A rental invoice example typically includes essential details such as the renter's name, rental period, item or property description, and the total amount due. It serves as a formal document to request payment and record financial transactions between the landlord and tenant. Accurate rental invoice examples help ensure transparency and smooth rental management.

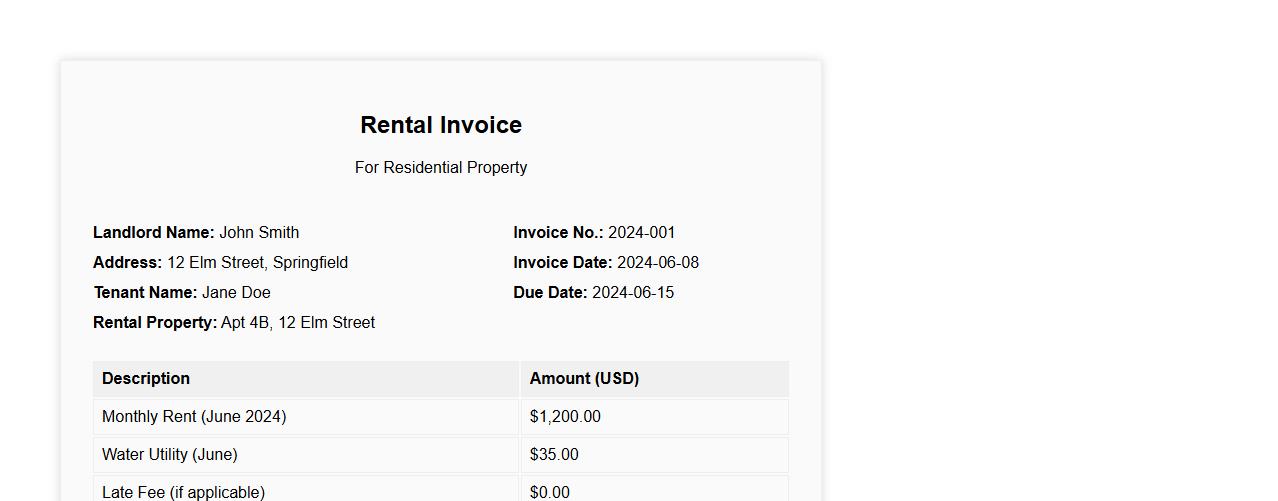

Rental invoice example for residential property

A rental invoice example for residential property clearly outlines the payment details for tenants, including rent amount, due date, and any additional charges. It serves as a formal request for payment, ensuring clarity and transparency between landlords and tenants. Proper documentation helps in maintaining accurate financial records for both parties.

