A receipt format outlines the structured layout used to document sales transactions, ensuring all essential details such as date, items purchased, quantities, prices, and total amount are clearly presented. This format helps businesses maintain accurate records while providing customers with proof of purchase. A well-designed receipt format enhances transparency and facilitates smooth accounting processes.

Restaurant receipt format with gst details

A restaurant receipt format with GST details ensures clear billing by displaying itemized charges alongside applicable tax information. This format enhances transparency for customers and compliance with tax regulations. Including GST details helps streamline accounting and simplifies auditing processes.

Hotel bill receipt format in excel

A hotel bill receipt format in Excel provides a structured template to easily record guest details, services availed, and total charges. This format ensures accurate billing and simplifies financial tracking for hotel management. Using Excel allows for customizable and professional receipt generation with automated calculations.

Simple cash payment receipt format for rent

This simple cash payment receipt format is designed to efficiently document rent transactions. It ensures clear recording of payment details, date, and amount for both landlords and tenants. Using this format helps maintain organized and transparent financial records.

Itemized purchase receipt format for small business

An itemized purchase receipt format for small businesses clearly lists each product or service along with its price, quantity, and total cost, ensuring transparency and easy tracking. This format helps both the seller and buyer maintain accurate financial records and simplifies tax preparation. Utilizing an organized receipt format enhances professionalism and customer trust.

Digital receipt format for online transactions

The digital receipt format for online transactions ensures a clear and organized presentation of purchase details, including item descriptions, prices, and payment methods. This format enhances transparency and simplifies record-keeping for both merchants and customers. By leveraging standardized structures, digital receipts improve the overall e-commerce experience and facilitate easy returns or audits.

Salary payment receipt format with employee details

The salary payment receipt format provides a clear and organized record of employee payments, including essential details such as employee name, ID, payment date, and amount. This format ensures transparency and accuracy in documenting salary transactions for both employers and employees. Utilizing a standardized receipt helps maintain proper financial records and facilitates easy reference during audits.

Medical bill receipt format for insurance claim

The medical bill receipt format for insurance claims is designed to provide a clear and detailed record of medical expenses incurred. It includes essential information such as patient details, treatment descriptions, and cost breakdowns to facilitate smooth claim processing. Using a standardized format ensures accuracy and helps in quick reimbursement from insurance providers.

School fee payment receipt format with monthly breakdown

The school fee payment receipt format with monthly breakdown provides a clear and organized record of payments made each month. This format helps parents and administrators track fee transactions efficiently and ensures transparency in financial dealings. It typically includes details such as the student's name, payment dates, amounts, and outstanding balances.

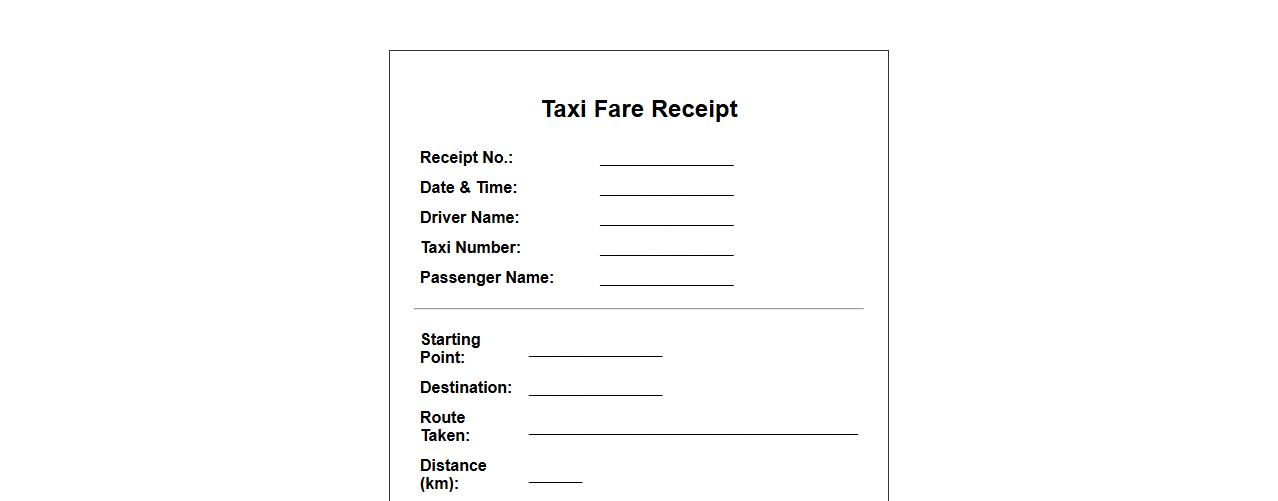

Taxi fare receipt format with route and distance

A taxi fare receipt format with route and distance details provides clear documentation of the journey for both driver and passenger. It includes essential information such as starting point, destination, distance traveled, and the fare calculated based on the route. This format ensures transparency and accurate record-keeping for taxi services.

Donation receipt format with 80g tax exemption details

Download our donation receipt format with 80G tax exemption details, designed to provide donors with a clear and compliant acknowledgment of their contributions. This format includes all necessary information to ensure eligibility for tax benefits under Section 80G of the Income Tax Act. Use it to maintain transparency and foster trust with your supporters.

What are the essential components of a professional receipt format?

A professional receipt format must include the business name and contact information at the top for clear identification. It should display the transaction date and unique receipt number to ensure proper record-keeping. Additionally, details of the purchased items, payment method, and total amount paid are crucial for transparency.

How should tax details be presented in a receipt letter?

Tax details should be clearly itemized and presented as a separate line in the receipt, showing the tax rate and the exact tax amount. This enhances clarity and any required traceability by law. Presenting tax information right before the total payment section helps maintain an organized format.

What is the correct placement for digital signature in an e-receipt format?

The digital signature must be placed at the bottom right corner of the e-receipt for authenticity and verification purposes. This position is conventionally accepted and easy for recipients to identify. It acts as an official endorsement of the transaction details listed above.

How do you format multi-item transactions in a receipt letter?

Multi-item transactions should be displayed in a tabular format detailing each item's description, quantity, unit price, and total price. This format provides clear visibility of each purchase component. Including subtotals for categories before the total amount enhances readability and accuracy.

What are the legal disclaimers often included in receipt formats?

Legal disclaimers typically include statements limiting the liability for returned goods or services and clarifying refund policies. They also may contain notes on data protection and the buyer's responsibility for providing accurate information. These disclaimers safeguard the business and outline essential terms for consumers.