the tenant for both rent and utilities. Keep this document for your records and future reference.

Rental payment receipt for partial payment made

This rental payment receipt confirms a partial payment has been received towards the total rent due. It serves as proof of payment and details the amount paid and the outstanding balance. Keep this receipt for your records and future reference.

Rental payment receipt for Airbnb or vacation rental

This rental payment receipt provides a detailed record of your Airbnb or vacation rental transaction, ensuring transparency and proof of payment. It includes essential information such as booking dates, payment amount, and property details. Use this receipt to keep track of your travel expenses and confirm your reservation status.

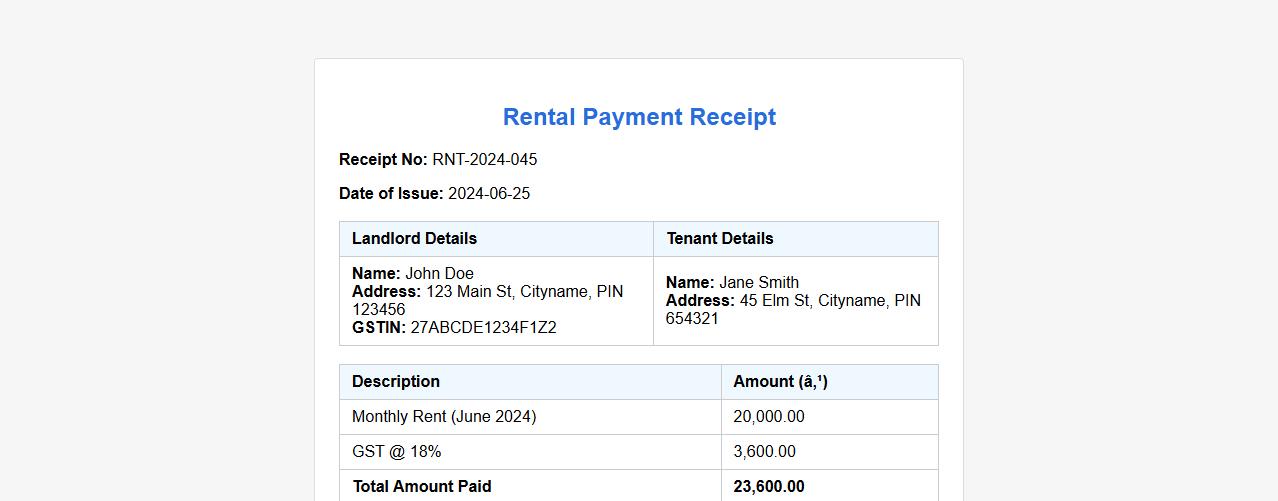

Rental payment receipt with GST or tax details

Receive a detailed rental payment receipt that includes accurate GST or tax information for your records. This receipt ensures transparency by clearly stating all tax components applied to the rental transaction. Keep your financial documentation organized and compliant with tax regulations using this comprehensive rental payment receipt.

Rental payment receipt for lease renewal period

This rental payment receipt confirms the successful payment for the lease renewal period, ensuring continuous tenancy. It serves as an official record for both landlord and tenant, detailing the transaction date and amount. Keep this document for future reference and validation of lease terms.

What details must a compliant rental payment receipt include by law?

A compliant rental payment receipt must include the tenant's name, payment amount, and payment date. Additionally, it should display the landlord's name and signature to confirm authenticity. Including the rental period covered by the payment is also essential for clarity and legal compliance.

How should partial rental payments be documented on receipts?

Receipts for partial rental payments must clearly state the exact amount paid and specify that it is a partial payment. They should also include the remaining balance and the rental period covered by the payment. This ensures transparency between the landlord and tenant regarding payment status.

Can digital signatures validate electronic rental payment receipts?

Digital signatures are legally recognized and can validate electronic rental payment receipts effectively. They provide security and verification of the landlord's identity and intent. Using encrypted digital signatures enhances the trustworthiness of electronic documents.

How long should landlords retain rental payment receipt records?

Landlords must retain rental payment receipts for a minimum of 3 to 7 years, depending on local laws. Maintaining records for this period is crucial for tax purposes and potential legal disputes. Digital storage is recommended for easy access and durability.

What are common errors that void a rental payment receipt's validity?

Errors such as missing landlord signatures, incorrect payment amounts, or vague descriptions can void a rental payment receipt's validity. Additionally, failing to specify the rental period or payment date reduces the receipt's legal effectiveness. Ensuring all mandatory fields are accurately completed is essential for a valid receipt.