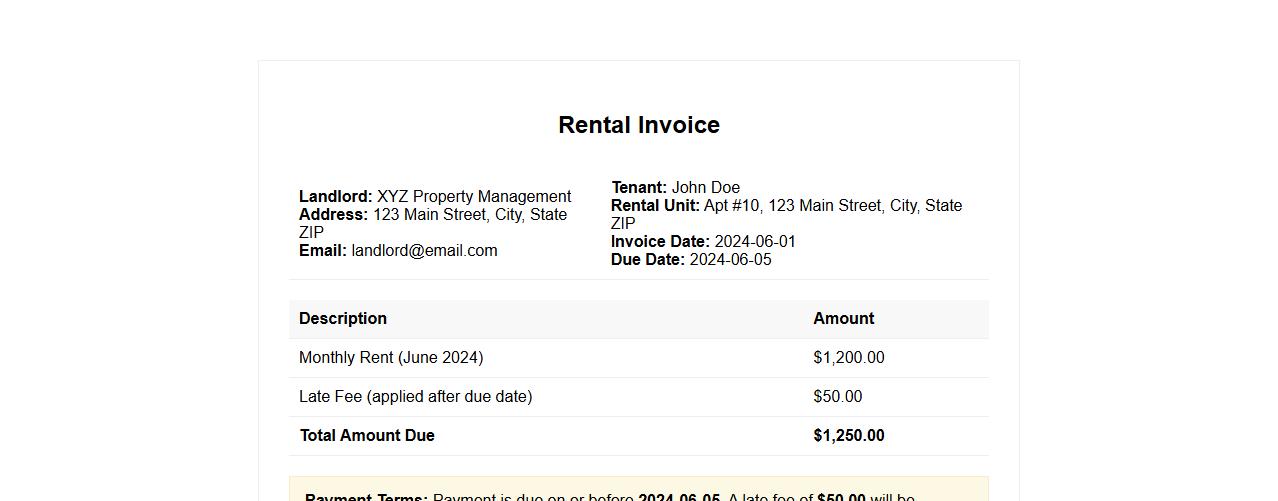

Rental invoice example with late fee included

This rental invoice example clearly outlines the rental charges along with any applicable late fees to ensure transparent billing. It highlights the total amount due, payment terms, and the specific late fee policy. Such invoices help landlords and tenants maintain clear financial records and avoid disputes.

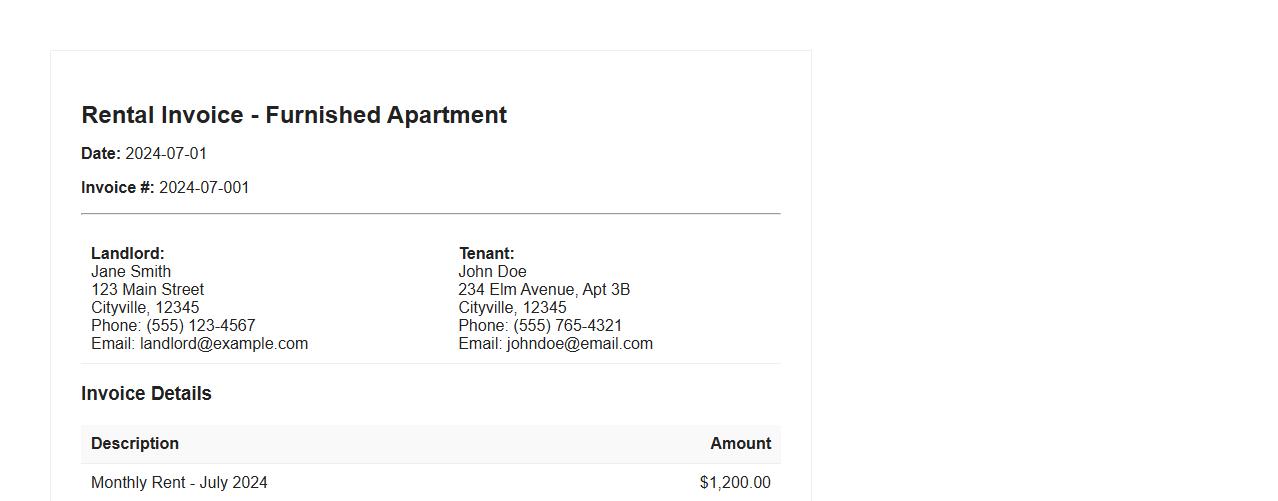

Rental invoice example for furnished apartment

A rental invoice example for a furnished apartment provides a clear breakdown of charges including rent, utilities, and furniture fees. It helps both landlords and tenants maintain transparent financial records. Using a detailed template ensures payments are tracked accurately and efficiently.

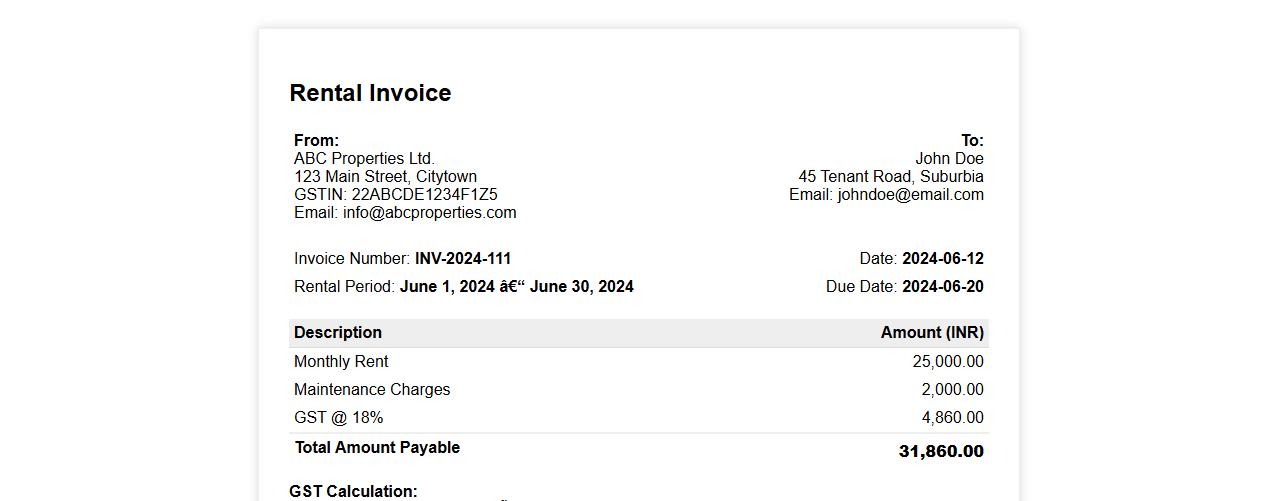

Rental invoice example with GST calculation

Discover a clear rental invoice example that includes GST calculation to simplify your billing process. This template ensures accurate tax inclusion and transparent payment details for both landlords and tenants. Easily customize it to fit your rental business needs and stay compliant with tax regulations.

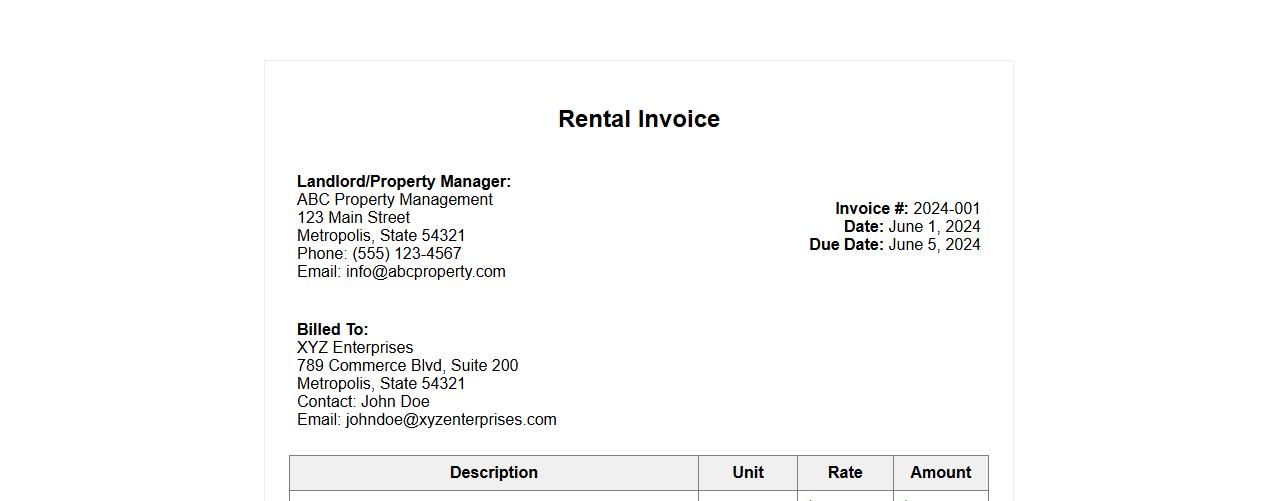

Rental invoice example for monthly commercial space

This rental invoice example demonstrates a clear and professional format for billing monthly commercial space. It includes essential details such as tenant information, payment terms, and the rental amount due. Utilizing this template ensures accurate and timely invoicing for property managers and business owners.

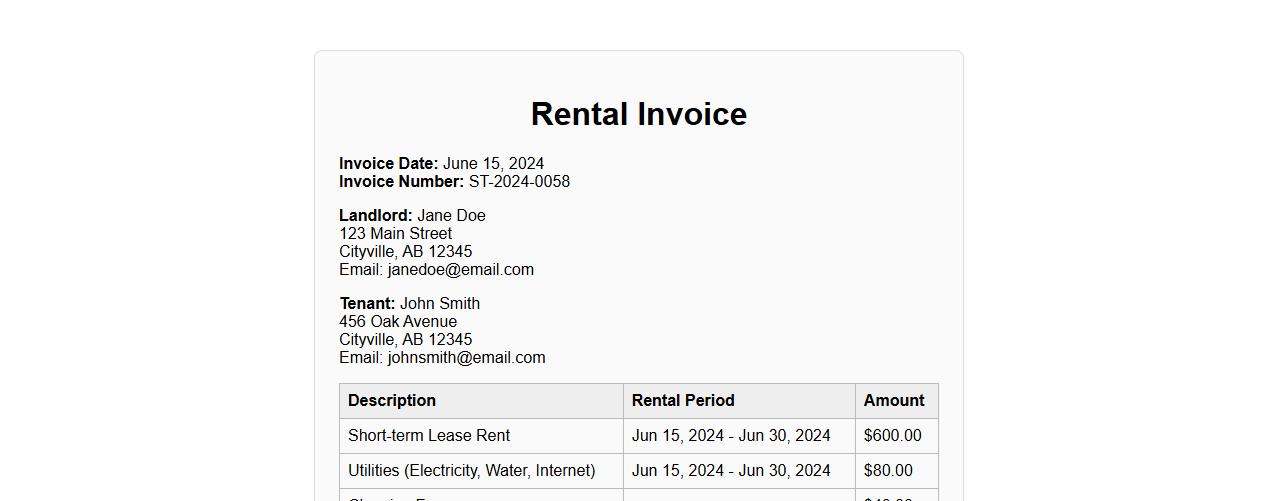

Rental invoice example for short-term lease

Discover a clear rental invoice example tailored for short-term lease agreements, ensuring accurate billing and transparent payment records. This template simplifies tracking rental periods and associated charges for both landlords and tenants. Use it to maintain organized financial documentation throughout the lease term.

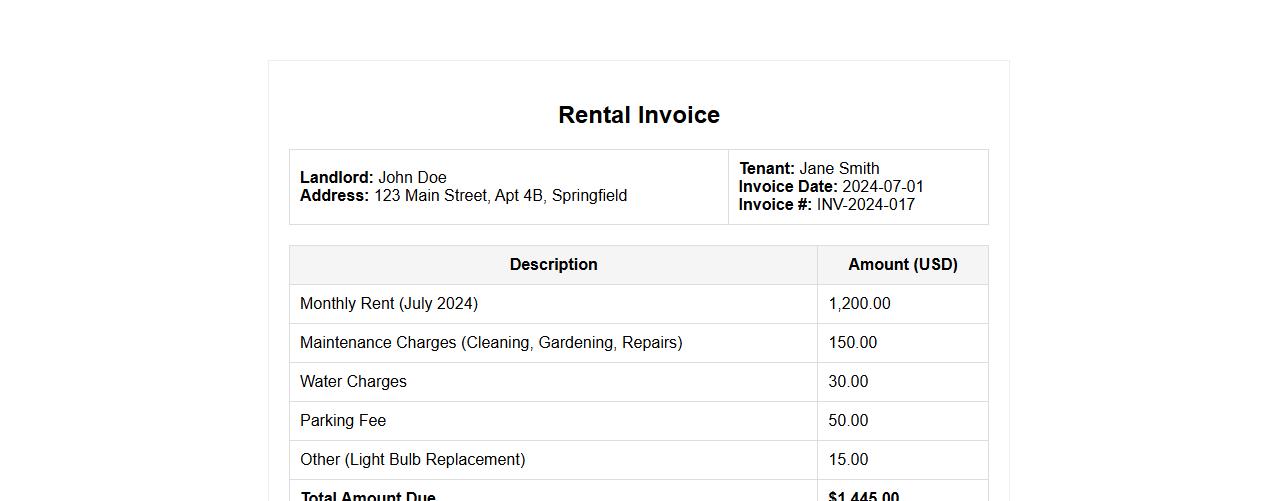

Rental invoice example with maintenance charges

This rental invoice example includes detailed maintenance charges, ensuring transparent billing for tenants. It clearly itemizes rent, maintenance fees, and any additional costs, providing a comprehensive summary. Such invoices help streamline payment processes and maintain accurate records for landlords and tenants alike.

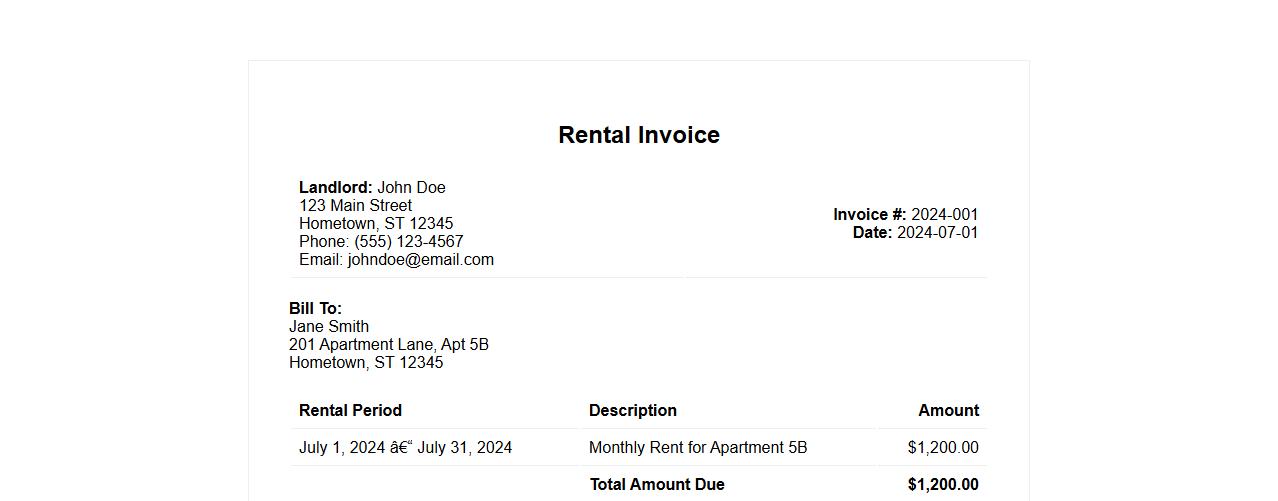

Rental invoice example in PDF format download

Download a comprehensive rental invoice example in PDF format to streamline your billing process. This professionally designed template ensures all essential rental details are clearly presented, making it easy for both landlords and tenants to understand payment terms. Access the file instantly and customize it to fit your specific rental agreements.

Rental invoice example for individual landlord

An rental invoice example for an individual landlord provides a clear and organized template to request payment from tenants. It includes essential details such as tenant information, rental period, amount due, and payment instructions. This document helps ensure timely and accurate rent collection while maintaining professional records.

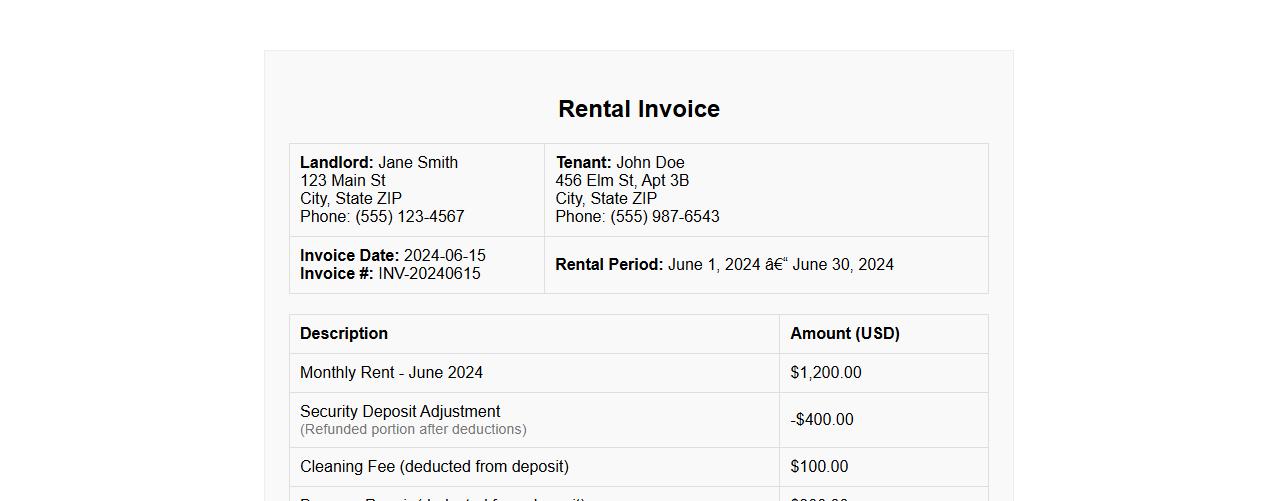

Rental invoice example with security deposit adjustment

A rental invoice example with security deposit adjustment clearly outlines the tenant's monthly rent along with any deductions or refunds related to the security deposit. This document ensures transparency by detailing charges and adjustments, helping both landlords and tenants maintain accurate financial records. Proper invoicing facilitates smooth rental transactions and minimizes disputes.

What essential details must be included in a rental invoice for legal compliance?

A rental invoice must include the tenant's and landlord's full names and contact information for clear identification. It should specify the rental period, amount due, and payment due date to avoid disputes. Additionally, including the invoice number and date ensures the document is easily trackable and compliant with legal standards.

How should late payment penalties be documented in a rental invoice?

Late payment penalties must be explicitly stated in the invoice with clear terms, including the penalty amount or percentage and when it applies. The details should be easy to understand to enforce compliance and avoid tenant confusion. It is also important to reference the lease agreement clauses that authorize such penalties for legal backing.

Which tax or VAT requirements apply to rental invoices in different jurisdictions?

Rental invoices must comply with local tax regulations, which vary widely by jurisdiction and often include VAT or sales tax. The invoice should show the tax rate applied and the total tax amount separately for transparency. It is crucial to verify specific rules, such as exemptions or reverse charges, to ensure full compliance.

How do you reference lease agreements or terms within a rental invoice?

Referencing the lease agreement in a rental invoice increases clarity by linking the payment to a specific contract or terms. This can be done by including the lease agreement number, signing date, or a brief summary of key terms. Such references protect both parties and streamline dispute resolution if needed.

What digital tools automate rental invoice creation and tracking?

Several digital tools like QuickBooks, FreshBooks, and Zoho Invoice automate rental invoice generation and tracking efficiently. These platforms provide templates, reminders, and integration with payment gateways for smooth transactions. Automation reduces errors, saves time, and enhances financial management for landlords and property managers.